Key Insights

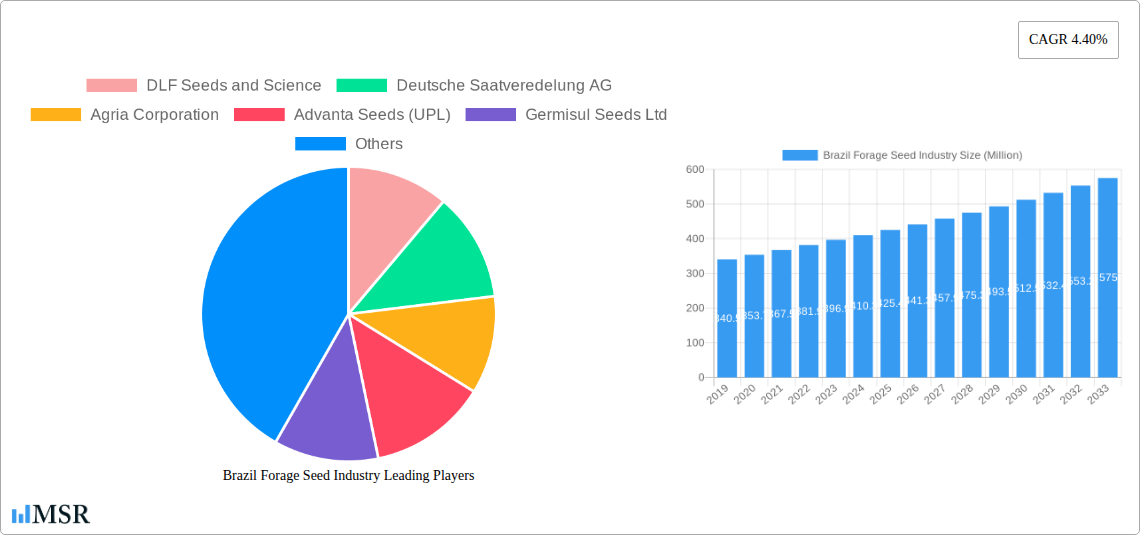

The Brazil Forage Seed market is poised for robust expansion, projected to reach an estimated USD 410.32 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.40% anticipated through 2033. This growth is primarily propelled by the escalating demand for high-quality forage to support Brazil's burgeoning livestock sector. As the nation continues to solidify its position as a global leader in beef and dairy production, the need for nutritious and productive pasturelands becomes paramount. Government initiatives promoting sustainable agricultural practices and investments in livestock infrastructure further fuel this demand, creating a fertile ground for forage seed innovation and adoption. Key drivers include the continuous need for improved feed conversion ratios in cattle, the expansion of pastureland to meet increasing herd sizes, and the growing awareness among farmers regarding the economic benefits of using superior forage genetics for enhanced animal health and productivity.

Brazil Forage Seed Industry Market Size (In Million)

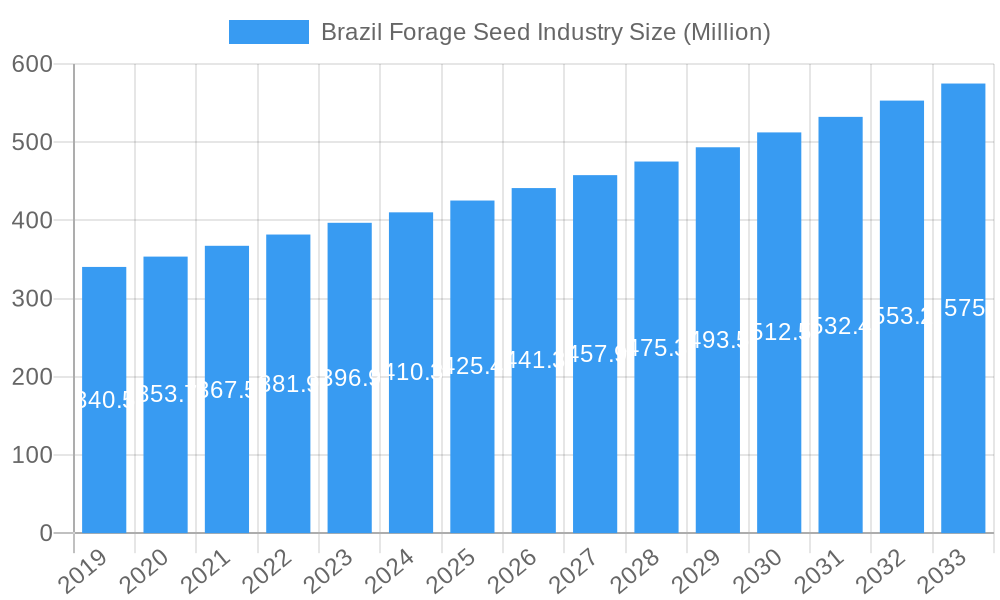

The market is characterized by dynamic trends such as the increasing adoption of genetically improved and drought-tolerant forage varieties, crucial for navigating Brazil's diverse climate. Innovations in seed coating technologies and precision agriculture are also gaining traction, promising enhanced germination rates and optimized resource utilization. However, the market faces certain restraints, including fluctuations in commodity prices, which can impact farmer investment in premium seeds, and the potential for adverse weather conditions. Despite these challenges, the outlook remains exceptionally positive. The competitive landscape features prominent players like DLF Seeds and Science, Deutsche Saatveredelung AG, and Corteva Agriscience, all actively engaged in research and development to offer a diverse portfolio of forage seeds, catering to various regional needs and farming practices across Brazil. The focus is shifting towards sustainable and climate-resilient forage solutions to ensure long-term productivity and profitability for Brazilian livestock operations.

Brazil Forage Seed Industry Company Market Share

Brazil Forage Seed Industry Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock critical insights into Brazil's burgeoning forage seed market with this in-depth report. Covering 2019-2033, with a base and estimated year of 2025, and a forecast period of 2025-2033, this analysis delves into production, consumption, imports, exports, and price trends. Equip yourself with actionable intelligence on the Brazilian agriculture sector, driven by pastoral farming and livestock development. This report is essential for seed companies, agribusiness stakeholders, farmers, investors, and government agencies seeking to capitalize on the growth of the Brazilian forage seed industry.

Brazil Forage Seed Industry Market Concentration & Dynamics

The Brazil forage seed market exhibits a moderate to high concentration, with key players dominating market share. Innovation is a crucial differentiator, driven by R&D in drought-tolerant varieties, high-yield forage crops, and sustainable agricultural practices. Regulatory frameworks, overseen by entities like the Ministry of Agriculture, Livestock and Food Supply (MAPA), ensure quality and biosecurity, though evolving regulations can impact market entry and operations. Substitute products, such as alternative feed sources and advancements in livestock nutrition, pose a competitive challenge, though the inherent benefits of quality forage seed remain significant for Brazilian livestock producers. End-user trends are heavily influenced by the demand for high-quality animal feed, the expansion of cattle ranching, and the increasing adoption of precision agriculture in forage cultivation. Mergers and acquisitions (M&A) are observed as companies seek to consolidate market position and expand their product portfolios. For instance, the past few years have seen approximately 3-5 significant M&A deals, representing a total transaction value estimated to be in the range of 50-100 Million. Key players like DLF Seeds and Science and Advanta Seeds (UPL) consistently invest in expanding their reach and product offerings, contributing to the market's competitive landscape.

Brazil Forage Seed Industry Industry Insights & Trends

The Brazil forage seed industry is poised for substantial growth, driven by a confluence of economic, agricultural, and technological factors. The market size is projected to reach approximately 800 Million to 1 Billion by 2025, with a Compound Annual Growth Rate (CAGR) estimated between 7% and 9% during the forecast period of 2025-2033. This robust growth is underpinned by the increasing demand for high-quality animal protein globally, which directly fuels the expansion of Brazil's significant livestock sector, particularly beef and dairy production. Government initiatives promoting sustainable agriculture and enhancing livestock productivity further bolster this demand. Technological disruptions are playing a transformative role, with advancements in seed genetics, biotechnology, and precision farming techniques enabling the development of forage varieties with improved nutritional content, higher yields, and enhanced resilience to environmental challenges such as drought and pests. The adoption of digital tools for farm management and seed selection is also on the rise, optimizing forage production and resource utilization. Evolving consumer behaviors, including a growing preference for ethically produced and high-quality animal products, are indirectly driving the demand for superior forage, which directly impacts animal health and productivity. The industry is witnessing a shift towards more specialized forage solutions tailored to specific livestock needs and regional climatic conditions. Furthermore, the Brazilian government's commitment to modernizing its agricultural infrastructure and providing financial incentives for farmers to adopt advanced farming practices are significant growth catalysts. The ongoing expansion of the soybean and corn cultivation, while significant, has also led to increased demand for rotational grazing and improved pasture management, further driving the forage seed market. Agribusiness consulting services are becoming increasingly important for optimizing forage strategies, contributing to the overall market expansion.

Key Markets & Segments Leading Brazil Forage Seed Industry

The Brazil forage seed industry is dominated by several key markets and segments, with distinct drivers contributing to their leadership.

Production Analysis: The Southeast and Center-West regions of Brazil are the primary hubs for forage seed production. This dominance is attributed to:

- Favorable Climate: These regions offer ideal climatic conditions for cultivating a wide variety of forage grasses and legumes, including Pangola grass, Brachiaria, and alfalfa.

- Vast Agricultural Land: Extensive arable land is available for large-scale forage cultivation, supported by robust agricultural infrastructure.

- Proximity to Consumption Centers: Being close to major livestock farming areas reduces logistical costs and ensures timely supply.

- Government Support: Policies encouraging agricultural expansion and productivity in these regions further incentivize production.

Consumption Analysis: The consumption of forage seed is highest in the Southeast, South, and Center-West regions, mirroring the concentration of the nation's cattle population. Key drivers include:

- Extensive Cattle Ranching: Brazil's status as a major global beef exporter necessitates vast areas of high-quality pasture.

- Dairy Farming Expansion: The growing demand for dairy products supports the need for nutritious forage for dairy cows.

- Intensification of Pastures: Farmers are increasingly investing in improved forage varieties to maximize carrying capacity and animal performance.

- Feedlot Operations: While not solely reliant on pasture, feedlot operations still require high-quality forages as a component of their ration.

Import Market Analysis (Value & Volume): While Brazil is a significant producer, imports play a crucial role, particularly for specialized or high-performance varieties.

- Value: The import market value is estimated to be around 150 Million to 200 Million, with a forecast to grow to 250 Million to 300 Million by 2025.

- Volume: Import volumes are significant, driven by the demand for tropical forages and novel varieties not yet widely produced domestically. Countries like the United States, Australia, and European nations are key suppliers.

- Drivers: Access to advanced genetics, a wider range of species for specific environmental conditions, and filling domestic supply gaps.

Export Market Analysis (Value & Volume): Brazil's export market for forage seed is growing, driven by its agricultural prowess.

- Value: Export value is estimated at 80 Million to 120 Million, with projections to reach 150 Million to 200 Million by 2025.

- Volume: Exports are focused on regions with developing agricultural sectors and a need for adapted forage varieties. South America and parts of Africa are key destinations.

- Drivers: Competitive pricing, the availability of adapted varieties, and Brazil's reputation as a major agricultural exporter.

Price Trend Analysis: Forage seed prices in Brazil are influenced by several factors.

- Supply and Demand: Fluctuations in domestic production and import availability directly impact pricing.

- Input Costs: The cost of fertilizers, labor, and machinery for seed production significantly affects final prices.

- Variety and Quality: High-performance, disease-resistant, and genetically superior seeds command premium prices.

- Currency Exchange Rates: For imported seeds, the exchange rate plays a critical role in determining landed costs.

- Historical Trends: Prices have seen an upward trend over the historical period (2019-2024) due to increased input costs and demand, with an average annual increase of approximately 4-6%.

Brazil Forage Seed Industry Product Developments

Product development in the Brazil forage seed industry is highly dynamic, focusing on enhancing drought tolerance, pest resistance, and nutritional value. Innovations include the introduction of new hybrid varieties of Brachiaria and Panicum, offering superior biomass production and improved digestibility for livestock. Advancements in seed coating technologies are also prevalent, enhancing germination rates and seedling establishment under challenging conditions. Genetic research is leading to forage legumes with higher nitrogen fixation capabilities, reducing the need for synthetic fertilizers. These developments are crucial for improving animal feed efficiency and promoting sustainable agricultural practices within Brazil's vast pastoral farming landscape. The market relevance of these innovations lies in their ability to boost livestock productivity and profitability for farmers.

Challenges in the Brazil Forage Seed Industry Market

The Brazil forage seed market faces several challenges that can impede its growth trajectory.

- Regulatory Hurdles: Navigating complex registration processes for new seed varieties can be time-consuming and costly.

- Climate Change Vulnerability: Extreme weather events like prolonged droughts or excessive rainfall can impact seed production and forage availability.

- Pest and Disease Outbreaks: The spread of specific pests and diseases can decimate forage crops, leading to significant economic losses.

- Inadequate Infrastructure: In some remote agricultural regions, poor transportation and storage infrastructure can hinder efficient seed distribution.

- Informal Seed Market: The presence of an informal seed market can compromise quality and introduce uncertified varieties, impacting overall productivity and farm economics.

Forces Driving Brazil Forage Seed Industry Growth

Several powerful forces are propelling the growth of the Brazil forage seed industry.

- Growing Global Demand for Meat: Brazil's position as a leading meat exporter means an ever-increasing need for high-quality, cost-effective animal feed.

- Expansion of the Livestock Sector: Continuous growth in both beef and dairy cattle populations directly translates to higher demand for superior forage.

- Technological Advancements in Seed Science: Innovations in breeding, genetics, and seed enhancement are creating more resilient and productive forage varieties.

- Government Support and Incentives: Policies promoting agricultural modernization and sustainable farming practices encourage investment in better forage solutions.

- Increasing Focus on Pasture Intensification: Farmers are actively seeking ways to maximize land use and animal productivity, driving the adoption of improved forage seeds.

Challenges in the Brazil Forage Seed Industry Market

The long-term growth catalysts for the Brazil forage seed industry are rooted in innovation and market adaptation. The increasing adoption of precision agriculture and digital farming tools will optimize forage management, leading to better resource allocation and higher yields. Furthermore, the development of climate-resilient forage varieties will be crucial in addressing the impacts of climate change, ensuring consistent supply. Strategic partnerships between research institutions and seed companies will foster continuous product innovation. Expansion into emerging agricultural frontiers within Brazil and exploring export opportunities to other developing agricultural economies will also serve as significant growth catalysts. The focus on sustainable land management and regenerative agriculture practices will further enhance the demand for specialized and high-performing forage seeds.

Emerging Opportunities in Brazil Forage Seed Industry

Emerging trends and opportunities in the Brazil forage seed industry are ripe for exploration.

- Development of Forage for Specialty Diets: Growing demand for niche animal products (e.g., organic, grass-fed) is creating opportunities for forage seeds that support these specific production systems.

- Biotechnology Advancements: Gene editing and other biotechnological tools offer potential for developing forage with enhanced nutritional profiles and stress tolerance.

- Sustainable and Regenerative Agriculture: The global shift towards more environmentally friendly farming practices creates a demand for forage seeds that contribute to soil health and carbon sequestration.

- Expansion into New Geographic Regions: As Brazil's agricultural frontier expands, new areas will require adapted forage solutions.

- Digital Agronomy Services: Integrating advanced data analytics and IoT devices for forage management presents significant opportunities for value-added services.

Leading Players in the Brazil Forage Seed Industry Sector

- DLF Seeds and Science

- Deutsche Saatveredelung AG

- Agria Corporation

- Advanta Seeds (UPL)

- Germisul Seeds Ltd

- Wolf Sementes

- MN Agro Consulting In Seeds & Agribusiness

- SGM Group

- Corteva Agriscience

Key Milestones in Brazil Forage Seed Industry Industry

- 2019: Increased investment in R&D for drought-tolerant forage varieties in response to drier climatic conditions.

- 2020: Launch of several new Brachiaria hybrids by leading companies, offering improved yield and nutritional content.

- 2021: Growing adoption of seed treatment technologies to enhance seedling establishment and protect against early-season pests.

- 2022: Significant M&A activity as larger players sought to consolidate market share and expand product portfolios.

- 2023: Enhanced focus on sustainable forage production practices driven by increased consumer and regulatory pressure.

- 2024: Introduction of digital platforms for forage seed selection and pasture management gaining traction among large-scale producers.

Strategic Outlook for Brazil Forage Seed Industry Market

The strategic outlook for the Brazil forage seed industry is characterized by sustained growth driven by increasing domestic and international demand for animal protein. Key growth accelerators include continued investment in genomic research to develop superior forage varieties, the adoption of digital agriculture for optimized pasture management, and strategic partnerships to expand market reach. The industry will likely see further consolidation through M&A as companies strive for economies of scale and enhanced competitiveness. Companies focusing on sustainable forage solutions and those that can effectively navigate evolving regulatory landscapes will be best positioned for long-term success. Emphasis on providing comprehensive agronomic support alongside seed products will also be a critical differentiator in this dynamic market.

Brazil Forage Seed Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Forage Seed Industry Segmentation By Geography

- 1. Brazil

Brazil Forage Seed Industry Regional Market Share

Geographic Coverage of Brazil Forage Seed Industry

Brazil Forage Seed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Meat and Meat Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Forage Seed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DLF Seeds and Science

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deutsche Saatveredelung AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agria Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advanta Seeds (UPL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Germisul Seeds Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wolf Sementes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MN Agro Consulting In Seeds & Agribusiness

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGM Grou

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 DLF Seeds and Science

List of Figures

- Figure 1: Brazil Forage Seed Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Forage Seed Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Forage Seed Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Brazil Forage Seed Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Brazil Forage Seed Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Brazil Forage Seed Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Brazil Forage Seed Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Brazil Forage Seed Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Brazil Forage Seed Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Brazil Forage Seed Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Brazil Forage Seed Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Brazil Forage Seed Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Brazil Forage Seed Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Brazil Forage Seed Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Forage Seed Industry?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Brazil Forage Seed Industry?

Key companies in the market include DLF Seeds and Science, Deutsche Saatveredelung AG, Agria Corporation, Advanta Seeds (UPL), Germisul Seeds Ltd, Wolf Sementes, MN Agro Consulting In Seeds & Agribusiness, SGM Grou, Corteva Agriscience.

3. What are the main segments of the Brazil Forage Seed Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 410.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increasing Demand for Meat and Meat Products.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Forage Seed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Forage Seed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Forage Seed Industry?

To stay informed about further developments, trends, and reports in the Brazil Forage Seed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence