Key Insights

The European agricultural enzymes market is set for substantial growth, propelled by the increasing demand for sustainable and efficient farming methods. With a projected market size of 635.2 million in the base year of 2025, the sector anticipates a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is driven by European farmers adopting enzyme-based solutions to boost crop yields, enhance nutrient absorption, and strengthen plant resistance to environmental stressors and diseases. The global shift away from synthetic chemicals, alongside stringent environmental regulations, significantly accelerates the adoption of these bio-based alternatives. Furthermore, technological advancements in enzyme development are yielding more effective and economical products, making them increasingly viable for diverse agricultural applications, including soil improvement, seed treatment, and crop protection.

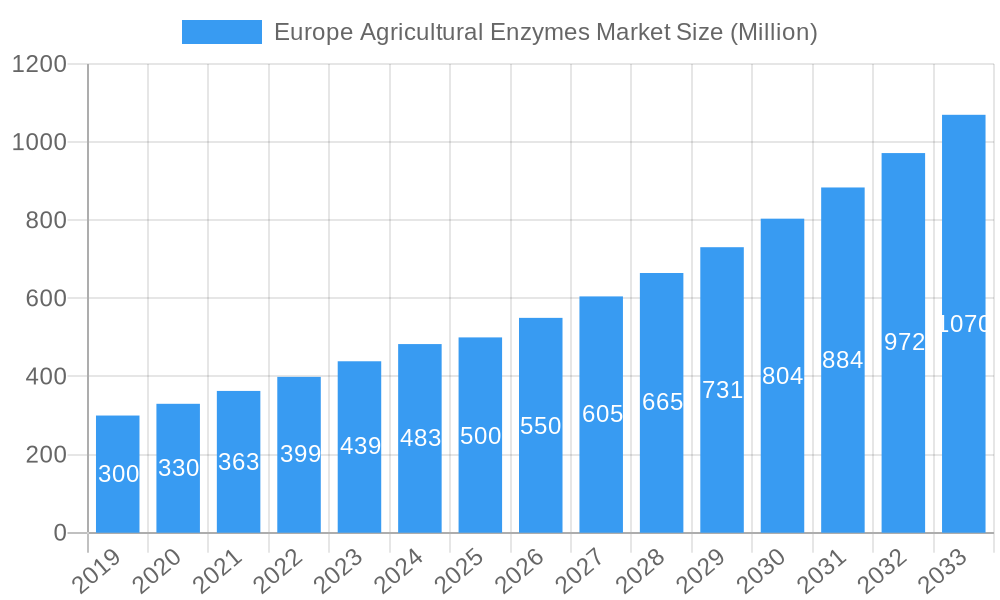

Europe Agricultural Enzymes Market Market Size (In Million)

The market's vibrancy is evident in its segmentation and competitive environment. Production analysis indicates a consistent rise in enzyme manufacturing capacity, while consumption analysis reveals growing adoption across various crop types. Active import and export markets underscore a globalized supply chain for agricultural enzymes within Europe. Price trends are expected to remain stable, potentially declining slightly due to improved production efficiencies and increased competition. Key industry leaders, including Novozymes A/S, BASF SE, and Syngenta AG, are actively investing in research and development to introduce innovative enzyme formulations. Challenges, such as the initial investment cost for smaller farms and the need for enhanced farmer education, are being addressed through strategic collaborations and government-backed initiatives promoting bio-input utilization. The growing emphasis on precision agriculture and the circular economy further solidifies the long-term growth potential for agricultural enzymes in Europe.

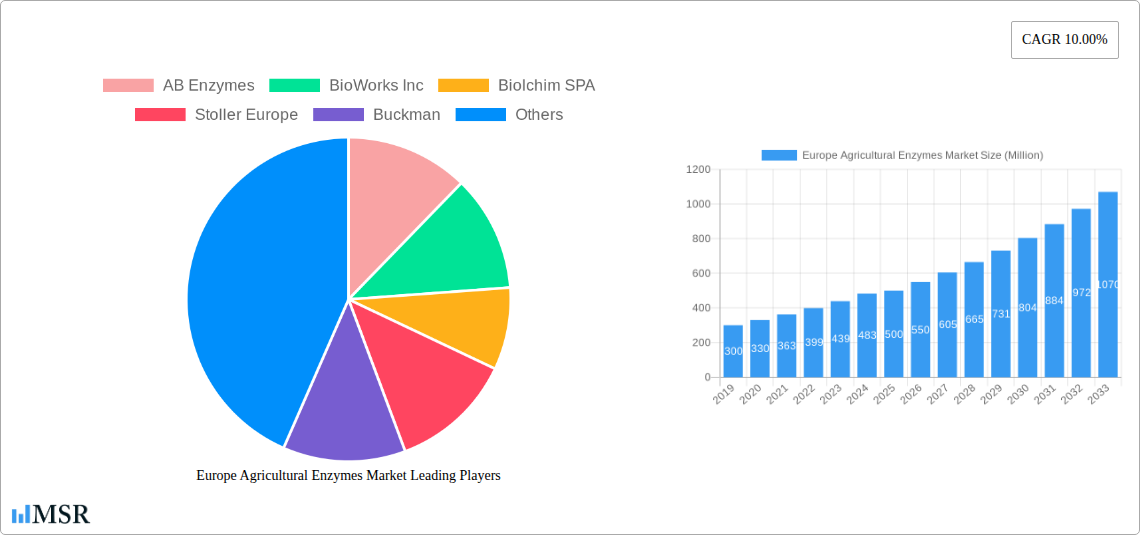

Europe Agricultural Enzymes Market Company Market Share

Europe Agricultural Enzymes Market: In-depth Analysis & Forecast (2019-2033)

Acquire a competitive edge in the expanding Europe agricultural enzymes market with this comprehensive report. Delve into critical growth drivers, market dynamics, and emerging opportunities within this vital sector. This detailed analysis covers production, consumption, import/export (value & volume), price trends, and key industry developments. Uncover actionable insights into market concentration, innovation, regulatory frameworks, and the strategies of leading players such as AB Enzymes, BioWorks Inc, Biolchim SPA, Stoller Europe, Buckman, Elemental Enzyme, Syngenta AG, Novozymes A/S, and BASF SE. This report is essential for farmers, agronomists, enzyme manufacturers, distributors, investors, and policymakers aiming to understand and leverage the growth of agricultural enzymes in Europe.

Europe Agricultural Enzymes Market Market Concentration & Dynamics

The Europe agricultural enzymes market exhibits a moderate to high concentration, with a few key players dominating market share. This dominance is fueled by significant investments in research and development, robust intellectual property portfolios, and established distribution networks across the continent. Innovation ecosystems are vibrant, driven by academic-industry collaborations focused on developing novel enzyme formulations for enhanced crop yields, improved nutrient uptake, and reduced reliance on synthetic fertilizers and pesticides. Regulatory frameworks, particularly those set by the European Union, play a crucial role, influencing product registration, labeling, and permissible application rates. The market is characterized by a growing demand for sustainable agricultural practices, pushing the development of eco-friendly agricultural enzymes. Substitute products, such as synthetic fertilizers and conventional pesticides, continue to pose a competitive challenge, albeit with increasing consumer and regulatory pressure favoring biological solutions. End-user trends are strongly influenced by a desire for precision agriculture, increased farm profitability, and adherence to stringent environmental standards. Merger and acquisition (M&A) activities, while not as frequent as in some other sectors, are strategic maneuvers by established companies to acquire innovative technologies or expand their market reach within specific product categories or geographic sub-regions. For instance, recent M&A deal counts indicate a trend towards consolidating specialized enzyme producers to offer comprehensive solutions to farmers. The market share of leading players is estimated to be in the range of 15-25% for the top three companies.

Europe Agricultural Enzymes Market Industry Insights & Trends

The Europe agricultural enzymes market is poised for substantial growth, driven by a confluence of economic, technological, and environmental factors. The market size was valued at approximately $850 Million in the base year 2025, and it is projected to reach $1,700 Million by the end of the forecast period in 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 9.5%. This expansion is underpinned by increasing global food demand, necessitating more efficient and sustainable agricultural practices. Technological disruptions are at the forefront, with advancements in enzyme engineering leading to the development of highly specific and effective enzymes for a wide array of agricultural applications. These include enzymes that enhance soil health by improving nutrient availability, break down crop residues for faster decomposition, and protect crops against various pathogens. Evolving consumer behaviors, particularly a growing preference for organically produced food and a heightened awareness of the environmental impact of conventional farming, are significantly influencing the demand for bio-based agricultural solutions. Farmers are increasingly adopting these enzymes to comply with stricter environmental regulations, reduce their carbon footprint, and improve the overall sustainability of their operations. Furthermore, government initiatives and subsidies aimed at promoting sustainable agriculture and precision farming techniques are providing a significant boost to market adoption. The integration of enzymes into precision agriculture systems, enabling targeted application based on crop needs, is another key trend. The Europe agricultural enzymes market is thus transitioning from a niche segment to a mainstream component of modern farming, driven by a commitment to both economic viability and ecological responsibility.

Key Markets & Segments Leading Europe Agricultural Enzymes Market

The Europe agricultural enzymes market is characterized by dynamic regional and segmental contributions to its overall growth. From a Production Analysis: perspective, Germany, France, and the Netherlands are emerging as key production hubs, owing to their strong agricultural sectors, established biotechnology infrastructure, and supportive government policies for R&D. These countries benefit from significant economic growth and a high adoption rate of advanced farming techniques. The Consumption Analysis: reveals that Western European countries, including the UK, Spain, and Italy, are leading in the adoption of agricultural enzymes, driven by intensive farming practices and a greater emphasis on crop yield optimization and soil health. Infrastructure development in terms of distribution networks and technical support for farmers further fuels consumption in these regions.

For the Import Market Analysis (Value & Volume):, countries with a high demand for specialized enzymes and limited domestic production capabilities, such as Switzerland and Scandinavian nations, are significant import markets. The value of imports is projected to reach approximately $600 Million by 2025. The Export Market Analysis (Value & Volume): indicates that countries with strong manufacturing capabilities and innovative product portfolios, such as Denmark (home to Novozymes A/S) and Germany, are major exporters, with export value estimated at around $550 Million in 2025.

The Price Trend Analysis: for agricultural enzymes in Europe has seen a gradual stabilization, with fluctuations driven by raw material costs, production efficiencies, and market competition. While premium, specialized enzymes command higher prices, the increasing availability of cost-effective alternatives is exerting downward pressure. The Industry Developments: segment highlights a strong focus on developing enzymes for specific crop types and soil conditions, catering to diverse agricultural needs across Europe.

Europe Agricultural Enzymes Market Product Developments

Product development in the Europe agricultural enzymes market is sharply focused on enhancing efficacy, sustainability, and ease of application. Innovations are centered around enzymes that improve nutrient solubilization, stimulate root development, and enhance plant resistance to biotic and abiotic stresses. Key advancements include the development of multi-enzyme formulations that offer synergistic effects, leading to more robust crop performance. Applications are expanding beyond traditional use in animal feed to direct application on crops and in soil amendments, boosting soil microbial activity and nutrient cycling. Companies are investing in research for enzymes that can degrade complex organic matter, thereby improving soil structure and water retention. The competitive edge lies in developing enzymes with extended shelf life, improved stability under varying environmental conditions, and compatibility with existing agricultural machinery.

Challenges in the Europe Agricultural Enzymes Market Market

The Europe agricultural enzymes market faces several challenges that could impede its growth trajectory. Regulatory hurdles, particularly the stringent approval processes for new biological products within the EU, can lead to extended time-to-market and increased R&D costs. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can affect the availability and cost of raw materials, impacting production volumes and pricing. Competitive pressures from established synthetic agrochemicals remain a significant factor, requiring continuous innovation and market education to demonstrate the superior long-term benefits of enzyme-based solutions. Furthermore, the initial cost of enzyme products can be a barrier for some smaller-scale farmers, necessitating efforts to improve cost-effectiveness and demonstrate a clear return on investment. The lack of widespread farmer awareness and understanding of enzyme applications also presents a challenge, requiring concerted educational campaigns and technical support.

Forces Driving Europe Agricultural Enzymes Market Growth

Several powerful forces are propelling the growth of the Europe agricultural enzymes market. The escalating demand for sustainable and environmentally friendly agricultural practices, driven by consumer preferences and stringent EU regulations, is a primary catalyst. Technological advancements in enzyme engineering are leading to the development of more potent, targeted, and cost-effective enzyme formulations. Increased awareness among farmers regarding the benefits of improved nutrient use efficiency, enhanced crop yields, and reduced reliance on chemical inputs is fostering wider adoption. Government initiatives and subsidies supporting the transition to bio-based agriculture and precision farming techniques further accelerate market penetration. The growing understanding of the vital role of soil health in overall agricultural productivity is also a significant driver, as enzymes play a crucial role in nutrient cycling and microbial activity within the soil ecosystem.

Challenges in the Europe Agricultural Enzymes Market Market

The long-term growth of the Europe agricultural enzymes market hinges on overcoming persistent challenges and capitalizing on emerging trends. Continued investment in research and development is critical to unlock new enzyme applications and improve the efficacy of existing products. Strategic partnerships between enzyme manufacturers, agricultural technology providers, and research institutions can accelerate innovation and market penetration. Expansion into under-served geographical regions within Europe and exploring new crop segments will be crucial for sustained growth. Furthermore, ongoing efforts to educate farmers about the benefits and proper application of agricultural enzymes are essential to foster trust and drive adoption. The development of integrated solutions that combine enzymes with other biological inputs and precision agriculture tools will also be a key growth catalyst.

Emerging Opportunities in Europe Agricultural Enzymes Market

The Europe agricultural enzymes market presents a wealth of emerging opportunities for stakeholders. The increasing focus on regenerative agriculture and organic farming practices creates a significant demand for bio-based inputs like agricultural enzymes. Innovations in enzyme delivery systems, such as encapsulated enzymes for controlled release, offer enhanced performance and convenience for farmers. The development of enzymes tailored for specific crops and regional soil conditions, enabling precision agriculture, is another key opportunity. Furthermore, the growing interest in biostimulants and biofertilizers presents a fertile ground for enzyme-based products that enhance nutrient uptake and plant vitality. Exploring new applications, such as enzymes for wastewater treatment in agricultural settings or for the valorization of agricultural by-products, also represents promising avenues for market expansion.

Leading Players in the Europe Agricultural Enzymes Market Sector

- AB Enzymes

- BioWorks Inc

- Biolchim SPA

- Stoller Europe

- Buckman

- Elemental Enzyme

- Syngenta AG

- Novozymes A/S

- BASF SE

Key Milestones in Europe Agricultural Enzymes Market Industry

- 2019: Launch of a new generation of plant growth-promoting enzymes by Novozymes A/S, enhancing nutrient uptake in cereals.

- 2020: AB Enzymes acquires a strategic stake in a European biotech firm to expand its portfolio of industrial enzymes for agricultural applications.

- 2021: BASF SE announces significant R&D investment in novel enzyme formulations for sustainable crop protection.

- 2022: Syngenta AG partners with a leading European university to develop enzymes for improved soil health and carbon sequestration.

- 2023: BioWorks Inc introduces a new range of soil enzyme activators to enhance microbial activity in vineyards across Southern Europe.

- 2024: Biolchim SPA expands its European distribution network to enhance the accessibility of its agricultural enzyme products.

- 2025 (Estimated): Launch of novel enzyme blends for enhanced stress tolerance in crops facing climate change impacts.

- 2026 (Projected): Increased adoption of drone-based enzyme application technologies for precision farming.

- 2028 (Projected): Development of highly specific enzymes targeting fungal pathogens with reduced environmental impact.

- 2030 (Projected): Significant market share gained by enzyme-based solutions replacing a portion of synthetic fertilizer usage.

- 2033 (Projected): Widespread integration of AI-driven enzyme recommendations for optimized crop management.

Strategic Outlook for Europe Agricultural Enzymes Market Market

The strategic outlook for the Europe agricultural enzymes market is exceptionally positive, driven by an unwavering global commitment to sustainable agriculture. Growth accelerators include the continued development of highly specialized enzymes for niche crop requirements and challenging environmental conditions. Further innovation in synergistic enzyme formulations, combining multiple enzymatic activities for enhanced biological impact, will drive market share. Strategic collaborations between enzyme manufacturers, seed companies, and ag-tech providers will create integrated solutions for farmers, fostering wider adoption. The increasing regulatory push for reduced chemical pesticide and fertilizer usage will inevitably lead to greater reliance on biological alternatives like agricultural enzymes. Market expansion will also be fueled by geographical penetration into Eastern European markets and the development of cost-effective solutions suitable for a broader range of farming operations.

Europe Agricultural Enzymes Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Agricultural Enzymes Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

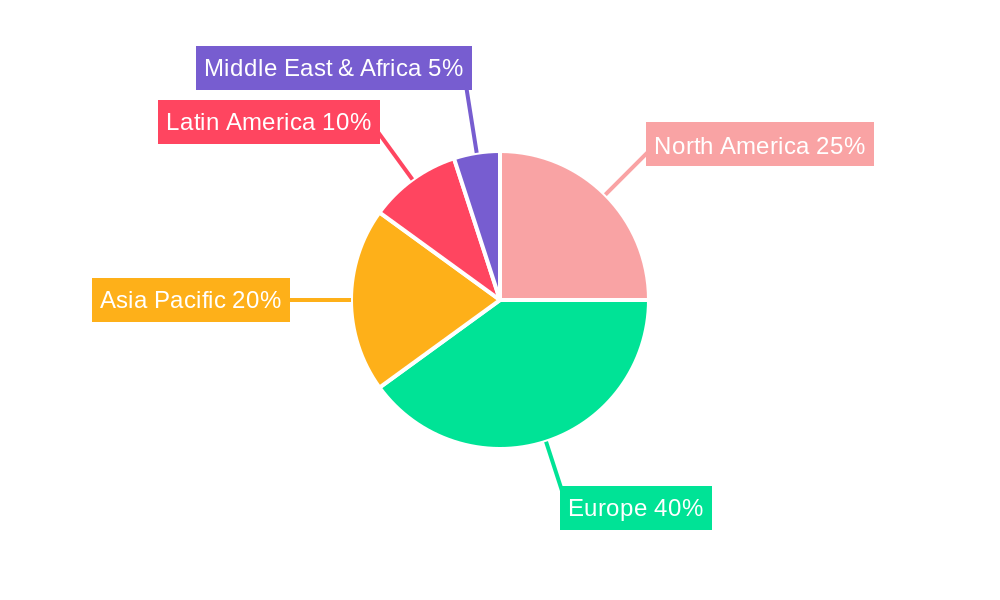

Europe Agricultural Enzymes Market Regional Market Share

Geographic Coverage of Europe Agricultural Enzymes Market

Europe Agricultural Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Rising demand for Organic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Agricultural Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Enzymes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BioWorks Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biolchim SPA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stoller Europe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Buckman

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elemental Enzyme

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Syngenta AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novozymes A/S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BASF SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 AB Enzymes

List of Figures

- Figure 1: Europe Agricultural Enzymes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Agricultural Enzymes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Agricultural Enzymes Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Agricultural Enzymes Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Agricultural Enzymes Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Agricultural Enzymes Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Agricultural Enzymes Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Agricultural Enzymes Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Europe Agricultural Enzymes Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Agricultural Enzymes Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Agricultural Enzymes Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Agricultural Enzymes Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Agricultural Enzymes Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Agricultural Enzymes Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Agricultural Enzymes Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Europe Agricultural Enzymes Market?

Key companies in the market include AB Enzymes, BioWorks Inc, Biolchim SPA, Stoller Europe, Buckman, Elemental Enzyme, Syngenta AG, Novozymes A/S, BASF SE.

3. What are the main segments of the Europe Agricultural Enzymes Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 635.2 million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Rising demand for Organic Products.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Agricultural Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Agricultural Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Agricultural Enzymes Market?

To stay informed about further developments, trends, and reports in the Europe Agricultural Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence