Key Insights

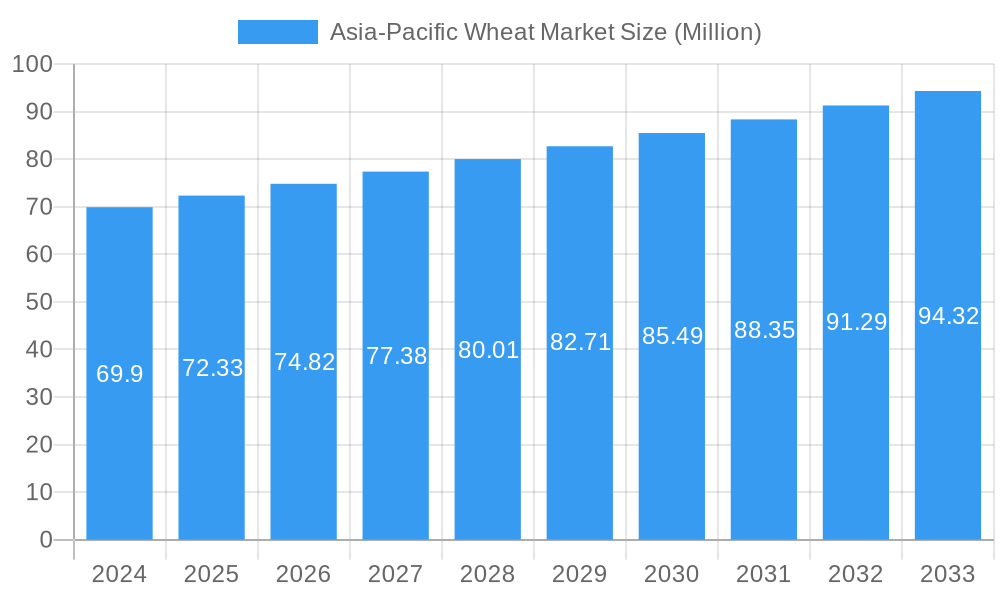

The Asia-Pacific Wheat Market is a significant and evolving sector, projected to reach a market size of $72.33 million with a Compound Annual Growth Rate (CAGR) of 3.00% through 2033. This steady growth is primarily fueled by increasing global demand for staple food grains, particularly in populous Asian nations, and the continuous adoption of advanced agricultural technologies aimed at enhancing yield and crop resilience. Key drivers include the growing need for food security in the region, government initiatives promoting agricultural modernization and support for farmers, and the rising disposable incomes that contribute to a diversified dietary intake, including a greater consumption of wheat-based products. Furthermore, the expansion of the food processing industry, which relies heavily on wheat as a raw material for bread, pasta, and other processed foods, directly contributes to market expansion. Innovations in seed technology, offering improved disease resistance and higher nutritional value, are also pivotal in sustaining and growing the market.

Asia-Pacific Wheat Market Market Size (In Million)

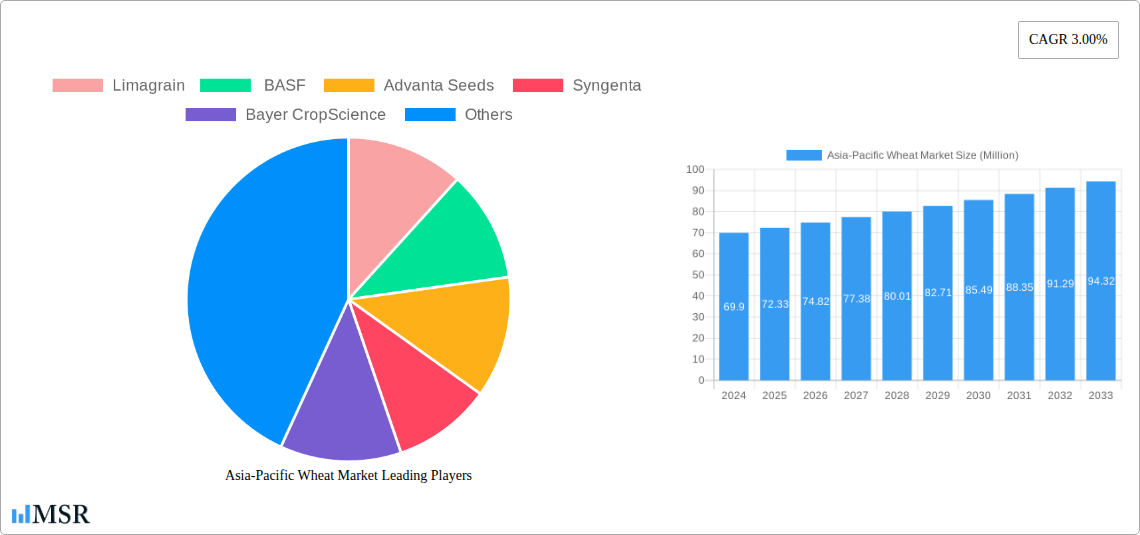

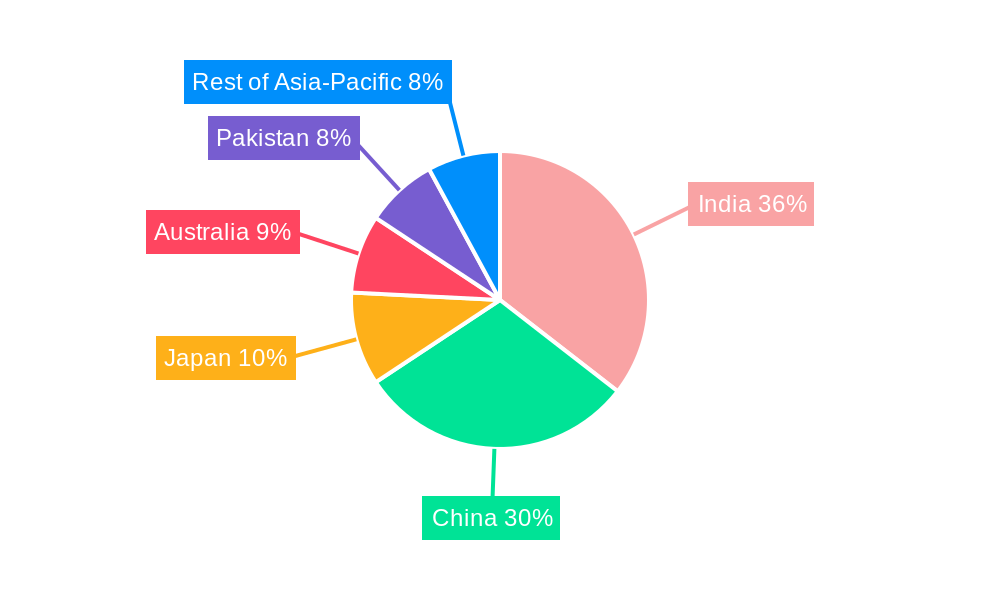

The market's trajectory is further shaped by distinct trends and challenges. Emerging trends like the development of climate-resilient wheat varieties, sustainable farming practices, and the increasing demand for high-quality, specialized wheat for niche applications are gaining traction. However, the market also faces restraints such as fluctuating weather patterns, the impact of climate change on crop yields, volatile commodity prices, and trade policies that can influence import and export dynamics. Geographically, countries like India and China are dominant players, driven by their vast agricultural land and substantial domestic consumption. Other significant contributors include Japan, Australia, and Pakistan, each with unique market characteristics influenced by their agricultural policies, technological adoption, and export capabilities. The competitive landscape is characterized by the presence of major global players such as Limagrain, BASF, Advanta Seeds, Syngenta, and Bayer CropScience, who are actively involved in research and development, product innovation, and strategic collaborations to capture market share.

Asia-Pacific Wheat Market Company Market Share

Here is an SEO-optimized, engaging report description for the Asia-Pacific Wheat Market, incorporating your specified keywords, structure, and content:

Asia-Pacific Wheat Market: Comprehensive Analysis & Forecast (2019–2033)

Report Description:

Gain a profound understanding of the dynamic Asia-Pacific wheat market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into production, consumption, import/export dynamics, and price trends. Explore critical industry developments, product innovations from leading players like Limagrain, BASF, Syngenta, and Bayer CropScience, and actionable insights into market concentration, growth drivers, challenges, and emerging opportunities. This report is an indispensable resource for industry stakeholders seeking to navigate and capitalize on the evolving wheat production in Asia-Pacific, wheat consumption trends in Asia-Pacific, Asia-Pacific wheat import market, Asia-Pacific wheat export market, and wheat price analysis Asia-Pacific.

Asia-Pacific Wheat Market Market Concentration & Dynamics

The Asia-Pacific wheat market exhibits moderate to high concentration, primarily driven by the presence of a few dominant agricultural nations and a consolidated seed and agrochemical industry. Key players like Limagrain, BASF, Advanta Seeds, Syngenta, Bayer CropScience, and Nuseed are actively shaping market dynamics through innovation and strategic alliances. The innovation ecosystem is robust, with significant investment in research and development for higher-yielding, disease-resistant, and climate-resilient wheat varieties. Regulatory frameworks vary across countries, impacting trade policies, import/export regulations, and the adoption of genetically modified (GM) crops. Substitute products, such as rice and other grains, exert some influence, particularly in staple food consumption patterns, but wheat's versatility ensures its sustained demand. End-user trends reveal a growing demand for specialty wheat for baking, animal feed, and processed food industries. Merger and acquisition (M&A) activities are notable, with companies consolidating their market positions and expanding their technological portfolios. For instance, recent M&A activities in the global agrochemical and seed sector are likely to have ripple effects within the Asia-Pacific region. The market share of major players is significant, with estimations suggesting top companies hold substantial portions of the specialized wheat seed market.

Asia-Pacific Wheat Market Industry Insights & Trends

The Asia-Pacific wheat market is experiencing robust growth, driven by a confluence of economic development, evolving dietary habits, and advancements in agricultural technology. The market size is projected to reach substantial figures, with a Compound Annual Growth Rate (CAGR) anticipated to be in the range of 4.5% to 6.0% during the forecast period (2025–2033). This growth is underpinned by increasing population, rising disposable incomes leading to higher demand for diverse food products, and government initiatives aimed at enhancing food security and agricultural productivity. Technological disruptions are at the forefront, with precision agriculture, advanced breeding techniques, and biotechnology playing pivotal roles in improving wheat yields and quality. For example, the development of drought-tolerant and pest-resistant wheat varieties is crucial in regions facing climate change challenges. Evolving consumer behaviors are also significant; a growing preference for healthier food options and demand for specific wheat varieties for baking and processed foods are creating new market niches. The expansion of the middle class in countries like China, India, and Southeast Asian nations is directly correlating with an increased consumption of wheat-based products, from bread and noodles to pastries and animal feed. Furthermore, investments in modern milling and processing infrastructure are enabling the efficient utilization of wheat, further bolstering market demand. The Asia-Pacific wheat market value is expected to see significant appreciation due to these factors.

Key Markets & Segments Leading Asia-Pacific Wheat Market

The Asia-Pacific wheat market's dominance is distributed across several key regions and segments, with China and India standing out as the largest contributors to both production and consumption.

- Production Analysis: China, as the world's largest wheat producer, significantly influences global supply. Its vast agricultural land and government support for grain production are key drivers. India follows as another major producer, with policies focused on increasing yields and farmer incomes. Australia is a crucial exporter, contributing significantly to regional and global trade.

- Drivers: Government subsidies for wheat cultivation, advancements in farming techniques, favorable agro-climatic conditions in key regions, and the adoption of high-yield seed varieties.

- Consumption Analysis: The sheer population size in China and India makes them the largest consumers of wheat, driven by staple food consumption. Southeast Asian countries, with their rapidly growing economies and evolving diets, represent a significant growth area for wheat consumption, moving beyond traditional rice-based diets.

- Drivers: Growing population, increasing disposable income, shifting dietary patterns towards more bread and noodle consumption, and the expanding processed food industry.

- Import Market Analysis (Value & Volume): Southeast Asian nations, particularly Vietnam, Indonesia, and the Philippines, are major importers of wheat. They rely on imports to supplement domestic production and meet their growing demand for animal feed and food processing. Australia and Russia are key suppliers to this region.

- Drivers: Insufficient domestic production to meet demand, competitive pricing from major exporting nations, and the need for specific wheat grades for various industrial applications.

- Export Market Analysis (Value & Volume): Australia is a dominant wheat exporter in the Asia-Pacific region, known for its high-quality feed and milling wheat. Russia has also emerged as a significant player, offering competitive pricing.

- Drivers: Favorable climate for wheat cultivation, advanced agricultural infrastructure, strong government support for export-oriented agriculture, and established trade relationships.

- Price Trend Analysis: Wheat prices in the Asia-Pacific region are influenced by global commodity markets, domestic production levels, currency fluctuations, and trade policies. Weather events in major producing countries, geopolitical situations affecting supply chains, and changes in demand from large consumers like China and India significantly impact price trends.

- Drivers: Global supply and demand dynamics, weather patterns affecting harvests, input costs (fertilizers, energy), and government trade interventions.

Asia-Pacific Wheat Market Product Developments

The Asia-Pacific wheat market is witnessing significant product innovation, driven by companies like Limagrain and BASF, focusing on enhancing yield, resilience, and quality. In February 2022, Limagrain launched the First CoAXium Soft White Winter wheat variety, offering high yield potential, good straw strength, and excellent tolerance to wheat streak mosaic virus and stripe rust, addressing key farmer concerns. Demonstrating a commitment to advancing wheat genetics, BASF introduced Ideltis as the seed brand name for its future hybrid wheat in July 2021, aiming for higher and more stable performance in yield and quality for farmers. Further solidifying their presence, in October 2022, BASF and its partner Seednet released Kingston and Reilly wheat varieties for the Australian market. Kingston wheat boasts high yield potential, superior grain quality, exceptional straw strength, and outstanding lodging resistance, while Reilly wheat excels in grain quality and offers exceptional resistance to stripe rust pathotypes. These developments highlight a strong trend towards genetically improved varieties that combat prevalent diseases and environmental stresses, crucial for ensuring stable wheat supply in Asia-Pacific.

Challenges in the Asia-Pacific Wheat Market Market

The Asia-Pacific wheat market faces several significant challenges. Regulatory hurdles, including varying import/export policies and stringent food safety standards across different countries, can impede market access and increase operational complexities. Supply chain disruptions, exacerbated by logistical inefficiencies, inadequate storage facilities, and the impact of global events, can lead to price volatility and shortages. Competitive pressures from other grain staples, particularly rice in many Asian diets, and the pricing strategies of major global wheat exporters, pose ongoing challenges. Furthermore, climate change impacts, including extreme weather events like droughts and floods, threaten crop yields and the stability of Asia-Pacific wheat production. The increasing cost of agricultural inputs, such as fertilizers and pesticides, also puts pressure on farmer profitability and overall market competitiveness.

Forces Driving Asia-Pacific Wheat Market Growth

Several key forces are driving the growth of the Asia-Pacific wheat market. Technological advancements in seed breeding and agricultural practices are leading to higher yields and more resilient crops, crucial for meeting growing demand. The expanding middle class in many Asian economies is fueling a shift in dietary preferences, with increased consumption of wheat-based products like bread, noodles, and pastries. Government initiatives promoting food security, agricultural modernization, and trade facilitation are also providing a significant impetus. The burgeoning animal feed industry across the region, particularly in China and Southeast Asia, is a substantial driver for feed-grade wheat. Furthermore, the increasing adoption of innovative farming techniques, including precision agriculture and digital farming solutions, is enhancing efficiency and productivity across the value chain, contributing to the overall expansion of the wheat market size Asia-Pacific.

Challenges in the Asia-Pacific Wheat Market Market

Long-term growth catalysts for the Asia-Pacific wheat market are deeply rooted in continuous innovation and strategic market expansion. Investments in research and development for drought-resistant and climate-resilient wheat varieties are paramount, ensuring sustained productivity amidst changing environmental conditions. Strategic partnerships and collaborations between seed companies, agrochemical providers, and local distributors can facilitate wider market penetration and technology transfer. Exploring untapped rural markets and developing tailored solutions for smallholder farmers will unlock new growth avenues. Furthermore, the increasing focus on value-added wheat products and the expansion of the food processing industry will continue to drive demand for diverse wheat types. Government support for infrastructure development, including improved logistics and storage, will be crucial for ensuring efficient supply chains and price stability, supporting the sustained growth of wheat trade in Asia-Pacific.

Emerging Opportunities in Asia-Pacific Wheat Market

Emerging opportunities in the Asia-Pacific wheat market are diverse and promising. The rising demand for specialty wheat products, such as whole grain, organic, and gluten-free options, presents a significant niche market. Advancements in biotechnology and gene editing offer potential for developing wheat varieties with enhanced nutritional profiles and improved stress tolerance, catering to evolving consumer health consciousness. The growing popularity of plant-based diets also creates opportunities for wheat as a key ingredient in various meat alternatives and food products. Furthermore, the development of sustainable agricultural practices and the demand for traceability in the food supply chain present opportunities for companies that can offer environmentally friendly wheat solutions. The expansion of e-commerce platforms for agricultural inputs and produce also provides new avenues for market reach and consumer engagement. These trends are expected to significantly shape the future Asia-Pacific wheat market landscape.

Leading Players in the Asia-Pacific Wheat Market Sector

- Limagrain

- BASF

- Advanta Seeds

- Syngenta

- Bayer CropScience

- Nuseed

Key Milestones in Asia-Pacific Wheat Market Industry

- February 2022: Limagrain launched the First CoAXium Soft White Winter wheat variety, emphasizing high yield potential, good straw strength, and superior tolerance to wheat streak mosaic virus and stripe rust.

- October 2022: BASF and its commercial partner Seednet released two new wheat varieties, Kingston and Reilly, for the Australian market. Kingston wheat offers high yield potential, grain quality, exceptional straw strength, and lodging resistance, while Reilly wheat provides excellent grain quality and stripe rust resistance.

- July 2021: BASF introduced Ideltis as the seed brand name for its future hybrid wheat, aiming for higher and more stable performance in yield and quality for farmers.

Strategic Outlook for Asia-Pacific Wheat Market Market

The strategic outlook for the Asia-Pacific wheat market is characterized by sustained growth driven by demographic expansion, evolving consumer preferences, and technological advancements. Key growth accelerators include the increasing demand for wheat-based food products, the expansion of the animal feed industry, and government policies aimed at enhancing agricultural self-sufficiency and trade. Strategic opportunities lie in the development and adoption of climate-resilient wheat varieties, precision agriculture technologies, and value-added processing. Companies focusing on sustainable farming practices and digital solutions are well-positioned to capture market share. The region's diverse markets offer scope for customized product offerings and market entry strategies, ensuring continued expansion and innovation in the Asia-Pacific wheat sector.

Asia-Pacific Wheat Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Wheat Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Pakistan

Asia-Pacific Wheat Market Regional Market Share

Geographic Coverage of Asia-Pacific Wheat Market

Asia-Pacific Wheat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. The Increasing Demand for Wheat Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.6.2. China

- 5.6.3. Japan

- 5.6.4. Australia

- 5.6.5. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. India Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. China Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Japan Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Australia Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Pakistan Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Limagrain

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Advanta Seeds

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Syngenta

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bayer CropScience

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nuseed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Limagrain

List of Figures

- Figure 1: Asia-Pacific Wheat Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Wheat Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Wheat Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 20: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 32: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Wheat Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Asia-Pacific Wheat Market?

Key companies in the market include Limagrain, BASF , Advanta Seeds , Syngenta , Bayer CropScience , Nuseed.

3. What are the main segments of the Asia-Pacific Wheat Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.33 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

The Increasing Demand for Wheat Protein.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

February 2022: Limagrain launched the First CoAXium Soft White Winter wheat variety with high yield potential, good straw strength, and very good tolerance to wheat streak mosaic virus and stripe rust.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Wheat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Wheat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Wheat Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Wheat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence