Key Insights

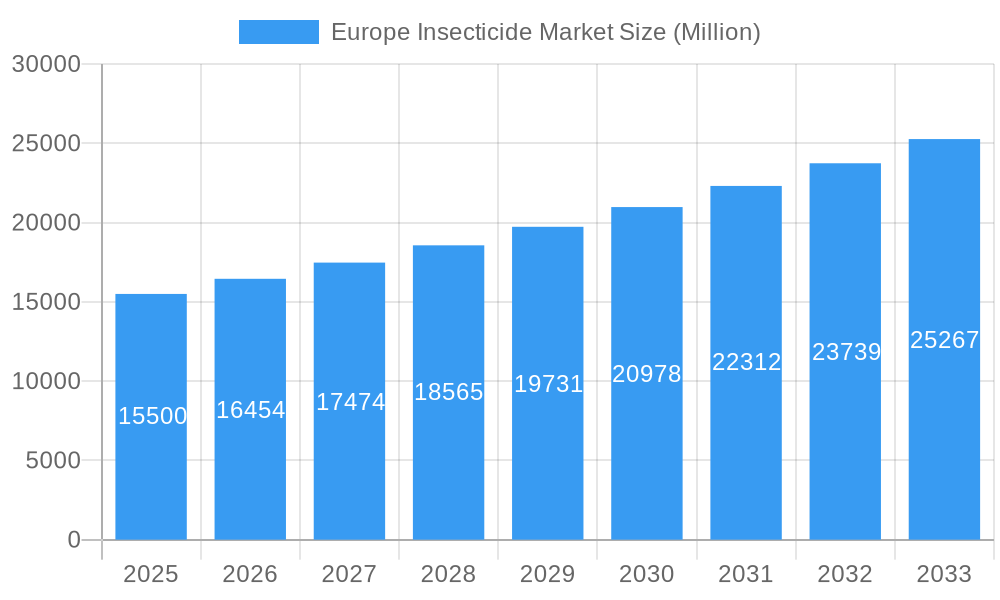

The European insecticide market is projected for substantial growth, expected to reach $15.5 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 4.64% through 2033. This expansion is fueled by the increasing demand for effective crop protection solutions to support a growing global population and enhance food security across Europe. Key growth factors include the adoption of advanced farming techniques like chemigation and foliar applications, which optimize insecticide efficacy and delivery. Furthermore, the rise in pest infestations, exacerbated by climate change and monoculture farming, necessitates advanced insect control strategies. The market is also seeing a trend towards sustainable formulations, including bio-insecticides and integrated pest management (IPM), influenced by stringent regulations and growing consumer awareness of food safety and environmental impact.

Europe Insecticide Market Market Size (In Billion)

Market dynamics are further shaped by continuous product innovation, with significant R&D investment in novel active ingredients and formulations to combat resistance and improve safety profiles. Seed treatment is gaining prominence as a key application, offering early-stage crop protection. While growth prospects remain strong, regulatory scrutiny on certain chemical insecticides, potential pest resistance, and fluctuating raw material costs present challenges. However, diverse application areas including commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, and turf & ornamentals, offer significant opportunities. Leading companies such as Bayer AG, Syngenta Group, BASF SE, and UPL Limited are actively driving innovation and strategic expansion within the European market.

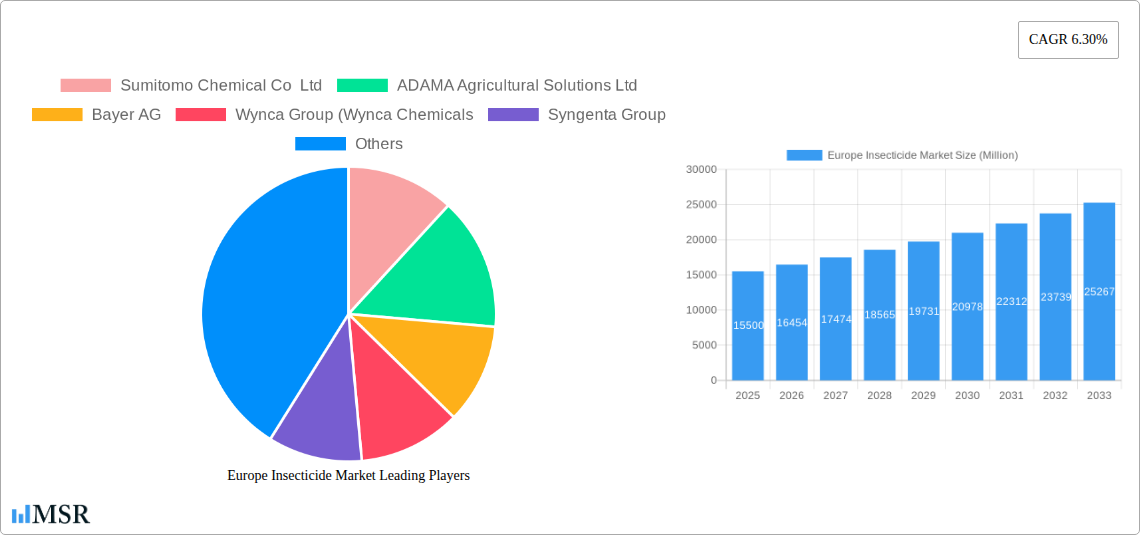

Europe Insecticide Market Company Market Share

Europe Insecticide Market: Comprehensive Analysis & Growth Forecast (2019-2033)

Unlock critical insights into the dynamic Europe Insecticide Market with our in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report offers a definitive guide for stakeholders seeking to navigate the complexities of crop protection solutions across Europe. Understand market dynamics, key players like Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals), Syngenta Group, UPL Limited, BASF SE, FMC Corporation, Corteva Agriscience, and Nufarm Ltd, and leverage actionable strategies for growth. This report is meticulously crafted for immediate use, requiring no further modifications.

Europe Insecticide Market Market Concentration & Dynamics

The Europe Insecticide Market exhibits a moderately concentrated landscape, with a few dominant players, including Bayer AG, Syngenta Group, and BASF SE, holding significant market share. Innovation is a key driver, with companies investing heavily in R&D to develop novel, more sustainable, and targeted insecticide formulations. The regulatory framework in Europe, particularly stringent due to the European Union's focus on environmental protection and food safety, significantly influences product development and market entry. This includes a rigorous approval process for new active ingredients and restrictions on certain older chemistries. The ecosystem is characterized by a growing demand for integrated pest management (IPM) solutions and a shift towards biological insecticides, posing a threat from substitute products. End-user trends are increasingly favoring precision agriculture techniques and digital farming solutions, influencing the application modes and demand for specific insecticide types. Mergers and acquisitions (M&A) activities, though not as frequent as in other sectors, play a crucial role in consolidating market share and expanding product portfolios. For instance, key acquisitions in the historical period have reshaped competitive dynamics, with approximately 5-10 significant M&A deals anticipated in the forecast period, impacting market concentration.

- Market Share Concentration: Top 5 players estimated to hold over 60% of the market share by 2025.

- Innovation Ecosystem: Strong focus on R&D for bio-based and low-toxicity insecticides.

- Regulatory Impact: EU's stringent regulations influence product approvals and market access.

- Substitute Products: Growing adoption of biological control agents and precision farming.

- M&A Activities: Strategic acquisitions and partnerships to enhance portfolio and market reach.

Europe Insecticide Market Industry Insights & Trends

The Europe Insecticide Market is poised for significant growth, driven by an escalating demand for increased agricultural productivity to feed a growing population and the imperative to protect crops from a wide array of destructive pests. The market size was estimated at approximately $6,500 Million in the base year 2025, and it is projected to grow at a Compound Annual Growth Rate (CAGR) of around 4.2% during the forecast period of 2025–2033. This upward trajectory is fueled by several critical factors. Firstly, the continuous threat of pest infestations, exacerbated by climate change leading to unpredictable weather patterns and the emergence of new pest species, necessitates robust crop protection strategies. Secondly, technological advancements in pesticide formulations, including the development of more targeted, efficient, and environmentally friendly insecticides, are driving adoption. This includes the rise of neonicotinoid alternatives and the increasing integration of digital technologies for precise application, minimizing environmental impact. Evolving consumer behaviors, with a growing preference for sustainably produced food and reduced pesticide residues, are compelling manufacturers to innovate towards safer and more eco-conscious products. The European Union's Green Deal and its Farm to Fork Strategy, aiming for a more sustainable food system, are further pushing the market towards greener solutions, including biological insecticides and reduced reliance on synthetic chemicals. However, the market also faces challenges from increasing regulatory scrutiny and the potential for pest resistance development, which requires continuous research and development efforts. The overall trend indicates a market that is not only expanding in volume but also evolving in its composition and technological sophistication, with a projected market size of over $9,000 Million by 2033.

Key Markets & Segments Leading Europe Insecticide Market

The Europe Insecticide Market is characterized by strong performance across several key segments, with specific application modes and crop types demonstrating remarkable dominance. Within Application Mode, Foliar application consistently leads the market due to its broad applicability and direct impact on pest control during critical growth stages of crops. This method is essential for managing a wide spectrum of chewing and sucking insects across diverse agricultural settings. Soil Treatment, while a smaller segment, is crucial for long-term pest management and is gaining traction with the development of novel granular formulations and nematicides. Seed Treatment is also a growing area, offering early-stage protection against soil-borne pests and reducing the need for subsequent foliar applications. The Crop Type segmentation reveals that Commercial Crops and Grains & Cereals represent the largest market shares. The vast cultivation areas of staple crops like wheat, barley, and corn across major European agricultural nations necessitate substantial insecticide usage to ensure yield security. Fruits & Vegetables represent another significant segment, characterized by high-value crops that are particularly susceptible to pest damage, driving demand for specialized and effective insecticide solutions. The Turf & Ornamental segment, though smaller in overall volume, is a high-value niche driven by professional landscaping, golf courses, and sports facilities, where aesthetic appeal and pest-free conditions are paramount. Economically, countries with large agricultural sectors, such as France, Germany, Spain, and Italy, are leading the market demand due to their extensive cultivation of cereals, fruits, vegetables, and commercial crops. Infrastructure supporting advanced agricultural practices, including irrigation systems and precision farming technologies, further bolsters insecticide consumption. The economic growth in these regions, coupled with government support for agricultural modernization, creates a fertile ground for the Europe Insecticide Market.

- Dominant Application Modes:

- Foliar: Widespread use for direct pest control across various crops.

- Soil Treatment: Growing importance for long-term pest management and specific pest issues.

- Seed Treatment: Increasing adoption for early-stage crop protection.

- Leading Crop Types:

- Commercial Crops: Extensive usage in large-scale agricultural operations.

- Grains & Cereals: Essential for maintaining yields of staple crops.

- Fruits & Vegetables: High demand due to crop value and susceptibility to pests.

- Key Geographical Drivers:

- France, Germany, Spain, Italy: Large agricultural economies with significant crop production.

- Economic Growth: Driving investment in agricultural inputs and technology.

- Infrastructure: Advanced farming practices and precision agriculture adoption.

Europe Insecticide Market Product Developments

The Europe Insecticide Market is witnessing a surge in product developments focused on enhanced efficacy, reduced environmental impact, and targeted pest control. Innovations are geared towards creating next-generation insecticides that offer broad-spectrum control while minimizing harm to beneficial insects and non-target organisms. This includes the development of novel active ingredients with improved toxicological profiles and the refinement of existing chemistries for more precise application. The integration of advanced formulation technologies, such as microencapsulation and slow-release mechanisms, is also a key trend, ensuring extended protection and reduced frequency of application. Furthermore, the market is seeing a growing emphasis on biological insecticides and biopesticides, driven by regulatory pressures and consumer demand for sustainable agriculture. These products, derived from natural sources, offer a complementary or alternative approach to synthetic insecticides, expanding the toolkit for integrated pest management. The focus on resistance management strategies is also influencing product development, with companies introducing new modes of action and combination products to combat pest resistance. This dynamic landscape of product innovation is critical for maintaining competitiveness and meeting the evolving needs of European agriculture.

Challenges in the Europe Insecticide Market Market

The Europe Insecticide Market faces significant challenges that can impede growth and market access. Foremost among these are the increasingly stringent regulatory hurdles imposed by the European Union, which often lead to longer approval timelines and higher R&D costs for new products. The ongoing scrutiny and potential ban of certain active ingredients can disrupt established product lines and necessitate rapid reformulation or replacement. Supply chain disruptions, as witnessed in recent global events, can affect the availability and cost of raw materials, impacting manufacturing and distribution. Furthermore, the growing threat of pest resistance to existing insecticide classes requires continuous innovation and strategic resistance management programs, adding complexity and cost. Competitive pressures from a consolidated market and the rising demand for more sustainable, non-chemical alternatives also present significant challenges.

- Regulatory Hurdles: Strict EU regulations leading to longer approval times and higher compliance costs.

- Supply Chain Volatility: Potential for disruptions affecting raw material availability and pricing.

- Pest Resistance: The need for continuous innovation and effective resistance management strategies.

- Competition: Intense rivalry from major players and the growing demand for sustainable alternatives.

Forces Driving Europe Insecticide Market Growth

Several powerful forces are propelling the Europe Insecticide Market forward. A primary driver is the persistent threat of devastating pest infestations that endanger crop yields and quality, necessitating effective crop protection solutions. The increasing global population and the concomitant demand for higher agricultural output further amplify the need for insecticides to safeguard food security. Technological advancements play a crucial role, with the development of more efficient, targeted, and environmentally benign insecticide formulations, including bio-insecticides and precision application technologies, stimulating market adoption. Government initiatives and subsidies aimed at boosting agricultural productivity and ensuring food safety also contribute to market expansion. Furthermore, the growing awareness among farmers about the economic impact of pest damage and the benefits of proactive pest management strategies is driving the uptake of these products.

Challenges in the Europe Insecticide Market Market

While the market is experiencing growth, long-term sustainability hinges on addressing inherent challenges. The continuous evolution of pest resistance necessitates ongoing investment in research and development for novel modes of action and integrated pest management strategies. Navigating the complex and evolving regulatory landscape in Europe, particularly concerning environmental and health impacts, requires significant adaptation and innovation. The growing consumer and societal demand for reduced pesticide residues on food products also pushes manufacturers towards more sustainable and organic solutions, creating a competitive pressure to innovate beyond conventional synthetic insecticides. Furthermore, ensuring consistent and cost-effective supply chains for active ingredients and formulated products remains a critical factor for sustained market performance.

Emerging Opportunities in Europe Insecticide Market

The Europe Insecticide Market is ripe with emerging opportunities for innovation and expansion. The increasing adoption of precision agriculture and digital farming technologies presents a significant avenue for growth. These technologies enable more targeted and efficient application of insecticides, reducing waste and environmental impact, creating demand for smart insecticide formulations and delivery systems. The burgeoning market for biological insecticides and biopesticides, driven by regulatory pressures and consumer demand for sustainable agriculture, offers substantial growth potential. Companies that can develop and commercialize effective and economically viable biological solutions will find a receptive market. Furthermore, the focus on integrated pest management (IPM) creates opportunities for companies offering comprehensive pest control solutions that combine chemical, biological, and cultural practices. The development of insecticides that are effective against resistant pest populations also presents a crucial unmet need and a significant opportunity.

Leading Players in the Europe Insecticide Market Sector

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- Syngenta Group

- UPL Limited

- BASF SE

- FMC Corporation

- Corteva Agriscience

- Nufarm Ltd

Key Milestones in Europe Insecticide Market Industry

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

- August 2022: Syngenta introduced Acelepryn, a novel insecticide for the control of white worms in lawns. The product can be used in sports courts, golf courses, racecourses, bowling fields, and aerodromes and for professional application in commercial and residential lawns.

- June 2022: Corteva Agriscience launched a new insecticide called Geronimo. The product is effective against important pests, especially certain lepidoptera, rigidoptera, bedbugs, and ticks.

Strategic Outlook for Europe Insecticide Market Market

The strategic outlook for the Europe Insecticide Market is characterized by a strong imperative for innovation, sustainability, and regulatory compliance. Companies are focusing on developing advanced formulations that minimize environmental impact while maximizing efficacy, including a significant push towards bio-based insecticides and integrated pest management solutions. Strategic partnerships and collaborations will be crucial for navigating complex regulatory landscapes and accelerating the development and commercialization of novel products. The adoption of digital technologies for precision application and data-driven decision-making in pest management will also shape future strategies. Furthermore, a proactive approach to resistance management and a commitment to product stewardship will be essential for maintaining market leadership and ensuring long-term growth in this evolving sector.

Europe Insecticide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Europe Insecticide Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

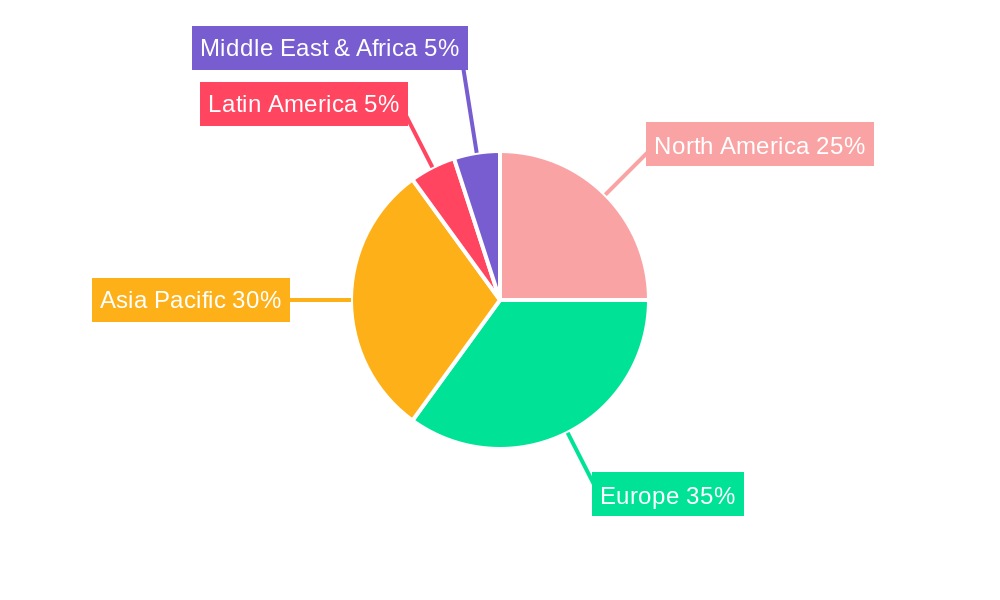

Europe Insecticide Market Regional Market Share

Geographic Coverage of Europe Insecticide Market

Europe Insecticide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Germany's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insecticide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sumitomo Chemical Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ADAMA Agricultural Solutions Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wynca Group (Wynca Chemicals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Syngenta Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UPL Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FMC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nufarm Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: Europe Insecticide Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Insecticide Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Insecticide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 2: Europe Insecticide Market Volume Kiloton Forecast, by Application Mode 2020 & 2033

- Table 3: Europe Insecticide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 4: Europe Insecticide Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 5: Europe Insecticide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 6: Europe Insecticide Market Volume Kiloton Forecast, by Application Mode 2020 & 2033

- Table 7: Europe Insecticide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 8: Europe Insecticide Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 9: Europe Insecticide Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Europe Insecticide Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 11: Europe Insecticide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 12: Europe Insecticide Market Volume Kiloton Forecast, by Application Mode 2020 & 2033

- Table 13: Europe Insecticide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 14: Europe Insecticide Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 15: Europe Insecticide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 16: Europe Insecticide Market Volume Kiloton Forecast, by Application Mode 2020 & 2033

- Table 17: Europe Insecticide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 18: Europe Insecticide Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 19: Europe Insecticide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Europe Insecticide Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 23: Germany Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 25: France Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: France Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Italy Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: Spain Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Spain Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Netherlands Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Netherlands Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Belgium Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Belgium Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: Sweden Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Sweden Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Norway Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Norway Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Poland Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Poland Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Denmark Europe Insecticide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Denmark Europe Insecticide Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insecticide Market?

The projected CAGR is approximately 4.64%.

2. Which companies are prominent players in the Europe Insecticide Market?

Key companies in the market include Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, BASF SE, FMC Corporation, Corteva Agriscience, Nufarm Ltd.

3. What are the main segments of the Europe Insecticide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.72 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Germany's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control..

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.August 2022: Syngenta introduced Acelepryn, a novel insecticide for the control of white worms in lawns. The product can be used in sports courts, golf courses, racecourses, bowling fields, and aerodromes and for professional application in commercial and residential lawns.June 2022: Corteva Agriscience launched a new insecticide called Geronimo. The product is effective against important pests, especially certain lepidoptera, rigidoptera, bedbugs, and ticks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insecticide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insecticide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insecticide Market?

To stay informed about further developments, trends, and reports in the Europe Insecticide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence