Key Insights

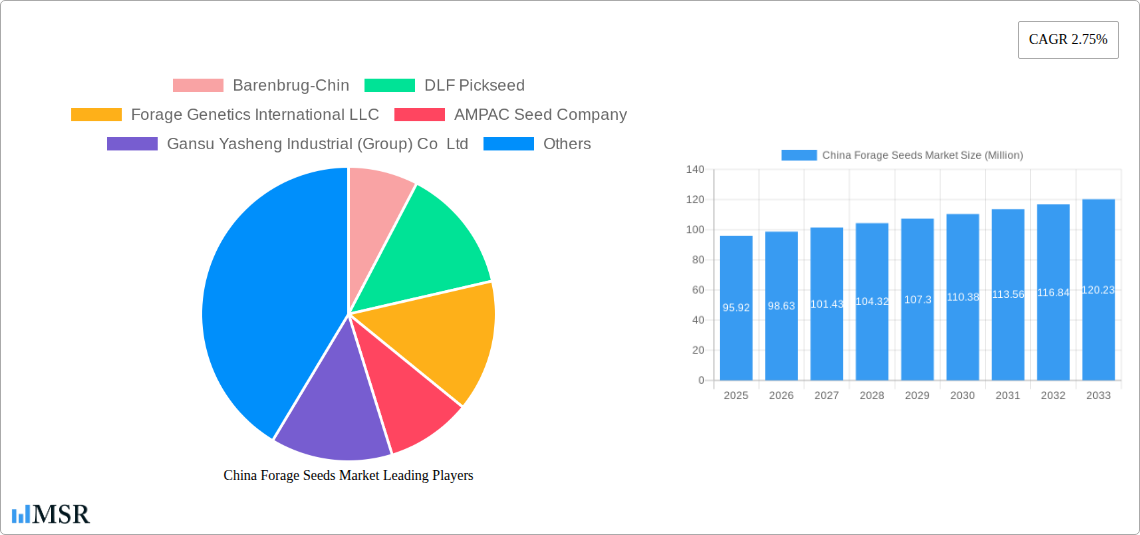

The China Forage Seeds Market is poised for steady growth, with an estimated market size of USD 95.92 million in 2025. This expansion is driven by a projected Compound Annual Growth Rate (CAGR) of 2.75% over the forecast period of 2025-2033. The primary catalyst for this growth is the increasing demand for high-quality animal feed, fueled by the burgeoning livestock industry in China. As the nation prioritizes modern agricultural practices and seeks to improve livestock productivity and animal welfare, the adoption of superior forage seed varieties becomes paramount. Furthermore, government initiatives aimed at promoting sustainable agriculture and reducing reliance on imported feed ingredients are expected to bolster the domestic forage seed market. The market is segmented into distinct crop types, including Cereals (such as Forage Corn and Forage Sorghum), Legumes (including Alfalfa), and Grasses, each catering to specific nutritional and environmental needs of different livestock. The product types are further categorized into Fresh Forage and Stored Forage, reflecting the diverse usage patterns within the animal husbandry sector.

China Forage Seeds Market Market Size (In Million)

The market's trajectory, however, is not without its challenges. Factors such as the fluctuating prices of raw agricultural inputs, potential impacts of climate change on crop yields, and the need for continuous research and development to introduce resilient and high-yielding forage varieties are key considerations. Restraints may also stem from varying levels of adoption of advanced forage cultivation techniques across different regions of China and the inherent complexities of seed production and distribution. Despite these hurdles, the market is characterized by significant opportunities for innovation, particularly in developing drought-resistant and disease-tolerant forage seeds. Key players such as Barenbrug-China, DLF Pickseed, and Groupe Limagrain (Vilmorin) are actively involved in research, product development, and expanding their distribution networks to capture market share. The focus on enhancing the nutritional content of forage, improving pasture management practices, and increasing the efficiency of livestock farming will continue to shape the dynamics of the China Forage Seeds Market, ensuring its sustained upward movement.

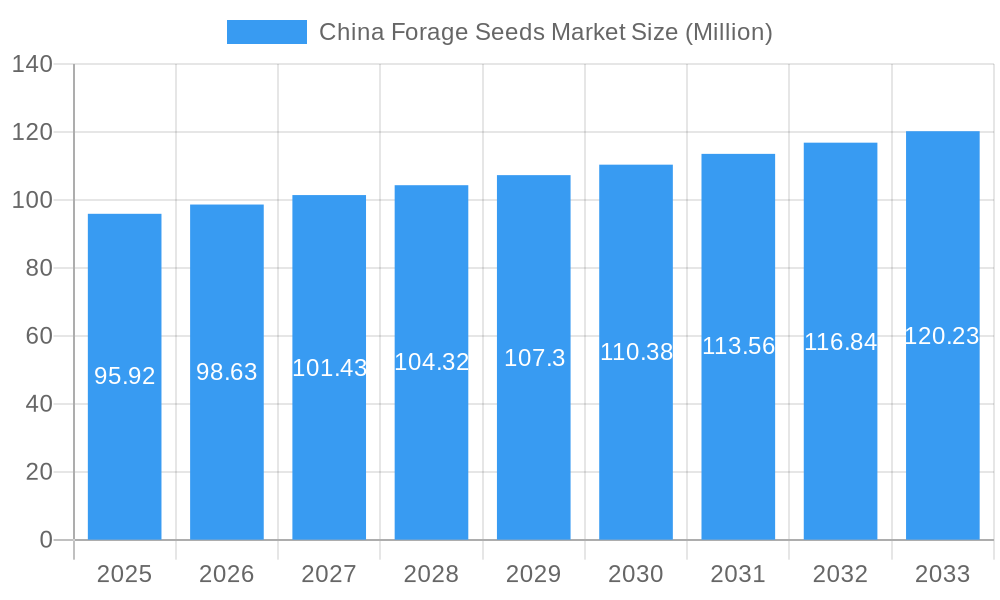

China Forage Seeds Market Company Market Share

China Forage Seeds Market: Comprehensive Analysis & Growth Forecast (2019–2033)

This in-depth report offers a strategic overview of the China Forage Seeds Market, providing critical insights into market dynamics, key trends, and future growth trajectories. Delving into the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period extending from 2025 to 2033, this analysis is essential for stakeholders seeking to understand and capitalize on the burgeoning Chinese animal feed industry. We meticulously examine forage seed market size, CAGR, market share, and segment analysis across cereals (forage corn, forage sorghum, other cereals), legumes (alfalfa, other legumes), and grasses, as well as fresh forage and stored forage product types. Uncover actionable strategies for navigating this dynamic market, driven by advancements in forage genetics, sustainable agriculture, and livestock nutrition.

China Forage Seeds Market Market Concentration & Dynamics

The China Forage Seeds Market is characterized by a moderate level of market concentration, with a blend of established multinational corporations and growing domestic players vying for market dominance. Innovation ecosystems are steadily developing, fueled by investments in research and development for improved forage varieties, enhanced seed quality, and disease resistance. Regulatory frameworks, while evolving, are increasingly focused on ensuring seed safety, germination standards, and sustainable agricultural practices. Substitute products, such as alternative feed ingredients, pose a competitive challenge, though the inherent nutritional and economic benefits of high-quality forage seeds maintain their strong market position. End-user trends are heavily influenced by the expansion and modernization of China's livestock sector, demanding higher yields, improved nutritional content, and more efficient land utilization for forage cultivation. Mergers and acquisitions (M&A) activities are anticipated to play a significant role in shaping market structure, enabling companies to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A activities have seen companies consolidating to gain economies of scale and enhance their competitive edge in the animal feed raw material sector. The market is poised for increased consolidation as key players seek strategic advantages.

China Forage Seeds Market Industry Insights & Trends

The China Forage Seeds Market is on a robust growth trajectory, projected to reach an estimated market size of XX Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is primarily driven by the rapidly evolving Chinese animal husbandry sector. The increasing demand for high-quality livestock feed to support the burgeoning dairy, beef, and poultry industries is a significant market growth driver. As China continues to urbanize and its population's demand for protein-rich foods escalates, the need for efficient and sustainable livestock farming practices becomes paramount. This directly translates into a greater reliance on superior forage crop yields and nutritional value, which are directly influenced by the quality of forage seeds. Technological disruptions are playing a crucial role, with advancements in biotechnology, genomic selection, and precision agriculture leading to the development of novel forage varieties with enhanced characteristics such as drought tolerance, disease resistance, and improved digestibility. These innovations contribute to higher forage production and reduced input costs for farmers. Evolving consumer behaviors, particularly a growing awareness and demand for ethically sourced and sustainably produced food products, are indirectly impacting the forage seed market. Consumers are increasingly conscious of the entire food production chain, pushing for more environmentally friendly agricultural practices. This encourages the adoption of sustainable forage cultivation techniques and the use of environmentally friendly forage seeds. Furthermore, government initiatives aimed at promoting agricultural modernization and food security are providing a favorable regulatory environment, encouraging investment and innovation within the forage seed industry. The shift towards large-scale, modern livestock farming operations necessitates the use of specialized and high-performing forage seeds to optimize feed conversion ratios and animal health. The market is also witnessing a trend towards diversification of forage crops to cater to specific regional climates and animal dietary requirements, further stimulating demand for a wider range of forage seed types.

Key Markets & Segments Leading China Forage Seeds Market

The China Forage Seeds Market is experiencing robust growth across various segments, with specific regions and crop types demonstrating significant leadership. Among Crop Types, Grasses currently hold a dominant position, driven by their widespread use in pastures and for silage production across diverse agricultural landscapes. Their adaptability to various soil and climatic conditions, coupled with their role in providing essential nutrients for a broad spectrum of livestock, underpins their market leadership. Following closely are Legumes, with Alfalfa emerging as a cornerstone for high-protein forage, crucial for dairy cattle and beef production. The growing emphasis on improved livestock nutrition and the economic benefits of nitrogen fixation associated with legumes further propel their demand. Cereals, particularly Forage Corn and Forage Sorghum, also represent substantial market segments, offering high energy content and significant biomass yield, making them indispensable for silage and grain production for animal feed.

In terms of Product Type, Stored Forage dominates the market. This is largely attributable to the prevalent practice of silage making and hay production, which allows for year-round feeding and effective inventory management for livestock farmers. The economic advantages and the ability to mitigate seasonal forage availability challenges make stored forage solutions highly sought after. Fresh Forage, while important for immediate consumption, represents a smaller share due to its limited shelf life and logistical complexities in distribution across a vast country like China.

Geographically, the North China Plain and the Northeast China region are key markets leading the China Forage Seeds Market.

North China Plain:

- Economic Growth: High concentration of large-scale dairy and beef farming operations, driving demand for high-quality forage.

- Infrastructure: Well-developed agricultural infrastructure, including irrigation systems and transportation networks, facilitates efficient forage cultivation and distribution.

- Government Support: Proactive government policies promoting agricultural modernization and livestock sector development in this vital breadbasket region.

- Technological Adoption: Farmers in this region are generally early adopters of new agricultural technologies, including advanced forage seed varieties and cultivation techniques.

Northeast China Region:

- Vast Arable Land: Significant land availability for extensive pasture development and forage crop cultivation.

- Livestock Industry Expansion: Rapid growth in the beef and dairy sectors, creating sustained demand for forage seeds.

- Favorable Climate for Certain Forages: Suitable climatic conditions for specific high-yield forage crops like corn and sorghum.

- Investment in Agricultural Modernization: Ongoing government and private sector investments aimed at enhancing agricultural productivity in this strategically important region.

The dominance of these regions is further amplified by the concentration of advanced research institutions and seed companies actively developing and distributing tailored forage seed solutions to meet local agricultural needs and support the nation's food security objectives.

China Forage Seeds Market Product Developments

Innovation in the China Forage Seeds Market is primarily focused on developing high-yielding forage varieties with enhanced nutritional profiles, superior resilience, and improved agronomic traits. Significant efforts are directed towards creating genetically improved seeds that exhibit greater resistance to common pests and diseases, thereby reducing the need for chemical interventions and promoting sustainable agriculture. Advancements in seed coating technologies are also gaining traction, offering improved germination rates, seedling vigor, and protection against early-season stresses. The market is witnessing the introduction of novel forage grass and legume cultivars specifically bred for China's diverse agro-climatic zones, catering to the nuanced requirements of different livestock breeds and feeding systems. These product developments aim to maximize forage biomass production, improve digestibility, and enhance the overall health and productivity of livestock, providing a significant competitive edge for seed providers in this dynamic market.

Challenges in the China Forage Seeds Market Market

The China Forage Seeds Market faces several challenges, including:

- Regulatory Hurdles: Navigating complex and sometimes evolving seed registration and approval processes can delay market entry for new varieties.

- Intellectual Property Protection: Ensuring robust protection for proprietary seed genetics remains a concern for research-intensive companies.

- Fragmented Distribution Channels: Reaching a vast and diverse agricultural landscape with a multitude of smallholder farmers presents logistical complexities and increased distribution costs.

- Awareness and Adoption of Advanced Varieties: Educating farmers on the benefits and proper cultivation techniques for newer, higher-performing forage seed varieties requires sustained effort.

- Climate Change Impacts: Increasing incidence of extreme weather events, such as droughts and floods, can impact forage yields and necessitate the development of more resilient seed varieties, posing a significant challenge for consistent supply. The estimated impact of these challenges on market growth could be in the range of XX% if not addressed effectively.

Forces Driving China Forage Seeds Market Growth

Several key forces are driving the growth of the China Forage Seeds Market:

- Expansion of the Livestock Sector: The burgeoning demand for meat, dairy, and eggs in China necessitates increased livestock production, directly fueling the need for high-quality forage crops.

- Government Support for Agricultural Modernization: National policies aimed at enhancing food security, promoting sustainable farming, and modernizing the agricultural sector provide significant tailwinds for the forage seed industry.

- Technological Advancements in Seed Development: Innovations in breeding techniques, genetics, and biotechnology are leading to the creation of superior forage varieties with enhanced yield, nutritional value, and resilience.

- Increasing Focus on Animal Nutrition and Health: A growing understanding of the direct correlation between forage quality and animal health/productivity is driving demand for premium forage seeds.

- Growth of the Feed Industry: The overall expansion of the animal feed industry, a major consumer of forage-derived ingredients, acts as a significant growth accelerator.

Challenges in the China Forage Seeds Market Market

Long-term growth catalysts for the China Forage Seeds Market lie in sustained innovation and strategic market expansion. Continued investment in research and development to create climate-resilient forage varieties capable of withstanding environmental stresses will be crucial for long-term sustainability. Furthermore, the development of specialized forage blends tailored to specific livestock needs and regional conditions will unlock new market opportunities. Strengthening intellectual property rights and fostering a more transparent seed regulatory environment will encourage greater foreign and domestic investment in cutting-edge forage seed technology. Strategic partnerships between seed companies, research institutions, and livestock producers can foster knowledge transfer and accelerate the adoption of best practices, ensuring sustained market growth. The focus on sustainable agriculture and reduced environmental impact is also a key long-term growth driver, positioning companies that prioritize eco-friendly solutions for future success.

Emerging Opportunities in China Forage Seeds Market

Emerging opportunities within the China Forage Seeds Market are abundant, driven by evolving agricultural practices and consumer preferences. The increasing adoption of precision agriculture techniques presents an opportunity for the development and marketing of smart forage seeds with enhanced data-tracking capabilities or optimized nutrient uptake. The growing consumer demand for organic and sustainably produced animal products is creating a niche market for organic certified forage seeds and non-GMO forage varieties. Furthermore, the expanding aquaculture sector presents an untapped market for specialized aquatic forage species or ingredients derived from high-quality forage. As China continues to focus on rural revitalization and grassland ecological restoration, there is a significant opportunity for introducing and promoting native and restorative forage species. Finally, the ongoing urbanization and increasing disposable incomes of the Chinese population are likely to boost demand for higher quality and more diverse meat and dairy products, indirectly driving the need for advanced forage solutions.

Leading Players in the China Forage Seeds Market Sector

- Barenbrug-Chin

- DLF Pickseed

- Forage Genetics International LLC

- AMPAC Seed Company

- Gansu Yasheng Industrial (Group) Co Ltd

- Groupe Limagrain (Vilmorin)

- Pennington Seed Inc

- PGG Wrightson

Key Milestones in China Forage Seeds Market Industry

- 2019: Increased government focus on agricultural modernization and food security policies, leading to greater investment in forage research and development.

- 2020: Introduction of new regulations aimed at improving seed quality standards and promoting the use of certified forage seeds.

- 2021: Significant advancements in forage breeding technologies, leading to the release of several high-yield and disease-resistant forage varieties.

- 2022: Growing interest and investment in sustainable agriculture practices within the livestock sector, boosting demand for environmentally friendly forage seeds.

- 2023: Emergence of regional forage seed innovation hubs in key agricultural provinces, fostering collaboration and accelerating product development.

- 2024: Increased M&A activities as larger companies seek to consolidate their market position and expand their forage seed portfolios.

Strategic Outlook for China Forage Seeds Market Market

The strategic outlook for the China Forage Seeds Market is highly positive, characterized by sustained growth and evolving market dynamics. Key growth accelerators include the continued expansion of China's livestock industry, driven by increasing domestic demand for protein. Strategic opportunities lie in leveraging technological advancements to develop high-performance forage varieties tailored to specific regional needs and climate conditions. Furthermore, a focus on sustainable agricultural practices and the development of environmentally friendly forage solutions will be crucial for long-term market penetration and brand loyalty. Collaborations with research institutions and proactive engagement with government initiatives promoting agricultural innovation will further strengthen market positioning. The increasing sophistication of Chinese livestock producers presents an opportunity to move towards higher-value, specialized forage seed products, driving both volume and value growth in the coming years.

China Forage Seeds Market Segmentation

-

1. Crop Type

-

1.1. Cereals

- 1.1.1. Forage Corn

- 1.1.2. Forage Sorghum

- 1.1.3. Other Cereals

-

1.2. Legumes

- 1.2.1. Alfalfa

- 1.2.2. Other Legumes

- 1.3. Grasses

-

1.1. Cereals

-

2. Product Type

- 2.1. Fresh Forage

- 2.2. Stored Forage

-

3. Crop Type

-

3.1. Cereals

- 3.1.1. Forage Corn

- 3.1.2. Forage Sorghum

- 3.1.3. Other Cereals

-

3.2. Legumes

- 3.2.1. Alfalfa

- 3.2.2. Other Legumes

- 3.3. Grasses

-

3.1. Cereals

-

4. Product Type

- 4.1. Fresh Forage

- 4.2. Stored Forage

China Forage Seeds Market Segmentation By Geography

- 1. China

China Forage Seeds Market Regional Market Share

Geographic Coverage of China Forage Seeds Market

China Forage Seeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increasing Livestock Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Forage Seeds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Crop Type

- 5.1.1. Cereals

- 5.1.1.1. Forage Corn

- 5.1.1.2. Forage Sorghum

- 5.1.1.3. Other Cereals

- 5.1.2. Legumes

- 5.1.2.1. Alfalfa

- 5.1.2.2. Other Legumes

- 5.1.3. Grasses

- 5.1.1. Cereals

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Fresh Forage

- 5.2.2. Stored Forage

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Cereals

- 5.3.1.1. Forage Corn

- 5.3.1.2. Forage Sorghum

- 5.3.1.3. Other Cereals

- 5.3.2. Legumes

- 5.3.2.1. Alfalfa

- 5.3.2.2. Other Legumes

- 5.3.3. Grasses

- 5.3.1. Cereals

- 5.4. Market Analysis, Insights and Forecast - by Product Type

- 5.4.1. Fresh Forage

- 5.4.2. Stored Forage

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Crop Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Barenbrug-Chin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DLF Pickseed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Forage Genetics International LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AMPAC Seed Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gansu Yasheng Industrial (Group) Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Groupe Limagrain (Vilmorin)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pennington Seed Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PGG Wrightson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Barenbrug-Chin

List of Figures

- Figure 1: China Forage Seeds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Forage Seeds Market Share (%) by Company 2025

List of Tables

- Table 1: China Forage Seeds Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 2: China Forage Seeds Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: China Forage Seeds Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 4: China Forage Seeds Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: China Forage Seeds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Forage Seeds Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 7: China Forage Seeds Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: China Forage Seeds Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 9: China Forage Seeds Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: China Forage Seeds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Forage Seeds Market?

The projected CAGR is approximately 2.75%.

2. Which companies are prominent players in the China Forage Seeds Market?

Key companies in the market include Barenbrug-Chin, DLF Pickseed, Forage Genetics International LLC, AMPAC Seed Company, Gansu Yasheng Industrial (Group) Co Ltd, Groupe Limagrain (Vilmorin), Pennington Seed Inc, PGG Wrightson.

3. What are the main segments of the China Forage Seeds Market?

The market segments include Crop Type, Product Type, Crop Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 95.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increasing Livestock Production.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Forage Seeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Forage Seeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Forage Seeds Market?

To stay informed about further developments, trends, and reports in the China Forage Seeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence