Key Insights

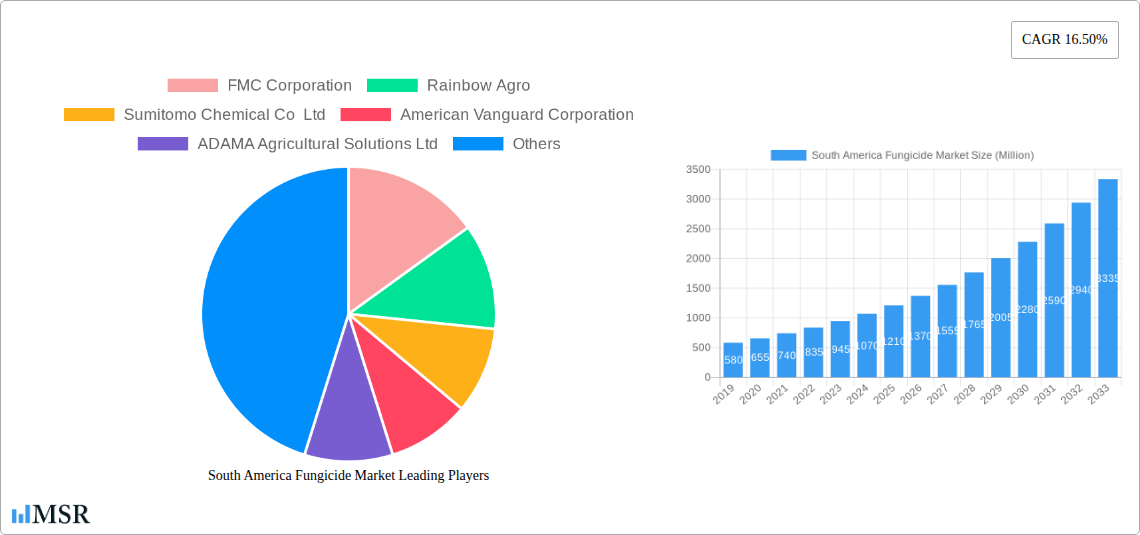

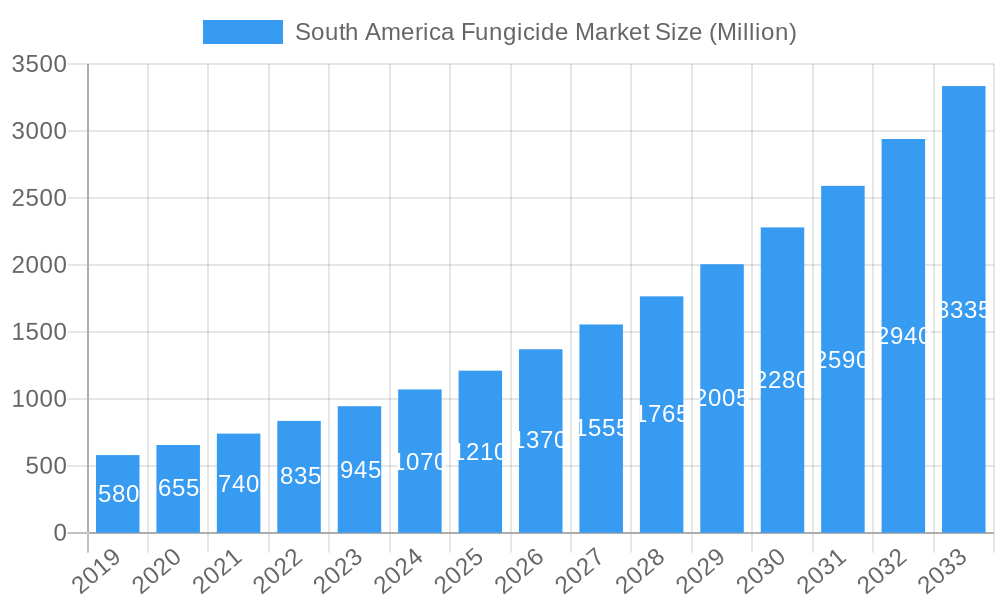

The South American fungicide market is poised for substantial growth, projected to reach an estimated XX Million by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 16.50% through 2033. This significant expansion is primarily fueled by an increasing demand for enhanced crop yields and improved food security across the region, driven by the growing global population and rising disposable incomes. Key drivers include the adoption of advanced agricultural practices, a heightened awareness among farmers regarding disease management for optimal crop health, and supportive government initiatives promoting sustainable agriculture. Furthermore, the burgeoning export markets for South American agricultural produce necessitate stringent quality control and disease prevention, further bolstering the demand for effective fungicide solutions. The region's diverse agricultural landscape, encompassing commercial crops, fruits, vegetables, grains, pulses, and oilseeds, creates a broad spectrum of application opportunities for various fungicide types.

South America Fungicide Market Market Size (In Million)

The market's trajectory is significantly influenced by emerging trends such as the increasing preference for integrated pest management (IPM) strategies, which often incorporate fungicides as a crucial component. Innovations in fungicide formulations, including the development of more targeted and environmentally friendly products, are also shaping market dynamics. However, certain restraints, such as the escalating cost of raw materials, stringent regulatory frameworks for pesticide registration and usage in some countries, and the potential for fungicide resistance development in pathogens, could pose challenges to sustained growth. Nevertheless, the strong foundational demand from major agricultural economies like Brazil and Argentina, coupled with ongoing investments in agricultural research and development by leading global agrochemical companies, points towards a dynamic and expanding fungicide market in South America.

South America Fungicide Market Company Market Share

South America Fungicide Market: Comprehensive Analysis and Forecast 2019-2033

Gain unparalleled insights into the dynamic South America Fungicide Market with this in-depth report. Covering the historical period of 2019-2024 and projecting through to 2033, with a base and estimated year of 2025, this research provides a definitive guide for stakeholders seeking to understand and capitalize on market expansion. Explore key segments including Application Modes like Chemigation, Foliar, Fumigation, Seed Treatment, and Soil Treatment, alongside critical Crop Types such as Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, and Turf & Ornamental. Understand the competitive landscape, market drivers, challenges, and emerging opportunities within this vital agricultural sector.

South America Fungicide Market Market Concentration & Dynamics

The South America Fungicide Market exhibits a moderate to high level of concentration, driven by the presence of global agrochemical giants alongside regional players. Innovation ecosystems are robust, particularly in countries with strong agricultural bases like Brazil and Argentina, fostering the development of new fungicide formulations to combat prevalent crop diseases. Regulatory frameworks are evolving, with increased scrutiny on product efficacy, environmental impact, and residue limits, influencing product development and market entry strategies. Substitute products, including biological fungicides and integrated pest management (IPM) practices, are gaining traction, prompting traditional fungicide manufacturers to innovate and diversify their portfolios. End-user trends are leaning towards sustainable agriculture and precision farming, demanding targeted and efficient fungicide solutions. Mergers and acquisitions (M&A) activities are a notable feature, with companies strategically acquiring smaller players or forming alliances to enhance their market presence and technological capabilities. While specific M&A deal counts fluctuate, their consistent occurrence signifies a consolidation trend aimed at strengthening market share and expanding product offerings. Key players like FMC Corporation, Bayer AG, Syngenta Group, BASF SE, and UPL Limited are actively shaping the market through strategic investments and product introductions. The market share distribution is dynamic, with leading companies holding significant portions due to their extensive product portfolios and distribution networks.

South America Fungicide Market Industry Insights & Trends

The South America Fungicide Market is poised for significant growth, driven by an increasing demand for enhanced crop yields and quality to meet the burgeoning global food requirements. The market size is estimated to be over $2,500 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the escalating prevalence of crop diseases and pests, exacerbated by changing climatic patterns and intensive farming practices, necessitates the widespread adoption of effective fungicide solutions. Secondly, technological disruptions are playing a pivotal role. Innovations in fungicide formulations, including the development of more targeted, systemic, and environmentally friendly products, are enhancing efficacy and reducing application rates. The integration of digital agriculture technologies, such as precision spraying and sensor-based disease detection, is further optimizing fungicide application, leading to increased efficiency and reduced waste. Evolving consumer behaviors, such as a growing preference for organic and sustainably produced food, are also influencing the market. While this trend might suggest a shift away from conventional fungicides, it also drives innovation in biological and low-impact chemical fungicide alternatives. Moreover, government initiatives promoting agricultural modernization and food security in various South American nations are providing a supportive environment for market growth. The continuous research and development efforts by leading companies to introduce novel active ingredients and formulations capable of overcoming fungicide resistance are crucial for sustaining market momentum. The economic growth and increasing disposable income in many South American countries also contribute to enhanced agricultural investments, further bolstering the demand for advanced crop protection solutions like fungicides.

Key Markets & Segments Leading South America Fungicide Market

The South America Fungicide Market is dominated by key segments and regions demonstrating robust agricultural activity and a high demand for crop protection solutions.

Dominant Crop Types:

- Grains & Cereals: This segment holds a substantial market share due to the extensive cultivation of crops like soybeans, corn, and wheat across the continent. These staple crops are susceptible to a range of fungal diseases, necessitating consistent fungicide application to ensure optimal yields and quality, particularly given South America's role as a major global exporter.

- Fruits & Vegetables: This segment is experiencing significant growth, driven by increasing domestic consumption and export opportunities. The diverse range of fruits and vegetables grown in South America, from tropical fruits to temperate vegetables, are prone to various fungal infections, creating a continuous demand for effective fungicides.

- Commercial Crops: This broad category, encompassing crops like sugarcane, coffee, and cotton, also represents a significant market. The economic importance of these crops in South American economies underscores the need for robust disease management strategies, including the use of fungicides.

Leading Application Modes:

- Foliar Application: This remains the most prevalent application mode, accounting for a substantial portion of the fungicide market. Its effectiveness in directly addressing fungal infections on plant leaves and stems makes it indispensable for a wide array of crops. The ease of application and widespread availability of spraying equipment further contribute to its dominance.

- Seed Treatment: This segment is gaining considerable traction due to its preventive efficacy and efficiency. Treating seeds with fungicides before sowing protects young seedlings from soil-borne and seed-borne diseases, promoting healthy germination and early plant establishment, which is critical for maximizing crop potential.

Geographical Dominance:

- Brazil: As the largest agricultural producer and exporter in South America, Brazil represents the most significant market for fungicides. Its vast land area dedicated to crops like soybeans, corn, and sugarcane, coupled with its susceptibility to various fungal pathogens, drives immense demand. Government support for agricultural innovation and a strong presence of multinational agrochemical companies further solidify Brazil's leading position.

- Argentina: Following closely, Argentina's agricultural sector, particularly its significant production of soybeans and corn, makes it another pivotal market for fungicides. The country's climate and farming practices create a conducive environment for fungal diseases, necessitating extensive use of crop protection products.

The economic growth in these key countries, coupled with ongoing investments in agricultural infrastructure and technology adoption, acts as a powerful driver for these dominant segments and regions.

South America Fungicide Market Product Developments

Product innovation is a cornerstone of the South America Fungicide Market, with companies continuously introducing advanced solutions. October 2022 saw Corteva Agriscience introduce HavizaTM Active, a novel picolinamide fungicide brand specifically targeting Asian soybean rot, offering a crucial alternative for farmers. This innovation signifies a commitment to addressing emerging resistance issues and providing tailored solutions for key South American crops. Furthermore, ADAMA's February 2023 inauguration of a new multi-purpose facility in Brazil underscores its strategic intent to bolster its Prothioconazole-based product pipeline for the global market and accelerate the introduction of innovative products within Brazil, demonstrating a proactive approach to market needs and expansion. These developments highlight a trend towards more targeted, effective, and disease-specific fungicide formulations designed to enhance crop protection and improve farm productivity across the region.

Challenges in the South America Fungicide Market Market

The South America Fungicide Market faces several significant challenges that can impede growth. Regulatory hurdles, including stringent approval processes for new active ingredients and complex residue limit regulations in export markets, can delay product launches and increase operational costs. Supply chain disruptions, exacerbated by logistical complexities within the vast South American continent and global economic uncertainties, can impact the timely availability of raw materials and finished products. Competitive pressures from both global giants and emerging local players intensify market dynamics, requiring continuous innovation and strategic pricing. Furthermore, increasing consumer and governmental pressure towards sustainable agriculture and reduced chemical usage poses a challenge, necessitating the development of more environmentally benign fungicide options and integrated pest management (IPM) strategies. The fluctuating commodity prices can also influence farmers' investment capacity in crop protection solutions.

Forces Driving South America Fungicide Market Growth

Several key forces are propelling the growth of the South America Fungicide Market. Technological advancements in fungicide formulation, leading to more effective, targeted, and residue-mitigated products, are a primary driver. The increasing adoption of precision agriculture techniques, allowing for optimized fungicide application based on real-time crop needs, further enhances market demand. Growing awareness and implementation of sustainable farming practices, while posing some challenges, also drive the demand for innovative, lower-impact fungicides. Economic growth and increasing investments in the agricultural sector across key South American nations, particularly Brazil and Argentina, are significantly boosting farmers' purchasing power for crop protection solutions. Furthermore, the continuous threat of crop diseases, amplified by climate change and intensive farming, creates an ongoing and escalating need for effective fungicide solutions to safeguard yields and ensure food security.

Challenges in the South America Fungicide Market Market

Long-term growth catalysts in the South America Fungicide Market are underpinned by continuous innovation and strategic market expansion. The development of novel fungicide chemistries with new modes of action is crucial to combat the growing issue of fungal resistance, ensuring the sustained efficacy of crop protection programs. Partnerships and collaborations between agrochemical companies, research institutions, and local agricultural stakeholders are vital for tailoring solutions to specific regional needs and fostering knowledge transfer. Market expansions into emerging agricultural regions within South America, where the adoption of modern farming practices is on the rise, present significant growth opportunities. Furthermore, a sustained focus on developing integrated pest management (IPM) solutions, which combine chemical, biological, and cultural control methods, will be essential for long-term market relevance and sustainability, catering to evolving regulatory and consumer demands.

Emerging Opportunities in South America Fungicide Market

Emerging opportunities in the South America Fungicide Market are diverse and promising. The increasing demand for high-value crops, such as berries and specialty vegetables, in both domestic and international markets, opens avenues for specialized fungicide solutions. The growing adoption of biological fungicides and biopesticides presents a significant opportunity for companies to diversify their portfolios and cater to the rising consumer preference for organic and sustainably produced food. Furthermore, the integration of digital technologies, including AI-powered disease prediction models and drone-based application systems, offers opportunities to enhance the precision and efficiency of fungicide use, creating value-added services for farmers. Expansion into less saturated agricultural markets within the continent, coupled with strategic investments in local manufacturing and distribution networks, can unlock substantial growth potential. The development of fungicides with improved environmental profiles and reduced impact on beneficial insects will also be a key differentiator.

Leading Players in the South America Fungicide Market Sector

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co Ltd

- American Vanguard Corporation

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- UPL Limited

- Syngenta Group

- Corteva Agriscience

- BASF SE

Key Milestones in South America Fungicide Market Industry

- February 2023: ADAMA opened a new multi-purpose facility in Brazil, enhancing its capability to deliver Prothioconazole-based products globally and introduce innovative items to the Brazilian market.

- January 2023: Bayer formed a new partnership with Oerth Bio to advance crop protection technology and develop more eco-friendly crop protection solutions.

- October 2022: Corteva Agriscience added HavizaTM Active to its innovation pipeline, offering farmers a new option to manage Asian soybean rot and expanding its picolinamide active class.

Strategic Outlook for South America Fungicide Market Market

The strategic outlook for the South America Fungicide Market is characterized by a strong emphasis on innovation, sustainability, and market penetration. Growth accelerators will include the continuous development of novel fungicide chemistries to combat resistance and meet stringent regulatory standards. Companies will likely focus on expanding their portfolios to include more biological and integrated pest management solutions, aligning with global sustainability trends. Strategic partnerships and acquisitions will remain crucial for consolidating market share, accessing new technologies, and expanding geographical reach. Furthermore, investments in digital agriculture platforms and precision application technologies will be key to enhancing product efficacy and offering comprehensive crop management solutions to farmers. Tailoring product offerings to address the specific disease pressures and crop varieties prevalent in different South American regions will be vital for sustained market leadership.

South America Fungicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

South America Fungicide Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Fungicide Market Regional Market Share

Geographic Coverage of South America Fungicide Market

South America Fungicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Brazil dominated the market as the threat of fungal diseases to crops became increasingly significant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Fungicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rainbow Agro

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Chemical Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Vanguard Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADAMA Agricultural Solutions Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL Limite

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Syngenta Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: South America Fungicide Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Fungicide Market Share (%) by Company 2025

List of Tables

- Table 1: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 2: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 3: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 4: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 5: South America Fungicide Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 7: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 8: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 9: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 10: South America Fungicide Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Brazil South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Argentina South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Chile South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Colombia South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Peru South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Venezuela South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Ecuador South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Bolivia South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Paraguay South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Uruguay South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Fungicide Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the South America Fungicide Market?

Key companies in the market include FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group, Corteva Agriscience, BASF SE.

3. What are the main segments of the South America Fungicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Brazil dominated the market as the threat of fungal diseases to crops became increasingly significant.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

February 2023: ADAMA opened a new multi-purpose facility in Brazil. With this factory, the company will be able to deliver all the Prothioconazole-based products in its pipeline to the global market and achieve its objective of introducing a number of innovative items to the Brazilian market in the upcoming years.January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.October 2022: HavizaTM Active was the newest fungicide brand added to Corteva Agriscience's strong innovation pipeline. The product is an alternative for farmers in South America to manage Asian soybean rot. The company broadened its active class of picolinamide through this innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Fungicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Fungicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Fungicide Market?

To stay informed about further developments, trends, and reports in the South America Fungicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence