Key Insights

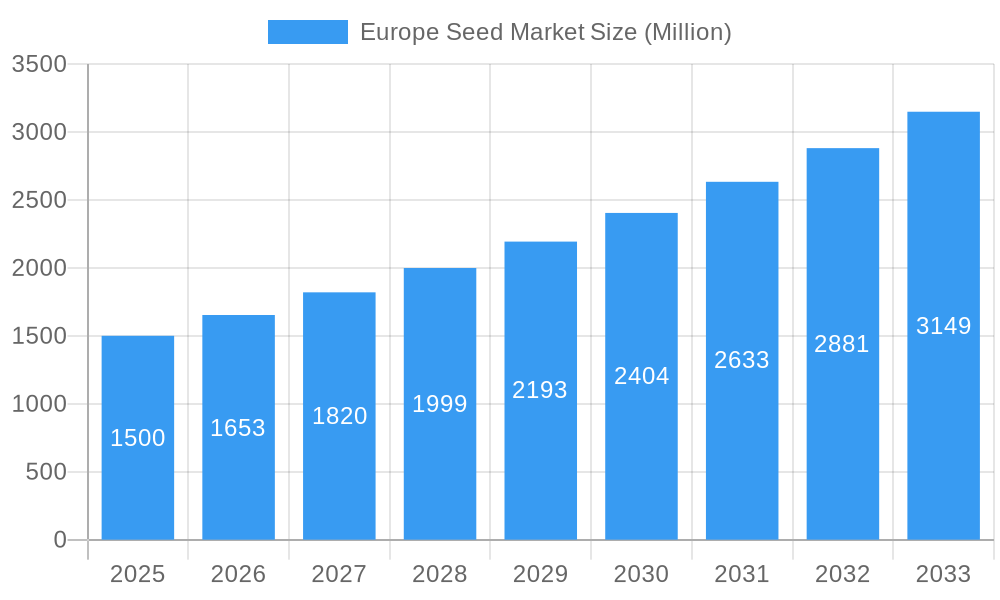

The European seed market, valued at €2.61 billion in 2025, is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 6.96% through the forecast period of 2025-2033. This growth is propelled by escalating demand for superior crop varieties, addressing global food security imperatives and supporting a growing European population. Innovations in seed breeding, including advanced hybrid and genetically modified (GM) seed technologies, are enhancing crop productivity. The integration of precision agriculture and optimized farming methodologies further amplifies seed efficacy, creating a synergistic effect on market expansion. Additionally, EU-driven policies championing sustainable agriculture provide a robust framework for market growth.

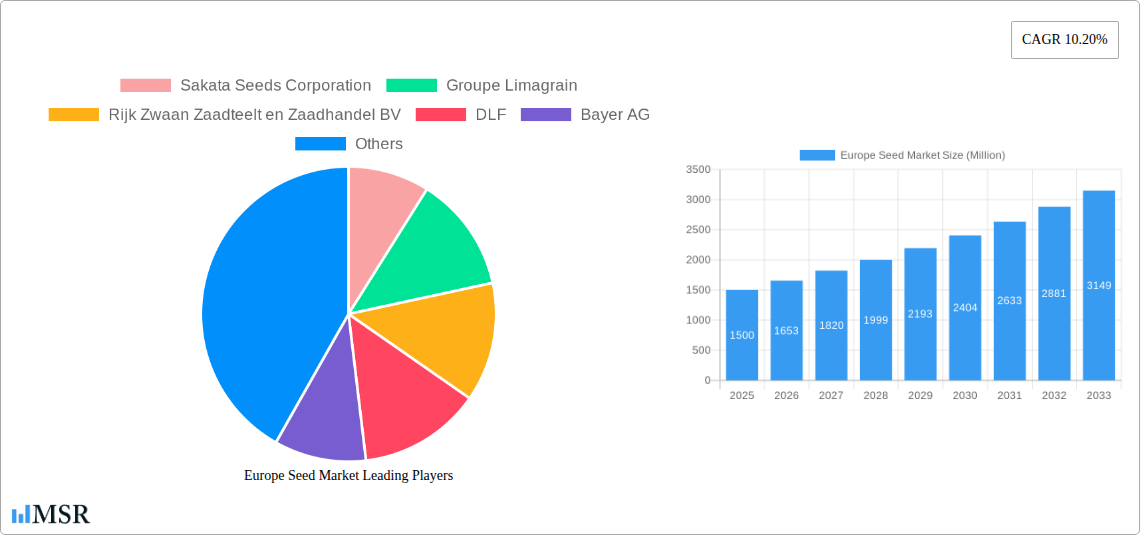

Europe Seed Market Market Size (In Billion)

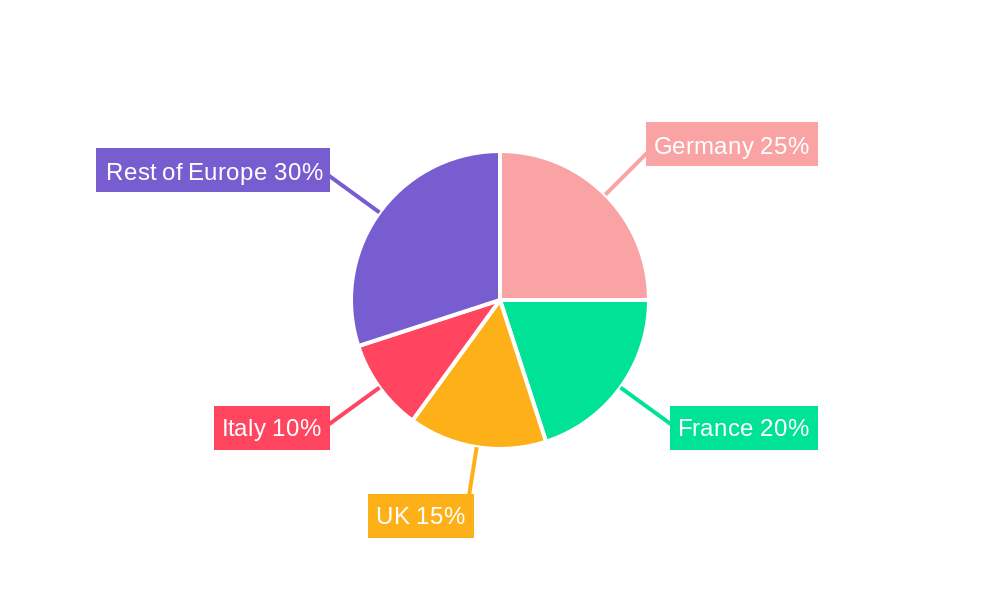

Challenges within the European seed market include the inherent risks associated with climate variability impacting crop yields, consequently influencing seed demand. Stringent regulatory landscapes concerning GM seeds across diverse European nations present operational complexities for seed manufacturers. Economic fluctuations and evolving agricultural policies can also temper market progression. Nevertheless, the persistent need for food security, coupled with ongoing agricultural innovation, positions the European seed market for sustained positive momentum. Key markets include Germany, France, and the UK, with other regions demonstrating variable growth influenced by local agricultural dynamics and consumer preferences. Hybrid seeds and open-field cultivation currently lead market share, while protected cultivation emerges as a significant growth avenue.

Europe Seed Market Company Market Share

Europe Seed Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe seed market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, including seed producers, distributors, farmers, investors, and policymakers. The report leverages extensive market research to provide a detailed understanding of market dynamics, growth drivers, key segments, leading players, and future opportunities within the European seed industry. The base year for this report is 2025, with estimations for 2025 and a forecast period extending to 2033, encompassing historical data from 2019-2024.

Europe Seed Market Concentration & Dynamics

The European seed market exhibits a moderately concentrated landscape, dominated by a few major players like Bayer AG, Syngenta Group, and Corteva Agriscience, controlling approximately xx% of the total market share in 2025. However, smaller, specialized companies also hold significant regional influence. The market is characterized by continuous innovation in breeding technologies, with a strong focus on hybrid seeds and genetically modified (GM) varieties. Stringent regulatory frameworks regarding seed approvals and GMO usage significantly influence market dynamics. Substitute products, such as conventional seeds and organic seeds, present competition, while the increasing demand for high-yield, disease-resistant crops drives market growth. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. End-user trends show a growing preference for sustainable and high-quality seeds, which is creating opportunities for companies that can meet these demands.

- Market Share: Major players hold approximately xx% in 2025.

- M&A Activity: Approximately xx deals between 2019 and 2024.

- Regulatory Landscape: Stringent regulations governing seed approvals and GMO usage.

- Innovation: Focus on Hybrids, GM crops and improved disease resistance.

Europe Seed Market Industry Insights & Trends

The Europe seed market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033 from xx Million in 2025. This growth is fueled by several factors, including increasing demand for food and feed, rising agricultural productivity, favorable government policies, and ongoing technological advancements in seed breeding and cultivation techniques. Technological disruptions, such as precision agriculture and advanced breeding technologies, are transforming the industry, enabling the development of seeds with improved traits like higher yields, pest resistance, and stress tolerance. Consumer behaviors are also evolving, with a growing preference for sustainably produced food, driving demand for organically grown crops and environmentally friendly seed varieties. The increasing adoption of protected cultivation methods further contributes to the market's growth.

Key Markets & Segments Leading Europe Seed Market

The key markets and segments driving the European seed market are diverse. While the United Kingdom, Germany, and France represent significant markets based on consumption volume, high-value crops grown in protected cultivation systems across the Netherlands and Spain yield disproportionately high revenue. The row crops segment, particularly cereals and oilseeds, holds a major market share. The demand for Hybrid seeds is significantly higher than conventional seeds due to high yield and disease resistance. Both open-field and protected cultivation mechanisms play crucial roles, with protected cultivation exhibiting higher growth potential due to increased efficiency and control over the growing environment.

- Country-Specific Drivers:

- France: Strong agricultural sector, government support for innovation.

- Germany: Advanced agricultural technology adoption, high consumer demand for quality produce.

- Netherlands: Leading position in protected cultivation, high emphasis on sustainable agriculture.

- Spain: Large area under protected cultivation, increasing demand for high-quality vegetables.

- UK: Significant agricultural output, investment in modern farming techniques.

- Segment Drivers:

- Row Crops: High demand for food and feed, government policies supporting increased production.

- Hybrids: Superior yield and disease resistance compared to conventional seeds.

- Protected Cultivation: Enables year-round production, improved crop quality, and higher yields.

Europe Seed Market Product Developments

Recent product developments have focused on enhancing seed traits through advanced breeding technologies, resulting in seeds with increased yield potential, improved disease resistance, and enhanced stress tolerance. The introduction of new hybrid varieties with enhanced characteristics has significantly improved agricultural productivity and efficiency. These developments reflect market demands for more resilient and productive crops, creating a strong competitive edge for companies that offer innovative seed solutions.

Challenges in the Europe Seed Market Market

The European seed market faces challenges including stringent regulations for seed approvals and GMOs, leading to increased costs and longer approval times which limit market access for new products. Supply chain disruptions, particularly those related to logistics and raw materials, impact the timely availability of seeds. Furthermore, intense competition among major players and the increasing prevalence of counterfeit seeds pose significant threats to market growth. These factors collectively impede market expansion and profitability.

Forces Driving Europe Seed Market Growth

Key drivers include growing global demand for food, technological advancements in seed breeding and biotechnology leading to enhanced seed quality, and governmental initiatives and subsidies to enhance agricultural production and sustainability. Increasing adoption of precision agriculture techniques and the expanding use of protected cultivation further stimulate market expansion. The rising consumer demand for organically produced foods also contributes to the market growth, though at a slower rate compared to conventional products.

Challenges in the Europe Seed Market Market (Long-Term Growth Catalysts)

Long-term growth will be propelled by continued innovation in seed breeding technologies, leading to the development of improved seed varieties with increased yield, disease resistance, and stress tolerance. Strategic partnerships between seed companies and agricultural technology providers will accelerate the adoption of precision farming techniques. Expansion into new markets and regions, particularly in Eastern Europe, will also contribute to market growth.

Emerging Opportunities in Europe Seed Market

Emerging opportunities lie in the growing demand for organic and sustainable seeds, personalized seed solutions tailored to specific farming conditions and needs, and the development of seeds suitable for climate-resilient agriculture. The increasing adoption of data-driven decision-making and digital agriculture technologies provides further opportunities for innovation and market expansion.

Leading Players in the Europe Seed Market Sector

Key Milestones in Europe Seed Market Industry

- July 2023: Syngenta launched a new hybrid winter barley with BYDV tolerance and higher yield, enhancing crop resilience and productivity.

- July 2023: BASF expanded its Xitavo soybean seed portfolio with 11 new high-yielding varieties featuring Enlist E3 technology, improving weed control and yields.

- June 2023: Corteva Agriscience invested USD 6.61 Million in a new R&D facility in Eschbach, Germany, demonstrating commitment to innovation and sustainability within the EMEA region.

Strategic Outlook for Europe Seed Market Market

The Europe seed market exhibits strong growth potential driven by technological advancements, sustainable agriculture practices, and increasing global food demand. Strategic opportunities for companies lie in investing in research and development, forging strategic partnerships, and focusing on the development of climate-resilient and high-yielding seed varieties. Companies that effectively address the challenges posed by regulations, supply chain issues, and competition will be best positioned to capitalize on the future growth prospects of this dynamic market.

Europe Seed Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Insect Resistant Hybrids

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Cultivation Mechanism

- 2.1. Open Field

- 2.2. Protected Cultivation

-

3. Crop Type

-

3.1. Row Crops

-

3.1.1. Fiber Crops

- 3.1.1.1. Cotton

- 3.1.1.2. Other Fiber Crops

-

3.1.2. Forage Crops

- 3.1.2.1. Alfalfa

- 3.1.2.2. Forage Corn

- 3.1.2.3. Forage Sorghum

- 3.1.2.4. Other Forage Crops

-

3.1.3. Grains & Cereals

- 3.1.3.1. Rice

- 3.1.3.2. Wheat

- 3.1.3.3. Other Grains & Cereals

-

3.1.4. Oilseeds

- 3.1.4.1. Canola, Rapeseed & Mustard

- 3.1.4.2. Soybean

- 3.1.4.3. Sunflower

- 3.1.4.4. Other Oilseeds

- 3.1.5. Pulses

-

3.1.1. Fiber Crops

-

3.2. Vegetables

-

3.2.1. Brassicas

- 3.2.1.1. Cabbage

- 3.2.1.2. Carrot

- 3.2.1.3. Cauliflower & Broccoli

- 3.2.1.4. Other Brassicas

-

3.2.2. Cucurbits

- 3.2.2.1. Cucumber & Gherkin

- 3.2.2.2. Pumpkin & Squash

- 3.2.2.3. Other Cucurbits

-

3.2.3. Roots & Bulbs

- 3.2.3.1. Garlic

- 3.2.3.2. Onion

- 3.2.3.3. Potato

- 3.2.3.4. Other Roots & Bulbs

-

3.2.4. Solanaceae

- 3.2.4.1. Chilli

- 3.2.4.2. Eggplant

- 3.2.4.3. Tomato

- 3.2.4.4. Other Solanaceae

-

3.2.5. Unclassified Vegetables

- 3.2.5.1. Asparagus

- 3.2.5.2. Lettuce

- 3.2.5.3. Okra

- 3.2.5.4. Peas

- 3.2.5.5. Spinach

- 3.2.5.6. Other Unclassified Vegetables

-

3.2.1. Brassicas

-

3.1. Row Crops

-

4. Breeding Technology

-

4.1. Hybrids

- 4.1.1. Non-Transgenic Hybrids

- 4.1.2. Insect Resistant Hybrids

- 4.2. Open Pollinated Varieties & Hybrid Derivatives

-

4.1. Hybrids

-

5. Cultivation Mechanism

- 5.1. Open Field

- 5.2. Protected Cultivation

-

6. Crop Type

-

6.1. Row Crops

-

6.1.1. Fiber Crops

- 6.1.1.1. Cotton

- 6.1.1.2. Other Fiber Crops

-

6.1.2. Forage Crops

- 6.1.2.1. Alfalfa

- 6.1.2.2. Forage Corn

- 6.1.2.3. Forage Sorghum

- 6.1.2.4. Other Forage Crops

-

6.1.3. Grains & Cereals

- 6.1.3.1. Rice

- 6.1.3.2. Wheat

- 6.1.3.3. Other Grains & Cereals

-

6.1.4. Oilseeds

- 6.1.4.1. Canola, Rapeseed & Mustard

- 6.1.4.2. Soybean

- 6.1.4.3. Sunflower

- 6.1.4.4. Other Oilseeds

- 6.1.5. Pulses

-

6.1.1. Fiber Crops

-

6.2. Vegetables

-

6.2.1. Brassicas

- 6.2.1.1. Cabbage

- 6.2.1.2. Carrot

- 6.2.1.3. Cauliflower & Broccoli

- 6.2.1.4. Other Brassicas

-

6.2.2. Cucurbits

- 6.2.2.1. Cucumber & Gherkin

- 6.2.2.2. Pumpkin & Squash

- 6.2.2.3. Other Cucurbits

-

6.2.3. Roots & Bulbs

- 6.2.3.1. Garlic

- 6.2.3.2. Onion

- 6.2.3.3. Potato

- 6.2.3.4. Other Roots & Bulbs

-

6.2.4. Solanaceae

- 6.2.4.1. Chilli

- 6.2.4.2. Eggplant

- 6.2.4.3. Tomato

- 6.2.4.4. Other Solanaceae

-

6.2.5. Unclassified Vegetables

- 6.2.5.1. Asparagus

- 6.2.5.2. Lettuce

- 6.2.5.3. Okra

- 6.2.5.4. Peas

- 6.2.5.5. Spinach

- 6.2.5.6. Other Unclassified Vegetables

-

6.2.1. Brassicas

-

6.1. Row Crops

Europe Seed Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Seed Market Regional Market Share

Geographic Coverage of Europe Seed Market

Europe Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Insect Resistant Hybrids

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.2.1. Open Field

- 5.2.2. Protected Cultivation

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Row Crops

- 5.3.1.1. Fiber Crops

- 5.3.1.1.1. Cotton

- 5.3.1.1.2. Other Fiber Crops

- 5.3.1.2. Forage Crops

- 5.3.1.2.1. Alfalfa

- 5.3.1.2.2. Forage Corn

- 5.3.1.2.3. Forage Sorghum

- 5.3.1.2.4. Other Forage Crops

- 5.3.1.3. Grains & Cereals

- 5.3.1.3.1. Rice

- 5.3.1.3.2. Wheat

- 5.3.1.3.3. Other Grains & Cereals

- 5.3.1.4. Oilseeds

- 5.3.1.4.1. Canola, Rapeseed & Mustard

- 5.3.1.4.2. Soybean

- 5.3.1.4.3. Sunflower

- 5.3.1.4.4. Other Oilseeds

- 5.3.1.5. Pulses

- 5.3.1.1. Fiber Crops

- 5.3.2. Vegetables

- 5.3.2.1. Brassicas

- 5.3.2.1.1. Cabbage

- 5.3.2.1.2. Carrot

- 5.3.2.1.3. Cauliflower & Broccoli

- 5.3.2.1.4. Other Brassicas

- 5.3.2.2. Cucurbits

- 5.3.2.2.1. Cucumber & Gherkin

- 5.3.2.2.2. Pumpkin & Squash

- 5.3.2.2.3. Other Cucurbits

- 5.3.2.3. Roots & Bulbs

- 5.3.2.3.1. Garlic

- 5.3.2.3.2. Onion

- 5.3.2.3.3. Potato

- 5.3.2.3.4. Other Roots & Bulbs

- 5.3.2.4. Solanaceae

- 5.3.2.4.1. Chilli

- 5.3.2.4.2. Eggplant

- 5.3.2.4.3. Tomato

- 5.3.2.4.4. Other Solanaceae

- 5.3.2.5. Unclassified Vegetables

- 5.3.2.5.1. Asparagus

- 5.3.2.5.2. Lettuce

- 5.3.2.5.3. Okra

- 5.3.2.5.4. Peas

- 5.3.2.5.5. Spinach

- 5.3.2.5.6. Other Unclassified Vegetables

- 5.3.2.1. Brassicas

- 5.3.1. Row Crops

- 5.4. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.4.1. Hybrids

- 5.4.1.1. Non-Transgenic Hybrids

- 5.4.1.2. Insect Resistant Hybrids

- 5.4.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.4.1. Hybrids

- 5.5. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.5.1. Open Field

- 5.5.2. Protected Cultivation

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Row Crops

- 5.6.1.1. Fiber Crops

- 5.6.1.1.1. Cotton

- 5.6.1.1.2. Other Fiber Crops

- 5.6.1.2. Forage Crops

- 5.6.1.2.1. Alfalfa

- 5.6.1.2.2. Forage Corn

- 5.6.1.2.3. Forage Sorghum

- 5.6.1.2.4. Other Forage Crops

- 5.6.1.3. Grains & Cereals

- 5.6.1.3.1. Rice

- 5.6.1.3.2. Wheat

- 5.6.1.3.3. Other Grains & Cereals

- 5.6.1.4. Oilseeds

- 5.6.1.4.1. Canola, Rapeseed & Mustard

- 5.6.1.4.2. Soybean

- 5.6.1.4.3. Sunflower

- 5.6.1.4.4. Other Oilseeds

- 5.6.1.5. Pulses

- 5.6.1.1. Fiber Crops

- 5.6.2. Vegetables

- 5.6.2.1. Brassicas

- 5.6.2.1.1. Cabbage

- 5.6.2.1.2. Carrot

- 5.6.2.1.3. Cauliflower & Broccoli

- 5.6.2.1.4. Other Brassicas

- 5.6.2.2. Cucurbits

- 5.6.2.2.1. Cucumber & Gherkin

- 5.6.2.2.2. Pumpkin & Squash

- 5.6.2.2.3. Other Cucurbits

- 5.6.2.3. Roots & Bulbs

- 5.6.2.3.1. Garlic

- 5.6.2.3.2. Onion

- 5.6.2.3.3. Potato

- 5.6.2.3.4. Other Roots & Bulbs

- 5.6.2.4. Solanaceae

- 5.6.2.4.1. Chilli

- 5.6.2.4.2. Eggplant

- 5.6.2.4.3. Tomato

- 5.6.2.4.4. Other Solanaceae

- 5.6.2.5. Unclassified Vegetables

- 5.6.2.5.1. Asparagus

- 5.6.2.5.2. Lettuce

- 5.6.2.5.3. Okra

- 5.6.2.5.4. Peas

- 5.6.2.5.5. Spinach

- 5.6.2.5.6. Other Unclassified Vegetables

- 5.6.2.1. Brassicas

- 5.6.1. Row Crops

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sakata Seeds Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Groupe Limagrain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DLF

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bayer AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KWS SAAT SE & Co KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanta Seeds - UPL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Syngenta Grou

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sakata Seeds Corporation

List of Figures

- Figure 1: Europe Seed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Seed Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 2: Europe Seed Market Revenue billion Forecast, by Cultivation Mechanism 2020 & 2033

- Table 3: Europe Seed Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 4: Europe Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 5: Europe Seed Market Revenue billion Forecast, by Cultivation Mechanism 2020 & 2033

- Table 6: Europe Seed Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 7: Europe Seed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 9: Europe Seed Market Revenue billion Forecast, by Cultivation Mechanism 2020 & 2033

- Table 10: Europe Seed Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 11: Europe Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 12: Europe Seed Market Revenue billion Forecast, by Cultivation Mechanism 2020 & 2033

- Table 13: Europe Seed Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 14: Europe Seed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Sweden Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Norway Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Poland Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Denmark Europe Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Seed Market?

The projected CAGR is approximately 6.96%.

2. Which companies are prominent players in the Europe Seed Market?

Key companies in the market include Sakata Seeds Corporation, Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel BV, DLF, Bayer AG, KWS SAAT SE & Co KGaA, Advanta Seeds - UPL, Syngenta Grou, Corteva Agriscience, BASF SE.

3. What are the main segments of the Europe Seed Market?

The market segments include Breeding Technology, Cultivation Mechanism, Crop Type, Breeding Technology, Cultivation Mechanism, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

July 2023: Syngenta launched a new hybrid winter barley with tolerance to barley yellowing virus (BYDV) and higher yield.July 2023: BASF expanded its Xitavo soybean seed portfolio with the addition of its 11 new high-yielding varieties for the 2024 growing season, featuring the Enlist E3 technology to combat difficult weeds.June 2023: Corteva Agriscience opened its first combined crop protection and seed research laboratory in the EMEA region. With an investment of USD 6.61 million, the R&D site is located in Eschbach, Germany, which is energy-efficient and in line with Corteva Agriscience's sustainability commitment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Seed Market?

To stay informed about further developments, trends, and reports in the Europe Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence