Key Insights

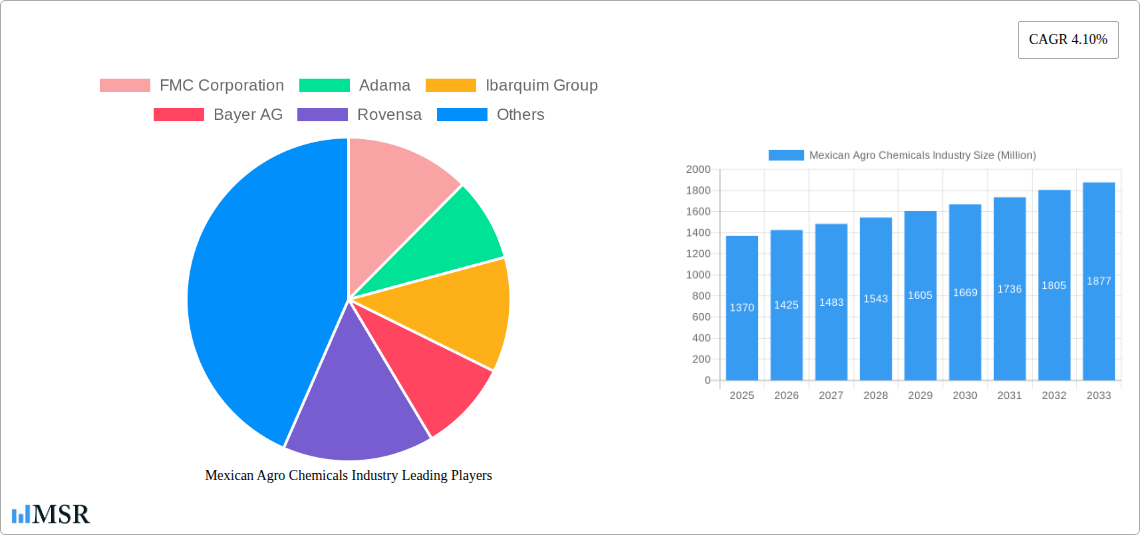

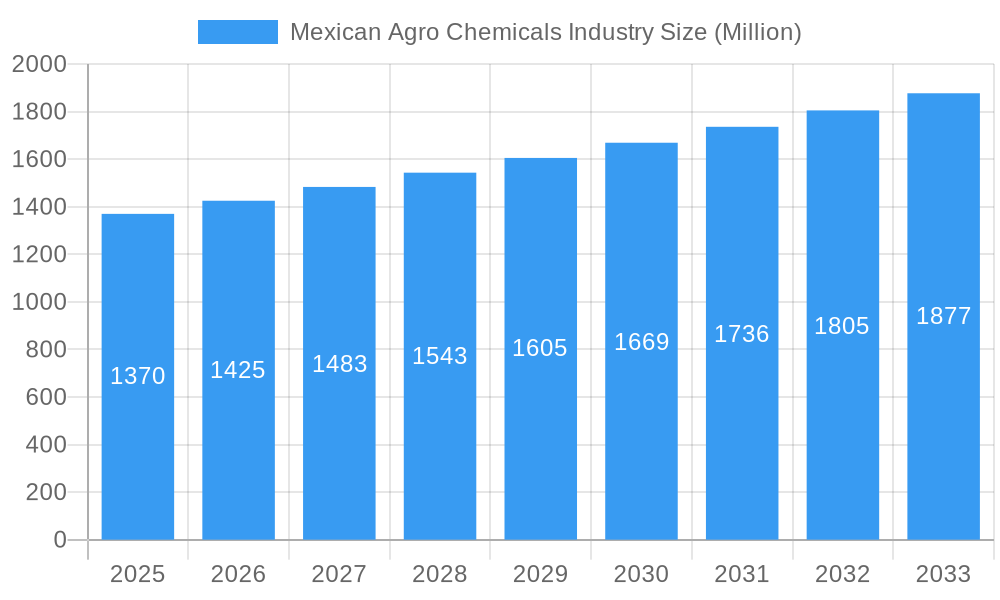

The Mexican agrochemical market is poised for robust expansion, projected to reach a significant valuation of USD 1.37 billion. Driven by a burgeoning agricultural sector and the increasing adoption of modern farming practices, the industry is expected to witness a Compound Annual Growth Rate (CAGR) of 4.10% between 2025 and 2033. Key growth drivers include the escalating demand for enhanced crop yields and quality to meet domestic consumption and export requirements, coupled with government initiatives aimed at modernizing agricultural infrastructure and promoting sustainable farming. The market is also benefiting from increased investment in research and development for innovative agrochemical solutions, including biopesticides and precision agriculture technologies, which address environmental concerns and improve efficiency. Furthermore, Mexico's strategic geographical location and its role as a major food producer and exporter create a sustained demand for effective crop protection and enhancement products.

Mexican Agro Chemicals Industry Market Size (In Billion)

The Mexican agrochemical industry is characterized by a dynamic competitive landscape with both global giants and local players vying for market share. Major companies such as Bayer AG, Syngenta, BASF SE, and FMC Corporation are actively involved, bringing their extensive product portfolios and technological expertise to the market. Local players like Adama and UPL Ltd are also significant contributors, often leveraging their understanding of regional agricultural needs. The market's trajectory is influenced by prevailing trends such as the growing preference for integrated pest management (IPM) strategies, the rising adoption of digital farming technologies, and a focus on developing agrochemicals with lower environmental impact. However, challenges such as stringent regulatory frameworks, fluctuating raw material prices, and the need for farmer education on the responsible use of chemicals present potential restraints. Nonetheless, the overall outlook remains optimistic, with opportunities arising from the continuous need for food security and the modernization of Mexican agriculture.

Mexican Agro Chemicals Industry Company Market Share

Unlock critical insights into the dynamic Mexican agrochemicals market with this in-depth report. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this analysis delves into Mexico's agricultural chemical industry. Examine key segments including production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), and price trend analysis. Discover market-moving industry developments from March 2022 to November 2022, understand market concentration, identify leading players, and navigate challenges and opportunities. This report is essential for agribusiness stakeholders, chemical manufacturers, investors, policymakers, and distributors seeking to capitalize on the growth of sustainable agriculture in Mexico.

Mexican Agro Chemicals Industry Market Concentration & Dynamics

The Mexican agrochemicals market exhibits moderate concentration, with a few global giants and several local players vying for market share. Innovation is increasingly focused on sustainable agrochemicals, including biopesticides and biostimulants, driven by growing consumer demand for healthier food and stricter environmental regulations. The regulatory framework, while evolving, presents both opportunities and challenges for market entry and product development. Substitute products, such as integrated pest management (IPM) strategies and organic farming practices, are gaining traction but are yet to significantly displace conventional agrochemicals in large-scale production. End-user trends show a rising preference for products that enhance crop yield while minimizing environmental impact. Merger and acquisition (M&A) activities, while not as intense as in other regions, are on the rise as companies seek to expand their portfolios and market reach, indicating a strategic consolidation phase. Current market share for leading players is estimated at approximately xx% for FMC Corporation, xx% for Adama, and xx% for Bayer AG. The frequency of M&A deals is estimated at xx per year.

Mexican Agro Chemicals Industry Industry Insights & Trends

The Mexican agrochemicals industry is poised for significant growth, driven by a confluence of factors that are reshaping agricultural practices across the nation. The estimated market size for the Mexican agrochemicals sector is projected to reach USD XXX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of X.XX% anticipated from 2025 to 2033. This expansion is fueled by the increasing need to enhance agricultural productivity to meet the demands of a growing population and for export markets. Technological disruptions, particularly the advent of precision agriculture and digital farming solutions, are enabling more efficient and targeted application of agrochemicals, reducing waste and environmental footprint. Evolving consumer behaviors are playing a crucial role, with a pronounced shift towards sustainably produced food, pushing manufacturers to invest heavily in biologicals, biopesticides, and biostimulants. These eco-friendly alternatives are not only meeting consumer demand but also aligning with government initiatives promoting greener agricultural practices. Furthermore, the Mexican government's focus on food security and agricultural modernization necessitates greater adoption of advanced agrochemical solutions. The persistent challenges of pest resistance and the need for improved crop protection strategies also contribute to sustained demand for innovative and effective agrochemical products. The historical period (2019–2024) has seen a steady increase in the adoption of advanced crop protection solutions, setting a strong foundation for future growth. The estimated market size in 2024 was USD XXX Million.

Key Markets & Segments Leading Mexican Agro Chemicals Industry

The Mexican agrochemicals industry is characterized by dynamic market segments, each contributing significantly to the overall sector’s performance.

- Production Analysis: The production of agrochemicals is increasingly localized, driven by government initiatives to reduce reliance on imports and enhance national self-sufficiency. Key production hubs are emerging in regions with strong agricultural output and established chemical manufacturing infrastructure.

- Drivers: Government incentives for domestic manufacturing, availability of raw materials, and skilled labor contribute to localized production growth.

- Dominance: States with extensive agricultural activities, such as Sinaloa, Jalisco, and Veracruz, are becoming crucial centers for the formulation and packaging of agrochemicals, catering to both domestic and export demands.

- Consumption Analysis: Consumption patterns are heavily influenced by crop types, climatic conditions, and the adoption of modern farming techniques. High-value crops, particularly fruits and vegetables destined for export, exhibit higher consumption rates of specialized agrochemicals.

- Drivers: Growing demand for fruits and vegetables in international markets, increasing adoption of advanced farming practices, and the need for effective pest and disease management in diverse agricultural landscapes.

- Dominance: The central and western regions of Mexico, known for their intensive horticultural production, represent the largest consumer markets for a wide range of agrochemicals, including insecticides, fungicides, and herbicides.

- Import Market Analysis (Value & Volume): Mexico relies on imports for certain advanced agrochemical formulations and active ingredients. The import market is substantial, driven by the need for specialized products that may not be manufactured domestically.

- Drivers: Technological advancements in foreign markets, availability of patented agrochemicals, and the need to supplement domestic production capabilities.

- Dominance: The value of imports for agrochemicals is estimated to be USD XXX Million in 2025, with a projected volume of XXX Thousand Metric Tons. Key import origins include the United States, China, and European countries.

- Export Market Analysis (Value & Volume): Mexico is emerging as a significant exporter of agrochemicals, particularly to other Latin American countries. This segment is growing as Mexican companies develop competitive products and leverage established trade agreements.

- Drivers: Competitive pricing, quality of products, and strategic geographical location for regional distribution.

- Dominance: The value of agrochemical exports is projected to reach USD XXX Million by 2025, with an estimated volume of XXX Thousand Metric Tons. Central American and Caribbean nations are primary export destinations.

- Price Trend Analysis: Price trends are influenced by global commodity prices, currency fluctuations, regulatory changes, and the cost of raw materials. The market is sensitive to fluctuations in the cost of active ingredients and energy.

- Drivers: Global supply chain disruptions, currency exchange rates (e.g., USD/MXN), and the cost of essential chemical inputs.

- Dominance: Prices for key agrochemicals are expected to see a moderate increase of X.XX% annually due to these influencing factors, particularly in the forecast period.

Mexican Agro Chemicals Industry Product Developments

Recent product developments in the Mexican agrochemicals industry highlight a strong focus on sustainability and innovation. Companies are investing in the research and development of biological crop protection solutions, including biofungicides and bioinsecticides, offering environmentally friendly alternatives to conventional synthetic chemicals. The introduction of advanced seed treatment technologies aims to enhance germination rates and early-stage crop health. Furthermore, precision application technologies are being integrated into product offerings, allowing for targeted delivery of agrochemicals, thus optimizing efficacy and minimizing environmental impact. These advancements are crucial for addressing the evolving needs of Mexican agriculture, focusing on yield enhancement and sustainable practices.

Challenges in the Mexican Agro Chemicals Industry Market

The Mexican agrochemicals market faces several significant challenges that can impede growth and market penetration.

- Regulatory Hurdles: Evolving and sometimes complex regulations regarding the approval and use of specific chemical compounds can create delays and increase compliance costs.

- Supply Chain Disruptions: Global geopolitical events and logistical complexities can lead to shortages of raw materials and finished products, impacting availability and price.

- Competitive Pressures: Intense competition from both multinational corporations and smaller local manufacturers, alongside the growing influence of generic products, puts pressure on profit margins.

- Environmental Concerns & Public Perception: Increasing public awareness and demand for sustainable farming practices create pressure to adopt greener alternatives, potentially phasing out certain traditional chemicals. The estimated impact of regulatory hurdles on product launch timelines is xx months, and supply chain issues can lead to xx% of products being out of stock at peak season.

Forces Driving Mexican Agro Chemicals Industry Growth

The Mexican agrochemicals industry is experiencing robust growth driven by several powerful forces.

- Technological Advancements: The integration of precision agriculture, drones for spraying, and advanced formulations enhances the efficiency and effectiveness of agrochemical applications, leading to higher crop yields and reduced waste.

- Economic Growth and Export Demand: Mexico's expanding agricultural sector, particularly its significant role in global food exports, necessitates increased use of effective crop protection and enhancement solutions to meet international quality standards and volume demands.

- Government Support for Modernization: Initiatives aimed at modernizing agriculture, promoting food security, and enhancing export competitiveness indirectly encourage the adoption of advanced agrochemical products.

- Growing Adoption of Sustainable Practices: The increasing demand for eco-friendly farming methods is stimulating innovation in biologicals and biostimulants, creating new market segments and driving investment in these areas.

Challenges in the Mexican Agro Chemicals Industry Market

Long-term growth catalysts for the Mexican agrochemicals industry are deeply intertwined with ongoing innovations and strategic market expansions.

- Innovation in Biologicals: Continued investment in research and development of novel biological crop protection and enhancement solutions will be a key driver, catering to the escalating demand for sustainable agriculture.

- Strategic Partnerships and Acquisitions: Companies forming strategic alliances or engaging in M&A activities will consolidate market presence, expand product portfolios, and gain access to new technologies and distribution networks.

- Market Expansion into Untapped Segments: Identifying and developing solutions for under-served niche crops or regions within Mexico, as well as expanding export markets in Latin America, will fuel sustained growth.

- Digital Transformation: The full integration of digital platforms for farm management, data analytics, and product recommendations will further optimize agrochemical usage and enhance farm profitability.

Emerging Opportunities in Mexican Agro Chemicals Industry

The Mexican agrochemicals industry is ripe with emerging opportunities, driven by evolving agricultural practices and consumer preferences.

- Rise of Biopesticides and Biostimulants: The global shift towards sustainable agriculture is creating a significant demand for biological solutions. Mexico, with its vast agricultural land and diverse crops, is an ideal market for these products.

- Precision Agriculture Integration: The adoption of precision agriculture technologies offers opportunities for customized agrochemical solutions that are applied only where and when needed, leading to greater efficiency and reduced environmental impact.

- Focus on High-Value Crops: The growing importance of fruits, vegetables, and specialty crops in Mexico's export basket presents a strong market for specialized agrochemicals that enhance yield, quality, and shelf life.

- Technological Innovation in Formulations: Development of advanced delivery systems, nano-formulations, and slow-release technologies can improve product efficacy and sustainability, creating new market niches.

Leading Players in the Mexican Agro Chemicals Industry Sector

- FMC Corporation

- Adama

- Ibarquim Group

- Bayer AG

- Rovensa

- Summit Agro México

- UPL Ltd

- International Chemical Copper SA de CV

- Velsimex

- Yara International ASA

- Syngenta

- BASF SE

Key Milestones in Mexican Agro Chemicals Industry Industry

- November 2022: A broad coalition of Mexican lawmakers pushes for the ban of nearly 200 harmful pesticide chemicals, raising concerns among farmers about potential impacts on food production and agrochemical prices.

- August 2022: Futureco Bioscience partners with Innovak Global to distribute BESTCURE, a sustainable plant bioprotectant, in Mexico, targeting high-value crops like courgette, squash, chayote, melon, watermelon, and cucumber.

- March 2022: Mexico mandates the national production of fertilizers under the National Programme of Fertilizers, supported by Petroleos Mexicanos (Premex), due to rising international prices and supply shortages.

Strategic Outlook for Mexican Agro Chemicals Industry Market

The strategic outlook for the Mexican agrochemicals industry is exceptionally promising, driven by a confluence of accelerating factors. The sustained growth trajectory is expected to be propelled by the increasing adoption of sustainable agriculture solutions, particularly biologicals and biopesticides, aligning with both global trends and national environmental goals. Further integration of precision agriculture technologies will optimize resource utilization and enhance crop yields, creating demand for innovative, targeted agrochemical products. Government support for agricultural modernization and food security will continue to be a key accelerator, fostering an environment conducive to investment and technological advancement. Moreover, Mexico's strong position in international food exports will sustain the demand for high-quality crop protection and enhancement products. Strategic initiatives focusing on research and development, partnerships, and expanding market reach will be crucial for players to capitalize on these burgeoning opportunities and secure a competitive edge in this dynamic market.

Mexican Agro Chemicals Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

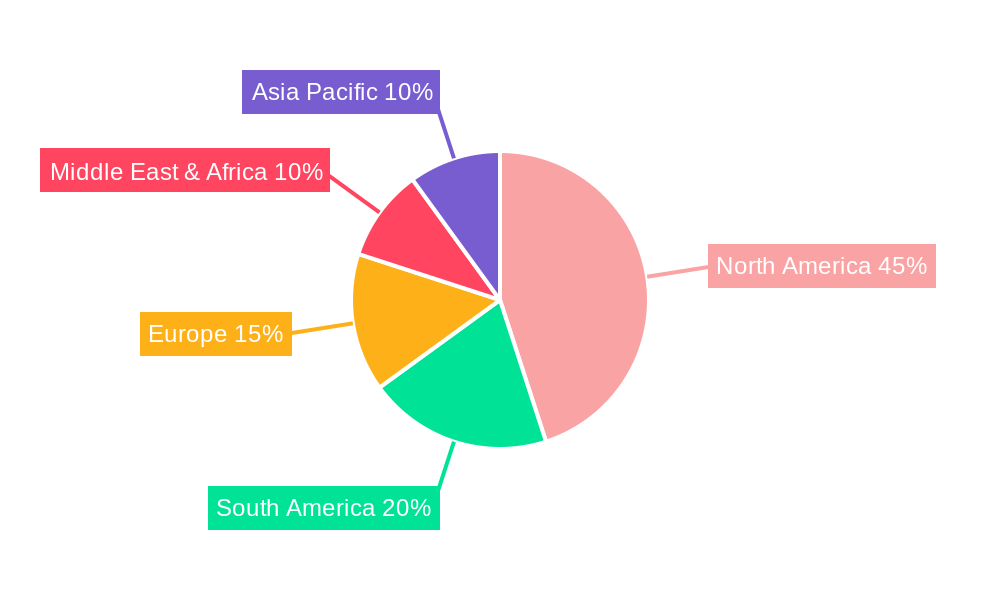

Mexican Agro Chemicals Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mexican Agro Chemicals Industry Regional Market Share

Geographic Coverage of Mexican Agro Chemicals Industry

Mexican Agro Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Need for Increased Land Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mexican Agro Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Mexican Agro Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Mexican Agro Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Mexican Agro Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Mexican Agro Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Mexican Agro Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 FMC Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adama

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ibarquim Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rovensa

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Summit Agro México

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UPL Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Chemical Copper SA de CV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Velsimex

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yara International ASA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Syngenta

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BASF SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 FMC Corporation

List of Figures

- Figure 1: Global Mexican Agro Chemicals Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mexican Agro Chemicals Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Mexican Agro Chemicals Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Mexican Agro Chemicals Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Mexican Agro Chemicals Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Mexican Agro Chemicals Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Mexican Agro Chemicals Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Mexican Agro Chemicals Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Mexican Agro Chemicals Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Mexican Agro Chemicals Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Mexican Agro Chemicals Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Mexican Agro Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Mexican Agro Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Mexican Agro Chemicals Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Mexican Agro Chemicals Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Mexican Agro Chemicals Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Mexican Agro Chemicals Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Mexican Agro Chemicals Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Mexican Agro Chemicals Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Mexican Agro Chemicals Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Mexican Agro Chemicals Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Mexican Agro Chemicals Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Mexican Agro Chemicals Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Mexican Agro Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Mexican Agro Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Mexican Agro Chemicals Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Mexican Agro Chemicals Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Mexican Agro Chemicals Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Mexican Agro Chemicals Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Mexican Agro Chemicals Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Mexican Agro Chemicals Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Mexican Agro Chemicals Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Mexican Agro Chemicals Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Mexican Agro Chemicals Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Mexican Agro Chemicals Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Mexican Agro Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Mexican Agro Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Mexican Agro Chemicals Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Mexican Agro Chemicals Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Mexican Agro Chemicals Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Mexican Agro Chemicals Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Mexican Agro Chemicals Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Mexican Agro Chemicals Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Mexican Agro Chemicals Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Mexican Agro Chemicals Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Mexican Agro Chemicals Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Mexican Agro Chemicals Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Mexican Agro Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Mexican Agro Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Mexican Agro Chemicals Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Mexican Agro Chemicals Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Mexican Agro Chemicals Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Mexican Agro Chemicals Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Mexican Agro Chemicals Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Mexican Agro Chemicals Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Mexican Agro Chemicals Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Mexican Agro Chemicals Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Mexican Agro Chemicals Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Mexican Agro Chemicals Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Mexican Agro Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Mexican Agro Chemicals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Mexican Agro Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Mexican Agro Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexican Agro Chemicals Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Mexican Agro Chemicals Industry?

Key companies in the market include FMC Corporation, Adama, Ibarquim Group, Bayer AG, Rovensa, Summit Agro México, UPL Ltd, International Chemical Copper SA de CV, Velsimex, Yara International ASA, Syngenta, BASF SE.

3. What are the main segments of the Mexican Agro Chemicals Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Need for Increased Land Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

November 2022; In Mexico, a broad coalition of Mexican lawmakers is pushing the government to ban nearly 200 chemicals used in pesticides, showing that they are harmful to humans. This plan has already alarmed farmers as it will affect food production and agrochemical prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexican Agro Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexican Agro Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexican Agro Chemicals Industry?

To stay informed about further developments, trends, and reports in the Mexican Agro Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence