Key Insights

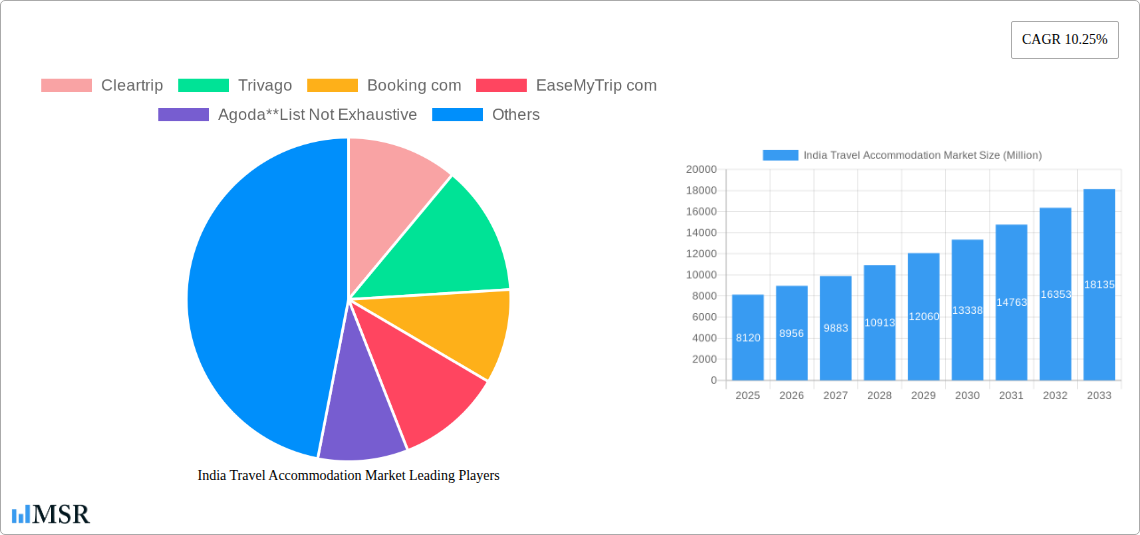

The India travel accommodation market, valued at approximately $8.12 billion in 2025, is projected to experience robust growth, fueled by a Compound Annual Growth Rate (CAGR) of 10.25% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes, particularly among the burgeoning middle class, are enabling more Indians to engage in leisure and business travel. Increased smartphone penetration and improved internet connectivity have significantly boosted online booking platforms' reach, making travel planning and booking more accessible. The government's initiatives to promote tourism, including infrastructure development and visa facilitation, further contribute to market growth. Furthermore, the increasing popularity of budget-friendly accommodations and the rise of unique travel experiences cater to diverse traveler preferences. Competition within the market remains intense, with established players like MakeMyTrip, Goibibo, and Booking.com vying for market share alongside newer entrants offering innovative services and targeted marketing strategies.

India Travel Accommodation Market Market Size (In Billion)

Segment-wise, the mobile application segment is likely to dominate due to its convenience and accessibility. Similarly, third-party online travel portals are expected to hold a larger market share compared to direct booking portals, as they offer wider choices and competitive pricing. Regional variations in growth are also anticipated, with metropolitan areas and popular tourist destinations witnessing faster growth than less-developed regions. However, factors such as economic downturns, fluctuating fuel prices, and potential safety concerns could pose challenges to sustained market growth. Nevertheless, the overall outlook remains positive, with the market poised for considerable expansion in the coming years. The market's future trajectory will depend on managing these challenges effectively while capitalizing on the growth opportunities presented by a rapidly evolving travel landscape.

India Travel Accommodation Market Company Market Share

India Travel Accommodation Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India travel accommodation market, offering valuable insights for stakeholders including investors, businesses, and policymakers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It analyzes market size, growth drivers, competitive landscape, and emerging trends, providing actionable intelligence for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Key players like MakeMyTrip.com, Goibibo, OYO Rooms, and EaseMyTrip.com are profiled, along with an assessment of the impact of recent developments.

India Travel Accommodation Market Market Concentration & Dynamics

The Indian travel accommodation market exhibits a moderately concentrated structure, with several major players holding significant market share. However, the market is also characterized by a high degree of dynamism, with constant innovation, evolving consumer preferences, and frequent mergers and acquisitions (M&A) activities.

The market share distribution is as follows (2024 estimates): MakeMyTrip.com (xx%), Goibibo (xx%), OYO Rooms (xx%), EaseMyTrip.com (xx%), Booking.com (xx%), and others (xx%). The remaining share is distributed amongst numerous smaller players, highlighting the fragmentation at the lower end of the market.

Innovation Ecosystem: The market is characterized by rapid technological advancements, with companies continuously introducing new platforms, features, and services to enhance user experience. Examples include the rise of voice-assisted booking and integration with financial technology (FinTech) solutions.

Regulatory Framework: Government regulations related to tourism, hospitality, and online businesses significantly impact market dynamics. Changes in these regulations can influence market growth and operations of market players.

Substitute Products: Homestays, guesthouses, and budget hotels present alternative accommodation choices, impacting the growth of the organised sector.

End-User Trends: A growing middle class, increasing disposable incomes, and a desire for unique travel experiences are driving market growth. The rise of mobile usage and online booking preferences further shapes market dynamics.

M&A Activities: The number of M&A deals in the sector has been steadily increasing over the past few years, with xx deals recorded in 2024 (an increase from xx deals in 2023). These activities reshape the competitive landscape and often lead to improved market efficiency and innovation.

India Travel Accommodation Market Industry Insights & Trends

The Indian travel accommodation market is witnessing robust growth, driven by several factors. The increasing affordability of travel, the rising popularity of domestic tourism, and the expanding middle class are key contributors to this expansion. Technological advancements, like AI-powered booking platforms and mobile-first strategies, are revolutionizing the way people plan and book their travel arrangements.

The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period. The growth is predominantly driven by the increasing adoption of online travel platforms, facilitated by high smartphone penetration and growing internet accessibility in India. Consumer behavior is shifting toward personalized and experiential travel, influencing service offerings. Furthermore, the industry’s response to disruption through the pandemic period has shaped strategic focus on hygiene and safety, and flexibility of booking and cancellation policies. Growth is also fueled by strategic partnerships and product innovations by key players like MakeMyTrip’s collaboration with Microsoft, allowing for voice-activated booking services in several Indian languages.

Key Markets & Segments Leading India Travel Accommodation Market

The Indian travel accommodation market is experiencing widespread growth across various regions. However, major metropolitan areas and popular tourist destinations exhibit the strongest growth. The mobile application platform segment dominates, followed by the website platform. The third-party online portal mode of booking accounts for a larger market share than direct booking through captive portals.

By Platform:

- Mobile Applications: Dominates the market due to high smartphone penetration and user convenience. Drivers include ease of use, personalized recommendations, and seamless booking processes.

- Websites: Remains significant, catering to users preferring desktop booking or detailed information browsing.

By Mode of Booking:

- Third-Party Online Portals: Hold a larger market share due to wider choices, competitive pricing, and user-friendly interfaces offered by platforms like MakeMyTrip, Goibibo, and Booking.com.

- Direct/Captive Portals: Maintain relevance, particularly for established hotels and chains offering loyalty programs and customized services.

The dominance of mobile applications and third-party online portals reflects the evolving preferences of Indian travelers for convenient and cost-effective booking options. The growth of these segments is further fueled by increasing internet and smartphone penetration, especially in rural areas. Economic growth, improving infrastructure, and rising disposable incomes also contribute to the expansion of this market.

India Travel Accommodation Market Product Developments

Recent product developments focus on enhancing user experience through technological integrations and personalization. Voice-assisted booking, AI-powered recommendations, and seamless integration with FinTech solutions are key trends. Companies are also investing in improving their mobile applications, offering loyalty programs, and expanding their range of accommodation options to cater to diverse traveller needs and budgets. The introduction of offline retail outlets by EaseMyTrip reflects a strategic move to bridge the online-offline gap and provide personalized customer service.

Challenges in the India Travel Accommodation Market Market

The Indian travel accommodation market faces various challenges, including intense competition, regulatory hurdles, and seasonal demand fluctuations impacting profitability. Supply chain disruptions, particularly in the wake of unforeseen events, can lead to increased costs and operational complexities. The high reliance on technology also exposes businesses to cybersecurity risks and data breaches. Furthermore, inconsistent infrastructure development in certain regions can hinder market expansion and affect accessibility. Quantifiable impact varies, with estimates suggesting an xx% fluctuation in occupancy rates due to seasonal variations.

Forces Driving India Travel Accommodation Market Growth

The Indian travel accommodation market is experiencing robust and sustained growth, propelled by a confluence of powerful driving forces. A primary catalyst is the rapidly expanding middle class, characterized by increasing disposable incomes and a growing appetite for travel and leisure experiences. This demographic shift translates directly into higher expenditure on travel and accommodation. Complementing this, proactive government initiatives aimed at boosting domestic and international tourism, including infrastructure development and promotional campaigns, are significantly nurturing market expansion. Technological advancements are playing a pivotal role, not only by enhancing the accessibility and user experience of booking platforms but also by enabling innovative service delivery. The demonstrable preference for convenient and efficient online booking channels further fuels market growth, making travel planning more accessible than ever before.

Long-Term Growth Catalysts in India Travel Accommodation Market

The long-term growth of the Indian travel accommodation market is fueled by continued technological advancements, strategic partnerships (like the Microsoft-MakeMyTrip collaboration), and expansion into new markets, including those with improved digital infrastructure. Investments in innovative solutions that cater to diverse traveller needs, such as sustainable tourism options and personalized travel experiences, will further drive growth.

Emerging Opportunities in India Travel Accommodation Market

The India travel accommodation market is ripe with emerging opportunities, particularly for those who can adeptly leverage evolving consumer trends and technological innovations. A significant avenue lies in the sophisticated use of technology to deliver hyper-personalized travel experiences, tailoring offerings to individual preferences and needs. Catering to niche segments, such as the burgeoning adventure tourism, serene wellness retreats, and immersive cultural experiences, presents substantial growth potential. Furthermore, tapping into the vast and largely untapped potential of Tier 2 and Tier 3 cities and rural destinations offers significant expansion prospects. The integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) holds immense promise for revolutionizing customer service through intelligent chatbots and predictive analytics for demand forecasting and personalized recommendations. The growing global and domestic consciousness around environmental impact is also creating a strong demand for sustainable tourism, opening doors for eco-friendly accommodations, responsible travel packages, and community-based tourism initiatives.

Leading Players in the India Travel Accommodation Market Sector

- Cleartrip

- Trivago

- Booking.com

- EaseMyTrip.com

- Agoda

- OYO Rooms

- IRCTC

- Goibibo

- MakeMyTrip.com

Key Milestones in India Travel Accommodation Market Industry

- May 2023: Microsoft partnered with MakeMyTrip to introduce voice-assisted booking.

- February 2024: EaseMyTrip opened its 10th offline retail outlet in Indore.

- February 2024: EaseMyTrip formed a strategic alliance with Zaggle Prepaid Ocean Services Limited.

These developments signify a shift towards more personalized and integrated travel experiences and a strategic move towards offline presence.

Strategic Outlook for India Travel Accommodation Market Market

The Indian travel accommodation market holds immense future potential, driven by sustained economic growth, technological innovation, and evolving consumer preferences. Strategic opportunities exist in leveraging data analytics, strengthening partnerships, and expanding into underserved markets. A focus on providing personalized, seamless, and sustainable travel experiences will be crucial for success in this dynamic market.

India Travel Accommodation Market Segmentation

-

1. Platform

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive Portals

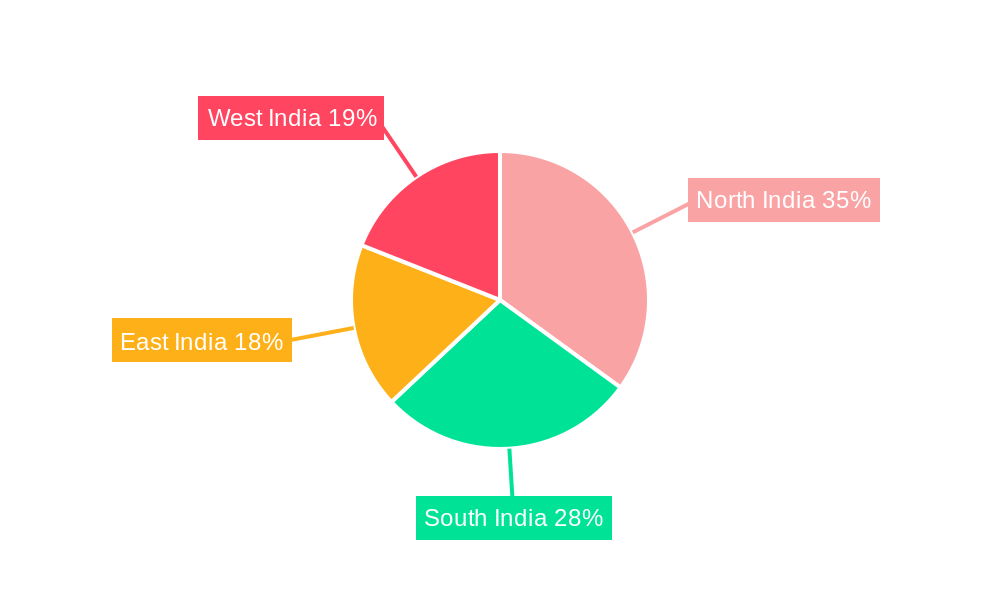

India Travel Accommodation Market Segmentation By Geography

- 1. India

India Travel Accommodation Market Regional Market Share

Geographic Coverage of India Travel Accommodation Market

India Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels

- 3.2.2 Resorts

- 3.2.3 and Airbnb Options for Consumers Driving the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Growth of Digital Payments Is Boosting the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive Portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trivago

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EaseMyTrip com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agoda**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OYO Rooms

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IRCTC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goibibo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MakeMyTrip com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Travel Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Travel Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: India Travel Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 6: India Travel Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Travel Accommodation Market?

The projected CAGR is approximately 10.25%.

2. Which companies are prominent players in the India Travel Accommodation Market?

Key companies in the market include Cleartrip, Trivago, Booking com, EaseMyTrip com, Agoda**List Not Exhaustive, OYO Rooms, IRCTC, Goibibo, MakeMyTrip com.

3. What are the main segments of the India Travel Accommodation Market?

The market segments include Platform, Mode of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels. Resorts. and Airbnb Options for Consumers Driving the Market's Growth.

6. What are the notable trends driving market growth?

Rising Growth of Digital Payments Is Boosting the Growth of the Market.

7. Are there any restraints impacting market growth?

Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth.

8. Can you provide examples of recent developments in the market?

February 2024: India’s biggest online travel tech platform, EaseMyTrip, opened its first offline retail outlet in the state of Madhya Pradesh, Indore. This is the 10th offline store launched under the brand's franchise model, which is a testament to its commitment to efficiently serving its customers online and offline. The new offline store is aimed at reaching out to its offline customers who are looking for a personalized meet-and-greet experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the India Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence