Key Insights

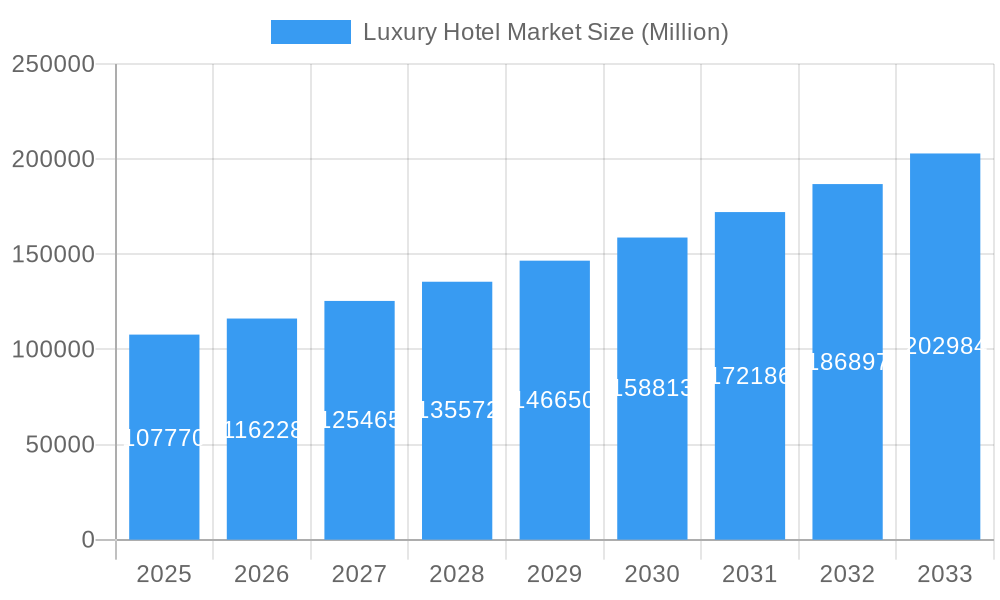

The global luxury hotel market, valued at $107.77 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 7.90% from 2025 to 2033. This expansion is fueled by several key factors. Increasing disposable incomes in emerging economies, particularly in Asia-Pacific, are creating a larger pool of high-net-worth individuals willing to spend on premium travel experiences. The rise of experiential travel, with a focus on unique and personalized services, further fuels demand. Luxury hotel chains are adapting to this trend by investing in innovative amenities, personalized concierge services, and sustainable practices to attract discerning travelers. Furthermore, the growth of the business travel sector, particularly within key regions like North America and Europe, provides a consistent revenue stream for luxury hotels. Competition within the market is fierce, with established players like Marriott International, Four Seasons, and Hyatt constantly vying for market share through strategic acquisitions, brand extensions, and technological advancements. However, economic downturns and global events can influence the demand for luxury travel.

Luxury Hotel Market Market Size (In Billion)

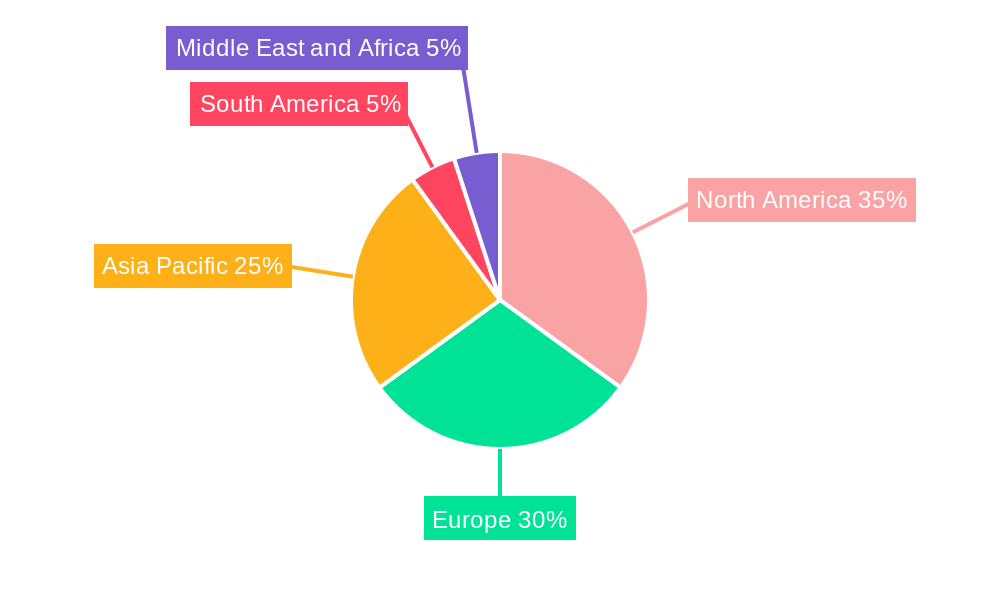

The segmentation of the luxury hotel market reveals considerable variation in growth potential across service types. Business hotels, benefiting from corporate travel, are likely to exhibit stable growth. Airport hotels maintain strong performance due to convenient location and high occupancy rates. Resort hotels, catering to leisure travelers, are expected to witness substantial growth driven by the increasing popularity of luxury vacations. The "Other Service Types" segment, potentially encompassing boutique hotels and unique accommodations, may offer niche opportunities with high profit margins. Regional analysis indicates that North America and Europe will retain significant market share due to established tourism infrastructure and a robust high-net-worth individual population. However, rapid economic growth in Asia-Pacific suggests this region will witness the most significant percentage growth in the coming years, driven by increasing demand from China and India. South America and the Middle East and Africa represent emerging markets with untapped potential for luxury hotel development.

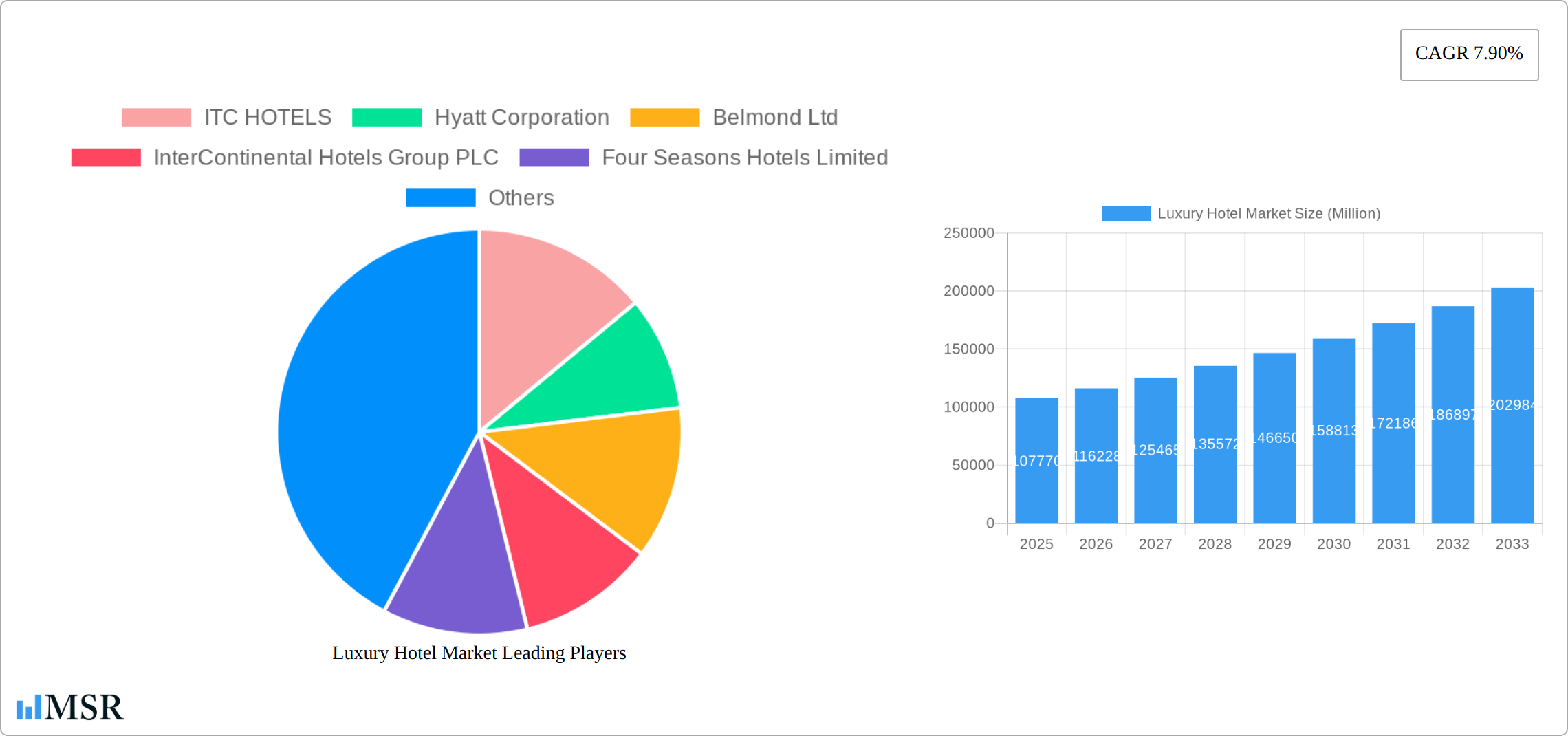

Luxury Hotel Market Company Market Share

Luxury Hotel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global luxury hotel market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The global luxury hotel market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Luxury Hotel Market Concentration & Dynamics

The luxury hotel market is characterized by a moderately concentrated landscape, with a handful of major players holding significant market share. However, the presence of numerous boutique and independent luxury hotels contributes to a dynamic competitive environment. Key metrics reveal a fluctuating market share among leading players, with ITC HOTELS, Hyatt Corporation, Belmond Ltd, InterContinental Hotels Group PLC, Four Seasons Hotels Limited, Rosewood Hotels & Resorts, Shangri-La International Hotel Management Ltd, Marriott International Inc, Ritz-Carlton Hotel Company LLC, and Accor SA consistently vying for dominance.

- Market Share: The top 5 players account for approximately xx% of the global market share in 2025, with a slight shift expected by 2033.

- M&A Activity: The historical period (2019-2024) witnessed xx major mergers and acquisitions, indicating a strong appetite for consolidation and expansion within the sector. This trend is anticipated to continue, driven by the pursuit of economies of scale and diversification.

- Innovation Ecosystems: The luxury hotel sector is witnessing growing investments in technological innovations, including AI-powered guest services, personalized experiences, and sustainable operational practices.

- Regulatory Frameworks: Varying regulations across different countries significantly impact operational costs and market entry strategies for luxury hotel chains.

- Substitute Products: While luxury hotels maintain their unique appeal, alternative accommodations such as high-end vacation rentals and private villas pose increasing competitive pressure.

- End-User Trends: The demand for luxury travel experiences is driven by affluent consumers seeking personalized services, authentic cultural immersion, and sustainable options.

Luxury Hotel Market Industry Insights & Trends

The luxury hotel market is experiencing robust growth, driven by a confluence of factors. A surge in disposable incomes within emerging economies, combined with increased global travel amongst high-net-worth individuals (HNWIs), is significantly boosting demand. This upward trend is further amplified by the integration of cutting-edge technologies, revolutionizing the guest experience through hyper-personalization and seamless, intuitive interactions. Market valuation reached xx Million USD in 2024 and is projected to surpass xx Million USD by 2033, indicating substantial growth potential. Evolving consumer preferences emphasize experiential travel, encompassing wellness-focused amenities and a strong commitment to sustainability. Technological innovations such as AI-powered concierge services and personalized in-room entertainment systems are transforming the guest journey, enhancing convenience and creating unforgettable experiences.

The rise of "bleisure" travel (a blend of business and leisure) presents lucrative opportunities within the luxury sector. The industry's strategic response involves substantial investments in advanced technologies, sustainable initiatives, and tailored guest experiences. This strategic focus is expected to yield a compound annual growth rate (CAGR) of xx% throughout the forecast period.

Key Markets & Segments Leading Luxury Hotel Market

The Asia-Pacific region is currently the dominant market for luxury hotels, driven by rapid economic growth, rising disposable incomes, and increasing international tourism. Europe and North America follow as significant markets, with sustained demand from both domestic and international travelers.

By Service Type:

Resorts: This segment leads the market due to its capacity for providing holistic luxury experiences, including wellness facilities, exclusive amenities, and breathtaking locations. Strong drivers include:

- Economic Growth: Rising disposable incomes in major tourism destinations drive demand for resort vacations.

- Infrastructure Development: Improved infrastructure in key resort locations facilitates access and enhances the overall experience.

- Tourism Promotion: Targeted marketing campaigns increase destination popularity and attract high-spending tourists.

Business Hotels: This segment maintains a strong presence, driven by corporate travel and MICE (Meetings, Incentives, Conferences, and Exhibitions) events. The performance of this segment is directly related to overall economic performance and business travel trends.

Suite Hotels: This niche market caters to affluent travellers prioritizing space and privacy, exhibiting strong potential for expansion.

Airport Hotels: Convenient location drives demand for these hotels, particularly among high-end business travelers.

Other Service Types: This category comprises smaller, niche luxury hotels focusing on specialized services, such as eco-tourism or wellness retreats. These types of hotels showcase strong resilience and often maintain high occupancy rates despite broader market fluctuations.

Luxury Hotel Market Product Developments

Recent innovations prioritize elevating the guest experience through personalized services, seamless technological integration, and sustainable practices. The introduction of AI-powered concierge services, personalized in-room entertainment systems, and streamlined mobile check-in/check-out options are revolutionizing the guest journey, offering unparalleled convenience and efficiency. A growing emphasis on sustainability, utilizing eco-friendly building materials and implementing responsible operational practices, is attracting environmentally conscious travelers and providing luxury hotels with a significant competitive edge. This focus demonstrates a shift towards responsible luxury.

Challenges in the Luxury Hotel Market Market

The luxury hotel market faces challenges including: increasing operational costs due to rising labor expenses and fluctuating energy prices (estimated impact: xx Million annually on average for large chains), stringent regulatory frameworks that hinder market entry and expansion, intense competition from both established players and emerging boutique hotels, and potential disruptions from unforeseen global events such as pandemics or economic downturns (causing an estimated xx% reduction in occupancy rates during peak crisis periods). Supply chain issues related to procurement of luxury goods and furnishings also pose an ongoing challenge.

Forces Driving Luxury Hotel Market Growth

Several key factors contribute to the market's robust growth trajectory. Sustained economic growth in emerging markets, coupled with a burgeoning population of high-net-worth individuals (HNWIs), is a primary driver. Technological advancements are not only enhancing the guest experience but also driving operational efficiencies. Supportive government policies promoting tourism and infrastructure investment further bolster market expansion. The increasing preference for personalized luxury experiences fuels growth within this discerning segment.

Challenges in the Luxury Hotel Market Market

Long-term growth relies on adapting to evolving consumer preferences, embracing sustainable practices, and leveraging technological innovations. Strategic partnerships, market expansions into underserved regions, and developing unique luxury experiences will be crucial for sustained growth.

Emerging Opportunities in Luxury Hotel Market

Emerging opportunities exist in expanding into underserved markets, particularly in Asia and Africa. The integration of new technologies such as AI, VR/AR, and blockchain will further enhance personalization and create new revenue streams. Furthermore, a continued focus on sustainable tourism and wellness experiences appeals to an increasingly conscious traveler segment.

Leading Players in the Luxury Hotel Market Sector

Key Milestones in Luxury Hotel Market Industry

- November 2020: The merger agreement between Accor and Ennismore created a major lifestyle hospitality operator, significantly reshaping the competitive landscape and driving innovation and market consolidation.

- February 2020: The merger of Hamilton Hotel Partners and Pyramid Hotel Group expanded the combined entity's global reach and asset management capabilities, reflecting the industry's ongoing trend towards consolidation and operational scaling.

Strategic Outlook for Luxury Hotel Market Market

The future of the luxury hotel market is bright, characterized by continued growth driven by a confluence of factors including rising affluence, technological advancements, and evolving travel preferences. Strategic players will need to focus on personalized experiences, sustainable practices, and leveraging technology to enhance operations and maintain a competitive edge. Expanding into new markets and forging strategic partnerships will be essential for capturing significant market share and securing long-term growth.

Luxury Hotel Market Segmentation

-

1. Service Type

- 1.1. Business Hotels

- 1.2. Airport Hotels

- 1.3. Suite Hotels

- 1.4. Resorts

- 1.5. Other Service Types

Luxury Hotel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Australia

- 3.3. Japan

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Luxury Hotel Market Regional Market Share

Geographic Coverage of Luxury Hotel Market

Luxury Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Popularity of Museums

- 3.2.2 Historical Sites

- 3.2.3 Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions

- 3.4. Market Trends

- 3.4.1. Increasing Digitization of Services and Online Booking on Apps and Websites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Hotels

- 5.1.2. Airport Hotels

- 5.1.3. Suite Hotels

- 5.1.4. Resorts

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Hotels

- 6.1.2. Airport Hotels

- 6.1.3. Suite Hotels

- 6.1.4. Resorts

- 6.1.5. Other Service Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Hotels

- 7.1.2. Airport Hotels

- 7.1.3. Suite Hotels

- 7.1.4. Resorts

- 7.1.5. Other Service Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Hotels

- 8.1.2. Airport Hotels

- 8.1.3. Suite Hotels

- 8.1.4. Resorts

- 8.1.5. Other Service Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. South America Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Business Hotels

- 9.1.2. Airport Hotels

- 9.1.3. Suite Hotels

- 9.1.4. Resorts

- 9.1.5. Other Service Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Business Hotels

- 10.1.2. Airport Hotels

- 10.1.3. Suite Hotels

- 10.1.4. Resorts

- 10.1.5. Other Service Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ITC HOTELS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyatt Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Belmond Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 InterContinental Hotels Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Four Seasons Hotels Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rosewood Hotels & Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shangri-La International Hotel Management Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marriott International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ritz-Carlton Hotel Company LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ITC HOTELS

List of Figures

- Figure 1: Global Luxury Hotel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 7: Europe Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: Europe Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Asia Pacific Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Asia Pacific Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: South America Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: South America Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Middle East and Africa Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Middle East and Africa Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Luxury Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Germany Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 19: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 27: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 32: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Hotel Market?

The projected CAGR is approximately 7.90%.

2. Which companies are prominent players in the Luxury Hotel Market?

Key companies in the market include ITC HOTELS, Hyatt Corporation, Belmond Ltd, InterContinental Hotels Group PLC, Four Seasons Hotels Limited, Rosewood Hotels & Resorts, Shangri-La International Hotel Management Ltd*List Not Exhaustive, Marriott International Inc, Ritz-Carlton Hotel Company LLC, Accor SA.

3. What are the main segments of the Luxury Hotel Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Museums. Historical Sites. Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Digitization of Services and Online Booking on Apps and Websites.

7. Are there any restraints impacting market growth?

Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions.

8. Can you provide examples of recent developments in the market?

In November 2020, Paris-based hotel company Accor and London-based hospitality firm Ennismore entered exclusive negotiations to form what they are claiming will be the world's leading lifestyle operator in the hospitality sector. Through this all-share merger, a new autonomous asset-light entity will combine the Hoxton, Gleneagles, Delano, SLS, Mondrian, SO/, Hyde, Mama Shelter, 25h, 21c Museum Hotels, Tribe, Jo&Joe, and Working From brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Hotel Market?

To stay informed about further developments, trends, and reports in the Luxury Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence