Key Insights

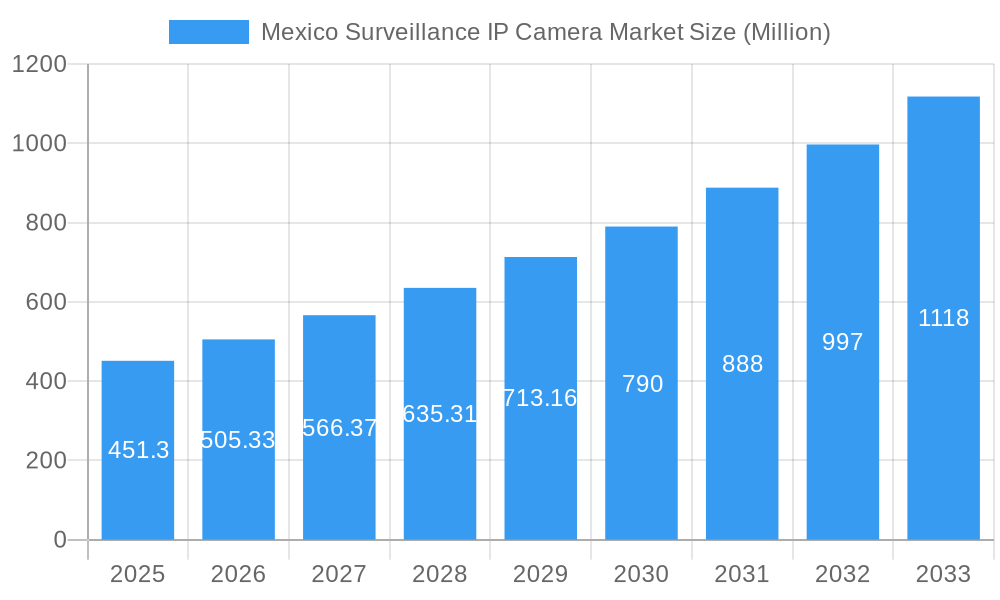

The Mexico surveillance IP camera market is experiencing robust growth, projected to reach \$451.30 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.77% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing concerns about security and safety in both urban and rural areas are fueling demand for advanced surveillance solutions. Secondly, the rising adoption of smart city initiatives across Mexico is creating a significant opportunity for IP camera deployment, particularly in public spaces and critical infrastructure. Furthermore, technological advancements in IP camera technology, such as higher resolution imaging, improved analytics capabilities (like facial recognition and object detection), and cost reductions, are making them more accessible and attractive to a wider range of consumers and businesses. The market is also benefiting from government initiatives promoting improved security and safety measures.

Mexico Surveillance IP Camera Market Market Size (In Million)

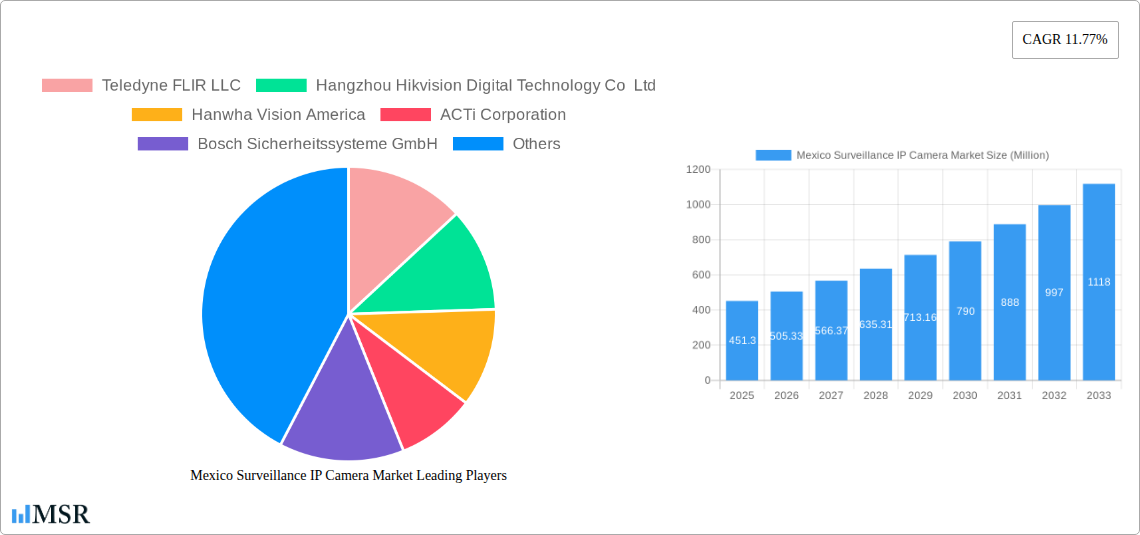

Competitive forces are shaping the market landscape. Major players like Teledyne FLIR, Hikvision, Hanwha Vision, and Axis Communications are vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. The market is segmented by camera type (dome, bullet, PTZ, etc.), resolution, features (analytics, integration capabilities), and end-user sector (residential, commercial, government). While the exact regional breakdown within Mexico isn't provided, we can anticipate higher growth in urban centers and regions with significant economic activity and ongoing infrastructure development. The restraints to market growth may include the initial high cost of installation and maintenance for some advanced systems, as well as concerns regarding data privacy and potential misuse of surveillance technology. However, the overall positive growth trajectory is expected to outweigh these challenges.

Mexico Surveillance IP Camera Market Company Market Share

Mexico Surveillance IP Camera Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico Surveillance IP Camera Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The report leverages extensive market research to deliver actionable intelligence on market size, growth drivers, competitive landscape, and emerging trends, ultimately helping you navigate the complexities of this dynamic market. The total market size in 2025 is estimated at xx Million.

Mexico Surveillance IP Camera Market Market Concentration & Dynamics

The Mexico Surveillance IP Camera Market exhibits a moderately concentrated landscape, with several major players holding significant market share. The market share distribution among the top five players is approximately xx%, indicative of a competitive yet consolidated environment. Several factors contribute to this dynamic:

- Innovation Ecosystems: Constant technological advancements, particularly in AI-powered surveillance and high-resolution imaging, drive innovation. The integration of cloud-based solutions and smart analytics further fuels market growth.

- Regulatory Frameworks: Government initiatives promoting security and public safety influence the demand for surveillance systems. Regulatory compliance and data privacy concerns also shape market dynamics.

- Substitute Products: While IP cameras dominate the market, competitive pressures exist from analog CCTV systems, though their market share is shrinking due to technological advantages offered by IP cameras.

- End-User Trends: The growing adoption of IP cameras across various sectors, including residential, commercial, and governmental applications, propels market expansion. Increasing concerns about security and safety among consumers and businesses are key drivers.

- M&A Activities: The market has witnessed a moderate number (xx) of mergers and acquisitions in the past five years, largely driven by companies seeking to expand their product portfolios and market reach. This consolidation trend further contributes to the moderate market concentration.

Mexico Surveillance IP Camera Market Industry Insights & Trends

The Mexico Surveillance IP Camera Market is experiencing robust growth, fueled by a multitude of factors. The market size reached xx Million in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million by 2033.

Key growth drivers include:

- Rising security concerns: Increasing crime rates and safety concerns across both residential and commercial sectors are driving the adoption of advanced surveillance systems.

- Technological advancements: The continuous development of high-resolution cameras, AI-powered analytics, and cloud-based solutions enhances the capabilities and appeal of IP cameras.

- Government initiatives: Government investments in public safety infrastructure and initiatives promoting smart city development are boosting demand.

- Expanding internet infrastructure: The growth of broadband internet access in Mexico is crucial for the adoption of IP-based surveillance solutions.

- Evolving consumer behaviors: Increased awareness of security threats and growing acceptance of technology for home and business security drive consumer demand for more sophisticated systems.

Key Markets & Segments Leading Mexico Surveillance IP Camera Market

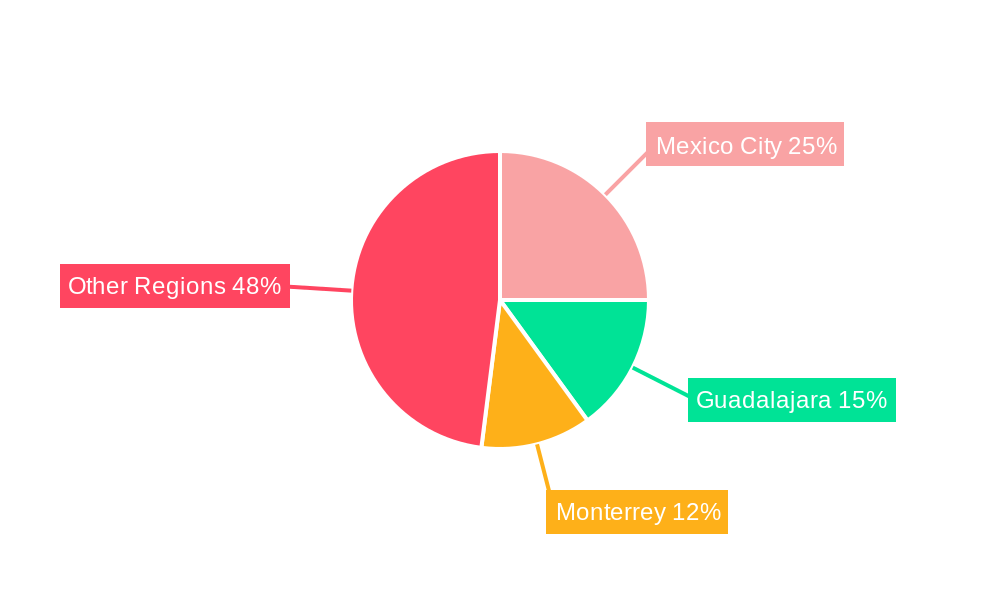

While data for precise regional segmentation is unavailable (xx), the urban areas of Mexico are expected to dominate the market due to higher concentration of commercial establishments and higher disposable income.

- Drivers for market dominance in Urban Areas:

- Higher security concerns: Urban areas typically face higher crime rates and security risks compared to rural areas.

- Stronger economic activity: A higher concentration of businesses and commercial establishments translates to increased spending on security infrastructure.

- Advanced infrastructure: Urban areas generally have better internet connectivity and infrastructure to support IP-based surveillance.

- Government initiatives: Investments in smart city projects and initiatives to improve public safety often concentrate on urban areas.

Detailed analysis of specific segments (e.g., by camera type, resolution, or application) is unavailable at this time (xx)

Mexico Surveillance IP Camera Market Product Developments

Recent product innovations highlight the trend towards higher resolution, AI-powered features, and improved usability. The launch of Reolink's 16MP dual-lens cameras and Hikvision's Stealth Edition cameras, both incorporating advanced features like image stitching, motion tracking, and AI-based object detection, illustrate the market's commitment to enhancing performance and intelligence. These advancements offer better clarity, wider coverage, and improved security capabilities, giving manufacturers a significant competitive edge.

Challenges in the Mexico Surveillance IP Camera Market Market

The Mexico Surveillance IP Camera Market faces several challenges:

- High initial investment costs: The implementation of advanced IP camera systems can be expensive, potentially hindering adoption by smaller businesses and residential users.

- Cybersecurity risks: The connectivity of IP cameras raises concerns about data breaches and unauthorized access.

- Data privacy regulations: Compliance with evolving data privacy regulations is crucial and adds a layer of complexity.

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability and pricing of components.

Forces Driving Mexico Surveillance IP Camera Market Growth

Several factors fuel the market's long-term growth:

- Technological innovation: Continued advancements in AI, image processing, and cloud-based solutions are key drivers.

- Increasing government spending: Investments in public safety and smart city initiatives will further stimulate market growth.

- Improved internet penetration: Increased broadband access expands the potential market for IP camera systems.

- Enhanced security awareness: Growing awareness of security vulnerabilities drives adoption of advanced surveillance technology.

Challenges in the Mexico Surveillance IP Camera Market Market

Long-term growth will depend on addressing challenges like cybersecurity risks and data privacy concerns through strong partnerships between technology providers, government bodies, and end-users. Innovations in affordable, user-friendly systems that prioritize data security and privacy will play a crucial role in sustained market expansion.

Emerging Opportunities in Mexico Surveillance IP Camera Market

Emerging opportunities lie in:

- Expansion into rural areas: Increasing internet access and awareness will create new market segments in previously underserved areas.

- Integration with other smart city technologies: IP cameras can integrate seamlessly with smart city infrastructure and contribute to broader applications.

- Development of specialized applications: Cameras tailored for specific sectors, such as logistics, transportation, or agriculture, offer niche growth potential.

Leading Players in the Mexico Surveillance IP Camera Market Sector

- Teledyne FLIR LLC (FLIR)

- Hangzhou Hikvision Digital Technology Co Ltd (Hikvision)

- Hanwha Vision America

- ACTi Corporation

- Bosch Sicherheitssysteme GmbH (Bosch Security Systems)

- Pelco (Pelco)

- Zhejiang Uniview Technologies Co Ltd (Uniview)

- IDIS Ltd (IDIS)

- Honeywell International Inc (Honeywell)

- Panasonic Corporation (Panasonic)

- CP Plus

- Axis Communication (Axis Communications)

Key Milestones in Mexico Surveillance IP Camera Market Industry

- February 2024: Reolink launches its 16MP Reolink Duo 3 PoE camera, introducing advanced features like image stitching and Motion Track technology, significantly improving image quality and detail capture.

- January 2024: Hikvision unveils its Stealth Edition Cameras, showcasing cutting-edge AI-powered features such as ColorVu for 24/7 full-color imaging and AcuSense technology for enhanced object detection. These launches highlight the ongoing trend of incorporating advanced features into IP cameras.

Strategic Outlook for Mexico Surveillance IP Camera Market Market

The Mexico Surveillance IP Camera Market holds substantial future potential, driven by continuous technological innovation, increasing security concerns, and government initiatives. Companies focusing on developing cost-effective, user-friendly, and secure solutions, while adhering to data privacy regulations, are well-positioned to capitalize on the market's long-term growth trajectory. Strategic partnerships and expansions into new market segments will be crucial for success.

Mexico Surveillance IP Camera Market Segmentation

-

1. End-user Industry

- 1.1. Banking and Financial Institutions

- 1.2. Transportation and Infrastructure

- 1.3. Government and Defense

- 1.4. Healthcare

- 1.5. Industrial

- 1.6. Retail

- 1.7. Enterprises

- 1.8. Residential

- 1.9. Other End-user Industries

Mexico Surveillance IP Camera Market Segmentation By Geography

- 1. Mexico

Mexico Surveillance IP Camera Market Regional Market Share

Geographic Coverage of Mexico Surveillance IP Camera Market

Mexico Surveillance IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Investments; Rising Crime Rate and Growing Consumer Awareness About Surveillance Cameras Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives and Investments; Rising Crime Rate and Growing Consumer Awareness About Surveillance Cameras Driving the Market

- 3.4. Market Trends

- 3.4.1. Rising Crime Rate and Growing Consumer Awareness About Surveillance Cameras Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Surveillance IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Banking and Financial Institutions

- 5.1.2. Transportation and Infrastructure

- 5.1.3. Government and Defense

- 5.1.4. Healthcare

- 5.1.5. Industrial

- 5.1.6. Retail

- 5.1.7. Enterprises

- 5.1.8. Residential

- 5.1.9. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teledyne FLIR LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision America

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CP Plus

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Axis Communication

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Teledyne FLIR LLC

List of Figures

- Figure 1: Mexico Surveillance IP Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Surveillance IP Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Surveillance IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Mexico Surveillance IP Camera Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Mexico Surveillance IP Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Mexico Surveillance IP Camera Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Mexico Surveillance IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Mexico Surveillance IP Camera Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Mexico Surveillance IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Mexico Surveillance IP Camera Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Surveillance IP Camera Market?

The projected CAGR is approximately 11.77%.

2. Which companies are prominent players in the Mexico Surveillance IP Camera Market?

Key companies in the market include Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision America, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Pelco, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Panasonic Corporation, CP Plus, Axis Communication.

3. What are the main segments of the Mexico Surveillance IP Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 451.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Investments; Rising Crime Rate and Growing Consumer Awareness About Surveillance Cameras Driving the Market.

6. What are the notable trends driving market growth?

Rising Crime Rate and Growing Consumer Awareness About Surveillance Cameras Driving the Market.

7. Are there any restraints impacting market growth?

Government Initiatives and Investments; Rising Crime Rate and Growing Consumer Awareness About Surveillance Cameras Driving the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Reolink, a surveillance camera manufacturer, launched the Reolink Duo 3 PoE camera, marking the debut of its new lineup of 16MP cameras. This 16MP series is designed to address the frequent challenges of low resolution and clarity faced by users of other popular dual-lens cameras. The upgraded dual-lens cameras come equipped with features such as image-stitching for a comprehensive 180-degree view, the capability to capture intricate details from distances of up to 80 feet, and cutting-edge Motion Track technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Surveillance IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Surveillance IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Surveillance IP Camera Market?

To stay informed about further developments, trends, and reports in the Mexico Surveillance IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence