Key Insights

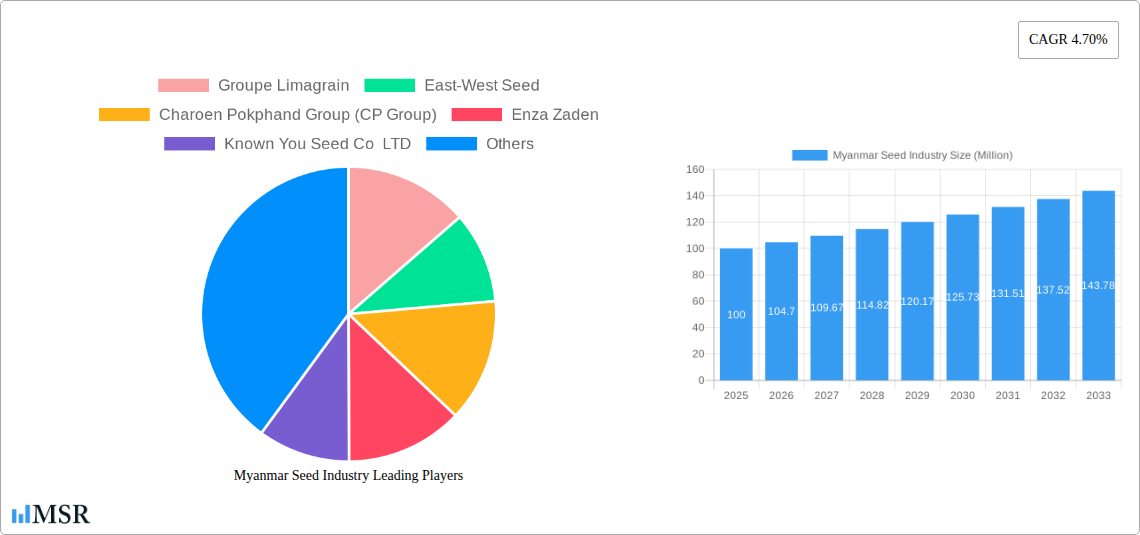

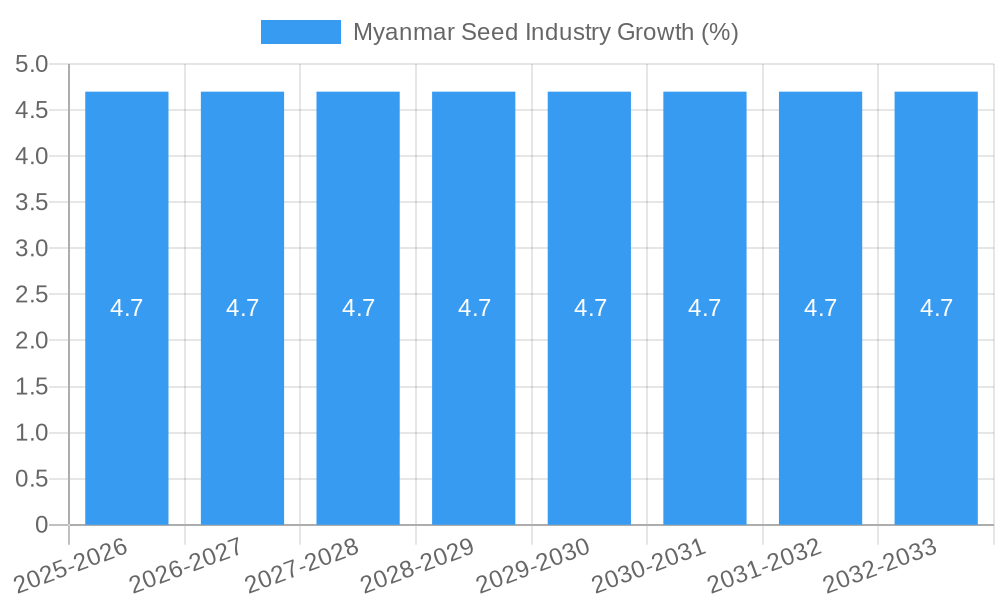

The Myanmar seed industry, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and market size, details omitted to avoid stating assumptions), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing agricultural production, driven by rising domestic demand and export opportunities, necessitates a higher demand for high-quality seeds. The adoption of improved farming techniques, including protected cultivation and the utilization of hybrid seeds, is further boosting market growth. Government initiatives promoting agricultural modernization and investment in research and development within the agricultural sector are also contributing positively to the market's expansion. However, challenges remain. Limited access to advanced agricultural technologies and infrastructure in certain regions, coupled with fluctuating weather patterns impacting crop yields, act as restraints on market growth. The industry is segmented by crop type (row crops, pulses, vegetables, other unclassified vegetables), cultivation mechanism (open field, protected cultivation), and breeding technology (hybrids). Leading players like Groupe Limagrain, East-West Seed, and Charoen Pokphand Group (CP Group) are actively shaping the market landscape through technological advancements and strategic partnerships.

The market's growth trajectory indicates significant potential for investors and stakeholders. The ongoing shift towards high-yielding and disease-resistant hybrid seeds will continue to drive segment growth. Furthermore, expanding protected cultivation practices, particularly in regions vulnerable to climate variability, present opportunities for market expansion. While challenges exist, strategic investments in agricultural infrastructure, improved farmer training, and the development of resilient seed varieties will be critical in unlocking the full potential of the Myanmar seed industry. The increasing integration of technology in seed production and distribution, including precision agriculture techniques, will likely play a significant role in shaping the industry's future.

Myanmar Seed Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Myanmar seed industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report projects Myanmar's seed market growth trajectory and identifies key opportunities. The report features a detailed analysis of market concentration, leading players, emerging trends, and challenges impacting the industry. Expect actionable data on market size (reaching xx Million by 2033), CAGR, and segment-specific performance across crop types, cultivation mechanisms, and breeding technologies.

Myanmar Seed Industry Market Concentration & Dynamics

The Myanmar seed industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. While precise figures are unavailable for this report and the market share data is xx%, key players such as Groupe Limagrain, East-West Seed, and Charoen Pokphand Group (CP Group) dominate the market. The innovation ecosystem is relatively nascent but demonstrates increasing activity, driven by both domestic and international companies. Regulatory frameworks are evolving, with potential for both opportunities and challenges for market entrants. Substitute products, primarily traditional seed saving practices, continue to compete with commercially produced seeds, particularly in rural areas. End-user trends point toward a growing preference for high-yielding, disease-resistant varieties.

- Market Share: xx% dominated by top 3 players (estimated)

- M&A Activity: xx deals recorded between 2019 and 2024 (estimated). The acquisition of Carosem by Enza Zaden is a key recent example.

- Regulatory Landscape: Evolving, with potential impact on market access and product registration.

- Substitute Products: Traditional seed saving practices remain a significant factor.

Myanmar Seed Industry Industry Insights & Trends

The Myanmar seed industry is projected to experience significant growth over the forecast period (2025-2033), driven by factors including increasing agricultural output, government support for the agricultural sector, and rising demand for high-yielding crop varieties. The market size is estimated to reach xx Million by 2025, with a CAGR of xx% projected from 2025 to 2033. Technological advancements in seed breeding, such as the development of hybrid seeds and disease-resistant varieties, are also driving market growth. Changing consumer preferences towards better quality and higher yield are also impacting the dynamics. However, challenges such as limited access to credit, inadequate infrastructure and climate change present significant headwinds.

Key Markets & Segments Leading Myanmar Seed Industry

Dominant Segments:

- Crop Type: Row crops (e.g., rice, corn, pulses) currently represent the largest segment, given their significance in Myanmar's agricultural economy.

- Cultivation Mechanism: Open field cultivation dominates, although protected cultivation is showing growth potential, particularly for high-value crops.

- Pulses: The demand for pulses is increasing.

- Vegetables: The vegetable seed market is experiencing considerable growth, driven by rising urban populations and changing dietary habits.

- Breeding Technology: Hybrid seeds are gaining popularity due to their higher yields and improved traits.

Growth Drivers:

- Economic Growth: Increasing disposable incomes and rising demand for food products are driving demand for improved seed varieties.

- Infrastructure Development: Investments in irrigation, transportation, and storage facilities improve access to markets and reduce post-harvest losses.

- Government Initiatives: Government support for the agricultural sector, including subsidies and extension services, plays a vital role in promoting seed adoption.

Myanmar Seed Industry Product Developments

Recent product innovations focus on developing disease-resistant and high-yielding varieties. Enza Zaden’s introduction of new lettuce varieties resistant to three new Bermian races and its launch of ToBRFV-resistant HREZ tomato varieties exemplify this trend. These advancements provide significant competitive advantages, increasing crop yields and improving farmer profitability. The development of hybrid seeds is another key area of innovation, offering higher yields and improved crop quality.

Challenges in the Myanmar Seed Industry Market

The Myanmar seed industry faces several challenges, including:

- Regulatory Hurdles: Navigating the regulatory landscape can be complex and time-consuming, impacting market entry and product registration.

- Supply Chain Issues: Infrastructure limitations can hinder the timely and efficient distribution of seeds to farmers.

- Competitive Pressures: Competition from both domestic and international seed companies is intense.

Forces Driving Myanmar Seed Industry Growth

Several factors are driving the growth of Myanmar's seed industry:

- Technological Advancements: Innovations in seed breeding are improving crop yields, disease resistance, and overall quality.

- Economic Growth: Rising disposable incomes are increasing consumer demand for higher quality agricultural products.

- Government Support: Government policies and initiatives aimed at promoting the agricultural sector are encouraging seed adoption.

Challenges in the Myanmar Seed Industry Market

Long-term growth catalysts for the Myanmar seed industry include continued investment in research and development, strategic partnerships between seed companies and farmers, and expansion into new market segments. Focus on developing climate-resilient varieties and incorporating sustainable farming practices are also critical for long-term success.

Emerging Opportunities in Myanmar Seed Industry

Emerging opportunities include:

- Expanding into new market segments: There's potential to introduce new crops and varieties to meet growing consumer demands.

- Adopting precision agriculture techniques: The utilization of technology and data analytics can significantly optimize seed production and distribution.

- Developing climate-resilient seed varieties: Adapting to climate change impacts is critical for ensuring long-term industry sustainability.

Leading Players in the Myanmar Seed Industry Sector

- Groupe Limagrain

- East-West Seed

- Charoen Pokphand Group (CP Group)

- Enza Zaden

- Known You Seed Co LTD

- Rijk Zwaan Zaadteelt en Zaadhandel B

- Nong Woo Bio

- Dagon Group of Companies

Key Milestones in Myanmar Seed Industry Industry

- May 2023: Enza Zaden launched a new line of HREZ tomato varieties resistant to ToBRFV.

- July 2023: Enza Zaden introduced new lettuce varieties resistant to three Bermian races (Bl: 38EU, Bl: 39EU, and Bl: 40EU).

- July 2023: Enza Zaden acquired the carrot breeding program from Carosem.

Strategic Outlook for Myanmar Seed Industry Market

The Myanmar seed industry is poised for significant growth in the coming years, driven by strong fundamentals and emerging opportunities. Strategic investments in research and development, partnerships, and sustainable practices will be crucial to capitalizing on this potential. The focus should be on developing high-quality, climate-resilient seed varieties to meet the evolving needs of farmers and consumers.

Myanmar Seed Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Myanmar Seed Industry Segmentation By Geography

- 1. Myanmar

Myanmar Seed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Seed Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Groupe Limagrain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 East-West Seed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Charoen Pokphand Group (CP Group)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enza Zaden

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Known You Seed Co LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rijk Zwaan Zaadteelt en Zaadhandel B

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nong Woo Bio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dagon Group of Companies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Groupe Limagrain

List of Figures

- Figure 1: Myanmar Seed Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Myanmar Seed Industry Share (%) by Company 2024

List of Tables

- Table 1: Myanmar Seed Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Myanmar Seed Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Myanmar Seed Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Myanmar Seed Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: Myanmar Seed Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Myanmar Seed Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Myanmar Seed Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Myanmar Seed Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Myanmar Seed Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Myanmar Seed Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Myanmar Seed Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Myanmar Seed Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Myanmar Seed Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Myanmar Seed Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: Myanmar Seed Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Myanmar Seed Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: Myanmar Seed Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Myanmar Seed Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 19: Myanmar Seed Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Myanmar Seed Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Myanmar Seed Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Myanmar Seed Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Myanmar Seed Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Myanmar Seed Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Myanmar Seed Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Myanmar Seed Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Myanmar Seed Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Myanmar Seed Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Seed Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Myanmar Seed Industry?

Key companies in the market include Groupe Limagrain, East-West Seed, Charoen Pokphand Group (CP Group), Enza Zaden, Known You Seed Co LTD, Rijk Zwaan Zaadteelt en Zaadhandel B, Nong Woo Bio, Dagon Group of Companies.

3. What are the main segments of the Myanmar Seed Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

July 2023: Enza Zaden introduced new lettuce varieties that exhibit high resistance to three new Bermian races, namely, Bl: 38EU, Bl: 39EU, and Bl: 40EU. The new lettuce varieties not only offer high resistance to these races but also have the capability to grow in various soil types while still achieving high yields.July 2023: Enza Zaden acquired the carrot breeding program from the German company Carosem. This strategic acquisition aims to expand Enza Zaden's product portfolio by incorporating carrot seeds with several commercial varieties and inventories.May 2023: Enza Zaden launched a new line of HREZ tomato varieties that are highly resistant to the tomato brown rugose fruit virus (ToBRFV) and deliver exceptional taste, yield, and quality. The HREZ tomatoes are available in various types, including Roma, Beef, Grape, Cherry, and Cocktail.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Seed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Seed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Seed Industry?

To stay informed about further developments, trends, and reports in the Myanmar Seed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence