Key Insights

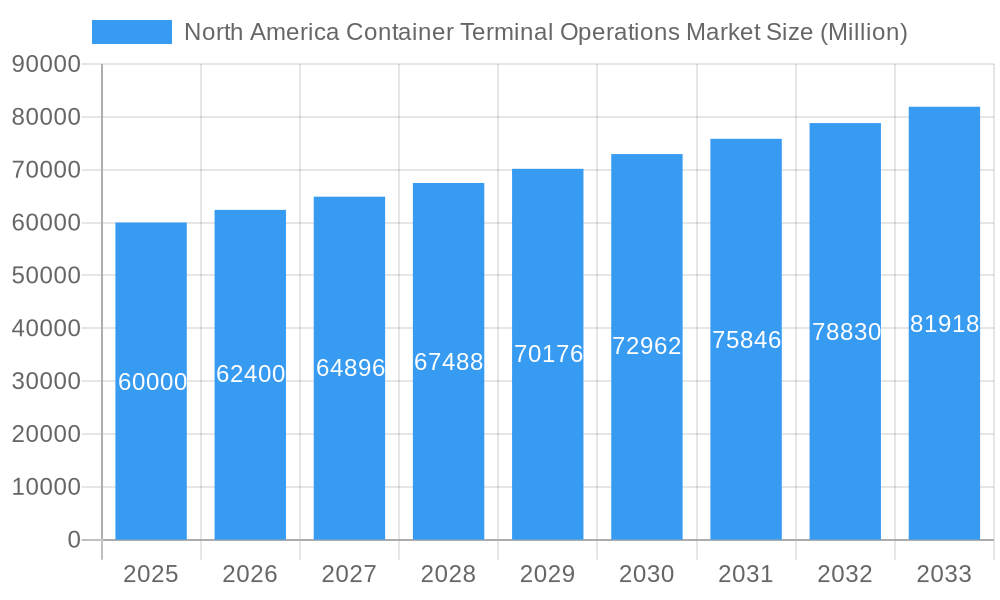

The North American container terminal operations market is projected for significant expansion, driven by escalating global trade volumes and the strategic adoption of larger container vessels. This dynamic sector is characterized by a Compound Annual Growth Rate (CAGR) of 4.5%. Key growth drivers include the burgeoning e-commerce sector and continuous advancements in port infrastructure. The market is segmented by cargo type, encompassing crude oil, dry cargo, and other liquid cargo, and by service type, including stevedoring, cargo and handling transportation, and other associated services. Prominent industry leaders such as Ports America Inc., SSA Marine, and Mediterranean Shipping Company S.A. are actively investing in technological upgrades and infrastructure development to bolster efficiency and capacity.

North America Container Terminal Operations Market Market Size (In Billion)

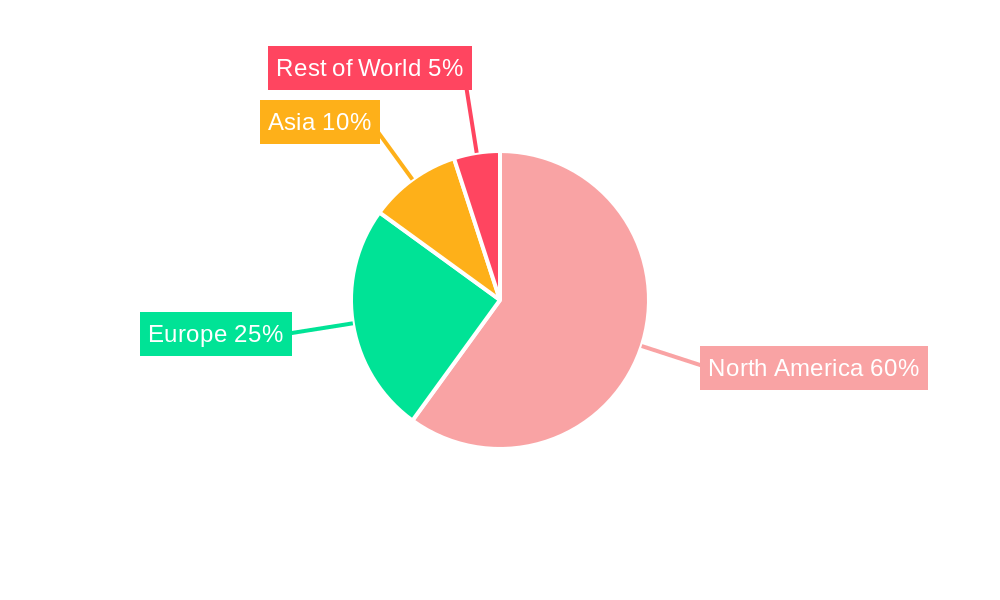

North America, leveraging its extensive port network and strategic geographic positioning, holds a commanding share of the global market. Regional growth is further propelled by robust import and export activities, particularly trade routes with Asia, and the ongoing development of key ports along the US East and West Coasts. However, the market faces challenges including port congestion, labor negotiations, and evolving regulatory frameworks, necessitating strategic mitigation efforts.

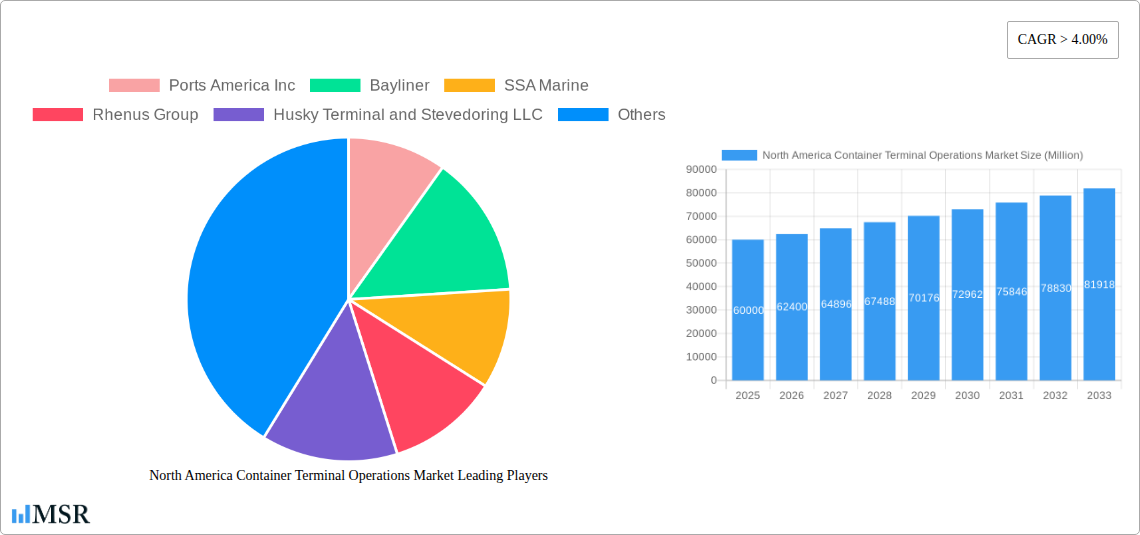

North America Container Terminal Operations Market Company Market Share

Market projections indicate sustained growth in the North American container terminal operations sector through 2033. With an estimated market size of $213.38 billion in the 2025 base year, and a CAGR of 4.5%, the market is expected to witness substantial value appreciation. Success in this competitive landscape will depend on effectively addressing operational inefficiencies, such as cargo handling bottlenecks, and embracing technological innovations for optimized logistics and reduced transit times. Strategic investments in automation, modernized infrastructure, and sustainable operational practices will be pivotal in shaping the long-term trajectory of this vital industry.

North America Container Terminal Operations Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the North America Container Terminal Operations market, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this study unveils market dynamics, growth drivers, challenges, and emerging opportunities. The report meticulously analyzes market segmentation by cargo type (Crude Oil, Dry Cargo, Other Liquid Cargo) and service (Stevedoring, Cargo and handling transportation, Others), identifying key players like Ports America Inc, SSA Marine, Rhenus Group, and Mediterranean Shipping Company S.A. Discover actionable strategies and informed decision-making based on rigorous data analysis and expert forecasts.

North America Container Terminal Operations Market Concentration & Dynamics

The North America container terminal operations market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Ports America Inc, SSA Marine, and Rhenus Group, among others, dominate the market, while smaller, regional players compete intensely for contracts. The market share of the top 5 players in 2025 is estimated to be xx%. Innovation within the sector is driven by advancements in automation, data analytics, and improved efficiency technologies. Regulatory frameworks, including environmental regulations and port security measures, significantly impact operations. Substitute products, such as intermodal transportation, pose a competitive threat, especially for short-distance hauls. End-user trends towards faster delivery times and increased supply chain visibility are shaping the market demand. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. Further consolidation is anticipated as companies seek to achieve economies of scale and expand their geographic reach.

- Market Concentration: Moderately concentrated, top 5 players holding xx% market share (2025).

- Innovation: Focus on automation, data analytics, and efficiency technologies.

- Regulatory Framework: Significant impact from environmental and security regulations.

- Substitute Products: Intermodal transport poses competitive threat.

- End-User Trends: Demand for faster delivery and supply chain visibility is rising.

- M&A Activity: Approximately xx deals between 2019-2024; further consolidation expected.

North America Container Terminal Operations Market Industry Insights & Trends

The North America container terminal operations market is experiencing robust growth, driven by the expanding global trade volume and the increasing reliance on containerized shipping. The market size reached approximately $xx Million in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching $xx Million by 2033. This growth is fueled by several factors, including the increasing demand for consumer goods, the growth of e-commerce, and the expansion of port infrastructure. Technological disruptions, such as the adoption of automation and digitization, are revolutionizing terminal operations, improving efficiency, and reducing costs. Evolving consumer behaviors, including a preference for faster delivery times, are placing pressure on terminal operators to enhance their speed and responsiveness. The growth is not uniform across all segments, with certain ports and cargo types exhibiting higher growth rates than others. Challenges such as port congestion, labor shortages, and cybersecurity threats remain significant concerns.

Key Markets & Segments Leading North America Container Terminal Operations Market

The East Coast of North America represents a dominant region within the market, driven primarily by high import and export volumes and strategically located major ports such as New York/New Jersey, Savannah, and Charleston. The Dry Cargo segment commands the largest share in terms of cargo type, reflecting the significant volume of manufactured goods and raw materials transported via container ships.

Dominant Region: East Coast of North America (New York/New Jersey, Savannah, Charleston)

Dominant Segment (Cargo Type): Dry Cargo

Dominant Segment (Service): Stevedoring

Drivers:

- High Import/Export Volumes: Strong demand for goods and robust international trade.

- Strategic Port Locations: Convenient access to major markets and efficient logistics networks.

- Infrastructure Development: Investments in port expansion and modernization.

- Economic Growth: Expanding national and regional economies fueling trade.

Detailed Dominance Analysis: The East Coast's dominance stems from its proximity to major consumption centers, robust infrastructure, and significant investments in port modernization projects. The Dry Cargo segment's leading position reflects the high volume of manufactured goods and raw materials traded internationally. Stevedoring services are fundamental to container terminal operations, representing the largest service segment.

North America Container Terminal Operations Market Product Developments

Recent product innovations include the deployment of automated guided vehicles (AGVs), automated stacking cranes (ASCs), and advanced terminal operating systems (TOS). These technologies significantly improve efficiency, reduce labor costs, and enhance safety. The integration of Internet of Things (IoT) sensors and data analytics platforms is also transforming the industry by optimizing operations and providing real-time visibility into cargo movements. This heightened efficiency and technological sophistication provides a key competitive edge for terminal operators.

Challenges in the North America Container Terminal Operations Market Market

The North America container terminal operations market faces several challenges. Port congestion, particularly at major gateways, leads to delays and increased costs. Labor shortages and union negotiations can disrupt operations and increase labor costs significantly. Stringent environmental regulations impose compliance costs and may restrict operational flexibility. Cybersecurity threats pose a risk to data security and operational integrity. Supply chain disruptions due to global events (e.g., pandemics, geopolitical instability) further impact capacity and efficiency. These factors combined can reduce profitability and limit growth potential. The estimated impact of these challenges on market growth is xx% reduction in CAGR.

Forces Driving North America Container Terminal Operations Market Growth

Several factors drive market growth. The ongoing expansion of global trade contributes significantly to increased demand for container terminal services. E-commerce growth fuels demand for faster and more efficient delivery systems. Technological advancements, such as automation and data analytics, enhance operational efficiency and capacity. Government investments in port infrastructure improvement and modernization initiatives facilitate growth. Favorable regulatory environments can attract investment and foster innovation.

Long-Term Growth Catalysts in the North America Container Terminal Operations Market

Long-term growth will be fueled by continued innovation in automation and data analytics, leading to increased efficiency and reduced costs. Strategic partnerships between terminal operators and shipping lines can improve coordination and optimize supply chains. Expansion into new markets and the development of new port facilities will support long-term growth, as will the increasing focus on sustainability and environmental responsibility within the industry.

Emerging Opportunities in North America Container Terminal Operations Market

Emerging opportunities include the adoption of autonomous vehicles and robots for cargo handling, the integration of blockchain technology for enhanced supply chain transparency, and the expansion of cold chain logistics for temperature-sensitive goods. Growth in e-commerce necessitates efficient last-mile delivery solutions, opening opportunities for terminal operators to integrate with other logistics providers. The development of sustainable port operations, including the use of renewable energy sources, presents a significant opportunity to enhance the industry's environmental profile and attract environmentally conscious clients.

Leading Players in the North America Container Terminal Operations Market Sector

- Ports America Inc

- Bayliner

- SSA Marine

- Rhenus Group

- Husky Terminal and Stevedoring LLC

- Viking Line

- Indiana Port Commission

- MEYER WERFT GmbH & Co KG

- Mississippi State Port Authority at Gulfport

- Mediterranean Shipping Company S.A

Key Milestones in North America Container Terminal Operations Market Industry

- 2020: Increased adoption of remote operations and contactless procedures due to the COVID-19 pandemic.

- 2021: Several major ports invested heavily in automation technologies to improve efficiency and reduce labor costs.

- 2022: Significant focus on enhancing cybersecurity measures to protect against data breaches and operational disruptions.

- 2023: Several M&A activities between smaller terminal operators and larger companies driving consolidation.

- 2024: Increased investments in sustainable technologies to reduce environmental impact and improve sustainability credentials.

Strategic Outlook for North America Container Terminal Operations Market Market

The North America container terminal operations market holds significant growth potential driven by continued global trade expansion, technological advancements, and investments in port infrastructure. Strategic opportunities exist for companies to leverage automation, data analytics, and sustainable practices to enhance efficiency, reduce costs, and gain a competitive advantage. Partnerships and collaborations are crucial for optimizing supply chains and improving coordination among stakeholders. A focus on innovation and adapting to evolving market demands will be vital for long-term success in this dynamic sector.

North America Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

- 3. US

- 4. Canada

North America Container Terminal Operations Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Container Terminal Operations Market Regional Market Share

Geographic Coverage of North America Container Terminal Operations Market

North America Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Initiatives towards Greener Industrial Port Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by US

- 5.4. Market Analysis, Insights and Forecast - by Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ports America Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayliner

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SSA Marine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rhenus Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Husky Terminal and Stevedoring LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Viking Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indiana Port Commission

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MEYER WERFT GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mississippi State Port Authority at Gulfport**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mediterranean Shipping Company S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ports America Inc

List of Figures

- Figure 1: North America Container Terminal Operations Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 4: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 5: North America Container Terminal Operations Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 8: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 9: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 10: North America Container Terminal Operations Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Container Terminal Operations Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Container Terminal Operations Market?

Key companies in the market include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport**List Not Exhaustive, Mediterranean Shipping Company S A.

3. What are the main segments of the North America Container Terminal Operations Market?

The market segments include Service, Cargo Type, US, Canada.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Initiatives towards Greener Industrial Port Activities.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the North America Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence