Key Insights

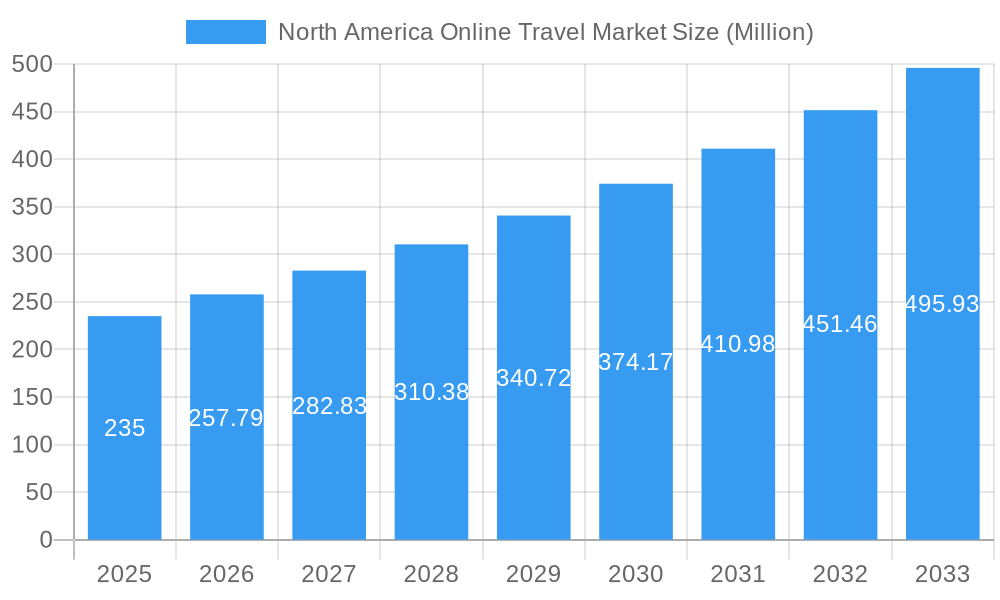

The North American online travel market, valued at $235 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of smartphones and mobile applications has significantly boosted online travel bookings, particularly for accommodation, travel tickets, and holiday packages. Furthermore, the rising disposable incomes and a growing preference for personalized travel experiences are fueling demand. The convenience and competitive pricing offered by online travel agencies (OTAs) like Expedia, Booking Holdings, and TripAdvisor, compared to traditional travel agents, are also major contributors to market expansion. Increased penetration of high-speed internet access across North America, coupled with the growing popularity of online travel reviews and social media influences on travel decisions, further enhances market growth. While the market faces challenges from potential economic downturns impacting consumer spending and increased competition among OTAs, the overall trajectory remains positive, fueled by technological advancements and evolving consumer preferences.

North America Online Travel Market Market Size (In Million)

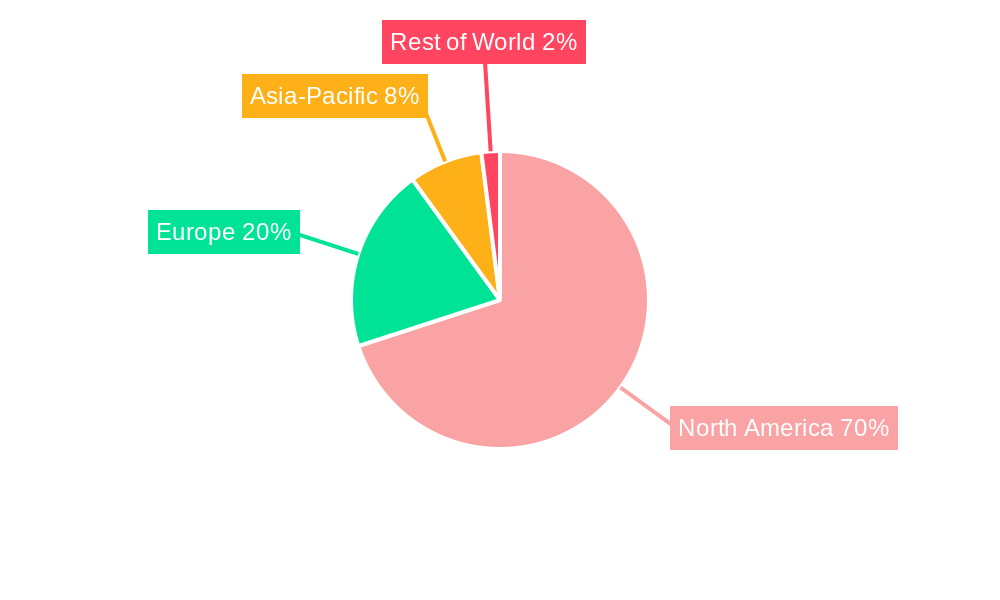

Segment-wise analysis reveals a strong demand across all service types, with accommodation booking, travel tickets booking, and holiday package booking being the most significant revenue generators. The mobile/tablet booking platform segment is experiencing the fastest growth due to the ubiquitous nature of mobile devices. Competition is intense, with established players like Booking Holdings and Expedia facing challenges from innovative startups and niche players focused on specific travel segments. The market is also witnessing an increasing preference for direct booking by consumers, bypassing intermediaries. North America's dominance in the online travel market is anticipated to continue, driven by high internet penetration, tech-savviness, and a large, affluent population with a high propensity for travel. The forecast period (2025-2033) anticipates continued expansion, with the CAGR of 9.80% suggesting substantial market expansion. Strategic partnerships between OTAs and hospitality providers, along with continuous technological innovations like AI-powered travel recommendations, are expected to shape the future landscape of the North American online travel market.

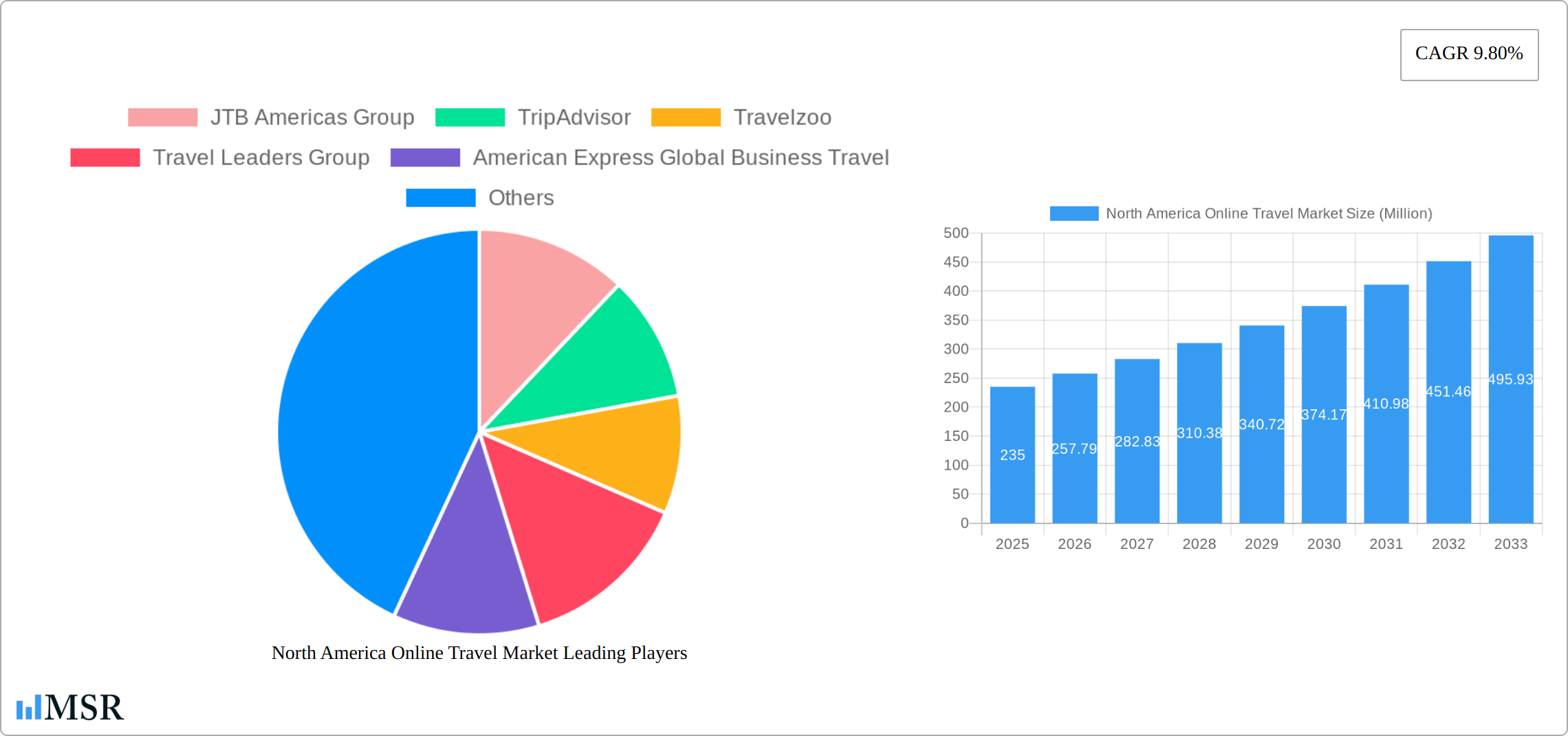

North America Online Travel Market Company Market Share

North America Online Travel Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America online travel market, covering market size, growth drivers, key segments, competitive landscape, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic sector. It leverages extensive data and analysis to provide actionable insights. The market is valued at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

North America Online Travel Market Market Concentration & Dynamics

The North American online travel market is a dynamic and competitive landscape shaped by a moderately concentrated structure and continuous evolution. Major players like Booking Holdings, Expedia, and TripAdvisor command significant market share, yet a multitude of smaller companies and emerging startups contribute to a vibrant ecosystem. This section delves into the market's competitive intensity, regulatory influences, and key trends affecting its trajectory.

- Market Share & Competitive Landscape: While precise figures are proprietary, Booking Holdings and Expedia Group collectively held a substantial market share in 2024 (estimated at approximately 45%), highlighting their dominance. Other key players such as TripAdvisor and Airbnb also contribute significantly (approximately 20% and 15%, respectively), with a diverse range of smaller companies vying for the remaining share. The market's competitive intensity is further fueled by ongoing innovation and the entry of new players.

- Mergers & Acquisitions (M&A): The past five years (2019-2024) have witnessed considerable M&A activity, with an estimated 100 deals averaging $XX million USD each. This trend reflects the strategic efforts of established companies to expand their service offerings, geographical reach, and technological capabilities. Recent notable examples include Airbnb's acquisition of Gameplanner.AI, a move strategically designed to enhance its AI-driven capabilities and personalize user experience.

- Innovation Ecosystem: Technological advancements are driving significant innovation within the online travel sector. AI, Big Data analytics, and mobile technologies are reshaping the customer experience, operational efficiencies, and the overall market landscape. Companies are investing heavily in research and development to create innovative products and services, fostering a competitive edge.

- Regulatory Framework & Compliance: The North American regulatory environment for online travel varies across jurisdictions, impacting aspects such as data privacy, consumer protection, and competition. Navigating this diverse regulatory landscape and maintaining compliance is crucial for all market participants.

- Substitute Products & Competitive Threats: Traditional travel agents and alternative accommodation platforms (like Airbnb's disruptive impact) pose a competitive challenge. The rise of such alternatives necessitates ongoing adaptation and innovation from established online travel agencies.

- Evolving End-User Trends: Consumer behavior is significantly influenced by the increasing adoption of mobile booking platforms, a preference for personalized travel experiences, and a growing demand for sustainable and responsible travel options. Understanding and adapting to these trends is crucial for success in this market.

North America Online Travel Market Industry Insights & Trends

The North America online travel market is witnessing robust growth fueled by several factors. Rising disposable incomes, increasing internet penetration, the growing preference for online booking convenience, and the proliferation of mobile devices are key market drivers. Technological advancements such as Artificial Intelligence (AI) and Machine Learning (ML) are reshaping the customer experience, enabling personalized recommendations, and optimizing operational efficiencies.

The market experienced significant disruption during the COVID-19 pandemic (2020-2022), with travel restrictions leading to a temporary decline. However, with the easing of restrictions, the market is experiencing a strong rebound, demonstrating resilience and growth potential. The evolving consumer behaviors emphasize personalized experiences, sustainable travel options, and value for money. This requires travel companies to adapt and offer products and services that cater to these changing preferences.

Key Markets & Segments Leading North America Online Travel Market

The US dominates the North American online travel market, followed by Canada and Mexico. Within the US, major metropolitan areas like New York, Los Angeles, and Chicago represent significant market segments.

By Service Type: Accommodation booking currently holds the largest market share, followed by travel tickets booking and holiday package booking. The "other services" segment is experiencing steady growth, driven by the increasing demand for ancillary services such as travel insurance and airport transfers.

By Mode of Booking: Direct booking through online travel platforms is steadily gaining popularity, surpassing travel agents. The shift towards self-service booking reflects the ease of online transactions and personalized choice.

By Booking Platform: Mobile/Tablet bookings are experiencing significant growth, exceeding desktop bookings, due to the widespread adoption of smartphones and tablets.

Growth Drivers:

- Economic Growth: Increasing disposable income in North America fuels demand for travel and tourism.

- Improved Infrastructure: Expansion of airports and transportation networks facilitates easier travel.

- Technological Advancements: AI, Big Data, and mobile technologies enhance user experience and operational efficiencies.

- Changing Consumer Preferences: Growing demand for personalized experiences, sustainable travel, and value-for-money packages drives market segmentation.

North America Online Travel Market Product Developments

The online travel market is witnessing continuous innovation in product offerings. AI-powered travel planning tools, personalized itinerary generators, and enhanced mobile applications are transforming the customer experience. Companies are leveraging data analytics to offer more relevant travel recommendations and customized packages. The integration of virtual reality (VR) and augmented reality (AR) technologies is enhancing the pre-travel planning experience. This technological advancement fuels competition, leading to improved user experience and increased market penetration.

Challenges in the North America Online Travel Market Market

The North America online travel market faces several challenges. Fluctuations in fuel prices, economic downturns, and geopolitical instability directly impact travel demand. Stringent regulatory frameworks around data privacy and consumer protection necessitate high compliance costs. Intense competition among players necessitates constant innovation and efficient cost management. The market is also susceptible to external events, including global pandemics, which impact travel patterns significantly. This necessitates strong business continuity plans and efficient risk management.

Forces Driving North America Online Travel Market Growth

Technological advancements, such as AI-driven personalized travel planning, and the increasing adoption of mobile booking platforms, are major growth catalysts. Economic growth, improving infrastructure, and changing consumer preferences toward experience-based travel are also crucial drivers. Favorable government policies promoting tourism contribute to market expansion, alongside globalization and increased international travel.

Challenges in the North America Online Travel Market Market (Long-Term Growth Catalysts)

Long-term growth will depend on addressing challenges and capitalizing on emerging trends. Strategic partnerships, investment in technological innovation, and expansion into niche markets are essential for sustainable growth. Companies focusing on sustainability and responsible travel will gain a competitive advantage, attracting environmentally conscious travelers. Focus on personalized experiences and innovative service offerings will also sustain growth.

Emerging Opportunities in North America Online Travel Market

The rise of sustainable and experiential travel is creating significant opportunities. The increasing demand for unique travel experiences, such as eco-tourism and adventure travel, presents growth prospects. The integration of blockchain technology for secure and transparent transactions offers a potential improvement in the overall experience for both the traveler and the online travel providers.

Leading Players in the North America Online Travel Market Sector

Key Milestones in North America Online Travel Market Industry

- November 2023: Airbnb acquires Gameplanner.AI for USD 200 Million, accelerating its AI initiatives.

- July 2023: TripAdvisor partners with OpenAI to launch an AI-powered travel itinerary generator.

Strategic Outlook for North America Online Travel Market Market

The North America online travel market exhibits strong growth potential, driven by technological advancements, evolving consumer preferences, and economic growth. Companies that leverage data analytics, personalize experiences, and focus on sustainable travel will gain a competitive edge. Strategic partnerships and expansion into niche markets will further enhance market penetration and ensure continued success.

North America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Online Travel Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Online Travel Market Regional Market Share

Geographic Coverage of North America Online Travel Market

North America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Work-Life Balance; Cost Savings for Both Travelers and Employers

- 3.3. Market Restrains

- 3.3.1. Stringent Company Policies; Suitability of Business Travel Destinations

- 3.4. Market Trends

- 3.4.1. The Expanding Tourism Industry in the United States is Helping the Market in Recording More Transactions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 JTB Americas Group

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 TripAdvisor

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Travelzoo

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Travel Leaders Group

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 American Express Global Business Travel

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Airbnb

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Travel and Transport Inc**List Not Exhaustive

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Booking Holdings

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Expedia

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 eDreams

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 JTB Americas Group

List of Figures

- Figure 1: North America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Travel Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the North America Online Travel Market?

Key companies in the market include JTB Americas Group, TripAdvisor, Travelzoo, Travel Leaders Group, American Express Global Business Travel, Airbnb, Travel and Transport Inc**List Not Exhaustive, Booking Holdings, Expedia, eDreams.

3. What are the main segments of the North America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 235 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Work-Life Balance; Cost Savings for Both Travelers and Employers.

6. What are the notable trends driving market growth?

The Expanding Tourism Industry in the United States is Helping the Market in Recording More Transactions.

7. Are there any restraints impacting market growth?

Stringent Company Policies; Suitability of Business Travel Destinations.

8. Can you provide examples of recent developments in the market?

In November 2023, Airbnb has acquired a startup called Gameplanner.AI in a deal valued at USD 200 million. Some of Airbnb's AI initiatives will be accelerated by Gameplanner.AI.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Travel Market?

To stay informed about further developments, trends, and reports in the North America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence