Key Insights

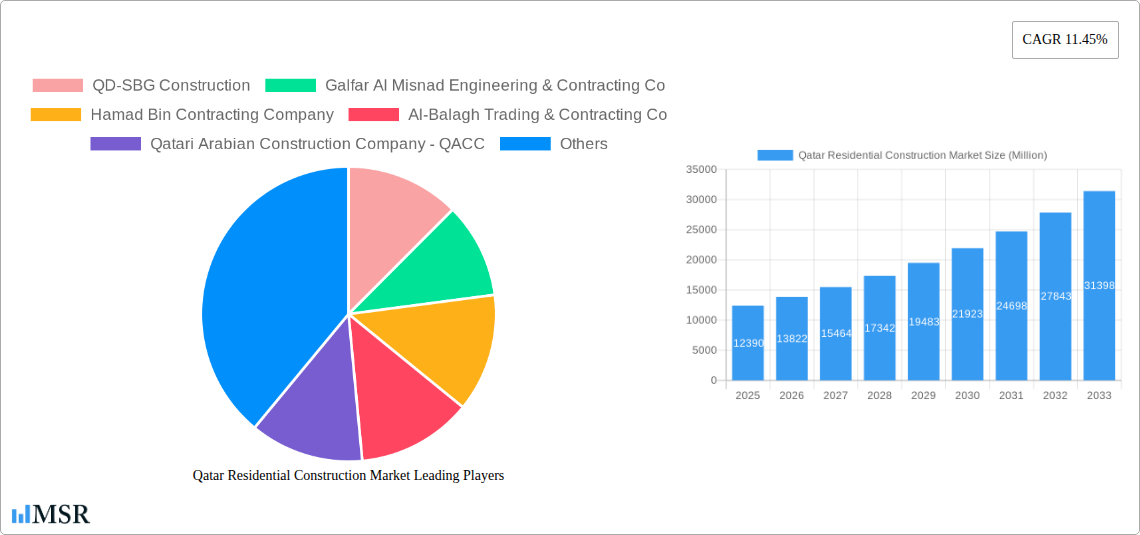

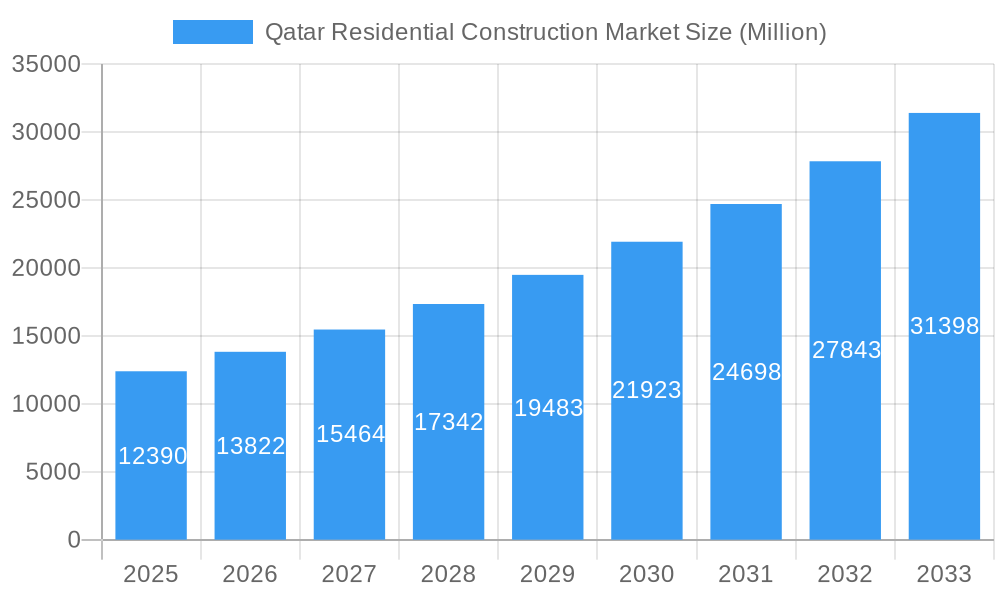

The Qatar residential construction market, valued at $12.39 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.45% from 2025 to 2033. This surge is primarily driven by Qatar's ambitious infrastructure development plans, particularly those related to the FIFA World Cup legacy projects and the ongoing urbanization process. Increased government spending on housing initiatives, coupled with a rising population and a burgeoning expatriate workforce, fuels strong demand for residential units across various segments, including apartments, condominiums, villas, and other property types. The market is witnessing a significant influx of both new construction and renovation projects, catering to diverse housing needs and preferences. Key players like QD-SBG Construction, Galfar Al Misnad Engineering & Contracting Co, and others are actively contributing to this growth, vying for a share in this lucrative market. However, challenges like fluctuating material costs and potential labor shortages may impact the overall market trajectory.

Qatar Residential Construction Market Market Size (In Billion)

The segment breakdown reveals a healthy mix of project types. While specific market share data for each segment (apartments & condominiums, villas, other types; new construction, renovation) is unavailable, a reasonable estimation based on market trends suggests apartments and condominiums likely hold the largest share, followed by villas, given the evolving urban landscape and preferences for diverse housing options. Similarly, new construction projects are expected to dominate over renovations in this growth phase, reflecting the substantial investment in new residential developments. The continuing influx of foreign investment and the government's commitment to sustainable urban development will be critical factors in shaping future market dynamics, influencing pricing, construction techniques, and overall growth prospects.

Qatar Residential Construction Market Company Market Share

Qatar Residential Construction Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar residential construction market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence to navigate the evolving landscape of Qatar's dynamic residential construction sector. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of xx%.

Qatar Residential Construction Market Market Concentration & Dynamics

The Qatar residential construction market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise market share figures for individual companies remain proprietary, QD-SBG Construction, Galfar Al Misnad Engineering & Contracting Co, and Hamad Bin Contracting Company are amongst the prominent firms. The market is characterized by a dynamic interplay of factors including:

- Innovation Ecosystems: The industry is witnessing increased adoption of Building Information Modeling (BIM) and sustainable construction practices, driving innovation and efficiency.

- Regulatory Frameworks: Government regulations related to building codes, safety standards, and environmental impact assessments play a significant role in shaping market dynamics. Changes in these regulations can influence project timelines and costs.

- Substitute Products: While limited, alternative building materials and construction methods are emerging, challenging traditional practices.

- End-User Trends: Growing demand for luxury apartments and villas, coupled with increasing preference for sustainable and smart homes, shapes the market’s trajectory.

- M&A Activities: The number of M&A deals in the sector has fluctuated over the historical period (2019-2024), with an average of xx deals per year, reflecting consolidation trends and strategic expansion moves by major players.

Qatar Residential Construction Market Industry Insights & Trends

The Qatar residential construction market is driven by several key factors, including:

- Robust Economic Growth: Qatar's strong economy, driven by its diverse revenue streams and large-scale infrastructure projects, fuels demand for residential properties.

- Government Initiatives: Government investments in infrastructure and affordable housing programs contribute to the overall market expansion.

- Population Growth and Urbanization: The steadily rising population and ongoing urbanization trends necessitate increased residential construction to meet housing demand.

- Technological Advancements: Adoption of advanced technologies, such as prefabricated construction methods and BIM, is enhancing efficiency and project delivery timelines.

- Changing Consumer Preferences: Growing preference for sustainable, smart, and energy-efficient housing options is influencing design and construction practices.

- Tourism Sector Growth: The flourishing tourism sector creates demand for residential units for both long-term rentals and short-term stays.

The market is witnessing significant technological disruptions, including the widespread adoption of BIM for efficient project management and enhanced design capabilities. Consumer behavior is shifting towards more sustainable and technologically advanced housing options, requiring builders to adapt and innovate to meet these demands.

Key Markets & Segments Leading Qatar Residential Construction Market

The Qatar residential construction market is dominated by the following segments:

- By Type: Apartments & Condominiums represent a significant share of the market, driven by high population density and increasing demand for affordable housing options. Villas constitute a smaller but rapidly growing segment, catering to the high-net-worth individuals' segment. The "Other Types" category includes townhouses and other residential structures.

- By Construction Type: New construction dominates the market, fueled by economic growth and population expansion. Renovation forms a notable segment driven by rising preference for improved living standards and building modernization.

Key Drivers:

- Economic Growth: High GDP growth rates in Qatar are a primary driver, creating a robust demand for residential construction.

- Infrastructure Development: Extensive investments in infrastructure development, including transportation networks and utilities, contribute to overall market expansion.

- Government Policies: Supportive government policies aimed at fostering economic growth and facilitating housing development further stimulate the market.

The dominance of Apartments & Condominiums is attributed to the high population density and the relatively lower cost compared to Villas. New construction remains dominant owing to sustained economic growth and population increase, though the renovation segment is gradually growing.

Qatar Residential Construction Market Product Developments

The Qatar residential construction market is witnessing several product innovations, including the adoption of prefabricated construction methods, smart home technologies, and sustainable building materials. These innovations offer enhanced efficiency, reduced construction timelines, and improved energy performance, providing significant competitive advantages to builders who adopt them. The increased use of green building materials and energy-efficient design is becoming increasingly critical, aligning with global sustainability goals and local environmental regulations.

Challenges in the Qatar Residential Construction Market Market

The Qatar residential construction market faces certain challenges, including:

- Regulatory Hurdles: Obtaining necessary permits and approvals can be time-consuming and complex, delaying project timelines. These regulatory complexities add to the cost and can create uncertainty for developers.

- Supply Chain Issues: Fluctuations in the global supply chain can impact the availability and cost of construction materials. This can disrupt project timelines and inflate budgets.

- Competitive Pressures: The relatively concentrated market creates intense competition among various contractors, demanding continuous innovation and efficiency enhancements to sustain profitability.

Forces Driving Qatar Residential Construction Market Growth

The Qatar residential construction market is projected to experience continued growth driven by:

- Technological Advancements: The adoption of BIM and prefabricated construction methods enhances efficiency and sustainability, boosting market expansion.

- Economic Growth: Continued strong economic performance fuels higher demand for housing, creating opportunities for new construction and renovation projects.

- Favorable Government Policies: Government initiatives, such as affordable housing programs and infrastructure investments, provide further impetus for market growth.

Challenges in the Qatar Residential Construction Market Market

Long-term growth in the Qatar residential construction market depends on addressing existing challenges and capitalizing on emerging opportunities. This necessitates strategic partnerships between developers, material suppliers, and technology providers. Furthermore, fostering innovation in sustainable building practices and integrating smart technologies will drive long-term market potential. Expanding into new market segments, such as eco-friendly and luxury housing, offers further growth opportunities.

Emerging Opportunities in Qatar Residential Construction Market

Emerging trends and opportunities include:

- Sustainable Construction: Increasing demand for green buildings and sustainable practices creates lucrative opportunities for environmentally conscious developers.

- Smart Home Technology: Integration of smart home technologies in residential properties adds value and enhances consumer appeal.

- Modular Construction: Prefabricated and modular construction methods offer enhanced efficiency and faster project completion times, presenting significant market opportunities.

Leading Players in the Qatar Residential Construction Market Sector

- QD-SBG Construction

- Galfar Al Misnad Engineering & Contracting Co

- Hamad Bin Contracting Company

- Al-Balagh Trading & Contracting Co

- Qatari Arabian Construction Company - QACC

- Q-MEP Contracting

- Alseal Contracting And Trading Company

- Ramco Trading & Contracting

- Al Majal International Trading And Contracting Company Wll

- Bemco Contracting Company Qatar

- Domopan Qatar W L

- Midmac Contracting Co W L L

- Lupp International Qatar L L C

- Porr Construction Qatar W L L

Key Milestones in Qatar Residential Construction Market Industry

- July 2022: Qatar First Bank LLC (QFB) acquires The Gateway Plaza building in Richmond, Virginia, demonstrating investment in US real estate.

- August 2022: Ascott's acquisition of Oakwood Worldwide significantly expands its global portfolio, indirectly influencing the demand for serviced apartments and influencing future investment strategies within the hospitality sector impacting the residential market.

Strategic Outlook for Qatar Residential Construction Market Market

The Qatar residential construction market is poised for sustained growth, driven by robust economic performance, ongoing urbanization, and government support. Strategic opportunities exist in adopting sustainable construction practices, integrating smart technologies, and tapping into the growing demand for luxury and eco-friendly housing. Partnerships and collaborations will be essential to leverage these opportunities and navigate market challenges effectively.

Qatar Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

Qatar Residential Construction Market Segmentation By Geography

- 1. Qatar

Qatar Residential Construction Market Regional Market Share

Geographic Coverage of Qatar Residential Construction Market

Qatar Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Qatar's Residential Market is Slightly Improving

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Residential Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 QD-SBG Construction

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Galfar Al Misnad Engineering & Contracting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hamad Bin Contracting Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al-Balagh Trading & Contracting Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Qatari Arabian Construction Company - QACC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Q-MEP Contracting

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alseal Contracting And Trading Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ramco Trading & Contracting

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Majal International Trading And Contracting Company Wll

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bemco Contracting Company Qatar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Domopan Qatar W L

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Midmac Contracting Co W L L

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Lupp International Qatar L L C*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Porr Construction Qatar W L L

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 QD-SBG Construction

List of Figures

- Figure 1: Qatar Residential Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Qatar Residential Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar Residential Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Qatar Residential Construction Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 3: Qatar Residential Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Qatar Residential Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Qatar Residential Construction Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 6: Qatar Residential Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Residential Construction Market?

The projected CAGR is approximately 11.45%.

2. Which companies are prominent players in the Qatar Residential Construction Market?

Key companies in the market include QD-SBG Construction, Galfar Al Misnad Engineering & Contracting Co, Hamad Bin Contracting Company, Al-Balagh Trading & Contracting Co, Qatari Arabian Construction Company - QACC, Q-MEP Contracting, Alseal Contracting And Trading Company, Ramco Trading & Contracting, Al Majal International Trading And Contracting Company Wll, Bemco Contracting Company Qatar, Domopan Qatar W L, Midmac Contracting Co W L L, Lupp International Qatar L L C*List Not Exhaustive, Porr Construction Qatar W L L.

3. What are the main segments of the Qatar Residential Construction Market?

The market segments include Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.39 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Qatar's Residential Market is Slightly Improving.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

July 2022: The Gateway Plaza building in Richmond, Virginia, USA, has been purchased by Qatar First Bank LLC (public) (QFB). A wonderful addition to the bank's investment portfolio, the new acquisition is a Class AA trophy asset with a 330,000-square-foot area that was built in 2015 as a build-to-suit building and will continue to ensure steady cash flows. With a goal to increase its presence and level of knowledge in the US real estate market, the new investment marks QFB's eleventh US real estate property and its fourteenth investment under its new Shari'a-compliant real estate investment strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Residential Construction Market?

To stay informed about further developments, trends, and reports in the Qatar Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence