Key Insights

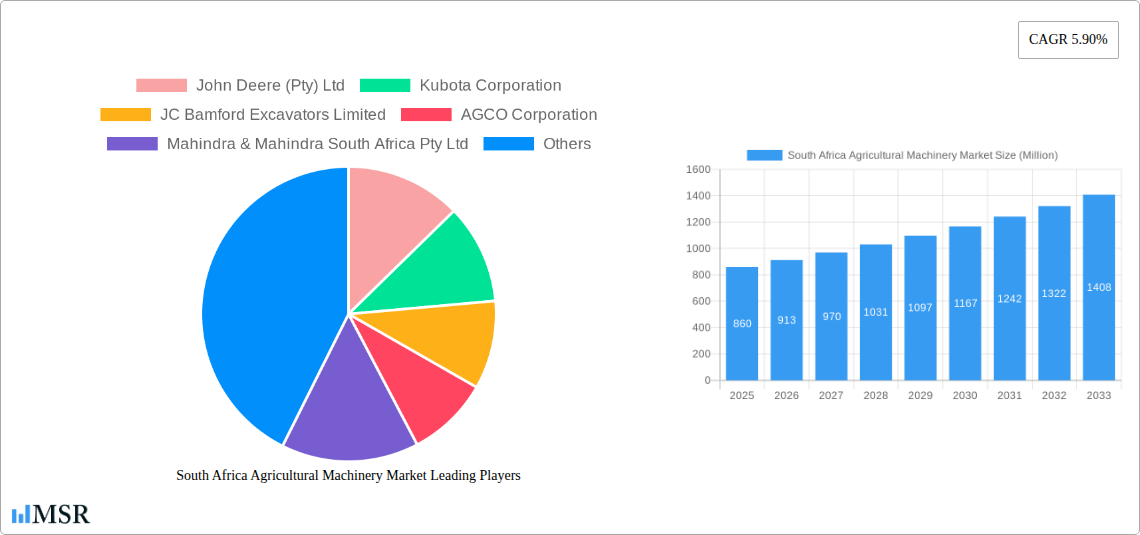

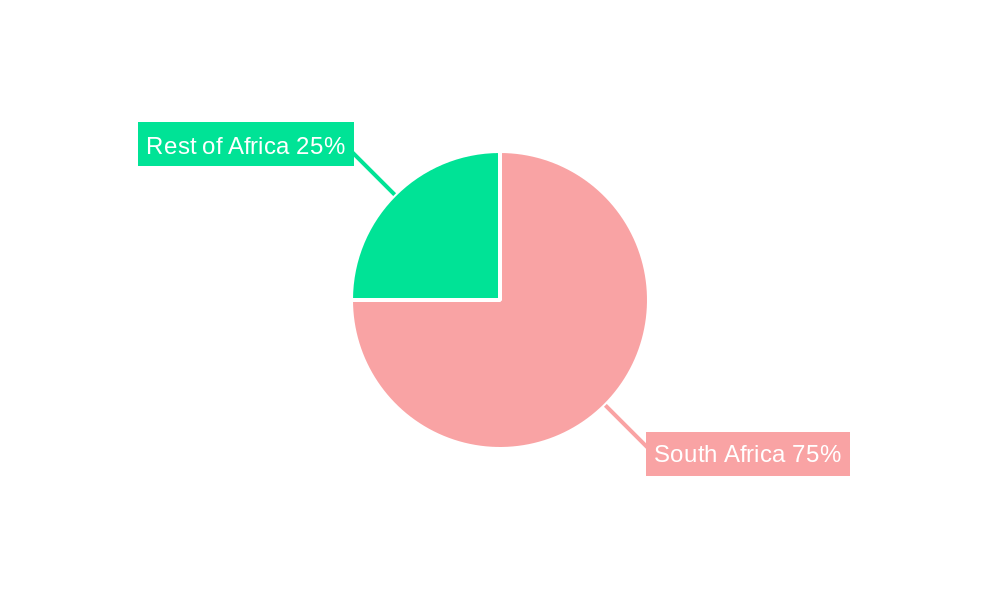

The South African agricultural machinery market, valued at $860 million in 2025, is projected to experience robust growth, driven by factors such as increasing government investments in agricultural infrastructure, rising demand for efficient farming techniques to enhance productivity, and a growing focus on mechanization to address labor shortages. The market's Compound Annual Growth Rate (CAGR) of 5.90% from 2019 to 2024 suggests a sustained upward trajectory. This growth is anticipated to continue through 2033, fueled by the expansion of commercial farming and government initiatives promoting agricultural modernization. Key segments driving this growth include tractors (particularly utility and compact utility tractors), ploughing and cultivating machinery, and planting and harvesting equipment. While the market faces challenges such as high input costs and fluctuating commodity prices, the overall outlook remains positive, with significant opportunities for manufacturers and distributors of advanced agricultural technologies. The increasing adoption of precision farming techniques and the growing preference for high-horsepower machinery, especially in the >100 HP category, will further shape market dynamics. Competition is primarily between established international players like John Deere, Kubota, and AGCO, alongside significant local players like Mahindra & Mahindra South Africa. The market’s regional distribution within South Africa is likely skewed towards regions with established agricultural hubs, with the rest of Africa contributing a smaller, but growing, share.

South Africa Agricultural Machinery Market Market Size (In Million)

The continued modernization of farming practices in South Africa, coupled with increasing investment in irrigation technologies and improved infrastructure, presents a compelling case for sustained growth in the agricultural machinery market. Opportunities exist for companies offering advanced features like GPS-guided systems, automated harvesting solutions, and data-driven analytics for improved farm management. This necessitates a focus on providing robust after-sales service and support networks to sustain customer relationships and maintain equipment efficiency. The growth trajectory is particularly promising for specialized machinery catering to specific crops and farming practices prevalent in the region, as well as technologies geared toward minimizing environmental impact. The successful navigation of economic uncertainties and the effective implementation of government policies supporting agricultural modernization will be crucial in realizing the full potential of this dynamic market.

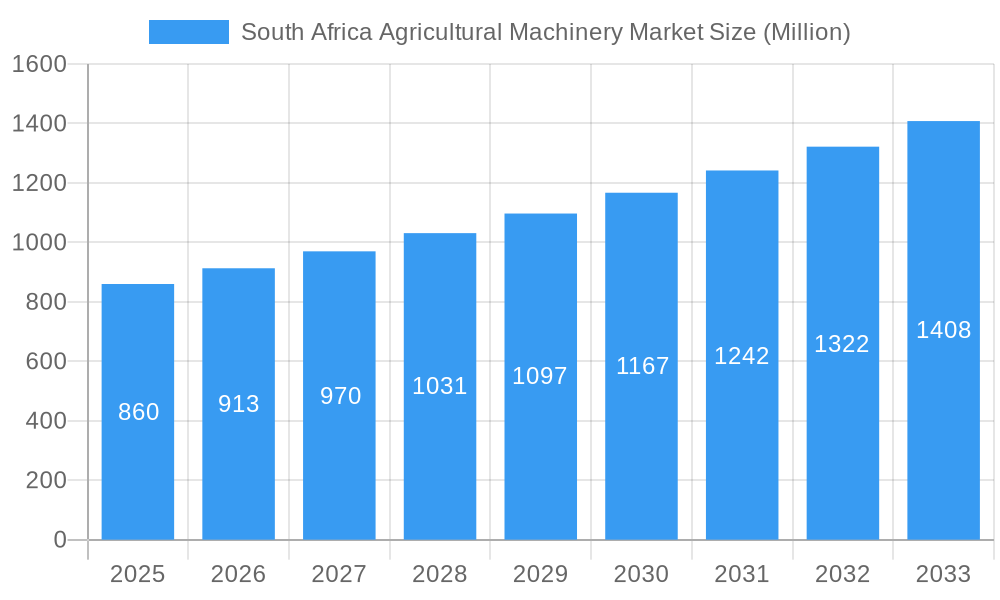

South Africa Agricultural Machinery Market Company Market Share

South Africa Agricultural Machinery Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South Africa agricultural machinery market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and emerging opportunities within this vital sector. Expect detailed breakdowns of market size, CAGR, and segment-specific growth drivers, empowering you to make informed decisions and capitalize on future growth prospects.

South Africa Agricultural Machinery Market Market Concentration & Dynamics

The South Africa agricultural machinery market exhibits a moderately concentrated landscape, with key players like John Deere (Pty) Ltd, Kubota Corporation, and AGCO Corporation holding significant market share. However, the presence of several regional and international players fosters competition. Innovation is driven by technological advancements in precision agriculture, automation, and data analytics. The regulatory framework, while generally supportive of agricultural development, presents certain challenges related to import/export regulations and safety standards. Substitute products, such as manual labor-intensive methods, remain relevant in certain segments, primarily small-scale farming operations. End-user trends indicate a growing demand for fuel-efficient, technologically advanced machinery, particularly amongst larger commercial farms. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024. Market share distribution amongst the top 5 players is estimated to be approximately 60% in 2025.

- Market Concentration: Moderately concentrated with top 5 players holding ~60% market share (2025 est.)

- Innovation Ecosystem: Strong focus on precision agriculture and automation.

- Regulatory Framework: Supportive but with challenges related to import/export and safety.

- Substitute Products: Manual labor remains relevant in small-scale farming.

- End-User Trends: Growing demand for fuel-efficient and technologically advanced machinery.

- M&A Activity: xx deals recorded between 2019 and 2024.

South Africa Agricultural Machinery Market Industry Insights & Trends

The South Africa agricultural machinery market is experiencing steady growth, driven by factors such as increasing agricultural production, government initiatives to modernize farming practices, and rising demand for efficient and technologically advanced equipment. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including the adoption of precision farming technologies, autonomous vehicles, and data-driven decision-making tools, are reshaping the industry landscape. Evolving consumer behaviors reflect a preference for machinery with enhanced fuel efficiency, reduced maintenance needs, and increased operational productivity. The growth trajectory is influenced by fluctuating commodity prices, climate change impacts on agricultural yields, and government policies impacting the agricultural sector.

Key Markets & Segments Leading South Africa Agricultural Machinery Market

The South Africa agricultural machinery market is geographically diverse, with significant demand across various provinces. However, the regions with the highest concentration of large-scale commercial farms typically exhibit the strongest demand. Within the product segments, tractors (including compact utility, utility, and row crop tractors) dominate the market, accounting for the largest revenue share. High horsepower tractors (greater than 100 HP) are particularly prevalent among large commercial farms, whereas lower horsepower tractors are more common amongst smallholders. Within the machinery types, the demand for ploughing and cultivating machinery, planting machinery, and harvesting machinery is significant, largely driven by the country's diverse agricultural output. Irrigation machinery also presents a notable segment within the "other haying and forage machinery" category, particularly in regions with water scarcity.

Growth Drivers:

- Economic growth in the agricultural sector

- Government investments in agricultural infrastructure

- Increasing adoption of modern farming techniques

- Favorable climatic conditions (in certain regions)

Segment Dominance:

- Tractors constitute the largest revenue segment.

- High horsepower tractors ( >100 HP) are dominant amongst larger commercial farms.

- Ploughing, cultivating, planting, and harvesting machinery exhibit strong demand.

South Africa Agricultural Machinery Market Product Developments

Recent product developments include the introduction of high-capacity combine harvesters (e.g., John Deere's X9 Series), offering increased efficiency and reduced grain loss. The market also witnesses ongoing innovation in precision farming technologies, such as GPS-guided machinery and automated planting systems, that enhance operational precision and reduce input costs. These advancements are primarily driven by competition amongst major manufacturers aiming for a competitive edge in terms of efficiency and technological superiority.

Challenges in the South Africa Agricultural Machinery Market Market

The South Africa agricultural machinery market faces challenges including fluctuating fuel prices impacting operational costs, the high initial investment required for modern machinery posing a barrier to smallholder farmers, and a somewhat uneven distribution network, particularly in remote areas. Import tariffs and import regulations can also create hurdles. Competition from international and domestic players intensifies pressures on pricing and profitability. These factors collectively influence the market growth rate and overall accessibility of advanced machinery to all segments of the agricultural industry.

Forces Driving South Africa Agricultural Machinery Market Growth

Key growth drivers include government incentives promoting agricultural mechanization, rising investments in agricultural infrastructure, and increasing demand for food security domestically. Technological advancements, such as precision farming technologies and automated systems, significantly increase efficiency and productivity, stimulating market demand. Favorable climatic conditions in certain regions also contribute to increased crop yields and the subsequent need for more advanced machinery.

Long-Term Growth Catalysts in South Africa Agricultural Machinery Market

Long-term growth will be fueled by increasing collaboration between machinery manufacturers and agricultural service providers to offer comprehensive solutions to farmers. Furthermore, government support through subsidies and training programs, expanding access to financing for farmers, and technological innovations in sustainable farming practices will positively shape the market's trajectory. The continued development of robust and reliable local supply chains will also contribute significantly to market growth.

Emerging Opportunities in South Africa Agricultural Machinery Market

Emerging opportunities lie in the growing adoption of precision agriculture technologies, the increasing demand for specialized machinery for specific crops, and the expansion of rental services for agricultural machinery, making advanced technology more accessible. The development of more cost-effective and fuel-efficient machinery specifically targeting smaller farms also presents a significant market opportunity. The growing awareness regarding sustainable agricultural practices and the need for environment-friendly solutions further opens up new avenues for innovation and growth.

Leading Players in the South Africa Agricultural Machinery Market Sector

- John Deere (Pty) Ltd (John Deere)

- Kubota Corporation (Kubota)

- JC Bamford Excavators Limited (JCB)

- AGCO Corporation (AGCO)

- Mahindra & Mahindra South Africa Pty Ltd (Mahindra)

- CNH Industrial NV (CNH Industrial)

- Lindsay Corporation

Key Milestones in South Africa Agricultural Machinery Market Industry

- June 2022: Argo Tractors South Africa expands its office, increasing production capacity to 2,000 units annually.

- June 2022: John Deere launches the X9 Series Combine, significantly enhancing grain handling efficiency.

- November 2022: Kubota establishes a supply chain for low-cost tractors from India, targeting small-scale African farms.

Strategic Outlook for South Africa Agricultural Machinery Market Market

The South Africa agricultural machinery market is poised for sustained growth, driven by technological advancements, government support, and the increasing demand for efficient and sustainable agricultural practices. Strategic opportunities lie in investing in innovative technologies, expanding distribution networks, and developing tailored solutions for specific farming segments, particularly smallholder farmers. Companies that successfully adapt to evolving consumer preferences and incorporate sustainable practices will be best positioned to capitalize on future growth potential.

South Africa Agricultural Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Agricultural Machinery Market Segmentation By Geography

- 1. South Africa

South Africa Agricultural Machinery Market Regional Market Share

Geographic Coverage of South Africa Agricultural Machinery Market

South Africa Agricultural Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Threat of Water Scarcity; Favorable Government Policies and Subsidies

- 3.3. Market Restrains

- 3.3.1. High Initial Capital Investments

- 3.4. Market Trends

- 3.4.1. Growing Grain Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 John Deere (Pty) Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kubota Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JC Bamford Excavators Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AGCO Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mahindra & Mahindra South Africa Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CNH Industrial NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lindsay Corporatio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 John Deere (Pty) Ltd

List of Figures

- Figure 1: South Africa Agricultural Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Agricultural Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South Africa Agricultural Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South Africa Agricultural Machinery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Agricultural Machinery Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the South Africa Agricultural Machinery Market?

Key companies in the market include John Deere (Pty) Ltd, Kubota Corporation, JC Bamford Excavators Limited, AGCO Corporation, Mahindra & Mahindra South Africa Pty Ltd, CNH Industrial NV, Lindsay Corporatio.

3. What are the main segments of the South Africa Agricultural Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Threat of Water Scarcity; Favorable Government Policies and Subsidies.

6. What are the notable trends driving market growth?

Growing Grain Industry.

7. Are there any restraints impacting market growth?

High Initial Capital Investments.

8. Can you provide examples of recent developments in the market?

In November 2022, Kubota set up a supply chain to sell Africa low-cost tractors produced in India that take advantage of India's low material and labor costs, wherein, instead of exporting from Japan, Kubota will have an Indian subsidiary ship compact models to the small-scale farms that dominate Africa's agricultural sector, including South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Agricultural Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Agricultural Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Agricultural Machinery Market?

To stay informed about further developments, trends, and reports in the South Africa Agricultural Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence