Key Insights

The South American freight and logistics market, projected to reach $360.2 billion by 2024 with a compound annual growth rate (CAGR) of 6.6%, is experiencing significant expansion. This growth is propelled by the booming e-commerce sector across key nations like Brazil, Argentina, and Chile, driving demand for efficient logistics, particularly temperature-controlled solutions for perishables. Substantial infrastructure investments in ports and transportation networks are enhancing regional connectivity and cargo movement. Increased cross-border trade further bolsters market growth. Key challenges include currency fluctuations, localized infrastructure limitations, and diverse regulatory landscapes. The courier, express, and parcel (CEP) sector and temperature-controlled logistics are poised for strong performance, fueled by demand for fresh produce and pharmaceuticals. Agricultural, fishing, and forestry industries are major volume contributors. Leading global players such as DB Schenker, DHL Group, and Kuehne + Nagel, alongside regional specialists like TASA Logística and Agunsa Logistics, are strategically positioned for market success.

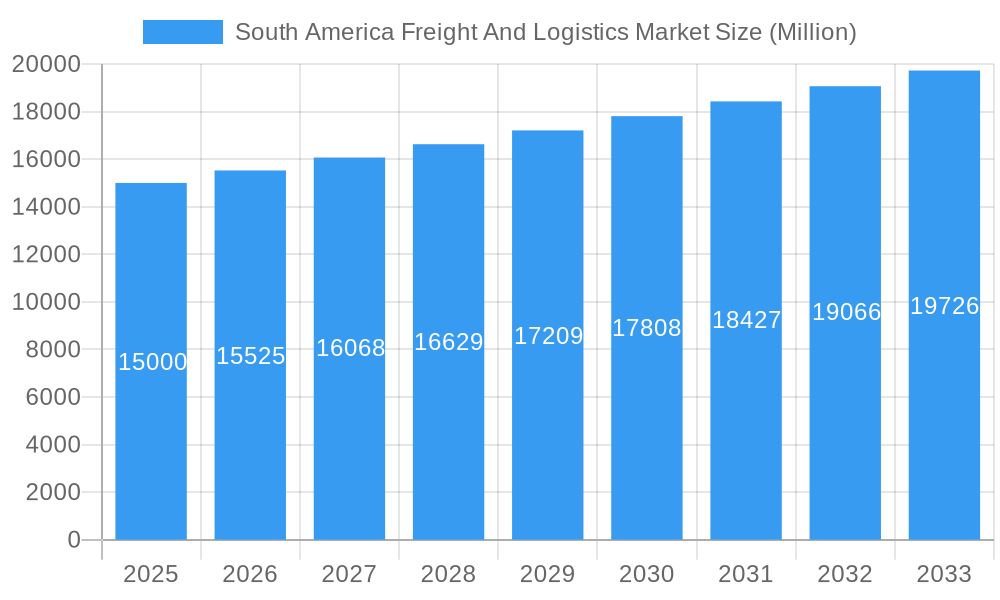

South America Freight And Logistics Market Market Size (In Billion)

Future growth will be contingent upon continued investment in digitalization, including advanced tracking systems and optimized routing. Addressing infrastructure gaps and streamlining cross-border customs processes are crucial for enhanced efficiency and cost reduction. Supportive government policies for logistics development and trade facilitation will significantly influence market trajectory. The competitive landscape is dynamic, requiring players to adapt to evolving customer needs, embrace technological innovation, and effectively navigate the region's unique market dynamics.

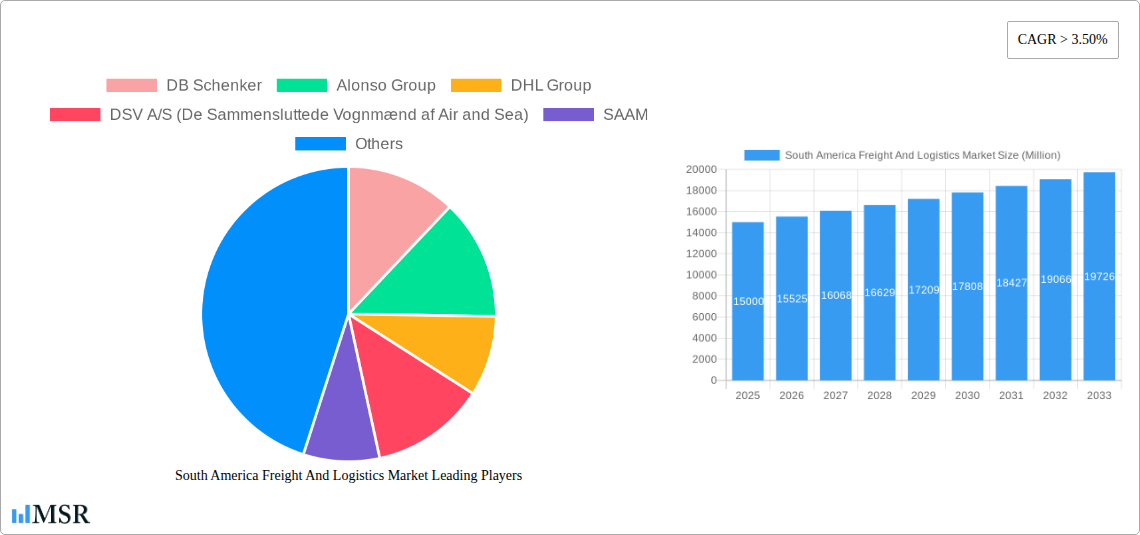

South America Freight And Logistics Market Company Market Share

South America Freight & Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America freight and logistics market, encompassing market size, growth drivers, key players, and future trends. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report covers key countries including Argentina, Brazil, Chile, and the Rest of South America, analyzing various segments like Agriculture, Fishing & Forestry, Construction, Manufacturing, Oil & Gas, Mining & Quarrying, Wholesale & Retail Trade, and other end-user industries. Logistics functions analyzed include Courier, Express, and Parcel (CEP); Temperature Controlled; and Other Services.

South America Freight And Logistics Market Market Concentration & Dynamics

The South America freight and logistics market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, regional operators ensures a competitive landscape. The market is influenced by a complex interplay of factors, including rapidly evolving regulatory frameworks, technological innovations, and fluctuating end-user demands. The market share of the top five players is estimated to be approximately xx%. Innovation is driven by technological advancements in areas such as data analytics, automation, and sustainable practices. The regulatory environment, though undergoing reforms, still presents challenges in some regions. Substitute products, such as improved in-house logistics operations by larger companies, exert some pressure. End-user trends favor efficiency, cost-effectiveness, and environmental sustainability.

M&A activity in the sector has been relatively consistent over the past five years, with an average of xx deals annually. These transactions often involve strategic acquisitions aimed at expanding geographical reach, enhancing service portfolios, and accessing new technologies.

- Market Concentration: Moderately concentrated, top 5 players holding approximately xx% market share.

- Innovation: Driven by data analytics, automation, and sustainability initiatives.

- Regulatory Framework: Evolving, presenting both opportunities and challenges.

- Substitute Products: Growing pressure from internalized logistics solutions in larger companies.

- End-User Trends: Focus on efficiency, cost-effectiveness, and sustainability.

- M&A Activity: Average of xx deals annually in the past five years.

South America Freight And Logistics Market Industry Insights & Trends

The South America freight and logistics market is experiencing significant growth, driven by factors such as increasing e-commerce penetration, expanding industrial activity, and infrastructure development. The market size in 2025 is estimated to be USD xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is further fueled by the rise of specialized logistics services like temperature-controlled transportation and the growing demand for efficient supply chain solutions. Technological advancements, including the adoption of digital platforms, blockchain technology, and Internet of Things (IoT) devices, are transforming the industry. The shift towards sustainable practices and increased regulatory scrutiny are influencing logistical operations and investments. The evolving consumer behavior emphasizes convenience, speed, and transparency in delivery services, placing pressure on logistics providers to enhance their capabilities and adapt to changing demands. Furthermore, the expanding middle class across several South American nations fuels increased consumer spending and a corresponding growth in e-commerce logistics.

Key Markets & Segments Leading South America Freight And Logistics Market

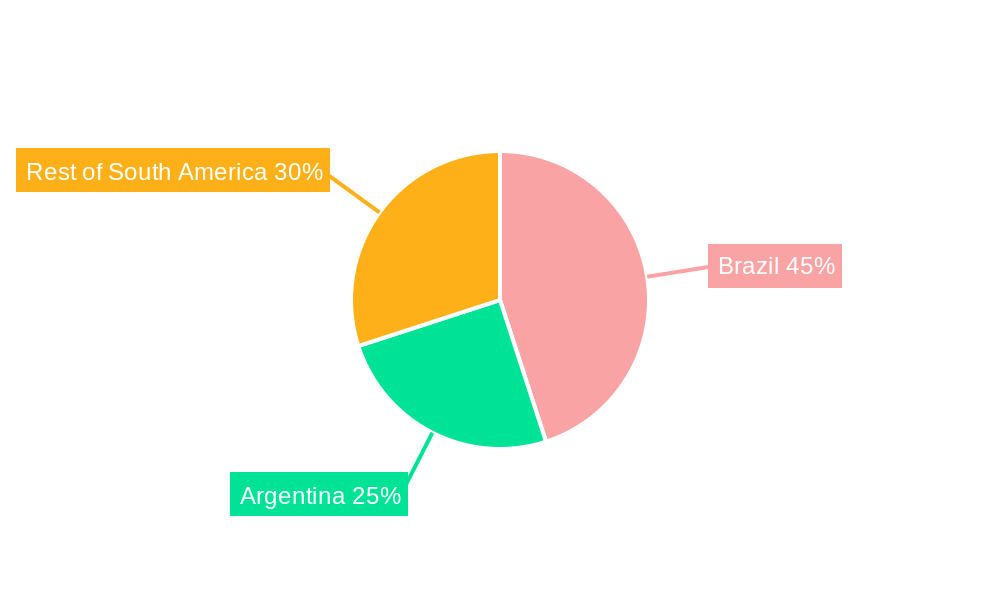

Brazil dominates the South America freight and logistics market, driven by its large economy and extensive infrastructure. However, other countries like Argentina and Chile are also experiencing significant growth, particularly in specific segments.

Dominant Regions/Countries:

- Brazil: Largest market share, driven by robust economy and developed infrastructure.

- Argentina & Chile: Experiencing significant growth, especially in specialized segments.

Dominant End-User Industries:

- Manufacturing: High volume of goods requiring efficient logistics solutions.

- Wholesale & Retail Trade: Fueled by e-commerce expansion and consumer demand.

- Oil & Gas: Specialized logistics needs due to the nature of the products.

Dominant Logistics Functions:

- Courier, Express, and Parcel (CEP): Driven by e-commerce growth and consumer expectations.

- Temperature Controlled: Growing demand for specialized handling of pharmaceuticals and perishables.

Drivers for Growth:

- Economic Growth: Increased industrial output and consumer spending in key markets.

- E-commerce Expansion: Surge in online retail creating high demand for delivery services.

- Infrastructure Development: Investments in ports, roads, and other logistics infrastructure.

- Technological Advancements: Adoption of digital platforms and automation technologies improving efficiency.

South America Freight And Logistics Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and traceability within the supply chain. This includes advanced tracking systems, automated warehousing solutions, and specialized temperature-controlled containers. The implementation of blockchain technology offers improved transparency and security in managing goods and information. These advancements provide companies with a significant competitive edge, improving delivery times, reducing costs, and enhancing customer satisfaction.

Challenges in the South America Freight And Logistics Market Market

The South American freight and logistics market faces significant challenges, including inconsistent infrastructure across regions, regulatory complexities and varying customs procedures, and high transportation costs. Supply chain disruptions, particularly in recent years, have highlighted vulnerabilities. Intense competition and fluctuating fuel prices also impact profitability. These challenges can lead to delays, increased costs, and reduced efficiency. For instance, infrastructure deficiencies in certain regions can add xx% to transportation times and costs.

Forces Driving South America Freight And Logistics Market Growth

Technological advancements, increasing e-commerce penetration, and infrastructure improvements are key drivers of market growth. The expanding middle class in several South American countries is also contributing significantly. Government initiatives focused on improving logistics infrastructure and easing regulatory hurdles are further fostering growth.

Challenges in the South America Freight And Logistics Market Market

Long-term growth hinges on continued investment in infrastructure, technological innovation, and the development of a more integrated and efficient logistics ecosystem. Strategic partnerships, fostering collaboration among stakeholders, and expanding into new market segments will be crucial for sustainable growth.

Emerging Opportunities in South America Freight And Logistics Market

Emerging opportunities exist in the growing e-commerce sector, the need for specialized logistics solutions (like cold chain logistics), and the adoption of sustainable practices. Expansion into underserved regions and offering integrated logistics solutions will unlock further market potential.

Leading Players in the South America Freight And Logistics Market Sector

- DB Schenker

- Alonso Group

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- SAAM

- Kuehne + Nagel

- TASA Logística

- Agunsa Logistics

- Americold

- TIBA Grou

- DP World

- CMA CGM Group

Key Milestones in South America Freight And Logistics Market Industry

- February 2024: DHL Supply Chain and Adidas inaugurated a new USD 14 Million distribution center in Brazil, incorporating advanced technology and sustainable practices. This signifies a significant investment in modernizing logistics infrastructure and enhancing efficiency within the Brazilian market.

- January 2024: Polar (DHL Group) added 5 multi-temperature trucks to its fleet, improving capabilities in the specialized medical and pharmaceutical logistics sector. This addresses the growing demand for temperature-sensitive product handling.

- January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles, showcasing commitment to sustainability and offering carbon reduction options to its customers. This enhances the company's appeal in a market increasingly focused on environmental responsibility.

Strategic Outlook for South America Freight And Logistics Market Market

The South America freight and logistics market holds significant long-term growth potential, driven by factors like continued economic expansion, technological advancements, and growing e-commerce. Companies that invest in infrastructure improvements, adopt innovative technologies, and build strong partnerships will be well-positioned to capitalize on this potential. Focusing on sustainability and providing tailored solutions to meet specific industry needs will also be critical success factors.

South America Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

South America Freight And Logistics Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Freight And Logistics Market Regional Market Share

Geographic Coverage of South America Freight And Logistics Market

South America Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Freight And Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alonso Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAAM

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TASA Logística

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agunsa Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Americold

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TIBA Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DP World

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CMA CGM Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: South America Freight And Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Freight And Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: South America Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: South America Freight And Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South America Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: South America Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: South America Freight And Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Freight And Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Freight And Logistics Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the South America Freight And Logistics Market?

Key companies in the market include DB Schenker, Alonso Group, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), SAAM, Kuehne + Nagel, TASA Logística, Agunsa Logistics, Americold, TIBA Grou, DP World, CMA CGM Group.

3. What are the main segments of the South America Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 360.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2024: DHL Supply Chain and ADIDAS, inaugurated one of the most modern Distribution Centers (DCs) in Brazil. With an investment of more than USD 14M (R$ 70 million), the facilities were built from scratch especially for this project and add innovative technologies and sustainable practices. The new CD, with nearly 40,000 m², will be adidas' main logistics operations center in Brazil, serving the three areas (e-commerce, retail and own stores) in a synergistic way in a more agile, efficient and technological logistics design.January 2024: Polar, a DHL Group company specialized in the transportation of medicines, vaccines and other medical and hospital supplies, has included in its fleet currently composed of more than 350 vehicles, 5 multi-temperature trucks, in an investment of more than R$ 5 million. The new vehicle profile makes it possible to deliver products that require different temperature ranges, something that is still uncommon in the health logistics market in Brazil.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the South America Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence