Key Insights

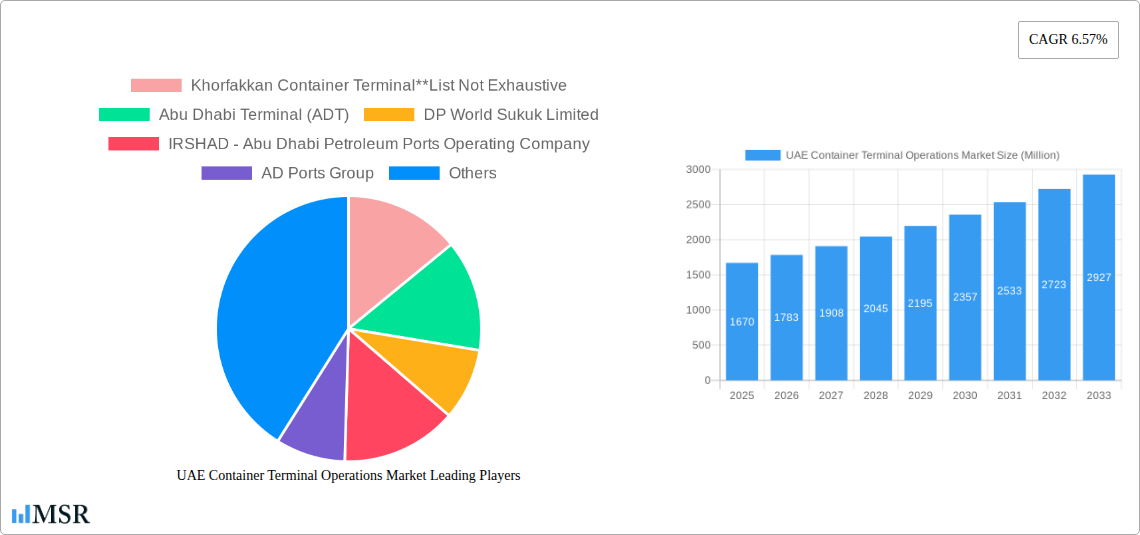

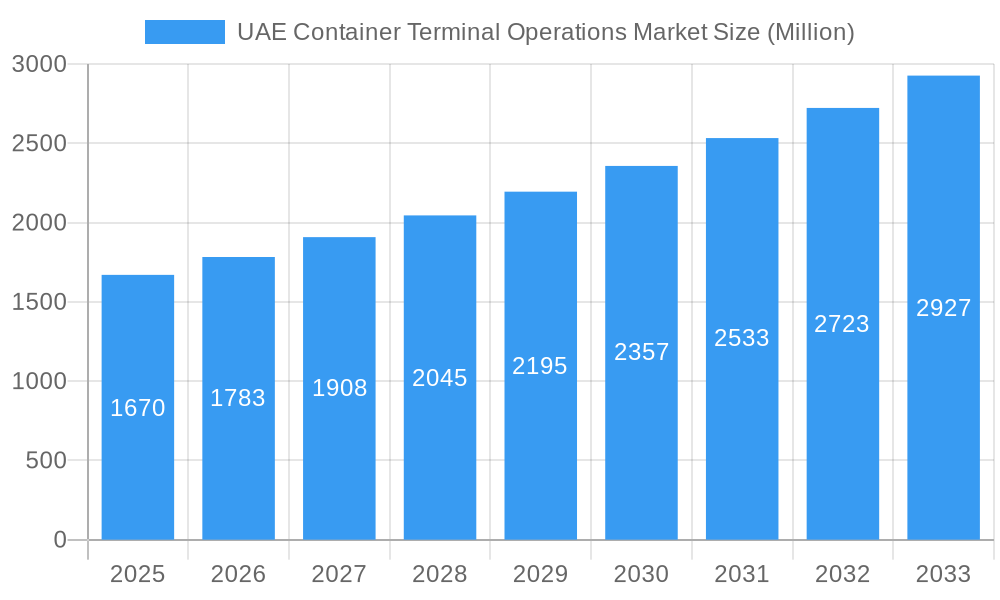

The UAE container terminal operations market, valued at $1.67 billion in 2025, is projected to experience robust growth, driven by the nation's strategic location as a global trade hub, increasing maritime traffic, and substantial investments in port infrastructure modernization. The compound annual growth rate (CAGR) of 6.57% from 2025 to 2033 indicates a promising outlook. Key growth drivers include the expansion of existing ports like Khorfakkan Container Terminal and Abu Dhabi Terminals, coupled with the development of new facilities and the ongoing diversification of the UAE economy, fostering increased import and export activities. The market is segmented by service type (stevedoring, cargo handling & transportation, and other services) and cargo type (crude oil, dry cargo, and other cargo). The dominance of crude oil and dry cargo reflects the UAE's significant role in global energy and commodity trade. However, the increasing reliance on e-commerce and related logistics is expected to drive growth in other cargo types. Competitive intensity is high, with major players like DP World, AD Ports Group, and several other privately owned companies vying for market share. This competition fosters innovation and efficiency improvements within the industry. Restraints to growth could include global economic downturns affecting trade volumes and potential regulatory changes impacting port operations.

UAE Container Terminal Operations Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continuous expansion, with the market size projected to surpass $2.8 billion by 2033. This growth will likely be propelled by ongoing infrastructure development initiatives, government support for logistics, and the increasing demand for efficient and reliable container handling services. The market's success will hinge on continued investment in advanced technologies like automation and digitalization to improve operational efficiency and competitiveness. Furthermore, sustainable practices and environmental considerations are becoming increasingly important, influencing the adoption of eco-friendly technologies and operations. Companies are strategically positioning themselves to capitalize on this growth, focusing on operational excellence, technological advancements, and diversification of their service offerings.

UAE Container Terminal Operations Market Company Market Share

UAE Container Terminal Operations Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Container Terminal Operations Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report dissects market dynamics, growth drivers, challenges, and emerging opportunities within the UAE's vibrant maritime sector. The report leverages robust data and analysis to forecast market trends and provide actionable intelligence for navigating the complexities of this dynamic industry.

UAE Container Terminal Operations Market Market Concentration & Dynamics

The UAE container terminal operations market exhibits a moderately concentrated landscape, dominated by major players like DP World, AD Ports Group, and smaller entities such as Khorfakkan Container Terminal and Abu Dhabi Terminal (ADT). Market share fluctuates based on individual terminal performance and strategic initiatives. Innovation in automation and digitalization is a key driver, with companies investing heavily in technologies to enhance efficiency and reduce operational costs. The regulatory framework, overseen by relevant UAE authorities, plays a significant role in shaping market dynamics, influencing operational standards and encouraging sustainable practices. Substitute products, such as alternative transportation modes, pose limited competition due to the inherent advantages of container shipping for bulk cargo. End-user trends point towards increasing demand for faster turnaround times and enhanced supply chain visibility.

- Market Concentration: Moderate, with a few dominant players and numerous smaller operators. DP World and AD Ports Group hold a significant market share (xx%).

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on expansion and consolidation within the sector. This activity is projected to remain steady during the forecast period (2025-2033).

- Innovation Ecosystem: Active, with investments in automation (e.g., automated guided vehicles, AI-powered systems), digitalization (e.g., blockchain for supply chain traceability), and sustainability initiatives.

- Regulatory Framework: Supportive, with regulations focused on safety, efficiency, and environmental protection.

- Substitute Products: Limited direct substitutes, with alternative transportation modes offering niche competition.

- End-User Trends: Growing demand for faster turnaround times, enhanced supply chain transparency, and reliable service quality.

UAE Container Terminal Operations Market Industry Insights & Trends

The UAE container terminal operations market is experiencing robust growth, driven by the nation's strategic location as a global trade hub and the continued expansion of its port infrastructure. The market size in 2025 is estimated at xx Million USD, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by factors such as increasing global trade volumes, the expansion of existing port facilities (as seen with Khalifa Port's drydock addition), and the growing adoption of advanced technologies aimed at optimizing operational efficiency. Technological advancements, particularly in automation and digitalization, are transforming the industry, leading to increased productivity and reduced operational costs. Consumer behavior reflects a growing preference for reliable and transparent supply chains, pushing terminals to invest in systems that enhance visibility and traceability.

Key Markets & Segments Leading UAE Container Terminal Operations Market

- Dominant Region: The market is concentrated primarily within the major port cities of the UAE, including Jebel Ali, Khalifa Port, and Khorfakkan.

By Service:

- Stevedoring: This segment dominates due to the high volume of container handling and associated services required. Drivers include the growth in global trade and the increasing demand for efficient cargo handling.

- Cargo Handling & Transportation: This segment experiences substantial growth, propelled by the rise in e-commerce and the need for seamless logistics solutions.

- Other Service Types: This includes specialized services like warehousing, customs brokerage, and value-added services. Growth is driven by the diversification of port operations and increased demand for specialized logistics solutions.

By Cargo Type:

- Crude Oil: While significant, growth in this segment is relatively stable compared to other cargo types due to the nature of the commodity market and its associated shipping patterns.

- Dry Cargo: This segment witnesses strong growth, driven by the expansion of manufacturing and retail sectors, resulting in increased import and export activities.

- Other Cargo Types: This category includes a diverse range of goods, showing varied growth based on individual sector performance and global market trends.

The dominance of each segment is largely influenced by economic growth in specific industries, infrastructural investments, and government policies supporting the maritime sector.

UAE Container Terminal Operations Market Product Developments

Recent product developments focus on enhancing operational efficiency and supply chain visibility. This includes the implementation of advanced automation technologies like automated stacking cranes and AI-powered systems for optimizing container placement and vessel scheduling. Emphasis is placed on real-time tracking and monitoring of cargo, providing clients with greater transparency and control over their supply chain. These advancements not only boost operational efficiency but also improve service quality, attracting new clients and giving operators a competitive edge.

Challenges in the UAE Container Terminal Operations Market Market

The UAE container terminal operations market faces challenges including potential regulatory changes, the impact of global supply chain disruptions (with quantifiable impacts of xx Million USD in lost revenue in 2024), and intense competition from regional and international players. Maintaining high levels of operational efficiency while adapting to changing global trade patterns and technological advancements also presents a significant challenge.

Forces Driving UAE Container Terminal Operations Market Growth

Key growth drivers include the UAE's strategic geographical location, facilitating global trade, continued investments in port infrastructure development, and the growing adoption of advanced technologies. Government initiatives promoting trade and logistics, coupled with increasing economic activity within the UAE and the wider region, further stimulate market expansion. The strong focus on sustainable practices and the development of smart ports are also significant contributors to growth.

Challenges in the UAE Container Terminal Operations Market Market

Long-term growth hinges on continuous innovation, strategic partnerships to enhance operational capabilities, and successful expansion into new markets. This includes developing robust digital platforms, integrating sustainable technologies, and fostering collaboration across the entire supply chain. Adaptability to changing global trade patterns and the ability to attract and retain skilled labor are equally crucial for sustained long-term growth.

Emerging Opportunities in UAE Container Terminal Operations Market

Emerging opportunities lie in leveraging advanced technologies like AI and IoT for predictive maintenance and optimized resource allocation. Exploring new market segments, expanding into specialized cargo handling, and developing robust e-commerce logistics solutions are key areas for future growth. Focus on enhancing sustainability through green initiatives and attracting investment in renewable energy solutions will attract environmentally conscious customers and improve overall standing in the market.

Leading Players in the UAE Container Terminal Operations Market Sector

- DP World

- AD Ports Group

- Khorfakkan Container Terminal

- Abu Dhabi Terminal (ADT)

- IRSHAD - Abu Dhabi Petroleum Ports Operating Company

- Saqr Port Authority

- Aztec Facilities Management

- CSP Abu Dhabi Terminal

- Abu Dhabi Ports PJSC

- Al Yasat Petroleum Operation Company Limited LLC

Key Milestones in UAE Container Terminal Operations Market Industry

- August 2023: DP World announces a plan to increase container handling capacity by 3 Million TEUs, reaching a total of 93.6 Million TEUs by the end of 2023. This significant expansion reflects growing global demand and strengthens DP World's position in the market.

- May 2023: Khalifa Port, under AD Ports Group, expands its services by adding a drydock, enhancing its capabilities and attracting new clients by offering a wider range of maritime logistics services. This diversifies revenue streams and positions AD Ports Group as a leading comprehensive maritime solutions provider.

Strategic Outlook for UAE Container Terminal Operations Market Market

The future of the UAE container terminal operations market appears bright, with considerable potential for growth driven by continued investments in infrastructure, technological advancements, and the strategic importance of the UAE as a global trade hub. Companies that effectively leverage digitalization, embrace sustainable practices, and focus on strategic partnerships will be best positioned to capture significant market share and drive long-term growth. The market is poised for continued expansion, presenting lucrative opportunities for investors and operators alike.

UAE Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo Handling & Transportation

- 1.3. Other Service Types

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Cargo Types

UAE Container Terminal Operations Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Container Terminal Operations Market Regional Market Share

Geographic Coverage of UAE Container Terminal Operations Market

UAE Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. UAE'S strategic location serving has an advantage for the market'; Morder infrastructure boosting the market

- 3.3. Market Restrains

- 3.3.1. Regulations and customs affecting the market; Lack of skilled workforce affecting the market

- 3.4. Market Trends

- 3.4.1. Booming Crude oil segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo Handling & Transportation

- 5.1.3. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Cargo Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America UAE Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Stevedoring

- 6.1.2. Cargo Handling & Transportation

- 6.1.3. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Crude Oil

- 6.2.2. Dry Cargo

- 6.2.3. Other Cargo Types

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America UAE Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Stevedoring

- 7.1.2. Cargo Handling & Transportation

- 7.1.3. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Crude Oil

- 7.2.2. Dry Cargo

- 7.2.3. Other Cargo Types

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe UAE Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Stevedoring

- 8.1.2. Cargo Handling & Transportation

- 8.1.3. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Crude Oil

- 8.2.2. Dry Cargo

- 8.2.3. Other Cargo Types

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa UAE Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Stevedoring

- 9.1.2. Cargo Handling & Transportation

- 9.1.3. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Crude Oil

- 9.2.2. Dry Cargo

- 9.2.3. Other Cargo Types

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific UAE Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Stevedoring

- 10.1.2. Cargo Handling & Transportation

- 10.1.3. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Crude Oil

- 10.2.2. Dry Cargo

- 10.2.3. Other Cargo Types

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Khorfakkan Container Terminal**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abu Dhabi Terminal (ADT)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DP World Sukuk Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IRSHAD - Abu Dhabi Petroleum Ports Operating Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AD Ports Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saqr Port Authority

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aztec Facilities Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CSP Abu Dhabi Terminal

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abu Dhabi Ports PJSC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Yasat Petroleum Operation Company Limited LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Khorfakkan Container Terminal**List Not Exhaustive

List of Figures

- Figure 1: Global UAE Container Terminal Operations Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Container Terminal Operations Market Revenue (Million), by Service 2025 & 2033

- Figure 3: North America UAE Container Terminal Operations Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America UAE Container Terminal Operations Market Revenue (Million), by Cargo Type 2025 & 2033

- Figure 5: North America UAE Container Terminal Operations Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 6: North America UAE Container Terminal Operations Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UAE Container Terminal Operations Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UAE Container Terminal Operations Market Revenue (Million), by Service 2025 & 2033

- Figure 9: South America UAE Container Terminal Operations Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: South America UAE Container Terminal Operations Market Revenue (Million), by Cargo Type 2025 & 2033

- Figure 11: South America UAE Container Terminal Operations Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 12: South America UAE Container Terminal Operations Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UAE Container Terminal Operations Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UAE Container Terminal Operations Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe UAE Container Terminal Operations Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe UAE Container Terminal Operations Market Revenue (Million), by Cargo Type 2025 & 2033

- Figure 17: Europe UAE Container Terminal Operations Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 18: Europe UAE Container Terminal Operations Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UAE Container Terminal Operations Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UAE Container Terminal Operations Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East & Africa UAE Container Terminal Operations Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East & Africa UAE Container Terminal Operations Market Revenue (Million), by Cargo Type 2025 & 2033

- Figure 23: Middle East & Africa UAE Container Terminal Operations Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 24: Middle East & Africa UAE Container Terminal Operations Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UAE Container Terminal Operations Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UAE Container Terminal Operations Market Revenue (Million), by Service 2025 & 2033

- Figure 27: Asia Pacific UAE Container Terminal Operations Market Revenue Share (%), by Service 2025 & 2033

- Figure 28: Asia Pacific UAE Container Terminal Operations Market Revenue (Million), by Cargo Type 2025 & 2033

- Figure 29: Asia Pacific UAE Container Terminal Operations Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 30: Asia Pacific UAE Container Terminal Operations Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UAE Container Terminal Operations Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 3: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 6: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 12: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 18: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 29: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 30: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 38: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 39: Global UAE Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UAE Container Terminal Operations Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Container Terminal Operations Market?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the UAE Container Terminal Operations Market?

Key companies in the market include Khorfakkan Container Terminal**List Not Exhaustive, Abu Dhabi Terminal (ADT), DP World Sukuk Limited, IRSHAD - Abu Dhabi Petroleum Ports Operating Company, AD Ports Group, Saqr Port Authority, Aztec Facilities Management, CSP Abu Dhabi Terminal, Abu Dhabi Ports PJSC, Al Yasat Petroleum Operation Company Limited LLC.

3. What are the main segments of the UAE Container Terminal Operations Market?

The market segments include Service, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.67 Million as of 2022.

5. What are some drivers contributing to market growth?

UAE'S strategic location serving has an advantage for the market'; Morder infrastructure boosting the market.

6. What are the notable trends driving market growth?

Booming Crude oil segment.

7. Are there any restraints impacting market growth?

Regulations and customs affecting the market; Lack of skilled workforce affecting the market.

8. Can you provide examples of recent developments in the market?

August 2023: DP World, a preeminent global trade facilitator, was poised to bolster the resilience of the global supply chain. The company plans a substantial enhancement in container handling capacity, aiming to incorporate an additional 3 million twenty-foot equivalent units (TEUs) by the close of 2023. These augmentations contribute to an anticipated overall gross capacity of 93.6 million TEUs, addressing the escalating demand in pivotal trade markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the UAE Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence