Key Insights

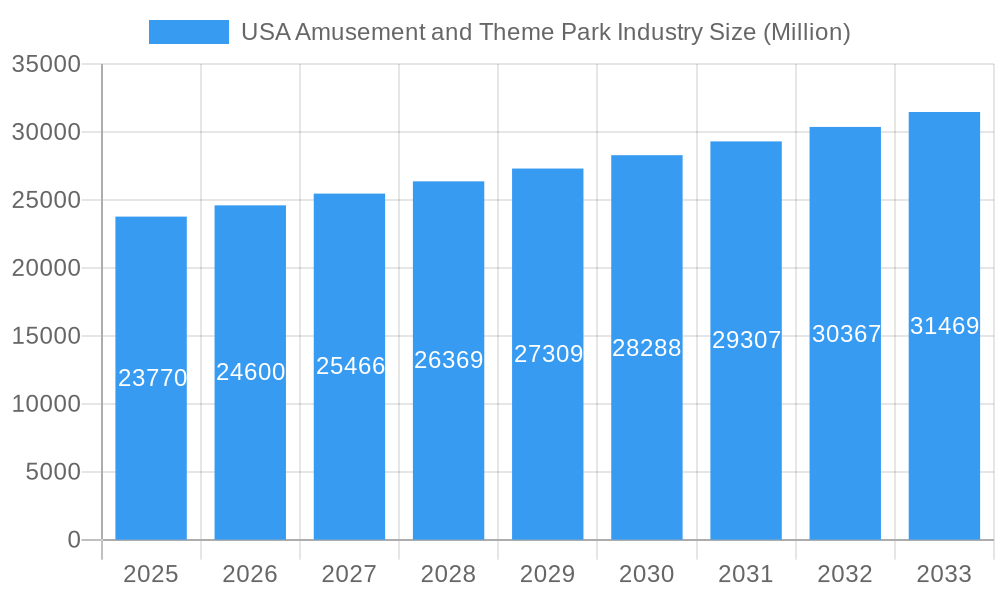

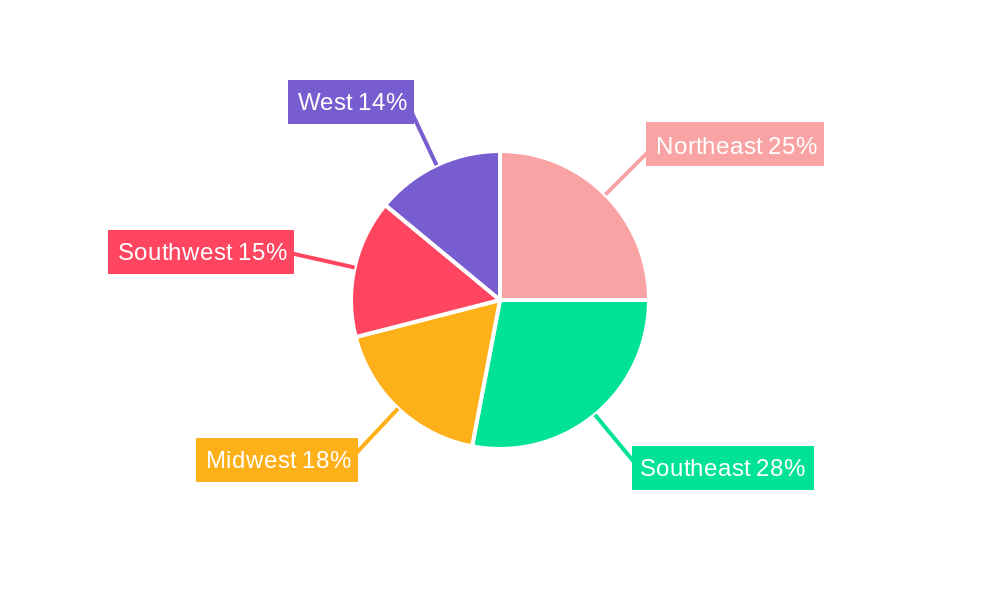

The US amusement and theme park industry, valued at $23.77 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) exceeding 3.5% from 2025 to 2033. This expansion is fueled by several key drivers. Increased disposable incomes, particularly amongst millennial and Gen Z demographics, coupled with a growing preference for experiential entertainment, are significantly boosting attendance. Furthermore, continuous innovation in ride technology, immersive storytelling, and themed experiences enhances visitor engagement and loyalty. The industry's segmentation, encompassing various ride types (land, water, and others), and revenue streams (tickets, food & beverage, merchandise, and hospitality), offers significant diversification and revenue-generation opportunities. Major players like Disney Parks, Universal Parks & Resorts, and Six Flags are leveraging these opportunities through strategic investments in new attractions, park expansions, and enhanced guest services to maintain a competitive edge. However, external factors such as economic downturns and increased operational costs, including labor and security, pose potential restraints to market growth. Regional variations also exist, with established tourist hubs in the Northeast and Southeast likely experiencing higher growth rates compared to other regions.

USA Amusement and Theme Park Industry Market Size (In Billion)

The forecast period (2025-2033) suggests a continued upward trajectory for the industry, driven by sustained consumer demand and effective industry strategies. The increasing popularity of themed parks offering immersive and unique experiences will continue to draw visitors. The industry's success will hinge on adapting to evolving consumer preferences, technological advancements, and addressing potential challenges, such as maintaining sustainable practices and ensuring guest safety. Strategic partnerships, technological upgrades and effective marketing strategies focusing on diverse audience segments will be critical for sustained success within the increasingly competitive landscape.

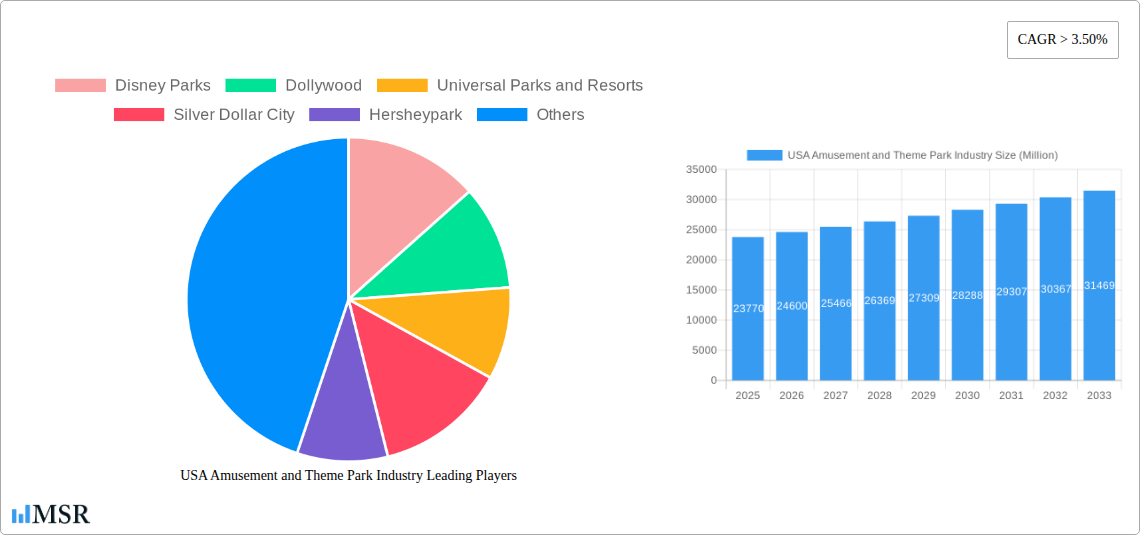

USA Amusement and Theme Park Industry Company Market Share

USA Amusement & Theme Park Industry Report: 2019-2033

Dive into the exhilarating world of the USA amusement and theme park industry with our comprehensive market analysis, projecting a vibrant future through 2033. This report provides in-depth insights into market dynamics, key players, and emerging trends, offering invaluable strategic guidance for stakeholders. We analyze the industry's performance from 2019 to 2024 (Historical Period), establishing a robust base year of 2025 (Base Year) for our detailed forecast spanning 2025-2033 (Forecast Period), with a focus on the Estimated Year of 2025 and overall Study Period of 2019-2033. The report covers major players like Disney Parks, Universal Parks & Resorts, Six Flags Inc., Cedar Fair Entertainment Company, and many more, providing crucial data for informed decision-making. Expect detailed breakdowns by revenue source (tickets, food & beverage, merchandise, hospitality, others) and ride type (land rides, water rides, other types).

USA Amusement and Theme Park Industry Market Concentration & Dynamics

The USA amusement and theme park industry exhibits moderate concentration, with a few dominant players capturing significant market share. Disney Parks and Universal Parks & Resorts hold substantial leadership positions, followed by Six Flags Inc. and Cedar Fair Entertainment Company. Smaller regional players like Dollywood, Silver Dollar City, and Hersheypark cater to niche markets. Market share fluctuations are influenced by new attraction launches, operational efficiency, and marketing strategies. The innovative ecosystem thrives on technological advancements, such as virtual reality integration and enhanced guest experiences, pushing creative boundaries. Regulatory frameworks, concerning safety standards and environmental impact, exert significant influence. Substitute products, like other leisure activities and entertainment options, pose competitive pressures. The sector witnesses consistent end-user trends of preference for immersive and unique experiences, leading to an active mergers and acquisitions (M&A) landscape. Between 2019 and 2024, an estimated xx M&A deals occurred, primarily driven by expansion strategies and diversification.

- Market Concentration: High concentration at the top, with xx% controlled by the top 5 players in 2024.

- M&A Activity: xx deals between 2019 and 2024, anticipating xx deals by 2033.

- Innovation: Emphasis on VR/AR technologies, personalized experiences, and sustainable practices.

- Regulatory Landscape: Stringent safety and environmental regulations influence operational costs and expansion strategies.

USA Amusement and Theme Park Industry Industry Insights & Trends

The USA amusement and theme park industry demonstrates robust growth, with the market size estimated at $xx Million in 2025, exhibiting a CAGR of xx% from 2025 to 2033. Key growth drivers include rising disposable incomes, increasing tourism, and the continuous innovation in attractions and technologies. The sector has witnessed a shift in consumer preferences, focusing on immersive experiences, themed environments, and personalized interactions, impacting marketing strategies and operational models. Technological disruptions, including mobile ticketing, personalized offers, and AI-powered guest services, are transforming customer engagement. The industry also confronts challenges like seasonality, competition from other leisure options, and increasing operating costs. Despite these headwinds, the long-term outlook remains positive, driven by the desire for memorable experiences and continuous industry innovation. The market is expected to reach $xx Million by 2033.

Key Markets & Segments Leading USA Amusement and Theme Park Industry

The industry's dominance is spread across multiple regions, with Florida and California as key markets. The "Tickets" segment contributes the largest portion of revenue (xx%), followed by "Food & Beverages" (xx%) and "Merchandise" (xx%). Growth is fueled by multiple factors:

Drivers for Growth:

- Economic Growth: Rising disposable income boosts spending on leisure and entertainment.

- Tourism: Increased domestic and international tourism fuels demand.

- Infrastructure Development: Improved transportation and accessibility enhance visitor convenience.

- Technological Advancements: Innovative technologies create exciting and memorable experiences.

Dominant Segments:

- By Type: Land rides consistently dominate, while water rides and other attractions contribute significantly. The balance is expected to shift slightly toward more immersive, technology-driven experiences by 2033.

- By Revenue: Tickets remain the primary revenue stream; however, growth in food and beverage, and merchandise sales indicates successful diversification.

USA Amusement and Theme Park Industry Product Developments

Recent product innovations emphasize immersive and interactive experiences. Virtual reality (VR) and augmented reality (AR) technologies are being integrated into rides and attractions. Personalized experiences, tailored to individual preferences, are becoming more prevalent. The development of innovative ticketing systems and mobile applications are enhancing customer convenience and loyalty programs. These technological advancements are delivering a competitive edge, providing unique and memorable experiences to attract and retain customers.

Challenges in the USA Amusement and Theme Park Industry Market

The industry faces challenges, including intense competition, seasonality, fluctuating attendance due to economic conditions, rising operating costs (labor, insurance, maintenance), and supply chain disruptions impacting timely maintenance and attraction upgrades. Regulatory compliance and maintaining safety standards present additional hurdles. These factors impact profitability and necessitate continuous adaptation.

Forces Driving USA Amusement and Theme Park Industry Growth

Several factors drive the sector's growth, including technological advancements, expanding tourism, and economic stability. The integration of innovative technologies like VR and AR enhances visitor experiences, driving increased attendance. Rising disposable incomes fuel higher spending on leisure activities. Government initiatives promoting tourism further boost the industry. Successful marketing campaigns and effective partnerships contribute to industry expansion and resilience.

Long-Term Growth Catalysts in the USA Amusement and Theme Park Industry

Long-term growth is fueled by continuous innovation in attractions and technologies, strategic partnerships with hotels and resorts, and expansion into new markets both domestically and internationally. The industry's focus on enhancing guest experiences, personalization, and sustainability creates a positive outlook for continued development and expansion in the coming years.

Emerging Opportunities in USA Amusement and Theme Park Industry

Emerging opportunities include the integration of cutting-edge technologies, such as AI-powered personalized experiences, immersive storytelling, and sustainable park designs. Expansion into new geographic markets and the development of unique niche themes catering to specialized demographics present significant growth potential. Leveraging data analytics to optimize operations and enhance customer engagement presents further opportunities.

Leading Players in the USA Amusement and Theme Park Industry Sector

- Disney Parks

- Dollywood

- Universal Parks & Resorts

- Silver Dollar City

- Hersheypark

- Six Flags Inc.

- Busch Gardens

- The Island in Pigeon Forge

- Cedar Fair Entertainment Company

- Magic Kingdom Park

- Dells Waterpark

- Seaworld Parks & Entertainment

Key Milestones in USA Amusement and Theme Park Industry Industry

- September 2023: Crescent Real Estate LLC's acquisition of Element Orlando Universal Blvd. hotel expands accommodation options near Icon Park, boosting tourism and industry revenue.

- July 2023: Asacha Media Group's acquisition of Arrow International Media, producer of Disney's Animal Kingdom, signifies increasing foreign investment and potential for content expansion and revenue generation within the industry.

Strategic Outlook for USA Amusement and Theme Park Industry Market

The future of the USA amusement and theme park industry is exceptionally promising. Continued technological advancements, coupled with a focus on creating unique and immersive experiences, will drive significant growth. Strategic partnerships, expansion into new markets, and sustainable practices will further enhance the industry's long-term potential. The market is poised for significant expansion, offering lucrative opportunities for investors and stakeholders alike.

USA Amusement and Theme Park Industry Segmentation

-

1. Type

- 1.1. Land Rides

- 1.2. Water Rides

- 1.3. Other Types

-

2. Source of Revenue

- 2.1. Tickets

- 2.2. Foods & Beverages

- 2.3. Merchandise

- 2.4. Hospitality

- 2.5. Other Source of Revenues

USA Amusement and Theme Park Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Amusement and Theme Park Industry Regional Market Share

Geographic Coverage of USA Amusement and Theme Park Industry

USA Amusement and Theme Park Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The number of baby-boomer tourists is expected to increase

- 3.2.2 which will fuel the growth of the worldwide amusement park market.; Incorporating energy-saving innovations like LED lighting and solar panels

- 3.3. Market Restrains

- 3.3.1. Theme parks are raising admission costs and letting guests ride every ride without waiting in queue; Theme parks utilising virtual reality are becoming more and more common.

- 3.4. Market Trends

- 3.4.1. Increase in the number of visitors in amusement and theme parks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Amusement and Theme Park Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Land Rides

- 5.1.2. Water Rides

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.2.1. Tickets

- 5.2.2. Foods & Beverages

- 5.2.3. Merchandise

- 5.2.4. Hospitality

- 5.2.5. Other Source of Revenues

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America USA Amusement and Theme Park Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Land Rides

- 6.1.2. Water Rides

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.2.1. Tickets

- 6.2.2. Foods & Beverages

- 6.2.3. Merchandise

- 6.2.4. Hospitality

- 6.2.5. Other Source of Revenues

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America USA Amusement and Theme Park Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Land Rides

- 7.1.2. Water Rides

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.2.1. Tickets

- 7.2.2. Foods & Beverages

- 7.2.3. Merchandise

- 7.2.4. Hospitality

- 7.2.5. Other Source of Revenues

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe USA Amusement and Theme Park Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Land Rides

- 8.1.2. Water Rides

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.2.1. Tickets

- 8.2.2. Foods & Beverages

- 8.2.3. Merchandise

- 8.2.4. Hospitality

- 8.2.5. Other Source of Revenues

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa USA Amusement and Theme Park Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Land Rides

- 9.1.2. Water Rides

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.2.1. Tickets

- 9.2.2. Foods & Beverages

- 9.2.3. Merchandise

- 9.2.4. Hospitality

- 9.2.5. Other Source of Revenues

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific USA Amusement and Theme Park Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Land Rides

- 10.1.2. Water Rides

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 10.2.1. Tickets

- 10.2.2. Foods & Beverages

- 10.2.3. Merchandise

- 10.2.4. Hospitality

- 10.2.5. Other Source of Revenues

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Disney Parks

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dollywood

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Universal Parks and Resorts

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Silver Dollar City

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hersheypark

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Six Flags Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Busch Garden

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Island in Pigeon Forge

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cedar Fair Entertainment Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Magic Kingdom Park

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dells Waterpark**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Seaworld Parks and Entertainment

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Disney Parks

List of Figures

- Figure 1: Global USA Amusement and Theme Park Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Amusement and Theme Park Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America USA Amusement and Theme Park Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America USA Amusement and Theme Park Industry Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 5: North America USA Amusement and Theme Park Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 6: North America USA Amusement and Theme Park Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America USA Amusement and Theme Park Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Amusement and Theme Park Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: South America USA Amusement and Theme Park Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America USA Amusement and Theme Park Industry Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 11: South America USA Amusement and Theme Park Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 12: South America USA Amusement and Theme Park Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America USA Amusement and Theme Park Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Amusement and Theme Park Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe USA Amusement and Theme Park Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe USA Amusement and Theme Park Industry Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 17: Europe USA Amusement and Theme Park Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 18: Europe USA Amusement and Theme Park Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe USA Amusement and Theme Park Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Amusement and Theme Park Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa USA Amusement and Theme Park Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa USA Amusement and Theme Park Industry Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 23: Middle East & Africa USA Amusement and Theme Park Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 24: Middle East & Africa USA Amusement and Theme Park Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Amusement and Theme Park Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Amusement and Theme Park Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific USA Amusement and Theme Park Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific USA Amusement and Theme Park Industry Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 29: Asia Pacific USA Amusement and Theme Park Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 30: Asia Pacific USA Amusement and Theme Park Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Amusement and Theme Park Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 3: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 6: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 12: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 18: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 30: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 39: Global USA Amusement and Theme Park Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Amusement and Theme Park Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Amusement and Theme Park Industry?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the USA Amusement and Theme Park Industry?

Key companies in the market include Disney Parks, Dollywood, Universal Parks and Resorts, Silver Dollar City, Hersheypark, Six Flags Inc, Busch Garden, The Island in Pigeon Forge, Cedar Fair Entertainment Company, Magic Kingdom Park, Dells Waterpark**List Not Exhaustive, Seaworld Parks and Entertainment.

3. What are the main segments of the USA Amusement and Theme Park Industry?

The market segments include Type, Source of Revenue.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.77 Million as of 2022.

5. What are some drivers contributing to market growth?

The number of baby-boomer tourists is expected to increase. which will fuel the growth of the worldwide amusement park market.; Incorporating energy-saving innovations like LED lighting and solar panels.

6. What are the notable trends driving market growth?

Increase in the number of visitors in amusement and theme parks.

7. Are there any restraints impacting market growth?

Theme parks are raising admission costs and letting guests ride every ride without waiting in queue; Theme parks utilising virtual reality are becoming more and more common..

8. Can you provide examples of recent developments in the market?

September 2023: Crescent Real Estate LLC acquired the Element Orlando Universal Blvd., a 165-key hotel operated under a franchise agreement with Marriott International. Located just outside the confines of the mixed-use development known as Icon Park, Element Orlando hotel guests have immediate access to 20 acres of entertainment opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Amusement and Theme Park Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Amusement and Theme Park Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Amusement and Theme Park Industry?

To stay informed about further developments, trends, and reports in the USA Amusement and Theme Park Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence