Key Insights

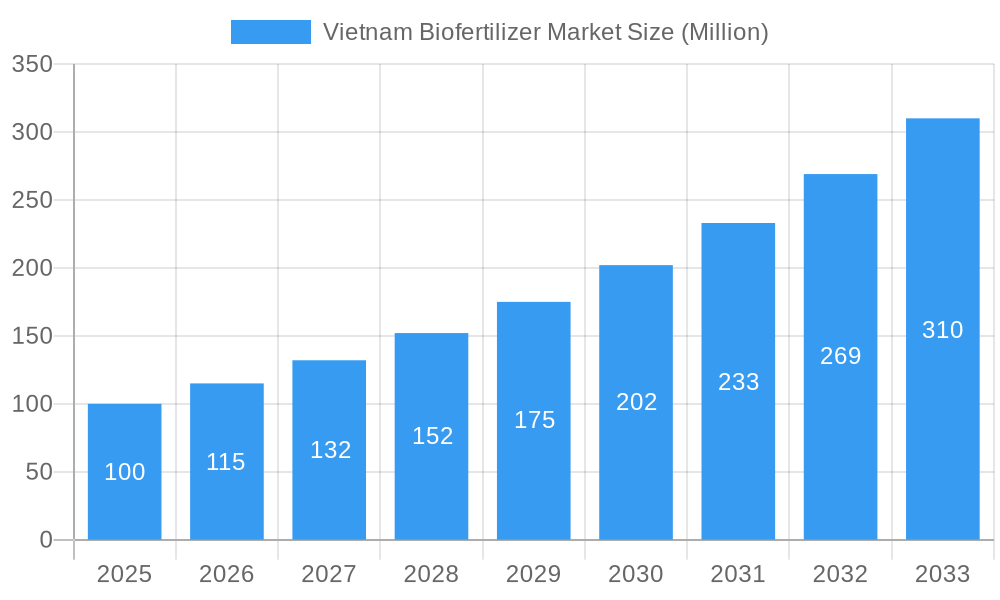

The Vietnam biofertilizer market is set for significant expansion, projected to reach $7.88 billion by 2033. This growth is propelled by heightened awareness of sustainable agriculture, supportive government policies for eco-friendly farming, and a growing demand for enhanced crop yields. The market's compound annual growth rate (CAGR) is estimated at 7.92% from the base year 2025 through 2033. Key drivers include increasing land scarcity and the critical need for improved soil health. Prominent biofertilizer types such as Azospirillum, Azotobacter, and Mycorrhiza are fueling this expansion, serving diverse crop categories including cash crops (rice, coffee, rubber), horticultural crops (vegetables, fruits), and row crops (corn, soybeans). The adoption of biofertilizers is accelerating due to their cost-effectiveness, environmental advantages, and superior nutrient uptake capabilities for plants. Leading industry players like DAI THANH JOINT STOCK COMPANY, Biotech Bio-Agriculture, and Suståne Natural Fertilizer Inc. are instrumental in market development through innovation and strategic alliances. Despite existing hurdles in farmer awareness and supply chain consistency, the market's future outlook remains highly promising.

Vietnam Biofertilizer Market Market Size (In Billion)

Vietnam's agricultural prominence is a central factor in the regional biofertilizer market dynamics. The preceding period (2019-2024) likely established a solid growth trajectory, setting the stage for future advancements. Increased market penetration will be achieved through intensified farmer education, improved access to high-quality biofertilizers, and the promotion of long-term economic benefits derived from sustainable agricultural practices. The competitive environment is dynamic, featuring both local and global enterprises contending for market share. This competition is expected to foster ongoing innovation and potentially reduce prices, thereby enhancing the accessibility and adoption of biofertilizers among Vietnamese farmers. Government initiatives supporting sustainable agriculture, technological progress in biofertilizer efficacy, and evolving consumer preferences for organic produce will significantly influence market growth during the forecast period.

Vietnam Biofertilizer Market Company Market Share

Vietnam Biofertilizer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Vietnam biofertilizer market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities. The Vietnamese biofertilizer market is poised for significant expansion, driven by factors such as increasing government support for sustainable agriculture, growing awareness of environmental concerns, and rising demand for high-quality crops. This report offers actionable data and forecasts to navigate this dynamic market.

Vietnam Biofertilizer Market Market Concentration & Dynamics

The Vietnam biofertilizer market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is witnessing increased competition from both domestic and international companies. Innovation is a key driver, with companies investing in research and development to improve product efficacy and sustainability. The regulatory framework, while generally supportive of biofertilizer adoption, faces ongoing evolution to adapt to technological advancements and ensure product safety. Substitute products, primarily chemical fertilizers, pose a significant challenge, although the growing awareness of environmental concerns is gradually shifting consumer preferences towards biofertilizers. End-user trends indicate a strong preference for eco-friendly and high-performing biofertilizers, specifically for cash crops and horticultural crops. M&A activity in the sector remains relatively low, with only xx deals recorded in the last five years. Key players are strategically focusing on organic growth and product diversification.

- Market Share: Top 3 players hold approximately xx% of the market.

- M&A Deal Count (2019-2024): xx

- Innovation Ecosystem: Moderate level of R&D investment, with a focus on improved formulations and application methods.

- Regulatory Framework: Supportive but requires further refinement.

- Substitute Products: Chemical fertilizers remain a major competitor.

Vietnam Biofertilizer Market Industry Insights & Trends

The Vietnam biofertilizer market is experiencing robust growth, with an estimated market size of USD xx Million in 2025 and projected to reach USD xx Million by 2033, exhibiting a CAGR of xx%. This growth is primarily driven by the increasing adoption of sustainable agricultural practices, government initiatives promoting biofertilizer usage, and rising consumer demand for organically grown produce. Technological disruptions, such as advancements in biofertilizer formulation and application techniques, are further fueling market expansion. Evolving consumer behavior, characterized by a growing preference for environmentally friendly products and a higher willingness to pay for premium quality, significantly contributes to the market's positive outlook. Furthermore, the increasing awareness of the negative impacts of chemical fertilizers on soil health and the environment is bolstering the adoption of biofertilizers. The market is also witnessing the emergence of innovative biofertilizers tailored to specific crops and soil conditions.

Key Markets & Segments Leading Vietnam Biofertilizer Market

The Vietnam biofertilizer market is dominated by the Cash Crops segment, followed by Horticultural Crops. The Southern region of Vietnam accounts for the largest market share.

Key Drivers:

- Economic Growth: Rising disposable incomes and increased agricultural output.

- Government Support: Policies promoting sustainable agriculture and biofertilizer usage.

- Infrastructure Development: Improved irrigation and transportation networks.

Dominance Analysis: The high demand for cash crops like coffee, rubber, and rice fuels the growth of the Azospirillum, Rhizobium, and Phosphate Solubilizing Bacteria segments. The Horticultural Crops segment shows strong demand for Mycorrhiza and Azotobacter based biofertilizers. The Row Crops segment shows potential growth with increasing adoption of sustainable farming practices.

- Form: Phosphate Solubilizing Bacteria and Rhizobium are the leading biofertilizer forms, owing to their effectiveness in nutrient uptake and improved crop yields. Azospirillum and Azotobacter also exhibit significant growth.

- Crop Type: Cash crops (coffee, rubber, rice) dominate the market due to higher profit margins and larger cultivation areas. Horticultural crops represent a rapidly expanding segment.

Vietnam Biofertilizer Market Product Developments

Significant advancements are being made in biofertilizer technology, with a focus on enhanced efficacy, targeted nutrient delivery, and improved shelf life. Companies are developing specialized biofertilizers for different crops and soil conditions, leading to increased crop yields and enhanced soil health. The introduction of biostimulants, such as Atlántica Agrícola's Micomix, demonstrates a significant leap in product sophistication, offering combined benefits of improved nutrient uptake and stress tolerance. This technological advancement creates a competitive advantage and caters to the growing demand for high-performing biofertilizers.

Challenges in the Vietnam Biofertilizer Market Market

The Vietnam biofertilizer market faces challenges such as the high initial investment required for biofertilizer production, a relatively underdeveloped distribution network, and stiff competition from established chemical fertilizer manufacturers. The lack of awareness among farmers regarding the benefits of biofertilizers also hinders market penetration. Regulatory hurdles and inconsistencies in quality control represent further obstacles. These factors lead to a slower-than-expected adoption rate compared to other Southeast Asian nations. The overall impact results in a lower market penetration rate, estimated at xx%.

Forces Driving Vietnam Biofertilizer Market Growth

Several factors drive market growth. Government policies supporting sustainable agriculture and biofertilizer usage provide crucial impetus. The rising demand for organic produce, coupled with increased awareness of the negative environmental impact of chemical fertilizers, is accelerating biofertilizer adoption. Technological advancements leading to improved efficacy and cost-effectiveness further enhance market prospects. Furthermore, the expansion of agricultural land and intensification of farming practices create greater demand for biofertilizers.

Challenges in the Vietnam Biofertilizer Market Market

Long-term growth hinges on continued innovation in biofertilizer technology, focusing on cost reduction and enhancing product efficacy. Strategic partnerships between biofertilizer producers, agricultural research institutions, and government agencies are essential for knowledge dissemination and technology transfer. Market expansion can be achieved by targeting new geographical regions and focusing on niche market segments within Vietnam.

Emerging Opportunities in Vietnam Biofertilizer Market

Significant opportunities exist in developing specialized biofertilizers for specific crops and soil conditions. The use of precision farming technologies and digital platforms to optimize biofertilizer application offers significant potential. Furthermore, exploring new market segments, such as the aquaculture and livestock sectors, can expand market reach. Growing consumer demand for organically produced food provides a strong foundation for sustained market growth.

Leading Players in the Vietnam Biofertilizer Market Sector

- DAI THANH JOINT STOCK COMPANY

- Biotech Bio-Agriculture

- Suståne Natural Fertilizer Inc

- Que Lam Group

- DAI NAM MANUFACTURING & TRADING COMPANY LIMITED

- BIOWAY ORGANIC HIGH TECH JOINT STOCK COMPANY

- Song Gianh Corporation Joint Stock Company

- Atlántica Agrícola

Key Milestones in Vietnam Biofertilizer Market Industry

- May 2019: Que Lam Group inaugurated a USD 21.54 Million bio-organic fertilizer plant, significantly boosting domestic production capacity.

- May 2017: Bioway Hitech Fertiliser Joint Stock Company adopted Bioway AT-12H super-fast fermentation technology, enhancing production efficiency and environmental sustainability.

- January 2021: Atlántica Agrícola launched Micomix, a biostimulant enhancing nutrient uptake and stress tolerance, introducing advanced biofertilizer technology to the market.

Strategic Outlook for Vietnam Biofertilizer Market Market

The Vietnam biofertilizer market presents substantial long-term growth potential. Continued investment in R&D, strategic partnerships, and government support will further propel market expansion. Focusing on product innovation, targeted marketing campaigns, and addressing supply chain challenges are crucial for capitalizing on the significant opportunities within this dynamic market. The shift towards sustainable agriculture and increased consumer awareness of environmental concerns create a favorable environment for sustained growth in the coming decade.

Vietnam Biofertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Biofertilizer Market Segmentation By Geography

- 1. Vietnam

Vietnam Biofertilizer Market Regional Market Share

Geographic Coverage of Vietnam Biofertilizer Market

Vietnam Biofertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Row Crops is the largest Crop Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Biofertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DAI THANH JOINT STOCK COMPANY

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Biotech Bio-Agriculture

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suståne Natural Fertilizer Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Que Lam Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DAI NAM MANUFACTURING & TRADING COMPANY LIMITED

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BIOWAY ORGANIC HIGH TECH JOINT STOCK COMPANY

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Song Gianh Corporation Joint Stock Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlántica Agrícola

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 DAI THANH JOINT STOCK COMPANY

List of Figures

- Figure 1: Vietnam Biofertilizer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Vietnam Biofertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Biofertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Vietnam Biofertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Vietnam Biofertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Vietnam Biofertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Vietnam Biofertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Vietnam Biofertilizer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Vietnam Biofertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Vietnam Biofertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Vietnam Biofertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Vietnam Biofertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Vietnam Biofertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Vietnam Biofertilizer Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Biofertilizer Market?

The projected CAGR is approximately 7.92%.

2. Which companies are prominent players in the Vietnam Biofertilizer Market?

Key companies in the market include DAI THANH JOINT STOCK COMPANY, Biotech Bio-Agriculture, Suståne Natural Fertilizer Inc, Que Lam Group, DAI NAM MANUFACTURING & TRADING COMPANY LIMITED, BIOWAY ORGANIC HIGH TECH JOINT STOCK COMPANY, Song Gianh Corporation Joint Stock Company, Atlántica Agrícola.

3. What are the main segments of the Vietnam Biofertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Row Crops is the largest Crop Type.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

January 2021: Atlántica Agrícola’s developed Micomix, a biostimulant composed primarily of mycorrhizal fungi, rhizobacteria, and chelated micronutrients. The presence and development of these microorganisms in the rhizosphere create a symbiotic relationship with the plant that favors the absorption of water and mineral nutrients and increases its tolerance to water and salt stress.May 2019: Ho Chi Minh City-based Que Lam Group inaugurated its bio-organic fertilizer plant worth USD 21.54 million in the northern province of Vinh Phuc. The plant is spread over 4 hectares of land with an annual production capacity of 250,000 metric tons of bio-organic fertilizers. This move helped the company strengthen its presence in the country.May 2017: Bioway Hitech Fertiliser Joint Stock Company signed an agreement on the sole reception of Bioway AT-12H super-fast fermentation technology from Bioway Organic USA Company. With this technology, all organic wastes from animal manure and microorganisms will be able to manufacture biofertilizers in a short time, perhaps less than 12 hours, without polluting the environment because of high-temperature sterilization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Biofertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Biofertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Biofertilizer Market?

To stay informed about further developments, trends, and reports in the Vietnam Biofertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence