Key Insights

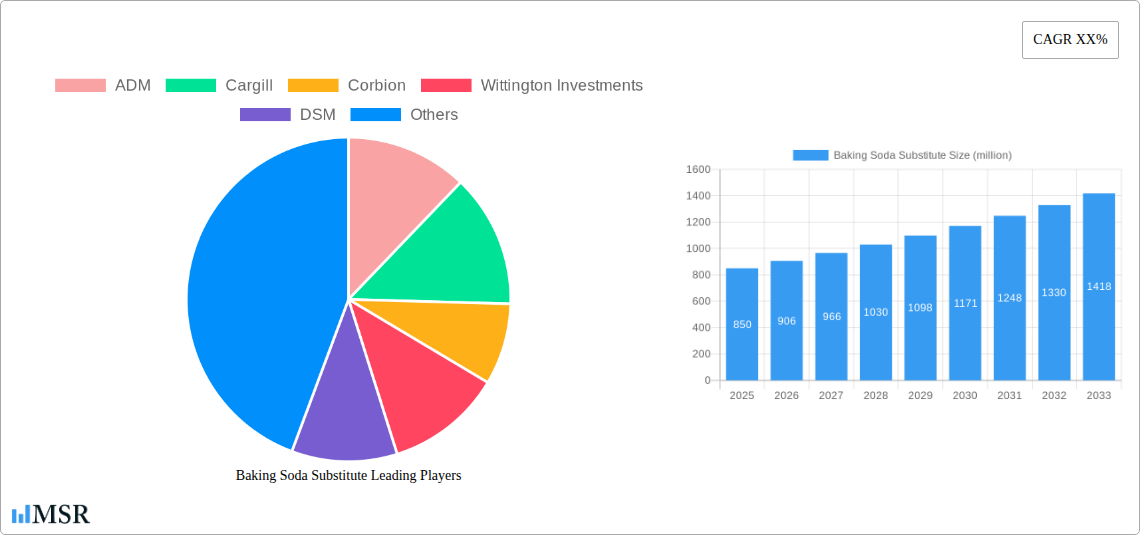

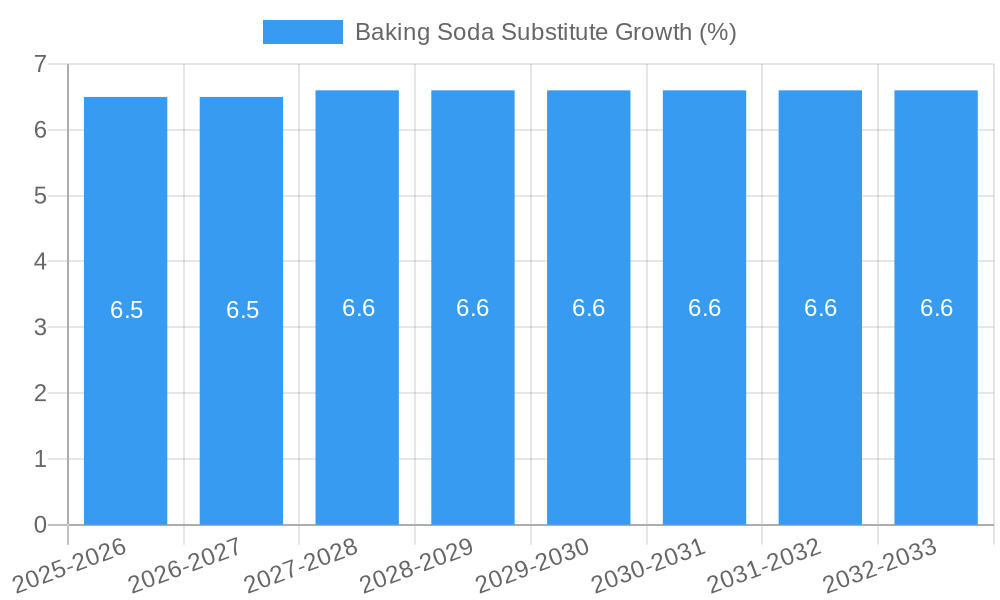

The global Baking Soda Substitute market is poised for significant expansion, estimated at USD 850 million in 2025, and projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033. This robust growth is fueled by increasing consumer demand for healthier and more natural food products, coupled with a rising awareness of the potential health concerns associated with excessive sodium intake. The "clean label" movement and a growing preference for ingredients perceived as more wholesome are key drivers, pushing manufacturers to explore and adopt alternatives to traditional baking soda. The market's expansion is also supported by advancements in food technology, leading to the development of highly effective and versatile baking soda substitutes that maintain desirable baking qualities, such as leavening and texture. The rising popularity of home baking, further amplified by recent global events, also contributes to a sustained demand for these alternatives, as consumers seek convenient and reliable options for their culinary endeavors.

The market segmentation reveals distinct opportunities within various applications and product types. The "Supermarket" segment is expected to lead in terms of value, reflecting the widespread availability and consumer accessibility of these substitutes in mainstream retail channels. Convenience stores and online platforms are also anticipated to witness steady growth, catering to evolving shopping habits and the demand for quick access to baking ingredients. In terms of product types, both "Powder" and "Liquid" forms of baking soda substitutes will see significant adoption, with the choice often dictated by specific culinary applications and consumer preferences for ease of use. Key players like ADM, Cargill, and DSM are actively investing in research and development to innovate and expand their product portfolios, solidifying their market positions. However, potential restraints such as the higher cost of some substitutes compared to conventional baking soda and consumer inertia in adopting new ingredients may temper the growth rate to some extent. Nevertheless, the overarching trend towards healthier eating and ingredient transparency suggests a bright future for the baking soda substitute market.

This comprehensive report delves into the burgeoning Baking Soda Substitute market, offering in-depth analysis and actionable insights for industry stakeholders. We meticulously examine market concentration, technological advancements, consumer trends, and competitive landscapes from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report provides a robust understanding of current market conditions and future trajectories, crucial for strategic decision-making in this rapidly evolving sector.

Baking Soda Substitute Market Concentration & Dynamics

The Baking Soda Substitute market exhibits a moderate concentration, with key players actively engaged in innovation and strategic expansion. The innovation ecosystem is characterized by ongoing research and development into novel leavening agents and functional alternatives. Regulatory frameworks are evolving, with a growing emphasis on food safety and clean label ingredients influencing product formulations and market entry. Substitute products are gaining traction, driven by consumer demand for healthier and more versatile alternatives. End-user trends reveal a significant shift towards convenience and perceived health benefits. Merger and acquisition (M&A) activities, though currently at a modest scale, are projected to increase as larger entities seek to consolidate market share and acquire innovative technologies. The market share of leading companies in 2025 is estimated to be approximately 40%, with M&A deal counts averaging 5 per year in the historical period.

- Market Concentration: Moderate, with a few dominant players and a growing number of niche innovators.

- Innovation Ecosystem: Flourishing, with a focus on developing natural, functional, and allergen-free leavening solutions.

- Regulatory Frameworks: Influenced by food safety standards and consumer protection laws, encouraging transparency in ingredient sourcing and labeling.

- Substitute Products: Expanding range, including cream of tartar, baking powder, potassium bicarbonate, and proprietary blends, catering to diverse dietary needs and applications.

- End-User Trends: Rising demand for clean label, gluten-free, and plant-based baking ingredients; increasing preference for convenient and readily available substitutes.

- M&A Activities: Expected to intensify as companies seek to expand their product portfolios and geographical reach.

Baking Soda Substitute Industry Insights & Trends

The global Baking Soda Substitute market is poised for robust growth, projected to reach a market size of over one million USD by the end of the forecast period, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This expansion is fueled by a confluence of factors, including increasing consumer awareness regarding the health implications of traditional ingredients and a growing preference for natural and healthier alternatives in food preparation. The rising adoption of gluten-free and allergen-free diets further propels the demand for effective substitutes that can replicate the leavening properties of baking soda. Technological disruptions are playing a pivotal role, with advancements in ingredient science enabling the development of highly functional and versatile baking soda alternatives. These innovations are not only enhancing product performance but also broadening the application spectrum across various food categories, from baked goods to dairy products and convenience foods.

Evolving consumer behaviors are a critical driver, with a pronounced shift towards home baking and a desire for clean-label products. Consumers are actively seeking ingredients with fewer artificial additives and a more transparent sourcing history. This trend directly benefits the baking soda substitute market, as many substitutes are perceived as more natural or derived from simpler sources. The burgeoning online retail landscape has also made these substitutes more accessible to a wider consumer base, fostering market penetration and growth. Furthermore, the increasing versatility of these substitutes, allowing for a wider range of culinary applications beyond traditional baking, is attracting new user segments and expanding the overall market potential. The competitive landscape is dynamic, with established food ingredient manufacturers and innovative startups vying for market share, driving continuous product development and marketing initiatives to capture consumer attention and loyalty. The market's growth trajectory is further supported by increasing disposable incomes in emerging economies, which translates to higher consumer spending on premium and specialized food ingredients.

Key Markets & Segments Leading Baking Soda Substitute

The Supermarket segment is projected to dominate the Baking Soda Substitute market, driven by its widespread accessibility and the consumer preference for one-stop shopping for all their culinary needs. Supermarkets offer a diverse range of products, allowing consumers to easily compare and purchase different types of baking soda substitutes based on their specific baking requirements and dietary preferences. The increasing shelf space dedicated to specialized baking ingredients further reinforces the supermarket's position as a key distribution channel.

- Dominant Application: Supermarket

- Drivers: High foot traffic, extensive product variety, prominent placement of baking ingredients, impulse purchase opportunities, and consumer trust in established retail channels.

- Dominance Analysis: Supermarkets are the primary point of purchase for a vast majority of households, making them the most significant channel for baking soda substitutes. The ability to offer both established brands and emerging alternatives ensures broad market reach and caters to a wide spectrum of consumer needs.

The Online Store segment is exhibiting the fastest growth, fueled by the convenience of e-commerce and the ability to reach consumers irrespective of their geographical location. Online platforms provide detailed product information, customer reviews, and competitive pricing, attracting a growing segment of digitally-savvy consumers.

- Emerging Application: Online Store

- Drivers: Convenience, wider selection of niche products, direct-to-consumer (DTC) sales models, personalized recommendations, and efficient logistics.

- Dominance Analysis: While currently smaller than supermarkets, online stores are rapidly gaining market share due to their ability to offer a curated selection of specialized baking soda substitutes and cater to niche dietary requirements that might not be readily available in traditional brick-and-mortar stores.

In terms of Types, the Powder form of baking soda substitutes is expected to maintain its leadership, owing to its ease of use, long shelf life, and versatility in various baking applications. Powdered substitutes are a direct replacement for conventional baking soda, making them a natural choice for most home bakers and commercial kitchens.

- Dominant Type: Powder

- Drivers: Familiarity and ease of use, established applications in baking, cost-effectiveness, and longer shelf life compared to liquid alternatives.

- Dominance Analysis: The powder format is the most conventional and widely recognized form of leavening agents. Its adoption is deeply ingrained in baking practices, ensuring its continued dominance.

The Liquid segment, while smaller, is experiencing significant growth due to its perceived convenience in specific applications and its potential for incorporation into ready-to-mix formulations.

- Growing Type: Liquid

- Drivers: Convenience in specific formulations, potential for improved solubility, and use in liquid baking mixes.

- Dominance Analysis: Liquid substitutes offer unique advantages for specific product developments, particularly in ready-to-use baking mixes or for applications where precise liquid measurement is preferred.

Baking Soda Substitute Product Developments

Recent product developments in the Baking Soda Substitute market are centered on enhancing functionality, improving taste profiles, and catering to a growing demand for natural and allergen-free ingredients. Innovations include novel blends designed to provide optimal leavening without imparting any undesirable flavors. Companies are also focusing on developing substitutes derived from sustainable sources, aligning with increasing consumer environmental consciousness. Market relevance is being driven by the ability of these new products to replicate the precise chemical reactions of baking soda, ensuring consistent baking results and expanding their applicability across a wider range of recipes and food product formulations. Technological advancements in ingredient processing are enabling the creation of more stable and effective substitutes.

Challenges in the Baking Soda Substitute Market

The Baking Soda Substitute market faces several challenges, including the established consumer familiarity with traditional baking soda, which creates a perception barrier for new products. Regulatory hurdles related to ingredient approval and labeling can also impact market entry for novel substitutes. Supply chain complexities, especially for specialty ingredients, can lead to price volatility and availability issues, impacting cost-effectiveness. Competitive pressure from established baking soda manufacturers and the ongoing development of new substitute technologies also pose significant challenges.

- Consumer Familiarity & Perception: Overcoming deeply ingrained habits and educating consumers about the efficacy and benefits of substitutes.

- Regulatory Hurdles: Navigating complex food safety regulations and ingredient approval processes for new chemical compounds or formulations.

- Supply Chain Vulnerabilities: Ensuring consistent and cost-effective sourcing of raw materials, especially for specialized or naturally derived ingredients.

- Competitive Landscape: Facing intense competition from both traditional baking soda and a rapidly evolving array of substitute products.

Forces Driving Baking Soda Substitute Growth

The growth of the Baking Soda Substitute market is propelled by several key forces. The rising consumer awareness regarding health and wellness is a primary driver, leading to a demand for cleaner label ingredients and alternatives perceived as healthier. Technological advancements in food science are enabling the development of more sophisticated and effective substitutes that can match or even exceed the performance of traditional baking soda. Evolving dietary trends, such as the increasing popularity of gluten-free and plant-based diets, create a natural market for substitutes that can accommodate these restrictions.

- Health and Wellness Trends: Growing consumer preference for natural, less processed, and perceived healthier ingredients.

- Technological Innovations: Advancements in food science leading to the development of high-performing and versatile leavening alternatives.

- Dietary Shifts: Increased adoption of gluten-free, allergen-free, and plant-based diets creating demand for suitable replacements.

- Convenience and Versatility: Development of substitutes that offer ease of use and broader applications in various food products.

Challenges in the Baking Soda Substitute Market

The long-term growth catalysts for the Baking Soda Substitute market lie in continued innovation and strategic market expansion. Developing novel ingredients that offer superior functionality, improved taste profiles, and enhanced nutritional benefits will be crucial. Partnerships between ingredient manufacturers and food product developers can accelerate the adoption of these substitutes across a wider range of applications. Furthermore, exploring untapped emerging markets and understanding localized consumer preferences will be key to unlocking new avenues for growth and solidifying the market's long-term potential.

Emerging Opportunities in Baking Soda Substitute

Emerging opportunities in the Baking Soda Substitute market are diverse and promising. The growing demand for clean-label and “free-from” products presents a significant avenue for innovation and market penetration. Developing plant-based and naturally derived leavening agents that align with sustainability trends will resonate strongly with environmentally conscious consumers. The expansion of the functional food sector also offers opportunities for substitutes that can provide added health benefits beyond basic leavening. Furthermore, advancements in biotechnology and fermentation processes could unlock entirely new categories of baking soda substitutes with unique properties.

- Clean Label & Free-From Market: Capitalizing on the demand for natural, organic, and allergen-free ingredients.

- Sustainable Sourcing: Developing and promoting substitutes derived from eco-friendly and renewable resources.

- Functional Ingredients: Incorporating health-promoting properties or nutritional enhancements into baking soda substitutes.

- Biotechnology Advancements: Exploring novel fermentation and enzyme technologies for unique leavening solutions.

Leading Players in the Baking Soda Substitute Sector

- ADM

- Cargill

- Corbion

- Wittington Investments

- DSM

- Lesaffre et Compagnie

- Lallemand

- Kudos Blends

- DuBois Chemicals

Key Milestones in Baking Soda Substitute Industry

- 2020: Increased consumer focus on home baking and ingredient transparency due to global events, boosting interest in alternative leavening agents.

- 2021: Emergence of several smaller, innovative companies focusing on plant-based and allergen-free baking soda substitutes.

- 2022: Key ingredient manufacturers begin investing heavily in R&D for novel leavening technologies.

- 2023: Growing awareness and adoption of baking soda substitutes in commercial food production due to demand for cleaner labels.

- 2024: Initial market consolidation through strategic partnerships and acquisitions, signaling growing maturity in the sector.

Strategic Outlook for Baking Soda Substitute Market

The strategic outlook for the Baking Soda Substitute market is overwhelmingly positive, characterized by sustained growth driven by evolving consumer preferences and ongoing technological advancements. The market is expected to witness further product diversification, with an increasing emphasis on natural, functional, and sustainably sourced ingredients. Strategic collaborations between ingredient suppliers and food manufacturers will be crucial for wider product adoption and market penetration. Investment in research and development to create next-generation leavening solutions will remain a key differentiator for market leaders. The expansion into emerging economies and the development of tailored product offerings for diverse regional tastes will also contribute significantly to future market expansion. The overall trajectory indicates a robust and dynamic market poised for continued innovation and substantial growth in the coming years.

Baking Soda Substitute Segmentation

-

1. Application

- 1.1. Supermarket

- 1.2. Convenience Store

- 1.3. Online Store

- 1.4. Others

-

2. Types

- 2.1. Powder

- 2.2. Liquid

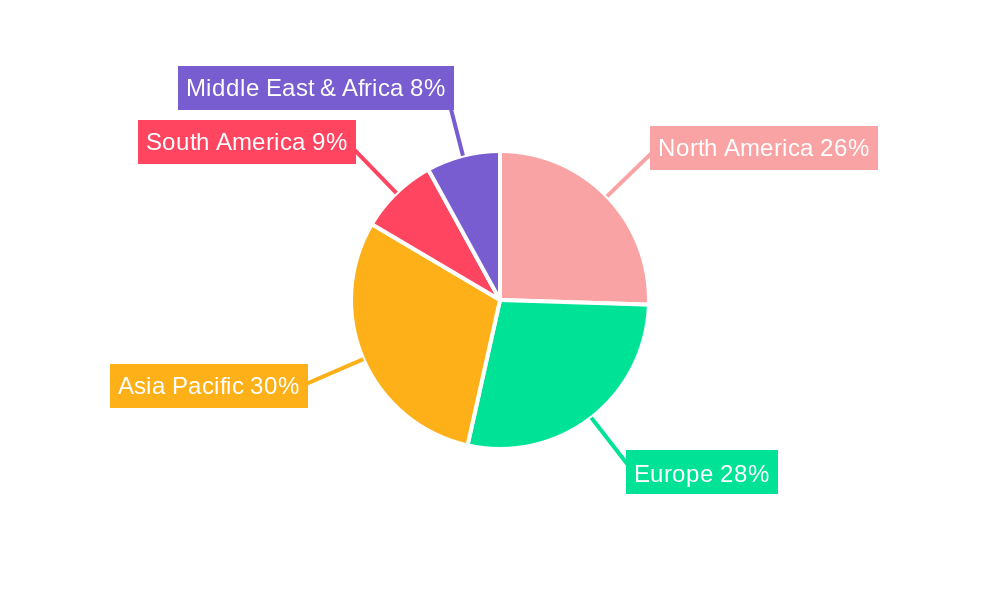

Baking Soda Substitute Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Baking Soda Substitute REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Baking Soda Substitute Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Supermarket

- 5.1.2. Convenience Store

- 5.1.3. Online Store

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Powder

- 5.2.2. Liquid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Baking Soda Substitute Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Supermarket

- 6.1.2. Convenience Store

- 6.1.3. Online Store

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Powder

- 6.2.2. Liquid

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Baking Soda Substitute Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Supermarket

- 7.1.2. Convenience Store

- 7.1.3. Online Store

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Powder

- 7.2.2. Liquid

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Baking Soda Substitute Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Supermarket

- 8.1.2. Convenience Store

- 8.1.3. Online Store

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Powder

- 8.2.2. Liquid

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Baking Soda Substitute Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Supermarket

- 9.1.2. Convenience Store

- 9.1.3. Online Store

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Powder

- 9.2.2. Liquid

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Baking Soda Substitute Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Supermarket

- 10.1.2. Convenience Store

- 10.1.3. Online Store

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Powder

- 10.2.2. Liquid

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Corbion

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wittington Investments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DSM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Corbion

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lesaffre et Compagnie

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lallemand

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kudos Blends

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DuBois Chemicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Baking Soda Substitute Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Baking Soda Substitute Revenue (million), by Application 2024 & 2032

- Figure 3: North America Baking Soda Substitute Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Baking Soda Substitute Revenue (million), by Types 2024 & 2032

- Figure 5: North America Baking Soda Substitute Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Baking Soda Substitute Revenue (million), by Country 2024 & 2032

- Figure 7: North America Baking Soda Substitute Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Baking Soda Substitute Revenue (million), by Application 2024 & 2032

- Figure 9: South America Baking Soda Substitute Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Baking Soda Substitute Revenue (million), by Types 2024 & 2032

- Figure 11: South America Baking Soda Substitute Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Baking Soda Substitute Revenue (million), by Country 2024 & 2032

- Figure 13: South America Baking Soda Substitute Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Baking Soda Substitute Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Baking Soda Substitute Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Baking Soda Substitute Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Baking Soda Substitute Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Baking Soda Substitute Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Baking Soda Substitute Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Baking Soda Substitute Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Baking Soda Substitute Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Baking Soda Substitute Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Baking Soda Substitute Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Baking Soda Substitute Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Baking Soda Substitute Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Baking Soda Substitute Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Baking Soda Substitute Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Baking Soda Substitute Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Baking Soda Substitute Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Baking Soda Substitute Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Baking Soda Substitute Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Baking Soda Substitute Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Baking Soda Substitute Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Baking Soda Substitute Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Baking Soda Substitute Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Baking Soda Substitute Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Baking Soda Substitute Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Baking Soda Substitute Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Baking Soda Substitute Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Baking Soda Substitute Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Baking Soda Substitute Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Baking Soda Substitute Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Baking Soda Substitute Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Baking Soda Substitute Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Baking Soda Substitute Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Baking Soda Substitute Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Baking Soda Substitute Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Baking Soda Substitute Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Baking Soda Substitute Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Baking Soda Substitute Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Baking Soda Substitute Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baking Soda Substitute?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Baking Soda Substitute?

Key companies in the market include ADM, Cargill, Corbion, Wittington Investments, DSM, Corbion, Lesaffre et Compagnie, Lallemand, Kudos Blends, DuBois Chemicals.

3. What are the main segments of the Baking Soda Substitute?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baking Soda Substitute," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baking Soda Substitute report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baking Soda Substitute?

To stay informed about further developments, trends, and reports in the Baking Soda Substitute, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence