Key Insights

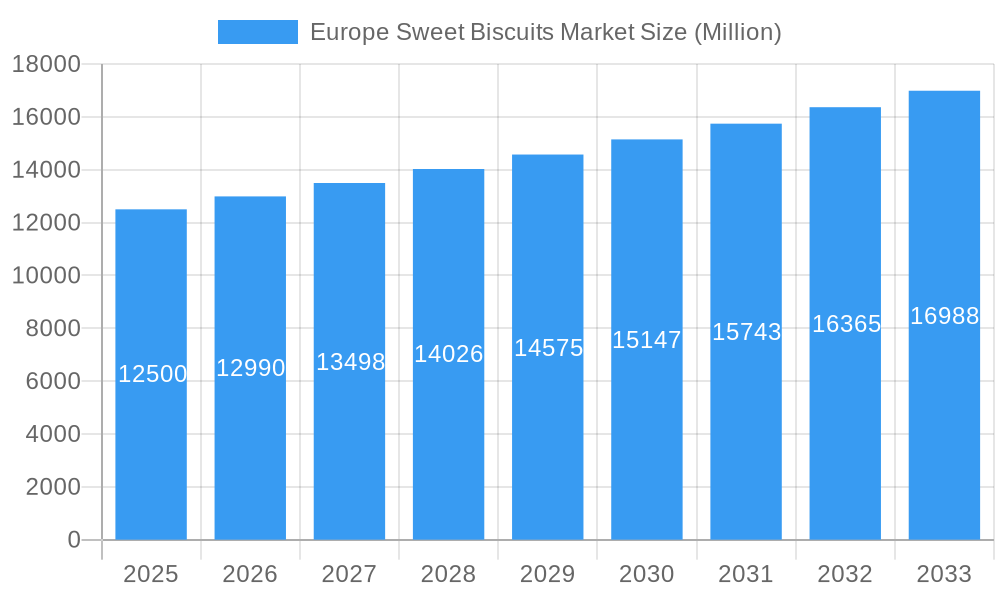

The Europe Sweet Biscuits Market is poised for steady growth, estimated to be valued at approximately XX million in 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of 4.10% through 2033. This expansion is driven by evolving consumer preferences for convenient, on-the-go snacking options and an increasing demand for premium and artisanal biscuit varieties. Key growth drivers include the rising disposable incomes across many European nations, leading to greater consumer spending on confectionery and bakery products, alongside innovative product development that caters to health-conscious consumers, such as reduced-sugar and gluten-free options. The market is also experiencing a significant shift towards online retail channels, facilitated by the convenience and wider product availability offered by e-commerce platforms, complementing traditional distribution networks like supermarkets and hypermarkets.

Europe Sweet Biscuits Market Market Size (In Billion)

The market landscape for sweet biscuits in Europe is characterized by a diverse range of segments, with cookies and plain biscuits holding a substantial share due to their widespread appeal and affordability. Filled biscuits and chocolate-coated varieties are also experiencing robust demand, reflecting a consumer inclination towards indulgence. Restraints, however, include fluctuating raw material prices, particularly for key ingredients like flour and sugar, and increasing competition from alternative snack categories. Despite these challenges, the inherent convenience and broad appeal of sweet biscuits, coupled with continuous innovation in flavors, formats, and healthier alternatives, are expected to sustain a positive growth trajectory. Leading companies like Nestle SA, Mondelez International Inc., and Britannia Industries Limited are actively investing in product innovation and expanding their distribution reach to capture a larger market share within this dynamic European confectionery sector.

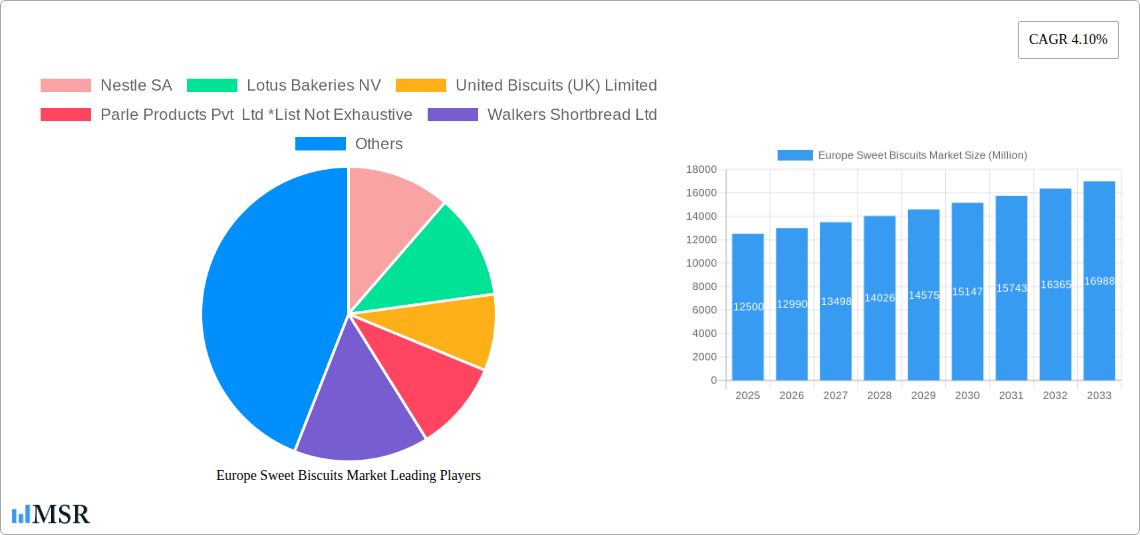

Europe Sweet Biscuits Market Company Market Share

Europe Sweet Biscuits Market: Comprehensive Industry Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the Europe sweet biscuits market, a dynamic and rapidly evolving sector. Covering the study period 2019–2033, with a base year of 2025, this report offers unparalleled insights into market size, growth drivers, emerging trends, competitive landscape, and future opportunities. Dive into detailed segment analysis, understand key regional dynamics, and gain actionable intelligence to navigate this lucrative market. This report is essential for biscuit manufacturers, ingredient suppliers, distributors, retailers, investors, and industry stakeholders seeking a competitive edge in the European biscuit industry. We meticulously analyze market segmentation by Type (Cookies, Plain Biscuits, Filled Biscuits, Sandwich Biscuits, Chocolate Coated, Other Types) and Distribution Channel (Supermarket/Hypermarket, Convenience Store, Online Retail Store, Other distribution channel).

Europe Sweet Biscuits Market Market Concentration & Dynamics

The Europe sweet biscuits market exhibits a moderate to high concentration, with key players like Nestle SA, Lotus Bakeries NV, United Biscuits (UK) Limited, Parle Products Pvt Ltd, Walkers Shortbread Ltd, Mondelez International Inc, Burton's Biscuits Company, ITC Ltd, Kellogg Company, and Britannia Industries Limited holding significant market shares. The innovation ecosystem is robust, driven by constant product development in healthy biscuits, premium offerings, and convenience formats. Regulatory frameworks, particularly concerning food safety, labeling, and sugar content, play a crucial role in shaping product formulations and market entry strategies. Substitute products, such as cakes, confectionery, and savory snacks, present ongoing competition, necessitating a focus on unique value propositions and consumer appeal. End-user trends are shifting towards healthier options, ethical sourcing, and indulgence experiences, influencing product innovation. Merger and Acquisition (M&A) activities are strategic, aimed at expanding product portfolios, gaining market access, and consolidating market presence. For instance, Mondelez International's acquisition of Grenade in March 2021 highlights the trend of expanding into the broader snacking and well-being segments. We anticipate a steady increase in M&A deal counts as companies seek to capitalize on market consolidation and synergistic opportunities within the European confectionery and bakery sector.

Europe Sweet Biscuits Market Industry Insights & Trends

The Europe sweet biscuits market is poised for significant growth, projected to reach USD XX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fueled by several key drivers. A primary growth driver is the increasing disposable income across European nations, leading to higher consumer spending on premium and indulgent food products. The rising demand for convenient and on-the-go snacking options further bolsters the market for sweet biscuits, particularly among busy urban populations. Technological disruptions are transforming manufacturing processes, leading to enhanced efficiency, improved product quality, and the development of novel biscuit formulations. Innovations in packaging technology, such as sustainable and resealable options, are also gaining traction, catering to evolving consumer preferences for eco-friendly products. Evolving consumer behaviors, including a growing inclination towards healthier snacking alternatives, are prompting manufacturers to introduce low-sugar, high-fiber, and gluten-free biscuit options. The "treat culture" remains strong, with consumers seeking moments of indulgence, which sweet biscuits effectively fulfill. The online retail channel is witnessing exponential growth, offering consumers wider accessibility and convenience, thereby contributing significantly to overall market expansion. The market is also influenced by the growing popularity of private-label brands, which offer consumers value-for-money alternatives. Furthermore, seasonal promotions and festive gifting occasions contribute to significant sales spikes throughout the year, underscoring the cultural significance of biscuits in Europe. The market's resilience, even during economic downturns, can be attributed to the perceived affordability and consistent demand for these staple sweet treats.

Key Markets & Segments Leading Europe Sweet Biscuits Market

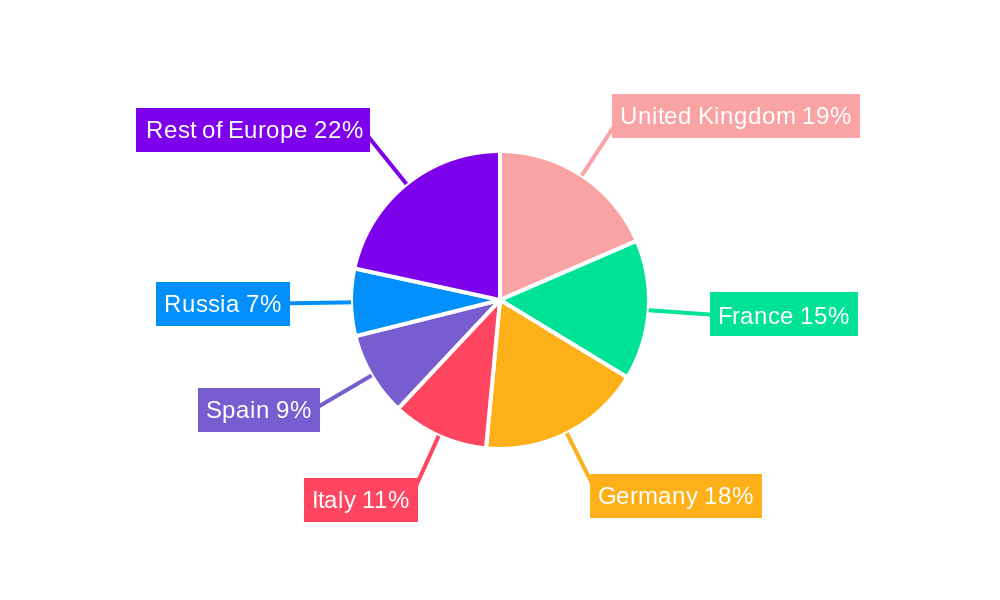

The Europe sweet biscuits market is characterized by the dominance of specific regions, countries, and product segments. Western Europe, with countries like the United Kingdom, Germany, France, and Italy, represents the largest and most mature market due to higher disposable incomes, established retail infrastructure, and strong consumer demand for premium and traditional biscuits. Within this region, the United Kingdom consistently leads in per capita consumption, driven by a rich heritage of biscuit-making and a strong culture of tea and biscuit pairing.

Dominant Segments by Type:

- Cookies: This segment consistently holds the largest market share owing to their widespread appeal, diverse flavor profiles, and versatility. The demand for premium and artisanal cookies, often featuring unique ingredients and indulgent textures, is particularly high.

- Chocolate Coated Biscuits: The inherent appeal of chocolate combined with the crunch of biscuits makes this segment a perennial favorite, especially during festive seasons and as indulgence treats.

- Filled and Sandwich Biscuits: These segments cater to consumers seeking a more substantial and flavor-packed snacking experience, with innovations in cream fillings and flavor combinations driving growth.

Dominant Segments by Distribution Channel:

- Supermarkets/Hypermarkets: These remain the primary distribution channel, offering a vast selection of brands, competitive pricing, and convenient shopping experiences. Their extensive reach and promotional activities are crucial for mass market penetration.

- Online Retail Stores: This channel is experiencing rapid growth, driven by the convenience of home delivery, wider product availability, and the increasing adoption of e-commerce by European consumers. This segment is crucial for reaching younger demographics and niche markets.

Drivers of Dominance:

- Economic Growth and Disposable Income: Higher purchasing power directly translates to increased demand for discretionary food items like sweet biscuits, especially premium varieties.

- Developed Retail Infrastructure: The presence of a well-established network of supermarkets, hypermarkets, and convenience stores ensures widespread product availability and accessibility.

- Consumer Habits and Preferences: Deep-rooted cultural traditions of tea and biscuit consumption, along with a growing trend of indulgence and seeking comfort in familiar treats, contribute to sustained demand.

- Innovation and Product Diversification: Manufacturers continuously introduce new flavors, formats, and healthier options, catering to evolving consumer tastes and preferences, thereby expanding the market's appeal.

- Effective Marketing and Promotions: Strategic marketing campaigns, promotional offers, and seasonal product launches by leading players significantly influence consumer purchasing decisions and drive segment growth.

Europe Sweet Biscuits Market Product Developments

Product development in the Europe sweet biscuits market is a key differentiator. Innovations are increasingly focused on catering to evolving consumer demands for healthier options, unique flavor experiences, and sustainable packaging. For instance, the relaunch of Furnish Foods' Cornish Scenic Range in September 2021, featuring thick, creamy butter shortbread with Belgian white chocolate and raspberry, exemplifies the trend towards premium and indulgent ingredients. Burton's Biscuits Company's expansion with The Skinny Cookie Co. in May 2021 showcases the growing demand for sugar-free and healthier cookie alternatives across the United Kingdom. These developments highlight a strategic response to market trends and a commitment to meeting diverse consumer needs, thereby enhancing competitive positioning and market relevance.

Challenges in the Europe Sweet Biscuits Market Market

Despite robust growth, the Europe sweet biscuits market faces several challenges. Fluctuating raw material prices, particularly for sugar, flour, and dairy products, can impact production costs and profit margins. Stringent regulatory frameworks concerning sugar content, artificial additives, and front-of-pack labeling require continuous product reformulation and compliance efforts. Intense competitive pressure, both from established players and emerging private-label brands, necessitates constant innovation and effective cost management. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can affect product availability and delivery timelines. Furthermore, the growing consumer preference for healthier alternatives and plant-based options poses a challenge to traditional sweet biscuit manufacturers, requiring strategic adaptation and product diversification.

Forces Driving Europe Sweet Biscuits Market Growth

Several forces are propelling the Europe sweet biscuits market forward. A significant driver is the increasing demand for convenient and on-the-go snacking solutions, aligning with modern lifestyles. The growing trend of premiumization, where consumers are willing to pay more for higher quality ingredients, unique flavors, and artisanal products, is a strong growth catalyst. Technological advancements in manufacturing, leading to increased efficiency and new product development capabilities, further support market expansion. Favorable demographic shifts, including a growing middle class with higher disposable incomes across several European nations, contribute to increased purchasing power for discretionary food items. Lastly, innovative marketing and promotional strategies, including digital marketing and influencer collaborations, are effectively engaging consumers and driving sales.

Challenges in the Europe Sweet Biscuits Market Market

Long-term growth catalysts for the Europe sweet biscuits market are deeply rooted in sustained innovation and strategic market expansion. The increasing focus on health and wellness presents an opportunity for companies to develop and market biscuits with reduced sugar, added fiber, and functional ingredients, tapping into a significant and growing consumer segment. Sustainable sourcing and production practices are becoming increasingly important, and companies that prioritize ethical and environmentally friendly operations can build stronger brand loyalty and market appeal. Furthermore, partnerships and collaborations within the value chain, from ingredient suppliers to distribution networks, can optimize operational efficiency and foster innovation. The exploration of emerging markets within Europe and the development of tailored product offerings for specific consumer groups, such as children or older adults, represent avenues for future growth.

Emerging Opportunities in Europe Sweet Biscuits Market

Emerging opportunities in the Europe sweet biscuits market are diverse and promising. The growing demand for plant-based and vegan biscuit options presents a significant untapped market segment. Personalized nutrition and functional biscuits, enriched with vitamins, minerals, or probiotics, are gaining traction as consumers seek health benefits beyond basic sustenance. The expansion of online retail channels and direct-to-consumer (DTC) models offers new avenues for reaching niche markets and building direct customer relationships. Innovations in sustainable packaging solutions, such as compostable or recyclable materials, are crucial for attracting environmentally conscious consumers. Furthermore, exploring novel flavor profiles and international culinary influences can create exciting new product lines and capture consumer interest.

Leading Players in the Europe Sweet Biscuits Market Sector

- Nestle SA

- Lotus Bakeries NV

- United Biscuits (UK) Limited

- Parle Products Pvt Ltd

- Walkers Shortbread Ltd

- Mondelez International Inc

- Burton's Biscuits Company

- ITC Ltd

- Kellogg Company

- Britannia Industries Limited

Key Milestones in Europe Sweet Biscuits Market Industry

- September 2021: Furnish Foods relaunched the Rebrand Of Cornish Scenic Range. The Cornish Scenic Biscuits are thick and creamy butter and added chunks of Belgian white chocolate and real raspberry pieces to luxury shortbread biscuits, indicating a focus on premium ingredients and indulgent experiences.

- May 2021: Burton's Biscuits Company expanded its portfolio by launching its new range of biscuits and cookies with The Skinny Cookie Co. These products also offer sugar-free and traditional cookies across the United Kingdom, highlighting a strategic move towards healthier alternatives and catering to a broader consumer base.

- March 2021: Mondelez International announced the acquisition of the majority of interest in Grenade, United Kingdom, a performance nutrition pioneer in the fast-growing high protein bar segment. After the acquisition, Mondelez expanded in the broader snacking and fast-growing well-being segment, signifying a strategic shift towards health-oriented and alternative snacking categories.

Strategic Outlook for Europe Sweet Biscuits Market Market

The strategic outlook for the Europe sweet biscuits market is one of continued evolution and targeted growth. Key accelerators include embracing innovation in health-conscious product development, such as low-sugar, high-fiber, and gluten-free variants, to meet the increasing consumer demand for healthier options. Strategic partnerships and collaborations with ingredient suppliers and technology providers will be crucial for optimizing supply chains and enhancing product quality. Expanding into niche markets and catering to specific dietary needs (e.g., vegan, allergen-free) presents significant untapped potential. Furthermore, leveraging digital marketing and e-commerce platforms to enhance consumer engagement and expand reach will be paramount. Investing in sustainable packaging and production processes will not only align with consumer values but also offer a competitive advantage in the long term. Companies that can effectively balance indulgence with health and sustainability will be best positioned for sustained success in this dynamic market.

Europe Sweet Biscuits Market Segmentation

-

1. Type

- 1.1. Cookies

- 1.2. Plain Biscuits

- 1.3. Filled Biscuits

- 1.4. Sandwich Biscuits

- 1.5. Chocolate Coated

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Store

- 2.3. Online Retail Store

- 2.4. Other distribution channel

Europe Sweet Biscuits Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe Sweet Biscuits Market Regional Market Share

Geographic Coverage of Europe Sweet Biscuits Market

Europe Sweet Biscuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Consumers' inclination towards Innovative Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cookies

- 5.1.2. Plain Biscuits

- 5.1.3. Filled Biscuits

- 5.1.4. Sandwich Biscuits

- 5.1.5. Chocolate Coated

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Store

- 5.2.3. Online Retail Store

- 5.2.4. Other distribution channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cookies

- 6.1.2. Plain Biscuits

- 6.1.3. Filled Biscuits

- 6.1.4. Sandwich Biscuits

- 6.1.5. Chocolate Coated

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Store

- 6.2.3. Online Retail Store

- 6.2.4. Other distribution channel

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. France Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cookies

- 7.1.2. Plain Biscuits

- 7.1.3. Filled Biscuits

- 7.1.4. Sandwich Biscuits

- 7.1.5. Chocolate Coated

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Store

- 7.2.3. Online Retail Store

- 7.2.4. Other distribution channel

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cookies

- 8.1.2. Plain Biscuits

- 8.1.3. Filled Biscuits

- 8.1.4. Sandwich Biscuits

- 8.1.5. Chocolate Coated

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Store

- 8.2.3. Online Retail Store

- 8.2.4. Other distribution channel

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cookies

- 9.1.2. Plain Biscuits

- 9.1.3. Filled Biscuits

- 9.1.4. Sandwich Biscuits

- 9.1.5. Chocolate Coated

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Store

- 9.2.3. Online Retail Store

- 9.2.4. Other distribution channel

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cookies

- 10.1.2. Plain Biscuits

- 10.1.3. Filled Biscuits

- 10.1.4. Sandwich Biscuits

- 10.1.5. Chocolate Coated

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Store

- 10.2.3. Online Retail Store

- 10.2.4. Other distribution channel

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Cookies

- 11.1.2. Plain Biscuits

- 11.1.3. Filled Biscuits

- 11.1.4. Sandwich Biscuits

- 11.1.5. Chocolate Coated

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarket/Hypermarket

- 11.2.2. Convenience Store

- 11.2.3. Online Retail Store

- 11.2.4. Other distribution channel

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Cookies

- 12.1.2. Plain Biscuits

- 12.1.3. Filled Biscuits

- 12.1.4. Sandwich Biscuits

- 12.1.5. Chocolate Coated

- 12.1.6. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarket/Hypermarket

- 12.2.2. Convenience Store

- 12.2.3. Online Retail Store

- 12.2.4. Other distribution channel

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Germany Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 14. France Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 15. Italy Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 16. United Kingdom Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 17. Netherlands Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 18. Sweden Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 19. Rest of Europe Europe Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2025

- 20.2. Company Profiles

- 20.2.1 Nestle SA

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Lotus Bakeries NV

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 United Biscuits (UK) Limited

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Parle Products Pvt Ltd *List Not Exhaustive

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Walkers Shortbread Ltd

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Mondelez International Inc

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Burton's Biscuits Company

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 ITC Ltd

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Kellogg Company

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Britannia Industries Limited

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Nestle SA

List of Figures

- Figure 1: Europe Sweet Biscuits Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Sweet Biscuits Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Sweet Biscuits Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Europe Sweet Biscuits Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 3: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 5: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Sweet Biscuits Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Europe Sweet Biscuits Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 11: Germany Europe Sweet Biscuits Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Sweet Biscuits Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: France Europe Sweet Biscuits Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Europe Sweet Biscuits Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Sweet Biscuits Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Sweet Biscuits Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Europe Sweet Biscuits Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Sweet Biscuits Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Sweet Biscuits Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Sweet Biscuits Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Sweden Europe Sweet Biscuits Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Sweden Europe Sweet Biscuits Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Europe Sweet Biscuits Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Europe Sweet Biscuits Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 33: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 39: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 44: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 45: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 50: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 51: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 52: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 53: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 54: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 55: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 56: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 57: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 58: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 59: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: Europe Sweet Biscuits Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 62: Europe Sweet Biscuits Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 63: Europe Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 64: Europe Sweet Biscuits Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 65: Europe Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 66: Europe Sweet Biscuits Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sweet Biscuits Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Europe Sweet Biscuits Market?

Key companies in the market include Nestle SA, Lotus Bakeries NV, United Biscuits (UK) Limited, Parle Products Pvt Ltd *List Not Exhaustive, Walkers Shortbread Ltd, Mondelez International Inc, Burton's Biscuits Company, ITC Ltd, Kellogg Company, Britannia Industries Limited.

3. What are the main segments of the Europe Sweet Biscuits Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Consumers' inclination towards Innovative Products.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In September 2021, Furnish foods relaunched the Rebrand Of Cornish Scenic Range. The Cornish Scenic Biscuitsare thick and creamy butter and added chunks of Belgian white chocolate and real raspberry pieces to luxury shortbread biscuits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sweet Biscuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sweet Biscuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sweet Biscuits Market?

To stay informed about further developments, trends, and reports in the Europe Sweet Biscuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence