Key Insights

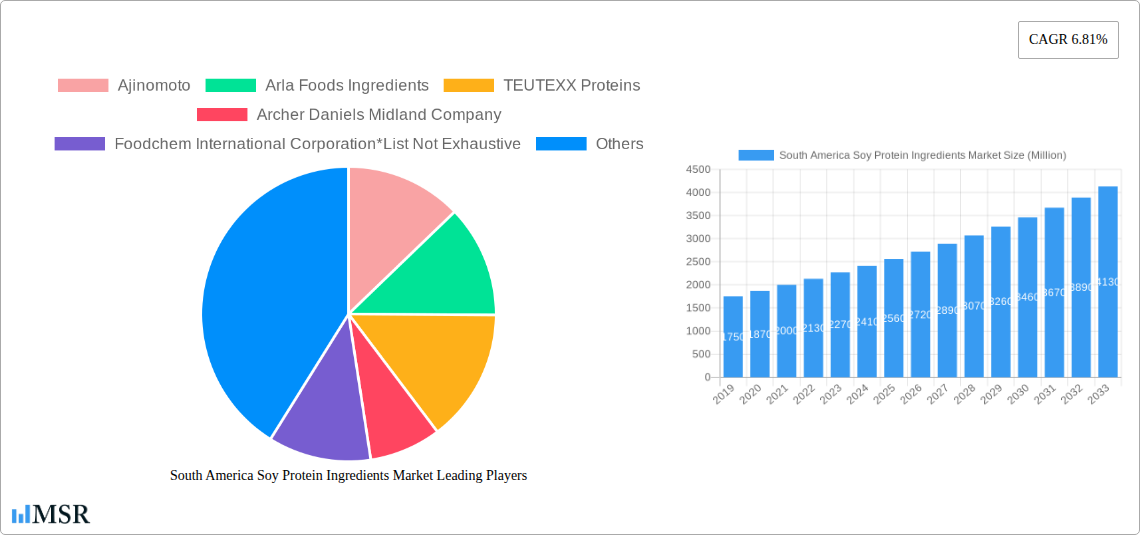

The South America Soy Protein Ingredients Market is poised for robust growth, projected to reach a significant market size of approximately $2,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.81% through 2033. This expansion is primarily fueled by a growing consumer demand for plant-based protein alternatives, driven by increasing health consciousness, ethical concerns surrounding animal agriculture, and a surge in vegan and vegetarian diets across the region, particularly in key markets like Brazil and Argentina. The versatility of soy protein, evident in its diverse applications spanning bakery and confectionery, meat extenders and substitutes, nutritional supplements, and beverages, further underpins this positive market trajectory. Innovations in processing technologies are also enhancing the functionality and appeal of soy-based ingredients, making them more competitive with traditional protein sources.

South America Soy Protein Ingredients Market Market Size (In Billion)

Several key trends are shaping the South American soy protein landscape. The rising popularity of meat substitutes and plant-based dairy alternatives is a major consumption driver, creating substantial opportunities for textured soy protein and soy isolates. Furthermore, the functional benefits of soy protein, including its high nutritional value and ability to improve food texture and emulsification, are increasingly recognized and leveraged by food and beverage manufacturers. While the market benefits from strong demand, it also faces certain restraints. Fluctuations in raw material prices (soybean commodity prices) can impact profit margins for ingredient manufacturers. Additionally, consumer perception and the availability of other alternative protein sources, such as pea protein, may present competitive challenges. However, the established infrastructure for soy cultivation in South America provides a competitive advantage, ensuring a consistent supply chain and cost-effectiveness for soy protein ingredients.

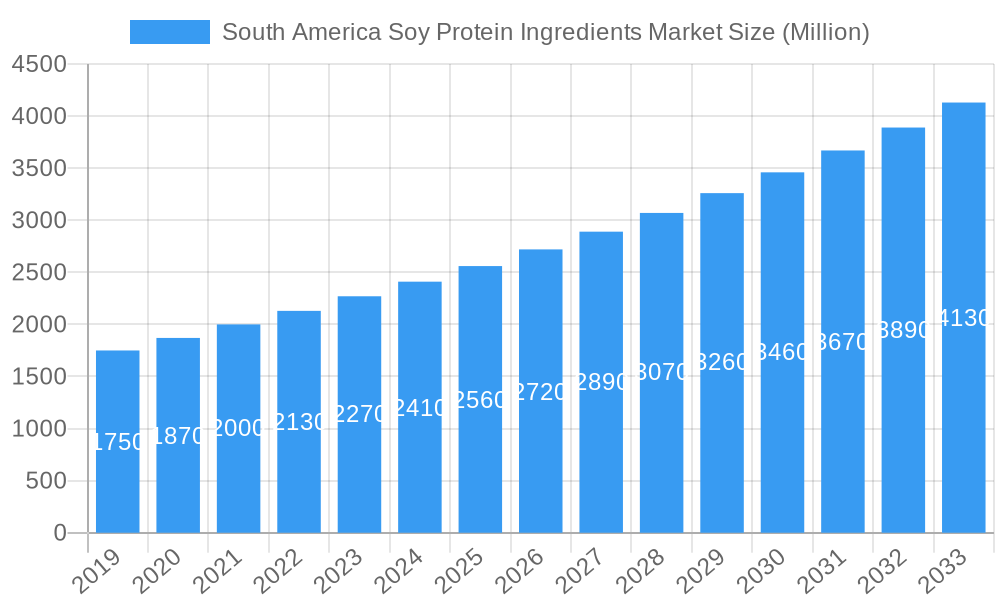

South America Soy Protein Ingredients Market Company Market Share

South America Soy Protein Ingredients Market: Comprehensive Growth Analysis & Strategic Insights (2019-2033)

This in-depth market research report provides a detailed examination of the South America Soy Protein Ingredients Market, encompassing market dynamics, key trends, segmentation analysis, and strategic outlook. Covering the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, this report offers actionable insights for stakeholders seeking to capitalize on the burgeoning demand for plant-based protein solutions in the region. The Historical Period: 2019–2024 provides context for current market conditions.

South America Soy Protein Ingredients Market Market Concentration & Dynamics

The South America Soy Protein Ingredients Market exhibits a moderate to high concentration, driven by a mix of established global players and regional specialists. Leading companies like Archer Daniels Midland Company, Kerry Group, Ajinomoto, and Tate & Lyle hold significant market share due to their extensive product portfolios, robust R&D capabilities, and established distribution networks across key South American nations such as Brazil and Argentina. Innovation is a key differentiator, with companies investing heavily in developing novel protein isolates and concentrates with improved functionalities, such as enhanced solubility, emulsification, and texturization for diverse applications. The innovation ecosystem is characterized by strategic partnerships between ingredient manufacturers and food product developers, fostering a dynamic environment for new product launches.

Regulatory frameworks, particularly those concerning food safety, labeling, and health claims, play a crucial role in shaping market entry and product development. Compliance with regional and national food standards is paramount. Substitute products, including pea protein, whey protein, and other plant-based protein sources, present a competitive challenge, necessitating continuous product differentiation and cost optimization. End-user trends, such as the rising consumer demand for plant-based diets, flexitarianism, and clean-label products, are major growth accelerators. Mergers and acquisitions (M&A) activity remains a strategic avenue for market expansion and consolidation, with recent deals focusing on acquiring specialized ingredient technologies or expanding geographical reach. While specific M&A deal counts for the region are under analysis, the trend indicates a keen interest in strengthening market positions and product offerings. The market share of key players is influenced by their product diversification, pricing strategies, and ability to cater to evolving consumer preferences for sustainable and healthy food options.

South America Soy Protein Ingredients Market Industry Insights & Trends

The South America Soy Protein Ingredients Market is poised for substantial growth, projected to reach an estimated market size of approximately $1,500 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the Forecast Period: 2025–2033. This expansion is primarily fueled by a confluence of powerful market growth drivers, technological disruptions, and evolving consumer behaviors. The increasing global awareness of health and wellness, coupled with a growing preference for plant-based diets and vegetarianism, is a fundamental catalyst. Consumers across South America are increasingly seeking protein-rich foods that offer a sustainable and ethical alternative to animal-based products. This shift is particularly evident in urban centers and among younger demographics who are more attuned to environmental concerns and the perceived health benefits of plant-derived proteins.

Technological advancements in processing and extraction techniques are enabling the production of higher-purity soy protein isolates and concentrates with improved functional properties. These advancements are crucial for enhancing the sensory appeal and applicability of soy protein ingredients in a wider range of food and beverage products. Innovations in textured soy protein (TSP), for instance, are creating more meat-like textures, making it an attractive ingredient for meat extenders and meat substitutes. Furthermore, the development of specialized soy protein ingredients catering to specific nutritional needs, such as those found in nutritional supplements and sports nutrition products, is opening up new market avenues.

Evolving consumer behaviors are also playing a significant role. The demand for clean-label products, free from artificial additives and preservatives, is driving the adoption of minimally processed soy protein ingredients. Transparency in sourcing and production processes is becoming increasingly important for consumers, pushing ingredient manufacturers to adopt sustainable practices. The growing popularity of bakery and confectionery products fortified with protein, as well as the use of soy protein in beverages for added nutritional value, are significant trends. The market is also witnessing a surge in demand from the functional food sector, where soy protein is incorporated for its purported health benefits, including cardiovascular health and weight management. The other applications segment, encompassing pet food and animal feed, also contributes to the overall market growth, albeit with different market dynamics and price sensitivities. The sustained economic development in several South American countries, leading to increased disposable income, further supports the premiumization of food products and the adoption of healthier, plant-based ingredients.

Key Markets & Segments Leading South America Soy Protein Ingredients Market

The South America Soy Protein Ingredients Market is characterized by the dominance of specific segments and geographical regions, driven by distinct economic, demographic, and industrial factors.

Brazil stands out as the largest and most influential market within South America for soy protein ingredients. Its position is underpinned by several key drivers:

- Extensive Soy Cultivation and Production: Brazil is a global powerhouse in soybean production, ensuring a readily available and cost-effective supply of raw materials for soy protein ingredient manufacturers. This local abundance significantly reduces import dependencies and offers a competitive edge.

- Robust Food Processing Industry: The country boasts a well-developed and diverse food processing sector, actively seeking innovative ingredients to cater to evolving consumer demands. This includes major players in the bakery and confectionery, meat extenders and substitutes, and nutritional supplements industries.

- Growing Health and Wellness Consciousness: A burgeoning middle class and increasing awareness of health benefits are fueling demand for plant-based proteins, particularly in urban areas. This trend is further amplified by the growing popularity of vegetarian and flexitarian diets.

- Government Support for Agriculture and Food Innovation: Policies aimed at supporting agricultural exports and fostering food technology innovation contribute to a favorable business environment for soy protein ingredient producers.

Argentina emerges as another significant contributor to the South America Soy Protein Ingredients Market, exhibiting strong growth potential due to:

- Established Agricultural Infrastructure: Similar to Brazil, Argentina has a strong agricultural base, contributing to the availability of soybeans.

- Increasing Demand for Processed Foods: The country's food industry is expanding, with a rising appetite for processed foods that incorporate functional ingredients like soy protein for enhanced nutritional profiles and texture.

- Focus on Meat Alternatives: Argentina's strong meat consumption culture also makes it a prime market for meat extenders and substitutes that utilize soy protein to offer familiar textures and tastes.

Within the product segments, Soy Isolates are leading the market. This dominance is attributed to their high protein content (typically >90%), excellent functional properties (solubility, emulsification), and relatively neutral flavor profile, making them versatile for a wide range of applications. They are highly sought after in nutritional supplements, beverages, and high-protein food formulations where purity and functionality are paramount.

The Application segment of Meat Extenders and Substitutes is experiencing rapid growth, directly correlating with the global surge in plant-based diets. Consumers are actively seeking alternatives that mimic the taste and texture of meat, and textured soy protein (TSP), a key soy protein ingredient, is a primary solution. This segment's growth is further propelled by increasing environmental consciousness and concerns regarding animal welfare.

The Rest of South America region, while individually smaller, collectively represents a significant growth opportunity. Countries like Colombia, Peru, and Chile are witnessing increasing adoption of plant-based diets and a growing food processing industry, driven by urbanization and rising disposable incomes. The demand for nutritional supplements and fortified beverages is also on the rise in these markets.

South America Soy Protein Ingredients Market Product Developments

Product innovation in the South America Soy Protein Ingredients Market is characterized by a focus on enhancing functionality and catering to specific dietary needs. Advancements in processing technologies have led to the development of soy protein isolates with improved solubility and emulsification properties, crucial for beverages and dairy alternatives. Textured soy protein (TSP) innovations are creating more diverse textures and appealing meat-like substitutes, driving its adoption in the food industry. Companies are also developing non-GMO and organic soy protein options to meet the growing consumer demand for clean-label and sustainable products, further differentiating their offerings and capturing niche market segments.

Challenges in the South America Soy Protein Ingredients Market Market

Despite its promising growth trajectory, the South America Soy Protein Ingredients Market faces several challenges. Consumer perception and taste preferences remain a significant hurdle, with some consumers still associating soy protein with off-flavors or associating it with genetically modified organisms (GMOs), despite increasing availability of non-GMO options. Supply chain volatility and price fluctuations of soybeans, influenced by weather patterns and global market dynamics, can impact ingredient costs and availability, posing a risk to profitability. Furthermore, intense competition from other plant-based protein sources like pea, rice, and fava bean proteins necessitates continuous innovation and cost-effectiveness to maintain market share. Regulatory landscapes across different South American countries can also vary, leading to complexities in market entry and product approvals.

Forces Driving South America Soy Protein Ingredients Market Growth

Several powerful forces are propelling the growth of the South America Soy Protein Ingredients Market. The escalating global demand for plant-based protein sources, driven by health consciousness, environmental concerns, and ethical considerations, is a primary accelerator. This trend is strongly mirrored in South America, where consumer awareness is rapidly increasing. Technological advancements in processing and extraction techniques are enabling the production of high-quality soy protein ingredients with superior functional properties, expanding their applicability across diverse food and beverage sectors. Government initiatives promoting sustainable agriculture and the growth of the food processing industry within several South American nations also provide a supportive ecosystem for market expansion.

Challenges in the South America Soy Protein Ingredients Market Market

Long-term growth catalysts in the South America Soy Protein Ingredients Market are expected to stem from continued innovation in product development and strategic market expansion. The ongoing trend towards personalized nutrition will drive demand for specialized soy protein ingredients tailored for specific health benefits and dietary requirements. Partnerships between soy protein ingredient manufacturers and food product developers will foster the creation of novel, appealing consumer products, thereby increasing adoption. Furthermore, the untapped potential in the "Rest of South America" regions, as economies develop and consumer preferences diversify, presents significant opportunities for market penetration and growth. Investment in R&D to overcome any lingering taste and texture challenges will also be crucial for sustained long-term success.

Emerging Opportunities in South America Soy Protein Ingredients Market

Emerging opportunities within the South America Soy Protein Ingredients Market are multifaceted and hold significant potential. The expansion of the alternative dairy market, utilizing soy protein for plant-based milk, yogurt, and cheese alternatives, presents a substantial growth avenue. Increasing consumer interest in functional foods and beverages designed for specific health outcomes, such as improved gut health or enhanced athletic performance, will create demand for specialized soy protein formulations. Furthermore, the development of sustainable and traceable soy protein supply chains offers a competitive advantage as consumers become more discerning about the provenance of their food. Exploring novel applications in animal nutrition, particularly for aquaculture and pet food, also represents a promising frontier for market diversification.

Leading Players in the South America Soy Protein Ingredients Market Sector

- Ajinomoto

- Arla Foods Ingredients

- TEUTEXX Proteins

- Archer Daniels Midland Company

- Foodchem International Corporation

- Kerry Group

- Tereos

- Tate & Lyle

Key Milestones in South America Soy Protein Ingredients Market Industry

- 2019: Increased global focus on plant-based diets drives early adoption of soy protein in emerging South American markets.

- 2020: COVID-19 pandemic accelerates health and immunity awareness, boosting demand for nutritional supplements and fortified foods, including those with soy protein.

- 2021: Growing investments in food technology and alternative protein research across South America.

- 2022: Expansion of meat substitute product lines by major food manufacturers utilizing textured soy protein.

- 2023: Introduction of new soy protein isolates with improved functionality for beverage applications.

- 2024: Enhanced focus on non-GMO and sustainable sourcing practices by key market players.

Strategic Outlook for South America Soy Protein Ingredients Market Market

The strategic outlook for the South America Soy Protein Ingredients Market is highly optimistic, driven by sustained growth in the plant-based protein sector and evolving consumer preferences. Future growth will be accelerated by continued innovation in product development, particularly in creating novel textures and flavors that closely mimic animal-based products. Strategic partnerships with food manufacturers, R&D institutions, and retailers will be crucial for expanding market reach and developing consumer-ready products. Leveraging the region's agricultural strengths for a cost-effective and sustainable supply chain will remain a key competitive advantage. Furthermore, a focus on educational campaigns to address consumer perceptions and highlight the health and environmental benefits of soy protein will be instrumental in unlocking its full market potential.

South America Soy Protein Ingredients Market Segmentation

-

1. Type

- 1.1. Soy Isolates

- 1.2. Soy Concentrate

- 1.3. Textured Soy Protein

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Meat Extenders and Substitutes

- 2.3. Nutritional Supplements

- 2.4. Beverages

- 2.5. Other Applications

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of the South America

-

3.1. South America

South America Soy Protein Ingredients Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of the South America

South America Soy Protein Ingredients Market Regional Market Share

Geographic Coverage of South America Soy Protein Ingredients Market

South America Soy Protein Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Nutritional Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Soy Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Soy Isolates

- 5.1.2. Soy Concentrate

- 5.1.3. Textured Soy Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Meat Extenders and Substitutes

- 5.2.3. Nutritional Supplements

- 5.2.4. Beverages

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of the South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Soy Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 7. Argentina South America Soy Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 8. Rest of South America South America Soy Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Ajinomoto

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Arla Foods Ingredients

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 TEUTEXX Proteins

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Archer Daniels Midland Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Foodchem International Corporation*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Kerry Group

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Tereos

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tate & Lyle

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Ajinomoto

List of Figures

- Figure 1: South America Soy Protein Ingredients Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Soy Protein Ingredients Market Share (%) by Company 2025

List of Tables

- Table 1: South America Soy Protein Ingredients Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: South America Soy Protein Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: South America Soy Protein Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: South America Soy Protein Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: South America Soy Protein Ingredients Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Soy Protein Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Soy Protein Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Soy Protein Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of South America South America Soy Protein Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South America Soy Protein Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: South America Soy Protein Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: South America Soy Protein Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 13: South America Soy Protein Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Brazil South America Soy Protein Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Soy Protein Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of the South America South America Soy Protein Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Soy Protein Ingredients Market?

The projected CAGR is approximately 6.81%.

2. Which companies are prominent players in the South America Soy Protein Ingredients Market?

Key companies in the market include Ajinomoto, Arla Foods Ingredients, TEUTEXX Proteins, Archer Daniels Midland Company, Foodchem International Corporation*List Not Exhaustive, Kerry Group, Tereos, Tate & Lyle.

3. What are the main segments of the South America Soy Protein Ingredients Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Increasing Demand for Nutritional Products.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Soy Protein Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Soy Protein Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Soy Protein Ingredients Market?

To stay informed about further developments, trends, and reports in the South America Soy Protein Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence