Key Insights

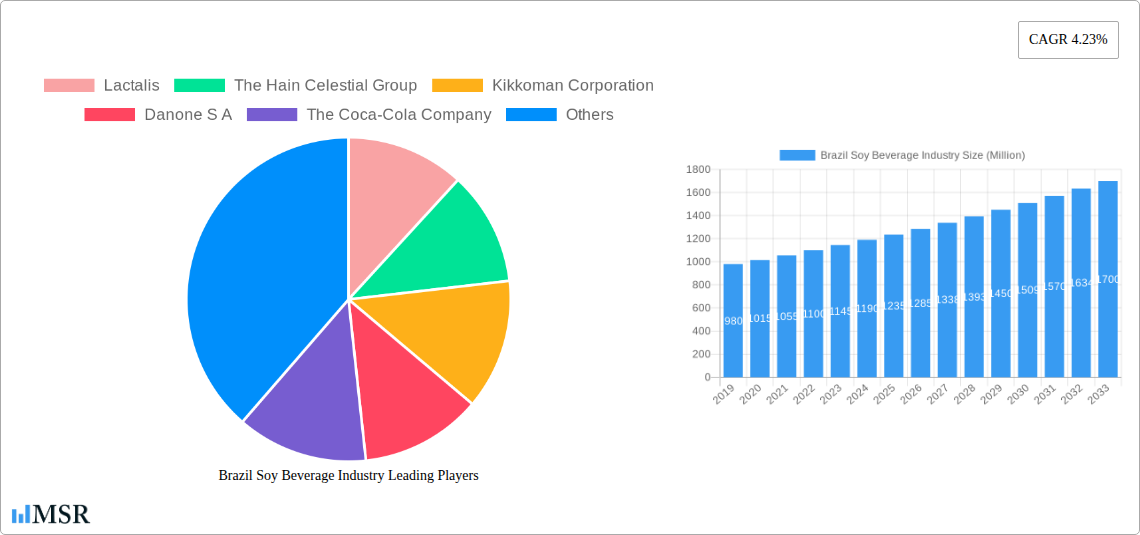

The Brazilian soy beverage market is projected for significant expansion, estimated at $549.78 million in 2023, with a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This growth is driven by increasing consumer preference for healthier, plant-based alternatives to dairy, heightened awareness of soy's nutritional advantages, and a growing vegan and vegetarian demographic in Brazil. Evolving consumer tastes for flavored varieties and an expanding distribution network, including supermarkets, online retailers, and convenience stores, further propel market dynamism. Key industry leaders are actively innovating and diversifying their product offerings to capture this expanding market share.

Brazil Soy Beverage Industry Market Size (In Million)

Despite positive growth, market challenges include fluctuations in soybean prices affecting production costs and product pricing, and the need for targeted marketing to overcome traditional dietary perceptions. The competitive landscape, with new and established brands vying for dominance, also requires strategic attention. Nevertheless, the prevailing trend towards healthier lifestyles and sustainable food choices in Brazil provides a strong foundation for sustained market growth. Product innovation, particularly in flavored soy beverages and convenient formats, alongside strategic distribution channel expansion, will be critical for capitalizing on the substantial opportunities within the Brazilian soy beverage industry.

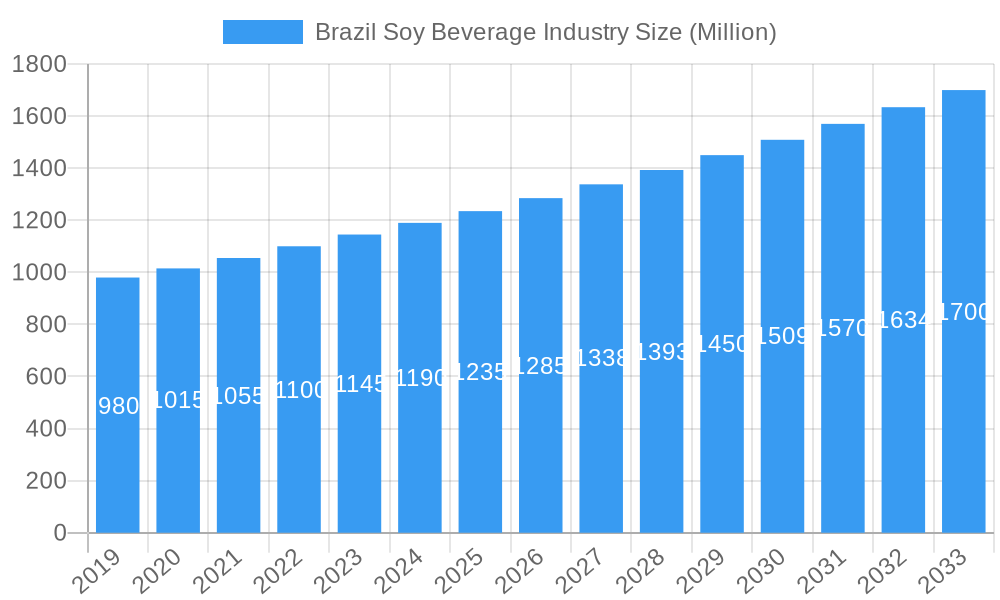

Brazil Soy Beverage Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Brazil Soy Beverage Industry, detailing market size, growth projections, and key trends for stakeholders.

Brazil Soy Beverage Industry Market Concentration & Dynamics

The Brazil soy beverage market, a dynamic and evolving sector within the broader plant-based food and beverage landscape, exhibits a moderate level of market concentration. While several key players like Lactalis, The Hain Celestial Group, Kikkoman Corporation, Danone S.A., The Coca-Cola Company, Campbell Soup Company, Jussara SA, and Pureharves are prominent, the market is not entirely dominated by a few entities. This allows for a vibrant innovation ecosystem driven by both established corporations and emerging brands seeking to capture market share in the Brazilian plant-based market.

The regulatory framework in Brazil, while generally supportive of food industry growth, can present specific compliance considerations for soy-based beverages, impacting product development and market entry strategies. The presence of numerous substitute products, including almond milk, oat milk, and other dairy alternatives, necessitates continuous product differentiation and value proposition enhancement for soy beverage manufacturers. End-user trends are increasingly leaning towards health-conscious choices, sustainability, and ethical sourcing, directly influencing product formulations and marketing campaigns. Mergers & Acquisitions (M&A) activities, though not at an exceptionally high volume, are strategically significant, indicating consolidation efforts by larger players and opportunities for smaller, innovative companies to be acquired or to partner. The study forecasts M&A deal counts to see a growth of approximately 15% over the forecast period, reflecting increasing investor interest.

Brazil Soy Beverage Industry Industry Insights & Trends

The Brazil soy beverage industry is poised for significant expansion, driven by a confluence of robust economic factors, evolving consumer preferences, and technological advancements. The market size for soy beverages in Brazil is projected to reach an estimated R$3,500 Million by the base year of 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period of 2025–2033. This impressive growth trajectory is fueled by a rising global demand for plant-based alternatives, aligning perfectly with increasing health consciousness among Brazilian consumers. The aging population in Brazil and a growing prevalence of lactose intolerance further bolster the demand for dairy-free options like soy beverages.

Technological disruptions are playing a crucial role in shaping the industry. Innovations in processing techniques are leading to improved taste profiles, enhanced nutritional content, and extended shelf life for soy beverages, making them more competitive with traditional dairy products. Furthermore, advancements in sustainable sourcing and production methods are appealing to environmentally conscious consumers, a segment that is rapidly growing in Brazil. The COVID-19 pandemic also acted as a catalyst, accelerating the adoption of e-commerce and online retail channels for food and beverage purchases, a trend that continues to shape the distribution channel landscape for soy beverages. The report delves deep into these market growth drivers, analyzing how shifts in consumer behavior, such as a greater emphasis on functional ingredients and personalized nutrition, are creating new avenues for product innovation and market penetration. The historical period of 2019–2024 laid the groundwork for this expansion, with steady growth driven by early adoption of plant-based diets and increasing awareness of soy's health benefits.

Key Markets & Segments Leading Brazil Soy Beverage Industry

The Brazil soy beverage market exhibits distinct leadership across various segments, driven by fundamental economic factors and evolving consumer demands. Dominance is clearly established within the Product Type segment, where Soy Milk commands the largest market share, estimated at 65% of the total soy beverage market in 2025. This is attributed to its long-standing recognition as a staple dairy alternative, its versatility in culinary applications, and its widespread availability. Soy-Based Drinkable Yogurt is an emerging segment, predicted to grow at a CAGR of 8.5% over the forecast period, driven by convenience and the appeal of probiotic benefits.

In terms of Flavor, Plain Soy Beverages continue to be the preferred choice, accounting for approximately 55% of the market in 2025. However, Flavored Soy Beverages are experiencing a faster growth rate, particularly chocolate, vanilla, and fruit-infused varieties, catering to a younger demographic and those seeking a more palatable introduction to soy. The Distribution Channel landscape is largely led by Supermarkets/Hypermarkets, which represent 50% of all sales in 2025, owing to their extensive reach and product variety. Online Retail Stores are the fastest-growing channel, with an estimated 20% market share by 2025 and a projected CAGR of 12%, reflecting the increasing digital penetration in Brazil. Convenience Stores hold a significant 15% share due to impulse purchases and accessibility.

- Economic Growth & Infrastructure: Brazil's robust economic development, particularly in urban centers, underpins increased purchasing power for premium and health-oriented products like soy beverages. Well-established retail infrastructure, including large supermarket chains, facilitates widespread product availability.

- Health & Wellness Trends: Growing consumer awareness of health benefits associated with soy, such as heart health and bone density, drives demand for plain and fortified soy milk.

- Vegan & Flexitarian Diets: The rising adoption of vegan and flexitarian lifestyles in Brazil directly translates to increased consumption of plant-based alternatives, with soy remaining a primary choice due to its protein content and affordability.

Brazil Soy Beverage Industry Product Developments

Product innovation in the Brazil soy beverage industry is a key differentiator. Manufacturers are focusing on enhancing taste profiles to rival dairy milk, developing fortified options with added vitamins and minerals like calcium and Vitamin D, and creating specialized formulations for different dietary needs. The introduction of novel flavors, functional ingredients such as probiotics and prebiotics, and the exploration of new applications beyond simple beverages, such as in coffee creamers and culinary bases, are significant. Technological advancements in protein extraction and processing are enabling cleaner labels and improved texture, increasing the market relevance of soy-based drinks as consumers seek healthier and more sustainable choices.

Challenges in the Brazil Soy Beverage Industry Market

Despite substantial growth, the Brazil soy beverage market faces several challenges. Regulatory hurdles related to labeling and health claims can impede market entry for new products. Price volatility of raw soybeans can impact production costs and profit margins. Intense competition from other plant-based milk alternatives, including almond, oat, and coconut milk, requires continuous product innovation and effective marketing strategies. Consumer perception of GMO soybeans also remains a concern for a segment of the population, necessitating clear communication about sourcing practices.

Forces Driving Brazil Soy Beverage Industry Growth

Several forces are propelling the Brazil soy beverage industry forward. A significant driver is the escalating demand for plant-based diets, fueled by increasing health consciousness and environmental awareness. Technological advancements in processing and flavor enhancement are making soy beverages more appealing and competitive. Government initiatives promoting healthier food choices and the growing prevalence of lactose intolerance and dairy allergies are creating a receptive market. The expanding reach of e-commerce channels also facilitates greater accessibility for consumers nationwide.

Challenges in the Brazil Soy Beverage Industry Market

Long-term growth in the Brazil soy beverage industry is predicated on overcoming specific challenges and capitalizing on inherent strengths. The primary challenge involves effectively communicating the diverse health benefits of soy to a broader consumer base, moving beyond its established role as a dairy alternative. Addressing concerns about soy's potential allergens and perceptions of its taste profile through continued product development and targeted marketing campaigns will be crucial. Furthermore, ensuring sustainable and ethical sourcing practices throughout the supply chain will become increasingly important as consumer scrutiny intensifies, fostering brand loyalty and trust.

Emerging Opportunities in Brazil Soy Beverage Industry

Emerging opportunities within the Brazil soy beverage industry are abundant. The rising popularity of functional foods presents a significant avenue, with opportunities to develop soy beverages enriched with probiotics, prebiotics, vitamins, and minerals tailored to specific health needs like immunity support or digestive health. The ‘clean label’ trend is also creating demand for products with minimal, recognizable ingredients. Furthermore, expanding into under-served regions and exploring innovative distribution channels, such as direct-to-consumer models and partnerships with food service providers, can unlock new growth potential. The development of plant-based protein alternatives derived from soy for wider culinary applications also represents a promising frontier.

Leading Players in the Brazil Soy Beverage Industry Sector

- Lactalis

- The Hain Celestial Group

- Kikkoman Corporation

- Danone S A

- The Coca-Cola Company

- Campbell Soup Company

- Jussara SA

- Pureharves

Key Milestones in Brazil Soy Beverage Industry Industry

- 2019: Increased consumer adoption of plant-based diets, leading to steady growth in soy beverage sales.

- 2020: Impact of the COVID-19 pandemic accelerating online grocery shopping and demand for at-home consumption beverages.

- 2021: Emergence of new product launches focusing on fortified and flavored soy beverages to cater to diverse preferences.

- 2022: Growing awareness of sustainability driving demand for plant-based alternatives, including soy.

- 2023: Expansion of e-commerce platforms and partnerships with online retailers to enhance market reach.

- 2024: Focus on innovative sourcing and production methods to address consumer concerns regarding GMOs and environmental impact.

Strategic Outlook for Brazil Soy Beverage Industry Market

The strategic outlook for the Brazil soy beverage market is exceptionally positive, driven by sustained consumer demand for healthier, sustainable, and plant-based options. The market is anticipated to continue its upward trajectory, fueled by product innovation, expanding distribution networks, and increasing consumer awareness. Key growth accelerators will include the development of premiumized soy beverages with enhanced nutritional profiles and unique flavor combinations, alongside strategic partnerships to broaden market penetration, particularly in emerging urban and digital consumption spaces. Continued investment in research and development will be crucial for maintaining a competitive edge and capitalizing on the evolving preferences of the Brazilian consumer.

Brazil Soy Beverage Industry Segmentation

-

1. Product Type

- 1.1. Soy Milk

- 1.2. Soy-Based Drinkable Yogurt

-

2. Flavor

- 2.1. Plain Soy Beverages

- 2.2. Flavored Soy Beverages

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Convenience Stores

- 3.4. Others

Brazil Soy Beverage Industry Segmentation By Geography

- 1. Brazil

Brazil Soy Beverage Industry Regional Market Share

Geographic Coverage of Brazil Soy Beverage Industry

Brazil Soy Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Plant based Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Soy Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Soy Milk

- 5.1.2. Soy-Based Drinkable Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Flavor

- 5.2.1. Plain Soy Beverages

- 5.2.2. Flavored Soy Beverages

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Convenience Stores

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lactalis

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Hain Celestial Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kikkoman Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Coca-Cola Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Campbell Soup Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jussara SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pureharves

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Lactalis

List of Figures

- Figure 1: Brazil Soy Beverage Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Soy Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Soy Beverage Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Brazil Soy Beverage Industry Revenue million Forecast, by Flavor 2020 & 2033

- Table 3: Brazil Soy Beverage Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Brazil Soy Beverage Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Brazil Soy Beverage Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Brazil Soy Beverage Industry Revenue million Forecast, by Flavor 2020 & 2033

- Table 7: Brazil Soy Beverage Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Brazil Soy Beverage Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Soy Beverage Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Brazil Soy Beverage Industry?

Key companies in the market include Lactalis, The Hain Celestial Group, Kikkoman Corporation, Danone S A, The Coca-Cola Company, Campbell Soup Company, Jussara SA, Pureharves.

3. What are the main segments of the Brazil Soy Beverage Industry?

The market segments include Product Type, Flavor, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 549.78 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Growing Demand for Plant based Products.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Soy Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Soy Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Soy Beverage Industry?

To stay informed about further developments, trends, and reports in the Brazil Soy Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence