Key Insights

The South American digestive health supplements market is projected to reach $18.86 billion by 2025, expanding at a compound annual growth rate (CAGR) of 11.4% during the forecast period. This growth is propelled by heightened consumer awareness of gut health's impact on overall well-being, a rise in digestive disorders, and a growing preference for natural, science-backed health solutions. Consumers are actively seeking to enhance digestion, reduce discomfort, and boost immunity, making digestive health supplements a vital part of their wellness regimens. This proactive health management trend, combined with an aging population experiencing age-related digestive concerns, further stimulates market demand.

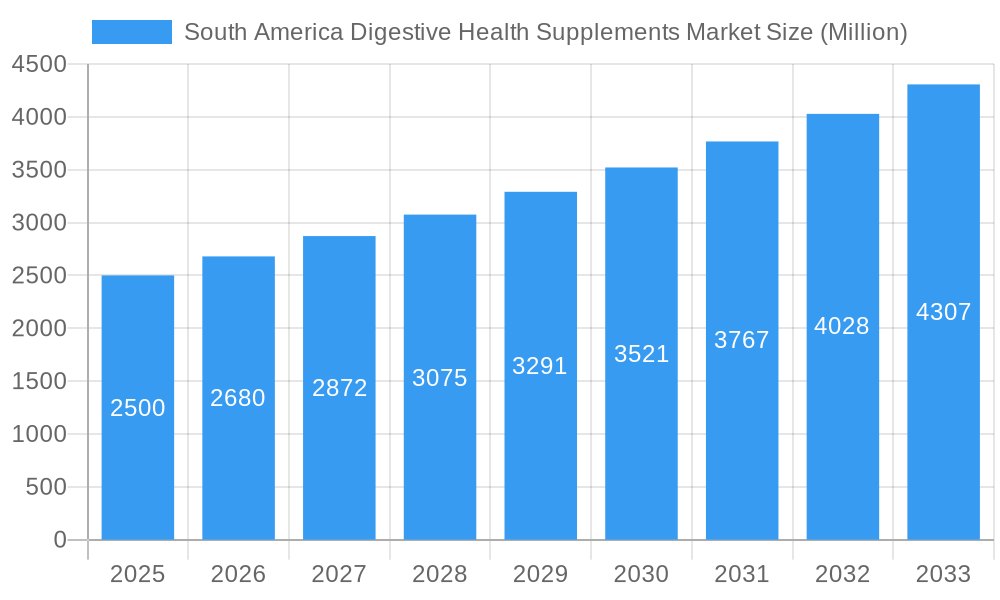

South America Digestive Health Supplements Market Market Size (In Billion)

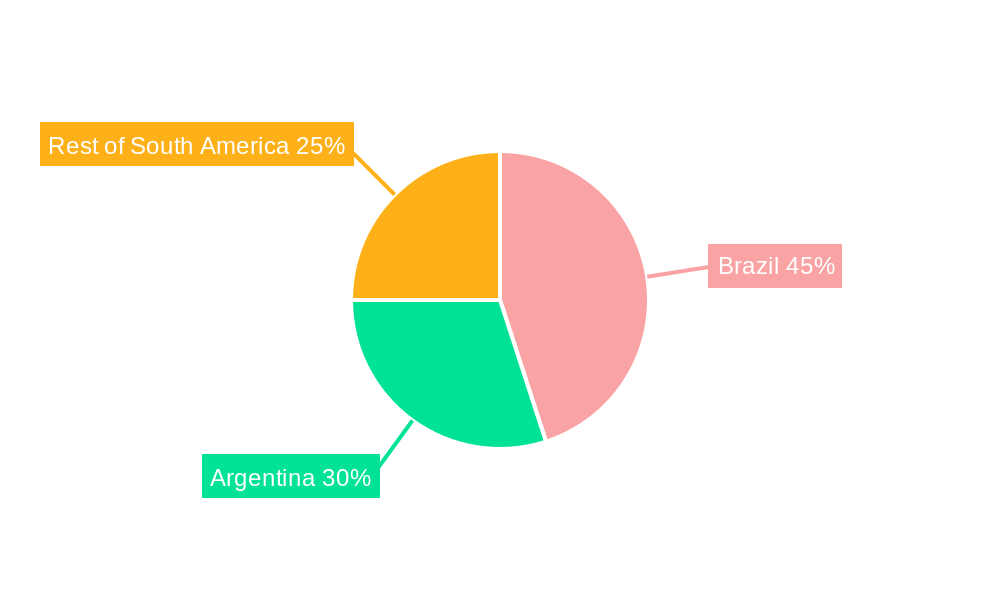

Market segmentation highlights significant opportunities across product categories, with probiotics leading due to their established benefits for gut microbiota balance. Prebiotics are also gaining prominence as their role in supporting beneficial bacteria becomes more recognized. In terms of product form, capsules and powders maintain market dominance, valued for their convenience and efficacy. However, gummies are emerging as a popular option, particularly among younger consumers seeking palatable alternatives. Distribution channels are increasingly shifting towards online retail, owing to its accessibility and extensive product selection, while supermarkets, hypermarkets, and pharmacies/drugstores remain crucial sales points. Geographically, Brazil is anticipated to lead the market, followed by Argentina and other South American nations, as each region embraces the expanding trend of digestive wellness and supplement adoption.

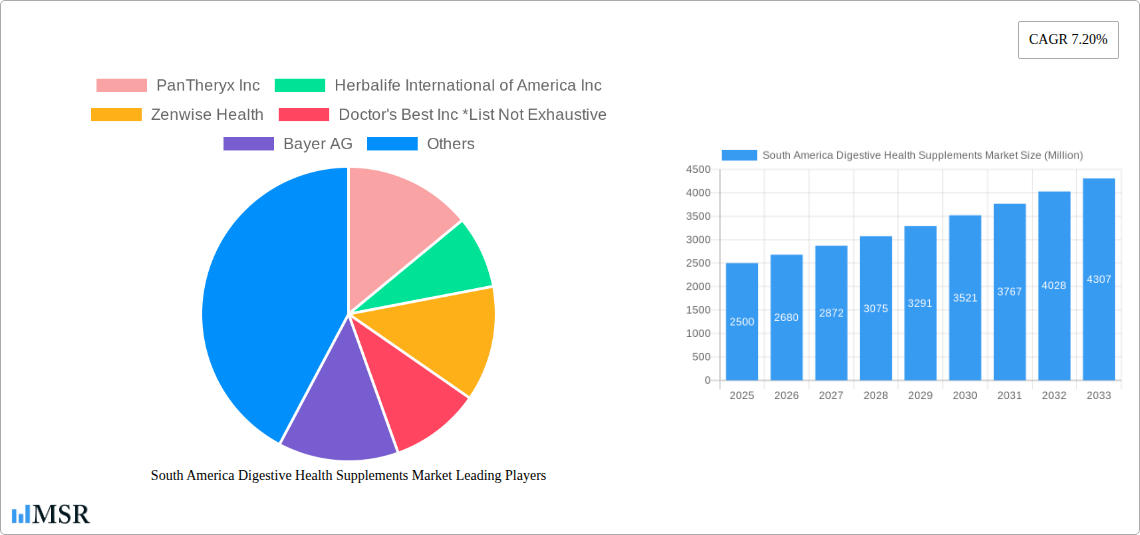

South America Digestive Health Supplements Market Company Market Share

This market research report provides an in-depth analysis of the South America digestive health supplements market, offering actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report details market size, growth trends, key segments, competitive dynamics, and emerging opportunities. Driven by increasing regional focus on gut health and wellness, the demand for digestive health supplements is experiencing substantial expansion, influenced by evolving consumer preferences and advancements in nutritional science. This report is an essential resource for manufacturers, suppliers, distributors, investors, and other stakeholders aiming to navigate and capitalize on the growing South American market for prebiotics, probiotics, enzymes, and other digestive health solutions.

South America Digestive Health Supplements Market Market Concentration & Dynamics

The South America digestive health supplements market exhibits a moderate to high concentration, with a mix of established global players and agile local manufacturers vying for market share. Innovation remains a critical differentiator, with companies investing in research and development to introduce novel formulations and delivery systems that enhance efficacy and consumer appeal. The digestive health supplements market in South America is characterized by a strong emphasis on natural ingredients and scientifically backed claims. Regulatory frameworks, while evolving, are generally supportive of the growth of the nutraceutical sector, though compliance with local standards is paramount. Substitute products, such as fortified foods and beverages with digestive benefits, present a competitive challenge, but the targeted efficacy of supplements continues to drive demand. End-user trends highlight a growing consumer awareness of the gut-brain axis and its impact on overall well-being, fueling demand for probiotic supplements, prebiotic supplements, and digestive enzymes. Mergers and acquisitions (M&A) activities, though not extensively documented in recent public records, are expected to play a role in consolidating market positions and expanding product portfolios as companies seek to strengthen their presence in this lucrative market. The market is segmented into various product types, including prebiotics, probiotics, enzymes, and other specialized formulations, each catering to distinct consumer needs.

South America Digestive Health Supplements Market Industry Insights & Trends

The South America digestive health supplements market is poised for significant expansion, driven by a confluence of factors that underscore the growing importance of gastrointestinal wellness in the region. With an estimated market size of approximately $XXX million in 2025, the market is projected to experience a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period of 2025–2033. This growth is underpinned by increasing consumer awareness regarding the link between gut health and overall immunity, mental well-being, and nutrient absorption. The rising prevalence of digestive disorders, such as irritable bowel syndrome (IBS), bloating, and indigestion, further fuels the demand for effective dietary interventions. Technological disruptions are playing a crucial role, with advancements in encapsulation technologies enhancing the stability and bioavailability of probiotics, ensuring their survival through the digestive tract and maximizing their therapeutic benefits. The development of novel strains of probiotics with targeted functionalities, such as strain-specific benefits for constipation, diarrhea, and general digestive discomfort, is also contributing to market growth. Evolving consumer behaviors are marked by a preference for natural, clean-label products, with a growing inclination towards supplements free from artificial additives, fillers, and allergens. This trend is driving innovation in ingredient sourcing and formulation. The increasing adoption of online retail channels for purchasing health supplements, owing to their convenience and wider product selection, is another significant trend impacting market dynamics. Furthermore, growing disposable incomes in key South American economies are enabling a larger segment of the population to invest in preventive healthcare and dietary supplements, contributing to the overall market expansion. The digestive health market is witnessing a surge in demand for probiotic and prebiotic supplements, driven by increasing consumer education and the availability of diverse product offerings.

Key Markets & Segments Leading South America Digestive Health Supplements Market

Brazil stands out as the dominant geographical market within the South America digestive health supplements landscape, driven by its large population, increasing health consciousness, and a burgeoning nutraceutical industry. The Brazilian digestive health supplements market is significantly influenced by economic growth and a well-established retail infrastructure.

- Dominant Geography: Brazil

- Drivers: Large consumer base, rising disposable incomes, increasing awareness of gut health benefits, expanding distribution networks including online retailers and pharmacies.

- Detailed Analysis: Brazil's robust economy and a growing middle class have fostered a greater willingness to invest in health and wellness products. The country's healthcare system, while facing its own challenges, has also seen an increased emphasis on preventive measures, including the use of dietary supplements. The penetration of supermarkets/hypermarkets and pharmacies and drugstores ensures wide accessibility, while the rapid growth of e-commerce platforms is further expanding reach, particularly in urban centers.

Key Segment Dominance:

Type: Probiotics consistently lead the market.

- Drivers: Proven benefits for gut health, wide range of applications (e.g., immunity, digestion), extensive scientific research supporting their efficacy, and increasing consumer familiarity.

- Detailed Analysis: The diverse range of probiotic strains and their targeted benefits for various digestive issues have cemented their position as the frontrunner. Innovations in live culture delivery and a growing understanding of the microbiome's role in overall health continue to fuel this segment's growth.

Form: Capsules and Tablets remain the most popular forms.

- Drivers: Consumer familiarity, ease of consumption, stability of active ingredients, established manufacturing processes, and perceived efficacy.

- Detailed Analysis: These traditional forms offer a balance of convenience, shelf-life, and accurate dosing, making them the preferred choice for a broad consumer base. However, the growing popularity of Gummy formats, particularly among children and those who have difficulty swallowing pills, is a significant emerging trend.

Distribution Channel: Pharmacies and Drugstores currently hold a substantial market share.

- Drivers: Consumer trust in healthcare professionals, accessibility, perceived credibility, and the ability to seek advice from pharmacists regarding product selection.

- Detailed Analysis: Pharmacies serve as trusted hubs for health-related purchases, offering a curated selection of supplements. However, Online Retailers are rapidly gaining ground, driven by convenience, competitive pricing, and a wider selection of niche products, posing a strong competitive force.

South America Digestive Health Supplements Market Product Developments

Recent product developments in the South America digestive health supplements market reflect a clear focus on enhancing efficacy, palatability, and consumer convenience. In January 2022, PanTheryx Inc. launched two sugar-free probiotic gummy products, TruBiotics for children and adults, incorporating Vitamin C for the children's variant and Vitamin D for adults, addressing the growing demand for pediatrician-recommended solutions and immune support. This move highlights a trend towards combining digestive health benefits with essential vitamins in easily consumable formats. Furthermore, in December 2021, Cymbiotika expanded its production line with the addition of probiotic supplements for digestive health, underscoring a commitment to organic, clinically-backed formulations. These innovations are pivotal in capturing market share by catering to specific demographic needs and leveraging scientific advancements to offer premium, effective digestive health supplements.

Challenges in the South America Digestive Health Supplements Market Market

The South America digestive health supplements market faces several challenges that can impede growth and profitability. Regulatory hurdles, including varying approval processes and labeling requirements across different countries, can lead to significant delays and increased compliance costs for manufacturers. Supply chain disruptions, exacerbated by economic volatility and logistical complexities within the region, can impact the availability and cost of raw materials. Furthermore, intense competitive pressure from both international and local players, coupled with the constant need for product innovation and marketing investment, can strain profit margins. The challenge of consumer education also persists, as a significant portion of the population may still be unaware of the full benefits of specific digestive health supplements or may harbor misconceptions, requiring continuous outreach and clear communication of scientific evidence.

Forces Driving South America Digestive Health Supplements Market Growth

Several potent forces are propelling the growth of the South America digestive health supplements market. Technological advancements in probiotic strain identification and cultivation, along with improved encapsulation techniques, are enhancing the efficacy and stability of products. The growing global emphasis on preventive healthcare and a deeper understanding of the gut microbiome's role in overall well-being are significant consumer-driven factors. Economic growth in several South American nations, leading to increased disposable incomes, allows more consumers to invest in premium health and wellness solutions. Supportive regulatory environments in key markets, which are increasingly recognizing the importance of the nutraceutical sector, also contribute to a favorable growth trajectory for digestive health supplements.

Challenges in the South America Digestive Health Supplements Market Market

Looking beyond immediate hurdles, long-term growth catalysts for the South America digestive health supplements market lie in sustained innovation and strategic market expansion. The continuous discovery of novel probiotic strains with targeted health benefits, such as improved cognitive function or enhanced nutrient absorption, will open new avenues for product development. Strategic partnerships between supplement manufacturers and healthcare providers or research institutions can foster greater credibility and broader adoption. Furthermore, market expansion into underserved regions within South America, coupled with tailored marketing strategies that resonate with local cultural nuances and dietary habits, will be crucial for sustained growth. The development of personalized digestive health solutions based on individual microbiome analysis represents a significant future growth opportunity.

Emerging Opportunities in South America Digestive Health Supplements Market

Emerging opportunities in the South America digestive health supplements market are abundant, driven by evolving consumer preferences and technological advancements. The rising demand for plant-based and vegan digestive health supplements presents a significant untapped market segment. Innovations in synbiotic formulations, combining prebiotics and probiotics, are gaining traction due to their synergistic effects. The growing popularity of personalized nutrition approaches, leveraging data analytics and genetic testing, offers a pathway to develop customized supplement regimens for specific digestive needs. Furthermore, the increasing awareness of the link between gut health and mental well-being is creating a demand for supplements that address both aspects, opening doors for products targeting mood, stress, and cognitive function alongside digestive comfort.

Leading Players in the South America Digestive Health Supplements Market Sector

- PanTheryx Inc.

- Herbalife International of America Inc.

- Zenwise Health

- Doctor's Best Inc.

- Bayer AG

- The Nature's Bounty Co (Puritan's Pride Inc.)

- Metagenics Inc.

- Koninklijke DSM NV

- General Nutrition Centers Inc.

- GlaxoSmithKline PLC

Key Milestones in South America Digestive Health Supplements Market Industry

- January 2022: PanTheryx Inc., a specialist in digestive and immune health products, launched two sugar-free probiotic gummy products to its TruBiotics line for children and adults. The Children's Probiotic Gummies include vitamin C, and the adult Probiotic Gummies include vitamin D, enhancing product appeal and addressing dual health benefits.

- December 2021: Cymbiotika, a leading nutritional supplement brand known for its organic and clinically-backed offerings, expanded its production line with the addition of probiotic supplements specifically designed for digestive health, signaling a growing market focus on this segment.

Strategic Outlook for South America Digestive Health Supplements Market Market

The strategic outlook for the South America digestive health supplements market is highly promising, with continued growth anticipated due to sustained consumer interest in preventive health and the increasing scientific validation of gut health benefits. Key growth accelerators will include ongoing innovation in novel probiotic and prebiotic strains, the development of more palatable and convenient delivery forms like gummies, and the expansion of online retail channels for enhanced accessibility. Companies that focus on transparent ingredient sourcing, evidence-based product claims, and targeted marketing strategies that address specific consumer concerns related to digestive discomfort, immunity, and overall wellness will be well-positioned for success. Strategic partnerships, including collaborations with healthcare professionals and the integration of personalized nutrition approaches, will further solidify market positions and unlock new revenue streams in this dynamic sector.

South America Digestive Health Supplements Market Segmentation

-

1. Type

- 1.1. Prebiotics

- 1.2. Probiotics

- 1.3. Enzymes

- 1.4. Other Types

-

2. Form

- 2.1. Capsules

- 2.2. Tablets

- 2.3. Powders

- 2.4. Gummy

- 2.5. Other Forms

-

3. Distibution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Pharmacies and Drugstores

- 3.3. Online Retailers

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Digestive Health Supplements Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Digestive Health Supplements Market Regional Market Share

Geographic Coverage of South America Digestive Health Supplements Market

South America Digestive Health Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Increased Importance of Digestive Health

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prebiotics

- 5.1.2. Probiotics

- 5.1.3. Enzymes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Capsules

- 5.2.2. Tablets

- 5.2.3. Powders

- 5.2.4. Gummy

- 5.2.5. Other Forms

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Pharmacies and Drugstores

- 5.3.3. Online Retailers

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Prebiotics

- 6.1.2. Probiotics

- 6.1.3. Enzymes

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Capsules

- 6.2.2. Tablets

- 6.2.3. Powders

- 6.2.4. Gummy

- 6.2.5. Other Forms

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Pharmacies and Drugstores

- 6.3.3. Online Retailers

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Prebiotics

- 7.1.2. Probiotics

- 7.1.3. Enzymes

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Capsules

- 7.2.2. Tablets

- 7.2.3. Powders

- 7.2.4. Gummy

- 7.2.5. Other Forms

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Pharmacies and Drugstores

- 7.3.3. Online Retailers

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Prebiotics

- 8.1.2. Probiotics

- 8.1.3. Enzymes

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Capsules

- 8.2.2. Tablets

- 8.2.3. Powders

- 8.2.4. Gummy

- 8.2.5. Other Forms

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Pharmacies and Drugstores

- 8.3.3. Online Retailers

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 PanTheryx Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Herbalife International of America Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Zenwise Health

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Doctor's Best Inc *List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Bayer AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 The Nature's Bounty Co (Puritan's Pride Inc )

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Metagenics Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Koninklijke DSM NV

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 General Nutrition Centers Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 GlaxoSmithKline PLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 PanTheryx Inc

List of Figures

- Figure 1: South America Digestive Health Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Digestive Health Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: South America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 3: South America Digestive Health Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 4: South America Digestive Health Supplements Market Volume k tons Forecast, by Form 2020 & 2033

- Table 5: South America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: South America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 7: South America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 9: South America Digestive Health Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: South America Digestive Health Supplements Market Volume k tons Forecast, by Region 2020 & 2033

- Table 11: South America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: South America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 13: South America Digestive Health Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 14: South America Digestive Health Supplements Market Volume k tons Forecast, by Form 2020 & 2033

- Table 15: South America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 16: South America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 17: South America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: South America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 19: South America Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: South America Digestive Health Supplements Market Volume k tons Forecast, by Country 2020 & 2033

- Table 21: South America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: South America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 23: South America Digestive Health Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 24: South America Digestive Health Supplements Market Volume k tons Forecast, by Form 2020 & 2033

- Table 25: South America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 26: South America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 27: South America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: South America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 29: South America Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: South America Digestive Health Supplements Market Volume k tons Forecast, by Country 2020 & 2033

- Table 31: South America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: South America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 33: South America Digestive Health Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 34: South America Digestive Health Supplements Market Volume k tons Forecast, by Form 2020 & 2033

- Table 35: South America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 36: South America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 37: South America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: South America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 39: South America Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: South America Digestive Health Supplements Market Volume k tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Digestive Health Supplements Market?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the South America Digestive Health Supplements Market?

Key companies in the market include PanTheryx Inc, Herbalife International of America Inc, Zenwise Health, Doctor's Best Inc *List Not Exhaustive, Bayer AG, The Nature's Bounty Co (Puritan's Pride Inc ), Metagenics Inc, Koninklijke DSM NV, General Nutrition Centers Inc, GlaxoSmithKline PLC.

3. What are the main segments of the South America Digestive Health Supplements Market?

The market segments include Type, Form, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Increased Importance of Digestive Health.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

January 2022: PanTheryx, a company specializing in digestive and immune health products, launched two sugar-free probiotic gummy products to its TruBiotics line for children and adults. The Children's Probiotic Gummies include vitamin C, and the adult Probiotic Gummies include vitamin D.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in k tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Digestive Health Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Digestive Health Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Digestive Health Supplements Market?

To stay informed about further developments, trends, and reports in the South America Digestive Health Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence