Key Insights

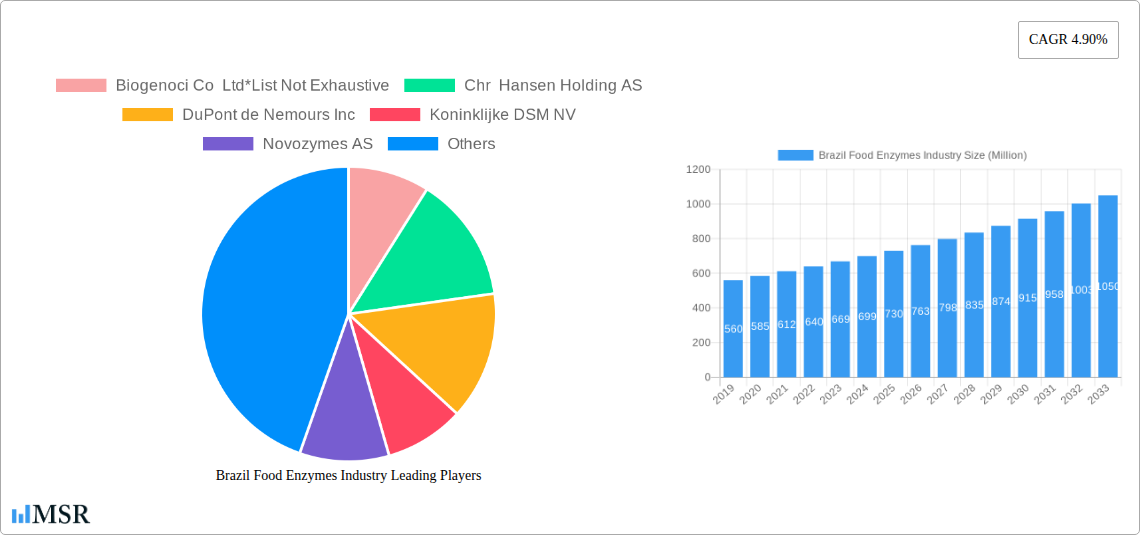

The Brazilian food enzyme market is poised for robust expansion, projected to reach approximately USD 750 million by 2025, with a healthy Compound Annual Growth Rate (CAGR) of 4.90% extending through to 2033. This growth is propelled by a confluence of significant drivers, primarily the increasing consumer demand for processed and convenience foods, a growing awareness of the health benefits associated with enzyme-treated food products, and the persistent drive for improved food quality and shelf-life. Furthermore, the Brazilian food industry's commitment to innovation and the adoption of advanced processing technologies are instrumental in fostering this upward trajectory. Enzymes are increasingly recognized as essential tools for enhancing texture, flavor, and nutritional profiles, while also contributing to more efficient and sustainable food production processes, thereby aligning with evolving consumer preferences and regulatory landscapes.

Brazil Food Enzymes Industry Market Size (In Million)

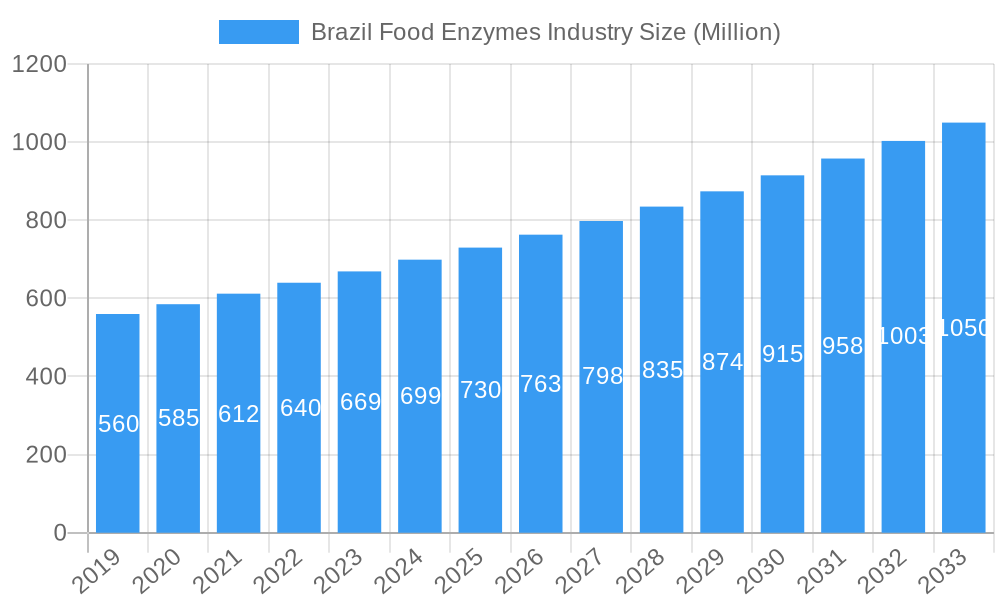

The market segmentation reveals key areas of opportunity within Brazil. Carbohydrases and proteases are anticipated to dominate, driven by their extensive applications in bakery, confectionery, and meat processing, respectively. The dairy and frozen dessert sectors also represent significant growth avenues, with enzymes playing a crucial role in improving product texture and stability. While the overall market is characterized by strong growth, certain restraints such as the fluctuating raw material costs and the initial investment required for enzyme technology adoption may present challenges. However, the overarching trend of premiumization in the Brazilian food market and the growing emphasis on clean-label ingredients are expected to outweigh these limitations, ensuring sustained market vitality. Key players like Chr Hansen Holding AS, DuPont de Nemours Inc, and Novozymes AS are actively shaping this dynamic landscape through product innovation and strategic market penetration.

Brazil Food Enzymes Industry Company Market Share

Dive deep into the dynamic Brazil Food Enzymes Industry with our comprehensive report. This in-depth analysis covers market concentration, key trends, segment dominance, product innovations, challenges, growth drivers, emerging opportunities, leading players, and critical milestones, providing actionable intelligence for stakeholders.

This report is meticulously crafted to offer unparalleled insights into the Brazilian enzyme market, focusing on segments like Carbohydrases, Proteases, Lipases, and Other Types, and their applications in Bakery, Confectionery, Dairy and Frozen Desserts, Meat Poultry and Seafood Products, and Beverages.

Brazil Food Enzymes Industry Market Concentration & Dynamics

The Brazil Food Enzymes Industry exhibits a moderate market concentration, with a few major global players such as DuPont de Nemours Inc, Novozymes AS, Koninklijke DSM NV, Chr Hansen Holding AS, and ABF Ingredients holding significant market share, estimated at over 65%. The innovation ecosystem is robust, driven by continuous R&D investments from these key companies, focusing on developing novel enzymes for enhanced food processing, improved shelf-life, and healthier food alternatives. Brazil's regulatory framework, overseen by agencies like ANVISA, is evolving to align with international standards, fostering trust and facilitating market entry for new technologies. Substitute products, such as chemical additives, pose a challenge, but the increasing demand for clean-label and natural ingredients favors enzymatic solutions. End-user trends are leaning towards demand for enhanced nutritional profiles, reduced sugar and fat content, and sustainable food production, all areas where enzymes offer significant advantages. Mergers and acquisitions (M&A) activities are expected to remain strategic, with an estimated 2-3 significant deals anticipated between 2025 and 2033, aimed at expanding product portfolios and market reach.

Brazil Food Enzymes Industry Industry Insights & Trends

The Brazil Food Enzymes Industry is poised for significant growth, projected to reach an estimated market size of US$ 750 Million by 2025 and grow to approximately US$ 1,200 Million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 6.2% over the forecast period. This expansion is primarily fueled by the burgeoning food and beverage sector in Brazil, a global agricultural powerhouse. Increasing consumer awareness regarding health and wellness is a major market driver, propelling demand for natural ingredients and clean-label products, where enzymes play a crucial role in enhancing texture, flavor, nutritional value, and extending shelf life without the use of synthetic additives. Technological disruptions, including advancements in enzyme engineering and fermentation techniques, are enabling the development of more efficient and cost-effective enzyme solutions for a wider range of applications. The rise of e-commerce and sophisticated supply chains also contributes to market accessibility and growth. Evolving consumer behaviors, such as a preference for plant-based diets and processed foods with improved functional attributes, are creating new avenues for enzyme utilization in sectors like meat alternatives and functional beverages. The demand for enzymes in meat poultry and seafood products is particularly strong due to their ability to improve tenderness and processing efficiency. Furthermore, government initiatives promoting sustainable agriculture and food processing are indirectly supporting the adoption of enzyme technologies that contribute to reduced waste and energy consumption. The Bakery segment continues to be a dominant force, driven by the staple nature of baked goods and the continuous innovation in product offerings. The Dairy and Frozen Desserts sector also presents substantial growth opportunities, with enzymes enhancing texture, flavor, and lactose reduction.

Key Markets & Segments Leading Brazil Food Enzymes Industry

The Bakery segment is a dominant force within the Brazil Food Enzymes Industry, accounting for an estimated 30% of the total market revenue in 2025. This leadership is underpinned by several key drivers, including the widespread consumption of bread and baked goods as dietary staples, coupled with a growing demand for premium and artisanal bakery products. Economic growth and rising disposable incomes contribute to increased consumer spending on processed foods, including a wide variety of baked goods. The sector's embrace of innovation, driven by the need for improved dough handling, enhanced crumb structure, extended shelf life, and cleaner labels, directly translates to a higher adoption rate of enzymatic solutions like Carbohydrases (amylases) and Proteases.

- Carbohydrases (Amylases): Crucial for bread production, improving dough consistency, volume, and crumb softness. Their application is widespread due to the fundamental role of starch in baking.

- Proteases: Used to modify gluten, improve dough extensibility, and enhance the texture of baked goods.

- Economic Growth: Sustained economic development in Brazil directly fuels consumer spending on food products, including bakery items.

- Consumer Preference for Natural Ingredients: Enzymes are perceived as natural processing aids, aligning with the growing consumer demand for clean-label products.

- Technological Advancements in Baking: The bakery sector is actively adopting new technologies to improve efficiency and product quality, creating a receptive environment for enzyme solutions.

The Meat Poultry and Seafood Products segment is another significant contributor, expected to hold an estimated 25% market share in 2025. This dominance is driven by Brazil's strong position as a global exporter and producer of meat and poultry. Enzymes in this sector are vital for tenderization, flavor development, and improving the processing efficiency of various meat and seafood products.

- Proteases: Widely used for meat tenderization, enhancing palatability and reducing cooking times.

- Lipases: Contribute to flavor development and texture improvement in processed meat products.

- Infrastructure Development: Robust cold chain infrastructure supports the handling and distribution of meat, poultry, and seafood products, indirectly benefiting enzyme applications.

- Rising Protein Consumption: Increasing global and domestic demand for protein-rich diets fuels the growth of this segment.

The Dairy and Frozen Desserts segment, expected to capture approximately 20% of the market share in 2025, is witnessing steady growth due to the increasing popularity of functional dairy products and innovative frozen desserts. Enzymes play a critical role in lactose reduction, texture modification, and flavor enhancement in this diverse segment.

- Lactases: Essential for producing lactose-free dairy products, catering to a growing population with lactose intolerance.

- Other Types (e.g., Transglutaminase): Used for improving the texture and stability of dairy products and frozen desserts.

- Health and Wellness Trends: The demand for healthier dairy options, such as reduced-fat and high-protein products, is driving enzyme adoption.

Beverages represent an important segment, holding an estimated 15% market share in 2025. Enzymes are instrumental in juice clarification, fruit preparation, brewing, and the production of specialty beverages, contributing to improved yield and quality.

- Pectinases: Widely used in fruit juice production for clarification and increased yield.

- Amylases and Glucanases: Crucial in the brewing industry for starch conversion and fermentation.

- Growing Demand for Processed Beverages: The expansion of the ready-to-drink beverage market fuels enzyme demand.

The Confectionery segment, with an estimated 5% market share in 2025, and Other Applications (e.g., animal feed, pharmaceuticals) comprising the remaining 5%, are also crucial for a holistic market understanding. While smaller in immediate share, these segments represent emerging growth areas with significant future potential.

Brazil Food Enzymes Industry Product Developments

Recent product developments in the Brazil Food Enzymes Industry are characterized by a focus on enhanced specificity, improved stability, and broader application ranges. Innovations in enzyme engineering are yielding highly efficient Carbohydrases for better starch conversion in baking and brewing, alongside advanced Proteases offering superior meat tenderization with minimized side effects. The development of novel enzyme cocktails tailored for specific processing challenges in Dairy and Frozen Desserts, such as improving ice crystal formation or enhancing protein functionality, is also gaining traction. Furthermore, the industry is witnessing a surge in the development of enzymes derived from sustainable sources and through advanced biotechnological processes, aligning with the global trend towards greener food production. These advancements directly address the growing demand for clean-label ingredients and improved food quality, providing competitive edges for manufacturers and end-users alike.

Challenges in the Brazil Food Enzymes Industry Market

The Brazil Food Enzymes Industry Market faces several challenges that could impact its growth trajectory. Regulatory hurdles, although evolving, can still present complexities in terms of approval processes for novel enzymes, leading to extended market entry times. Supply chain disruptions, exacerbated by Brazil's vast geography and logistical complexities, can affect the timely and cost-effective delivery of enzyme products. Furthermore, the competitive pressure from established chemical additives, which may offer lower upfront costs in certain applications, remains a significant restraint. The cost of advanced enzyme technologies and the need for specialized technical expertise for optimal implementation can also pose barriers for smaller food manufacturers. Quantifiable impacts include potential delays in new product launches, increased operational costs for distributors, and a slower adoption rate in certain niche applications.

Forces Driving Brazil Food Enzymes Industry Growth

Several powerful forces are driving the growth of the Brazil Food Enzymes Industry. The escalating consumer demand for natural, clean-label, and healthier food products is a primary catalyst, as enzymes are perceived as natural processing aids. Technological advancements in enzyme discovery, engineering, and production are leading to more efficient, cost-effective, and versatile enzyme solutions. Brazil's position as a major global food producer and exporter creates a substantial domestic market and a strong export potential for enzyme-enhanced food products. Government initiatives promoting food safety, quality, and sustainable agricultural practices indirectly support the adoption of enzyme technologies. The increasing adoption of enzymes in the Bakery, Dairy, and Meat Poultry and Seafood Products sectors, driven by their ability to improve product quality, texture, and shelf life, further fuels market expansion.

Challenges in the Brazil Food Enzymes Industry Market

Long-term growth catalysts for the Brazil Food Enzymes Industry are deeply intertwined with continuous innovation and strategic market expansion. The ongoing pursuit of novel enzyme functionalities, such as those contributing to enhanced nutrient bioavailability or improved digestibility, will unlock new market segments. Strategic partnerships between enzyme manufacturers and food processing companies are crucial for co-developing tailored solutions that address specific industry needs, fostering deeper integration of enzymatic technologies. Expanding the application of enzymes into emerging categories like plant-based alternatives and functional foods will broaden the market’s reach. Furthermore, investments in R&D focused on improving enzyme stability and efficacy in challenging processing environments will solidify their position as indispensable tools for the food industry.

Emerging Opportunities in Brazil Food Enzymes Industry

Emerging opportunities in the Brazil Food Enzymes Industry are plentiful and diverse. The burgeoning plant-based food sector presents a significant avenue, with enzymes being crucial for improving the texture, flavor, and nutritional profile of meat and dairy alternatives. Growing consumer interest in gut health and functional foods is creating demand for enzymes that enhance digestibility and nutrient absorption, particularly in the Dairy and Frozen Desserts and Beverages segments. The development of enzymes for valorizing food processing by-products, contributing to a circular economy, offers both environmental and economic advantages. Furthermore, the increasing demand for personalized nutrition and specialized dietary solutions opens doors for enzyme applications in niche markets. The expansion of export markets, particularly within Latin America, also presents substantial growth potential for Brazilian enzyme producers.

Leading Players in the Brazil Food Enzymes Industry Sector

- Biogenoci Co Ltd

- Chr Hansen Holding AS

- DuPont de Nemours Inc

- Koninklijke DSM NV

- Novozymes AS

- ABF Ingredients

Key Milestones in Brazil Food Enzymes Industry Industry

- 2019: Introduction of novel protease enzymes for improved meat tenderization, significantly enhancing yield for processors.

- 2020: Launch of specialized carbohydrase enzyme blends for the Brazilian bakery sector, leading to improved dough handling and crumb structure.

- 2021: Significant investment by a major player in expanding production capacity for lipases to meet growing demand in the dairy and savory food markets.

- 2022: Regulatory approval for a new generation of lactase enzymes, facilitating the wider production of lactose-free dairy products in Brazil.

- 2023: Strategic collaboration between a leading enzyme producer and a Brazilian beverage company to develop enzymes for enhanced juice clarification and flavor profiles.

- 2024: Increased focus on developing enzymes from sustainable, locally sourced raw materials to address environmental concerns and reduce import dependency.

Strategic Outlook for Brazil Food Enzymes Industry Market

The strategic outlook for the Brazil Food Enzymes Industry Market is highly optimistic, characterized by robust growth accelerators. The continued consumer-driven demand for healthier and natural food products will remain a primary growth engine. Innovations in enzyme technology, leading to more sustainable and cost-effective solutions, will further solidify their market position. Strategic collaborations and potential mergers and acquisitions are expected to shape the competitive landscape, enabling companies to expand their product portfolios and market reach. Brazil's status as a major food producer and exporter presents significant opportunities for both domestic consumption and international sales, making it a key market for global enzyme manufacturers. The industry is well-positioned to capitalize on emerging trends in plant-based diets, functional foods, and sustainable food processing.

Brazil Food Enzymes Industry Segmentation

-

1. Type

- 1.1. Carbohydrases

- 1.2. Proteases

- 1.3. Lipases

- 1.4. Other Types

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy and Frozen Desserts

- 2.4. Meat Poultry and Seafood Products

- 2.5. Beverages

- 2.6. Other Applications

Brazil Food Enzymes Industry Segmentation By Geography

- 1. Brazil

Brazil Food Enzymes Industry Regional Market Share

Geographic Coverage of Brazil Food Enzymes Industry

Brazil Food Enzymes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Rising Demand for Processed Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Food Enzymes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbohydrases

- 5.1.2. Proteases

- 5.1.3. Lipases

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy and Frozen Desserts

- 5.2.4. Meat Poultry and Seafood Products

- 5.2.5. Beverages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Biogenoci Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chr Hansen Holding AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DuPont de Nemours Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke DSM NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Novozymes AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ABF Ingredients

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Biogenoci Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: Brazil Food Enzymes Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Food Enzymes Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Food Enzymes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Brazil Food Enzymes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Brazil Food Enzymes Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil Food Enzymes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Brazil Food Enzymes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Brazil Food Enzymes Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Food Enzymes Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Brazil Food Enzymes Industry?

Key companies in the market include Biogenoci Co Ltd*List Not Exhaustive, Chr Hansen Holding AS, DuPont de Nemours Inc, Koninklijke DSM NV, Novozymes AS, ABF Ingredients.

3. What are the main segments of the Brazil Food Enzymes Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Rising Demand for Processed Food.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Food Enzymes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Food Enzymes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Food Enzymes Industry?

To stay informed about further developments, trends, and reports in the Brazil Food Enzymes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence