Key Insights

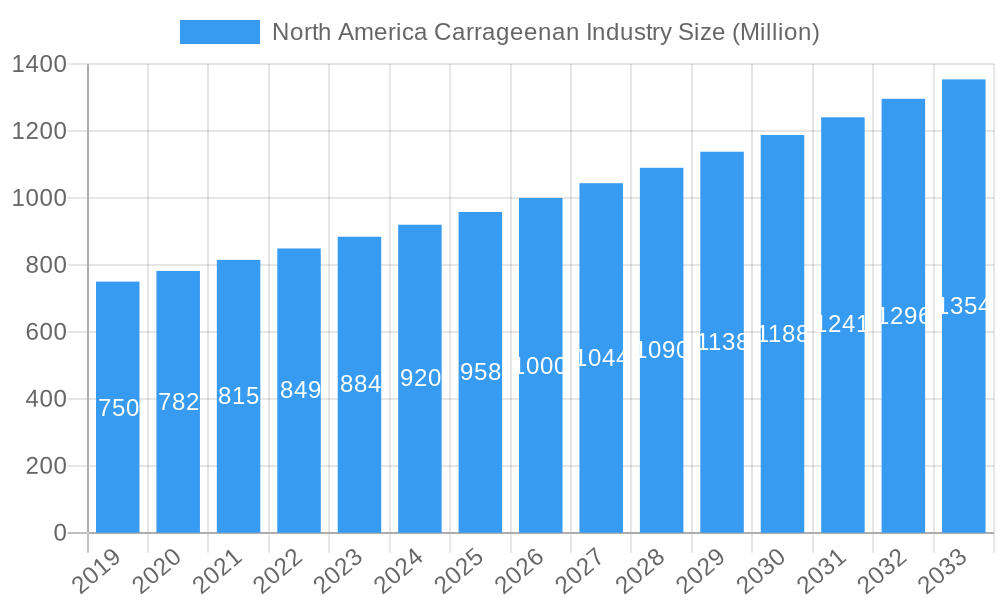

The North America Carrageenan Industry is poised for robust expansion, driven by a Compound Annual Growth Rate (CAGR) of 4.78% from 2019 to 2033, with the market size projected to reach approximately $XXX million by 2025. This growth is primarily fueled by the increasing demand for natural hydrocolloids across diverse applications, particularly in the food and beverage sector. The versatility of carrageenan, encompassing Kappa, Iota, and Lambda types, allows it to function as a gelling, thickening, and stabilizing agent in dairy products like ice cream and yogurt, meat and poultry products for texture enhancement, and beverages for viscosity modification. Furthermore, the rising consumer preference for clean-label ingredients and the expanding market for plant-based foods are significant tailwinds for carrageenan adoption. The pharmaceutical and nutraceutical industries are also contributing to market growth through their use of carrageenan in drug delivery systems and dietary supplements, leveraging its biocompatibility and unique functional properties.

North America Carrageenan Industry Market Size (In Million)

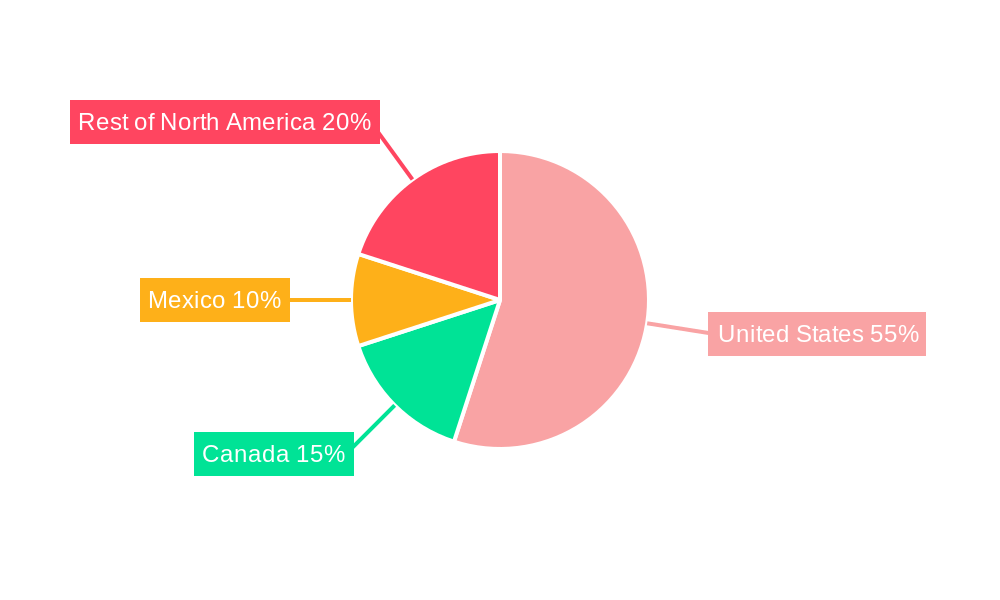

The market's trajectory is further shaped by evolving consumer trends and technological advancements. The personal care and cosmetics sector is increasingly incorporating carrageenan for its moisturizing and emulsifying capabilities in skincare products and lotions. While the industry benefits from strong demand, it also faces certain restraints. Fluctuations in raw material prices, particularly seaweed, and the ongoing development of alternative hydrocolloids can pose challenges. Regulatory scrutiny regarding the health impacts of certain carrageenan derivatives also warrants attention. Geographically, the United States is expected to dominate the North American market due to its large consumer base and well-established food processing industry. Canada and Mexico, along with the broader Rest of North America, are anticipated to witness steady growth, driven by similar demand trends and expanding food and beverage manufacturing capabilities. Key players such as DuPont de Nemours Inc., Ingredion Inc., and Cargill Inc. are actively innovating and expanding their product portfolios to cater to these evolving market dynamics and maintain their competitive edge.

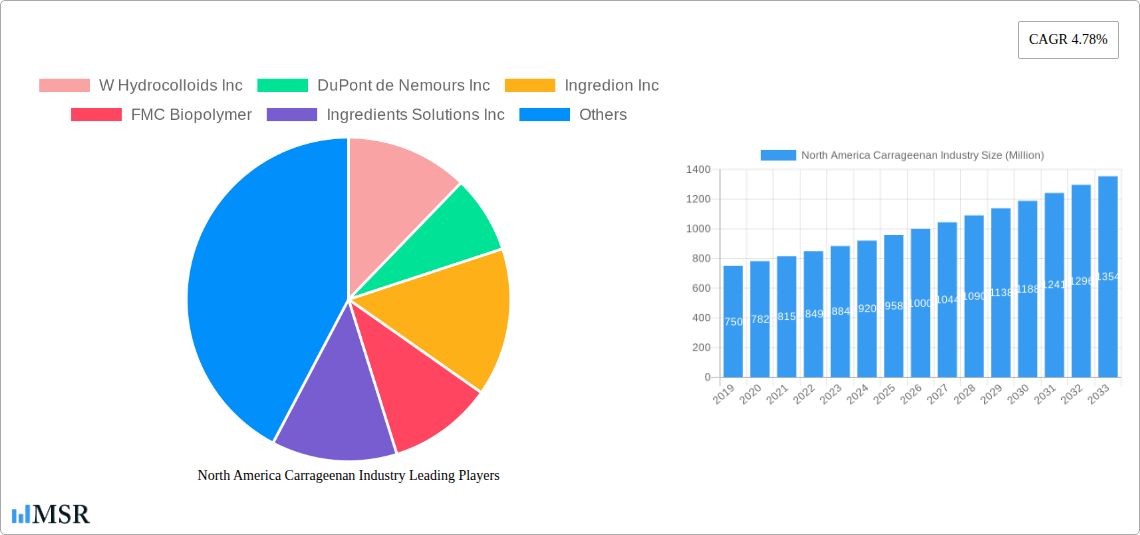

North America Carrageenan Industry Company Market Share

Gain comprehensive insights into the North America carrageenan market, a vital ingredient segment within the global hydrocolloids industry. This in-depth report, covering the study period 2019–2033 and analyzing historical data from 2019–2024, with the base year and estimated year as 2025, and a forecast period of 2025–2033, delivers actionable intelligence for industry stakeholders. We dissect market concentration, analyze key trends and growth drivers, identify dominant segments, explore product innovations, and pinpoint challenges and emerging opportunities. With an estimated market size of $XXX Million in 2025, the North America carrageenan industry is poised for significant expansion.

North America Carrageenan Industry Market Concentration & Dynamics

The North America carrageenan industry exhibits moderate to high market concentration, with key players like DuPont de Nemours Inc., Ingredion Inc., CP Kelco U S Inc., and Cargill Inc. dominating the landscape. These entities leverage extensive R&D capabilities and robust distribution networks to maintain their competitive edge. The innovation ecosystem is driven by advancements in extraction technologies and the development of novel carrageenan formulations for specialized applications. Regulatory frameworks, primarily governed by the FDA in the United States, ensure product safety and efficacy, influencing product development and market access. The presence of substitute products like pectin, agar-agar, and xanthan gum necessitates continuous innovation and cost-efficiency from carrageenan manufacturers. End-user trends, particularly the growing demand for clean-label and plant-based ingredients, are reshaping product portfolios. Mergers & Acquisitions (M&A) activities, with an estimated XX M&A deal counts between 2019 and 2024, have been strategic, aimed at expanding product offerings, geographical reach, and technological expertise. For instance, W Hydrocolloids Inc. and Ingredients Solutions Inc. are actively participating in this dynamic.

North America Carrageenan Industry Industry Insights & Trends

The North America carrageenan industry is experiencing robust growth, projected to reach $XXX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by several market growth drivers, most notably the escalating demand for processed foods and beverages. The versatility of carrageenan as a gelling agent, thickener, stabilizer, and emulsifier makes it indispensable in a wide array of food products. The increasing consumer preference for convenience foods and the expanding ready-to-eat meal market further bolster its consumption.

Technological disruptions are playing a pivotal role in shaping the industry. Innovations in extraction and purification processes are leading to higher quality carrageenan with improved functionalities, catering to specific application needs. For example, advancements in seaweed cultivation and processing techniques are enhancing yield and sustainability. Furthermore, the development of specialized carrageenan blends tailored for dairy products, meat and poultry, and beverages is a significant trend.

Evolving consumer behaviors are also a key influence. The rising awareness regarding health and wellness, coupled with a preference for natural ingredients, is driving demand for carrageenan derived from sustainable sources. The "clean label" movement encourages manufacturers to use ingredients perceived as natural and minimally processed, a trend that favors carrageenan. The growing vegan and vegetarian populations are also contributing to the demand, as carrageenan serves as an effective plant-based alternative to animal-derived stabilizers. The pharmaceutical and nutraceutical sectors, appreciating carrageenan's unique properties for drug delivery and dietary supplements, represent a substantial and growing market segment.

Key Markets & Segments Leading North America Carrageenan Industry

The United States stands as the most dominant market within the North America carrageenan industry, driven by its large consumer base, advanced food processing infrastructure, and high disposable income. The robust presence of major food and beverage manufacturers, coupled with a strong emphasis on innovation and product development, solidifies its leading position. Canada and Mexico represent significant and growing markets, benefiting from expanding food processing sectors and increasing adoption of processed food products. The Rest of North America, while smaller, also contributes to the overall market dynamics.

Within the Application segments, Food and Beverage commands the largest market share, primarily due to the extensive use of carrageenan in:

- Dairy Products: Carrageenan is crucial for achieving desired texture and stability in products like ice cream, yogurt, milk beverages, and processed cheese. The constant demand for novel dairy alternatives and creamy textures propels its use in this sub-segment.

- Meat and Poultry Products: Used as a binder and texturizer in processed meats, sausages, and hams, carrageenan enhances water-holding capacity and improves product consistency.

- Beverages: In beverages, carrageenan acts as a stabilizer and thickener, preventing sedimentation and ensuring uniform dispersion of ingredients, particularly in chocolate milk and plant-based milk alternatives.

The Pharmaceutical and Nutraceutical segment is a rapidly growing area, driven by carrageenan's applications in:

- Capsules for pharmaceutical formulations.

- Thickening and stabilizing agents in nutraceutical products and dietary supplements.

- Its biocompatibility and ability to form gels make it ideal for controlled-release drug delivery systems.

The Personal Care and Cosmetics segment also utilizes carrageenan for its thickening and emulsifying properties in products like lotions, creams, and toothpaste.

By Type, Kappa carrageenan generally leads in market volume due to its strong gelling properties, widely used in dairy desserts and meat products. Iota carrageenan is favored for its elastic gel formation, finding applications in confectionery and softer gels. Lambda carrageenan, while less common in food, is recognized for its thickening capabilities in specific industrial and pharmaceutical applications.

North America Carrageenan Industry Product Developments

Leading players like DuPont de Nemours Inc. and CP Kelco U S Inc. are at the forefront of carrageenan product innovation. Recent developments focus on enhancing carrageenan's functionality for specific applications, such as creating carrageenan variants with improved heat stability for retort processing or developing blends that offer synergistic texturizing effects. There's a growing emphasis on developing carrageenan grades derived from sustainably sourced seaweed, aligning with consumer demand for eco-friendly ingredients. These innovations aim to provide superior texture, stability, and mouthfeel in a diverse range of food, pharmaceutical, and cosmetic products, offering manufacturers a competitive edge in a dynamic market.

Challenges in the North America Carrageenan Industry Market

The North America carrageenan industry faces several challenges that impact its growth trajectory. Regulatory hurdles, while ensuring safety, can sometimes lead to lengthy approval processes for new applications or formulations. Supply chain volatility, particularly concerning the availability and price of raw seaweed, can affect production costs and market stability. The ongoing debate and consumer perception regarding the health implications of carrageenan, despite scientific consensus on its safety in regulated amounts, continue to pose a significant challenge. Furthermore, increasing competitive pressures from alternative hydrocolloids and the drive for cost-effective solutions necessitate continuous optimization of production and supply chain management.

Forces Driving North America Carrageenan Industry Growth

Several key forces are driving the expansion of the North America carrageenan industry. The consistent growth of the processed food and beverage sector, particularly in segments like dairy, meat, and ready-to-eat meals, provides a strong foundational demand. The rising popularity of plant-based diets and dairy alternatives significantly boosts the need for carrageenan as a vegan-friendly stabilizer and texturizer. Advancements in extraction and purification technologies are enabling the development of higher-quality carrageenan with tailored functionalities, opening up new application possibilities. Moreover, the increasing use of carrageenan in the pharmaceutical and nutraceutical industries for its unique gelling and stabilizing properties presents a significant growth avenue.

Challenges in the North America Carrageenan Industry Market

Long-term growth catalysts for the North America carrageenan industry lie in sustained innovation and strategic market expansion. Continued research and development into novel carrageenan functionalities, such as enhanced emulsification or improved resistance to shear, will unlock new application areas. Strategic partnerships between carrageenan manufacturers and food technology companies can foster collaborative product development, addressing evolving consumer demands for healthier and more functional foods. Exploring untapped potential within the pharmaceutical sector for advanced drug delivery systems and expanding into niche personal care applications represent significant long-term growth opportunities. Furthermore, investing in sustainable sourcing and transparent production processes can bolster consumer trust and brand loyalty.

Emerging Opportunities in North America Carrageenan Industry

Emerging opportunities within the North America carrageenan industry are abundant. The growing demand for plant-based and "free-from" products presents a significant opening for carrageenan as a natural and effective stabilizer. Innovations in bioprocessing and fermentation could lead to more sustainable and cost-effective production methods. The increasing focus on functional foods and personalized nutrition offers potential for carrageenan in specialized dietary supplements and therapeutic products. Furthermore, exploring novel applications in areas such as biodegradable packaging or bioplastics could diversify the market and create new revenue streams, driven by environmental consciousness and technological advancements.

Leading Players in the North America Carrageenan Industry Sector

- W Hydrocolloids Inc.

- DuPont de Nemours Inc.

- Ingredion Inc.

- FMC Biopolymer

- Ingredients Solutions Inc.

- Cargill Inc.

- MCPI Corporation

- Marcel Trading Corporation

- CP Kelco U S Inc.

Key Milestones in North America Carrageenan Industry Industry

- 2019: Increased R&D focus on plant-based and vegan applications of carrageenan.

- 2020: Emergence of new carrageenan blends for improved texture in dairy alternatives.

- 2021: Significant investment in sustainable seaweed sourcing initiatives by major players.

- 2022: Growing adoption of carrageenan in pharmaceutical drug delivery systems.

- 2023: Enhanced regulatory clarity for carrageenan use in specific food categories.

- 2024: Expansion of production capacities by key manufacturers to meet growing demand.

Strategic Outlook for North America Carrageenan Industry Market

The strategic outlook for the North America carrageenan market is overwhelmingly positive, driven by its intrinsic versatility and alignment with major consumer trends. Growth accelerators include the persistent demand from the expanding food and beverage industry, the burgeoning plant-based movement, and the increasing applications in pharmaceuticals and nutraceuticals. Manufacturers focusing on innovation, sustainability, and clear communication regarding the safety and benefits of carrageenan are best positioned for success. Strategic investments in advanced processing technologies and exploring new market niches will be crucial for capitalizing on future market potential and securing a dominant position in this evolving industry.

North America Carrageenan Industry Segmentation

-

1. Type

- 1.1. Kappa

- 1.2. Iota

- 1.3. Lambda

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Dairy Products

- 2.1.2. Meat and Poultry Products

- 2.1.3. Beverages

- 2.2. Personal Care and Cosmetics

- 2.3. Pharmaceutical and Nutraceutical

- 2.4. Other Applications

-

2.1. Food and Beverage

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Carrageenan Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Carrageenan Industry Regional Market Share

Geographic Coverage of North America Carrageenan Industry

North America Carrageenan Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector is Progressing at a Rapid Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Carrageenan Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Kappa

- 5.1.2. Iota

- 5.1.3. Lambda

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Dairy Products

- 5.2.1.2. Meat and Poultry Products

- 5.2.1.3. Beverages

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Pharmaceutical and Nutraceutical

- 5.2.4. Other Applications

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Carrageenan Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Kappa

- 6.1.2. Iota

- 6.1.3. Lambda

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.1.1. Dairy Products

- 6.2.1.2. Meat and Poultry Products

- 6.2.1.3. Beverages

- 6.2.2. Personal Care and Cosmetics

- 6.2.3. Pharmaceutical and Nutraceutical

- 6.2.4. Other Applications

- 6.2.1. Food and Beverage

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Carrageenan Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Kappa

- 7.1.2. Iota

- 7.1.3. Lambda

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.1.1. Dairy Products

- 7.2.1.2. Meat and Poultry Products

- 7.2.1.3. Beverages

- 7.2.2. Personal Care and Cosmetics

- 7.2.3. Pharmaceutical and Nutraceutical

- 7.2.4. Other Applications

- 7.2.1. Food and Beverage

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Carrageenan Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Kappa

- 8.1.2. Iota

- 8.1.3. Lambda

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.1.1. Dairy Products

- 8.2.1.2. Meat and Poultry Products

- 8.2.1.3. Beverages

- 8.2.2. Personal Care and Cosmetics

- 8.2.3. Pharmaceutical and Nutraceutical

- 8.2.4. Other Applications

- 8.2.1. Food and Beverage

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Carrageenan Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Kappa

- 9.1.2. Iota

- 9.1.3. Lambda

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.1.1. Dairy Products

- 9.2.1.2. Meat and Poultry Products

- 9.2.1.3. Beverages

- 9.2.2. Personal Care and Cosmetics

- 9.2.3. Pharmaceutical and Nutraceutical

- 9.2.4. Other Applications

- 9.2.1. Food and Beverage

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 W Hydrocolloids Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DuPont de Nemours Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ingredion Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 FMC Biopolymer

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ingredients Solutions Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cargill Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MCPI Corporation*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Marcel Trading Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CP Kelco U S Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 W Hydrocolloids Inc

List of Figures

- Figure 1: North America Carrageenan Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Carrageenan Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Carrageenan Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Carrageenan Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Carrageenan Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Carrageenan Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Carrageenan Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Carrageenan Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Carrageenan Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Carrageenan Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Carrageenan Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Carrageenan Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: North America Carrageenan Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Carrageenan Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Carrageenan Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: North America Carrageenan Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: North America Carrageenan Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Carrageenan Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Carrageenan Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: North America Carrageenan Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: North America Carrageenan Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Carrageenan Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Carrageenan Industry?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the North America Carrageenan Industry?

Key companies in the market include W Hydrocolloids Inc, DuPont de Nemours Inc, Ingredion Inc, FMC Biopolymer, Ingredients Solutions Inc, Cargill Inc, MCPI Corporation*List Not Exhaustive, Marcel Trading Corporation, CP Kelco U S Inc.

3. What are the main segments of the North America Carrageenan Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Pharmaceutical Sector is Progressing at a Rapid Pace.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Carrageenan Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Carrageenan Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Carrageenan Industry?

To stay informed about further developments, trends, and reports in the North America Carrageenan Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence