Key Insights

The Asia-Pacific Omega-3 Products Market is projected for substantial growth, expected to reach $2.11 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.77%. This expansion is driven by heightened consumer awareness of omega-3 benefits for cardiovascular health, cognitive function, and inflammation management. The rising incidence of lifestyle diseases and an aging demographic further boost demand for preventative health solutions, solidifying omega-3s' role in dietary strategies. Increased disposable incomes and a growing middle class, particularly in China and India, are enhancing purchasing power for premium wellness products. The market features dynamic product innovation in functional foods and dietary supplements, addressing diverse health needs. Infant nutrition also represents a significant growth segment as parents prioritize early development.

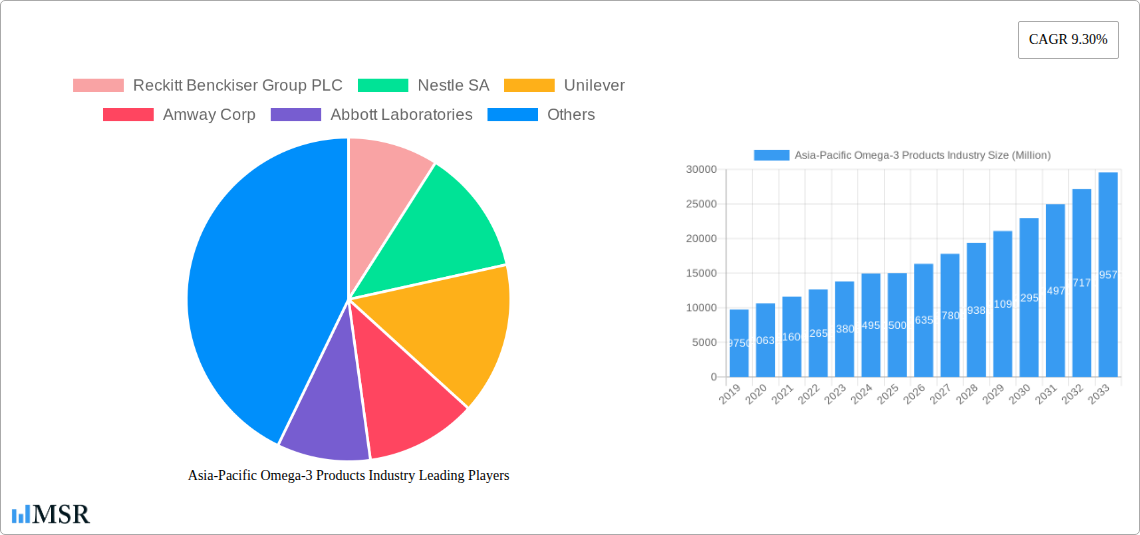

Asia-Pacific Omega-3 Products Industry Market Size (In Billion)

Consumer preference for natural and sustainable omega-3 sources, including algal and krill-based products, is escalating market expansion. Online retail is a key distribution channel, offering convenience and accessibility, while traditional channels like grocery stores and pharmacies remain vital, especially in urban areas. Leading companies are investing in product development, marketing, and distribution network expansion. Potential challenges include volatile raw material prices and varying regulatory environments. However, a strong emphasis on health and wellness is anticipated to drive sustained market growth.

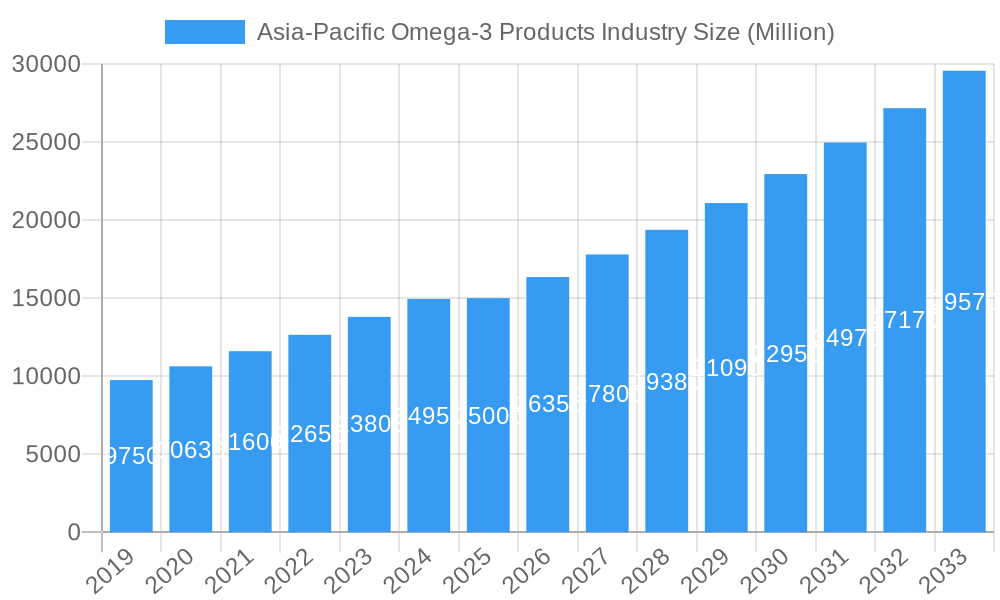

Asia-Pacific Omega-3 Products Industry Company Market Share

Asia-Pacific Omega-3 Products Industry Market Insights and Strategic Outlook (2019-2033)

This comprehensive report delves deep into the burgeoning Asia-Pacific Omega-3 Products Industry, providing granular insights into market dynamics, growth drivers, and strategic opportunities. Covering the study period of 2019–2033, with 2025 as the base and estimated year, and a forecast period of 2025–2033, this analysis is essential for stakeholders seeking to navigate and capitalize on this rapidly expanding market. We examine key segments including Functional Food, Dietary Supplements, Infant Nutrition, Pet Food and Feed, and Pharmaceuticals, alongside distribution channels like Grocery Retailers, Pharmacies and Drug Stores, Internet Retailing, and Other Distribution Channels. Geographical focus encompasses China, India, Japan, Australia, and the Rest of Asia-Pacific.

Asia-Pacific Omega-3 Products Industry Market Concentration & Dynamics

The Asia-Pacific Omega-3 Products Industry exhibits a moderate to high market concentration, characterized by the presence of global giants and a growing number of regional and specialized players. Key companies like Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, and Herbalife Nutrition command significant market share, particularly in dietary supplements and infant nutrition. Innovation ecosystems are vibrant, driven by increasing consumer awareness of health benefits and advancements in extraction and formulation technologies. Regulatory frameworks vary across countries, with stringent standards in Japan and Australia contrasting with evolving regulations in India and China. Substitute products, primarily other fatty acids and general multivitamins, pose a challenge but are increasingly differentiated by the specific health benefits attributed to Omega-3s. End-user trends are strongly aligned with rising disposable incomes, aging populations, and a proactive approach to preventive healthcare. Merger and acquisition (M&A) activities are expected to accelerate as larger players seek to expand their portfolios, gain access to new technologies, or penetrate underserved markets. For instance, the [XX] M&A deals recorded in the historical period (2019-2024) are projected to increase by [XX]% during the forecast period.

Asia-Pacific Omega-3 Products Industry Industry Insights & Trends

The Asia-Pacific Omega-3 Products Industry is poised for substantial growth, driven by a confluence of factors that underscore its robust market potential. The market size is estimated to reach USD [XXX] Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of [XX]% during the forecast period of 2025–2033. This expansion is primarily fueled by a growing health-conscious consumer base across the region, with increasing awareness of the critical roles Omega-3 fatty acids play in cardiovascular health, cognitive function, and inflammatory response. Technological disruptions are revolutionizing product development, leading to enhanced bioavailability and diverse delivery formats, from traditional capsules to innovative functional foods and beverages. Evolving consumer behaviors are evident in the rising demand for natural and sustainable sources of Omega-3s, including algae-based alternatives, catering to both health and environmental concerns. The burgeoning middle class in countries like India and China is a significant driver, with increased disposable incomes enabling greater spending on health and wellness products. Furthermore, the pharmaceutical segment is witnessing increased research and development into Omega-3s for specific therapeutic applications, further propelling market growth. The aging population across the Asia-Pacific region also contributes significantly, as older demographics seek to manage age-related health conditions. The expansion of online retail channels is democratizing access to these products, reaching remote areas and catering to the convenience-driven preferences of modern consumers.

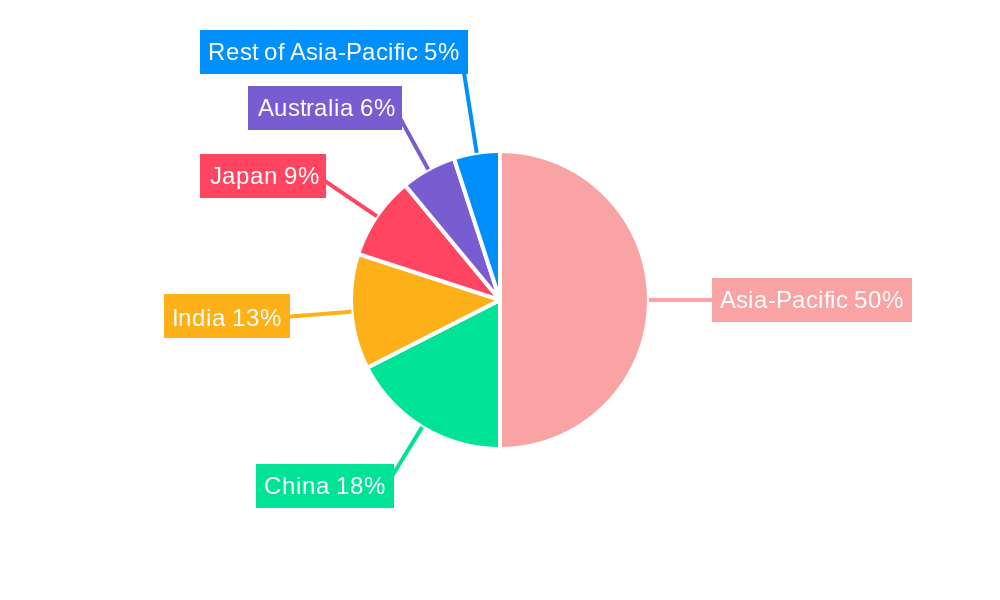

Key Markets & Segments Leading Asia-Pacific Omega-3 Products Industry

The Asia-Pacific region stands as a powerhouse for the Omega-3 Products Industry, with China and India emerging as the dominant markets due to their massive populations and rapidly growing economies. Within product types, Dietary Supplements currently lead the market, driven by widespread consumer adoption and a broad range of product offerings. However, Infant Nutrition is exhibiting the fastest growth trajectory, reflecting increased parental focus on early childhood development and neurological health.

Dominant Regions & Countries:

- China: Boasts the largest market share due to its immense population, rising disposable incomes, and a significant surge in health and wellness awareness. Government initiatives promoting healthy living further bolster demand.

- India: Exhibits robust growth driven by a growing middle class, increasing prevalence of lifestyle diseases, and a strong traditional belief in the benefits of natural health supplements.

- Japan: A mature market with high consumer awareness of Omega-3 benefits, particularly for cardiovascular and cognitive health, contributing to a steady demand.

- Australia: Characterized by a well-established health and wellness culture and a higher per capita consumption of dietary supplements.

Dominant Product Segments:

- Dietary Supplements: This segment benefits from established consumer trust, a wide variety of formulations (capsules, softgels, liquids), and targeted health claims (heart health, brain function). The market size for dietary supplements is estimated at USD [XXX] Million in 2025.

- Infant Nutrition: Experiencing significant growth due to increasing parental concern for infant cognitive development and early-life health benefits associated with DHA and EPA. This segment is projected to grow at a CAGR of [XX]%.

- Functional Food: Gaining traction as manufacturers integrate Omega-3s into everyday food items like fortified dairy products, cereals, and snacks, offering a convenient way for consumers to increase intake.

Dominant Distribution Channels:

- Internet Retailing: This channel is experiencing explosive growth, offering convenience, wider product selection, and competitive pricing. It's particularly strong in urban areas and among younger demographics. The market share of internet retailing is projected to reach [XX]% by 2033.

- Pharmacies and Drug Stores: Remain a crucial channel due to the perceived credibility and expert advice available, especially for health-conscious consumers seeking premium or therapeutic-grade products.

- Grocery Retailers: Increasing inclusion of Omega-3 fortified products and supplements in mainstream grocery stores is expanding accessibility.

Asia-Pacific Omega-3 Products Industry Product Developments

Product innovation in the Asia-Pacific Omega-3 Products Industry is characterized by a focus on enhanced bioavailability, novel delivery systems, and diversification into new product categories. Companies are developing microencapsulated Omega-3s for improved taste and stability in food applications, alongside advanced formulations in softgels and chewable forms for better consumer compliance. The development of vegan and sustainable Omega-3 sources, particularly from microalgae, is gaining significant market traction, catering to a growing segment of environmentally conscious consumers and those seeking alternatives to fish-based oils. These advancements are creating competitive edges by addressing consumer preferences for taste, efficacy, and ethical sourcing.

Challenges in the Asia-Pacific Omega-3 Products Industry Market

The Asia-Pacific Omega-3 Products Industry faces several hurdles, including supply chain volatility impacting raw material sourcing, particularly for fish oil derivatives. Regulatory variations across different countries create complexities for market entry and product standardization, with varying approval processes and labeling requirements. Intense competition from established players and emerging brands can lead to price pressures, affecting profit margins. Furthermore, consumer education gaps regarding the specific benefits and optimal dosage of Omega-3s, as well as concerns about potential contaminants in fish-based products, continue to be challenges that require targeted marketing and clear communication strategies. The estimated impact of these challenges on market growth is projected to be a [XX]% slowdown in specific sub-segments if not addressed proactively.

Forces Driving Asia-Pacific Omega-3 Products Industry Growth

Several powerful forces are propelling the Asia-Pacific Omega-3 Products Industry forward. Rising disposable incomes and a growing middle class across the region are enabling consumers to prioritize health and wellness products. Increasing health consciousness and awareness of the preventative health benefits of Omega-3s, particularly for cardiovascular and cognitive health, are key drivers. Technological advancements in extraction, purification, and formulation are leading to higher quality, more bioavailable, and palatable products. Furthermore, government initiatives promoting healthy lifestyles and dietary guidelines are indirectly supporting the market. The aging demographics in countries like Japan and South Korea also contribute significantly.

Challenges in the Asia-Pacific Omega-3 Products Industry Market

Long-term growth catalysts for the Asia-Pacific Omega-3 Products Industry are rooted in innovation and strategic market expansion. Continued research and development into new therapeutic applications of Omega-3s for chronic diseases will unlock significant market potential. Strategic partnerships and collaborations between ingredient suppliers, manufacturers, and retailers can enhance market reach and product development. Furthermore, expansion into emerging economies within Southeast Asia and greater penetration in rural areas of larger countries present substantial untapped opportunities. The development of novel delivery systems, such as ODF (Orally Disintegrating Films) and advanced gummies, will cater to evolving consumer preferences.

Emerging Opportunities in Asia-Pacific Omega-3 Products Industry

Emerging opportunities in the Asia-Pacific Omega-3 Products Industry are diverse and promising. The burgeoning demand for plant-based and sustainable Omega-3 sources from microalgae presents a significant growth avenue, aligning with environmental consciousness and dietary preferences. Personalized nutrition solutions, leveraging Omega-3s based on individual genetic profiles or health goals, are an emerging trend. The expansion of Omega-3 fortified pet food and feed is another substantial opportunity, as pet owners increasingly treat their animals as family members and invest in their health. Furthermore, the integration of Omega-3s into functional beverages and ready-to-eat meals offers a convenient way to increase consumer intake. The growing e-commerce landscape in the region facilitates direct-to-consumer sales and market penetration.

Leading Players in the Asia-Pacific Omega-3 Products Industry Sector

- Reckitt Benckiser Group PLC

- Nestle SA

- Unilever

- Amway Corp

- Abbott Laboratories

- Herbalife Nutrition

- Healthvit

- NOW Foods

- Nature's Bounty

- Solgar Inc.

Key Milestones in Asia-Pacific Omega-3 Products Industry Industry

- 2019: Increased regulatory scrutiny on fish oil quality and purity across several Asian countries.

- 2020: Surge in demand for Omega-3 dietary supplements driven by heightened health awareness during the global pandemic.

- 2021: Launch of innovative algae-based Omega-3 products catering to vegan and vegetarian consumers.

- 2022: Significant investment in R&D for Omega-3s in infant nutrition and cognitive health products.

- 2023: Expansion of internet retailing channels, leading to increased accessibility and competitive pricing.

- 2024: Growing focus on traceability and sustainability in Omega-3 sourcing.

Strategic Outlook for Asia-Pacific Omega-3 Products Industry Market

The strategic outlook for the Asia-Pacific Omega-3 Products Industry is overwhelmingly positive, driven by sustained consumer interest in health and wellness and continuous product innovation. Key growth accelerators include the expansion of functional food and beverage categories, offering convenient Omega-3 intake opportunities. Increased investment in clinical research validating the multifaceted health benefits of Omega-3s will further boost consumer confidence and market demand. Leveraging digital channels and e-commerce platforms will be crucial for reaching a wider audience and driving sales. Strategic opportunities also lie in tailoring products to specific demographic needs, such as the elderly and infants, and in developing premium, ethically sourced, and sustainable Omega-3 solutions. The market is expected to witness increased consolidation and strategic alliances as companies aim to capture a larger share of this dynamic and growing sector.

Asia-Pacific Omega-3 Products Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Dietary Supplements

- 1.3. Infant Nutrition

- 1.4. Pet Food and Feed

- 1.5. Pharmaceuticals

-

2. Distribution Channel

- 2.1. Grocery Retailers

- 2.2. Pharmacies and Drug Store

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Omega-3 Products Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Omega-3 Products Industry Regional Market Share

Geographic Coverage of Asia-Pacific Omega-3 Products Industry

Asia-Pacific Omega-3 Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Omega-3 supplements can be expensive compared to other nutritional products

- 3.4. Market Trends

- 3.4.1. Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Omega-3 Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Dietary Supplements

- 5.1.3. Infant Nutrition

- 5.1.4. Pet Food and Feed

- 5.1.5. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Grocery Retailers

- 5.2.2. Pharmacies and Drug Store

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reckitt Benckiser Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Herbalife Nutrition

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Healthvit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: Asia-Pacific Omega-3 Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Omega-3 Products Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Australia Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Omega-3 Products Industry?

The projected CAGR is approximately 7.77%.

2. Which companies are prominent players in the Asia-Pacific Omega-3 Products Industry?

Key companies in the market include Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, Herbalife Nutrition, Healthvit.

3. What are the main segments of the Asia-Pacific Omega-3 Products Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources.

7. Are there any restraints impacting market growth?

Omega-3 supplements can be expensive compared to other nutritional products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Omega-3 Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Omega-3 Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Omega-3 Products Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Omega-3 Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence