Key Insights

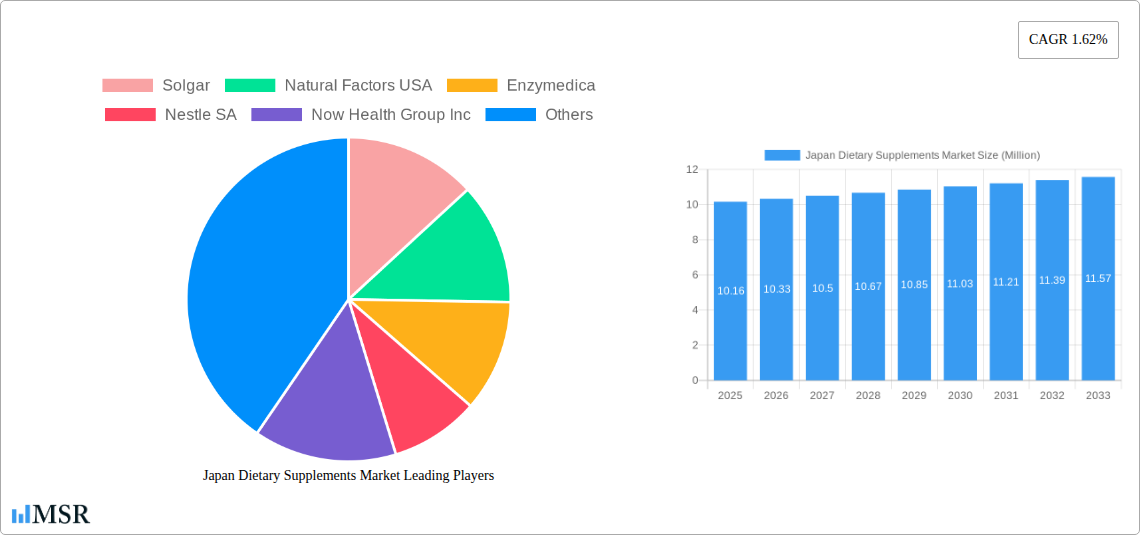

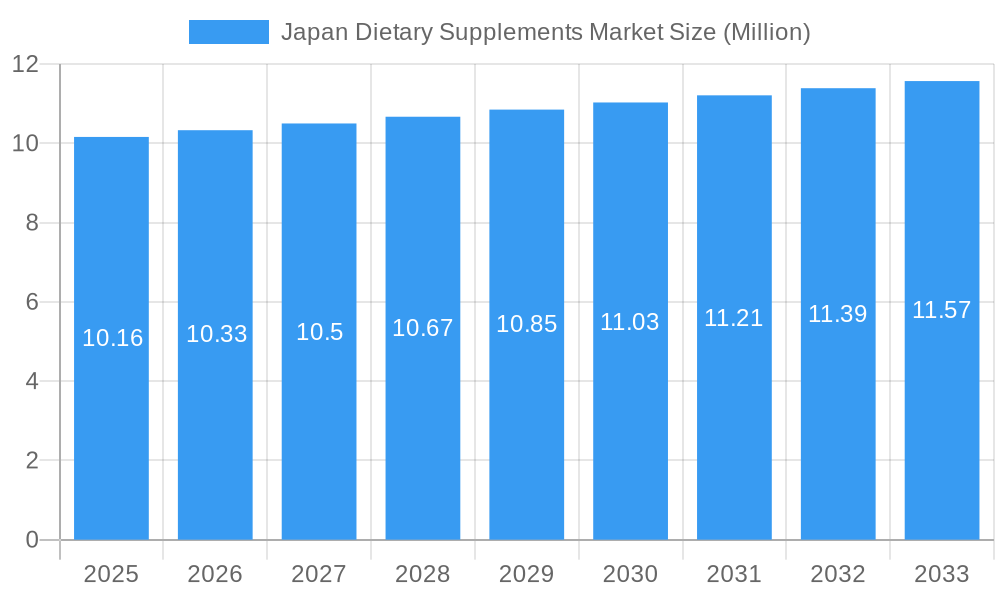

The Japanese dietary supplements market is poised for steady expansion, projected to reach a valuation of USD 10.16 million with a Compound Annual Growth Rate (CAGR) of 1.62% between 2025 and 2033. This growth is underpinned by a rising consumer awareness of preventative healthcare and a proactive approach to well-being, particularly within an aging population. Key drivers include the increasing demand for scientifically backed ingredients such as Vitamin K2, which is gaining traction for its bone and cardiovascular health benefits. The market is also witnessing a surge in demand for probiotics to support gut health and immunity, alongside protein and amino acid supplements for fitness and recovery. Fatty acids, crucial for overall health, also represent a significant segment. This growing preference for targeted nutritional support reflects a shift from general health maintenance to more specialized wellness solutions, indicating a mature yet evolving consumer base.

Japan Dietary Supplements Market Market Size (In Million)

Distribution channels are mirroring broader retail trends, with online retail channels experiencing robust growth due to their convenience and accessibility. Pharmacies and drug stores remain strong pillars, offering trusted advice and a wide selection, while supermarkets and hypermarkets cater to convenience-driven purchases. The market is characterized by a dynamic competitive landscape with established players like Solgar, Natural Factors USA, and Nestle SA, alongside local giants such as Amway Japan and Abbott Japan Co Ltd, all vying for market share. Future growth will likely be influenced by innovation in product formulations, increasingly personalized supplement recommendations driven by advancements in genomics and health tracking, and effective marketing strategies that highlight the specific benefits of various supplement types. Navigating potential restraints such as stringent regulatory frameworks and price sensitivity will be crucial for sustained success.

Japan Dietary Supplements Market Company Market Share

This in-depth report provides a definitive analysis of the Japan dietary supplements market, offering critical insights for industry stakeholders. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study meticulously examines market dynamics, growth drivers, emerging trends, and competitive landscapes. Leveraging extensive data from the historical period of 2019–2024, this report forecasts the Japan dietary supplements market size to reach USD XXX Million by 2025, with a projected CAGR of XX% from 2025 to 2033. Discover opportunities in vitamins and mineral supplements, including Vitamin K2 supplements, proteins and amino acids, fatty acids, probiotic supplements, and other specialized offerings. Understand distribution through supermarkets/hypermarkets, pharmacies/drug stores, and online retail channels.

Japan Dietary Supplements Market Market Concentration & Dynamics

The Japan dietary supplements market exhibits a moderate to high level of concentration, characterized by a blend of established global players and agile domestic manufacturers. Innovation is a key driver, with companies actively investing in research and development to introduce novel formulations and delivery systems, particularly in areas like personalized nutrition and functional ingredients. The regulatory framework, overseen by bodies like the Ministry of Health, Labour and Welfare (MHLW), emphasizes product safety and efficacy, influencing product development and market entry strategies. Substitute products, primarily from the food and beverage industry offering fortified options, present a minor challenge. End-user trends reveal a growing demand for preventive healthcare solutions, driven by an aging population and increased health consciousness. Merger and acquisition activities, while not as frequent as in some other mature markets, are strategic plays aimed at expanding product portfolios and market reach. Specific metrics such as an estimated market share dominance of XXX% by key players and a recent uptick in M&A deal counts of XX% in the past two years underscore these dynamics.

Japan Dietary Supplements Market Industry Insights & Trends

The Japan dietary supplements market is poised for significant expansion, propelled by a confluence of compelling factors. A rapidly aging demographic with a strong emphasis on proactive health management is a primary growth driver, increasing the demand for products that support vitality, cognitive function, and overall well-being. Rising disposable incomes and a growing middle class further fuel consumer spending on health-promoting products. Technological advancements are revolutionizing product development, with a surge in interest for personalized supplements, bioavailability-enhanced formulations, and innovative delivery methods such as gummies and effervescent tablets. The increasing prevalence of lifestyle-related diseases and a greater awareness of the link between diet and health are also significant catalysts. Furthermore, the growing acceptance of online retail channels for health products provides convenient access for consumers, expanding the market's reach. The market size is estimated at USD XXX Million in 2025, projected to grow at a robust CAGR of XX% during the forecast period, driven by these converging trends.

Key Markets & Segments Leading Japan Dietary Supplements Market

Vitamins and Mineral Supplements stand as the most dominant segment within the Japan dietary supplements market, driven by widespread consumer understanding of their essential role in maintaining health. Within this category, Vitamin K2 supplements are experiencing remarkable growth, owing to increasing awareness of their benefits for bone health and cardiovascular well-being. The Probiotic Supplements segment is also a significant growth engine, fueled by a growing interest in gut health and its impact on immunity and digestion.

Vitamins and Mineral Supplements:

- Drivers: High consumer awareness, diverse product offerings targeting specific health needs (e.g., immunity, energy, bone health), and increasing demand for age-specific formulations.

- Dominance Analysis: This segment's dominance is anchored by its broad appeal across all age groups and its perception as a foundational element of a healthy lifestyle. The established presence of major brands and continuous product innovation within this category further solidify its leading position.

Probiotic Supplements:

- Drivers: Growing consumer understanding of the gut-brain axis, the link between gut health and immunity, and the development of more targeted probiotic strains for specific conditions.

- Dominance Analysis: The escalating focus on preventative healthcare and the rising incidence of digestive issues have propelled probiotics to the forefront. The market is witnessing an influx of new products featuring diverse bacterial strains and synbiotic formulations.

Proteins and Amino Acids:

- Drivers: Increasing popularity of sports nutrition, a growing vegan and vegetarian population seeking plant-based protein sources, and the rising awareness of protein's role in muscle health and recovery.

- Dominance Analysis: While not as large as vitamins, this segment is experiencing rapid growth, particularly among athletes and fitness enthusiasts. The expansion of plant-based alternatives is broadening its consumer base.

Fatty Acids:

- Drivers: Growing awareness of the benefits of omega-3 fatty acids for cognitive function and cardiovascular health, and the increasing availability of plant-based omega sources.

- Dominance Analysis: This segment benefits from consistent demand driven by established health benefits. Innovations focus on improving absorption and offering vegetarian alternatives.

Distribution Channel: Pharmacies/Drug Stores:

- Drivers: Consumer trust in pharmacists as health advisors, the convenience of one-stop shopping for health and wellness products, and the ability to access expert advice.

- Dominance Analysis: Pharmacies and drug stores remain a crucial channel due to the inherent trust associated with healthcare professionals and the accessibility of these outlets.

Distribution Channel: Online Retail Channels:

- Drivers: Convenience, wider product selection, competitive pricing, and the ability for consumers to research products thoroughly.

- Dominance Analysis: Online channels are experiencing exponential growth, capturing a significant share of the market. This is facilitated by sophisticated e-commerce platforms and targeted digital marketing.

Japan Dietary Supplements Market Product Developments

Recent product developments highlight a strong focus on innovation and consumer-centric solutions within the Japan dietary supplements market. Shiseido Company's June 2024 launch of an ingestible probiotic powder, enriched with Bifidobacterium animalis, amla fruit, and blueberry, targets improved gut health, immune support, and oral care. CURE's April 2024 introduction of CBD-infused functional beverages and gummies caters to the sports nutrition segment, signaling an emerging trend in cannabinoid-based wellness products. Furthermore, Suntory Holdings' November 2022 investment in Nourished, a vitamin supplement manufacturer utilizing patented 3D printing and vegan encapsulation, underscores the drive towards personalized nutrition and efficient delivery systems, promising customized daily nutrient gummies.

Challenges in the Japan Dietary Supplements Market Market

Despite robust growth, the Japan dietary supplements market faces several challenges. Stringent regulatory approval processes for novel ingredients and product claims can slow down market entry and innovation. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials. Intense competition from both domestic and international players necessitates continuous product differentiation and aggressive marketing strategies. Furthermore, consumer skepticism regarding the efficacy of certain supplements and the potential for misleading marketing claims require brands to build and maintain strong credibility. Quantifiable impacts include an estimated increase of XX% in product development timelines due to regulatory hurdles and potential XX% fluctuations in raw material costs.

Forces Driving Japan Dietary Supplements Market Growth

The Japan dietary supplements market is propelled by several powerful forces. The growing health consciousness among the Japanese population, particularly driven by an aging demographic seeking to maintain an active and healthy lifestyle, is a primary driver. Increased awareness of preventive healthcare and the role of nutrition in managing chronic diseases further fuels demand. Technological advancements in formulation and delivery systems, leading to more effective and palatable products, are also significant growth catalysts. Government initiatives promoting health and wellness, coupled with a robust e-commerce infrastructure, facilitate market expansion. The rising disposable income also empowers consumers to invest more in their well-being.

Challenges in the Japan Dietary Supplements Market Market

Long-term growth catalysts in the Japan dietary supplements market are rooted in continued innovation and strategic market expansion. The increasing integration of scientific research into product development, focusing on evidence-based efficacy and personalized nutrition solutions, will be crucial. Partnerships between supplement manufacturers and healthcare providers can foster greater consumer trust and wider adoption. Expanding into niche markets, such as sports nutrition for aging athletes or specialized supplements for specific health conditions, presents significant opportunities. Furthermore, leveraging advanced delivery technologies and exploring sustainable sourcing practices will enhance brand appeal and long-term viability.

Emerging Opportunities in Japan Dietary Supplements Market

Emerging opportunities in the Japan dietary supplements market are diverse and promising. The burgeoning demand for plant-based and vegan supplements reflects a growing consumer preference for ethical and sustainable products. The rise of personalized nutrition, driven by advancements in genomics and AI, offers a significant avenue for tailored supplement solutions. Functional foods and beverages fortified with supplements are another growth area, blending everyday consumption with health benefits. Furthermore, the increasing acceptance of telehealth and digital health platforms presents opportunities for integrated supplement recommendations and direct-to-consumer models. Exploring the potential of adaptogens and nootropics for stress management and cognitive enhancement also represents a significant emerging trend.

Leading Players in the Japan Dietary Supplements Market Sector

- Solgar

- Natural Factors USA

- Enzymedica

- Nestle SA

- Now Health Group Inc

- Amway Japan

- Glanbia PLC

- Abbott Japan Co Ltd

- Bayer Japan

- Nu Skin Enterprises Inc

Key Milestones in Japan Dietary Supplements Market Industry

- June 2024: Shiseido Company launched its new ingestible probiotic powder across Japan, featuring Bifidobacterium animalis, amla fruit, and blueberry, aiming to improve intestinal environment, support the immune system, and enhance oral health.

- April 2024: CURE, a New York-based brand, announced the launch of CBD-infused functional beverages and gummies in Japan, specifically targeting the sports nutrition segment.

- November 2022: Rem3dy Health's brand, Nourished, received an investment of JPY 518.8 million from Suntory Holdings, signaling Suntory's interest in Nourished’s patented 3D printing methods for personalized vitamin gummies, particularly for the Japanese market.

Strategic Outlook for Japan Dietary Supplements Market Market

The Japan dietary supplements market is set for continued robust growth, driven by a strong foundation of health-conscious consumers and an aging population. Strategic opportunities lie in embracing personalized nutrition through advanced diagnostics and digital platforms, thereby meeting individual health needs with greater precision. The expansion of plant-based and sustainable offerings will resonate with a growing segment of ethically conscious consumers. Furthermore, investing in scientific validation and transparent communication will solidify consumer trust and combat misinformation. Collaborations with healthcare professionals and a focus on innovative delivery systems, such as functional beverages and smart supplements, will be key to capturing future market share and ensuring long-term success in this dynamic sector.

Japan Dietary Supplements Market Segmentation

-

1. Type

-

1.1. Vitamins and Mineral Supplements

- 1.1.1. Vitamin K2 Supplements

- 1.2. Proteins and Amino Acids

- 1.3. Fatty Acids

- 1.4. Probiotic Supplements

- 1.5. Other Dietary Supplements

-

1.1. Vitamins and Mineral Supplements

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies/Drug Stores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

Japan Dietary Supplements Market Segmentation By Geography

- 1. Japan

Japan Dietary Supplements Market Regional Market Share

Geographic Coverage of Japan Dietary Supplements Market

Japan Dietary Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products

- 3.3. Market Restrains

- 3.3.1. Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products

- 3.4. Market Trends

- 3.4.1. Consumption of Vitamins and Mineral Supplements Dominates the Japanese Dietary Supplements Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamins and Mineral Supplements

- 5.1.1.1. Vitamin K2 Supplements

- 5.1.2. Proteins and Amino Acids

- 5.1.3. Fatty Acids

- 5.1.4. Probiotic Supplements

- 5.1.5. Other Dietary Supplements

- 5.1.1. Vitamins and Mineral Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies/Drug Stores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solgar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Natural Factors USA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enzymedica

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestle SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Now Health Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amway Japan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glanbia PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbott Japan Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bayer Japan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nu Skin Enterprises Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Solgar

List of Figures

- Figure 1: Japan Dietary Supplements Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Dietary Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Dietary Supplements Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Japan Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Japan Dietary Supplements Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Japan Dietary Supplements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Dietary Supplements Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Japan Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Japan Dietary Supplements Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Japan Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Japan Dietary Supplements Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Japan Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Dietary Supplements Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Dietary Supplements Market?

The projected CAGR is approximately 1.62%.

2. Which companies are prominent players in the Japan Dietary Supplements Market?

Key companies in the market include Solgar, Natural Factors USA, Enzymedica, Nestle SA, Now Health Group Inc, Amway Japan, Glanbia PLC, Abbott Japan Co Ltd, Bayer Japan, Nu Skin Enterprises Inc *List Not Exhaustive.

3. What are the main segments of the Japan Dietary Supplements Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products.

6. What are the notable trends driving market growth?

Consumption of Vitamins and Mineral Supplements Dominates the Japanese Dietary Supplements Market.

7. Are there any restraints impacting market growth?

Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products.

8. Can you provide examples of recent developments in the market?

June 2024: Shiseido Company launched its new ingestible probiotic powder across Japan. The product is filled with probiotic strain Bifidobacterium animalis, amla fruit, and blueberry ingredients. The product claims to improve the intestinal environment and support the immune system and oral health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Dietary Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Dietary Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Dietary Supplements Market?

To stay informed about further developments, trends, and reports in the Japan Dietary Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence