Key Insights

The United Kingdom soy protein market is projected to reach £3.29 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 2.9%. This growth is primarily driven by increasing consumer preference for plant-based protein alternatives, particularly within the food and beverage sector. Key segments including bakery, dairy and dairy alternatives, and meat alternatives are significant contributors. Consumers are actively seeking healthier and more sustainable food options, with soy protein offering a versatile and nutrient-rich solution that aligns with these evolving preferences. The supplements market, especially for sports and elderly nutrition, also fuels market expansion as individuals prioritize health and wellness. Growing awareness of the environmental impact of traditional animal protein production is another significant catalyst, encouraging a shift towards sustainable protein sources like soy.

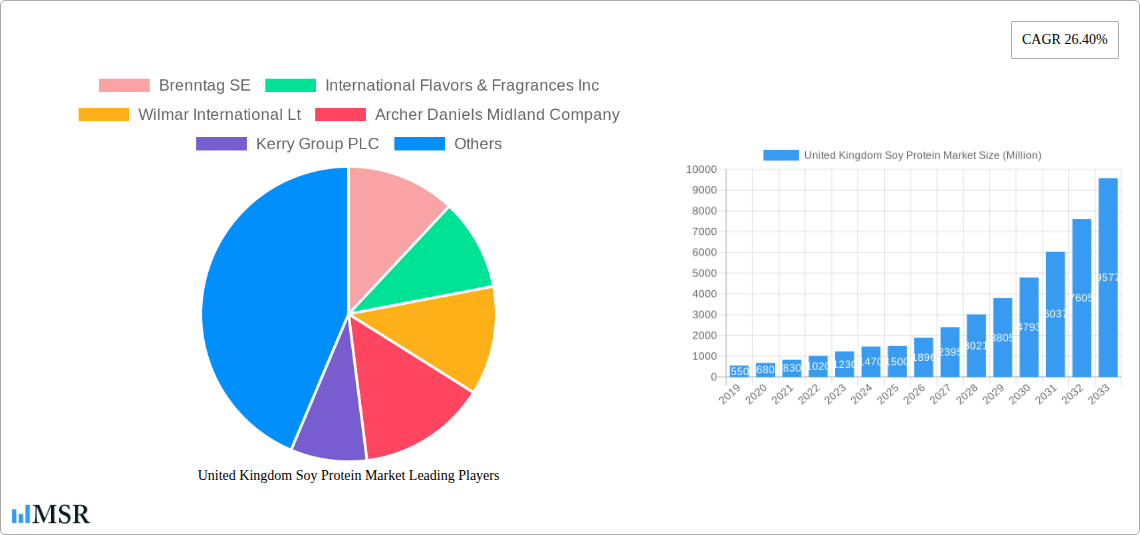

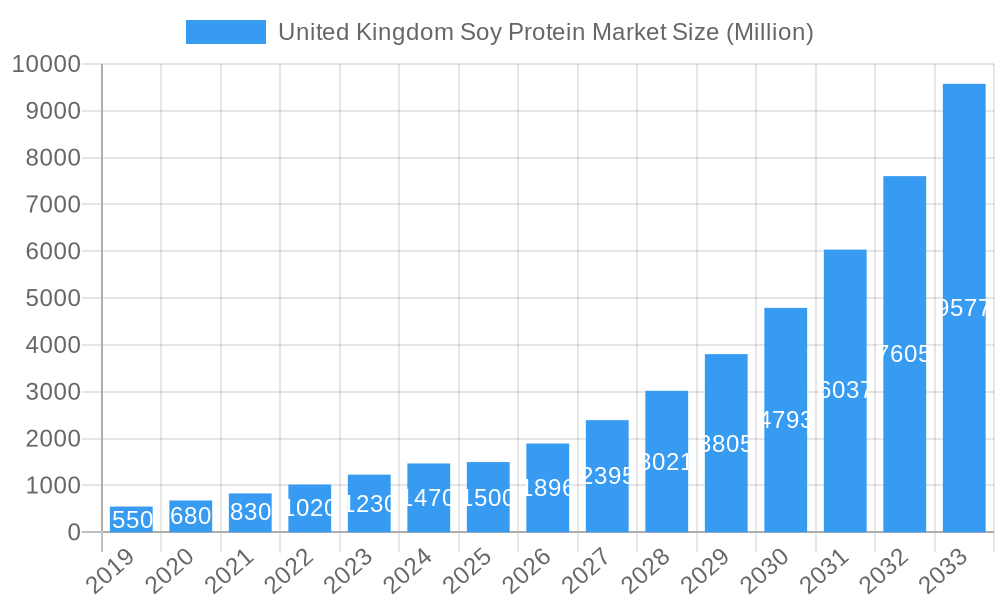

United Kingdom Soy Protein Market Market Size (In Billion)

The market's dynamism is further supported by the availability of various soy protein forms, including concentrates, isolates, and textured/hydrolyzed varieties, catering to diverse product development needs. While the United Kingdom is the primary focus, its position within the broader European market is crucial, with Europe being a significant region for soy protein consumption. Key industry players are investing in research and development to innovate and expand product portfolios. Potential restraints such as fluctuating raw material prices and the emergence of alternative plant-based proteins necessitate strategic market navigation. Nevertheless, the overarching trend towards healthier lifestyles, sustainable consumption, and innovative food solutions positions the UK soy protein market for sustained expansion.

United Kingdom Soy Protein Market Company Market Share

Gain comprehensive insights into the lucrative United Kingdom soy protein market. This report details the dynamics of plant-based protein, soy ingredients, and food innovation across the UK. Our in-depth analysis covers market size, CAGR, key drivers, and challenges, providing actionable intelligence for food manufacturers, ingredient suppliers, animal feed producers, and nutraceutical companies. Discover emerging opportunities in alternative proteins, dairy alternatives, and sports nutrition, and understand the strategic approaches of leading players such as Brenntag SE, International Flavors & Fragrances Inc, Wilmar International Ltd, Archer Daniels Midland Company, Kerry Group PLC, The Scoular Company, A Costantino & C spa, and Fuji Oil Holdings Inc. Navigate the evolving landscape of the UK's plant-based sector with data-driven forecasts and expert analysis.

United Kingdom Soy Protein Market Market Concentration & Dynamics

The United Kingdom soy protein market exhibits a moderate to high concentration, driven by the presence of established global players and a growing ecosystem of domestic ingredient processors and food innovators. Key companies like Archer Daniels Midland Company and Wilmar International Lt command significant market share due to their extensive production capabilities and integrated supply chains. Innovation is a critical differentiator, with a strong emphasis on developing functional soy ingredients with enhanced taste, texture, and nutritional profiles. The regulatory framework, particularly concerning food safety standards and labeling for plant-based foods, plays a pivotal role in shaping market entry and product development. The increasing availability and consumer acceptance of plant-based meat alternatives and dairy-free products are continuously reshaping end-user trends. The market is also witnessing a rise in M&A activities as larger corporations seek to expand their plant-based protein portfolios and gain access to innovative technologies and niche market segments. For instance, the acquisition of smaller, specialized soy ingredient manufacturers by larger food conglomerates aims to consolidate market position and accelerate product launches. The competitive landscape is further intensified by the growing prominence of alternative protein sources and the continuous pursuit of cleaner label solutions.

United Kingdom Soy Protein Market Industry Insights & Trends

The United Kingdom soy protein market is poised for substantial growth, projected to reach an estimated value of over £1,500 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2025 and 2033. This expansion is primarily fueled by a confluence of factors, including a significant shift in consumer preferences towards plant-based diets and sustainable food choices. The rising health consciousness among UK consumers, coupled with an increasing awareness of the environmental impact of conventional meat production, is a key growth driver. The demand for healthy protein sources for various applications, from food and beverages to animal feed and nutritional supplements, continues to surge. Technological advancements in processing soy proteins are leading to the development of high-quality soy ingredients with improved functionality, taste, and texture, making them more appealing substitutes for animal-derived proteins. This includes innovations in textured soy protein, soy isolates, and soy concentrates, which are finding wider applications in products like meat alternatives, dairy-free yogurts, and protein bars. The UK government's commitment to sustainability and its supportive policies for the plant-based food industry are further bolstering market growth. Furthermore, the expanding sports nutrition market and the increasing demand for vegan and vegetarian protein powders are contributing significantly to the market's upward trajectory. The animal feed sector is also a substantial contributor, driven by the need for cost-effective and sustainable protein sources for livestock. The growing adoption of plant-based food solutions in the foodservice sector and the increasing availability of soy-based ingredients in retail channels are also positive indicators for market expansion.

Key Markets & Segments Leading United Kingdom Soy Protein Market

The United Kingdom soy protein market is characterized by the dominance of specific segments and applications, driven by evolving consumer demands and industry trends.

Food and Beverages Segment: This segment holds the largest market share and is a primary driver of growth, propelled by the burgeoning demand for plant-based food and beverage products.

- Meat/Poultry/Seafood and Meat Alternative Products: This sub-segment is experiencing phenomenal growth, with textured soy protein and soy isolates being crucial ingredients in the creation of highly palatable and versatile plant-based meat alternatives. The consumer desire for familiar textures and flavors in a plant-based format is a significant catalyst.

- Dairy and Dairy Alternative Products: The demand for soy-based dairy alternatives such as soy milk, soy yogurt, and soy cheese is robust. Soy isolates and soy concentrates are vital for achieving the desired mouthfeel, protein content, and stability in these products.

- Bakery and Snacks: Soy flour, soy protein concentrates, and isolates are increasingly incorporated into baked goods and snacks to enhance protein content, improve texture, and provide nutritional benefits, catering to the demand for healthier snack options.

- Condiments/Sauces and RTE/RTC Food Products: The versatility of soy ingredients allows for their integration into a wide array of condiments, sauces, and ready-to-eat/ready-to-cook meals, offering functional benefits and contributing to the overall protein profile.

Supplements Segment: This segment is a significant growth area, driven by the rising awareness of health and wellness and the demand for convenient protein sources.

- Sport/Performance Nutrition: Soy protein isolates are a popular choice for protein powders, shakes, and bars, favored for their high protein content, rapid absorption, and affordability. The growing fitness culture and the demand for plant-based muscle-building supplements are key drivers.

- Baby Food and Infant Formula: Soy-based infant formulas are an important alternative for infants with cow's milk allergies or lactose intolerance. The demand for specialized infant nutrition continues to support this sub-segment.

- Elderly Nutrition and Medical Nutrition: Soy protein is utilized in specialized nutritional products for the elderly and patients requiring medical nutrition due to its digestibility and comprehensive amino acid profile.

Animal Feed Segment: While often overlooked, this segment represents a substantial portion of the UK soy protein market. The need for cost-effective and sustainable protein sources for livestock, poultry, and aquaculture continues to drive demand for soybean meal and soy protein concentrates. The efficiency of soy protein in animal nutrition makes it a staple ingredient.

The dominance of the Food and Beverages segment is underpinned by the widespread consumer adoption of plant-based diets and the continuous innovation in plant-based product development. The Supplements segment's growth is directly linked to the increasing focus on personal health and fitness. The Animal Feed segment's consistent demand reflects its fundamental role in the agricultural industry.

United Kingdom Soy Protein Market Product Developments

Product innovation in the United Kingdom soy protein market is characterized by a focus on enhancing functionality, taste, and texture to meet the evolving demands of consumers and food manufacturers. Companies are investing in advanced processing technologies to produce highly functional soy isolates and concentrates that offer superior emulsification, gelling, and water-holding properties. The development of non-GMO and organic soy protein ingredients is also gaining traction, catering to consumer preferences for clean label and sustainable products. Novel applications for textured soy protein are emerging, allowing for more realistic meat-like textures in plant-based meat alternatives. Furthermore, research into hydrolyzed soy proteins is leading to ingredients with improved digestibility and bioavailability for specialized nutritional applications, including infant formula and medical nutrition. The competitive landscape is driving continuous advancements in product diversification, with a strong emphasis on creating tailored solutions for specific end-user applications, ensuring a steady stream of innovative soy-based ingredients entering the market.

Challenges in the United Kingdom Soy Protein Market Market

Despite its strong growth trajectory, the United Kingdom soy protein market faces several challenges.

- Supply Chain Vulnerabilities: Dependence on imported soybeans and soy protein ingredients exposes the market to global price volatility and geopolitical disruptions.

- Consumer Perception and Allergen Concerns: Although growing, some consumer skepticism regarding soy protein and concerns about potential allergens can limit wider adoption in certain demographics.

- Competition from Other Plant-Based Proteins: The market faces intense competition from other plant-based protein sources like pea, fava bean, and rice protein, which also offer unique functional and nutritional benefits.

- Regulatory Hurdles and Labeling Requirements: Navigating complex food regulations and evolving labeling standards for plant-based products can pose challenges for new market entrants and product innovation.

- Cost Competitiveness: While generally cost-effective, fluctuating raw material prices can impact the overall price competitiveness of soy protein ingredients compared to certain animal-derived proteins.

Forces Driving United Kingdom Soy Protein Market Growth

Several key forces are propelling the growth of the United Kingdom soy protein market.

- Rising Consumer Demand for Plant-Based Foods: A significant societal shift towards vegetarianism, veganism, and flexitarianism driven by health, environmental, and ethical concerns.

- Health and Wellness Trends: Increasing consumer awareness of the nutritional benefits of soy protein, including its complete amino acid profile and potential health advantages.

- Innovation in Food Technology: Advancements in processing techniques leading to improved taste, texture, and functionality of soy ingredients, making them viable substitutes for animal-based proteins.

- Government Initiatives and Sustainability Goals: Supportive policies and growing emphasis on sustainable food systems and reducing the environmental footprint of food production.

- Growth of the Sports Nutrition and Functional Foods Market: The increasing popularity of protein supplements and functional foods for performance enhancement and overall well-being.

Challenges in the United Kingdom Soy Protein Market Market

The long-term growth catalysts for the United Kingdom soy protein market are multifaceted, focusing on continuous innovation and market expansion.

- Technological Advancements in Protein Extraction and Modification: Ongoing research into more efficient and sustainable methods for extracting and processing soy proteins, leading to novel ingredients with enhanced functionalities.

- Development of New Applications: Exploration and creation of new end-uses for soy proteins beyond traditional markets, such as in the development of biodegradable materials or advanced food ingredients.

- Strategic Partnerships and Collaborations: Increased collaboration between soy ingredient suppliers, food manufacturers, and research institutions to drive product development and market penetration.

- Geographic Market Expansion and Export Opportunities: Leveraging the UK's strong position in plant-based food innovation to expand into international markets and tap into growing global demand.

- Focus on Sustainable Sourcing and Traceability: Growing consumer and regulatory demand for ethically and sustainably sourced soy ingredients, creating a competitive advantage for companies with transparent supply chains.

Emerging Opportunities in United Kingdom Soy Protein Market

Emerging opportunities within the United Kingdom soy protein market are ripe for exploration by forward-thinking businesses.

- Personalized Nutrition and Fortified Products: The growing interest in personalized diets presents opportunities for soy protein to be incorporated into customized nutritional products and fortified foods targeting specific dietary needs.

- Clean Label and Allergen-Free Solutions: Continued demand for "clean label" products with minimal ingredients and the development of soy protein derivatives that address allergen concerns (e.g., through advanced processing) will be crucial.

- Alternative Dairy Applications: Expanding beyond milk and yogurt into innovative soy-based cheese alternatives, ice creams, and other dairy products with improved sensory profiles.

- Emerging Markets and Demographics: Tapping into new consumer segments, such as the growing older adult population seeking protein-rich diets, and exploring untapped potential in developing regions within the UK.

- Sustainable Packaging and Circular Economy Integration: Innovations in sustainable packaging for soy protein products and the integration of soy processing by-products into other industries align with broader sustainability goals.

Leading Players in the United Kingdom Soy Protein Market Sector

- Brenntag SE

- International Flavors & Fragrances Inc

- Wilmar International Lt

- Archer Daniels Midland Company

- Kerry Group PLC

- The Scoular Company

- A Costantino & C spa

- Fuji Oil Holdings Inc

Key Milestones in United Kingdom Soy Protein Market Industry

- March 2021: Fuji Oil Group appointed Mikio Sakai as the new president and CEO. Mikio Sakai is engaged in developing Plant-based Food Solutions as a core concept to grow a third business pillar, along with the Oil and Fat and Chocolate businesses. Plant-based Food Solutions include soy meat and soybeans, which are used as raw materials for plant-based protein. This strategic shift signifies a strong commitment to expanding their presence and innovation in the plant-based protein sector.

- July 2020: DuPont Nutrition & Biosciences (DuPont), a subsidiary of IFF, offers the industry's broadest assortment of ingredients for plant-based product development with the new Danisco Planit range. Danisco Planit is a global launch that includes services, expertise, and an unparalleled ingredient portfolio for plant-based food and beverages, including plant proteins, hydrocolloids, cultures, probiotics, fibers, food protection, antioxidants, natural extracts, emulsifiers, and enzymes, as well as tailor-made systems. This launch underscores the growing importance of comprehensive ingredient solutions for the burgeoning plant-based market.

- July 2019: Fuji Oil Holdings Inc. established a new subsidiary named Fuji Brandenburg GmbH in Germany as part of its aim to provide high-value, function-enhancing food ingredients to the global food industry. Fuji Brandenburg GmbH is currently involved in the production of soy-based ingredients in all of Europe. This expansion into Europe demonstrates a strategic effort to bolster its production capabilities and serve the European market more effectively with specialized soy ingredients.

Strategic Outlook for United Kingdom Soy Protein Market Market

The strategic outlook for the United Kingdom soy protein market is overwhelmingly positive, driven by persistent consumer demand for plant-based solutions, ongoing innovation in food technology, and a favorable regulatory environment. Key growth accelerators include the continuous development of high-value soy ingredients with improved nutritional and functional properties, catering to the expanding meat and dairy alternative segments. Strategic partnerships and vertical integration within the supply chain will be crucial for ensuring cost-effectiveness and reliability. Furthermore, focusing on sustainability and ethical sourcing will be paramount for maintaining consumer trust and competitive advantage. Companies that invest in R&D for novel applications, such as in sports nutrition, medical foods, and functional beverages, are poised to capture significant market share. The long-term potential lies in leveraging the UK as a hub for plant-based food innovation and expanding export opportunities, solidifying its position in the global alternative protein landscape.

United Kingdom Soy Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Dairy and Dairy Alternative Products

- 2.2.1.5. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.6. RTE/RTC Food Products

- 2.2.1.7. Snacks

-

2.2.1. By Sub End User

-

2.3. Supplements

- 2.3.1. Baby Food and Infant Formula

- 2.3.2. Elderly Nutrition and Medical Nutrition

- 2.3.3. Sport/Performance Nutrition

United Kingdom Soy Protein Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Soy Protein Market Regional Market Share

Geographic Coverage of United Kingdom Soy Protein Market

United Kingdom Soy Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Soy Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Dairy and Dairy Alternative Products

- 5.2.2.1.5. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.6. RTE/RTC Food Products

- 5.2.2.1.7. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Supplements

- 5.2.3.1. Baby Food and Infant Formula

- 5.2.3.2. Elderly Nutrition and Medical Nutrition

- 5.2.3.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Brenntag SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Flavors & Fragrances Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wilmar International Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Archer Daniels Midland Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kerry Group PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Scoular Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 A Costantino & C spa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fuji Oil Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Brenntag SE

List of Figures

- Figure 1: United Kingdom Soy Protein Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Soy Protein Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Soy Protein Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: United Kingdom Soy Protein Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: United Kingdom Soy Protein Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Soy Protein Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: United Kingdom Soy Protein Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: United Kingdom Soy Protein Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Soy Protein Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the United Kingdom Soy Protein Market?

Key companies in the market include Brenntag SE, International Flavors & Fragrances Inc, Wilmar International Lt, Archer Daniels Midland Company, Kerry Group PLC, The Scoular Company, A Costantino & C spa, Fuji Oil Holdings Inc.

3. What are the main segments of the United Kingdom Soy Protein Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

March 2021: Fuji Oil Group appointed Mikio Sakai as the new president and CEO. Mikio Sakai is engaged in developing Plant-based Food Solutions as a core concept to grow a third business pillar, along with the Oil and Fat and Chocolate businesses. Plant-based Food Solutions include soy meat and soybeans, which are used as raw materials for plant-based protein.July 2020: DuPont Nutrition & Biosciences (DuPont), a subsidiary of IFF, offers the industry's broadest assortment of ingredients for plant-based product development with the new Danisco Planit range. Danisco Planit is a global launch that includes services, expertise, and an unparalleled ingredient portfolio for plant-based food and beverages, including plant proteins, hydrocolloids, cultures, probiotics, fibers, food protection, antioxidants, natural extracts, emulsifiers, and enzymes, as well as tailor-made systems.July 2019: Fuji Oil Holdings Inc. established a new subsidiary named Fuji Brandenburg GmbH in Germany as part of its aim to provide high-value, function-enhancing food ingredients to the global food industry. Fuji Brandenburg GmbH is currently involved in the production of soy-based ingredients in all of Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Soy Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Soy Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Soy Protein Market?

To stay informed about further developments, trends, and reports in the United Kingdom Soy Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence