Key Insights

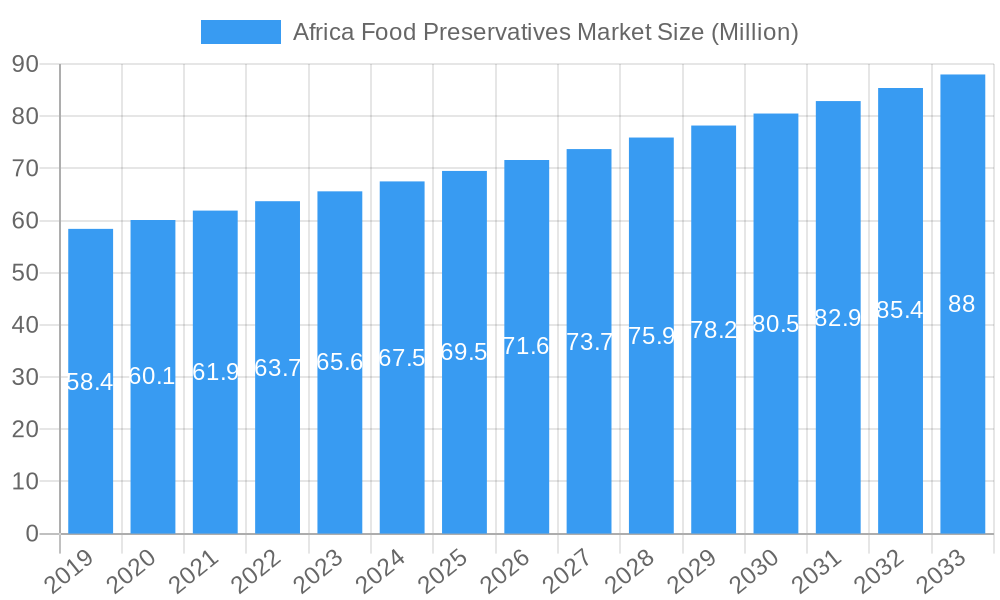

The Africa Food Preservatives Market is poised for significant expansion, projected to reach a substantial XX Million USD by 2033, driven by a steady Compound Annual Growth Rate (CAGR) of 3.20% from 2019 to 2033. This robust growth is primarily fueled by an increasing demand for processed and packaged foods across the continent, a direct consequence of urbanization and evolving consumer lifestyles. Consumers are increasingly seeking convenience and longer shelf lives for their food products, which directly translates to a higher adoption rate of food preservatives. Furthermore, the growing emphasis on food safety and quality standards by regulatory bodies across various African nations is also a key catalyst, encouraging manufacturers to invest in effective preservation techniques. The market is also witnessing a rising preference for natural preservatives as consumer awareness regarding health and wellness gains traction, alongside the continued demand for cost-effective synthetic alternatives.

Africa Food Preservatives Market Market Size (In Million)

The market segmentation reveals diverse opportunities. In terms of type, both Natural and Synthetic preservatives are expected to witness demand, with natural alternatives gaining momentum due to consumer preference. Applications span a wide spectrum, with Beverages, Dairy and Frozen Products, Bakery, and Confectionery anticipated to be the dominant segments. The meat, poultry, and seafood sector also presents a significant growth avenue as cold chain infrastructure improves. Key industry players like Kerry Inc, Cargill Incorporated, ADM, Jungbunzlauer Suisse AG, and DuPont are actively expanding their presence and product portfolios to cater to these evolving demands. The African region, particularly countries like Nigeria, South Africa, and Egypt, are at the forefront of this market expansion, benefiting from larger populations, developing economies, and increasing disposable incomes. While growth is strong, challenges such as the fluctuating cost of raw materials and the need for greater consumer education on preservative usage will need to be strategically managed by market participants.

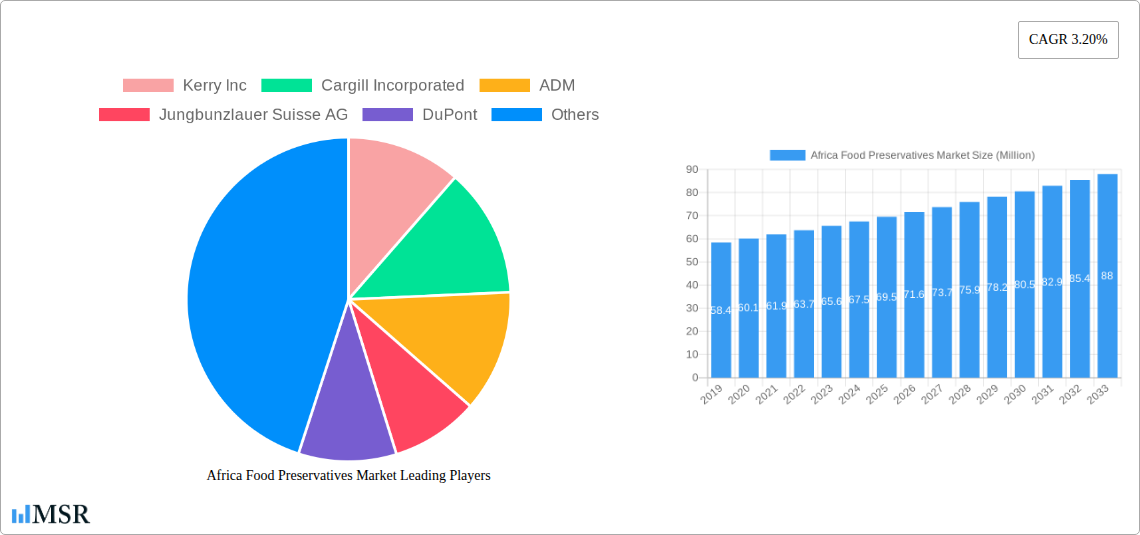

Africa Food Preservatives Market Company Market Share

Unlock critical insights into the burgeoning Africa food preservatives market, a sector poised for significant expansion driven by evolving consumer demands, rising disposable incomes, and a growing need for extended food shelf-life across the continent. This in-depth report offers a detailed analysis of market dynamics, industry trends, key players, and future outlook, providing actionable intelligence for stakeholders navigating this dynamic landscape. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this report is your definitive guide to understanding and capitalizing on opportunities within Africa's food preservation industry.

Africa Food Preservatives Market Market Concentration & Dynamics

The Africa food preservatives market exhibits a moderate level of concentration, with key players like Kerry Inc, Cargill Incorporated, ADM, Jungbunzlauer Suisse AG, and DuPont, alongside DSM, actively shaping its trajectory. These industry giants, while dominant, are increasingly encountering competition from regional innovators and specialized ingredient suppliers. The innovation ecosystem is characterized by a growing focus on natural food preservatives and clean-label solutions, driven by consumer demand for healthier and more transparent food products. Regulatory frameworks across African nations are gradually evolving to align with international standards, creating both opportunities and challenges for market participants. The availability of substitute products, such as improved packaging technologies and processing methods, presents a constant competitive pressure. End-user trends are heavily influenced by urbanization, a growing middle class with increasing disposable income, and a heightened awareness of food safety and quality. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to expand their geographical reach and product portfolios, potentially consolidating market share. The number of significant M&A deals is projected to be between 5-8 in the forecast period, indicative of strategic consolidation.

Africa Food Preservatives Market Industry Insights & Trends

The Africa food preservatives market is projected to reach a valuation of approximately $1,500 Million in 2025 and is expected to witness a robust Compound Annual Growth Rate (CAGR) of around 5.8% during the forecast period of 2025–2033, culminating in an estimated market size of $2,350 Million by 2033. This significant growth is propelled by several converging factors. Firstly, rapid population growth and increasing urbanization across Africa are driving up the demand for processed and packaged foods, which inherently require preservatives to ensure safety and extend shelf life. Secondly, rising disposable incomes among the burgeoning middle class are leading to greater consumption of convenience foods and beverages, further boosting the need for effective preservation solutions. Technological disruptions are playing a crucial role, with advancements in both synthetic and natural preservative technologies enhancing their efficacy and safety profiles. The growing consumer preference for natural and organic food products is a major trend, prompting manufacturers to invest in and adopt natural preservatives derived from sources like fruits, vegetables, and microbial fermentation. This shift is also influenced by increasing consumer awareness regarding the potential health implications of synthetic additives. Furthermore, the expansion of the food processing industry, supported by government initiatives to boost local food production and reduce post-harvest losses, directly fuels the demand for food preservatives. The imperative to reduce food wastage, a persistent challenge in many African regions, also underscores the importance of effective preservation methods. The market is witnessing a paradigm shift towards solutions that offer not only preservation but also contribute to the nutritional and sensory qualities of food products, aligning with the holistic consumer demand for healthier and more appealing food options. The impact of e-commerce and online grocery platforms is also indirectly contributing by increasing the availability and reach of preserved food products across diverse geographies.

Key Markets & Segments Leading Africa Food Preservatives Market

The Africa food preservatives market is characterized by the significant dominance of certain regions and segments. South Africa currently stands as the leading market, driven by its well-established food processing infrastructure, higher consumer spending power, and a more mature regulatory environment. Nigeria and Egypt are rapidly emerging as key growth engines, fueled by their large populations and expanding food industries.

Dominant Segments by Type:

- Synthetic Preservatives: Despite the rising trend of natural alternatives, synthetic preservatives continue to hold a substantial market share due to their cost-effectiveness and proven efficacy across a wide range of applications. Their lower production costs make them an attractive option for mass-produced food items.

- Natural Preservatives: This segment is experiencing the fastest growth, propelled by strong consumer demand for clean-label products and a growing perception of health benefits associated with natural ingredients. Investments in research and development are leading to innovative natural preservative solutions.

Dominant Segments by Application:

- Beverages: The vast and rapidly growing beverage industry, encompassing soft drinks, juices, and alcoholic beverages, is a major consumer of food preservatives. The need for extended shelf life and microbial stability in these high-volume products makes preservation a critical factor.

- Dairy and Frozen Products: This segment also represents a significant application area, with preservatives crucial for maintaining the quality and safety of milk-based products, ice creams, and frozen meals. The susceptibility of these products to spoilage necessitates robust preservation strategies.

- Meat, Poultry, and Seafood: The preservation of perishable protein-rich foods is paramount for public health and consumer safety. Preservatives play a vital role in preventing microbial growth and extending the shelf life of these products, a growing demand category across Africa.

Drivers of Dominance:

- Economic Growth: Higher GDP per capita and increased disposable incomes in leading economies directly translate to greater spending on processed foods and beverages.

- Infrastructure Development: Improved cold chain logistics and manufacturing facilities in key countries enable broader distribution and consumption of preserved food products.

- Population Growth: The sheer size of the populations in countries like Nigeria and Egypt creates an inherent demand for food products that can be efficiently produced and distributed.

- Consumer Awareness: A growing understanding of food safety standards and the desire for longer-lasting products are driving adoption.

Africa Food Preservatives Market Product Developments

Product developments in the Africa food preservatives market are increasingly focused on innovation that addresses both efficacy and consumer preferences. Manufacturers are introducing advanced synthetic preservatives with improved safety profiles and lower usage levels. Simultaneously, there's a significant surge in the development of natural preservatives derived from plant extracts, essential oils, and fermented ingredients, offering clean-label solutions. These innovations aim to enhance product stability, inhibit a broader spectrum of spoilage microorganisms, and contribute to sensory attributes without compromising health perceptions, thereby expanding their market relevance.

Challenges in the Africa Food Preservatives Market Market

The Africa food preservatives market faces several significant challenges. Regulatory fragmentation across different African nations creates complex compliance landscapes for manufacturers and suppliers. Supply chain inefficiencies and limited cold chain infrastructure in some regions can hinder the effective distribution and application of preservatives, leading to spoilage. Furthermore, the fluctuating raw material prices for both synthetic and natural ingredients can impact production costs and market competitiveness. The strong and growing consumer demand for "free-from" and minimally processed foods also poses a challenge, pushing for innovation in preservative alternatives.

Forces Driving Africa Food Preservatives Market Growth

Several powerful forces are propelling the Africa food preservatives market. Technological advancements in preservation science are leading to more effective and safer natural and synthetic options. Economic development, characterized by rising disposable incomes and a growing middle class, is boosting demand for processed and packaged foods. Evolving consumer preferences for convenience and longer shelf-life products, coupled with increasing awareness of food safety standards, are significant drivers. Moreover, government initiatives aimed at reducing food waste and improving food security across the continent indirectly foster the adoption of preservation technologies.

Challenges in the Africa Food Preservatives Market Market

Long-term growth catalysts for the Africa food preservatives market lie in continued innovation and strategic market expansion. The development of novel bio-preservatives and fermentation-based solutions offers immense potential. Partnerships between international ingredient suppliers and local food manufacturers can accelerate technology transfer and market penetration. Furthermore, increased investment in research and development focused on African raw materials for natural preservatives can create unique market advantages and address specific regional needs.

Emerging Opportunities in Africa Food Preservatives Market

Emerging opportunities in the Africa food preservatives market are abundant. The growing demand for halal-certified preservatives presents a significant niche market. The expansion of the ready-to-eat meal and convenient snack segments offers substantial growth avenues. Furthermore, the increasing adoption of e-commerce for food distribution creates opportunities for preservatives that ensure product integrity during transit. Exploring plant-based protein sources for preservation also aligns with global health and sustainability trends.

Leading Players in the Africa Food Preservatives Market Sector

- Kerry Inc

- Cargill Incorporated

- ADM

- Jungbunzlauer Suisse AG

- DuPont

- DSM

Key Milestones in Africa Food Preservatives Market Industry

- 2019: Increased focus on natural preservatives in response to growing consumer demand for clean-label products.

- 2020: Advancements in fermentation technologies for producing natural preservatives gain traction.

- 2021: Several African nations begin to harmonize food safety regulations, easing market entry for some players.

- 2022: Significant investments made by multinational corporations in expanding their presence in key African markets.

- 2023: Launch of new product lines by major players focusing on shelf-life extension solutions for tropical fruits and vegetables.

- 2024: Growing adoption of antimicrobial packaging as a complementary preservation strategy.

Strategic Outlook for Africa Food Preservatives Market Market

The strategic outlook for the Africa food preservatives market is exceptionally positive. Future growth will be driven by a dual approach of leveraging existing strengths in cost-effective synthetic solutions while aggressively investing in and promoting natural and bio-preservative technologies. Strategic partnerships, localized research and development, and a keen understanding of evolving consumer preferences for health and wellness will be crucial for sustained success. Market players should also focus on building robust supply chains and navigating diverse regulatory environments to capitalize on the continent's vast untapped potential.

Africa Food Preservatives Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Beverages

- 2.2. Dairy and Frozen Products

- 2.3. Bakery

- 2.4. Meat

- 2.5. Poultry and Seafood

- 2.6. Confectionery

- 2.7. Sauces and Salad Sixes

- 2.8. Other Applications

Africa Food Preservatives Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

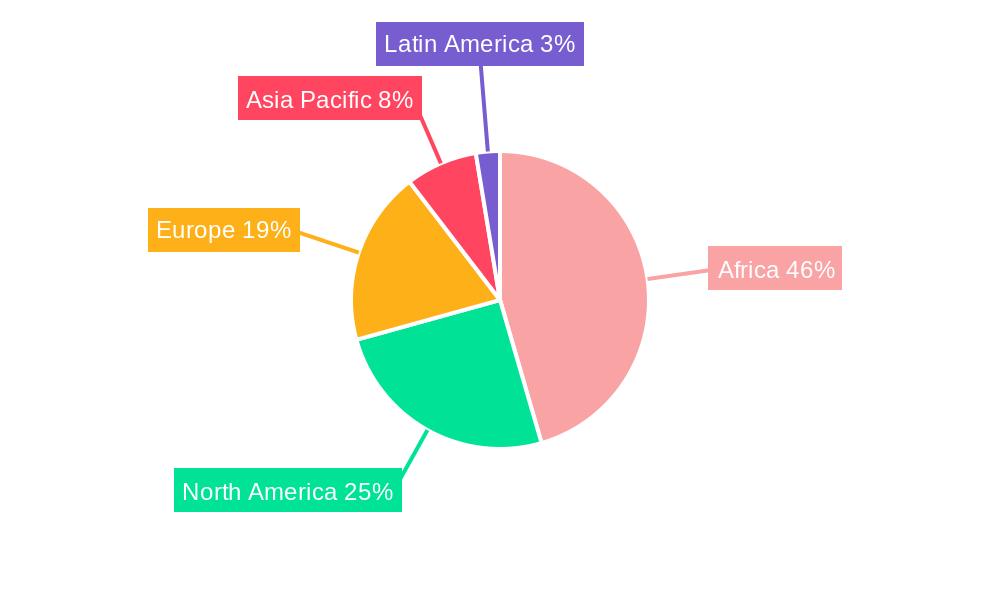

Africa Food Preservatives Market Regional Market Share

Geographic Coverage of Africa Food Preservatives Market

Africa Food Preservatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Inclination toward Clean Label Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat

- 5.2.5. Poultry and Seafood

- 5.2.6. Confectionery

- 5.2.7. Sauces and Salad Sixes

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kerry Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADM

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jungbunzlauer Suisse AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSM*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Kerry Inc

List of Figures

- Figure 1: Africa Food Preservatives Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Food Preservatives Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Food Preservatives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Africa Food Preservatives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Africa Food Preservatives Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Africa Food Preservatives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Africa Food Preservatives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Africa Food Preservatives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Food Preservatives Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Food Preservatives Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Africa Food Preservatives Market?

Key companies in the market include Kerry Inc, Cargill Incorporated, ADM, Jungbunzlauer Suisse AG, DuPont, DSM*List Not Exhaustive.

3. What are the main segments of the Africa Food Preservatives Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Consumer Inclination toward Clean Label Products.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Food Preservatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Food Preservatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Food Preservatives Market?

To stay informed about further developments, trends, and reports in the Africa Food Preservatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence