Key Insights

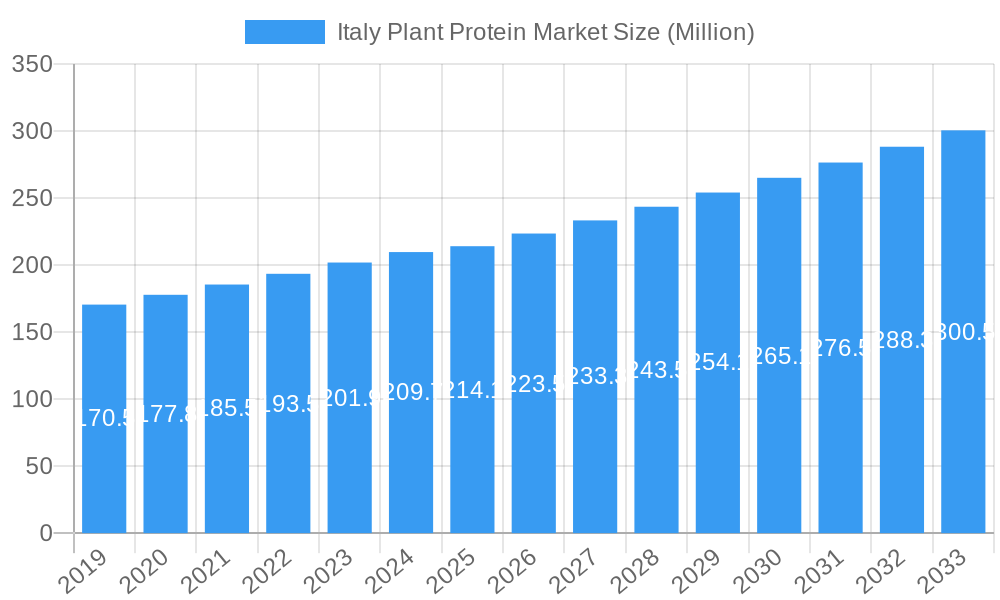

The Italian plant protein market is poised for significant expansion, projected to reach an estimated €214.10 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.52% anticipated through 2033. This growth trajectory is fueled by a confluence of evolving consumer preferences, a burgeoning awareness of health and environmental sustainability, and the increasing availability of diverse plant-based protein sources. Consumers in Italy are increasingly seeking healthier dietary options, leading to a greater demand for plant-based alternatives in food and beverages, as well as in supplements and animal feed. The market's versatility is evident in its segmentation by protein type, with hemp, oat, pea, potato, rice, soy, and wheat proteins all contributing to the market's dynamism. Furthermore, the expanding applications across animal feed, personal care and cosmetics, and a wide array of food and beverage sub-segments (including bakery, dairy alternatives, meat alternatives, and snacks) alongside specialized supplements for infants, the elderly, and athletes, underscore the broad appeal and integration of plant proteins into various aspects of daily life.

Italy Plant Protein Market Market Size (In Million)

Key market drivers for Italy's plant protein sector include the rising prevalence of lifestyle diseases, a growing vegan and vegetarian population, and a heightened focus on ethical and sustainable food production. The demand for clean-label products and the desire to reduce carbon footprints are also significant contributors to this market's ascent. While the market is characterized by strong growth, certain factors may present challenges. The competitive landscape, with major players like Cargill, Brenntag SE, DuPont, Archer Daniels Midland, Roquette Frères, Kerry Group, The Scoular Company, Ingredion, and A Costantino & C spa, necessitates continuous innovation and strategic market penetration. Emerging trends include the development of novel plant protein sources with improved taste and functionality, as well as the integration of plant proteins into functional foods and beverages targeting specific health benefits. The European region, with Italy at its core, is a significant hub for these developments, demonstrating a strong commitment to sustainable food systems and consumer well-being.

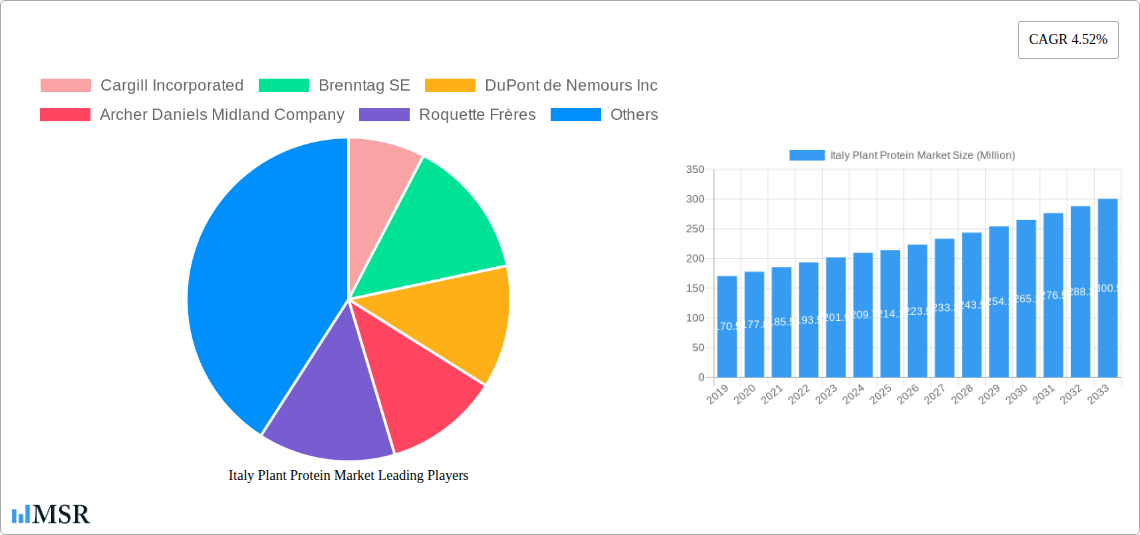

Italy Plant Protein Market Company Market Share

Italy Plant Protein Market: A Comprehensive Industry Analysis and Forecast (2019–2033)

This report offers an in-depth analysis of the Italy Plant Protein Market, a rapidly expanding sector driven by surging consumer demand for sustainable and health-conscious food and beverage alternatives, animal feed innovation, and advancements in personal care. With a study period spanning from 2019 to 2033, and a base year of 2025, this research provides critical insights into market dynamics, key growth drivers, and future opportunities. The Italy Plant Protein Market Size is projected to reach XX Million Euros by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) during the forecast period of 2025–2033. This comprehensive report is an indispensable resource for plant-based protein manufacturers, ingredient suppliers, food and beverage companies, animal feed producers, personal care brands, and investment firms seeking to capitalize on the burgeoning Italian plant-based food industry and the broader European plant protein market.

Italy Plant Protein Market Market Concentration & Dynamics

The Italy Plant Protein Market exhibits a moderate level of market concentration, with key players like Cargill Incorporated, DuPont de Nemours Inc, and Roquette Frères holding significant market shares. The innovation ecosystem is dynamic, fueled by ongoing research and development in extraction technologies and new protein sources. Italy's regulatory frameworks are supportive of plant-based products, particularly concerning labeling and food safety standards, fostering a conducive environment for market growth. Substitute products, primarily conventional animal proteins, still hold a strong position, but the rising awareness of health and environmental concerns is gradually shifting consumer preferences towards plant-based alternatives. End-user trends show a clear inclination towards plant-based diets, driving demand across various food and beverage applications, particularly in dairy and dairy alternative products and meat alternative products. Merger and acquisition (M&A) activities are observed as companies seek to expand their product portfolios and gain a competitive edge. The plant protein market share for key segments is continuously evolving due to these strategic moves.

- Market Concentration: Moderate, with a few key global players dominating.

- Innovation Ecosystem: Vibrant, driven by R&D in new protein sources and processing technologies.

- Regulatory Frameworks: Supportive of plant-based products, focusing on safety and clear labeling.

- Substitute Products: Traditional animal proteins remain a significant competitor, though their dominance is challenged.

- End-User Trends: Growing adoption of plant-based diets across all age groups and consumer segments.

- M&A Activities: Present, as companies aim for market consolidation and portfolio expansion.

Italy Plant Protein Market Industry Insights & Trends

The Italy Plant Protein Market is poised for substantial growth, driven by a confluence of factors including increasing consumer health consciousness, a growing awareness of the environmental impact of animal agriculture, and the rising popularity of flexitarian, vegetarian, and vegan diets. The market size for plant proteins in Italy is experiencing a significant upswing, with the pea protein market and soy protein market leading the charge due to their versatility and established supply chains. Technological disruptions are playing a crucial role, with advancements in protein isolation and texturization techniques enabling the development of plant-based products that closely mimic the taste, texture, and nutritional profile of their animal-based counterparts. This is particularly evident in the meat alternative products segment, where innovation is rapidly addressing consumer demands for palatable and sustainable protein sources. Evolving consumer behaviors are a cornerstone of this growth; Italians are increasingly seeking functional foods and ingredients that offer health benefits, and plant proteins, with their inherent nutritional advantages, are perfectly positioned to meet this demand. The expansion of the plant-based protein supplements sector, particularly for sport/performance nutrition and elderly nutrition and medical nutrition, further underscores this trend. The projected CAGR of the Italy Plant Protein Market reflects a strong upward trajectory, indicating a significant shift in dietary patterns and food industry innovation.

Key Markets & Segments Leading Italy Plant Protein Market

The Italy Plant Protein Market is characterized by strong performance across several key segments, propelled by diverse consumer needs and industry applications. Within the Protein Type segmentation, Pea Protein currently leads, owing to its excellent amino acid profile, functional properties, and widespread availability. Soy Protein remains a significant player due to its cost-effectiveness and established use in various food products. However, emerging protein sources like Hemp Protein and Oat Protein are gaining traction, driven by their perceived health benefits and sustainability credentials.

In terms of End-User segments, Food and Beverages represent the largest market share. This is further broken down into highly dynamic sub-segments:

- Dairy and Dairy Alternative Products: This segment is experiencing explosive growth, with a burgeoning demand for plant-based milk, yogurt, cheese, and ice cream alternatives, directly benefiting pea protein, oat protein, and soy protein.

- Meat/Poultry/Seafood and Meat Alternative Products: The demand for plant-based burgers, sausages, and other meat substitutes is a major growth driver, fueled by consumer desire for sustainable and healthier protein options.

- Supplements: The Sport/Performance Nutrition sub-segment is a critical market for plant proteins, as athletes and fitness enthusiasts seek effective, plant-derived protein sources. The Baby Food and Infant Formula and Elderly Nutrition and Medical Nutrition segments are also showing promising growth as parents and healthcare providers opt for allergen-friendly and easily digestible protein options.

The dominance of these segments is underpinned by several drivers:

- Economic Growth: Rising disposable incomes empower consumers to make premium dietary choices, including plant-based alternatives.

- Infrastructure Development: Improved logistics and cold chain infrastructure facilitate the widespread distribution of plant-based products across Italy.

- Consumer Education and Awareness: Growing awareness of the health and environmental benefits of plant proteins, disseminated through media and health professionals, significantly influences purchasing decisions.

- Technological Advancements: Innovations in processing and ingredient development are making plant-based products more appealing and accessible.

The Personal Care and Cosmetics segment is also experiencing steady growth, with plant proteins being incorporated for their moisturizing and skin-conditioning properties. The Animal Feed segment is another crucial area, as feed manufacturers increasingly incorporate plant proteins to enhance animal nutrition and reduce reliance on animal-based feed ingredients. The Bakery, Breakfast Cereals, Condiments/Sauces, Confectionery, RTE/RTC Food Products, and Snacks sub-segments within Food and Beverages are all demonstrating consistent growth as manufacturers integrate plant proteins to boost nutritional content and cater to evolving consumer preferences.

Italy Plant Protein Market Product Developments

Product development in the Italy Plant Protein Market is characterized by a strong focus on enhancing taste, texture, and nutritional profiles of plant-based ingredients. Companies are investing in innovative processing techniques to create novel protein isolates and concentrates with improved functionalities for a wide range of applications. This includes the development of textured plant proteins that offer a meat-like bite, catering to the growing demand for plant-based meat alternatives. Furthermore, there is a significant push towards creating allergen-free and clean-label plant protein products, utilizing sources like hemp protein and rice protein to meet consumer demands for healthier options. The market is also witnessing advancements in sustainable sourcing and production methods, contributing to the overall appeal of these ingredients.

Challenges in the Italy Plant Protein Market Market

Despite the strong growth trajectory, the Italy Plant Protein Market faces several challenges. A primary restraint is the perception of taste and texture in some plant-based products, particularly when compared to their animal-derived counterparts, which can limit widespread consumer adoption. Supply chain complexities and the cost of raw materials, especially for niche protein sources, can also impact pricing and availability. Regulatory hurdles, though generally supportive, can sometimes create complexities in product labeling and formulation, particularly concerning claims about nutritional value and health benefits. Competitive pressures from established animal protein industries and the need for continuous innovation to meet evolving consumer expectations also present significant challenges.

Forces Driving Italy Plant Protein Market Growth

The Italy Plant Protein Market is propelled by several powerful forces. Growing consumer awareness regarding health and wellness is a primary driver, as individuals seek protein sources that support better digestion, offer essential amino acids, and contribute to overall well-being. The increasing emphasis on sustainability and environmental concerns is also a significant factor, with consumers actively choosing plant-based options to reduce their carbon footprint and support eco-friendly food systems. Technological advancements in processing and ingredient innovation are crucial, enabling the creation of more palatable and versatile plant-based products. Furthermore, supportive government initiatives and a rising trend towards flexitarian, vegetarian, and vegan diets are creating a fertile ground for market expansion.

Challenges in the Italy Plant Protein Market Market

Looking ahead, several long-term growth catalysts are expected to shape the Italy Plant Protein Market. Continued innovation in product development, focusing on overcoming taste and texture barriers and expanding the range of functional benefits offered by plant proteins, will be critical. Strategic partnerships between ingredient suppliers and food manufacturers will foster new product introductions and broader market penetration. The increasing acceptance and integration of plant proteins in mainstream food categories, beyond specialized health products, will also drive sustained growth. Expansion into new end-user applications and geographical regions within Italy will unlock further market potential.

Emerging Opportunities in Italy Plant Protein Market

Emerging opportunities in the Italy Plant Protein Market lie in several key areas. The growing demand for plant-based dairy alternatives presents a substantial avenue for growth, with opportunities to develop innovative cheeses, yogurts, and frozen desserts. The meat alternative market continues to offer vast potential, with a need for products that better mimic the sensory experience of traditional meat. There is also an emerging opportunity in the functional foods and beverages space, where plant proteins can be integrated to provide specific health benefits beyond basic nutrition. Furthermore, the increasing interest in alternative protein sources like lupin protein and chickpea protein, driven by a desire for diversification and unique nutritional profiles, offers significant untapped potential.

Leading Players in the Italy Plant Protein Market Sector

- Cargill Incorporated

- Brenntag SE

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Roquette Frères

- Kerry Group PLC

- The Scoular Company

- Ingredion Incorporated

- A Costantino & C spa

- Cargil

Key Milestones in Italy Plant Protein Market Industry

- October 2022: Roquette Frères introduced four new grades of organic pea protein isolates and starches to the European market, including Italy, reinforcing their commitment to organic and sustainable plant-based ingredients.

- June 2022: Roquette unveiled its innovative Nutralys range of organic textured proteins derived from peas and fava beans for the European market, including Italy, expanding the options for plant-based meat alternatives.

Strategic Outlook for Italy Plant Protein Market Market

The strategic outlook for the Italy Plant Protein Market is exceptionally positive. Growth accelerators will be driven by continued innovation in product development, focusing on enhancing the sensory appeal and functional properties of plant-based proteins. Strategic collaborations between ingredient providers and food manufacturers will be pivotal in expanding the reach of plant-based products into mainstream consumption. Investment in research and development for novel protein sources and sustainable sourcing practices will further strengthen market positions. The growing consumer demand for healthy, sustainable, and ethical food choices ensures a robust future for the plant protein sector in Italy.

Italy Plant Protein Market Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Oat Protein

- 1.3. Pea Protein

- 1.4. Potato Protein

- 1.5. Rice Protein

- 1.6. Soy Protein

- 1.7. Wheat Protein

- 1.8. Other Plant Protein

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.7. RTE/RTC Food Products

- 2.3.8. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

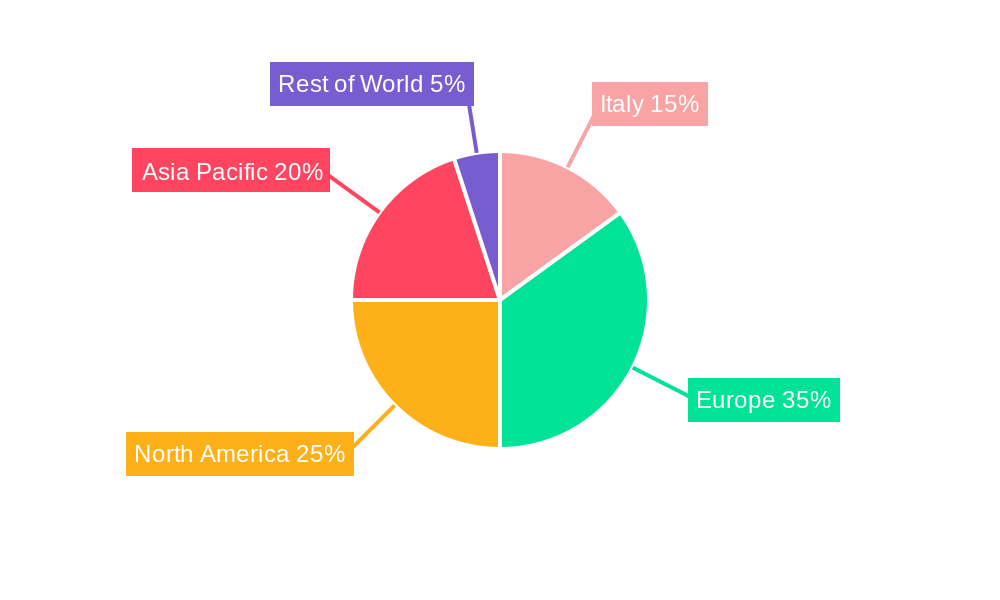

Italy Plant Protein Market Segmentation By Geography

- 1. Italy

Italy Plant Protein Market Regional Market Share

Geographic Coverage of Italy Plant Protein Market

Italy Plant Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Innovation in Food and Beverage Industry especially in Vegan Meat Alternatives; Increasing Inclination Towards Plant-based Food and Beverage Products

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products Available at Affordable Prices

- 3.4. Market Trends

- 3.4.1. Growing Innovation in Food and Beverage Industry Especially in Vegan Meat Alternatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Plant Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Oat Protein

- 5.1.3. Pea Protein

- 5.1.4. Potato Protein

- 5.1.5. Rice Protein

- 5.1.6. Soy Protein

- 5.1.7. Wheat Protein

- 5.1.8. Other Plant Protein

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.7. RTE/RTC Food Products

- 5.2.3.8. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brenntag SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DuPont de Nemours Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Archer Daniels Midland Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roquette Frères

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Group PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Scoular Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ingredion Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A Costantino & C spa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargil

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Italy Plant Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Plant Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Plant Protein Market Revenue Million Forecast, by Protein Type 2020 & 2033

- Table 2: Italy Plant Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Italy Plant Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Italy Plant Protein Market Revenue Million Forecast, by Protein Type 2020 & 2033

- Table 5: Italy Plant Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Italy Plant Protein Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Plant Protein Market?

The projected CAGR is approximately 4.52%.

2. Which companies are prominent players in the Italy Plant Protein Market?

Key companies in the market include Cargill Incorporated, Brenntag SE, DuPont de Nemours Inc, Archer Daniels Midland Company, Roquette Frères, Kerry Group PLC, The Scoular Company, Ingredion Incorporated, A Costantino & C spa, Cargil.

3. What are the main segments of the Italy Plant Protein Market?

The market segments include Protein Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 214.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Innovation in Food and Beverage Industry especially in Vegan Meat Alternatives; Increasing Inclination Towards Plant-based Food and Beverage Products.

6. What are the notable trends driving market growth?

Growing Innovation in Food and Beverage Industry Especially in Vegan Meat Alternatives.

7. Are there any restraints impacting market growth?

Competition from Substitute Products Available at Affordable Prices.

8. Can you provide examples of recent developments in the market?

October 2022: Roquette Frères introduced four new grades of organic pea protein isolates and starches to the European market, including Italy. The company asserts that these organic peas were sourced from Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Plant Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Plant Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Plant Protein Market?

To stay informed about further developments, trends, and reports in the Italy Plant Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence