Key Insights

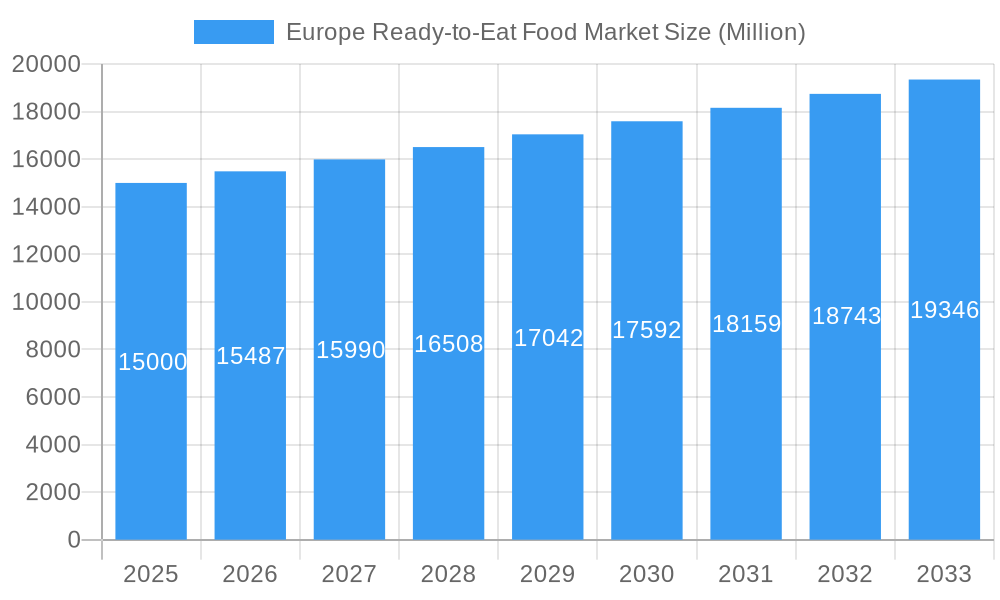

The European Ready-to-Eat (RTE) food market is projected for significant expansion, anticipated to reach $75.61 billion by 2025. This dynamic sector is expected to exhibit a Compound Annual Growth Rate (CAGR) of 5.22% through 2033. Key growth drivers include evolving consumer lifestyles, a rising demand for convenient and time-saving meal solutions, and a preference for healthy, readily available options. The burgeoning online retail channel significantly enhances accessibility and product selection. Furthermore, increasing disposable income across key European nations boosts purchasing power for premium and convenient food offerings.

Europe Ready-to-Eat Food Market Market Size (In Billion)

Prominent segments such as Instant Breakfast/Cereals, Ready Meals, and Instant Noodles are experiencing substantial demand, catering to busy schedules and the need for quick, satisfying meals. While Hypermarkets/Supermarkets remain primary distribution channels, the rapid growth of Online Retail Stores indicates a substantial shift in consumer purchasing behavior. Competitive pricing and the necessity for continuous innovation present market challenges. However, the inherent convenience, diverse product portfolios, and a strong company focus on quality and taste by leaders like Nestlé S.A. and The Kellogg Company will continue to drive market growth across major European economies including Germany, France, and the United Kingdom.

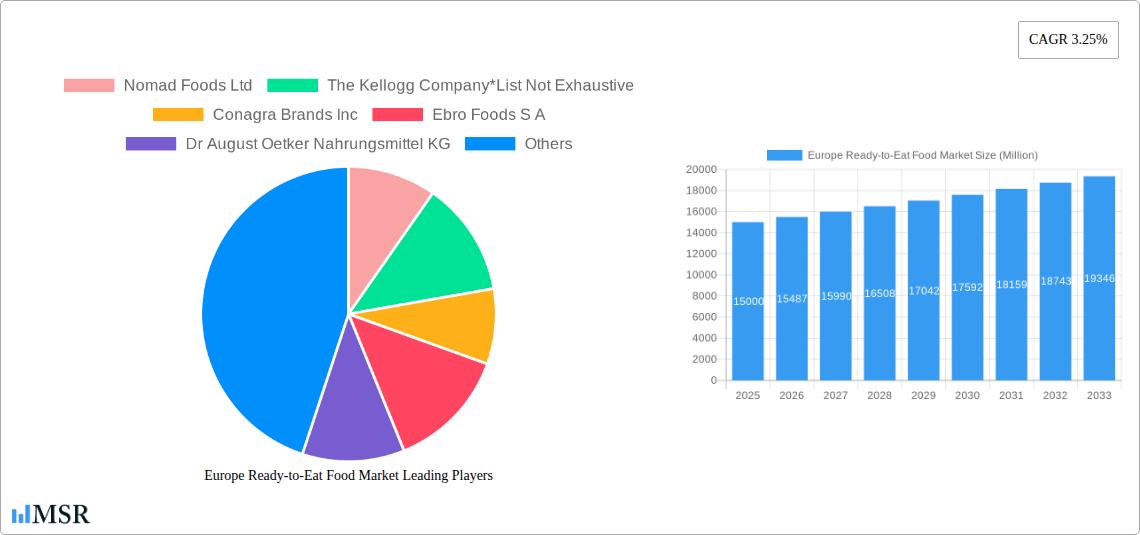

Europe Ready-to-Eat Food Market Company Market Share

Europe Ready-to-Eat Food Market: Comprehensive Analysis and Forecast (2019-2033)

Gain unparalleled insights into the Europe Ready-to-Eat (RTE) food market, a rapidly expanding sector driven by evolving consumer lifestyles and technological advancements. This in-depth report provides a robust analysis for the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, building upon historical data from 2019–2024. Discover key market dynamics, growth drivers, segment performance, and strategic opportunities within the European RTE food landscape. This report is essential for industry stakeholders seeking to understand market concentration, innovation ecosystems, and the competitive strategies of leading players.

Europe Ready-to-Eat Food Market Market Concentration & Dynamics

The Europe Ready-to-Eat food market exhibits a moderate to high concentration, with a significant presence of multinational corporations alongside a growing number of regional and niche players. Innovation is a key differentiator, with companies actively investing in R&D to develop healthier, more convenient, and sustainably packaged RTE options. Regulatory frameworks, particularly concerning food safety, labeling, and ingredient sourcing, play a crucial role in shaping market entry and product development strategies. The presence of readily available substitute products, such as fresh ingredients and traditional home cooking, necessitates continuous product differentiation and value addition within the RTE segment. End-user trends are increasingly leaning towards plant-based, organic, and low-calorie options, influencing product formulation and marketing efforts. Merger and acquisition (M&A) activities remain a strategic tool for market consolidation and portfolio expansion. For instance, the market has witnessed several strategic acquisitions aimed at enhancing market share and acquiring innovative technologies or specialized product lines. The overall M&A deal count reflects a dynamic landscape where companies seek to bolster their competitive positions and capitalize on emerging consumer demands.

Europe Ready-to-Eat Food Market Industry Insights & Trends

The Europe Ready-to-Eat food market is experiencing robust growth, projected to reach significant market value by 2033. This expansion is fueled by several key factors. Firstly, the increasing urbanization and busy lifestyles across Europe have led to a greater demand for convenient food solutions that minimize preparation time. Consumers are willing to pay a premium for products that offer both convenience and perceived nutritional value. Secondly, technological disruptions are transforming the RTE landscape. Advancements in food processing, preservation techniques, and packaging technology enable the creation of a wider variety of RTE products with improved shelf life and sensory appeal, catering to diverse dietary needs and preferences. The proliferation of online retail stores and efficient last-mile delivery services has further democratized access to RTE foods, expanding reach beyond traditional brick-and-mortar channels. Evolving consumer behaviors are central to this market's trajectory. There is a discernible shift towards healthier eating habits, with a growing preference for RTE options that are perceived as nutritious, low in artificial additives, and ethically sourced. The demand for plant-based RTE meals, organic ingredients, and gluten-free options is on the rise, compelling manufacturers to adapt their product portfolios. Furthermore, the increasing awareness of sustainability and environmental impact is influencing purchasing decisions, with consumers favoring brands that demonstrate eco-friendly packaging and responsible sourcing practices. The overall market size is expected to witness a healthy Compound Annual Growth Rate (CAGR) during the forecast period, indicating sustained consumer adoption and market expansion.

Key Markets & Segments Leading Europe Ready-to-Eat Food Market

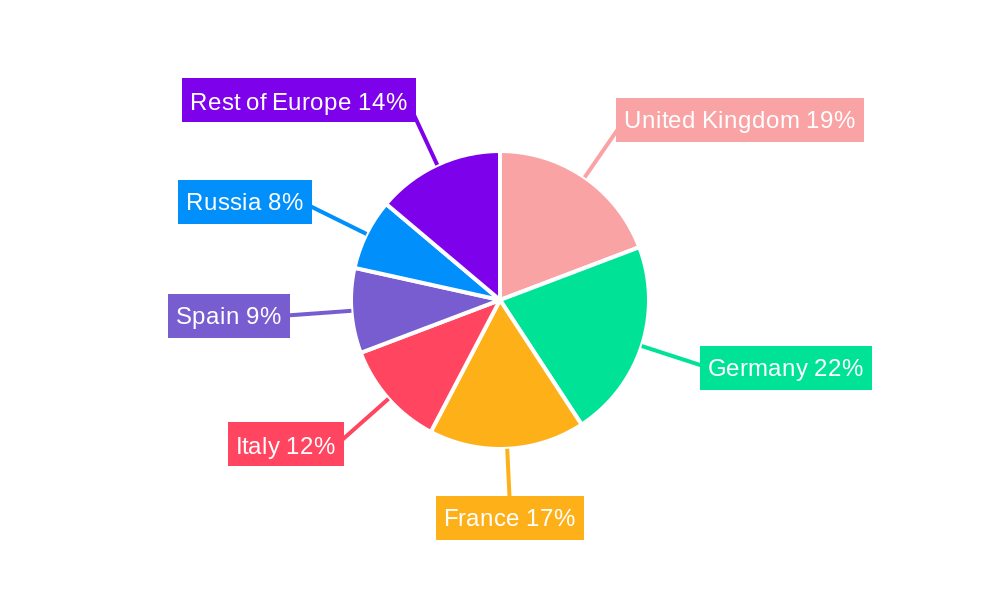

The Europe Ready-to-Eat food market is characterized by strong regional performance, with Western Europe, particularly countries like the United Kingdom, Germany, and France, leading the charge. This dominance is attributed to a combination of factors including higher disposable incomes, a well-developed retail infrastructure, and a consumer base that is more receptive to novel food products and convenience-oriented solutions. Within the Type segment, Ready Meals represent the largest and fastest-growing category, driven by their appeal as complete and satisfying meal solutions that require minimal effort. Frozen snacks are also gaining significant traction due to their versatility and long shelf life. Instant noodles continue to be a popular choice for budget-conscious consumers and those seeking quick meal options. The growth in Instant Breakfast/Cereals is linked to the rising trend of grab-and-go breakfast options. In terms of Distribution Channel, Hypermarkets/Supermarkets remain the primary avenue for RTE food sales, owing to their extensive product variety and promotional activities. However, Online Retail Stores are rapidly gaining market share, offering unparalleled convenience, wider product selection, and personalized shopping experiences. The growth in online channels is further amplified by dedicated food delivery platforms and direct-to-consumer (DTC) models adopted by some manufacturers.

- Dominant Regions & Countries:

- United Kingdom: High adoption of RTE meals, strong online grocery penetration.

- Germany: Significant demand for frozen RTE products and convenience foods.

- France: Growing preference for premium and gourmet RTE options.

- Leading Segments (Type):

- Ready Meals: Largest segment due to convenience and variety.

- Frozen Snacks: Growing demand for quick, versatile, and long-lasting options.

- Instant Noodles: Consistent demand driven by affordability and speed.

- Leading Segments (Distribution Channel):

- Hypermarkets/Supermarkets: Established dominance with wide product availability.

- Online Retail Stores: Rapidly growing channel driven by convenience and reach.

Europe Ready-to-Eat Food Market Product Developments

Product innovation in the Europe Ready-to-Eat food market is a cornerstone of competitive advantage. Manufacturers are focusing on enhancing nutritional profiles, incorporating functional ingredients, and offering a wider array of global cuisines. The emphasis is on creating RTE options that cater to specific dietary needs, such as vegan, gluten-free, and low-FODMAP diets. Advancements in packaging technology are also crucial, with a growing trend towards sustainable, recyclable, and portion-controlled packaging solutions that reduce food waste and enhance convenience. For example, the launch of boil-in-bag rice blends signifies a move towards more sophisticated and ingredient-focused RTE offerings. The integration of smart packaging that indicates freshness or provides cooking instructions is also an emerging area.

Challenges in the Europe Ready-to-Eat Food Market Market

Despite its growth, the Europe Ready-to-Eat food market faces several challenges. Regulatory hurdles, particularly concerning stringent food safety standards and evolving labeling requirements, can increase compliance costs and complexity. Supply chain disruptions, influenced by geopolitical events, climate change, and labor shortages, can impact ingredient availability and logistics, leading to price volatility. Intense competitive pressures from both established brands and emerging players necessitate continuous innovation and marketing investment to maintain market share. Furthermore, consumer perceptions regarding the healthiness of processed foods can act as a restraint, requiring manufacturers to actively communicate the nutritional benefits and quality of their RTE offerings.

Forces Driving Europe Ready-to-Eat Food Market Growth

Several forces are propelling the growth of the Europe Ready-to-Eat food market. Technological advancements in food processing and preservation are enabling the creation of safer, tastier, and more diverse RTE products. The economic factor of rising disposable incomes in many European nations supports increased consumer spending on convenience-oriented food items. Furthermore, favorable regulatory environments that support food innovation and safety standards indirectly encourage market expansion. The increasing consumer demand for convenience due to evolving work-life balances and a preference for less time spent on cooking are significant societal drivers.

Challenges in the Europe Ready-to-Eat Food Market Market

Long-term growth catalysts in the Europe Ready-to-Eat food market are deeply intertwined with ongoing societal shifts and industry evolution. Continuous innovation in product development, focusing on healthier ingredients, plant-based alternatives, and globally inspired flavors, will be crucial for sustained consumer interest. Strategic partnerships and collaborations, such as those fostering open innovation platforms, can accelerate the development of novel products and sustainable solutions. Furthermore, market expansions into underserved regions and the development of specialized RTE offerings for specific demographic groups will unlock new growth avenues. The increasing focus on food sustainability and ethical sourcing presents a significant long-term driver, as consumers become more conscious of the environmental and social impact of their food choices.

Emerging Opportunities in Europe Ready-to-Eat Food Market

Emerging opportunities within the Europe Ready-to-Eat food market are abundant, driven by shifting consumer preferences and technological advancements. The burgeoning demand for plant-based and vegan RTE options presents a significant untapped potential. Growing awareness of health and wellness is creating opportunities for RTE products fortified with vitamins, minerals, and functional ingredients. The expansion of online retail and direct-to-consumer models offers direct engagement with consumers and personalized product offerings. Furthermore, the increasing demand for ethically sourced and sustainable RTE foods opens avenues for brands with strong environmental and social responsibility credentials. Opportunities also lie in catering to specific dietary needs, such as allergen-free and low-calorie RTE meals.

Leading Players in the Europe Ready-to-Eat Food Market Sector

- Nestlé S A

- Nomad Foods Ltd

- The Kraft Heinz Company

- Conagra Brands Inc

- McCain Foods Limited

- Premier Foods Group Limited

- The Kellogg Company

- Ebro Foods S A

- Dr August Oetker Nahrungsmittel KG

- Frosta Aktiengesellschaft (FRoSTA AG)

Key Milestones in Europe Ready-to-Eat Food Market Industry

- April 2022: Nomad Foods launched a platform for open innovation in partnership with Innoget, fostering collaborations for product development.

- February 2022: Nestlé SA acquired a majority stake in Orgain, aiming to expand its organic and plant-based nutrition portfolio, with initial retail presence in Tesco UK stores.

- July 2021: Ebro Foods' business unit, Riviana Foods Inc., launched Success Garden & Grains Blends, introducing the first boil-in-bag rice product with simple ingredients.

Strategic Outlook for Europe Ready-to-Eat Food Market Market

The strategic outlook for the Europe Ready-to-Eat food market is exceptionally promising, characterized by sustained growth and evolving consumer demands. Key growth accelerators include continued investment in product innovation, particularly in the plant-based, organic, and functional food categories. Strategic alliances and acquisitions will remain pivotal for market consolidation and the acquisition of specialized technologies. Companies that effectively leverage e-commerce platforms and data analytics to understand and cater to individual consumer preferences will gain a competitive edge. The focus on sustainable packaging and ethical sourcing will not only meet growing consumer expectations but also become a significant differentiator. The market is poised for further expansion as it adapts to emerging dietary trends and embraces technological advancements to deliver convenient, healthy, and appealing food solutions.

Europe Ready-to-Eat Food Market Segmentation

-

1. Type

- 1.1. Instant Breakfast/Cereals

- 1.2. Instant Soups

- 1.3. Frozen snacks

- 1.4. Meat snacks

- 1.5. Ready Meals

- 1.6. Instant noodles

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores/Grocery stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Europe Ready-to-Eat Food Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Ready-to-Eat Food Market Regional Market Share

Geographic Coverage of Europe Ready-to-Eat Food Market

Europe Ready-to-Eat Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The numerous benefits offered by collagen in the food and beverage industry

- 3.3. Market Restrains

- 3.3.1. Increasing vegan population in the region

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Pre-cooked Meals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instant Breakfast/Cereals

- 5.1.2. Instant Soups

- 5.1.3. Frozen snacks

- 5.1.4. Meat snacks

- 5.1.5. Ready Meals

- 5.1.6. Instant noodles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores/Grocery stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Instant Breakfast/Cereals

- 6.1.2. Instant Soups

- 6.1.3. Frozen snacks

- 6.1.4. Meat snacks

- 6.1.5. Ready Meals

- 6.1.6. Instant noodles

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores/Grocery stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Instant Breakfast/Cereals

- 7.1.2. Instant Soups

- 7.1.3. Frozen snacks

- 7.1.4. Meat snacks

- 7.1.5. Ready Meals

- 7.1.6. Instant noodles

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores/Grocery stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Instant Breakfast/Cereals

- 8.1.2. Instant Soups

- 8.1.3. Frozen snacks

- 8.1.4. Meat snacks

- 8.1.5. Ready Meals

- 8.1.6. Instant noodles

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores/Grocery stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Instant Breakfast/Cereals

- 9.1.2. Instant Soups

- 9.1.3. Frozen snacks

- 9.1.4. Meat snacks

- 9.1.5. Ready Meals

- 9.1.6. Instant noodles

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores/Grocery stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Instant Breakfast/Cereals

- 10.1.2. Instant Soups

- 10.1.3. Frozen snacks

- 10.1.4. Meat snacks

- 10.1.5. Ready Meals

- 10.1.6. Instant noodles

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Convenience Stores/Grocery stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Instant Breakfast/Cereals

- 11.1.2. Instant Soups

- 11.1.3. Frozen snacks

- 11.1.4. Meat snacks

- 11.1.5. Ready Meals

- 11.1.6. Instant noodles

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Hypermarkets/Supermarkets

- 11.2.2. Convenience Stores/Grocery stores

- 11.2.3. Online Retail Stores

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Instant Breakfast/Cereals

- 12.1.2. Instant Soups

- 12.1.3. Frozen snacks

- 12.1.4. Meat snacks

- 12.1.5. Ready Meals

- 12.1.6. Instant noodles

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Hypermarkets/Supermarkets

- 12.2.2. Convenience Stores/Grocery stores

- 12.2.3. Online Retail Stores

- 12.2.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nomad Foods Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 The Kellogg Company*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Conagra Brands Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Ebro Foods S A

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dr August Oetker Nahrungsmittel KG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Frosta Aktiengesellschaft (FRoSTA AG)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Kraft Heinz Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 McCain Foods Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Premier Foods Group Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nestlé S A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nomad Foods Ltd

List of Figures

- Figure 1: Europe Ready-to-Eat Food Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Ready-to-Eat Food Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Ready-to-Eat Food Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ready-to-Eat Food Market?

The projected CAGR is approximately 5.22%.

2. Which companies are prominent players in the Europe Ready-to-Eat Food Market?

Key companies in the market include Nomad Foods Ltd, The Kellogg Company*List Not Exhaustive, Conagra Brands Inc, Ebro Foods S A, Dr August Oetker Nahrungsmittel KG, Frosta Aktiengesellschaft (FRoSTA AG), The Kraft Heinz Company, McCain Foods Limited, Premier Foods Group Limited, Nestlé S A.

3. What are the main segments of the Europe Ready-to-Eat Food Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.61 billion as of 2022.

5. What are some drivers contributing to market growth?

The numerous benefits offered by collagen in the food and beverage industry.

6. What are the notable trends driving market growth?

Increasing Demand for Pre-cooked Meals.

7. Are there any restraints impacting market growth?

Increasing vegan population in the region.

8. Can you provide examples of recent developments in the market?

April 2022: A platform for open innovation was launched by Nomad Foods in partnership with the international innovation network Innoget. It will be accessible to academics, subject matter experts, start-ups, and SMEs looking to form new collaborations from the ideation phase to product development and the eventual launch of new products in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ready-to-Eat Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ready-to-Eat Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ready-to-Eat Food Market?

To stay informed about further developments, trends, and reports in the Europe Ready-to-Eat Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence