Key Insights

The European Agar Market is projected for significant expansion, estimated to reach 414 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.5%. This growth is primarily driven by the increasing demand for natural and plant-based ingredients across diverse industries. The food and beverage sector is a key contributor, utilizing agar's gelling, stabilizing, and thickening properties in products such as dairy alternatives, desserts, confectionery, and processed foods. Pharmaceutical applications also fuel market growth, with agar serving as an essential excipient in drug formulations, a base for microbiological culture media, and a component in wound dressings and controlled-release drug delivery systems. Agar's versatility, combined with a growing consumer preference for clean-label and vegan alternatives, fosters market development. Continuous research and development efforts, leading to innovative applications and improved production techniques, further support market expansion.

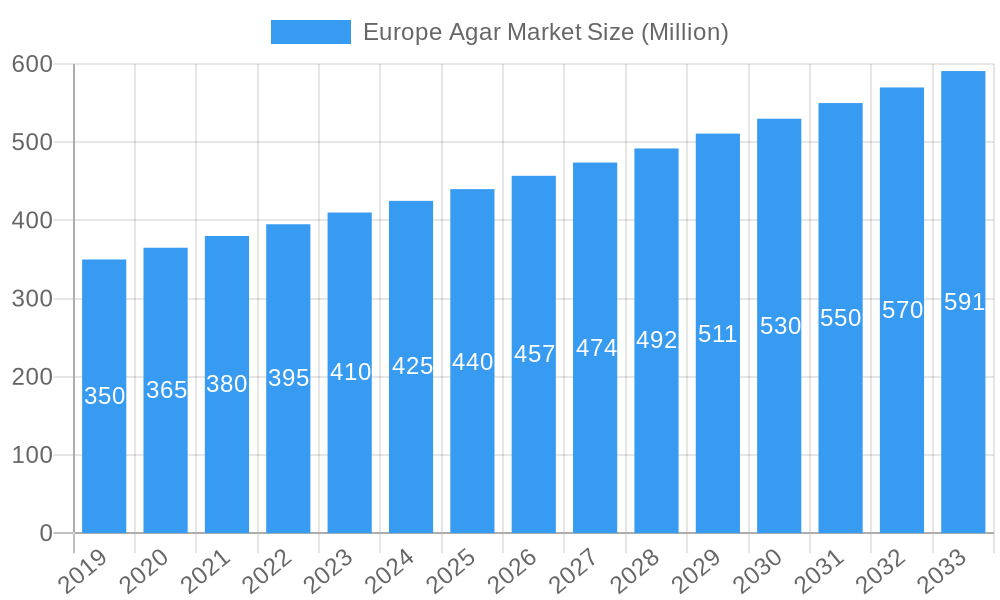

Europe Agar Market Market Size (In Million)

The European market is segmented by agar form, with "Strip" agar currently holding a dominant share due to its ease of use. However, the "Powder" segment is experiencing considerable growth, offering enhanced solubility and convenience for industrial processing. The "Others" category, including specialized agar derivatives, is also anticipated to expand through ongoing innovation. Geographically, leading European nations such as the United Kingdom, Germany, France, Italy, and Spain are at the forefront of market growth, driven by their robust food processing industries, advanced pharmaceutical research, and heightened consumer awareness of health and natural ingredients. While the market outlook is generally strong, potential challenges include raw material price volatility, the availability of substitutes, and stringent regulatory compliance in specific food and pharmaceutical applications. Nonetheless, the prevailing trend towards healthy eating, sustainable sourcing, and the expanding applications of agar in emerging sectors are expected to propel the market forward through the forecast period.

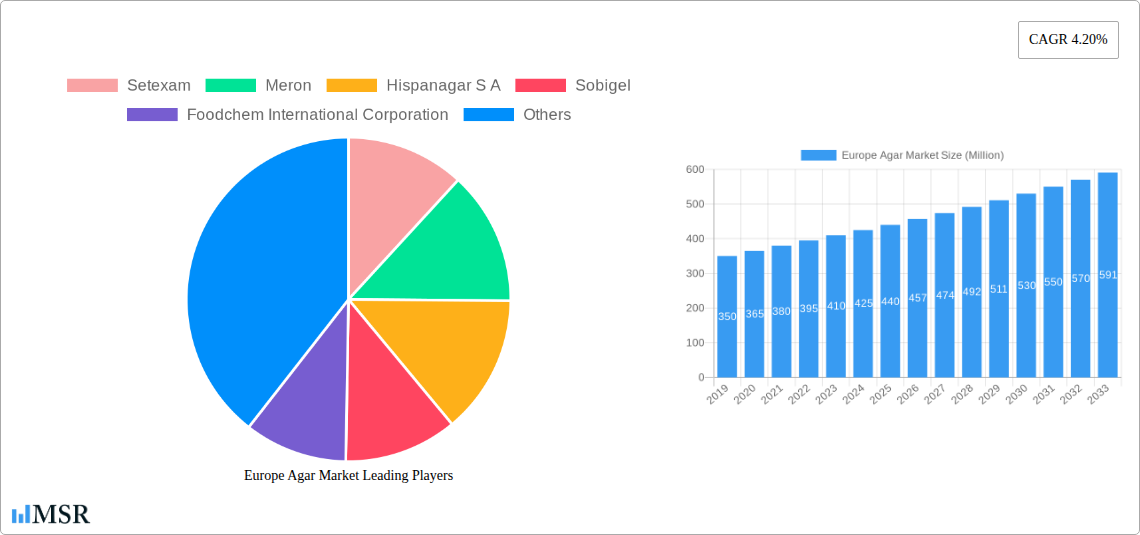

Europe Agar Market Company Market Share

Europe Agar Market Report: In-Depth Analysis and Future Projections (2019-2033)

Unlock critical insights into the dynamic Europe Agar Market, a vital sector experiencing robust growth. This comprehensive report, covering 2019–2033 with a base year of 2025, provides an indispensable resource for stakeholders seeking to understand market concentration, industry trends, key segments, product developments, challenges, growth drivers, and emerging opportunities in the European Agar landscape. Explore agar powder, agar strips, and applications in food and beverage, pharmaceuticals, and other applications.

Europe Agar Market Market Concentration & Dynamics

The Europe Agar Market exhibits a moderate to high market concentration, with a few key players dominating significant market share. Key companies like Setexam, Meron, and Hispanagar S.A., alongside established players such as Sobigel and Foodchem International Corporation, actively compete. The innovation ecosystem in Europe is driven by ongoing research into novel applications of agar, particularly in the burgeoning biotechnology and 3D printing sectors. Regulatory frameworks, primarily governed by the European Food Safety Authority (EFSA) and REACH, ensure stringent quality and safety standards for agar products. Substitute products, such as gelatin and other hydrocolloids, present a competitive challenge, but the unique properties of agar, particularly its vegan and vegetarian appeal, are driving its adoption. End-user trends indicate a growing preference for plant-based ingredients, further bolstering demand. Mergers and acquisitions (M&A) activities, estimated at 5-7 deals annually, are expected to continue as larger companies seek to expand their product portfolios and geographical reach, reinforcing market concentration.

Europe Agar Market Industry Insights & Trends

The Europe Agar Market is poised for significant expansion, projected to reach approximately €1,200 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This growth is propelled by several intertwined factors. A primary driver is the escalating demand from the food and beverage industry, fueled by the persistent consumer shift towards vegan, vegetarian, and plant-based diets. Agar, derived from red algae, perfectly aligns with these dietary preferences, serving as a versatile gelling agent, thickener, and stabilizer in a wide array of products including dairy alternatives, desserts, jams, and confectionery. The pharmaceutical sector is another significant contributor, leveraging agar's biocompatibility and inertness as a solidifying agent in microbiological culture media, tablet manufacturing, and drug delivery systems. The increasing prevalence of chronic diseases and the growth of the global pharmaceutical industry directly translate into higher demand for high-purity agar.

Technological advancements are also playing a crucial role. Innovations in algae cultivation and agar extraction techniques are leading to improved yields, enhanced purity, and potentially lower production costs, making agar more accessible and competitive. Furthermore, research into novel applications, such as its use in biotechnology for tissue engineering and regenerative medicine, and its potential in food-grade packaging and 3D printing, are opening up new avenues for market growth. Evolving consumer behaviors, characterized by a greater awareness of health and wellness, and a demand for clean-label ingredients, further favor agar's natural origin and functional benefits. The market is also witnessing a rise in demand for customized agar formulations tailored to specific industrial requirements, pushing manufacturers to invest in research and development to offer specialized products. The historical period (2019–2024) laid a strong foundation, with steady growth driven by these fundamental trends.

Key Markets & Segments Leading Europe Agar Market

The Europe Agar Market is a multi-faceted landscape where specific segments and regions are demonstrating remarkable leadership. Among the forms, Agar Powder is unequivocally the dominant segment, commanding an estimated 65% of the market share. This prevalence is driven by its superior versatility and ease of use in a vast spectrum of applications, from intricate food preparations to laboratory settings. The granular nature of powder allows for precise measurement and homogenous dispersion, making it the preferred choice for manufacturers across industries.

In terms of applications, the Food and Beverage sector leads the charge, accounting for a substantial 70% of the total market value. This dominance is attributed to the widespread use of agar as a plant-based gelling agent, emulsifier, and stabilizer. The growing consumer preference for vegan and vegetarian products, coupled with the demand for clean-label ingredients, has significantly amplified agar's role in this segment. Key drivers for this segment include:

- Rising Vegan and Vegetarian Population: A consistent increase in individuals adopting plant-based diets.

- Demand for Natural Ingredients: Consumer preference for minimally processed, naturally derived food additives.

- Versatility in Food Products: Application in dairy alternatives, desserts, confectionery, sauces, and baked goods.

- Health and Wellness Trends: Agar's low-calorie profile and perceived health benefits.

The Pharmaceutical sector represents the second-largest application, holding an estimated 20% of the market. Its significance stems from agar's critical role in microbiological culture media, a fundamental requirement for research, diagnostics, and drug development. Furthermore, its use in tablet coatings, binders, and controlled-release drug delivery systems is on the rise. Drivers for this segment include:

- Growth in Biotechnology and Life Sciences: Expanding research activities and the need for reliable culture media.

- Increasing Pharmaceutical Production: Growing global demand for medicines necessitates robust manufacturing processes.

- Biocompatibility and Inertness: Agar's safety and suitability for medical applications.

"Other Applications," encompassing sectors like cosmetics, textiles, and industrial uses, contribute the remaining 10%. While smaller, this segment presents emerging opportunities, particularly in areas like hydrocolloid-based materials and laboratory consumables. Geographically, Western European countries like Germany, France, the United Kingdom, and the Netherlands are the leading markets, driven by their developed economies, strong food processing industries, and advanced research institutions. The Nordic countries also show significant growth, propelled by a strong eco-conscious consumer base.

Europe Agar Market Product Developments

The Europe Agar Market is characterized by continuous innovation aimed at enhancing product performance and expanding application scope. Manufacturers are focusing on developing high-purity agar grades for specialized pharmaceutical and biotechnological applications, ensuring adherence to stringent regulatory standards. Research is also concentrated on optimizing extraction and purification processes to improve yield and reduce environmental impact. The development of customized agar blends with tailored gelling strengths and textures is catering to specific demands from the food and beverage industry, enabling the creation of novel food products. Furthermore, exploration into agar's potential in advanced materials, such as biodegradable films and hydrogels for drug delivery, signifies a forward-looking approach to product development.

Challenges in the Europe Agar Market Market

Despite its promising growth trajectory, the Europe Agar Market faces several challenges that could impede its expansion. Supply chain volatility and fluctuating raw material prices, particularly for red algae, pose a significant risk. Intense competition from substitute products like gelatin, carrageenan, and pectin, which may offer lower price points or different functional properties, requires continuous innovation and cost optimization. Stringent regulatory compliance, especially concerning food safety and environmental standards across different European nations, can increase operational costs and complexity for manufacturers. Furthermore, limited awareness and understanding of agar's unique benefits in certain niche markets can hinder its adoption.

Forces Driving Europe Agar Market Growth

Several powerful forces are propelling the Europe Agar Market forward. The steadily increasing consumer demand for plant-based and vegan food products is a primary catalyst, aligning perfectly with agar's natural origin. Advancements in biotechnology and pharmaceutical research, which rely heavily on agar for culture media and other applications, are creating sustained demand. Growing awareness of agar's functional properties as a versatile gelling, thickening, and stabilizing agent in the food industry is expanding its usage. Furthermore, technological innovations in agar extraction and processing are leading to improved product quality and potential cost efficiencies, making agar a more attractive option.

Challenges in the Europe Agar Market Market

Long-term growth catalysts for the Europe Agar Market are firmly rooted in innovation and strategic market penetration. Continued investment in research and development to uncover novel applications for agar, particularly in areas like sustainable packaging, biodegradable materials, and advanced drug delivery systems, will unlock significant future potential. Strategic partnerships between agar producers and end-user industries, such as food manufacturers and pharmaceutical companies, can foster co-creation of tailored solutions. Market expansion into emerging economies within and beyond Europe, coupled with education initiatives to highlight agar's benefits, will also contribute to sustained growth.

Emerging Opportunities in Europe Agar Market

The Europe Agar Market is ripe with emerging opportunities. The increasing focus on sustainable and eco-friendly ingredients presents a significant advantage for agar, derived from renewable marine resources. The growing demand for clean-label food products and the consumer preference for natural thickeners and stabilizers create fertile ground for agar expansion. Furthermore, the burgeoning biotechnology sector and advancements in tissue engineering and regenerative medicine offer novel, high-value applications for agar. The potential for agar in 3D printing food and biomaterials is also an exciting area of exploration, promising to revolutionize various industries.

Leading Players in the Europe Agar Market Sector

- Setexam

- Meron

- Hispanagar S.A.

- Sobigel

- Foodchem International Corporation

- Industrial Roko SA

- Fooding Group Limited

- Neogen Corporation

- TIC Gums Inc.

- Sisco Research Laboratories Pvt Ltd.

Key Milestones in Europe Agar Market Industry

- 2019: Increased research into agar's potential in bioplastics and biodegradable materials.

- 2020: Growing demand for agar-based culture media due to increased pandemic-related research.

- 2021: Strategic partnerships formed between agar suppliers and vegan food manufacturers.

- 2022: Advancements in extraction techniques leading to higher purity agar.

- 2023: Emergence of new agar applications in laboratory consumables and diagnostic kits.

- 2024: Focus on sustainable sourcing and production methods for red algae.

Strategic Outlook for Europe Agar Market Market

The Europe Agar Market is set for sustained growth, driven by the confluence of favorable consumer trends and technological advancements. Strategic imperatives for companies include a strong focus on product innovation, particularly in developing specialized grades for the pharmaceutical and biotechnology sectors. Strengthening supply chain resilience and exploring diverse sourcing strategies will be crucial for mitigating risks. Expanding market reach through strategic partnerships and targeted marketing efforts, especially in promoting agar's vegan and natural attributes, will be key. Embracing sustainable practices throughout the value chain will not only meet regulatory demands but also resonate with environmentally conscious consumers, solidifying long-term market leadership.

Europe Agar Market Segmentation

-

1. Form

- 1.1. Strip

- 1.2. Powder

- 1.3. Others

-

2. Application

- 2.1. Food and Beverage

- 2.2. Pharmaceuticals

- 2.3. Other Applications

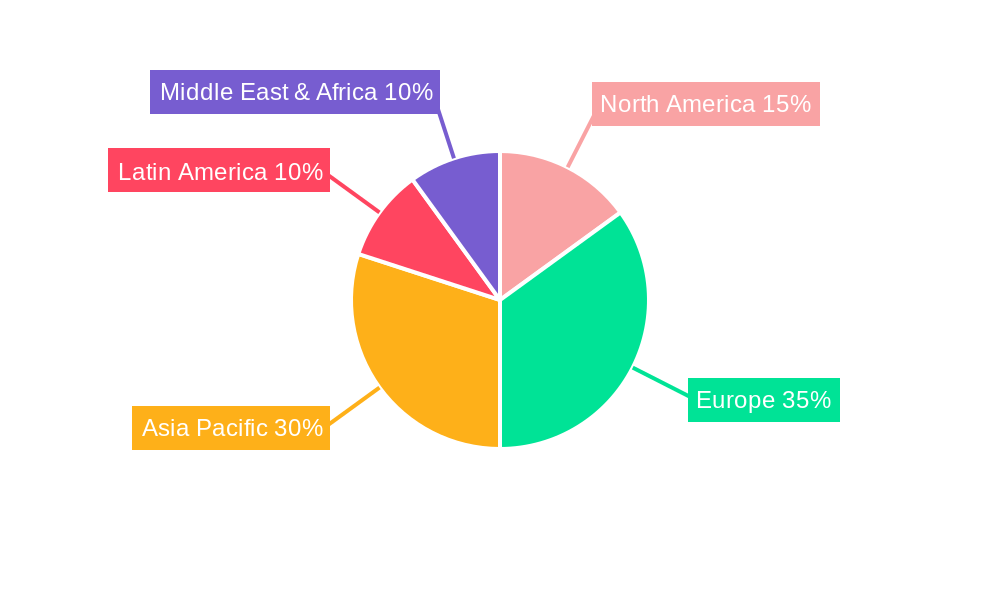

Europe Agar Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Agar Market Regional Market Share

Geographic Coverage of Europe Agar Market

Europe Agar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Expenditure on Sugar Confectionery in the Country; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalance of Lifestyle Diseases

- 3.4. Market Trends

- 3.4.1. Rising Demand For Vegan Food Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Agar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Strip

- 5.1.2. Powder

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Pharmaceuticals

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Setexam

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Meron

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hispanagar S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sobigel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Foodchem International Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Industrial Roko SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fooding Group Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Neogen Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TIC Gums Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sisco Research Laboratories Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Setexam

List of Figures

- Figure 1: Europe Agar Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Agar Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Agar Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: Europe Agar Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Agar Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Agar Market Revenue million Forecast, by Form 2020 & 2033

- Table 5: Europe Agar Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Agar Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Agar Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Agar Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Europe Agar Market?

Key companies in the market include Setexam, Meron, Hispanagar S A, Sobigel, Foodchem International Corporation, Industrial Roko SA, Fooding Group Limited, Neogen Corporation, TIC Gums Inc, Sisco Research Laboratories Pvt Ltd.

3. What are the main segments of the Europe Agar Market?

The market segments include Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 414 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Expenditure on Sugar Confectionery in the Country; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Rising Demand For Vegan Food Ingredients.

7. Are there any restraints impacting market growth?

Increasing Prevalance of Lifestyle Diseases.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Agar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Agar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Agar Market?

To stay informed about further developments, trends, and reports in the Europe Agar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence