Key Insights

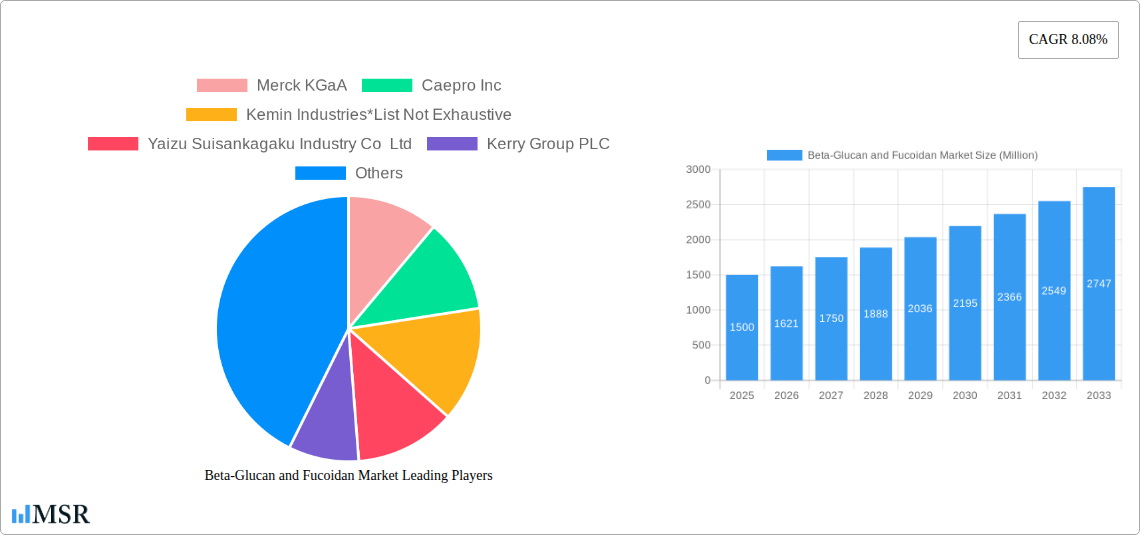

The global Beta-Glucan and Fucoidan market is projected for substantial growth, expected to reach a market size of 393 million by 2025, expanding at a compound annual growth rate (CAGR) of 6.1% from the base year 2025. This expansion is driven by increasing consumer focus on health and wellness. Beta-glucans, sourced from oats and yeast, are recognized for their immune-boosting properties, heightened by recent global health events. Fucoidan, a polysaccharide from brown seaweed, is gaining recognition for its cardiovascular, anti-inflammatory, and potential anti-cancer benefits. These attributes are fueling demand in the Food and Beverages sector for functional products and in the Supplements market for targeted health solutions. Emerging applications in pharmaceuticals and cosmetics also contribute to market potential.

Beta-Glucan and Fucoidan Market Market Size (In Million)

Market growth faces challenges including the high cost of extraction and purification, potentially impacting affordability. Raw material availability for fucoidan, dependent on seasonal and geographical factors, can also influence supply chain stability. However, advancements in extraction technologies, sustainable sourcing, and ongoing research into novel applications like antiviral and digestive health benefits, alongside strategic partnerships, are poised to overcome these restraints and drive market expansion and innovation.

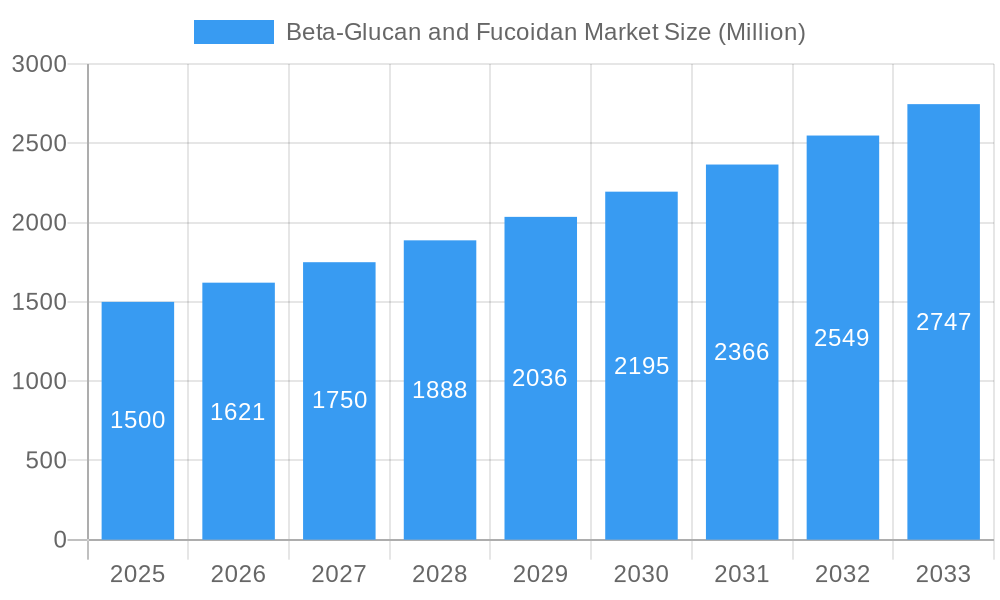

Beta-Glucan and Fucoidan Market Company Market Share

Unlock the Potential: Comprehensive Beta-Glucan and Fucoidan Market Report (2019–2033)

**Dive deep into the burgeoning *Beta-Glucan Market* and Fucoidan Market with our definitive industry report. Covering the extensive Study Period of 2019–2033, this analysis provides unparalleled insights into market dynamics, industry trends, key applications, and growth catalysts. Our Base Year is 2025, with detailed projections for the Forecast Period 2025–2033, building upon a robust Historical Period from 2019–2024. Discover how leading companies are capitalizing on the increasing demand for natural health ingredients, driving innovation in immunity boosters, cardiovascular health solutions, and a wide array of applications in food and beverages and supplements. This report is an essential resource for stakeholders seeking to understand and leverage the substantial growth opportunities within this dynamic sector.

Beta-Glucan and Fucoidan Market Market Concentration & Dynamics

The Beta-Glucan and Fucoidan Market exhibits a moderate level of concentration, with a few dominant players alongside a growing number of niche manufacturers. Innovation ecosystems are flourishing, particularly around novel extraction techniques and bio-fortification of beta-glucans from diverse sources like oats, barley, and mushrooms, and fucoidan from brown seaweed. Regulatory frameworks are evolving, with increasing scrutiny on health claims and product efficacy, impacting market entry and expansion strategies. Substitute products, such as other soluble fibers and antioxidants, pose a competitive challenge, yet the unique health benefits of beta-glucan and fucoidan continue to drive consumer preference. End-user trends show a significant shift towards natural, plant-based, and scientifically-backed health ingredients, fueling demand. Mergers and acquisitions (M&A) activities are on the rise as key players seek to consolidate market share, expand product portfolios, and gain access to advanced technologies. For instance, the past few years have witnessed xx significant M&A deals, indicating a strong trend towards consolidation and strategic partnerships. Key market players are actively investing in R&D to differentiate their offerings and capture a larger market share.

- Market Share Concentration: Top 5 players hold approximately xx% of the market.

- Innovation Ecosystems: Focus on sustainable sourcing and advanced purification.

- Regulatory Landscape: Increasing emphasis on GRAS status and clinical validation for health claims.

- Substitute Product Impact: Growing awareness of synergistic effects with other functional ingredients.

- End-User Trends: High demand for clean-label, scientifically proven health benefits.

- M&A Activities: xx M&A deals in the historical period, indicating strategic consolidation.

Beta-Glucan and Fucoidan Market Industry Insights & Trends

The Beta-Glucan and Fucoidan Market is poised for remarkable expansion, driven by a confluence of factors including heightened consumer awareness of health and wellness, a growing preference for natural and functional ingredients, and robust scientific validation of their therapeutic benefits. The global market size for beta-glucan and fucoidan is estimated to reach xx Million in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is underpinned by increasing demand for immunity boosters as global health concerns persist, and a surging interest in cardiovascular health solutions. Technological disruptions are playing a pivotal role, with advancements in extraction and purification methods leading to higher yields, improved purity, and novel applications. For example, enzymatic extraction techniques are enabling the production of beta-glucans with specific molecular weights, enhancing their bioavailability and efficacy. Furthermore, the exploration of new sources for fucoidan, beyond traditional brown seaweed varieties, is broadening the market’s scope. Evolving consumer behaviors are characterized by a proactive approach to health management, with individuals actively seeking dietary supplements and functional foods to support their well-being. This trend is further amplified by the aging global population, which is more inclined to invest in preventive healthcare measures. The food and beverage sector is increasingly integrating these ingredients into everyday products, from fortified cereals and yogurts to functional beverages, making them more accessible to a wider consumer base. Similarly, the supplements market continues to be a major driver, with a proliferation of products targeting immune support, gut health, and cardiovascular wellness. The rising disposable income in emerging economies also contributes to market growth, as consumers have greater purchasing power for premium health products. The sustained investment in research and development by key industry players, exploring new applications in areas like anti-inflammatory properties and even potential anti-cancer benefits of fucoidan, further fuels market optimism.

Key Markets & Segments Leading Beta-Glucan and Fucoidan Market

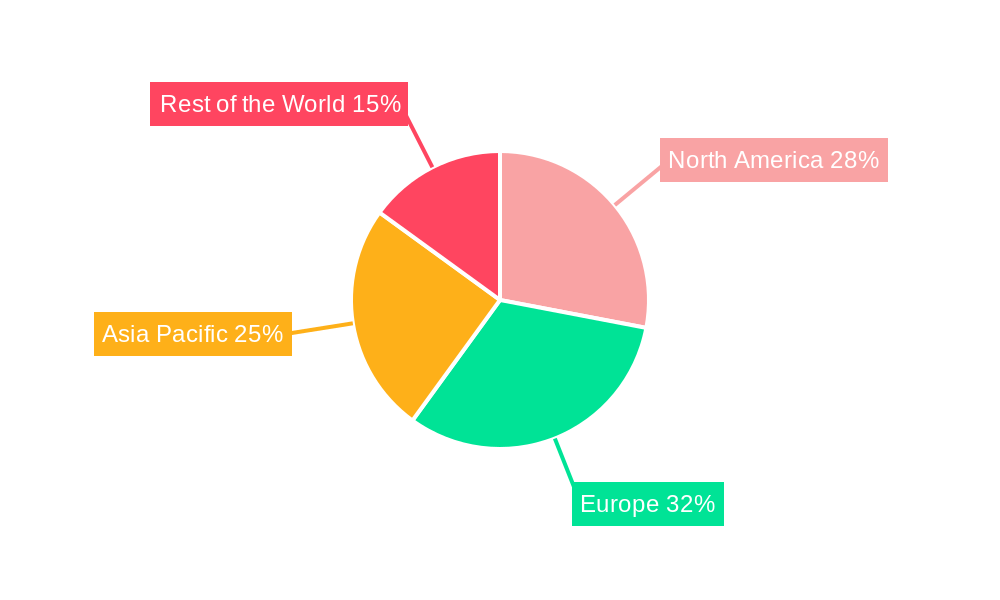

The Beta-Glucan and Fucoidan Market is witnessing robust growth across various regions and segments, with North America and Europe currently leading the charge due to their established health and wellness consciousness and advanced research infrastructure. However, the Asia-Pacific region is emerging as a rapidly expanding market, driven by increasing disposable incomes, a growing middle class, and a traditional inclination towards natural remedies.

Category Dominance:

- Beta Glucan: This category currently holds a larger market share due to its widespread availability from sources like oats and barley, and its well-established benefits for cholesterol management and immune support. The demand for beta-glucan in the food and beverage industry, particularly in breakfast cereals and dairy products, is substantial.

- Fucoidan: While currently a smaller segment, fucoidan is experiencing accelerated growth owing to its potent antioxidant, anti-inflammatory, and potential anti-cancer properties. Its application in specialized supplements and high-value nutraceuticals is a key driver.

Functionality Trends:

- Immunity Booster: This functionality remains paramount, especially in the wake of global health events, with consumers actively seeking ingredients that bolster immune responses. The supplements segment heavily relies on this claim, with a significant portion of the market dedicated to immune-enhancing products.

- Cardiovascular Health: Beta-glucan's proven ability to lower cholesterol levels makes this a consistently strong segment. Its integration into functional foods and beverages targeting heart health is a major market contributor.

- Others: This includes emerging functionalities like gut health support, anti-inflammatory effects, and potential anti-aging benefits, which are gaining traction and driving innovation.

Application Landscape:

- Food and Beverages: This segment is the largest contributor to overall market revenue, driven by the incorporation of beta-glucan and fucoidan into everyday consumables. The trend towards fortified and functional foods continues to expand this application.

- Supplements: This segment is expected to witness the highest growth rate, as consumers increasingly turn to concentrated forms of these beneficial compounds for targeted health benefits. The demand for scientifically backed and high-purity supplements is on the rise.

- Others: This encompasses emerging applications in cosmetics, animal feed, and pharmaceuticals, representing future growth avenues.

Regional Dominance and Drivers:

- North America: Characterized by high consumer awareness, strong R&D capabilities, and a well-developed regulatory framework supporting health claims. Economic growth and high disposable incomes contribute to premium product adoption.

- Europe: Similar to North America, with a strong focus on functional foods and a mature market for dietary supplements. Stringent quality standards and consumer demand for natural ingredients drive innovation.

- Asia-Pacific: Rapidly emerging market driven by increasing health consciousness, a growing middle class, and government initiatives promoting health and wellness. Economic development and a large population base present significant growth potential.

Beta-Glucan and Fucoidan Market Product Developments

Product innovation within the Beta-Glucan and Fucoidan Market is characterized by advancements in purity, bioavailability, and novel delivery systems. Manufacturers are focusing on developing beta-glucans with specific molecular weights to optimize their functional benefits for cardiovascular health and immune modulation. For fucoidan, research is exploring enhanced extraction methods for higher yields and the identification of specific fucoidan compounds with potent anti-inflammatory and anti-cancer properties. These developments are directly influencing product formulations in food and beverages and supplements, leading to more targeted and effective health solutions. Technological advancements are enabling the incorporation of these ingredients into a wider range of products, from powdered mixes to capsules and even functional beverages, enhancing their market relevance and competitive edge.

Challenges in the Beta-Glucan and Fucoidan Market Market

Despite its promising growth trajectory, the Beta-Glucan and Fucoidan Market faces several challenges. Regulatory hurdles, particularly concerning health claims and ingredient standardization across different regions, can slow down market penetration. Supply chain disruptions, especially for fucoidan sourced from specific seaweed species, can impact availability and price stability. Furthermore, the cost of production for high-purity extracts can be substantial, making them less accessible for certain consumer segments. Intense competition from established functional ingredients and the need for continuous scientific validation to maintain consumer trust also present ongoing challenges. The market is valued at xx Million in the base year 2025.

- Regulatory Complexity: Navigating diverse international regulations for health claims.

- Supply Chain Volatility: Dependence on natural resource availability for fucoidan.

- Production Costs: High expenses associated with advanced extraction and purification.

- Consumer Education: The need to continuously educate consumers about benefits and differentiation.

- Competition: Intense rivalry from other functional ingredients.

Forces Driving Beta-Glucan and Fucoidan Market Growth

The Beta-Glucan and Fucoidan Market is propelled by several key growth drivers. A primary force is the escalating global consumer demand for natural, plant-based, and scientifically validated health ingredients, particularly for immunity boosters and cardiovascular health. Advances in scientific research continually uncover new therapeutic benefits, fueling innovation and product development. The growing awareness of preventive healthcare, coupled with an aging global population, significantly boosts the demand for dietary supplements and functional foods. Furthermore, the increasing adoption of these ingredients by the food and beverage industry to enhance the nutritional profile of everyday products is a major growth catalyst. Regulatory bodies' increasing acceptance of well-substantiated health claims also plays a crucial role.

Challenges in the Beta-Glucan and Fucoidan Market Market

Long-term growth in the Beta-Glucan and Fucoidan Market will be sustained by a focus on continuous innovation and strategic market expansion. The development of novel extraction technologies that improve yield, reduce costs, and enhance the purity of beta-glucan and fucoidan will be critical. Partnerships between research institutions and industry players will accelerate the discovery of new applications, such as their potential roles in managing chronic diseases beyond cardiovascular health and immunity. Market expansion into emerging economies, where health awareness is rapidly growing, presents significant opportunities. Furthermore, fostering collaborations across the value chain, from ingredient suppliers to end-product manufacturers, will ensure a consistent supply of high-quality products and drive market penetration.

Emerging Opportunities in Beta-Glucan and Fucoidan Market

Emerging opportunities within the Beta-Glucan and Fucoidan Market are abundant and diverse. The growing interest in personalized nutrition opens avenues for developing tailored supplements based on individual health needs. The pharmaceutical sector is showing increased interest in fucoidan's potential therapeutic applications, particularly in oncology and immunology, which could lead to significant market growth. Furthermore, the exploration of microalgae and fungi as alternative sources for beta-glucan and fucoidan offers opportunities for sustainable and cost-effective production. Consumer demand for natural alternatives in the cosmetic industry is also creating new application possibilities for these bioactive compounds, focusing on anti-aging and skin health benefits.

Leading Players in the Beta-Glucan and Fucoidan Market Sector

- Merck KGaA

- Caepro Inc

- Kemin Industries

- Yaizu Suisankagaku Industry Co Ltd

- Kerry Group PLC

- Super Beta Glucan Inc

- Koninklijke DSM NV

- Lantmannen

- Arcticzymes Technologies ASA

- BASF SA

Key Milestones in Beta-Glucan and Fucoidan Market Industry

- 2019: Increased research publications on fucoidan's immunomodulatory and anti-cancer properties.

- 2020: Surge in demand for immunity-boosting ingredients, significantly impacting beta-glucan sales.

- 2021: Advancements in enzymatic extraction techniques for beta-glucan production by key manufacturers.

- 2022: Several new fucoidan-based supplements launched targeting gut health and anti-inflammatory benefits.

- 2023: Increased M&A activities as larger players seek to strengthen their portfolios in the functional ingredients space.

- 2024: Growing focus on sustainability and traceable sourcing for fucoidan ingredients.

Strategic Outlook for Beta-Glucan and Fucoidan Market Market

The strategic outlook for the Beta-Glucan and Fucoidan Market is exceptionally positive, driven by an ongoing surge in consumer demand for health-promoting ingredients. Growth accelerators will be fueled by continued investment in research and development, leading to the discovery of novel applications and enhanced product efficacy. Strategic partnerships between ingredient manufacturers, food and beverage companies, and supplement brands will expand market reach. The focus on expanding into emerging markets, coupled with an increasing understanding and acceptance of the scientifically proven benefits of beta-glucan and fucoidan, will solidify their position as indispensable components in health and wellness products globally. The market is projected to reach xx Million by 2033.

Beta-Glucan and Fucoidan Market Segmentation

-

1. Category

- 1.1. Beta Glucan

- 1.2. Fucoidan

-

2. Functionality

- 2.1. Immunity Booster

- 2.2. Cardiovascular Health

- 2.3. Others

-

3. Application

- 3.1. Food and Beverages

- 3.2. Supplements

- 3.3. Others

Beta-Glucan and Fucoidan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

- 4.3. Africa

Beta-Glucan and Fucoidan Market Regional Market Share

Geographic Coverage of Beta-Glucan and Fucoidan Market

Beta-Glucan and Fucoidan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Growing Expansion In Immunity Ingredient Space

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beta-Glucan and Fucoidan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Beta Glucan

- 5.1.2. Fucoidan

- 5.2. Market Analysis, Insights and Forecast - by Functionality

- 5.2.1. Immunity Booster

- 5.2.2. Cardiovascular Health

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverages

- 5.3.2. Supplements

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North America Beta-Glucan and Fucoidan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Beta Glucan

- 6.1.2. Fucoidan

- 6.2. Market Analysis, Insights and Forecast - by Functionality

- 6.2.1. Immunity Booster

- 6.2.2. Cardiovascular Health

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food and Beverages

- 6.3.2. Supplements

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Europe Beta-Glucan and Fucoidan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Beta Glucan

- 7.1.2. Fucoidan

- 7.2. Market Analysis, Insights and Forecast - by Functionality

- 7.2.1. Immunity Booster

- 7.2.2. Cardiovascular Health

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food and Beverages

- 7.3.2. Supplements

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Asia Pacific Beta-Glucan and Fucoidan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Beta Glucan

- 8.1.2. Fucoidan

- 8.2. Market Analysis, Insights and Forecast - by Functionality

- 8.2.1. Immunity Booster

- 8.2.2. Cardiovascular Health

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food and Beverages

- 8.3.2. Supplements

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Rest of the World Beta-Glucan and Fucoidan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Beta Glucan

- 9.1.2. Fucoidan

- 9.2. Market Analysis, Insights and Forecast - by Functionality

- 9.2.1. Immunity Booster

- 9.2.2. Cardiovascular Health

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food and Beverages

- 9.3.2. Supplements

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Merck KGaA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Caepro Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kemin Industries*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Yaizu Suisankagaku Industry Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kerry Group PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Super Beta Glucan Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Koninklijke DSM NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lantmannen

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Arcticzymes Technologies ASA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BASF SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Merck KGaA

List of Figures

- Figure 1: Global Beta-Glucan and Fucoidan Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Beta-Glucan and Fucoidan Market Revenue (million), by Category 2025 & 2033

- Figure 3: North America Beta-Glucan and Fucoidan Market Revenue Share (%), by Category 2025 & 2033

- Figure 4: North America Beta-Glucan and Fucoidan Market Revenue (million), by Functionality 2025 & 2033

- Figure 5: North America Beta-Glucan and Fucoidan Market Revenue Share (%), by Functionality 2025 & 2033

- Figure 6: North America Beta-Glucan and Fucoidan Market Revenue (million), by Application 2025 & 2033

- Figure 7: North America Beta-Glucan and Fucoidan Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Beta-Glucan and Fucoidan Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Beta-Glucan and Fucoidan Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Beta-Glucan and Fucoidan Market Revenue (million), by Category 2025 & 2033

- Figure 11: Europe Beta-Glucan and Fucoidan Market Revenue Share (%), by Category 2025 & 2033

- Figure 12: Europe Beta-Glucan and Fucoidan Market Revenue (million), by Functionality 2025 & 2033

- Figure 13: Europe Beta-Glucan and Fucoidan Market Revenue Share (%), by Functionality 2025 & 2033

- Figure 14: Europe Beta-Glucan and Fucoidan Market Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Beta-Glucan and Fucoidan Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Beta-Glucan and Fucoidan Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Beta-Glucan and Fucoidan Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Beta-Glucan and Fucoidan Market Revenue (million), by Category 2025 & 2033

- Figure 19: Asia Pacific Beta-Glucan and Fucoidan Market Revenue Share (%), by Category 2025 & 2033

- Figure 20: Asia Pacific Beta-Glucan and Fucoidan Market Revenue (million), by Functionality 2025 & 2033

- Figure 21: Asia Pacific Beta-Glucan and Fucoidan Market Revenue Share (%), by Functionality 2025 & 2033

- Figure 22: Asia Pacific Beta-Glucan and Fucoidan Market Revenue (million), by Application 2025 & 2033

- Figure 23: Asia Pacific Beta-Glucan and Fucoidan Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Beta-Glucan and Fucoidan Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Beta-Glucan and Fucoidan Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Beta-Glucan and Fucoidan Market Revenue (million), by Category 2025 & 2033

- Figure 27: Rest of the World Beta-Glucan and Fucoidan Market Revenue Share (%), by Category 2025 & 2033

- Figure 28: Rest of the World Beta-Glucan and Fucoidan Market Revenue (million), by Functionality 2025 & 2033

- Figure 29: Rest of the World Beta-Glucan and Fucoidan Market Revenue Share (%), by Functionality 2025 & 2033

- Figure 30: Rest of the World Beta-Glucan and Fucoidan Market Revenue (million), by Application 2025 & 2033

- Figure 31: Rest of the World Beta-Glucan and Fucoidan Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Beta-Glucan and Fucoidan Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Beta-Glucan and Fucoidan Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Category 2020 & 2033

- Table 2: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Functionality 2020 & 2033

- Table 3: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Category 2020 & 2033

- Table 6: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Functionality 2020 & 2033

- Table 7: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Category 2020 & 2033

- Table 14: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Functionality 2020 & 2033

- Table 15: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Application 2020 & 2033

- Table 16: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Germany Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: France Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Italy Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Spain Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Russia Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Category 2020 & 2033

- Table 25: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Functionality 2020 & 2033

- Table 26: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Application 2020 & 2033

- Table 27: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: India Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Japan Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: India Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Australia Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Category 2020 & 2033

- Table 34: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Functionality 2020 & 2033

- Table 35: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Application 2020 & 2033

- Table 36: Global Beta-Glucan and Fucoidan Market Revenue million Forecast, by Country 2020 & 2033

- Table 37: South America Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Middle East Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Africa Beta-Glucan and Fucoidan Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beta-Glucan and Fucoidan Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Beta-Glucan and Fucoidan Market?

Key companies in the market include Merck KGaA, Caepro Inc, Kemin Industries*List Not Exhaustive, Yaizu Suisankagaku Industry Co Ltd, Kerry Group PLC, Super Beta Glucan Inc, Koninklijke DSM NV, Lantmannen, Arcticzymes Technologies ASA, BASF SA.

3. What are the main segments of the Beta-Glucan and Fucoidan Market?

The market segments include Category, Functionality, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 393 million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Growing Expansion In Immunity Ingredient Space.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beta-Glucan and Fucoidan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beta-Glucan and Fucoidan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beta-Glucan and Fucoidan Market?

To stay informed about further developments, trends, and reports in the Beta-Glucan and Fucoidan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence