Key Insights

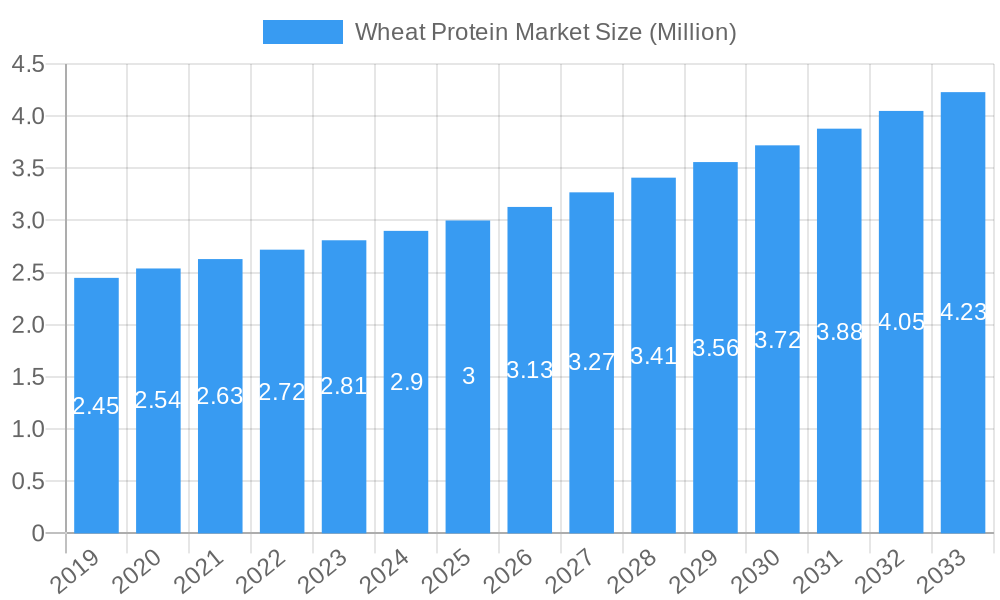

The global Wheat Protein Market is poised for significant expansion, projected to reach approximately USD 2.83 million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 4.45% through 2033. This upward trajectory is underpinned by a confluence of evolving consumer preferences and advancements in food technology. A primary driver for this growth is the escalating demand for plant-based protein alternatives, fueled by increasing health consciousness, environmental concerns, and a growing vegetarian and vegan population. Wheat protein, derived from a readily available and cost-effective agricultural commodity, offers a compelling solution for manufacturers seeking to meet this demand. Furthermore, the versatility of wheat protein ingredients, ranging from concentrates and isolates to textured forms, allows for their integration across a diverse array of applications, including dairy alternatives, bakery products, sports nutrition, confectionery, and even animal feed, thereby broadening its market penetration.

Wheat Protein Market Market Size (In Million)

Key trends shaping the market include the rising adoption of wheat protein in functional foods and beverages, where its nutritional profile and texturizing properties are highly valued. Innovations in processing technologies are also enhancing the quality and functionality of wheat protein, making it a more attractive ingredient for a wider range of food products. However, certain factors may present challenges. Potential restraints could involve price volatility of wheat as a raw material, influenced by agricultural yields and global commodity markets. Additionally, consumer perception regarding gluten content in wheat-derived products could pose a consideration for specific market segments. Despite these potential headwinds, the overarching market dynamics, characterized by strong consumer demand for sustainable and healthy protein sources, indicate a favorable outlook for the Wheat Protein Market, with continued innovation and strategic market penetration expected to drive sustained growth.

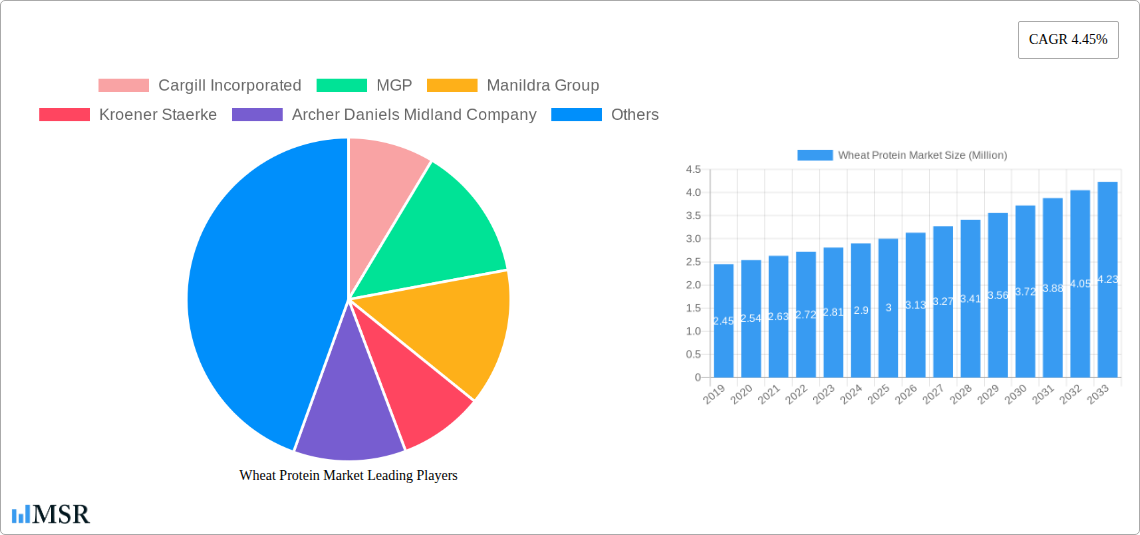

Wheat Protein Market Company Market Share

Gain unparalleled insights into the global wheat protein market with this in-depth report. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this analysis provides actionable intelligence for stakeholders navigating the dynamic plant-based protein landscape. Explore market size, CAGR, key drivers, emerging opportunities, and competitive strategies for wheat protein concentrate, wheat protein isolate, and textured wheat protein across diverse applications including dairy alternatives, bakery goods, sports nutrition, nutritional supplements, and animal feed.

Wheat Protein Market Market Concentration & Dynamics

The wheat protein market exhibits a moderate to high concentration, with key players like Cargill Incorporated, MGP, Manildra Group, Archer Daniels Midland Company, and Roquette Freres dominating significant market share. Innovation ecosystems are actively fostered through R&D investments in novel extraction techniques and application development, particularly for high-value wheat protein isolate and functional textured wheat protein. Regulatory frameworks are evolving to support the labeling and marketing of plant-based proteins, influencing product development and consumer acceptance. Substitute products, primarily soy and pea protein, exert competitive pressure, necessitating continuous innovation in wheat protein's functional and nutritional attributes. End-user trends heavily favor clean-label, non-GMO, and sustainably sourced ingredients, driving demand for premium wheat protein variants. Merger and acquisition (M&A) activities are expected to remain strategic, consolidating market presence and expanding product portfolios, with an estimated XX M&A deals anticipated during the forecast period.

Wheat Protein Market Industry Insights & Trends

The global wheat protein market is poised for substantial expansion, driven by a confluence of robust growth drivers, disruptive technological advancements, and profoundly evolving consumer behaviors. The estimated market size for wheat protein is projected to reach $XX Million in 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% anticipated from 2025 to 2033. This significant upward trajectory is primarily fueled by the burgeoning global demand for plant-based protein sources, attributed to increasing health consciousness, ethical considerations regarding animal agriculture, and a growing prevalence of dietary restrictions and allergies. Consumers are actively seeking alternatives to traditional animal proteins, making wheat protein a compelling option due to its accessibility, versatility, and increasingly sophisticated functional properties.

Technological disruptions are playing a pivotal role in reshaping the market. Advancements in protein extraction and modification technologies are yielding higher purity wheat protein isolate with improved solubility, emulsification, and gelation capabilities, expanding its utility in a wider array of food and beverage applications. The development of innovative textured wheat protein is mimicking the texture and mouthfeel of meat, making it an attractive ingredient for plant-based meat alternatives. Furthermore, significant investments in research and development are focused on enhancing the nutritional profile of wheat protein, including improving its amino acid composition and bioavailability, thereby increasing its competitiveness against other protein sources.

Evolving consumer behaviors are a cornerstone of this growth. The “flexitarian” diet, characterized by a reduction in meat consumption, is gaining widespread adoption globally, creating a substantial market for plant-based alternatives. Consumers are increasingly scrutinizing ingredient lists, favoring products with recognizable and natural ingredients. Wheat protein, derived from a widely cultivated grain, aligns well with this trend, especially when positioned as a sustainable and hypoallergenic option. The demand for fortified foods and beverages, particularly in the sports nutrition and nutritional supplements segments, is also a key driver, as wheat protein offers a valuable source of amino acids for muscle recovery and overall wellness. The animal feed sector also presents a significant market, where wheat protein is utilized for its nutritional value and palatability, contributing to the efficiency of livestock and aquaculture operations. The market's trajectory is further supported by policy shifts and industry initiatives promoting sustainable food systems and the adoption of plant-based diets.

Key Markets & Segments Leading Wheat Protein Market

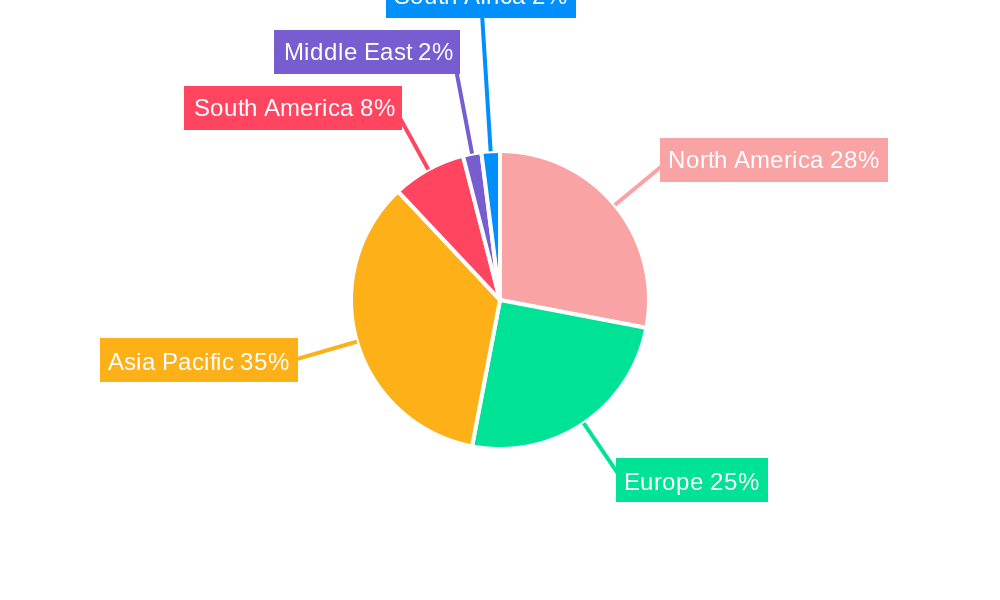

The wheat protein market is characterized by dynamic regional and segmental leadership, with North America and Europe currently holding substantial market shares. This dominance is propelled by well-established food processing industries, high consumer awareness of health and wellness trends, and significant investments in plant-based product development. Within these regions, economic growth, robust infrastructure for ingredient supply chains, and favorable regulatory environments contribute to the widespread adoption of wheat protein.

Dominant Segments Driving Market Growth:

- Wheat Protein Concentrate: This segment is a foundational pillar of the market, offering a cost-effective and versatile protein source. Its widespread use in animal feed, bakery goods, and as a general-purpose protein fortifier in various food products underpins its significant market presence. Economic factors, including the cost-effectiveness of sourcing and processing, make wheat protein concentrate a preferred choice for large-scale manufacturers.

- Wheat Protein Isolate: Exhibiting a higher protein content and enhanced purity, wheat protein isolate is increasingly capturing market attention. Its superior functional properties, such as excellent solubility and emulsification, are driving its adoption in premium nutritional supplements, sports food, and specialized dairy alternatives. Technological advancements in isolation techniques have improved its quality and cost-competitiveness, further fueling its growth.

- Textured Wheat Protein (TWP): The burgeoning demand for plant-based meat alternatives has catapulted TWP into a key growth segment. Its ability to mimic the texture and bite of traditional meat makes it indispensable in the development of vegetarian and vegan burgers, sausages, and other meat analogues. Growing consumer preference for sustainable and ethical food choices is a primary driver for TWP's expansion in the food & beverage sector.

Application Dominance Analysis:

The bakery segment continues to be a significant consumer of wheat protein, benefiting from its dough conditioning properties and ability to enhance protein content in bread, pastries, and other baked goods. The increasing demand for high-protein, gluten-free (where applicable through processing) bakery items further bolsters this segment.

The sports food and nutritional supplements sectors are experiencing rapid growth, driven by the fitness and wellness boom. Wheat protein isolate is highly valued here for its amino acid profile, supporting muscle repair and growth, making it a popular ingredient in protein powders, bars, and ready-to-drink beverages.

The dairy segment, particularly dairy alternatives, is a burgeoning area for wheat protein. As consumers seek dairy-free options, wheat protein is being incorporated into plant-based yogurts, cheeses, and milk alternatives, offering a complementary protein source and desirable texture.

Animal Feed remains a substantial market, accounting for a significant volume of wheat protein. Its nutritional value, particularly for poultry and swine, contributes to animal growth and health, making it a vital ingredient for feed manufacturers.

The Confectionery and Others segments, while smaller, represent growing avenues for innovation, with wheat protein finding applications in plant-based chocolates, snacks, and functional food ingredients.

Wheat Protein Market Product Developments

Product innovations in the wheat protein market are centered on enhancing functionality and expanding application versatility. Advanced processing techniques are yielding wheat protein isolates with superior solubility, emulsification, and foaming properties, making them ideal for sophisticated food formulations in dairy alternatives and nutritional supplements. The development of novel textured wheat protein formats offers improved texture and bite, crucial for the growing plant-based meat analogue market. Furthermore, research into bio-fortification and improved extraction methods is leading to wheat protein products with enhanced nutritional profiles and hypoallergenic characteristics, catering to niche dietary needs and expanding market reach.

Challenges in the Wheat Protein Market Market

Despite its promising growth, the wheat protein market faces several challenges. Significant competitive pressure from established plant proteins like soy and pea protein necessitates continuous innovation to differentiate wheat protein's functional and nutritional advantages. Supply chain volatility, influenced by crop yields and global trade dynamics, can impact raw material availability and pricing. Furthermore, consumer perception regarding gluten, even with protein isolates, can pose a hurdle in certain markets, requiring clear communication and targeted product development. Regulatory complexities surrounding novel food ingredients and labeling can also present obstacles to market entry and expansion. The market size of some niche applications may also be limited initially.

Forces Driving Wheat Protein Market Growth

The wheat protein market is experiencing robust growth, propelled by several key forces. The escalating global demand for plant-based protein alternatives, driven by health, environmental, and ethical concerns, is a primary catalyst. Technological advancements in protein extraction and texturization are improving product quality and expanding application versatility, particularly for wheat protein isolate and textured wheat protein. Supportive government policies and industry initiatives promoting sustainable diets further contribute to market expansion. The increasing consumer preference for clean-label and non-GMO ingredients aligns with wheat protein's positioning as a natural and accessible plant-based option.

Challenges in the Wheat Protein Market Market

Long-term growth in the wheat protein market hinges on overcoming persistent challenges and capitalizing on strategic advancements. Continued investment in R&D for enhanced protein functionality and improved amino acid profiles is crucial to compete effectively with other protein sources. Developing novel extraction and processing technologies that are both sustainable and cost-effective will be vital for broader market penetration. Furthermore, strategic partnerships with food manufacturers and ingredient distributors are essential for expanding product reach and diversifying applications. Market expansions into emerging economies with growing middle classes and increasing awareness of health and wellness trends present significant long-term growth opportunities.

Emerging Opportunities in Wheat Protein Market

Emerging opportunities within the wheat protein market are abundant and multifaceted. The booming demand for plant-based meat alternatives presents a substantial avenue for textured wheat protein, offering a versatile base for a wide range of meat-free products. Innovations in dairy alternatives, such as plant-based yogurts and cheeses, are increasingly incorporating wheat protein for its functional and nutritional benefits. The nutritional supplements and sports food sectors continue to offer lucrative avenues for high-purity wheat protein isolate due to its amino acid profile. Furthermore, exploring new geographical markets with increasing consumer interest in plant-based diets and expanding the application of wheat protein in animal feed for specialized livestock or aquaculture present significant growth potential.

Leading Players in the Wheat Protein Market Sector

- Cargill Incorporated

- MGP

- Manildra Group

- Kroener Staerke

- Archer Daniels Midland Company

- CropEnergies AG

- GLICO NUTRITION CO LT

- Roquette Freres

- Crespel & Deiters

- Tereos Syrol

Key Milestones in Wheat Protein Market Industry

- 2019: Increased R&D focus on high-protein, low-gluten wheat varieties.

- 2020: Launch of new textured wheat protein products for plant-based meat alternatives.

- 2021: Growing consumer awareness of plant-based diets drives demand for wheat protein in supplements.

- 2022: Investments in sustainable wheat cultivation and processing practices.

- 2023: Expansion of wheat protein applications in dairy-alternative beverages.

- 2024: Advancements in isolation technologies leading to higher purity wheat protein isolate.

- 2025 (Estimated): Increased M&A activity expected to consolidate market share.

- 2026-2033 (Forecast): Continued innovation in functional properties and market expansion.

Strategic Outlook for Wheat Protein Market Market

The strategic outlook for the wheat protein market is exceptionally positive, characterized by strong growth accelerators and significant untapped potential. The increasing global shift towards plant-based diets is the paramount growth engine, supported by rising health consciousness and environmental concerns. Continued innovation in product development, particularly in creating wheat protein isolate with enhanced functionalities and textured wheat protein that closely mimics meat texture, will be critical for capturing market share. Strategic partnerships across the value chain, from farmers to food manufacturers, will foster collaboration and drive market penetration. Expansion into underserved geographical regions and diversification of applications beyond traditional food and feed sectors will unlock new revenue streams, solidifying wheat protein's position as a key player in the global protein landscape.

Wheat Protein Market Segmentation

-

1. Type

- 1.1. Wheat Concentrate

- 1.2. Wheat Protein Isolate

- 1.3. Textured Wheat Protein

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Sports Food

- 2.4. Confectionery

- 2.5. Nutritional Supplements

- 2.6. Animal Feed

- 2.7. Others

Wheat Protein Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Wheat Protein Market Regional Market Share

Geographic Coverage of Wheat Protein Market

Wheat Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Plant-Based Food and Beverages; Increasing Application of Plant Proteins in Animal Feed

- 3.3. Market Restrains

- 3.3.1. Higher Cost of Production of Plant Proteins

- 3.4. Market Trends

- 3.4.1. Growing Significance for Nutrition and Weight Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wheat Concentrate

- 5.1.2. Wheat Protein Isolate

- 5.1.3. Textured Wheat Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Sports Food

- 5.2.4. Confectionery

- 5.2.5. Nutritional Supplements

- 5.2.6. Animal Feed

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wheat Concentrate

- 6.1.2. Wheat Protein Isolate

- 6.1.3. Textured Wheat Protein

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy

- 6.2.2. Bakery

- 6.2.3. Sports Food

- 6.2.4. Confectionery

- 6.2.5. Nutritional Supplements

- 6.2.6. Animal Feed

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wheat Concentrate

- 7.1.2. Wheat Protein Isolate

- 7.1.3. Textured Wheat Protein

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy

- 7.2.2. Bakery

- 7.2.3. Sports Food

- 7.2.4. Confectionery

- 7.2.5. Nutritional Supplements

- 7.2.6. Animal Feed

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wheat Concentrate

- 8.1.2. Wheat Protein Isolate

- 8.1.3. Textured Wheat Protein

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy

- 8.2.2. Bakery

- 8.2.3. Sports Food

- 8.2.4. Confectionery

- 8.2.5. Nutritional Supplements

- 8.2.6. Animal Feed

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wheat Concentrate

- 9.1.2. Wheat Protein Isolate

- 9.1.3. Textured Wheat Protein

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy

- 9.2.2. Bakery

- 9.2.3. Sports Food

- 9.2.4. Confectionery

- 9.2.5. Nutritional Supplements

- 9.2.6. Animal Feed

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wheat Concentrate

- 10.1.2. Wheat Protein Isolate

- 10.1.3. Textured Wheat Protein

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy

- 10.2.2. Bakery

- 10.2.3. Sports Food

- 10.2.4. Confectionery

- 10.2.5. Nutritional Supplements

- 10.2.6. Animal Feed

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Africa Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Wheat Concentrate

- 11.1.2. Wheat Protein Isolate

- 11.1.3. Textured Wheat Protein

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Dairy

- 11.2.2. Bakery

- 11.2.3. Sports Food

- 11.2.4. Confectionery

- 11.2.5. Nutritional Supplements

- 11.2.6. Animal Feed

- 11.2.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cargill Incorporated

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 MGP

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Manildra Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kroener Staerke

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Archer Daniels Midland Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 CropEnergies AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GLICO NUTRITION CO LT

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Roquette Freres

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Crespel & Deiters

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tereos Syrol

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Wheat Protein Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 33: South Africa Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South Africa Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 35: South Africa Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: South Africa Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 37: South Africa Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Wheat Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wheat Protein Market?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Wheat Protein Market?

Key companies in the market include Cargill Incorporated, MGP, Manildra Group, Kroener Staerke, Archer Daniels Midland Company, CropEnergies AG, GLICO NUTRITION CO LT, Roquette Freres, Crespel & Deiters, Tereos Syrol.

3. What are the main segments of the Wheat Protein Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plant-Based Food and Beverages; Increasing Application of Plant Proteins in Animal Feed.

6. What are the notable trends driving market growth?

Growing Significance for Nutrition and Weight Management.

7. Are there any restraints impacting market growth?

Higher Cost of Production of Plant Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wheat Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wheat Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wheat Protein Market?

To stay informed about further developments, trends, and reports in the Wheat Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence