Key Insights

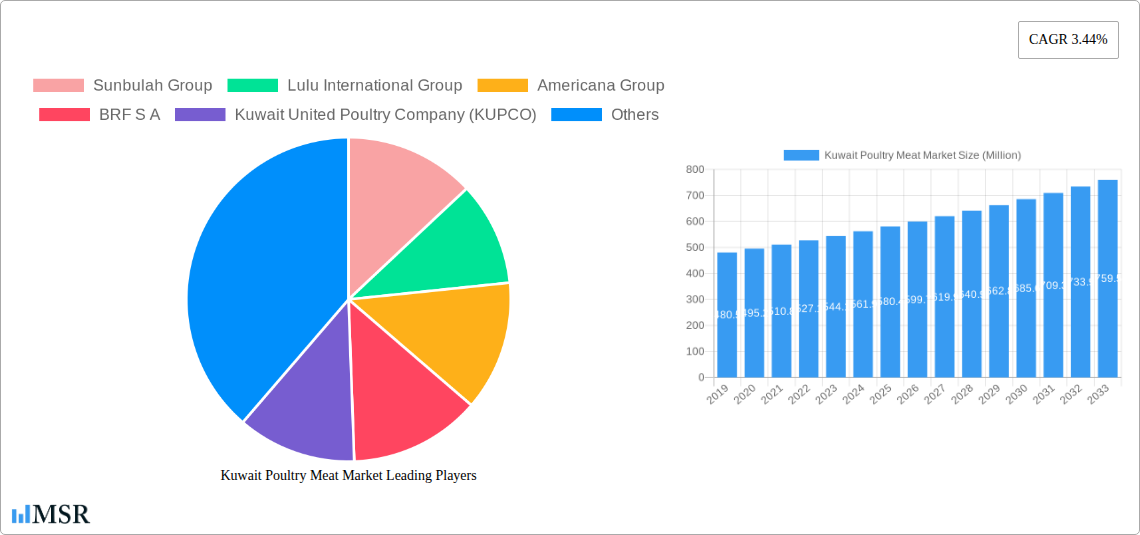

The Kuwait poultry meat market is projected to experience significant growth, reaching an estimated market size of 520.11 million by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 1.01% from 2025 to 2033. This upward trend is driven by increasing consumer demand for protein-rich food options, supported by Kuwait's growing population and rising disposable incomes. Poultry's perceived health benefits, culinary versatility, and affordability compared to other meats are key attractors. Strategic investments by major local producers in enhanced production and product innovation further fuel this expansion. Growing consumer emphasis on food safety and quality is also boosting the demand for processed and value-added poultry products, aligning with the convenience needs of urban consumers.

Kuwait Poultry Meat Market Market Size (In Million)

Market dynamics are further shaped by evolving consumer preferences and an efficient distribution network. The growing adoption of online retail channels and the continued strength of supermarkets and hypermarkets enhance product accessibility. While fresh and chilled poultry remains dominant, processed poultry varieties are witnessing accelerated growth due to their extended shelf life and convenience. However, potential challenges such as fluctuating feed costs and supply chain disruptions may moderate market expansion. Nonetheless, sustained demand for affordable and nutritious protein, coupled with ongoing sector investments, points to a positive outlook for the Kuwait poultry meat market, emphasizing quality, convenience, and product diversity.

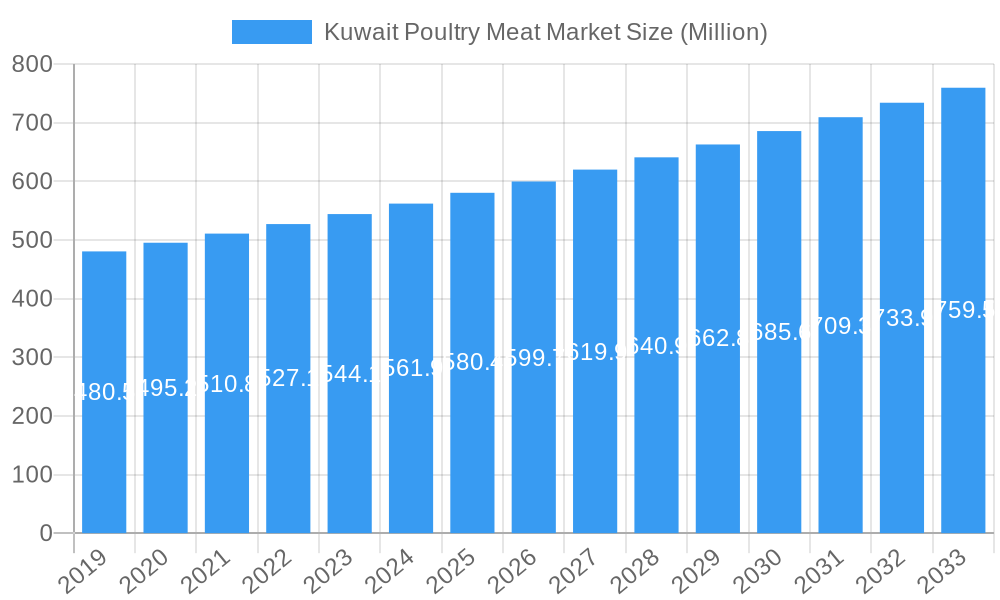

Kuwait Poultry Meat Market Company Market Share

Gain critical insights into the dynamic Kuwait Poultry Meat Market with our in-depth report. This comprehensive analysis offers actionable intelligence for industry stakeholders, detailing market dynamics, growth forecasts, and emerging opportunities for the period 2025–2033, with a specific focus on the base year 2025. Understand key market segments, leading companies, and pivotal industry trends shaping the future of poultry consumption in Kuwait.

Kuwait Poultry Meat Market Market Concentration & Dynamics

The Kuwait poultry meat market is characterized by a moderate level of concentration, with a few key players holding significant market share. Sunbulah Group, Lulu International Group, Americana Group, BRF S.A., Kuwait United Poultry Company (KUPCO), The Savola Group, JBS S.A., and Almarai Food Company are prominent entities driving competition and innovation. The innovation ecosystem is fueled by increasing demand for healthier options, leading to product diversification and the introduction of organic and gluten-free ranges. Regulatory frameworks are evolving to ensure food safety and quality standards. Substitute products, such as red meat and plant-based proteins, present a competitive challenge, but the perceived health benefits and affordability of poultry meat continue to drive end-user preference. Mergers and acquisitions (M&A) are anticipated to play a role in market consolidation and expansion, with an estimated xx M&A deals projected within the forecast period. Understanding these dynamics is crucial for navigating the competitive landscape and identifying strategic growth avenues within the Kuwaiti poultry sector.

- Market Share Distribution: Key players like Americana Group and Almarai Food Company hold substantial market shares, estimated at xx% and xx% respectively in the base year 2025.

- Innovation Focus: Increasing investments in R&D for value-added products and sustainable sourcing.

- Regulatory Impact: Stringent import regulations and local production standards influence market entry and product development.

- M&A Activity: Potential for strategic partnerships and acquisitions to enhance market penetration and product portfolios.

Kuwait Poultry Meat Market Industry Insights & Trends

The Kuwait poultry meat market is poised for significant expansion, driven by a confluence of factors including a growing population, rising disposable incomes, and an increasing awareness of poultry as a lean protein source. The market size is estimated to reach USD xx Million in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period 2025–2033. Technological disruptions, such as advancements in breeding, feed technology, and processing, are enhancing production efficiency and product quality. Evolving consumer behaviors, including a growing preference for convenience, value-added products, and healthier food options, are significantly influencing market trends. The demand for chilled and frozen poultry meat remains robust, while the processed segment is witnessing rapid growth due to the introduction of innovative products like marinated tenders and gourmet sausages. The online channel for grocery sales is also gaining traction, offering new avenues for poultry product distribution. Furthermore, government initiatives aimed at boosting local food production and ensuring food security are creating a more favorable investment climate. The increasing adoption of advanced farming techniques and automation in processing plants will further contribute to increased yields and reduced operational costs, thereby supporting market growth. The rising trend of healthy eating and the demand for high-protein diets are also acting as major catalysts for the poultry meat market. The integration of smart technologies in the supply chain will enhance traceability and reduce wastage, further improving market efficiency.

Key Markets & Segments Leading Kuwait Poultry Meat Market

The Fresh / Chilled segment is expected to dominate the Kuwait poultry meat market throughout the forecast period, driven by consumer preference for quality and freshness. This segment's dominance is underpinned by strong economic growth and a well-developed retail infrastructure. The Processed segment, however, is exhibiting the highest growth potential, fueled by the introduction of diverse product types such as Deli Meats, Marinated/Tenders, Meatballs, Nuggets, and Sausages. This growth is directly attributable to changing lifestyle patterns and the demand for convenient meal solutions.

Within distribution channels, Off-Trade remains the primary driver, with Supermarkets and Hypermarkets leading the charge due to their wide reach and product variety. The Online Channel is emerging as a significant growth area, catering to the convenience-seeking consumer base.

- Dominant Segment Drivers (Fresh / Chilled):

- Economic Growth: Rising disposable incomes support the purchase of premium fresh poultry.

- Consumer Preferences: Strong emphasis on freshness and perceived health benefits.

- Retail Infrastructure: Extensive network of modern retail outlets facilitating accessibility.

- High-Growth Segment Drivers (Processed):

- Convenience: Demand for ready-to-cook and ready-to-eat options.

- Product Innovation: Introduction of diverse flavors and formats catering to varied tastes.

- Urbanization: Busy urban lifestyles favor quick meal solutions.

- Distribution Channel Dynamics (Off-Trade):

- Supermarkets and Hypermarkets: Dominance due to extensive product offerings and promotional activities.

- Online Channel: Rapid expansion driven by e-commerce growth and last-mile delivery advancements.

- Convenience Stores: Growing importance for immediate consumption needs.

- On-Trade Potential: While smaller, the food service sector offers opportunities for bulk and specialty poultry products.

Kuwait Poultry Meat Market Product Developments

Product innovation is a key differentiator in the Kuwait poultry meat market. Companies are focusing on developing value-added products that cater to evolving consumer demands for convenience, health, and taste. Sunbulah Group's January 2021 launch of organic and gluten-free product ranges signifies a strategic move towards health-conscious consumers. Similarly, Almarai Food Company's July 2020 introduction of marinated chicken variants like tandoori and smoked barbecue demonstrates a commitment to expanding product offerings and penetrating new customer segments. These developments highlight a market trend towards diversification beyond basic poultry cuts, incorporating convenience, specialized diets, and premium offerings to capture a larger market share and foster brand loyalty.

Challenges in the Kuwait Poultry Meat Market Market

The Kuwait poultry meat market faces several challenges that can hinder growth. Regulatory hurdles, particularly concerning import licenses and food safety standards, can create barriers to entry for new players and increase operational costs. Supply chain disruptions, exacerbated by global events or localized logistical issues, can impact product availability and pricing. Furthermore, intense competitive pressures from both domestic and international players, coupled with price sensitivity among consumers, necessitate efficient cost management and innovative marketing strategies. The increasing availability of alternative protein sources also poses a threat.

Forces Driving Kuwait Poultry Meat Market Growth

Several forces are propelling the growth of the Kuwait poultry meat market. Technological advancements in poultry farming, including improved genetics, feed formulations, and disease management, are enhancing production efficiency and output. Economic factors, such as a growing young population and increasing per capita income, are boosting consumer spending power on protein-rich foods. Government support through initiatives aimed at localizing production and ensuring food security further stimulates the industry. Additionally, the perceived health benefits of poultry meat as a lean protein source continue to drive consumer demand.

Challenges in the Kuwait Poultry Meat Market Market

Long-term growth catalysts for the Kuwait poultry meat market lie in sustained innovation and strategic market expansion. The development of novel processed products, such as ready-to-cook meals and plant-based poultry alternatives, will cater to evolving consumer preferences. Partnerships between local producers and international brands can facilitate knowledge transfer and access to advanced technologies. Furthermore, expanding the distribution network into underserved areas and leveraging the growing e-commerce landscape will be crucial for sustained market penetration. Investing in sustainable farming practices can also enhance brand reputation and meet future regulatory demands.

Emerging Opportunities in Kuwait Poultry Meat Market

Emerging opportunities in the Kuwait poultry meat market are abundant. The rising demand for halal-certified and ethically sourced poultry presents a niche market. The growing trend of health and wellness is creating demand for organic, free-range, and low-fat poultry products. Furthermore, the expansion of the food service sector, including restaurants and catering services, offers significant potential for bulk supply and customized product offerings. The increasing adoption of e-commerce platforms for grocery shopping also provides a direct-to-consumer channel, enabling wider reach and personalized marketing.

Leading Players in the Kuwait Poultry Meat Market Sector

- Sunbulah Group

- Lulu International Group

- Americana Group

- BRF S.A.

- Kuwait United Poultry Company (KUPCO)

- The Savola Group

- JBS SA

- Almarai Food Company

Key Milestones in Kuwait Poultry Meat Market Industry

- January 2021: Sunbulah Group announced the launch of a range of products and SKUs that will be completely organic and gluten-free, due to the increasing demand.

- July 2020: Almarai Food Company introduced new products in the market, including marinated whole chicken tandoori, marinated whole chicken smoked barbecue, marinated whole chicken smoked barbecue, and marinated half chicken kabsa, thus penetrating new customer segments and increasing market share.

Strategic Outlook for Kuwait Poultry Meat Market Market

The strategic outlook for the Kuwait poultry meat market is highly positive, driven by a robust growth trajectory. Key growth accelerators include continued product innovation in value-added and health-conscious segments, further expansion of the online distribution channel, and strategic partnerships to enhance production capabilities. The market's resilience, coupled with increasing consumer demand for convenient and protein-rich food options, presents significant opportunities for market players. Investing in sustainable farming practices and exploring export markets will also be crucial for long-term success and maintaining a competitive edge in this dynamic sector.

Kuwait Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Kuwait Poultry Meat Market Segmentation By Geography

- 1. Kuwait

Kuwait Poultry Meat Market Regional Market Share

Geographic Coverage of Kuwait Poultry Meat Market

Kuwait Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1 The demand for poultry meat surges as separate counters captivate consumers

- 3.4.2 thus driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Poultry Meat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sunbulah Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lulu International Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Americana Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BRF S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuwait United Poultry Company (KUPCO)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Savola Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JBS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Almarai Food Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sunbulah Group

List of Figures

- Figure 1: Kuwait Poultry Meat Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Kuwait Poultry Meat Market Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Poultry Meat Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: Kuwait Poultry Meat Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Kuwait Poultry Meat Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Kuwait Poultry Meat Market Revenue million Forecast, by Form 2020 & 2033

- Table 5: Kuwait Poultry Meat Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Kuwait Poultry Meat Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Poultry Meat Market?

The projected CAGR is approximately 1.01%.

2. Which companies are prominent players in the Kuwait Poultry Meat Market?

Key companies in the market include Sunbulah Group, Lulu International Group, Americana Group, BRF S A, Kuwait United Poultry Company (KUPCO), The Savola Grou, JBS SA, Almarai Food Company.

3. What are the main segments of the Kuwait Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 520.11 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

The demand for poultry meat surges as separate counters captivate consumers. thus driving the market.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2021: Sunbulah Group announced the launch of range of products and SKUs that will be completely organic and gluten-free, due to the increasing demand.July 2020: Almarai Food Company introduced new products in the market, including marinated whole chicken tandoori, marinated whole chicken smoked barbecue, marinated whole chicken smoked barbecue, and marinated half chicken kabsa, thus penetrating new customer segments and increasing market share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Kuwait Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence