Key Insights

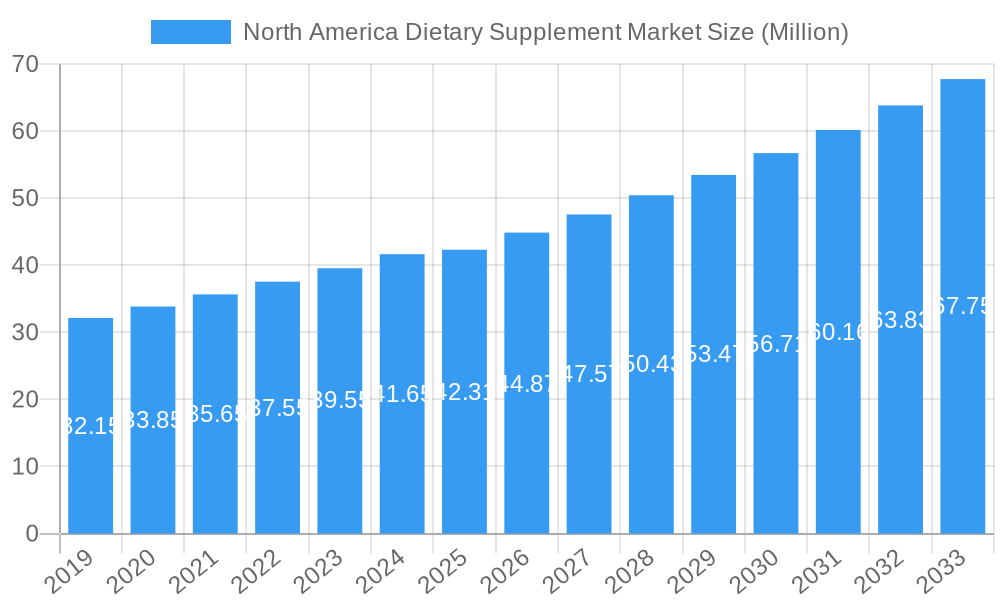

The North America dietary supplement market is poised for robust expansion, projected to reach an estimated market size of USD 42.31 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.10% through 2033. This dynamic growth is fueled by a confluence of factors, including increasing consumer awareness of preventative healthcare, a rising prevalence of lifestyle-related diseases, and a growing demand for personalized nutrition solutions. Key market drivers include the escalating emphasis on wellness and fitness, the growing popularity of plant-based and natural ingredients, and advancements in product innovation leading to more convenient and appealing supplement forms such as gummies and powders. Furthermore, the expanding e-commerce landscape is significantly enhancing accessibility and broadening the reach of dietary supplements across the North American region.

North America Dietary Supplement Market Market Size (In Million)

The market is segmented across a diverse range of product types, with Vitamins and Minerals, and Proteins and Amino Acids anticipated to lead the growth trajectory due to their widespread adoption and proven health benefits. Capsules and Tablets continue to be dominant forms, but the burgeoning demand for palatable and easy-to-consume options is propelling the growth of Gummies and Powders. Distribution channels are also evolving, with Online Retail Stores witnessing substantial growth alongside traditional Pharmacies/Drug Stores and Supermarkets/Hypermarkets, reflecting a shift towards digital purchasing habits. While the market enjoys significant growth, restraints such as stringent regulatory frameworks and concerns regarding product efficacy and safety could present challenges. Nevertheless, the overarching trend towards proactive health management and the continuous innovation in product offerings are expected to ensure sustained market expansion throughout the forecast period.

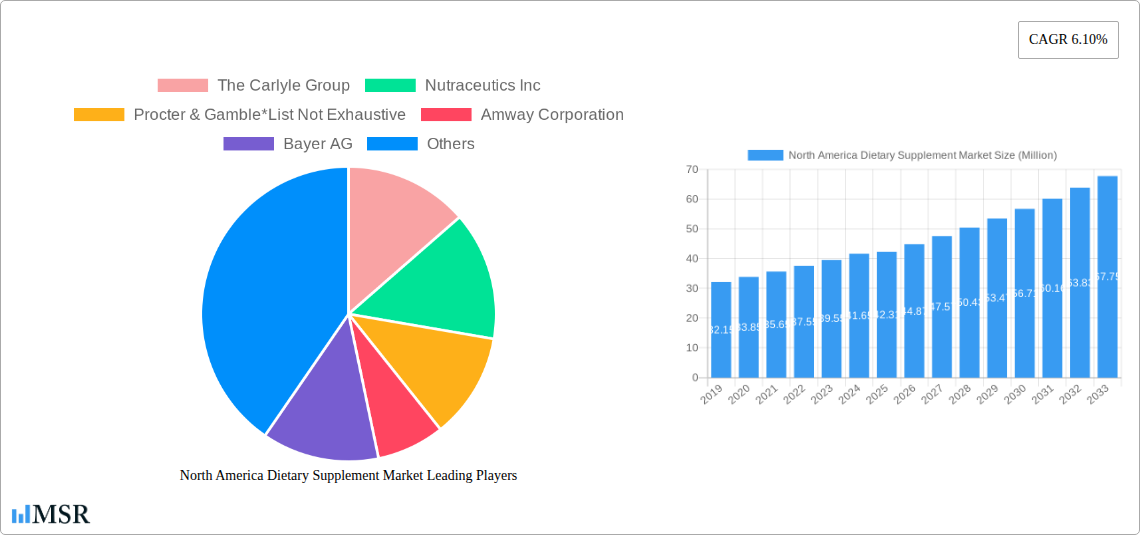

North America Dietary Supplement Market Company Market Share

This comprehensive report dives deep into the North America Dietary Supplement Market, offering invaluable insights for vitamins and minerals, proteins and amino acids, and herbal supplements stakeholders. Analyzing the dietary supplement market trends, growth drivers, and consumer behavior, this research covers the United States, Canada, and Mexico. From tablets and capsules to gummies and powders, we dissect the competitive landscape, including key players like The Carlyle Group, Amway Corporation, and Abbott. Our extensive market analysis spans the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033. Discover market opportunities, product developments, and strategic outlooks for this dynamic and expanding sector.

North America Dietary Supplement Market Market Concentration & Dynamics

The North America dietary supplement market exhibits a moderate to high market concentration, characterized by a blend of established global giants and a growing number of innovative, niche players. The innovation ecosystem is vibrant, fueled by continuous research and development in areas like personalized nutrition, gut health, and plant-based formulations. Robust regulatory frameworks overseen by bodies like the FDA in the United States and Health Canada ensure product safety and efficacy, albeit with evolving guidelines. Substitute products, such as fortified foods and beverages, present a mild competitive threat, but the convenience and targeted benefits of dietary supplements maintain their distinct market position. End-user trends lean towards proactive health management, preventative care, and a desire for natural and organic ingredients. Mergers and acquisitions (M&A) activities are moderately frequent, with larger companies acquiring smaller, innovative brands to expand their product portfolios and market reach. For instance, in the historical period, there were approximately 50-70 M&A deals recorded annually, with an average deal value in the tens of millions of dollars, highlighting the strategic importance of consolidation.

North America Dietary Supplement Market Industry Insights & Trends

The North America dietary supplement market is experiencing robust growth, driven by an increasing consumer focus on health and wellness, a growing aging population, and a rising prevalence of chronic diseases. The market size is projected to reach over $65,000 million by 2025, with a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This expansion is fueled by several key factors. Firstly, growing consumer awareness regarding the benefits of preventative healthcare and the role of micronutrients in maintaining overall well-being is a primary driver. This awareness is amplified by targeted marketing campaigns and increased access to health information online. Secondly, the aging demographic across North America necessitates greater attention to bone health, cognitive function, and energy levels, directly boosting demand for supplements like calcium, vitamin D, omega-3 fatty acids, and B vitamins. Thirdly, the rising incidence of lifestyle-related diseases, such as obesity, diabetes, and cardiovascular conditions, propels the consumption of supplements aimed at managing these ailments and supporting healthy bodily functions.

Technological disruptions are also playing a significant role. Advancements in biotechnology and ingredient innovation are leading to the development of novel, highly bioavailable forms of existing nutrients and the discovery of new beneficial compounds. For example, the encapsulation technology has improved the stability and absorption of certain active ingredients, enhancing product efficacy. Furthermore, the integration of digital platforms and e-commerce has revolutionized distribution channels, making dietary supplements more accessible to a wider consumer base. Online retailers offer a vast selection, competitive pricing, and convenient home delivery, significantly contributing to market penetration.

Evolving consumer behaviors further shape the market. There's a discernible shift towards personalized nutrition, with consumers seeking supplements tailored to their specific genetic makeup, lifestyle, and health goals. This trend is supported by advancements in diagnostic tools and AI-powered platforms that offer customized recommendations. Additionally, the demand for natural, organic, and ethically sourced ingredients is surging, pushing manufacturers to adopt sustainable sourcing practices and transparent labeling. The increasing popularity of plant-based diets also fuels the demand for vegan-friendly supplements, such as vitamin B12, iron, and protein derived from plant sources. The "farm-to-fork" and "seed-to-supplement" philosophies are gaining traction, emphasizing traceability and quality control throughout the supply chain.

Key Markets & Segments Leading North America Dietary Supplement Market

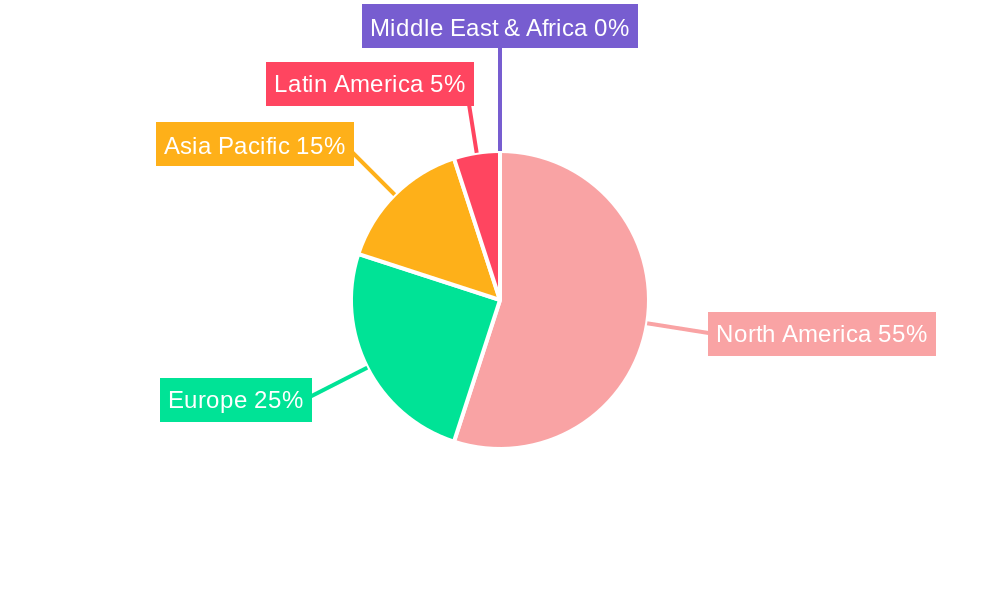

The United States stands as the dominant market within North America for dietary supplements, accounting for over 75% of the regional market share. This dominance is attributed to several factors, including a large, health-conscious population, high disposable incomes, extensive healthcare infrastructure, and strong consumer trust in supplement brands. The "Rest of North America," which includes countries like Mexico, is showing significant growth potential due to increasing health awareness and rising incomes.

In terms of Product Type, Vitamins and Minerals constitute the largest segment, driven by their foundational role in health maintenance and the widespread understanding of their benefits. This segment is projected to hold over 30% of the market share. Following closely are Proteins and Amino Acids, propelled by the booming fitness and sports nutrition industries, along with the growing demand for plant-based protein sources. Herbal Supplements are also experiencing substantial growth, fueled by consumer preference for natural remedies and traditional wellness practices.

Analyzing Form, Capsules and Tablets remain the most prevalent, offering convenience and precise dosing, collectively holding over 60% of the market. However, Gummies are rapidly gaining traction, especially among younger demographics and those who find traditional forms difficult to consume, exhibiting a CAGR exceeding 10%. The growth in gummy supplements is a key trend in the dietary supplement market forecast.

From a Distribution Channel perspective, Pharmacies/Drug Stores and Supermarkets/Hypermarkets have traditionally held significant market share, offering accessibility and impulse purchase opportunities. However, Online Retail Stores are witnessing explosive growth, projected to capture over 35% of the market by 2025. This surge is driven by convenience, wider product selection, competitive pricing, and the ease of doorstep delivery, making online sales a critical channel for dietary supplement companies.

- Dominant Segments & Drivers:

- Vitamins and Minerals: High consumer awareness, essential for general health, wide product availability.

- Proteins and Amino Acids: Growing fitness culture, demand for plant-based alternatives, post-workout recovery needs.

- Capsules & Tablets: Established consumer habit, ease of use, precise dosing.

- Gummies: Increasing appeal to younger consumers, taste preferences, perceived ease of consumption.

- Online Retail Stores: Convenience, price competitiveness, personalized recommendations, direct-to-consumer models.

North America Dietary Supplement Market Product Developments

Recent product developments highlight a strong trend towards functional ingredients and convenience. In February 2024, Medella Springs Healthcare launched AddiVance, a stimulant-free dietary supplement designed to address focus and impulsivity issues by correcting nutritional imbalances, emphasizing high-quality, cGMP-sourced ingredients manufactured in FDA-registered facilities. January 2024 saw Chobani innovate with its Greek Yogurt Creations, a source of protein, calcium, probiotics, and essential amino acids, expanding the functional food category. These developments underscore a market focus on targeted health benefits and ingredient transparency, driving innovation in formulations and delivery methods.

Challenges in the North America Dietary Supplement Market Market

Despite its growth, the North America dietary supplement market faces several challenges. Regulatory scrutiny and evolving compliance standards can increase operational costs and necessitate product reformulation. Supply chain disruptions, exacerbated by global events, can lead to ingredient shortages and price volatility. Furthermore, intense competitive pressures from both established players and new entrants require continuous innovation and effective marketing strategies. The market for dietary supplements is also influenced by consumer skepticism regarding efficacy and potential side effects, necessitating robust clinical validation and clear communication.

Forces Driving North America Dietary Supplement Market Growth

Several forces are propelling the North America dietary supplement market forward. Growing consumer awareness of preventative healthcare and the desire for improved well-being are primary drivers. The aging population fuels demand for supplements addressing age-related health concerns. Technological advancements in ingredient sourcing, formulation, and delivery systems enhance product efficacy and appeal. Favorable economic conditions and increasing disposable incomes allow consumers to invest more in health-related products. Lastly, the rise of e-commerce and direct-to-consumer models expands accessibility and convenience.

Challenges in the North America Dietary Supplement Market Market

Long-term growth catalysts in the North America dietary supplement market stem from continued innovation in personalized nutrition, driven by advancements in genomics and AI. The expanding understanding of the gut microbiome and its impact on overall health presents significant opportunities for probiotic and prebiotic supplement development. Furthermore, strategic partnerships between supplement manufacturers and healthcare providers can foster greater consumer trust and drive adoption. Market expansions into underserved demographics and the development of supplements catering to specific health needs, such as mental well-being and immune support, will also be crucial growth accelerators.

Emerging Opportunities in North America Dietary Supplement Market

Emerging opportunities in the North America dietary supplement market are abundant. The growing demand for plant-based and vegan supplements presents a significant untapped segment. Innovations in bioavailability enhancement and novel delivery systems like dissolvable strips and effervescents cater to evolving consumer preferences. The rise of digital health platforms and wearable technology opens avenues for personalized supplement recommendations and integrated wellness solutions. Furthermore, the increasing focus on mental health and cognitive function is creating a burgeoning market for supplements designed to support mood, stress reduction, and brain health.

Leading Players in the North America Dietary Supplement Market Sector

- The Carlyle Group

- Nutraceutics Inc

- Procter & Gamble

- Amway Corporation

- Bayer AG

- Glanbia PLC

- Forest Remedies

- Herbalife Nutrition

- Abbott

- NOW Food

Key Milestones in North America Dietary Supplement Market Industry

- February 2024: Medella Springs Healthcare launched AddiVance, a stimulant-free dietary supplement for focus and impulsivity, highlighting cGMP manufacturing and FDA-registered facilities.

- January 2024: Chobani introduced Chobani Creations Greek Yogurt, emphasizing protein, calcium, probiotics, and nine essential amino acids in a convenient, flavored format.

- January 2024: Amway’s Nutrilite brand focused on regenerative agriculture for botanical sourcing, partnering with farmers and leveraging its decades-long seed-to-supplement strategy.

Strategic Outlook for North America Dietary Supplement Market Market

The strategic outlook for the North America dietary supplement market is exceptionally positive, driven by ongoing shifts in consumer behavior towards proactive health management and preventative wellness. Key growth accelerators include the continued innovation in functional ingredients, the expansion of personalized nutrition solutions leveraging data analytics, and the increasing adoption of sustainable and transparent sourcing practices. Strategic opportunities lie in developing science-backed products that address specific health concerns, expanding e-commerce capabilities to reach a wider consumer base, and fostering collaborations with healthcare professionals to build consumer confidence and integrate supplements into holistic health plans. The market is poised for sustained growth as consumers prioritize their well-being.

North America Dietary Supplement Market Segmentation

-

1. Product Type

- 1.1. Vitamins and Minerals

- 1.2. Proteins and Amino Acids

- 1.3. Fatty Acids

- 1.4. Herbal Supplements

- 1.5. Enzymes

- 1.6. Other Product Types

-

2. Form

- 2.1. Tablets

- 2.2. Capsules

- 2.3. Powder

- 2.4. Gummies

- 2.5. Other Forms

-

3. Distribution Channel

- 3.1. Supermarkets/hypermarkets

- 3.2. Pharmacies/drug Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Dietary Supplement Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Dietary Supplement Market Regional Market Share

Geographic Coverage of North America Dietary Supplement Market

North America Dietary Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Maintaining Health and Well-Being

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vitamins and Minerals

- 5.1.2. Proteins and Amino Acids

- 5.1.3. Fatty Acids

- 5.1.4. Herbal Supplements

- 5.1.5. Enzymes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Tablets

- 5.2.2. Capsules

- 5.2.3. Powder

- 5.2.4. Gummies

- 5.2.5. Other Forms

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/hypermarkets

- 5.3.2. Pharmacies/drug Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vitamins and Minerals

- 6.1.2. Proteins and Amino Acids

- 6.1.3. Fatty Acids

- 6.1.4. Herbal Supplements

- 6.1.5. Enzymes

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Tablets

- 6.2.2. Capsules

- 6.2.3. Powder

- 6.2.4. Gummies

- 6.2.5. Other Forms

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/hypermarkets

- 6.3.2. Pharmacies/drug Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vitamins and Minerals

- 7.1.2. Proteins and Amino Acids

- 7.1.3. Fatty Acids

- 7.1.4. Herbal Supplements

- 7.1.5. Enzymes

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Tablets

- 7.2.2. Capsules

- 7.2.3. Powder

- 7.2.4. Gummies

- 7.2.5. Other Forms

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/hypermarkets

- 7.3.2. Pharmacies/drug Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vitamins and Minerals

- 8.1.2. Proteins and Amino Acids

- 8.1.3. Fatty Acids

- 8.1.4. Herbal Supplements

- 8.1.5. Enzymes

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Tablets

- 8.2.2. Capsules

- 8.2.3. Powder

- 8.2.4. Gummies

- 8.2.5. Other Forms

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/hypermarkets

- 8.3.2. Pharmacies/drug Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vitamins and Minerals

- 9.1.2. Proteins and Amino Acids

- 9.1.3. Fatty Acids

- 9.1.4. Herbal Supplements

- 9.1.5. Enzymes

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Tablets

- 9.2.2. Capsules

- 9.2.3. Powder

- 9.2.4. Gummies

- 9.2.5. Other Forms

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/hypermarkets

- 9.3.2. Pharmacies/drug Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Carlyle Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nutraceutics Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Procter & Gamble*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Amway Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bayer AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Glanbia PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Forest Remedies

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Herbalife Nutrition

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Abbott

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NOW Food

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Carlyle Group

List of Figures

- Figure 1: North America Dietary Supplement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Dietary Supplement Market Share (%) by Company 2025

List of Tables

- Table 1: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 3: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Dietary Supplement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 8: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 13: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 18: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 23: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Dietary Supplement Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the North America Dietary Supplement Market?

Key companies in the market include The Carlyle Group, Nutraceutics Inc, Procter & Gamble*List Not Exhaustive, Amway Corporation, Bayer AG, Glanbia PLC, Forest Remedies, Herbalife Nutrition, Abbott, NOW Food.

3. What are the main segments of the North America Dietary Supplement Market?

The market segments include Product Type , Form , Distribution Channel , Geography .

4. Can you provide details about the market size?

The market size is estimated to be USD 42.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Increasing Focus on Maintaining Health and Well-Being.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

February 2024: Medella Springs Healthcare launched AddiVance, a stimulant-free dietary supplement to address common nutritional imbalances in individuals experiencing a lack of focus and impulsive behavior. The company claimed that the product is designed using high-quality ingredients, sourced at cGMP facilities, tested, and manufactured at FDA-registered facilities in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Dietary Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Dietary Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Dietary Supplement Market?

To stay informed about further developments, trends, and reports in the North America Dietary Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence