Key Insights

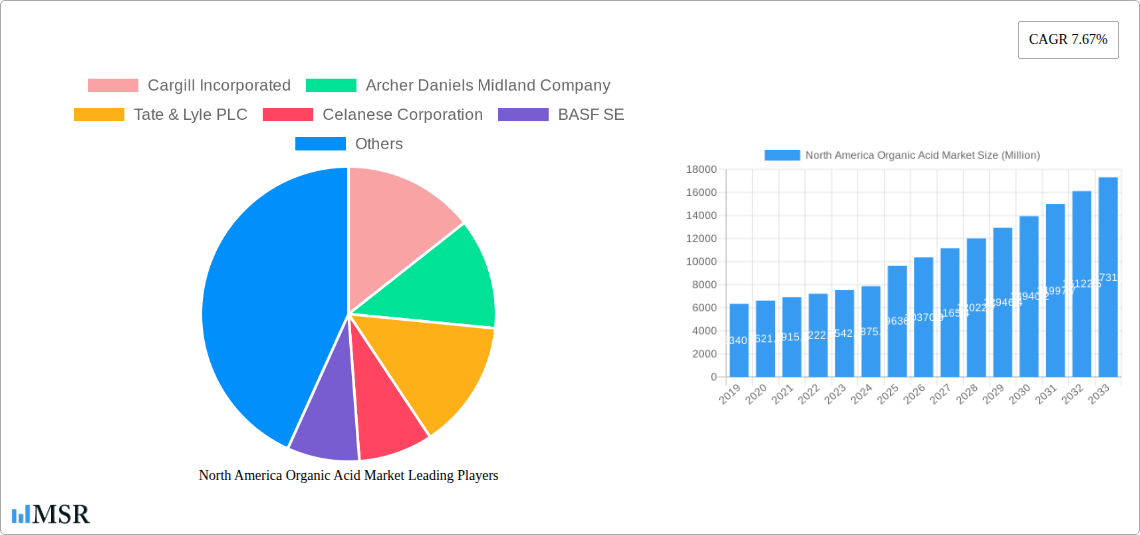

The North America Organic Acid Market is projected for substantial growth, forecast to reach a market size of USD 9,636 million by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 7.67% expected from 2025 to 2033. Key growth factors include increasing consumer preference for natural and healthy food and beverage products, where organic acids serve as essential acidulants, preservatives, and flavor enhancers. The pharmaceutical sector's rising demand for organic acids as Active Pharmaceutical Ingredients (APIs) and excipients, alongside their growing use in animal feed for improved gut health and nutrient absorption, are significant contributors. The industrial applications and biodegradable plastics segment also presents a considerable growth avenue.

North America Organic Acid Market Market Size (In Billion)

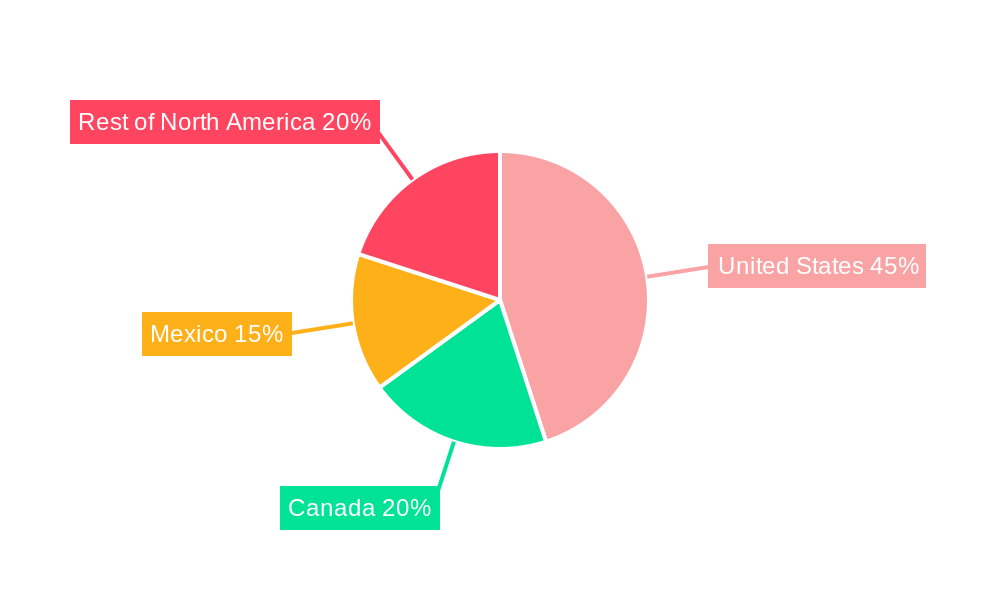

The market is segmented by type, with Acetic Acid, Citric Acid, and Lactic Acid leading due to their extensive industrial and commercial use. The "Others" category, including malic and succinic acids, is also poised for steady growth driven by innovation. Geographically, the United States is expected to dominate the North American market, supported by its strong industrial base and high consumer spending. Canada and Mexico will also contribute significantly, with emerging opportunities in the "Rest of North America." While fluctuating raw material prices and stringent regulatory compliance pose challenges, the overarching market trend toward health consciousness and sustainable solutions is expected to drive significant expansion.

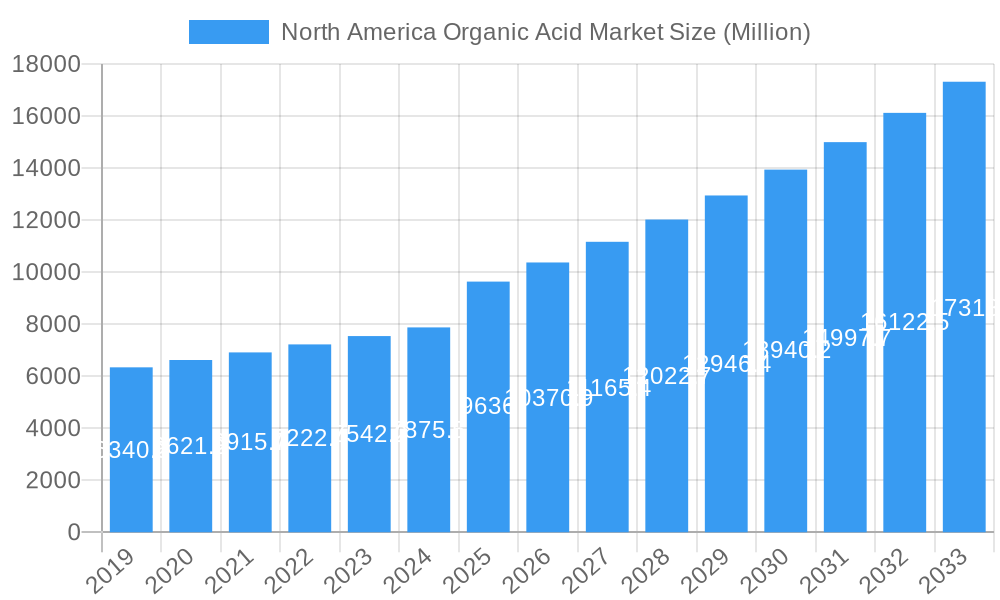

North America Organic Acid Market Company Market Share

This comprehensive report offers deep insights into the North American organic acid market. It details key market dynamics, growth catalysts, emerging trends, and strategic opportunities spanning from 2019 to 2033. Stakeholders will find actionable intelligence to leverage the increasing demand for organic acids across food & beverage, animal feed, pharmaceuticals, and various other applications.

Market Size: USD 9,636 million | Base Year: 2025 | Forecast Period: 2025–2033 | CAGR: 7.67%

North America Organic Acid Market Market Concentration & Dynamics

The North American organic acid market exhibits a moderate to high concentration, with key players like Cargill Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, Celanese Corporation, BASF SE, Koninklijke DSM N V, DuPont, Eastman Chemical Company, Corbion N V, and DNP Green Technology (BioAmber) holding significant market share. These established companies leverage their extensive R&D capabilities, robust manufacturing infrastructure, and strong distribution networks to maintain their competitive edge. Innovation ecosystems are thriving, driven by the continuous development of novel organic acid derivatives and the exploration of bio-based production methods. Regulatory frameworks, primarily concerning food safety, environmental impact, and chemical usage, play a crucial role in shaping market entry and product development strategies. The presence of substitute products, such as synthetic acids or alternative preservatives, poses a constant challenge, necessitating a focus on superior performance, cost-effectiveness, and sustainability. End-user trends are strongly influenced by the growing consumer preference for natural, clean-label ingredients and the increasing demand for sustainable solutions. Merger and acquisition (M&A) activities are sporadic but strategic, aimed at consolidating market presence, acquiring new technologies, or expanding product portfolios. For instance, recent M&A deal counts in the broader chemical sector indicate a trend towards partnerships that enhance specialty chemical capabilities.

North America Organic Acid Market Industry Insights & Trends

The North American organic acid market is poised for substantial growth, projected to reach an estimated XX Million in value by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust expansion is underpinned by a confluence of powerful market growth drivers, technological disruptions, and evolving consumer behaviors. The increasing demand for organic acids as natural preservatives, acidulants, and flavor enhancers in the Food & Beverage sector remains a primary catalyst. Consumers' heightened awareness regarding health and wellness fuels the preference for ingredients perceived as natural and safe, directly benefiting acetic acid, citric acid, and lactic acid. Furthermore, the Animal Feed industry is witnessing a significant uptake of organic acids for improving gut health, nutrient absorption, and reducing the reliance on antibiotics, contributing to a growing market segment. The Pharmaceuticals sector also presents opportunities, with organic acids finding applications in drug formulation, excipients, and active pharmaceutical ingredients. Technological advancements, particularly in fermentation technologies and enzyme catalysis, are enabling more efficient and cost-effective production of a wider range of organic acids, including those derived from renewable resources. This shift towards bio-based organic acids aligns with global sustainability initiatives and corporate environmental, social, and governance (ESG) goals. The exploration of novel applications for existing organic acids and the development of new organic acid compounds with enhanced functionalities are further propelling market innovation. Evolving consumer behaviors, characterized by a strong inclination towards clean-label products, demand for transparency in ingredient sourcing, and a growing concern for environmental sustainability, are reshaping product development and marketing strategies across the industry. The market is also witnessing a growing interest in specialty organic acids with unique properties catering to niche applications.

Key Markets & Segments Leading North America Organic Acid Market

The United States is the dominant geographic market within North America for organic acids, driven by its large consumer base, advanced food processing industry, and significant pharmaceutical sector. The country's robust economic growth, coupled with substantial investments in research and development, further solidifies its leadership.

Dominant Segments:

Type:

- Citric Acid: Leading the pack due to its widespread application as an acidulant, preservative, and flavor enhancer in food and beverages. Its versatility in confectionery, soft drinks, dairy products, and processed foods makes it indispensable. Economic growth in the food processing sector directly correlates with citric acid demand.

- Acetic Acid: A crucial component in the food industry as vinegar and a preservative, and also finds applications in the textile and chemical industries. Its consistent demand across multiple sectors contributes significantly to its market dominance.

- Lactic Acid: Gaining traction due to its use in food preservation, pH regulation, and its growing application in biodegradable polymers (polylactic acid - PLA). The increasing focus on sustainable materials is a key driver.

- Others: This segment includes a range of specialty organic acids with niche applications in pharmaceuticals, cosmetics, and industrial processes, demonstrating steady growth.

Application:

- Food & Beverage: This segment reigns supreme, fueled by consumer demand for processed foods, convenience meals, and beverages with improved shelf life and taste profiles. The "natural" and "clean label" trend amplifies the use of organic acids over synthetic alternatives.

- Animal Feed: Experiencing robust growth as organic acids are recognized for their role in improving animal gut health, reducing pathogen load, and enhancing nutrient utilization, thereby minimizing the need for antibiotics. Infrastructure development in the livestock sector supports this growth.

- Pharmaceuticals: A stable and growing segment where organic acids serve as excipients, pH adjusters, and intermediates in drug synthesis. The expanding healthcare sector and R&D investments are key drivers.

- Others: Encompasses a diverse range of applications including cosmetics, personal care products, industrial cleaning agents, and chemical intermediates, showcasing a steady expansion driven by innovation.

Geography:

- United States: Dominates due to its large market size, established infrastructure, and high disposable income. Economic stability and strong consumer spending power directly influence demand across all segments.

- Canada: A significant market with a growing food and beverage industry and increasing awareness of health and wellness products.

- Mexico: Experiencing rapid industrialization and a growing middle class, leading to increased demand for processed foods and animal feed.

- Rest of North America: Includes smaller but emerging markets with potential for growth, driven by increasing industrialization and consumer purchasing power.

North America Organic Acid Market Product Developments

Product development in the North American organic acid market is characterized by a strong emphasis on sustainability, enhanced functionality, and novel applications. Innovations in bio-fermentation technologies are yielding higher purity and yield of organic acids like lactic acid and succinic acid, often from renewable feedstocks. Companies are actively exploring new derivatives and blends to cater to specific industry needs, such as improved solubility, enhanced antimicrobial properties, or specific pH buffering capacities. For instance, the development of specialty lactic acid grades for pharmaceutical applications and advanced biopolymers is gaining momentum. The market relevance of these developments is significant, as they not only cater to evolving consumer preferences for natural and eco-friendly ingredients but also offer competitive advantages through improved performance and cost efficiencies.

Challenges in the North America Organic Acid Market Market

The North America organic acid market faces several challenges that can impede its growth trajectory. Regulatory hurdles related to food safety standards, chemical approvals, and environmental compliance can add to product development costs and time-to-market. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can impact production costs and availability, leading to market inefficiencies. Intense competitive pressures from both established players and emerging regional manufacturers necessitate continuous innovation and cost optimization. The availability and cost-effectiveness of raw materials, particularly for bio-based production, remain a critical concern. Quantifiable impacts include potential delays in product launches and increased operational expenditures.

Forces Driving North America Organic Acid Market Growth

Several key forces are driving the growth of the North America organic acid market. Technological advancements in fermentation and biocatalysis are making production more efficient and sustainable. The growing consumer preference for natural and clean-label ingredients in food and beverages is a significant accelerator, pushing demand for organic acids as alternatives to synthetic additives. Increasing awareness of the health benefits of organic acids in animal feed, particularly their role in gut health and antibiotic reduction, is creating a substantial market opportunity. Furthermore, supportive government policies and initiatives promoting bio-based products and sustainable agriculture contribute to market expansion. The robust growth of the pharmaceutical and nutraceutical industries, requiring high-purity organic acids for various applications, also acts as a key driver.

Challenges in the North America Organic Acid Market Market

Long-term growth catalysts in the North America organic acid market are intrinsically linked to innovation and market expansion. Continuous research and development into novel organic acid applications, such as in biodegradable plastics, advanced coatings, and specialty chemicals, will unlock new revenue streams. Strategic partnerships and collaborations between manufacturers, research institutions, and end-users can accelerate the development and adoption of new products and technologies. Furthermore, market expansion into untapped regions within North America and leveraging global supply chain efficiencies will be crucial for sustained growth. The increasing focus on circular economy principles and the valorization of industrial by-products for organic acid production present significant long-term opportunities for cost reduction and sustainability.

Emerging Opportunities in North America Organic Acid Market

Emerging opportunities in the North America organic acid market are abundant and diverse. The growing demand for plant-based and vegan food products presents a significant opportunity for organic acids as natural flavor enhancers and preservatives. The burgeoning nutraceutical and dietary supplement market is seeking organic acids for their health-promoting properties. Advancements in biotechnology are paving the way for the production of novel organic acids with unique functionalities, catering to specialized industrial applications. The increasing emphasis on sustainable packaging solutions is driving demand for bio-based polymers derived from organic acids like lactic acid (PLA). Furthermore, the exploration of organic acids for applications in personal care and cosmetics is an emerging trend with considerable growth potential.

Leading Players in the North America Organic Acid Market Sector

- Cargill Incorporated

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Celanese Corporation

- BASF SE

- Koninklijke DSM N V

- DuPont

- Eastman Chemical Company

- Corbion N V

- DNP Green Technology (BioAmber)

Key Milestones in North America Organic Acid Market Industry

- 2019: Increased investment in bio-based production facilities for lactic acid and succinic acid.

- 2020: Growing adoption of organic acids in animal feed to reduce antibiotic usage.

- 2021: FDA approval of new applications for certain organic acids in food processing.

- 2022: Significant advancements in fermentation technology leading to higher yields and lower production costs.

- 2023: Launch of new biodegradable polymers derived from organic acids by major chemical companies.

- 2024: Enhanced focus on sustainable sourcing of raw materials for organic acid production.

- 2025 (Estimated): Continued market expansion driven by clean-label trends and growing demand in animal nutrition.

- 2026-2033 (Forecast): Anticipated sustained growth with emerging applications in bio-based materials and specialty chemicals.

Strategic Outlook for North America Organic Acid Market Market

The strategic outlook for the North America organic acid market is exceptionally positive, characterized by sustained growth and innovation. Key growth accelerators include the ongoing shift towards natural and sustainable ingredients across all end-use industries, coupled with continuous technological advancements in production methods. The market will witness strategic investments in expanding production capacities, particularly for bio-based organic acids, and in research and development to unlock new applications and enhance product functionalities. Companies that can effectively navigate regulatory landscapes, ensure supply chain resilience, and align with evolving consumer preferences for health and environmental consciousness will be well-positioned for significant market share gains. The focus on circular economy principles and the development of value-added derivatives will further contribute to market dynamism and profitability.

North America Organic Acid Market Segmentation

-

1. Type

- 1.1. Acetic acid

- 1.2. Citric acid

- 1.3. Lactic acid

- 1.4. Others

-

2. Application

- 2.1. Food & Beverage

- 2.2. Animal Feed

- 2.3. Pharmaceuticals

- 2.4. Others

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Organic Acid Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Organic Acid Market Regional Market Share

Geographic Coverage of North America Organic Acid Market

North America Organic Acid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic Acids in Wide Array of Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Organic Acid Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Acetic acid

- 5.1.2. Citric acid

- 5.1.3. Lactic acid

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Beverage

- 5.2.2. Animal Feed

- 5.2.3. Pharmaceuticals

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Organic Acid Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Acetic acid

- 6.1.2. Citric acid

- 6.1.3. Lactic acid

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food & Beverage

- 6.2.2. Animal Feed

- 6.2.3. Pharmaceuticals

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Organic Acid Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Acetic acid

- 7.1.2. Citric acid

- 7.1.3. Lactic acid

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food & Beverage

- 7.2.2. Animal Feed

- 7.2.3. Pharmaceuticals

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Organic Acid Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Acetic acid

- 8.1.2. Citric acid

- 8.1.3. Lactic acid

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food & Beverage

- 8.2.2. Animal Feed

- 8.2.3. Pharmaceuticals

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Organic Acid Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Acetic acid

- 9.1.2. Citric acid

- 9.1.3. Lactic acid

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food & Beverage

- 9.2.2. Animal Feed

- 9.2.3. Pharmaceuticals

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Archer Daniels Midland Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tate & Lyle PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Celanese Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BASF SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Koninklijke DSM N V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 DuPont

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eastman Chemical Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Corbion N V

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 DNP Green Technology (BioAmber)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Organic Acid Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Organic Acid Market Share (%) by Company 2025

List of Tables

- Table 1: North America Organic Acid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Organic Acid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Organic Acid Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Organic Acid Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Organic Acid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Organic Acid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Organic Acid Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Organic Acid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Organic Acid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Organic Acid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: North America Organic Acid Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Organic Acid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Organic Acid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Organic Acid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: North America Organic Acid Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Organic Acid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Organic Acid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Organic Acid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: North America Organic Acid Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Organic Acid Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Organic Acid Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the North America Organic Acid Market?

Key companies in the market include Cargill Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, Celanese Corporation, BASF SE, Koninklijke DSM N V, DuPont, Eastman Chemical Company, Corbion N V, DNP Green Technology (BioAmber).

3. What are the main segments of the North America Organic Acid Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Increasing Demand for Organic Acids in Wide Array of Applications.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Organic Acid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Organic Acid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Organic Acid Market?

To stay informed about further developments, trends, and reports in the North America Organic Acid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence