Key Insights

The Asia Pacific frozen snacks market is set for significant expansion, projected to reach USD 153.91 billion by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 5.5%, reflecting escalating consumer demand for convenient, ready-to-eat food solutions. Key drivers include rising disposable incomes, a growing middle class, and rapid urbanization, especially in emerging economies like India and China, leading to increased purchasing power and a preference for foods aligning with fast-paced lifestyles. Enhanced product accessibility is also attributed to the expanding reach of modern retail formats and the significant growth of online retail channels. The inherent convenience of frozen snacks, coupled with ongoing product innovation and heightened awareness of global food trends, are further accelerating this market's upward trajectory.

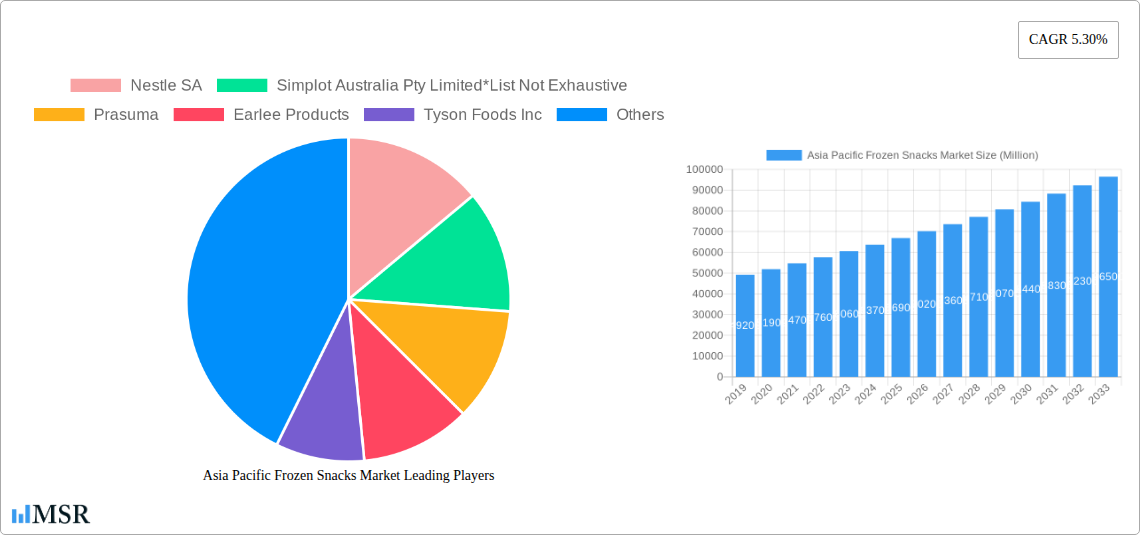

Asia Pacific Frozen Snacks Market Market Size (In Billion)

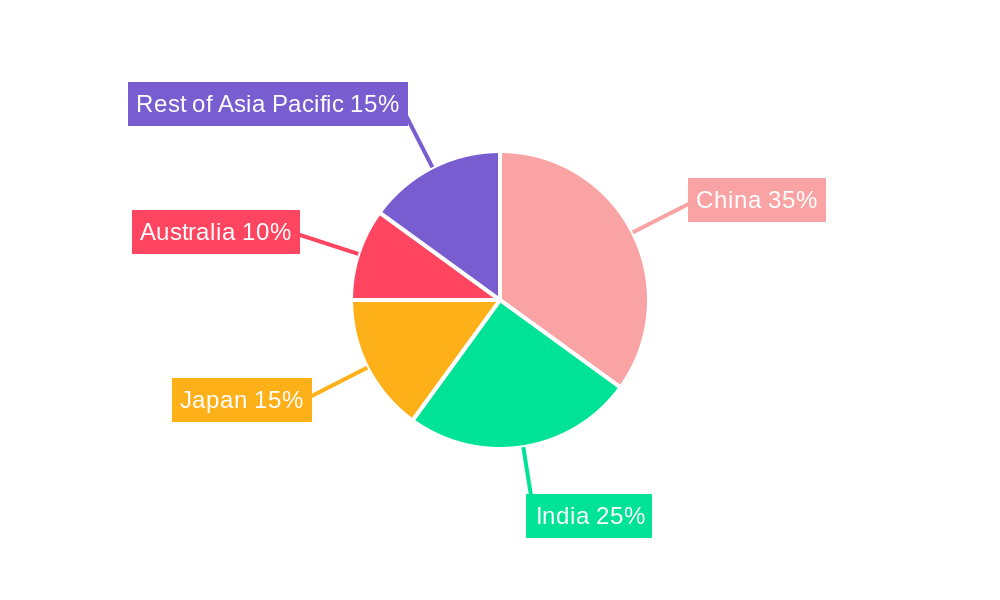

Market segmentation reveals a dynamic landscape with fruit-based, potato-based, and meat and seafood-based snacks contributing substantially. The "Other" category, encompassing vegetable-based and mixed-ingredient snacks, is also poised for steady growth as consumers increasingly seek healthier and more diverse options. Geographically, China and India are expected to dominate both market size and growth due to their large populations and rapidly developing economies. Japan and Australia also represent substantial markets with established consumer preferences for frozen foods. The competitive arena includes global leaders such as Nestle SA and McCain Foods Limited, alongside prominent regional players like ITC Limited and Ajinomoto Co. Inc. These companies are actively pursuing product innovation, strategic collaborations, and distribution network expansion to secure a larger share of this lucrative and expanding market.

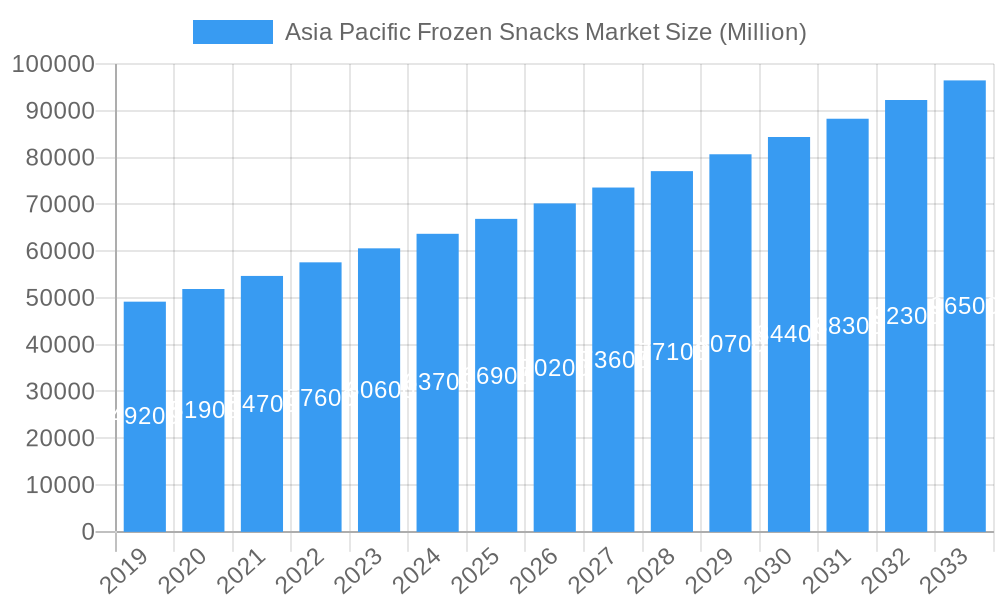

Asia Pacific Frozen Snacks Market Company Market Share

This comprehensive report offers in-depth analysis of the Asia Pacific Frozen Snacks Market, a rapidly expanding sector driven by evolving consumer preferences and innovative product offerings. Covering the period up to 2033, with a base year of 2025, this study provides critical insights into market dynamics, key segments, leading players, and future growth trajectories. The Asia Pacific frozen food market is experiencing unprecedented growth, with the frozen snacks segment emerging as a significant contributor. This report is essential for frozen food manufacturers, food distributors, retailers, and investors seeking to capitalize on the burgeoning opportunities in this dynamic region. Our analysis encompasses crucial aspects like market size, CAGR, and detailed segmentation by product type (including Fruit based Snacks, Potato based Snacks, Meat and Seafood based Snacks, and Other), distribution channel (Supermarkets/ Hypermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels), and geography (China, India, Japan, Australia, Rest of Asia Pacific).

Asia Pacific Frozen Snacks Market Market Concentration & Dynamics

The Asia Pacific frozen snacks market exhibits a moderate to high level of market concentration, with key players like Nestle SA, Simplot Australia Pty Limited, Prasuma, Earlee Products, Tyson Foods Inc., Ajinomoto Co. Inc., McCain Foods Limited, General Mills, Conagra Brands, and ITC Limited holding significant market share. The innovation ecosystem is vibrant, fueled by a growing demand for convenience and diverse culinary experiences. Regulatory frameworks across different Asia Pacific nations influence product development and market entry, with increasing emphasis on food safety and labeling. Substitute products, such as fresh snacks and ready-to-eat meals, pose a competitive challenge, but the convenience and extended shelf-life of frozen snacks continue to drive their adoption. End-user trends highlight a growing preference for healthier options, plant-based alternatives, and globally inspired flavors. Mergers and acquisitions (M&A) activities are on the rise as companies seek to expand their product portfolios and geographical reach. For instance, recent M&A activities in the broader Asia Pacific food sector indicate a trend towards consolidation and strategic partnerships. Understanding these dynamics is crucial for navigating the competitive landscape.

Asia Pacific Frozen Snacks Market Industry Insights & Trends

The Asia Pacific frozen snacks market is poised for remarkable growth, projected to reach an estimated USD 15,500 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period of 2025–2033. This expansion is primarily driven by the increasing disposable incomes and urbanization across the region, leading to a heightened demand for convenient food solutions. Evolving consumer lifestyles, characterized by busy schedules and a growing preference for home consumption of restaurant-style foods, are significant market growth drivers. Technological disruptions in frozen food processing and cold chain logistics are further bolstering the market by improving product quality, extending shelf life, and enhancing accessibility. Innovations in packaging, such as resealable and microwaveable options, are catering to the convenience-seeking consumer. The rise of e-commerce platforms has also democratized access to a wider variety of frozen snacks, contributing to increased sales and market penetration. Furthermore, a growing awareness of healthier eating habits is spurring demand for frozen snacks made with natural ingredients, reduced sodium content, and plant-based protein sources. The frozen potato snacks market and frozen meat snacks market are particularly robust segments, reflecting established consumer preferences.

Key Markets & Segments Leading Asia Pacific Frozen Snacks Market

China and India are the dominant geographical markets within the Asia Pacific frozen snacks market, driven by their large populations, rapidly expanding middle class, and increasing urbanization.

- China: Benefits from a well-established retail infrastructure, high consumer spending power, and a growing acceptance of Western food trends. The Supermarkets/ Hypermarkets distribution channel is particularly strong in China.

- India: Experiences rapid growth due to a burgeoning young population, increasing disposable incomes, and a strong demand for convenient and affordable food options. The rise of Online Retail Stores is a significant growth catalyst in India.

Dominant Segments:

- Product Type: Potato based Snacks hold a commanding market share, a testament to their widespread popularity and diverse product offerings like fries, hash browns, and potato wedges. The Meat and Seafood based Snacks segment is also experiencing significant growth, driven by increasing protein consumption and demand for convenient, ready-to-cook options.

- Distribution Channel: Supermarkets/ Hypermarkets remain the primary distribution channel, offering a wide selection and competitive pricing. However, Online Retail Stores are rapidly gaining traction, offering unparalleled convenience and reaching a broader consumer base, especially in urban areas.

The economic growth in these key regions, coupled with substantial investments in modern retail infrastructure and the expansion of online grocery platforms, directly fuels the demand for frozen snacks. Favorable government policies promoting food processing industries also contribute to market expansion.

Asia Pacific Frozen Snacks Market Product Developments

Product innovation is a key differentiator in the Asia Pacific frozen snacks market. Companies are actively developing new product lines that cater to evolving consumer tastes and dietary preferences. Recent developments include the launch of plant-based frozen snacks, such as vegan nuggets and kebabs, appealing to health-conscious and environmentally aware consumers. The introduction of globally inspired flavors and fusion snack concepts is also gaining traction. Advances in freezing technology are ensuring better texture and taste retention, enhancing the overall consumer experience. For example, the Continental Greenbird lineup offers 100% vegan frozen snacks, demonstrating a strong commitment to emerging dietary trends. The Prasuma company's expansion into frozen chicken nuggets and vegetable spring rolls signifies a focus on convenience and variety.

Challenges in the Asia Pacific Frozen Snacks Market Market

The Asia Pacific frozen snacks market faces several challenges that could impede its growth trajectory.

- Cold Chain Infrastructure: Inadequate and fragmented cold chain logistics in certain developing nations can lead to product spoilage and impact quality, thereby increasing operational costs and affecting consumer trust.

- Consumer Perception: In some traditional markets, there's a lingering perception that frozen foods are less fresh or nutritious than their fresh counterparts, requiring continuous consumer education and marketing efforts.

- Price Sensitivity: While demand is growing, a significant portion of the consumer base remains price-sensitive, making it challenging for premium or niche frozen snacks to penetrate the market.

- Regulatory Compliance: Navigating diverse and evolving food safety regulations across different countries can be complex and costly for manufacturers.

Forces Driving Asia Pacific Frozen Snacks Market Growth

Several key forces are propelling the Asia Pacific frozen snacks market forward.

- Convenience Demand: The fast-paced lifestyles of urban consumers across Asia Pacific are driving an insatiable demand for convenient, ready-to-cook, and easy-to-prepare food options, which frozen snacks perfectly fulfill.

- Rising Disposable Incomes: Increasing economic prosperity in emerging economies is empowering consumers to spend more on convenience foods and explore a wider variety of snack options.

- Product Innovation: Continuous innovation in product development, including the introduction of healthier options, international flavors, and plant-based alternatives, is attracting new consumer segments and retaining existing ones.

- E-commerce Expansion: The rapid growth of online retail and food delivery platforms has significantly enhanced the accessibility of frozen snacks, making them readily available to a broader consumer base.

Challenges in the Asia Pacific Frozen Snacks Market Market

Long-term growth catalysts for the Asia Pacific frozen snacks market are deeply rooted in sustained economic development and evolving consumer behaviors. Continued urbanization and the expansion of the middle class will solidify the demand for convenience. Investments in advanced frozen food technology, including improved processing techniques and energy-efficient freezing methods, will be crucial for maintaining product quality and reducing operational costs. Furthermore, strategic partnerships between manufacturers and retailers, particularly with the burgeoning online grocery sector, will be vital for expanding market reach and optimizing distribution. The increasing consumer focus on health and wellness will drive further innovation in the frozen snacks market, encouraging the development of snacks with reduced fat, sodium, and sugar, as well as the expansion of the plant-based frozen snacks category.

Emerging Opportunities in Asia Pacific Frozen Snacks Market

Emerging opportunities in the Asia Pacific frozen snacks market are multifaceted and ripe for exploitation. The untapped potential in developing Southeast Asian economies presents significant growth avenues as their economies mature and disposable incomes rise. The increasing demand for premium frozen snacks that offer unique flavors and high-quality ingredients is another key opportunity, allowing for market differentiation and higher profit margins. Furthermore, the growing trend of "food tourism" and the desire to experience global cuisines at home can be leveraged by offering authentic international frozen snack varieties. The integration of smart technologies in frozen food supply chains, from production to delivery, can enhance efficiency and reduce waste, presenting an operational opportunity. Finally, the development of sustainable and eco-friendly packaging solutions can appeal to a growing segment of environmentally conscious consumers.

Leading Players in the Asia Pacific Frozen Snacks Market Sector

- Nestle SA

- Simplot Australia Pty Limited

- Prasuma

- Earlee Products

- Tyson Foods Inc.

- Ajinomoto Co. Inc.

- McCain Foods Limited

- General Mills

- Conagra Brands

- ITC Limited

Key Milestones in Asia Pacific Frozen Snacks Market Industry

- July 2022: Continental Coffee launched its new frozen foods lineup across India, including plant-based frozen snacks like chicken-like nuggets, seekh kebab, and sausages.

- April 2022: Prasuma (India) launched new chilled meat and frozen snack products, including frozen chicken nuggets, frozen veg, and chicken spring rolls, across 70 cities at affordable price points.

- June 2021: Tyson Foods expanded its geographical presence in Asia by launching plant-based frozen Bites, Nuggets, and Strips in Malaysia.

These milestones underscore the industry's focus on product diversification, expansion into new product categories like plant-based options, and geographical market penetration.

Strategic Outlook for Asia Pacific Frozen Snacks Market Market

The strategic outlook for the Asia Pacific frozen snacks market is overwhelmingly positive, driven by strong underlying growth accelerators. Key strategies for sustained growth will involve continued product innovation, particularly in the health and wellness space with an emphasis on plant-based frozen snacks and reduced-ingredient formulations. Expansion into Tier 2 and Tier 3 cities, coupled with the leveraging of e-commerce and direct-to-consumer (DTC) models, will be crucial for broadening market reach. Strategic partnerships with local distributors and retailers will facilitate deeper penetration into diverse markets. Investing in efficient and robust cold chain infrastructure will remain paramount to ensure product quality and minimize losses. Furthermore, brands that can effectively communicate the convenience, quality, and nutritional benefits of their frozen snacks will be well-positioned to capture market share and foster long-term consumer loyalty in this dynamic and rapidly evolving sector.

Asia Pacific Frozen Snacks Market Segmentation

-

1. Product Type

- 1.1. Fruit based Snacks

- 1.2. Potato based Snacks

- 1.3. Meat and Seafood based Snacks

- 1.4. Other

-

2. distribution channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

Asia Pacific Frozen Snacks Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Frozen Snacks Market Regional Market Share

Geographic Coverage of Asia Pacific Frozen Snacks Market

Asia Pacific Frozen Snacks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus On Health and Wellness; Surge in Product Innovation

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes

- 3.4. Market Trends

- 3.4.1. Popularity of Shelf-stable Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fruit based Snacks

- 5.1.2. Potato based Snacks

- 5.1.3. Meat and Seafood based Snacks

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by distribution channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fruit based Snacks

- 6.1.2. Potato based Snacks

- 6.1.3. Meat and Seafood based Snacks

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by distribution channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia Pacific Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fruit based Snacks

- 7.1.2. Potato based Snacks

- 7.1.3. Meat and Seafood based Snacks

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by distribution channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia Pacific Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fruit based Snacks

- 8.1.2. Potato based Snacks

- 8.1.3. Meat and Seafood based Snacks

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by distribution channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia Pacific Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fruit based Snacks

- 9.1.2. Potato based Snacks

- 9.1.3. Meat and Seafood based Snacks

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by distribution channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia Pacific Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Fruit based Snacks

- 10.1.2. Potato based Snacks

- 10.1.3. Meat and Seafood based Snacks

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by distribution channel

- 10.2.1. Supermarkets/ Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Simplot Australia Pty Limited*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Prasuma

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Earlee Products

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tyson Foods Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ajinomoto Co inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McCain Foods Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Mills

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Conagra Brands

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ITC Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Asia Pacific Frozen Snacks Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Frozen Snacks Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 3: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 7: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 11: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 15: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 19: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 23: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Frozen Snacks Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Frozen Snacks Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Asia Pacific Frozen Snacks Market?

Key companies in the market include Nestle SA, Simplot Australia Pty Limited*List Not Exhaustive, Prasuma, Earlee Products, Tyson Foods Inc, Ajinomoto Co inc, McCain Foods Limited, General Mills, Conagra Brands, ITC Limited.

3. What are the main segments of the Asia Pacific Frozen Snacks Market?

The market segments include Product Type, distribution channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 153.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus On Health and Wellness; Surge in Product Innovation.

6. What are the notable trends driving market growth?

Popularity of Shelf-stable Food Products.

7. Are there any restraints impacting market growth?

Presence of Substitutes.

8. Can you provide examples of recent developments in the market?

In July 2022, Continental Coffee launched its new frozen foods lineup across India. Continental Greenbird lineup has a wide range of frozen snack products in the portfolio which include chicken-like nuggets, chicken-like seekh kebab, chicken-like sausages, and mutton-like keema. All the products offered under this line-up are 100% vegan and are made of plant-based protein derived from green pea, chickpea, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Frozen Snacks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Frozen Snacks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Frozen Snacks Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Frozen Snacks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence