Key Insights

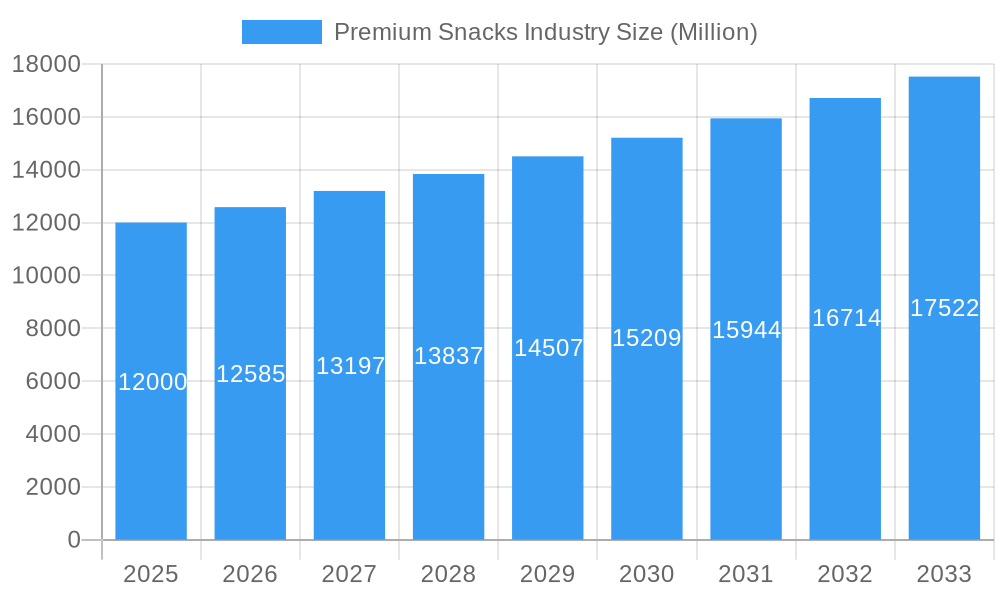

The global premium snacks market is projected to reach a size of $44.2 billion by 2025, with a compound annual growth rate (CAGR) of 2.4% through 2033. This growth is driven by evolving consumer demand for superior ingredients, unique flavors, and perceived health benefits, particularly in developed markets with busy lifestyles and heightened wellness awareness. The industry is segmented by type, with Savory Snacks and Confectionery Snacks anticipated to lead, alongside growing interest in Fruit Snacks and Frozen Snacks. Online retail channels are experiencing rapid expansion, complementing the continued dominance of supermarkets and hypermarkets, and the rise of specialty stores for premium brand engagement.

Premium Snacks Industry Market Size (In Billion)

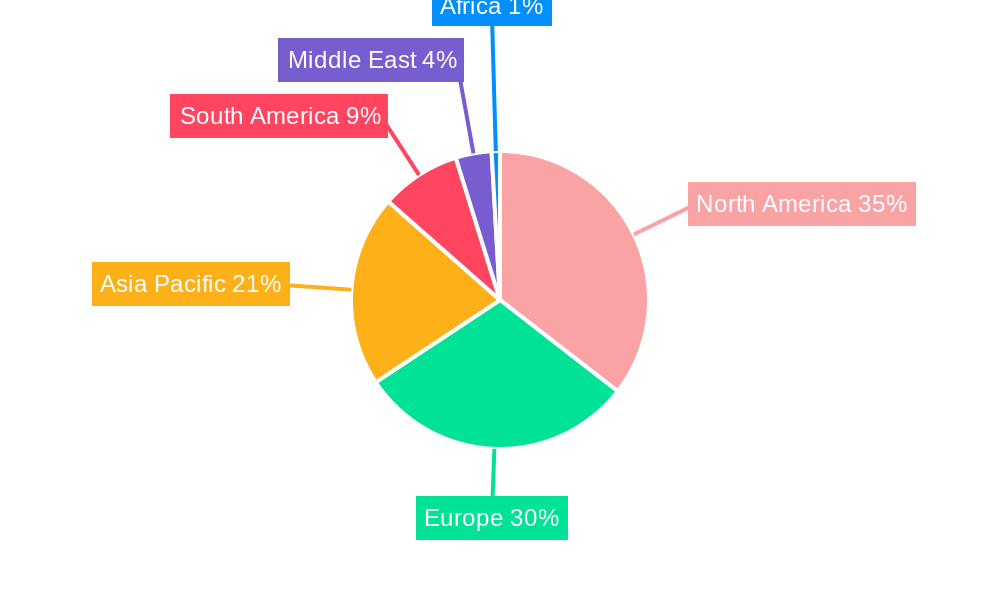

The competitive landscape features established global corporations and agile niche players. Key market drivers include convenience, the expanding global middle class, and a focus on health-conscious options like natural ingredients and reduced sugar content. Challenges involve the high cost of premium ingredients and intense competition. North America and Europe are expected to lead regional growth, with significant expansion anticipated in the Asia Pacific.

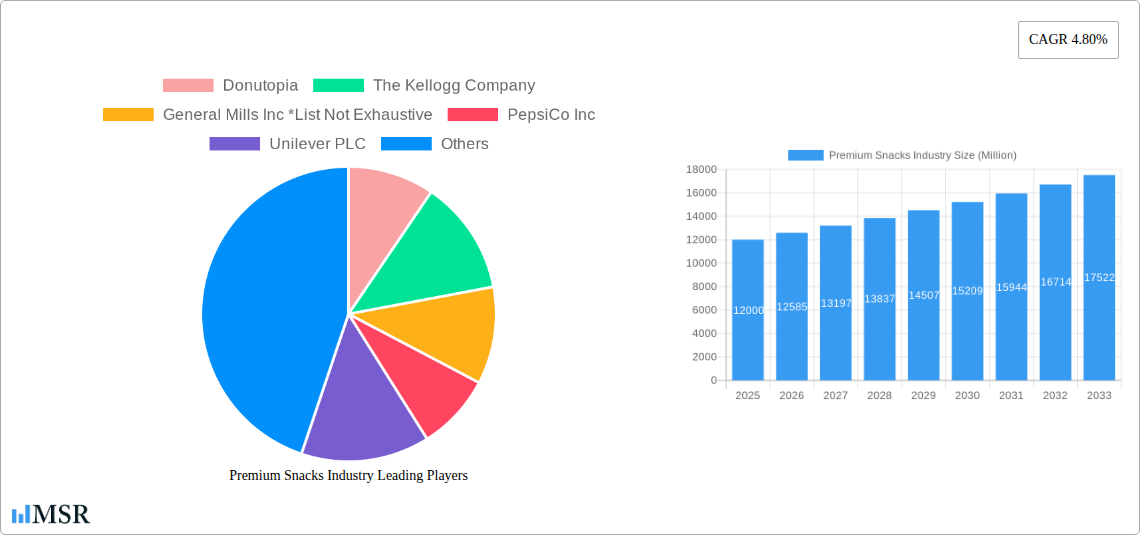

Premium Snacks Industry Company Market Share

Premium Snacks Industry Market Analysis: 2025-2033

This report delivers an in-depth analysis of the dynamic global premium snacks market. It provides critical insights and strategic forecasts for the period 2025-2033, with 2025 as the base year. The market is expected to reach a size of $44.2 billion by 2025 and expand significantly through 2033, driven by a CAGR of 2.4%. Essential for stakeholders aiming to capitalize on the growing demand for high-quality, indulgent, and health-conscious snacking solutions.

Premium Snacks Industry Market Concentration & Dynamics

The premium snacks market exhibits a dynamic yet moderately concentrated landscape, with a few dominant players like PepsiCo Inc., Mondelez International, and General Mills Inc. holding significant market share, while a vibrant ecosystem of niche and innovative companies fosters continuous disruption. The innovation ecosystem is characterized by a strong emphasis on ingredient quality, unique flavor profiles, and sophisticated packaging. Regulatory frameworks, particularly those concerning health claims, labeling, and sustainable sourcing, are increasingly influential, shaping product development and market entry strategies. Substitute products, ranging from traditional snacks to emerging health food options, present a constant competitive challenge, necessitating ongoing differentiation. End-user trends are overwhelmingly shifting towards healthier indulgence, personalized nutrition, and ethically sourced ingredients. Merger and acquisition (M&A) activities remain robust, with an estimated over 100 M&A deals occurring annually, as larger players seek to acquire innovative brands and expand their premium portfolios. The market share of the top 5 companies is estimated at over 50%.

- Market Share of Top Players: Over 50%

- Annual M&A Deal Count: Over 100

- Key Factors Influencing Concentration: Brand loyalty, economies of scale, R&D investments.

- Innovation Focus Areas: Functional ingredients, gourmet flavors, sustainable packaging.

Premium Snacks Industry Industry Insights & Trends

The premium snacks industry is poised for exceptional growth, fueled by a confluence of powerful market drivers. A primary catalyst is the escalating consumer demand for high-quality, indulgent, and convenient snacking options. As disposable incomes rise globally, consumers are increasingly willing to spend more on snacks that offer superior taste, unique ingredients, and a more satisfying experience. Technological disruptions are playing a pivotal role, with advancements in food processing and ingredient innovation enabling the creation of novel textures, flavors, and functional benefits in premium snacks. Online retail stores have emerged as a critical distribution channel, providing consumers with unprecedented access to a wide array of premium brands and facilitating direct-to-consumer sales models. Evolving consumer behaviors, including a growing preference for snacks that align with health and wellness goals, such as low-sugar, high-protein, and plant-based options, are reshaping product development. The market size for premium snacks is projected to reach over $100 Billion USD by 2033, exhibiting a CAGR of xx% from 2025 to 2033. This growth is further propelled by premiumization trends across all food categories, with consumers treating snacks as mini-meals or guilt-free indulgences. The development of specialized frozen snacks and bakery snacks with premium ingredients is also contributing significantly to market expansion. The savory snacks segment, particularly those featuring exotic flavors and artisanal production methods, is also experiencing robust growth. The confectionery snacks segment continues to innovate with premium chocolate and artisanal confectionery, catering to discerning palates. The fruit snacks segment is seeing a rise in organic and naturally sweetened options. The overarching trend is a move towards snacks that offer an experience, not just sustenance.

- Market Size (2033): Over $100 Billion USD

- CAGR (2025-2033): xx%

- Key Growth Drivers: Rising disposable incomes, demand for healthier indulgence, technological advancements in food science.

- Evolving Consumer Behaviors: Preference for natural ingredients, functional benefits, sustainable sourcing.

- Impact of Online Retail: Increased accessibility and personalized offerings.

Key Markets & Segments Leading Premium Snacks Industry

North America currently leads the premium snacks industry, driven by a mature market with a high consumer propensity for premium products and a well-established distribution infrastructure. The United States, in particular, is a powerhouse due to its large consumer base, high disposable incomes, and a culture that embraces snacking as an integral part of the diet. Economic growth and a strong focus on innovation within the country have cemented its dominance.

The Savory Snacks segment is a significant frontrunner in the premium space, encompassing artisanal chips, gourmet popcorn, and elevated jerky products. Consumers are increasingly seeking complex flavor profiles and high-quality ingredients in their savory options.

- Dominant Region: North America (especially the United States)

- Dominant Segment (Type): Savory Snacks

Drivers for North American dominance include:

- High Disposable Incomes: Enabling greater consumer spending on premium goods.

- Developed Retail Infrastructure: Efficient distribution networks through Supermarkets/Hypermarkets and a growing presence in Online Retail Stores.

- Strong Consumer Demand for Innovation: Consumers are receptive to new flavors and product formats.

- Established CPG Companies: Leading players are actively investing in premium offerings.

The Confectionery Snacks segment also holds substantial market share, with a continuous stream of new product launches featuring premium chocolate, artisanal candies, and ethically sourced ingredients.

- Dominant Distribution Channel: Supermarkets/Hypermarkets

- Emerging Distribution Channel: Online Retail Stores

Drivers for Supermarkets/Hypermarkets dominance:

- Wide Reach and Accessibility: Catering to a broad consumer base.

- Promotional Opportunities: Space for in-store displays and marketing.

- One-Stop Shopping Convenience: Consumers can purchase a variety of premium snacks alongside other groceries.

The rapid expansion of Online Retail Stores is a significant trend, offering unparalleled convenience and access to a wider variety of niche and international premium snack brands. This channel is crucial for reaching younger demographics and consumers seeking unique products not readily available in traditional brick-and-mortar stores.

- Key Segments Experiencing Growth:

- Bakery Snacks: Artisanal cookies, premium pastries, and gourmet baked goods.

- Frozen Snacks: High-quality, ready-to-eat premium frozen appetizers and desserts.

- Fruit Snacks: Organic, naturally sweetened, and functional fruit-based snacks.

Premium Snacks Industry Product Developments

Product innovation in the premium snacks industry is relentless, driven by a desire to offer consumers novel taste experiences and functional benefits. Companies are increasingly focusing on artisanal ingredients, unique flavor fusions, and sophisticated textures to differentiate their offerings. Sustainable packaging solutions are also a key area of development, aligning with growing consumer environmental consciousness. Advancements in plant-based formulations and the incorporation of functional ingredients like adaptogens and probiotics are creating new market segments within premium snacks, offering both indulgence and wellness.

Challenges in the Premium Snacks Industry Market

The premium snacks industry faces several significant challenges, including supply chain volatility for specialized and exotic ingredients, leading to increased costs and potential disruptions. Intensifying competitive pressures from both established giants and agile startups necessitate continuous innovation and aggressive marketing. Regulatory hurdles, particularly concerning health claims and ingredient sourcing, can impact product development timelines and market access. Furthermore, maintaining premium pricing while managing rising input costs and distribution expenses requires careful strategic planning. The threat of substitute products from both traditional snack categories and emerging health-focused alternatives also poses a constant challenge, demanding a strong value proposition.

- Key Challenges:

- Supply Chain Volatility (estimated impact: 10-15% cost increase)

- Intense Competition (leading to higher marketing spend)

- Evolving Regulatory Landscape

- Consumer Price Sensitivity for premium products

Forces Driving Premium Snacks Industry Growth

Several powerful forces are propelling the growth of the premium snacks industry. The macroeconomic trend of rising disposable incomes across emerging and developed economies empowers consumers to opt for higher-value, premium products. A significant shift in consumer lifestyles towards health and wellness is driving demand for snacks perceived as healthier, such as those with natural ingredients, reduced sugar, and added functional benefits. Technological advancements in food science and processing enable the creation of novel textures, flavors, and improved shelf life for premium offerings. Furthermore, the growing influence of social media and influencer marketing plays a crucial role in creating awareness and desirability for premium snack brands. The expansion of e-commerce platforms has democratized access, allowing smaller, niche brands to reach a global audience.

- Key Growth Drivers:

- Increasing Disposable Incomes

- Health and Wellness Trends

- Food Technology Innovations

- Digital Marketing and E-commerce Expansion

Challenges in the Premium Snacks Industry Market

Long-term growth catalysts in the premium snacks industry are deeply intertwined with ongoing consumer evolution and market adaptation. The persistent trend towards healthier indulgence means that brands focusing on functional ingredients, clean labels, and portion control will continue to thrive. Strategic partnerships and collaborations between ingredient suppliers, manufacturers, and retailers can unlock new product development opportunities and enhance supply chain resilience. Market expansion into untapped emerging economies, coupled with localized product innovation, presents significant future growth potential. Furthermore, companies that can effectively leverage data analytics to understand consumer preferences and personalize offerings will gain a distinct competitive advantage and drive sustained growth.

- Long-Term Growth Catalysts:

- Continued Demand for Healthier Indulgence

- Strategic Partnerships and Alliances

- Expansion into Emerging Markets

- Data-Driven Personalization

Emerging Opportunities in Premium Snacks Industry

Emerging opportunities within the premium snacks industry are abundant and varied, catering to an increasingly discerning consumer base. The rise of personalized nutrition presents a fertile ground for customizable snack formulations based on individual dietary needs and preferences. The plant-based movement continues to expand, offering immense potential for innovative vegan and vegetarian premium snack options. Furthermore, sustainable and ethically sourced ingredients are no longer a niche concern but a significant purchasing driver, creating opportunities for brands that prioritize transparency and environmental responsibility. The integration of smart packaging and connected consumer experiences offers avenues for brand engagement and loyalty building. Lastly, exploring new flavor frontiers and fusion cuisines can capture the adventurous consumer palate.

- Key Emerging Opportunities:

- Personalized Nutrition Snack Solutions

- Innovative Plant-Based Premium Snacks

- Sustainable and Ethically Sourced Product Lines

- Integration of Smart Packaging Technology

Leading Players in the Premium Snacks Industry Sector

- Donutopia

- The Kellogg Company

- General Mills Inc.

- PepsiCo Inc.

- Unilever PLC

- Conagra Brands Inc.

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Berco's Popcorn

- Mondelez International

Key Milestones in Premium Snacks Industry Industry

- May 2022: Kellogg's launched innovative packaging to improve its products' shelf appeal. In collaboration with international brand transformation company Landor & Fitch, Kellogg's is introducing a new appearance for its line of snacks, enhancing consumer engagement and market presence.

- September 2021: PepsiCo has declared that for the first time they have launched a 'Zero-Staff', AI-Powered Snack Store in Dubai at Expo 2020. The new AI-Powered store is designed to cater to shoppers' needs and is secure and contactless, signifying a leap in retail technology and customer experience.

- April 2021: Mondelez International and Olam Food Ingredients have announced a partnership to establish the largest sustainable commercial cocoa farm in the world in Asia. The strategy is based on the accomplishments of Mondelez International's renowned initiative for sustainable sourcing, aiming for a future cocoa farming model for 2,000 hectares to improve farmer livelihoods, the environment, and local communities, demonstrating a commitment to sustainability and responsible sourcing.

Strategic Outlook for Premium Snacks Industry Market

The strategic outlook for the premium snacks industry is exceptionally positive, driven by sustained consumer demand for elevated snacking experiences. Future growth will be propelled by continued innovation in functional ingredients, catering to evolving health and wellness needs, and a focus on sustainable and ethical sourcing, which resonates deeply with environmentally conscious consumers. Companies that can effectively leverage digital channels for direct-to-consumer sales and personalized marketing will gain a significant competitive edge. Strategic investments in emerging markets and the development of novel product formats and flavor profiles will be crucial for capturing new consumer segments. The ability to adapt to rapidly changing consumer preferences and maintain premium brand perception amidst economic fluctuations will define long-term success.

Premium Snacks Industry Segmentation

-

1. Type

- 1.1. Frozen Snacks

- 1.2. Savory Snacks

- 1.3. Fruit Snacks

- 1.4. Confectionery Snacks

- 1.5. Bakery Snacks

- 1.6. Others

-

2. Distribution Channels

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Premium Snacks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Premium Snacks Industry Regional Market Share

Geographic Coverage of Premium Snacks Industry

Premium Snacks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Influence of Endorsements

- 3.2.2 Aggressive Marketing

- 3.2.3 and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products; Fluctuating Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Increasing Premiumization in Confectionery Snacks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frozen Snacks

- 5.1.2. Savory Snacks

- 5.1.3. Fruit Snacks

- 5.1.4. Confectionery Snacks

- 5.1.5. Bakery Snacks

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Frozen Snacks

- 6.1.2. Savory Snacks

- 6.1.3. Fruit Snacks

- 6.1.4. Confectionery Snacks

- 6.1.5. Bakery Snacks

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Frozen Snacks

- 7.1.2. Savory Snacks

- 7.1.3. Fruit Snacks

- 7.1.4. Confectionery Snacks

- 7.1.5. Bakery Snacks

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Frozen Snacks

- 8.1.2. Savory Snacks

- 8.1.3. Fruit Snacks

- 8.1.4. Confectionery Snacks

- 8.1.5. Bakery Snacks

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Frozen Snacks

- 9.1.2. Savory Snacks

- 9.1.3. Fruit Snacks

- 9.1.4. Confectionery Snacks

- 9.1.5. Bakery Snacks

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Frozen Snacks

- 10.1.2. Savory Snacks

- 10.1.3. Fruit Snacks

- 10.1.4. Confectionery Snacks

- 10.1.5. Bakery Snacks

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Frozen Snacks

- 11.1.2. Savory Snacks

- 11.1.3. Fruit Snacks

- 11.1.4. Confectionery Snacks

- 11.1.5. Bakery Snacks

- 11.1.6. Others

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Specialty Stores

- 11.2.4. Online Retail Stores

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 12.1.4 Rest of North America

- 13. Europe Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 Spain

- 13.1.4 France

- 13.1.5 Italy

- 13.1.6 Russia

- 13.1.7 Rest of Europe

- 14. Asia Pacific Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 Australia

- 14.1.5 Rest of Asia Pacific

- 15. South America Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Middle East Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Saudi Arabia Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 South Africa

- 17.1.2 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2025

- 18.2. Company Profiles

- 18.2.1 Donutopia

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 The Kellogg Company

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 General Mills Inc *List Not Exhaustive

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 PepsiCo Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Unilever PLC

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Conagra Brands Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Chocoladefabriken Lindt & Sprungli AG

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Mars Incorporated

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Berco's Popcorn

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Mondelez International

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Donutopia

List of Figures

- Figure 1: Global Premium Snacks Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 3: North America Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Europe Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: Middle East Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Saudi Arabia Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Saudi Arabia Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: North America Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: North America Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 17: North America Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 18: North America Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: North America Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Europe Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 23: Europe Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 24: Europe Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 29: Asia Pacific Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 30: Asia Pacific Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: South America Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 35: South America Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 36: South America Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: South America Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 39: Middle East Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 40: Middle East Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 41: Middle East Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 42: Middle East Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 43: Middle East Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 44: Saudi Arabia Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 45: Saudi Arabia Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Saudi Arabia Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 47: Saudi Arabia Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 48: Saudi Arabia Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Saudi Arabia Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Premium Snacks Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 4: Global Premium Snacks Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 6: United States Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Canada Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Mexico Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Argentina Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: South Africa Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 35: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: United States Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Canada Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Mexico Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of North America Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 42: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: United Kingdom Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Germany Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: France Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Italy Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 51: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 52: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 53: China Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: India Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Australia Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Asia Pacific Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 59: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 60: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 61: Brazil Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Argentina Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of South America Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 65: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 66: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 67: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 68: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 69: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: South Africa Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Premium Snacks Industry?

The projected CAGR is approximately 2.4%.

2. Which companies are prominent players in the Premium Snacks Industry?

Key companies in the market include Donutopia, The Kellogg Company, General Mills Inc *List Not Exhaustive, PepsiCo Inc, Unilever PLC, Conagra Brands Inc, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Berco's Popcorn, Mondelez International.

3. What are the main segments of the Premium Snacks Industry?

The market segments include Type, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements. Aggressive Marketing. and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates.

6. What are the notable trends driving market growth?

Increasing Premiumization in Confectionery Snacks.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products; Fluctuating Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

In May 2022, Kellogg's launched innovative packaging to improve its products' shelf appeal. In collaboration with international brand transformation company Landor & Fitch, Kellogg's is introducing a new appearance for its line of snacks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Premium Snacks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Premium Snacks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Premium Snacks Industry?

To stay informed about further developments, trends, and reports in the Premium Snacks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence