Key Insights

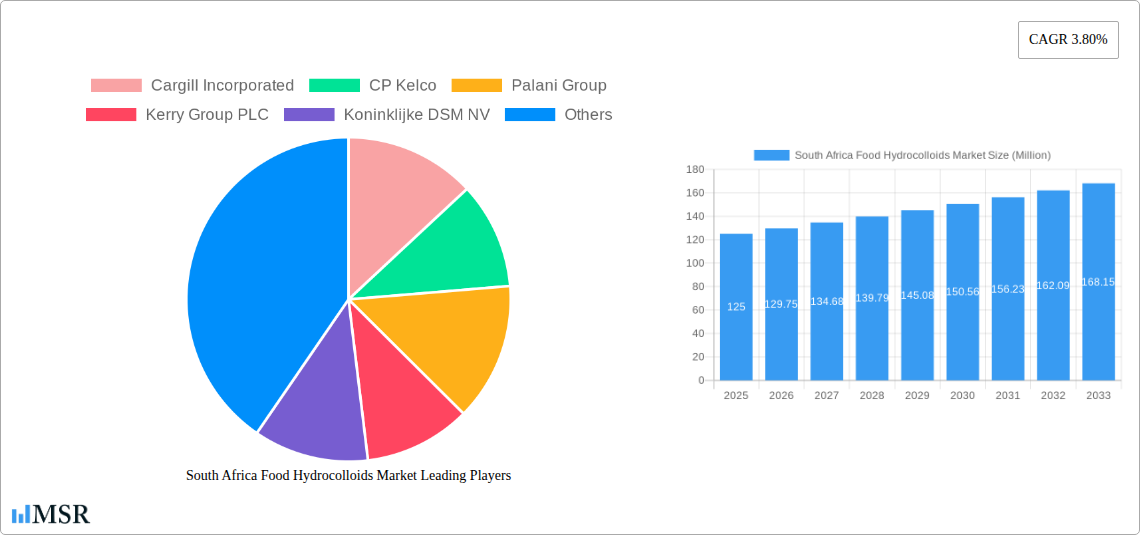

The South African Food Hydrocolloids Market is poised for significant expansion, projected to reach a market size of $4.44 billion by 2025. This growth is driven by escalating consumer demand for processed foods and beverages, coupled with a heightened awareness of the functional benefits these ingredients offer. With an anticipated Compound Annual Growth Rate (CAGR) of 3.8% for the period 2025-2033, market evolution will be sustained by the necessity for improved texture, stability, and extended shelf-life across a diverse range of food products. Key application segments, including Dairy and Frozen Products, Bakery and Confectionery, and Beverages, are expected to spearhead this expansion, reflecting evolving dietary patterns and the convenience-oriented preferences of South African consumers. The increasing adoption of plant-based alternatives and health-conscious food options further fuels demand for hydrocolloids that effectively replicate the texture and mouthfeel of traditional ingredients. Leading industry players such as Cargill Incorporated, CP Kelco, and Kerry Group PLC are actively contributing to market dynamism through continuous product innovation and strategic expansions.

South Africa Food Hydrocolloids Market Market Size (In Billion)

While the market outlook is generally positive, certain restraints, including fluctuating raw material prices and stringent regulatory compliance for food additives, present challenges. Nevertheless, ongoing research and development initiatives are focused on addressing these obstacles, exploring novel hydrocolloid sources and optimizing production methodologies. The market's segmentation by type, with Gelatin Gum, Pectin, and Xanthan Gum holding substantial shares, highlights a broad spectrum of applications, each addressing specific functional requirements. The growing utilization of these ingredients in meat and seafood products, as well as oils and fats, signifies the expanding application scope of hydrocolloids within the South African food industry. Regional dominance is anticipated in urbanized areas characterized by higher disposable incomes and a greater prevalence of processed food consumption.

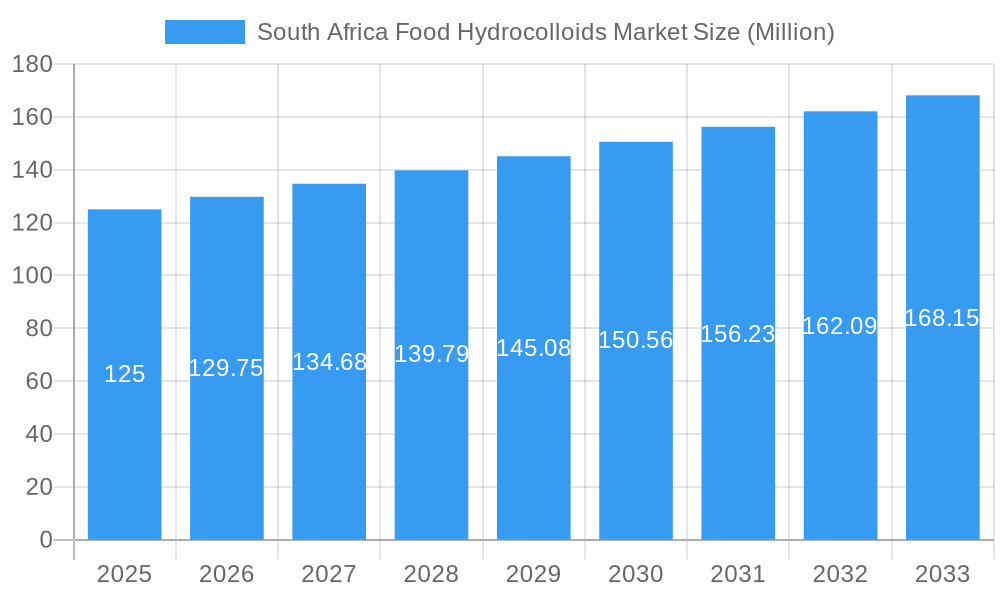

South Africa Food Hydrocolloids Market Company Market Share

This comprehensive market analysis offers in-depth insights and actionable intelligence for stakeholders in the South African food hydrocolloids sector. The study, covering the period from 2019 to 2033 with a base year of 2025, meticulously examines market dynamics, key players, and the future trajectory of this crucial industry. The forecast period from 2025 to 2033 highlights growth opportunities and potential challenges, building upon historical data from 2019-2024. Explore how key segments, including Gelatin Gum, Pectin, Xanthan Gum, and Other Types, alongside applications in Dairy and Frozen Products, Bakery and Confectionery, Beverages, Meat and Seafood Products, Oils and Fats, and Other Applications, are shaping the future of food formulation in South Africa.

South Africa Food Hydrocolloids Market Market Concentration & Dynamics

The South Africa food hydrocolloids market exhibits a moderate to high level of concentration, characterized by the presence of several global and regional players vying for market share. Key companies like Cargill Incorporated, CP Kelco, Ingredion Incorporated, and Koninklijke DSM NV hold significant influence, driving innovation and shaping market trends. The innovation ecosystem is vibrant, with continuous investment in research and development to enhance product functionality, explore new applications, and develop sustainable sourcing. Regulatory frameworks, primarily governed by the Department of Health and the Food and Drug Administration, ensure food safety and product quality, influencing product development and market entry strategies. The threat of substitute products exists, particularly from synthetic thickeners and stabilizers, but natural hydrocolloids often maintain a competitive edge due to consumer preference for clean labels and perceived health benefits. End-user trends are increasingly leaning towards demand for plant-based, non-GMO, and sustainably sourced ingredients, pushing manufacturers to adapt their product portfolios. Mergers and acquisitions (M&A) activities, though not extensively documented in terms of raw counts, have played a role in consolidating market presence and expanding product offerings, with the acquisition of Rhodia Food by Ingredion Inc. in 2018 being a notable example. Understanding these dynamics is crucial for strategic planning and identifying competitive advantages within the South African food ingredients landscape.

South Africa Food Hydrocolloids Market Industry Insights & Trends

The South Africa food hydrocolloids market is poised for robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and a dynamic economic landscape. The market size for food hydrocolloids in South Africa is estimated to reach approximately USD 350 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period of 2025-2033. This growth is significantly fueled by the increasing demand for processed foods, convenience meals, and beverages, where hydrocolloids play an indispensable role in enhancing texture, stability, and mouthfeel.

Key growth drivers include the burgeoning middle class, with its higher disposable income and increased consumption of value-added food products. The growing health and wellness trend is also a significant factor, prompting a demand for natural and functional ingredients, which hydrocolloids often fulfill. For instance, pectin’s gelling properties are increasingly utilized in low-sugar jams and jellies, catering to health-conscious consumers. Furthermore, the expansion of the dairy and frozen products sector, a major application area, is directly contributing to the demand for hydrocolloids like gelatin and carrageenan for improved texture and ice crystal control.

Technological disruptions are continually reshaping the market. Advancements in extraction and purification techniques are leading to higher quality hydrocolloids with improved functionalities. The development of novel hydrocolloid blends offers customized solutions for specific food applications, allowing manufacturers to achieve desired sensory attributes more effectively. The growing interest in plant-based alternatives has spurred innovation in hydrocolloids derived from non-animal sources, such as alginates and gellan gum, expanding their application scope beyond traditional uses.

Evolving consumer behaviors are a pivotal force. There is a discernible shift towards clean-label products, with consumers scrutinizing ingredient lists and preferring ingredients that are perceived as natural and minimally processed. This has led to a resurgence in demand for hydrocolloids like agar-agar and pectin, which are derived from natural sources. Moreover, the convenience-driven lifestyle of urban South Africans fuels the demand for ready-to-eat meals and snacks, where hydrocolloids are essential for shelf-life extension and texture maintenance. The food service industry, encompassing restaurants and catering, is also a significant contributor, seeking ingredients that offer consistency and efficiency in food preparation. The rise of e-commerce and online grocery platforms further facilitates access to a wider array of food products, indirectly boosting the demand for processed foods that rely on hydrocolloids. The report will delve deeper into these intricate relationships, providing a granular understanding of market drivers and their impact.

Key Markets & Segments Leading South Africa Food Hydrocolloids Market

The South Africa food hydrocolloids market is characterized by distinct segment leadership, with specific product types and application areas driving overall market value and volume. The dominant segment by application is undoubtedly Dairy and Frozen Products. This leadership is attributed to the widespread use of hydrocolloids as stabilizers, thickeners, and emulsifiers in products like yogurt, ice cream, cheeses, and desserts. These ingredients are crucial for achieving desired textures, preventing syneresis (whey separation), and controlling ice crystal formation in frozen goods, thereby enhancing product quality and shelf life. Economic growth and an expanding middle class with increased purchasing power for dairy and frozen treats directly fuel this segment.

Within the Type segment, Gelatin Gum and Pectin are anticipated to hold significant market share. Gelatin, derived from animal collagen, is widely used in confectionery, dairy, and meat products for its gelling, binding, and foaming properties. Its established presence and versatility make it a staple ingredient. Pectin, a naturally occurring polysaccharide found in fruits, is increasingly favored due to its gelling and stabilizing capabilities, particularly in low-sugar applications, jams, jellies, and dairy products, aligning with health-conscious consumer trends. The growing demand for plant-based alternatives is also boosting the prominence of Xanthan Gum, a microbial polysaccharide renowned for its thickening and stabilizing properties across a broad pH range and temperature.

The Bakery and Confectionery application segment also plays a crucial role in market leadership. Hydrocolloids in this sector contribute to dough conditioning, crumb structure enhancement, moisture retention, and improved texture in baked goods, as well as creating desirable textures and mouthfeel in confectionery items like gummies and candies. The robust growth of the bakery industry in South Africa, driven by both industrial production and artisanal baking, directly translates to higher hydrocolloid consumption.

The Beverages segment is another key market, where hydrocolloids are employed to provide viscosity, mouthfeel, and suspension for pulp or particulates in juices, sports drinks, and functional beverages. The increasing popularity of ready-to-drink beverages and the demand for enhanced sensory experiences in the South African market contribute to the segment’s growth. The Meat and Seafood Products segment utilizes hydrocolloids for binding, moisture retention, and texture improvement in processed meats, sausages, and seafood products. Similarly, the Oils and Fats segment benefits from hydrocolloids as emulsifiers and stabilizers, particularly in spreads and margarines. The overall dominance of these segments is a testament to the essential functional role hydrocolloids play in a vast array of food products consumed across South Africa.

South Africa Food Hydrocolloids Market Product Developments

Product developments in the South Africa food hydrocolloids market are increasingly focused on meeting evolving consumer demands for health, convenience, and sustainability. Innovations include the development of new plant-based hydrocolloids, offering viable alternatives to animal-derived ingredients for vegetarian and vegan food products. Companies are also investing in R&D to improve the functionality and application range of existing hydrocolloids, such as developing specialized blends for specific textures or improved stability under varying processing conditions. For instance, advancements in the production of pectin with controlled gelling parameters cater to the growing demand for low-sugar jams and jellies. Furthermore, a significant trend is the emphasis on clean-label solutions, leading to the reformulation of products to include hydrocolloids that are perceived as natural and minimally processed, enhancing market relevance and competitive advantage.

Challenges in the South Africa Food Hydrocolloids Market Market

The South Africa food hydrocolloids market faces several challenges that can impede its growth trajectory. Supply chain disruptions, exacerbated by global logistics issues and potential local agricultural variability, can impact the availability and cost of raw materials. Price volatility of raw materials, influenced by factors like weather patterns and global demand, directly affects the profitability of hydrocolloid manufacturers. Stringent regulatory hurdles and evolving food safety standards require continuous adaptation and investment in compliance, adding to operational costs. Furthermore, the increasing competition from alternative texturizers and stabilizers, both natural and synthetic, poses a threat, necessitating ongoing innovation to maintain market share.

Forces Driving South Africa Food Hydrocolloids Market Growth

Several key forces are propelling the growth of the South Africa food hydrocolloids market. The escalating demand for processed and convenience foods, driven by an urbanizing population and busy lifestyles, is a primary catalyst. The growing health and wellness trend encourages the use of natural hydrocolloids in functional foods and beverages, aligning with consumer preferences for clean labels and perceived health benefits. Technological advancements in hydrocolloid production and application offer enhanced functionalities, enabling the development of innovative food products with improved textures and shelf stability. Finally, a growing food export market necessitates high-quality ingredients that meet international standards, further boosting demand for advanced hydrocolloid solutions.

Challenges in the South Africa Food Hydrocolloids Market Market

Long-term growth catalysts for the South Africa food hydrocolloids market lie in continued innovation and strategic market expansions. The increasing focus on sustainability and ethical sourcing presents an opportunity for companies to differentiate themselves by investing in eco-friendly production methods and responsibly sourced raw materials. Furthermore, the development of novel hydrocolloid applications beyond traditional food uses, such as in pharmaceuticals or cosmetics, could unlock new revenue streams. Strategic partnerships and collaborations between hydrocolloid suppliers and food manufacturers can foster co-innovation, leading to the development of tailor-made solutions that address specific market needs and consumer trends. Expanding into untapped rural markets and catering to diverse regional preferences will also be crucial for sustained growth.

Emerging Opportunities in South Africa Food Hydrocolloids Market

Emerging opportunities in the South Africa food hydrocolloids market are ripe for exploitation. The rapidly expanding plant-based food sector presents a significant avenue for growth, with increasing demand for vegan-friendly hydrocolloids like carrageenan and agar-agar. Innovations in precision fermentation and biotechnological production methods offer the potential for more sustainable and cost-effective hydrocolloid sourcing. The burgeoning demand for functional foods and nutraceuticals, where hydrocolloids can act as carriers for active ingredients or improve the delivery of supplements, opens new application frontiers. Moreover, the rise of personalized nutrition and the demand for specialized dietary solutions create opportunities for customized hydrocolloid formulations. Exploring export markets for South African food products, particularly within the African continent, will also drive demand for high-quality hydrocolloids that meet international standards.

Leading Players in the South Africa Food Hydrocolloids Market Sector

- Cargill Incorporated

- CP Kelco

- Palani Group

- Kerry Group PLC

- Koninklijke DSM NV

- Tranarc Holdings (Pty) Ltd

- Ingredion Incorporated

Key Milestones in South Africa Food Hydrocolloids Market Industry

- 2018: Ingredion Inc. acquired Rhodia Food, significantly expanding its hydrocolloid portfolio and market reach in South Africa.

- 2021: CP Kelco launched a new range of plant-based hydrocolloids, catering to the growing demand for vegan and vegetarian ingredients and enhancing their competitive edge.

- 2022: Cargill invested heavily in research and development for sustainable hydrocolloid solutions, focusing on environmentally friendly sourcing and production methods, signaling a commitment to long-term market viability.

Strategic Outlook for South Africa Food Hydrocolloids Market Market

The strategic outlook for the South Africa food hydrocolloids market is highly optimistic, driven by sustained consumer demand for convenience, health, and natural ingredients. The market's growth trajectory will be significantly shaped by continued investment in research and development, particularly in plant-based and sustainable hydrocolloid solutions. Companies that can effectively navigate regulatory landscapes and adapt to evolving consumer preferences for clean labels will gain a competitive advantage. Strategic partnerships between ingredient manufacturers and food producers will be crucial for co-creating innovative products that meet specific market needs. Furthermore, exploring opportunities in emerging applications beyond traditional food sectors and expanding export capabilities will be key growth accelerators, ensuring the long-term prosperity and dynamism of the South African food hydrocolloids sector.

South Africa Food Hydrocolloids Market Segmentation

-

1. Type

- 1.1. Gelatin Gum

- 1.2. Pectin

- 1.3. Xanthan Gum

- 1.4. Other Types

-

2. Application

- 2.1. Dairy and Frozen Products

- 2.2. Bakery and Confectionery

- 2.3. Beverages

- 2.4. Meat and Seafood Products

- 2.5. Oils and Fats

- 2.6. Other Applications

South Africa Food Hydrocolloids Market Segmentation By Geography

- 1. South Africa

South Africa Food Hydrocolloids Market Regional Market Share

Geographic Coverage of South Africa Food Hydrocolloids Market

South Africa Food Hydrocolloids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Wide Application due to Varied Functionality

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gelatin Gum

- 5.1.2. Pectin

- 5.1.3. Xanthan Gum

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy and Frozen Products

- 5.2.2. Bakery and Confectionery

- 5.2.3. Beverages

- 5.2.4. Meat and Seafood Products

- 5.2.5. Oils and Fats

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa South Africa Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 7. Sudan South Africa Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 8. Uganda South Africa Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 9. Tanzania South Africa Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 10. Kenya South Africa Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Africa South Africa Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cargill Incorporated

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 CP Kelco

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Palani Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kerry Group PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Koninklijke DSM NV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Tranarc Holdings (Pty) Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ingredion Incorporated

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Cargill Incorporated

List of Figures

- Figure 1: South Africa Food Hydrocolloids Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Food Hydrocolloids Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Country 2020 & 2033

- Table 6: South Africa South Africa Food Hydrocolloids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Sudan South Africa Food Hydrocolloids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Uganda South Africa Food Hydrocolloids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Tanzania South Africa Food Hydrocolloids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Kenya South Africa Food Hydrocolloids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Africa South Africa Food Hydrocolloids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: South Africa Food Hydrocolloids Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Food Hydrocolloids Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the South Africa Food Hydrocolloids Market?

Key companies in the market include Cargill Incorporated, CP Kelco, Palani Group, Kerry Group PLC, Koninklijke DSM NV, Tranarc Holdings (Pty) Ltd, Ingredion Incorporated.

3. What are the main segments of the South Africa Food Hydrocolloids Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Wide Application due to Varied Functionality.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Rhodia Food by Ingredion Inc. (2018) 2. Launch of new plant-based hydrocolloids by CP Kelco (2021) 3. Investment in R&D for sustainable hydrocolloid solutions by Cargill (2022)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Food Hydrocolloids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Food Hydrocolloids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Food Hydrocolloids Market?

To stay informed about further developments, trends, and reports in the South Africa Food Hydrocolloids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence