Key Insights

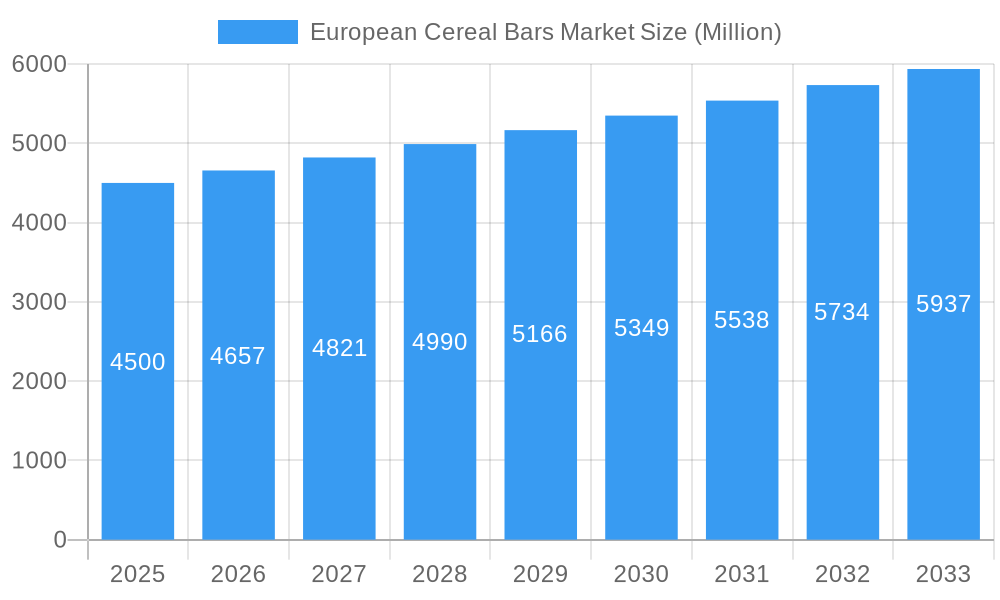

The European Cereal Bars Market is projected for substantial growth, forecasted to reach a market size of 14.08 billion by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.34% from the base year 2025 through 2033. This expansion is driven by a heightened consumer emphasis on health and wellness, increasing the demand for convenient and nutrient-rich snack alternatives. The growing recognition of the health advantages of whole grains, fiber, and vital nutrients found in cereal bars is a significant contributor to their rising popularity. Additionally, modern lifestyles characterized by demanding schedules and mobile consumption habits are fostering a consistent demand for portable and quick meal replacements or snacks. The market also benefits from ongoing product innovation, with manufacturers continually introducing novel flavors, formulations addressing specific dietary requirements (such as gluten-free, vegan, and high-protein options), and sustainably sourced ingredients, thereby attracting a wider consumer demographic.

European Cereal Bars Market Market Size (In Billion)

The market's strong growth is further bolstered by the expansion of distribution channels, with e-commerce platforms emerging as a key avenue for growth, complementing traditional retail outlets like supermarkets and convenience stores. While the ease and availability offered by these channels are primary drivers, specialized retailers also serve a niche segment seeking premium or health-focused products. However, the market encounters certain challenges, including vigorous competition from alternative snack categories and potential consumer price sensitivity, particularly during periods of economic uncertainty. Despite these factors, the persistent demand for healthier snack options and the ongoing commitment of major industry players, such as The Kellogg Company, Nestle S.A., and KIND LLC, to innovate and broaden their product offerings are anticipated to propel the European Cereal Bars Market forward throughout the projected period.

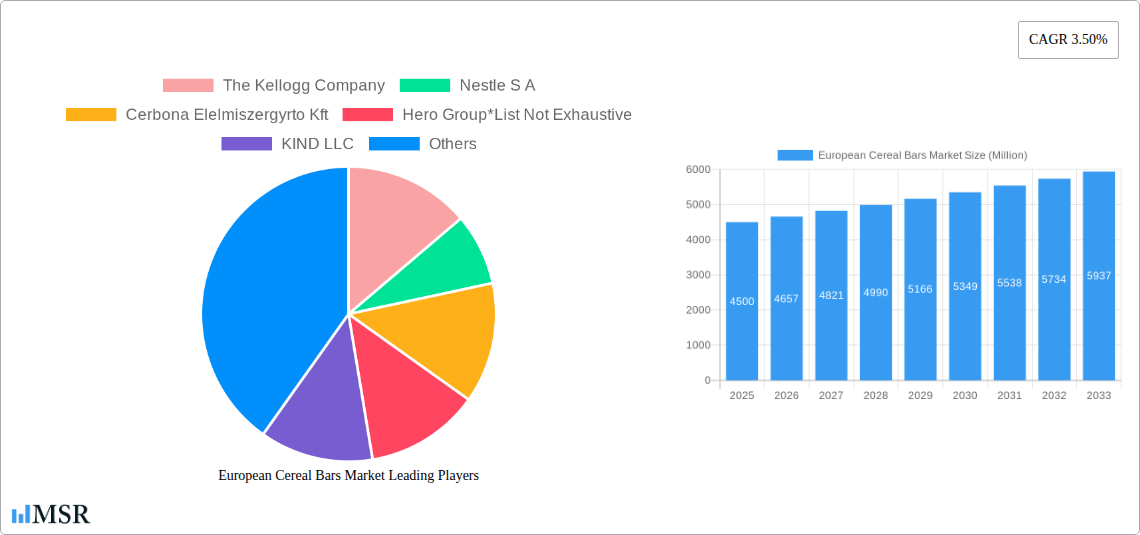

European Cereal Bars Market Company Market Share

European Cereal Bars Market: Comprehensive Analysis & Growth Forecast (2019-2033)

Report Description:

Unlock unparalleled insights into the dynamic European Cereal Bars Market with this definitive research report. Covering the extensive Study Period: 2019–2033, including Historical Period: 2019–2024, Base Year: 2025, Estimated Year: 2025, and a robust Forecast Period: 2025–2033, this report provides a deep dive into market size, CAGR, key drivers, challenges, and emerging opportunities. Equip your business with actionable intelligence to navigate the competitive landscape of healthy snack bars, granola bars, muesli bars, and convenience food. Discover how leading players like Nestle S.A., The Kellogg Company, General Mills, and Hero Group are shaping innovation and market trends. This report is essential for manufacturers, ingredient suppliers, distributors, retailers, and investors seeking to capitalize on the burgeoning demand for convenient, nutritious, and on-the-go European food market solutions.

European Cereal Bars Market Market Concentration & Dynamics

The European Cereal Bars Market exhibits a moderate to high level of concentration, with key players like Nestle S.A., The Kellogg Company, General Mills, and Hero Group holding significant market share. These established giants leverage extensive distribution networks, strong brand recognition, and substantial R&D investments to maintain their competitive edge. Innovation ecosystems are vibrant, driven by consumer demand for healthier, plant-based, and allergen-free options. Regulatory frameworks, including food safety standards and labeling requirements, play a crucial role in shaping product development and market entry. Substitute products, such as fresh fruits, yogurt, and other snack categories, pose a constant challenge, necessitating continuous product differentiation. End-user trends are increasingly favoring functional ingredients, reduced sugar content, and sustainable packaging. Mergers and acquisitions (M&A) activities, while not a constant, periodically reshape the market landscape, with smaller innovative brands being acquired by larger corporations to gain access to new product lines or market segments. For instance, in the historical period, there were approximately 3-5 significant M&A deals annually, impacting market share distributions. The market share of the top 5 players is estimated to be around 55% in the base year 2025.

European Cereal Bars Market Industry Insights & Trends

The European Cereal Bars Market is poised for substantial growth, driven by an escalating demand for convenient and healthy snacking options across the continent. The market size for European Cereal Bars is projected to reach USD 12,500 Million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. Several key factors are fueling this expansion. Firstly, the rising health consciousness among European consumers is a primary growth catalyst. There's a discernible shift towards products perceived as nutritious, with a growing preference for granola/muesli bars that offer perceived health benefits like fiber and whole grains. This trend is further amplified by increased awareness of dietary needs, leading to a demand for low-sugar cereal bars, gluten-free cereal bars, and vegan cereal bars.

Technological disruptions are also playing a pivotal role. Advancements in food processing and ingredient innovation allow manufacturers to develop bars with improved textures, extended shelf lives, and enhanced nutritional profiles. The incorporation of superfoods, functional ingredients (like probiotics, prebiotics, and added vitamins/minerals), and natural sweeteners are becoming commonplace. Furthermore, innovative packaging solutions are addressing consumer needs for portability and sustainability, with a growing adoption of recyclable and biodegradable materials.

Evolving consumer behaviors are another significant driver. The fast-paced modern lifestyle necessitates on-the-go food options, making cereal bars an ideal choice for breakfast, snacks, or post-workout fuel. The increasing penetration of online retail channels for grocery shopping has also made these products more accessible to a wider consumer base, facilitating direct-to-consumer sales and niche market penetration. The influence of social media and health influencers is also shaping consumer preferences, pushing demand for aesthetically pleasing and health-centric products. The overall European healthy snacks market is experiencing a renaissance, with cereal bars at its forefront. This upward trajectory is expected to continue as manufacturers innovate and cater to the diverse and evolving demands of the European populace, driving the market towards USD 20,000 Million by 2033.

Key Markets & Segments Leading European Cereal Bars Market

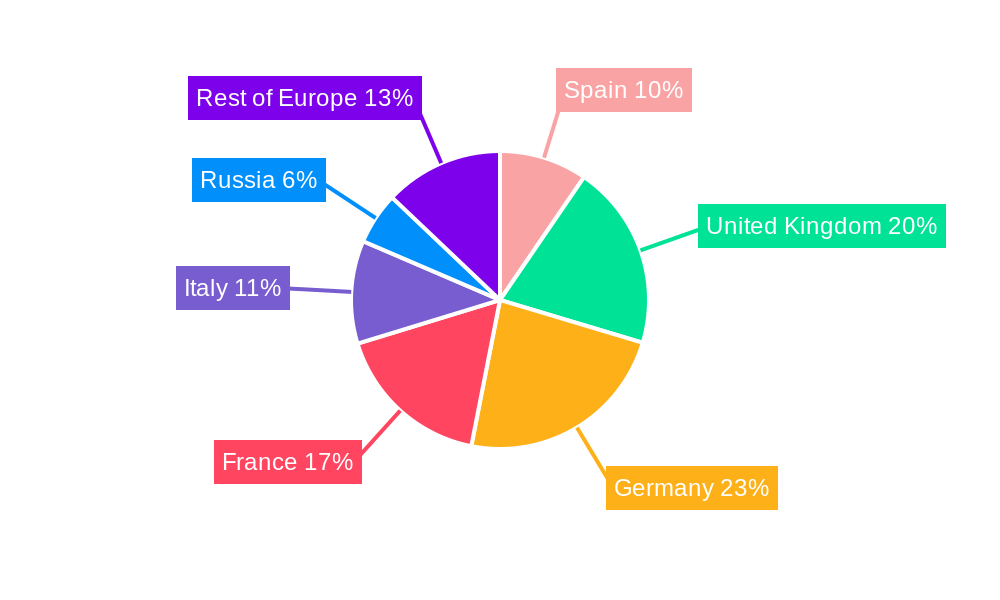

The European Cereal Bars Market is characterized by distinct regional leadership and segment dominance, driven by a confluence of economic factors, consumer preferences, and distribution infrastructure.

Dominant Region & Country:

- Western Europe, particularly countries like the United Kingdom, Germany, and France, currently leads the market. This dominance is attributed to higher disposable incomes, a well-established health and wellness trend, and a sophisticated retail landscape that readily embraces new product innovations. The presence of major food manufacturers and a strong consumer base for packaged goods further solidifies this region's leadership.

- Economic growth in these nations translates to higher consumer spending on premium and health-oriented food products.

- Advanced retail infrastructure, including a high density of supermarkets and hypermarkets, ensures widespread availability and accessibility of cereal bars.

- Consumer awareness regarding healthy eating and nutritional benefits is significantly higher, driving demand for products like organic cereal bars and those with specific functional claims.

Dominant Product Type:

- Granola/Muesli Bars currently hold the largest market share, accounting for an estimated 65% of the total European Cereal Bars Market value in 2025. This segment's popularity stems from their perceived natural ingredients, wholesome appeal, and versatility as a breakfast or snack option. Consumers often associate granola and muesli with healthier alternatives to traditional confectionery.

- The perceived nutritional value of whole grains, nuts, and dried fruits in granola and muesli bars appeals to health-conscious consumers.

- Their versatility allows for a wide range of flavor profiles and ingredient combinations, catering to diverse taste preferences.

- Strong brand marketing often positions these bars as a natural and energizing snack.

- The perceived nutritional value of whole grains, nuts, and dried fruits in granola and muesli bars appeals to health-conscious consumers.

- Their versatility allows for a wide range of flavor profiles and ingredient combinations, catering to diverse taste preferences.

- Strong brand marketing often positions these bars as a natural and energizing snack.

Dominant Distribution Channel:

- Supermarkets/Hypermarkets are the leading distribution channel, commanding approximately 50% of the market share. Their extensive reach, combined with prominent shelf space dedicated to impulse and convenience buys, makes them the primary point of purchase for the majority of consumers. The ability to offer a wide selection of brands and product types under one roof further reinforces their dominance.

- The convenience of one-stop shopping is a significant draw for consumers.

- Promotional activities and discounts offered by supermarkets often influence purchasing decisions.

- These channels facilitate bulk purchasing, appealing to price-sensitive consumers.

- Online Stores are experiencing rapid growth, projected to capture a significant portion of the market by 2033, driven by the increasing adoption of e-commerce for grocery shopping and the convenience of home delivery. This channel is particularly effective for niche brands and direct-to-consumer sales.

- The convenience of one-stop shopping is a significant draw for consumers.

- Promotional activities and discounts offered by supermarkets often influence purchasing decisions.

- These channels facilitate bulk purchasing, appealing to price-sensitive consumers.

European Cereal Bars Market Product Developments

Product innovation in the European Cereal Bars Market is heavily focused on enhancing health attributes and catering to specific dietary needs. Manufacturers are increasingly incorporating plant-based proteins, natural sweeteners like stevia and monk fruit, and functional ingredients such as probiotics and adaptogens to offer targeted health benefits. The trend towards reduced sugar and gluten-free options remains paramount. Furthermore, the development of unique flavor profiles, often inspired by global culinary trends, and the use of ethically sourced ingredients are gaining traction. Innovations in packaging, emphasizing sustainability with recyclable and biodegradable materials, are also becoming a key competitive differentiator, aligning with growing consumer environmental consciousness.

Challenges in the European Cereal Bars Market Market

Despite robust growth, the European Cereal Bars Market faces several challenges. Intense competition from both established brands and emerging players exerts downward pressure on pricing and profit margins. The increasing scrutiny of "health halo" claims requires manufacturers to be transparent and scientifically backed in their product formulations and marketing. Furthermore, fluctuating raw material costs, particularly for grains, nuts, and seeds, can impact production expenses and overall profitability. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can affect product availability and delivery times. Regulatory adherence, including evolving food labeling laws and allergen management, adds to operational complexities. The estimated financial impact of supply chain disruptions on market players in the historical period was approximately 3-5% of annual revenue.

Forces Driving European Cereal Bars Market Growth

Several forces are propelling the growth of the European Cereal Bars Market. The undeniable rise in health and wellness consciousness among European consumers is a primary driver, leading to increased demand for perceived nutritious and convenient snack options. The growing demand for on-the-go food solutions, driven by increasingly busy lifestyles, makes cereal bars a go-to choice for quick meals and snacks. Technological advancements in food science are enabling the development of innovative products with enhanced nutritional profiles and improved taste. Furthermore, the expansion of online retail channels is democratizing access and making a wider variety of cereal bars available to consumers across the continent. The proliferation of fitness and active lifestyles also fuels demand for bars with specific functional benefits, such as protein enrichment.

Challenges in the European Cereal Bars Market Market

Long-term growth in the European Cereal Bars Market will be significantly influenced by sustained innovation and strategic market expansion. Manufacturers that can effectively leverage new ingredient technologies, such as alternative protein sources and novel natural sweeteners, will gain a competitive advantage. The development of personalized nutrition solutions tailored to individual dietary needs and preferences presents a significant opportunity. Furthermore, strategic partnerships with retailers and e-commerce platforms can enhance market penetration and brand visibility. Exploring untapped markets within Europe and adapting product offerings to local tastes and cultural preferences will be crucial for continued success.

Emerging Opportunities in European Cereal Bars Market

Emerging opportunities within the European Cereal Bars Market are abundant. The growing demand for plant-based and vegan cereal bars presents a significant untapped segment. Innovations in functional ingredients, such as those offering cognitive benefits or stress reduction, are poised to capture consumer interest. The expansion of specialty stores and health food outlets provides a platform for niche and premium brands. Furthermore, the increasing focus on sustainability and ethical sourcing creates opportunities for brands that can demonstrate strong environmental and social responsibility in their supply chains. The development of meal replacement cereal bars and those specifically designed for children with improved taste and nutritional profiles also represent promising avenues for growth.

Leading Players in the European Cereal Bars Market Sector

- The Kellogg Company

- Nestle S.A.

- Cerbona Elelmiszergyrto Kft

- Hero Group

- KIND LLC

- Eat Natural

- General Mills

Key Milestones in European Cereal Bars Market Industry

- 2019: Increased consumer focus on reduced sugar content in packaged foods, leading to product reformulation.

- 2020: Significant surge in online grocery sales, boosting the e-commerce channel for cereal bars.

- 2021: Growing demand for plant-based and vegan alternatives drives product innovation in this segment.

- 2022: Enhanced consumer awareness of functional ingredients (e.g., protein, fiber) boosts sales of specialized bars.

- 2023: Increased emphasis on sustainable packaging solutions by leading manufacturers.

- 2024: Introduction of innovative flavor profiles and ingredient combinations to cater to evolving consumer palates.

Strategic Outlook for European Cereal Bars Market Market

The strategic outlook for the European Cereal Bars Market is highly promising, characterized by continuous innovation and market expansion. Growth accelerators will stem from deeper dives into personalized nutrition, the integration of novel functional ingredients, and the continued embrace of sustainable practices across the value chain. Strategic partnerships with health and wellness influencers, alongside targeted marketing campaigns emphasizing the health benefits and convenience of cereal bars, will be crucial for capturing consumer attention. Furthermore, an increasing focus on expanding distribution into emerging markets within Europe and leveraging the direct-to-consumer model will amplify market reach. Investments in R&D for next-generation healthy snack bars and a proactive approach to evolving regulatory landscapes will be key to sustained market leadership. The market is projected to reach USD 20,000 Million by 2033.

European Cereal Bars Market Segmentation

-

1. Product Type

- 1.1. Granola/Muesli Bars

- 1.2. Other Bars

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

European Cereal Bars Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

European Cereal Bars Market Regional Market Share

Geographic Coverage of European Cereal Bars Market

European Cereal Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1 Increased Preference for on-the-go Breakfast

- 3.4.2 Convenience

- 3.4.3 and Meal Replacement Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Granola/Muesli Bars

- 5.1.2. Other Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Granola/Muesli Bars

- 6.1.2. Other Bars

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Stores

- 6.2.2. Supermarkets/Hypermarkets

- 6.2.3. Specialty Stores

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Granola/Muesli Bars

- 7.1.2. Other Bars

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Stores

- 7.2.2. Supermarkets/Hypermarkets

- 7.2.3. Specialty Stores

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Granola/Muesli Bars

- 8.1.2. Other Bars

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Stores

- 8.2.2. Supermarkets/Hypermarkets

- 8.2.3. Specialty Stores

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Granola/Muesli Bars

- 9.1.2. Other Bars

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Stores

- 9.2.2. Supermarkets/Hypermarkets

- 9.2.3. Specialty Stores

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Granola/Muesli Bars

- 10.1.2. Other Bars

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Stores

- 10.2.2. Supermarkets/Hypermarkets

- 10.2.3. Specialty Stores

- 10.2.4. Online Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Granola/Muesli Bars

- 11.1.2. Other Bars

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Convenience Stores

- 11.2.2. Supermarkets/Hypermarkets

- 11.2.3. Specialty Stores

- 11.2.4. Online Stores

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Granola/Muesli Bars

- 12.1.2. Other Bars

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Convenience Stores

- 12.2.2. Supermarkets/Hypermarkets

- 12.2.3. Specialty Stores

- 12.2.4. Online Stores

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 14. France European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 15. Italy European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 16. United Kingdom European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 17. Netherlands European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 18. Sweden European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 19. Rest of Europe European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2025

- 20.2. Company Profiles

- 20.2.1 The Kellogg Company

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Nestle S A

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Cerbona Elelmiszergyrto Kft

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Hero Group*List Not Exhaustive

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 KIND LLC

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Eat Natural

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 General Mills

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.1 The Kellogg Company

List of Figures

- Figure 1: European Cereal Bars Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: European Cereal Bars Market Share (%) by Company 2025

List of Tables

- Table 1: European Cereal Bars Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Cereal Bars Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 6: Germany European Cereal Bars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France European Cereal Bars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy European Cereal Bars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: United Kingdom European Cereal Bars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands European Cereal Bars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Sweden European Cereal Bars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe European Cereal Bars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 33: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Cereal Bars Market?

The projected CAGR is approximately 7.34%.

2. Which companies are prominent players in the European Cereal Bars Market?

Key companies in the market include The Kellogg Company, Nestle S A, Cerbona Elelmiszergyrto Kft, Hero Group*List Not Exhaustive, KIND LLC, Eat Natural, General Mills.

3. What are the main segments of the European Cereal Bars Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Increased Preference for on-the-go Breakfast. Convenience. and Meal Replacement Products.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Cereal Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Cereal Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Cereal Bars Market?

To stay informed about further developments, trends, and reports in the European Cereal Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence