Key Insights

Australia's non-dairy milk market is projected for substantial growth, driven by escalating consumer health consciousness, ethical considerations, and the increasing incidence of lactose intolerance and veganism. The market is anticipated to reach a valuation of 396.4 million by 2025, expanding at a CAGR of 10.34%. Key drivers include the demand for plant-based alternatives, with oat and almond milk leading market penetration due to their taste and nutritional profiles. Coconut and cashew milk also contribute significantly to market share. Innovations from leading companies like Oatly Group AB and Califia Farms LLC, coupled with a growing preference for sustainable and eco-friendly food production, are fueling this expansion.

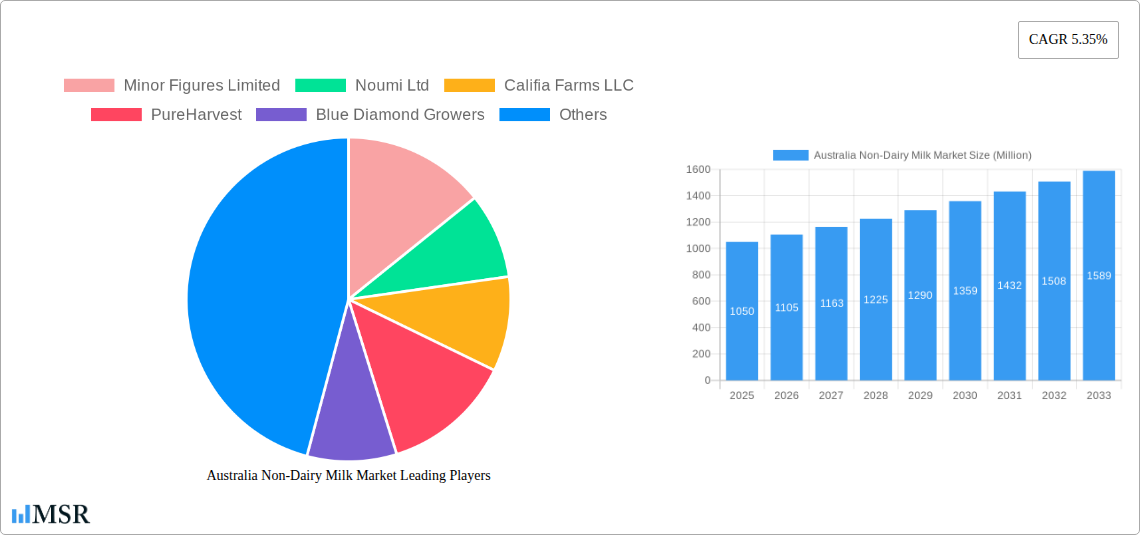

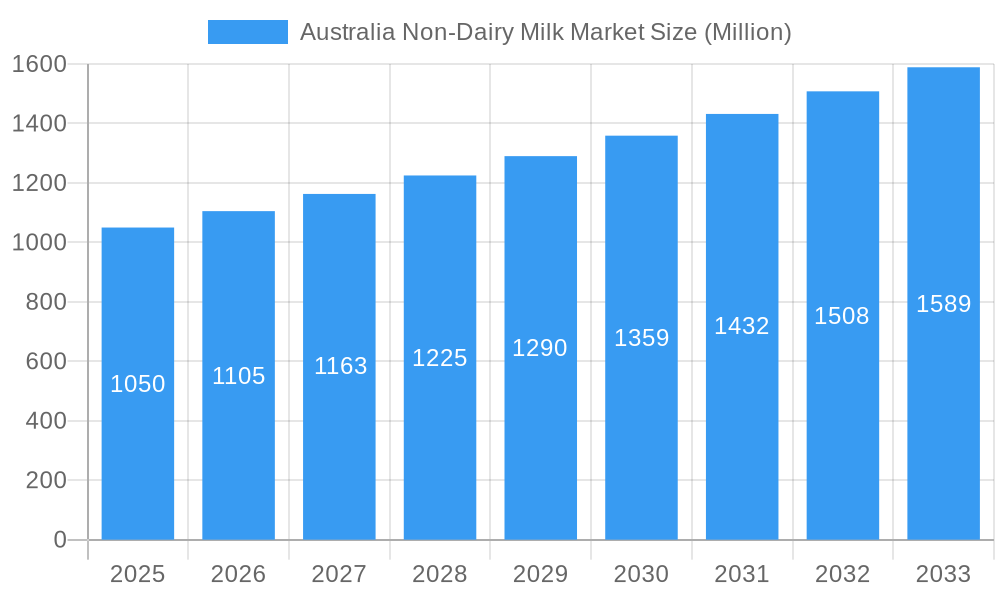

Australia Non-Dairy Milk Market Market Size (In Million)

Distribution channels are shifting towards off-trade segments, with online retail and supermarkets/hypermarkets leading sales. Convenience stores and specialist retailers are also gaining traction, enhancing product accessibility. While the on-trade channel is expected to grow as food service providers integrate plant-based options, higher price points and taste preferences remain potential challenges. The competitive landscape, featuring established brands such as Minor Figures Limited and Noumi Ltd, alongside emerging players, stimulates innovation and consumer choice, supporting continued market development. This dynamic Australian market is set for ongoing evolution, propelled by health awareness, ethical purchasing, and sustained demand for diverse dairy-free options.

Australia Non-Dairy Milk Market Company Market Share

Australia Non-Dairy Milk Market: Comprehensive Market Analysis & Forecast (2019-2033)

Unlock lucrative opportunities in Australia's burgeoning non-dairy milk sector with this in-depth market report. Covering the historical period 2019-2024, base year 2025, and an extensive forecast period from 2025-2033, this analysis provides actionable insights into market dynamics, key growth drivers, and emerging trends. Discover the competitive landscape, product innovations, and strategic imperatives shaping the future of plant-based beverages. With an estimated market size of over $1,800 Million in 2025 and a projected CAGR of 7.5% through 2033, the Australia non-dairy milk market presents a compelling investment and growth avenue for industry stakeholders.

Australia Non-Dairy Milk Market Market Concentration & Dynamics

The Australia non-dairy milk market is characterized by a moderate to high concentration, with several key players dominating the landscape. Innovation plays a crucial role in maintaining competitive advantage, evident in the continuous introduction of new formulations, flavors, and functional benefits. The regulatory framework, while generally supportive of food product standards, requires adherence to labeling and health claims. Substitute products, including traditional dairy milk and other beverage categories, pose a constant challenge, necessitating differentiation through quality, taste, and marketing. End-user trends are heavily influenced by growing health consciousness, environmental concerns, and the rising prevalence of lactose intolerance and dairy allergies. Merger and acquisition (M&A) activities, while not at an extreme level, are strategic for market expansion and portfolio enhancement. The market share distribution is dynamic, with oat milk and almond milk segments showing significant growth. M&A deal counts are expected to remain steady, focusing on acquiring innovative brands or expanding production capabilities.

- Market Share: Oat milk is projected to hold a significant market share, followed closely by almond milk.

- Innovation Ecosystem: Focus on functional ingredients, sustainable sourcing, and barista-grade formulations.

- Regulatory Framework: Adherence to Food Standards Australia New Zealand (FSANZ) guidelines for labeling and product safety.

- Substitute Products: Traditional dairy milk, plant-based yogurts, and other functional beverages.

- End-User Trends: Increased demand for vegan, gluten-free, and low-sugar options.

- M&A Activities: Strategic acquisitions for market penetration and product diversification.

Australia Non-Dairy Milk Market Industry Insights & Trends

The Australia non-dairy milk market is experiencing robust growth, fueled by a confluence of escalating health awareness and a deepening commitment to sustainable consumption patterns among Australian consumers. The estimated market size in 2025 stands at over $1,800 Million, with projections indicating a sustained Compound Annual Growth Rate (CAGR) of approximately 7.5% throughout the forecast period of 2025-2033. This upward trajectory is significantly driven by a growing preference for plant-based alternatives, spurred by concerns over dairy production's environmental impact and an increasing number of individuals opting for flexitarian, vegetarian, and vegan diets. Technological disruptions are also playing a pivotal role, with advancements in processing technologies enhancing the taste, texture, and nutritional profile of non-dairy milk. Innovations in extraction methods for plant-based ingredients are leading to smoother, more palatable products that closely mimic the sensory experience of dairy milk, thereby broadening their appeal to a wider consumer base.

Consumer behaviors are rapidly evolving, with a discernible shift towards products perceived as healthier and more ethically produced. This includes a demand for non-dairy milk options that are low in sugar, cholesterol-free, and fortified with essential nutrients like calcium and Vitamin D. The convenience factor, coupled with the increasing availability of diverse non-dairy milk varieties in retail channels, further propels market expansion. Online retail, in particular, has emerged as a significant channel, offering consumers wider choice and home delivery convenience. The perceived health benefits, ranging from improved digestion to reduced risk of chronic diseases, are powerful motivators for consumers, especially those managing dietary restrictions or seeking to optimize their well-being. Furthermore, the growing ethical considerations surrounding animal welfare are nudging more consumers towards plant-based diets. The market is witnessing a surge in demand for oat milk and almond milk, attributed to their favorable taste profiles and perceived health advantages. Coconut milk and soy milk continue to hold their ground, catering to specific consumer preferences and culinary uses. The overall industry trend points towards a more diversified and health-conscious consumer base, actively seeking alternatives that align with their lifestyle choices and values.

Key Markets & Segments Leading Australia Non-Dairy Milk Market

Dominant Segments and Driving Factors:

The Australia non-dairy milk market's impressive growth is underpinned by the exceptional performance of key product types and distribution channels. Within Product Type, Oat Milk has emerged as a dominant force, driven by its creamy texture, neutral flavor that blends well with coffee and cereals, and its perceived health benefits, including being a good source of fiber and often fortified. Following closely is Almond Milk, which has long been a popular choice due to its low calorie count and versatility in both sweet and savory applications. The increasing awareness of allergens and intolerances further supports these choices. Coconut Milk maintains a strong presence, particularly for its rich flavor and use in culinary applications, while Soy Milk, though facing some perception challenges, remains a significant player due to its protein content and established market presence. Cashew Milk and Hazelnut Milk are gaining traction as premium options, offering unique flavor profiles and catering to niche consumer preferences.

In terms of Distribution Channel, the Off-Trade segment is the primary driver of sales volume. Within Off-Trade, Supermarkets and Hypermarkets represent the largest share, offering consumers wide product availability, competitive pricing, and convenient one-stop shopping experiences. Online Retail is experiencing exponential growth, fueled by the convenience of home delivery, a broader selection of niche brands, and increasingly sophisticated e-commerce platforms. This channel is particularly effective for reaching a wider demographic and catering to busy lifestyles. Specialist Retailers, such as health food stores, cater to a more discerning consumer segment actively seeking specific dietary or health-focused products. Convenience Stores and Others (Warehouse clubs, gas stations, etc.) play a supplementary role, offering accessibility and impulse purchase opportunities, though their contribution to overall volume is less substantial compared to major retail channels.

Product Type Drivers:

- Oat Milk: Superior taste and texture, versatility in beverages, perception of being heart-healthy.

- Almond Milk: Low calorie content, refreshing taste, wide availability, perception as a healthy choice.

- Coconut Milk: Rich flavor profile, suitability for cooking and baking, popularity in tropical-inspired dishes.

- Soy Milk: High protein content, established market presence, affordability.

- Cashew Milk & Hazelnut Milk: Premium appeal, unique flavor profiles, catering to evolving consumer palates.

Distribution Channel Drivers:

- Supermarkets and Hypermarkets: Extensive product range, competitive pricing, consumer convenience.

- Online Retail: Home delivery convenience, wider selection of brands, accessibility for remote areas, ease of price comparison.

- Specialist Retailers: Niche product offerings, catering to specific dietary needs and preferences, knowledgeable staff.

- Convenience Stores: Impulse purchases, immediate availability, accessible locations.

Australia Non-Dairy Milk Market Product Developments

The Australia non-dairy milk market is a hotbed of innovation, with companies consistently introducing novel products to capture evolving consumer demands. Recent developments highlight a focus on enhanced nutritional profiles and specialized applications. For instance, Vitasoy has strategically launched its Plant+ range, featuring oat and almond milk varieties, emphasizing zero cholesterol, low sugar, and high calcium content, catering to health-conscious consumers. This innovation extends beyond local markets, with Vitasoy also introducing this range in Singapore, demonstrating a broader regional growth strategy. Furthermore, the development of barista milk series, specifically designed for the coffee industry, underscores a commitment to catering to professional culinary needs and enhancing the beverage experience. These product developments are crucial for maintaining a competitive edge and addressing the sophisticated preferences of Australian consumers, who increasingly seek functional, delicious, and ethically produced plant-based alternatives.

Challenges in the Australia Non-Dairy Milk Market Market

The Australia non-dairy milk market, despite its rapid growth, faces several critical challenges. Price sensitivity among consumers can be a significant barrier, as non-dairy milk products are often priced higher than their dairy counterparts, limiting adoption among budget-conscious individuals. Perceptions regarding taste and texture continue to be a challenge for some segments, with a portion of consumers still preferring the sensory experience of dairy milk. Supply chain complexities, including sourcing raw ingredients sustainably and ensuring consistent availability, can impact production costs and product consistency. Furthermore, intense competition from both established dairy brands introducing plant-based lines and a growing number of niche non-dairy brands necessitates continuous innovation and effective marketing strategies to stand out. Regulatory hurdles related to ingredient sourcing and labeling can also add to operational complexities.

Forces Driving Australia Non-Dairy Milk Market Growth

Several powerful forces are propelling the growth of the Australia non-dairy milk market. Increasing health consciousness among the Australian population is a primary driver, with consumers actively seeking alternatives perceived as healthier, such as low-sugar, cholesterol-free, and nutrient-fortified options. The rising global awareness of environmental sustainability is a significant catalyst, as plant-based diets are increasingly recognized for their lower carbon footprint compared to dairy production. Growing incidences of lactose intolerance and dairy allergies are compelling a substantial segment of the population to seek dairy-free alternatives. Technological advancements in processing and formulation are leading to improved taste, texture, and nutritional profiles of non-dairy milks, making them more appealing to a broader consumer base. The expanding vegan and vegetarian consumer base, driven by ethical considerations and lifestyle choices, also contributes significantly to market expansion.

Challenges in the Australia Non-Dairy Milk Market Market

Long-term growth catalysts for the Australia non-dairy milk market are deeply rooted in sustained consumer interest and strategic industry developments. The continuing trend towards plant-based diets, driven by ethical and environmental concerns, provides a stable foundation for future expansion. Ongoing innovation in product development, focusing on unique flavor profiles, functional ingredients, and improved nutritional content, will continue to attract new consumers and retain existing ones. Strategic partnerships between non-dairy milk producers and food service providers, such as cafes and restaurants, will enhance accessibility and trial, further normalizing these products in daily consumption. Market expansions into untapped geographical regions within Australia and the development of cost-effective production methods will also be crucial for sustained growth. Furthermore, increased consumer education around the benefits of non-dairy milk will solidify its position in the beverage market.

Emerging Opportunities in Australia Non-Dairy Milk Market

The Australia non-dairy milk market is ripe with emerging opportunities, driven by evolving consumer preferences and technological advancements. The increasing demand for novel plant-based ingredients, such as pea, rice, and hemp milk, presents an avenue for diversification beyond traditional offerings. The growth of the "better-for-you" segment continues to expand, with opportunities in developing non-dairy milks with added probiotics, prebiotics, or specific vitamins and minerals targeting immunity and cognitive health. The sustainable sourcing and packaging trend offers a significant opportunity to differentiate brands and appeal to environmentally conscious consumers. Furthermore, the expanding foodservice sector, particularly in plant-based cuisine and specialty coffee shops, provides a fertile ground for growth, with opportunities for customized barista blends and bulk supply. The rise of personalized nutrition could also lead to the development of tailored non-dairy milk formulations based on individual dietary needs and health goals.

Leading Players in the Australia Non-Dairy Milk Market Sector

- Minor Figures Limited

- Noumi Ltd

- Califia Farms LLC

- PureHarvest

- Blue Diamond Growers

- Oatly Group AB

- Vitasoy International Holdings Lt

- Sanitarium Health and Wellbeing Company

Key Milestones in Australia Non-Dairy Milk Market Industry

- September 2022: Vitasoy launched a plant-based milk range Plant+, which includes oat and almond milk varieties with zero cholesterol, low sugar, and high calcium.

- September 2022: Vitasoy launched the Vitasoy Plant+ range of plant milk in the Singaporean market. These plant-based milk products are available in almond, oat, and soy varieties and are high in calcium and low in sugar with zero cholesterol.

- August 2022: Vitasoy launched new barista milk series in Southeast Asia, specially designed for coffee.

Strategic Outlook for Australia Non-Dairy Milk Market Market

The strategic outlook for the Australia non-dairy milk market remains exceptionally positive, characterized by sustained growth and increasing sophistication. Key growth accelerators will include continued product innovation, with an emphasis on enhanced nutritional benefits, diverse flavor profiles, and functional ingredients to cater to a broadening consumer base. Strategic collaborations between manufacturers and retailers, alongside expanded online distribution, will be crucial for improving market reach and accessibility. The market will likely witness a greater focus on sustainable sourcing and packaging, aligning with growing consumer demand for environmentally responsible products. Furthermore, the development of specialized non-dairy milk formulations for specific applications, such as culinary uses and barista-grade beverages, will continue to drive value. The overall market potential is robust, offering significant opportunities for both established players and new entrants to capture market share and contribute to the evolving landscape of healthy and sustainable beverage consumption in Australia.

Australia Non-Dairy Milk Market Segmentation

-

1. Product Type

- 1.1. Almond Milk

- 1.2. Cashew Milk

- 1.3. Coconut Milk

- 1.4. Hazelnut Milk

- 1.5. Oat Milk

- 1.6. Soy Milk

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Australia Non-Dairy Milk Market Segmentation By Geography

- 1. Australia

Australia Non-Dairy Milk Market Regional Market Share

Geographic Coverage of Australia Non-Dairy Milk Market

Australia Non-Dairy Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Non-Dairy Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Milk

- 5.1.2. Cashew Milk

- 5.1.3. Coconut Milk

- 5.1.4. Hazelnut Milk

- 5.1.5. Oat Milk

- 5.1.6. Soy Milk

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Minor Figures Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Noumi Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Califia Farms LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PureHarvest

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Blue Diamond Growers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oatly Group AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vitasoy International Holdings Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanitarium Health and Wellbeing Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Minor Figures Limited

List of Figures

- Figure 1: Australia Non-Dairy Milk Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Australia Non-Dairy Milk Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Non-Dairy Milk Market Revenue million Forecast, by Region 2020 & 2033

- Table 2: Australia Non-Dairy Milk Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Australia Non-Dairy Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Australia Non-Dairy Milk Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Australia Non-Dairy Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 6: Australia Non-Dairy Milk Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Australia Non-Dairy Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Australia Non-Dairy Milk Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Non-Dairy Milk Market?

The projected CAGR is approximately 10.34%.

2. Which companies are prominent players in the Australia Non-Dairy Milk Market?

Key companies in the market include Minor Figures Limited, Noumi Ltd, Califia Farms LLC, PureHarvest, Blue Diamond Growers, Oatly Group AB, Vitasoy International Holdings Lt, Sanitarium Health and Wellbeing Company.

3. What are the main segments of the Australia Non-Dairy Milk Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 396.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

September 2022: Vitasoy launched a plant-based milk range Plant+, which includes oat and almond milk varieties with zero cholesterol, low sugar, and high calcium.September 2022: Vitasoy launched the Vitasoy Plant+ range of plant milk in the Singaporean market. These plant-based milk products are available in almond, oat, and soy varieties and are high in calcium and low in sugar with zero cholesterol.August 2022: Vitasoy launched new barista milk series in Southeast Asia, specially designed for coffee.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Non-Dairy Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Non-Dairy Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Non-Dairy Milk Market?

To stay informed about further developments, trends, and reports in the Australia Non-Dairy Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence