Key Insights

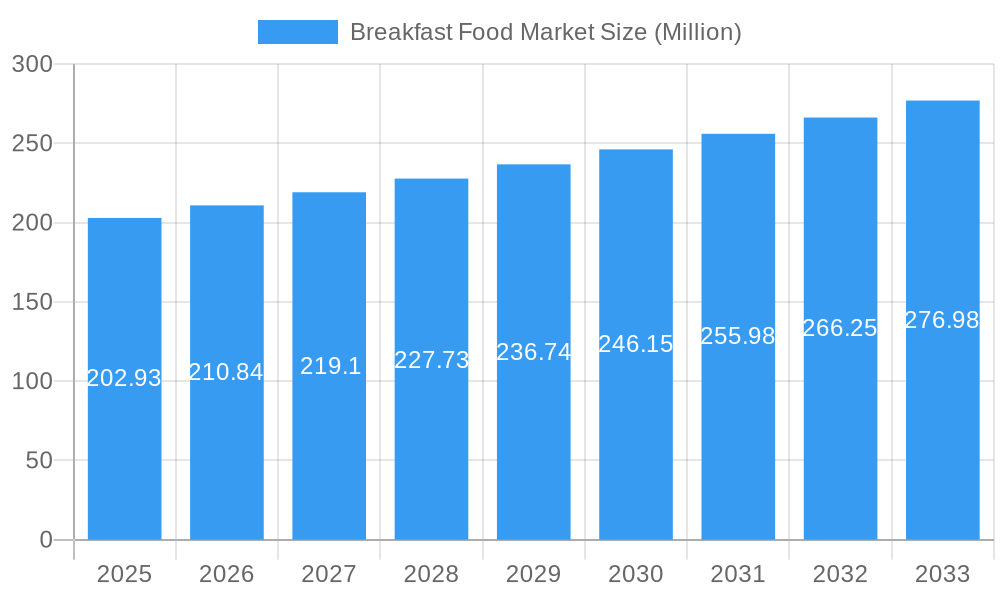

The global Breakfast Food Market is poised for robust expansion, with an estimated market size of USD 202.93 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 3.88% through 2033. This steady growth is fueled by an increasing consumer demand for convenient and healthy breakfast options. Factors such as evolving lifestyles, a greater emphasis on nutrition, and the rising disposable incomes in emerging economies are significant drivers. The market is witnessing a surge in demand for cereals, fortified beverages, and innovative snack bars as consumers seek quick yet nutritious ways to start their day. Ready meals are also gaining traction, catering to busy schedules and offering a balanced meal solution. The expansion of online retail channels is further democratizing access to a wider variety of breakfast products, complementing the strong presence of hypermarkets, supermarkets, and convenience stores.

Breakfast Food Market Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. Fluctuations in raw material prices, particularly for grains and dairy, can impact production costs and profit margins for key players like Nestle SA, Unilever, and The Kellogg Company. Additionally, increasing consumer awareness regarding the sugar content in many processed breakfast foods is leading to a demand for healthier, low-sugar alternatives, prompting manufacturers to innovate with natural sweeteners and whole-grain options. Competition among major players, including General Mills Inc., PepsiCo Inc., and Kraft Heinz Company, is intensifying, driving innovation in product development and marketing strategies. The market's trajectory will likely be shaped by companies’ ability to adapt to these evolving consumer preferences and navigate supply chain challenges, with a particular focus on sustainable sourcing and healthier formulations across all product segments.

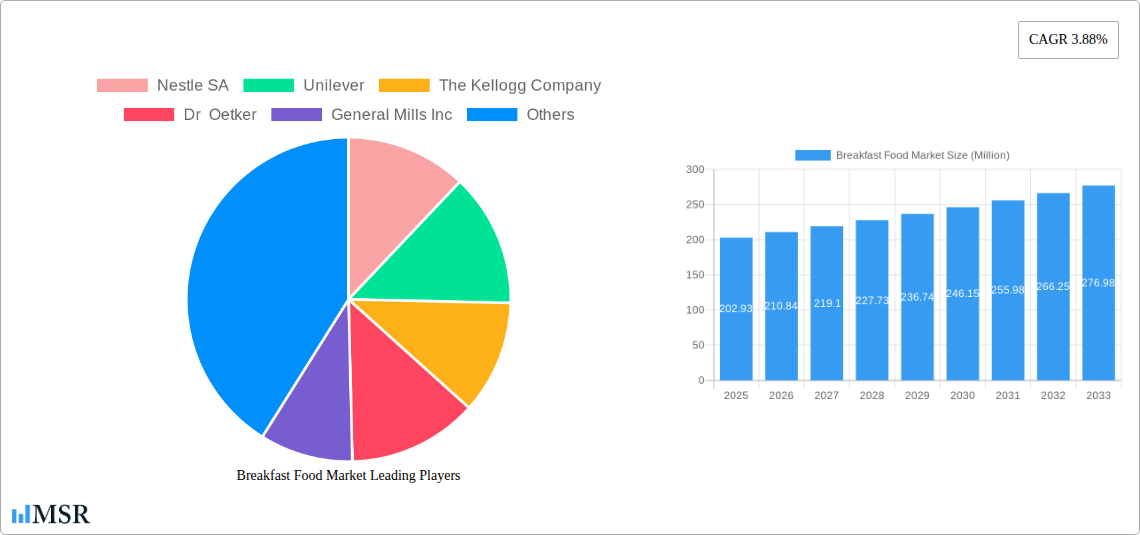

Breakfast Food Market Company Market Share

**Gain unparalleled insights into the dynamic *breakfast food market*, a sector projected for robust growth and innovation. This in-depth report meticulously analyzes *breakfast food trends*, *healthy breakfast options*, *convenience breakfast solutions*, and the burgeoning *ready-to-eat breakfast* landscape. Essential for food manufacturers, retailers, investors, and industry stakeholders, this study equips you with the data and strategic foresight needed to capitalize on this lucrative market. We explore the influence of leading brands such as Nestle SA, Unilever, The Kellogg Company, and PepsiCo Inc., examining their impact on the breakfast cereal market, beverage market, and the growing snack bar sector. Discover emerging opportunities within online retail for breakfast foods and the evolving consumer preferences for nutritious breakfast choices.

Breakfast Food Market Market Concentration & Dynamics

The global breakfast food market exhibits a moderate to high level of concentration, with key players like Nestle SA, Unilever, The Kellogg Company, General Mills Inc., and PepsiCo Inc. holding significant market shares. These established giants leverage extensive distribution networks, strong brand loyalty, and continuous product innovation to maintain their dominance. The innovation ecosystem is characterized by a growing focus on health and wellness, leading to the introduction of high-protein breakfast options, keto-friendly cereals, and gluten-free breakfast products. Regulatory frameworks, primarily focused on food safety and labeling, influence product formulations and marketing strategies. Substitute products, such as on-the-go snacks and home-prepared meals, present a constant competitive pressure. End-user trends reveal a growing demand for convenience, personalized nutrition, and sustainable sourcing. Merger and acquisition (M&A) activities, while not overtly frequent, serve to consolidate market positions and expand product portfolios. For instance, strategic acquisitions by larger players aim to capture niche markets or acquire innovative technologies. The market concentration, while evident, allows for significant growth for agile and innovative smaller companies focusing on specialized breakfast solutions.

- Market Share Dynamics: Leading companies command substantial market share, driven by brand recognition and extensive product ranges.

- Innovation Focus: Emphasis on health benefits, plant-based ingredients, and reduced sugar content.

- Regulatory Landscape: Stringent food safety standards and evolving labeling requirements shape product development.

- Competitive Substitutes: Pressure from snack bars, on-the-go meals, and home-prepared alternatives.

- M&A Activity: Strategic acquisitions to enhance market reach and acquire innovative brands.

Breakfast Food Market Industry Insights & Trends

The global breakfast food market is poised for substantial growth, driven by a confluence of economic, social, and technological factors. The market size is estimated to reach $XXX Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by an increasing global population, rising disposable incomes, and a growing awareness of the importance of a nutritious start to the day. Technological disruptions are transforming how consumers access and consume breakfast. The proliferation of online grocery delivery services and the rise of direct-to-consumer (DTC) brands are democratizing access to a wider variety of breakfast options, including specialized dietary breakfast foods. Evolving consumer behaviors are paramount, with a significant shift towards healthy breakfast choices, driven by health consciousness and a desire for improved well-being. Consumers are actively seeking low-sugar cereals, fortified breakfast foods, and options catering to specific dietary needs like vegan breakfast options and allergy-friendly breakfast. The demand for convenience continues to rise, with ready-to-eat breakfast meals and instant breakfast solutions gaining traction among busy professionals and families. Furthermore, the influence of social media and wellness influencers is shaping perceptions and driving demand for aesthetically pleasing and nutrient-dense breakfast creations. The market is also witnessing a surge in demand for plant-based and sustainable breakfast products, reflecting a broader ethical consumerism trend. The historical period (2019-2024) laid the groundwork for these trends, with steady growth in established categories and early adoption of healthier alternatives. The base year of 2025 serves as a critical juncture, with the forecast period (2025-2033) set to witness accelerated adoption of these evolving consumer preferences.

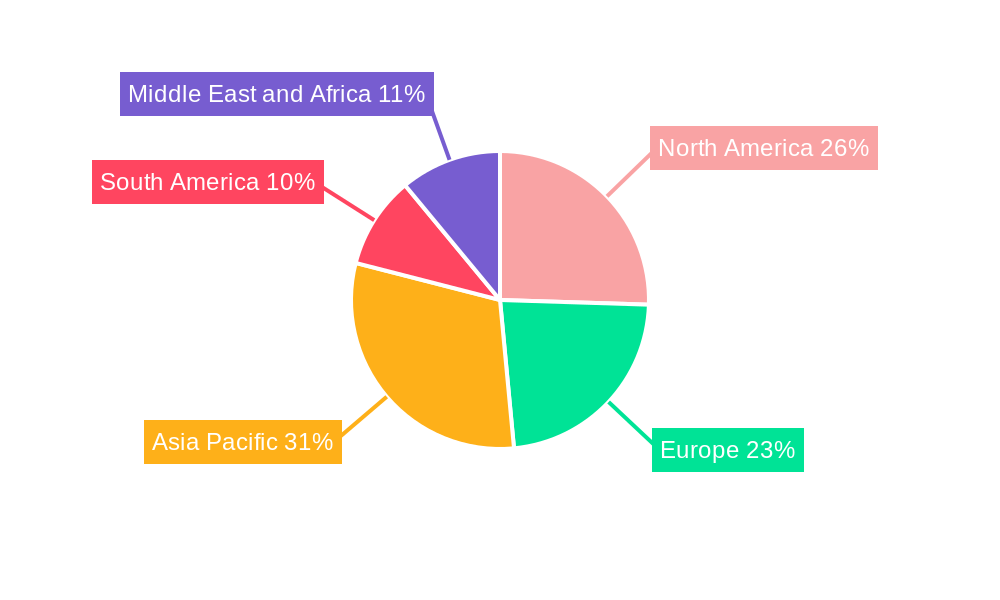

Key Markets & Segments Leading Breakfast Food Market

The breakfast food market is characterized by distinct regional strengths and segment dominance. North America currently leads the market, driven by high disposable incomes, a strong emphasis on convenience, and a well-established culture of breakfast consumption. Within North America, the United States remains a dominant country, with a robust demand for cereals, breakfast beverages, and ready-to-eat meals.

Product Type Dominance:

- Cereals: This segment remains a cornerstone of the breakfast food market, valued for its convenience and perceived health benefits, particularly fortified cereals and multigrain breakfast options. Brands like Kellogg's and General Mills continue to innovate with new flavors and healthier formulations. The launch of Froot Loops by Kellogg India in August 2021 highlights the ongoing appeal of flavored cereals.

- Beverages: The breakfast beverage market is experiencing significant growth, encompassing a wide range of products from traditional juices and milk to plant-based milk alternatives, coffee, and specialized nutritional breakfast drinks. Health-conscious consumers are driving demand for low-sugar beverages and functional breakfast drinks.

- Snack Bars: The snack bar market is a rapidly expanding segment, driven by their portability and perceived health benefits. Protein bars, energy bars, and granola bars are popular choices for busy consumers seeking quick and satisfying breakfast alternatives. Magic Spoon's expansion into waffles (August 2021) demonstrates the innovative drive within this sector.

- Ready Meals: The ready-to-eat breakfast market is gaining traction, offering ultimate convenience for time-pressed consumers. This includes frozen breakfast burritos, pre-packaged oatmeal, and single-serve breakfast bowls. Conagra Brands Inc.'s summer line launch in June 2022, featuring various single-serve frozen meals, exemplifies this trend.

Distribution Channel Dominance:

- Hypermarkets/Supermarkets: These remain the primary distribution channels, offering a vast selection of breakfast products and catering to a broad consumer base. Their extensive shelf space and promotional activities significantly influence purchasing decisions.

- Online Retailers: This channel is experiencing exponential growth, fueled by convenience, wider product availability, and competitive pricing. Consumers increasingly opt for online grocery shopping for breakfast foods.

- Convenience Stores: These outlets cater to immediate needs and impulse purchases, offering a curated selection of grab-and-go breakfast items.

- Specialist Stores: Health food stores and gourmet markets cater to niche markets seeking premium, organic, or specialized dietary breakfast products.

Breakfast Food Market Product Developments

Product innovation is a key differentiator in the breakfast food market. Companies are continuously introducing novel formulations and formats to cater to evolving consumer demands for health, convenience, and taste. Recent developments include the introduction of high-protein breakfast cereals and waffles, such as those offered by Magic Spoon. Furthermore, brands are focusing on natural ingredients, vibrant colors, and enhanced nutritional profiles, as seen with Kellogg India's Froot Loops, which utilizes natural colors and multigrain bases. The expansion of single-serve frozen breakfast meals by Conagra Brands Inc. reflects the trend towards convenient and portion-controlled options. These advancements leverage technological improvements in food processing and ingredient science to create appealing and nutritious breakfast solutions that capture significant market share and drive consumer engagement.

Challenges in the Breakfast Food Market Market

Despite its growth potential, the breakfast food market faces several challenges. Regulatory hurdles, including evolving labeling laws and ingredient restrictions, can increase compliance costs and necessitate product reformulations. Supply chain disruptions, exacerbated by global events, can lead to ingredient shortages and increased raw material prices, impacting profit margins. Intense competitive pressures from both established brands and emerging players, alongside the constant threat of substitute products like on-the-go snacks and home-prepared meals, necessitate continuous innovation and aggressive marketing strategies. Quantifiable impacts include potential delays in product launches and increased cost of goods sold, requiring companies to maintain agile supply chains and robust R&D investments.

Forces Driving Breakfast Food Market Growth

Several powerful forces are propelling the breakfast food market forward. A significant driver is the increasing consumer awareness of health and wellness, leading to a strong demand for nutritious breakfast options, low-sugar cereals, and high-fiber breakfast foods. Technological advancements in food processing and packaging enable the creation of more convenient and appealing ready-to-eat breakfast solutions. Economic factors, such as rising disposable incomes in emerging economies, are expanding the consumer base for breakfast products. Furthermore, evolving lifestyle trends, including busy schedules and the growing demand for on-the-go eating, are fueling the market for convenient breakfast items like snack bars and instant breakfast mixes. The growing emphasis on plant-based diets and sustainability is also creating new avenues for growth within the vegan breakfast and organic breakfast segments.

Challenges in the Breakfast Food Market Market

Long-term growth catalysts in the breakfast food market are intrinsically linked to continuous innovation and strategic market penetration. Key among these is the ongoing development of functional breakfast foods that offer specific health benefits, such as improved gut health or cognitive function. Partnerships between food manufacturers and technology providers can unlock new processing methods, enhancing product quality and shelf life. Expanding into underserved geographical markets with tailored product offerings that address local palates and dietary preferences presents a significant growth opportunity. Furthermore, embracing sustainable sourcing and eco-friendly packaging not only appeals to ethically conscious consumers but also contributes to long-term brand reputation and resilience.

Emerging Opportunities in Breakfast Food Market

Emerging opportunities within the breakfast food market are abundant and diverse. The rapid growth of online retail for breakfast foods presents a significant avenue for reaching a wider consumer base and offering personalized subscription services. There is a burgeoning demand for personalized nutrition solutions tailored to individual dietary needs and preferences, such as keto breakfast options and allergy-friendly breakfast products. The increasing popularity of plant-based diets is creating a substantial market for innovative vegan breakfast alternatives, including dairy-free yogurts, plant-based milks, and meat-free breakfast patties. Furthermore, exploring the potential of functional ingredients like adaptogens, probiotics, and prebiotics in breakfast products offers a pathway to capture the wellness-focused consumer.

Leading Players in the Breakfast Food Market Sector

- Nestle SA

- Unilever

- The Kellogg Company

- Dr Oetker

- General Mills Inc.

- PepsiCo Inc.

- Pladis Foods Limited (McVitie's)

- The Kraft Heinz Company

- Conagra Brands

- Del Monte Food Inc.

- ITC Limited

Key Milestones in Breakfast Food Market Industry

- June 2022: Conagra Brands Inc. launched its extensive summer line of products, introducing new dishes for Banquet, Marie Callender's, Wholesome Alternative, and Hungry Man, focusing on nutritional single-serve frozen meals.

- August 2021: Magic Spoon expanded its protein cereal offerings by adding Maple Waffle and Cookies & Cream flavors to its original waffles, catering to the high-protein, keto-friendly market.

- August 2021: Kellogg India launched Froot Loops under its breakfast cereal range, emphasizing its delightful fruity flavor, natural colors, and multigrain composition enriched with essential nutrients.

Strategic Outlook for Breakfast Food Market Market

The strategic outlook for the breakfast food market is exceptionally promising, driven by sustained consumer demand for convenient, healthy, and personalized options. Key growth accelerators include the continued expansion of online grocery platforms, enabling direct-to-consumer engagement and customized product offerings. The increasing consumer focus on preventative health will drive innovation in functional breakfast foods and nutraceutical breakfast ingredients. Strategic partnerships with technology providers to enhance supply chain efficiency and reduce waste will be crucial. Furthermore, brands that can effectively communicate their commitment to sustainability and ethical sourcing will resonate strongly with the growing segment of conscious consumers, solidifying their market position and ensuring long-term growth.

Breakfast Food Market Segmentation

-

1. Product Type

- 1.1. Cereals

- 1.2. Beverages

- 1.3. Snack Bars

- 1.4. Ready Meals

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailers

- 2.5. Other Distribution Channels

Breakfast Food Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Breakfast Food Market Regional Market Share

Geographic Coverage of Breakfast Food Market

Breakfast Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Ready-to-eat Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Breakfast Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereals

- 5.1.2. Beverages

- 5.1.3. Snack Bars

- 5.1.4. Ready Meals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailers

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Breakfast Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cereals

- 6.1.2. Beverages

- 6.1.3. Snack Bars

- 6.1.4. Ready Meals

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retailers

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Breakfast Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cereals

- 7.1.2. Beverages

- 7.1.3. Snack Bars

- 7.1.4. Ready Meals

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retailers

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Breakfast Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cereals

- 8.1.2. Beverages

- 8.1.3. Snack Bars

- 8.1.4. Ready Meals

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retailers

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Breakfast Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cereals

- 9.1.2. Beverages

- 9.1.3. Snack Bars

- 9.1.4. Ready Meals

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Stores

- 9.2.4. Online Retailers

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Breakfast Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cereals

- 10.1.2. Beverages

- 10.1.3. Snack Bars

- 10.1.4. Ready Meals

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialist Stores

- 10.2.4. Online Retailers

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unilever

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Kellogg Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dr Oetker

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PepsiCo Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pladis Foods Limited (McVitie's)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Kraft Heinz Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Conagra Brands*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Del Monte Food Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ITC Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Breakfast Food Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Breakfast Food Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Breakfast Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Breakfast Food Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Breakfast Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Breakfast Food Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Breakfast Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Breakfast Food Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Breakfast Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Breakfast Food Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Breakfast Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Breakfast Food Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Breakfast Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Breakfast Food Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Breakfast Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Breakfast Food Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Breakfast Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Breakfast Food Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Breakfast Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Breakfast Food Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Breakfast Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Breakfast Food Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Breakfast Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Breakfast Food Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Breakfast Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Breakfast Food Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Breakfast Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Breakfast Food Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Breakfast Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Breakfast Food Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Breakfast Food Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Breakfast Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Breakfast Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Breakfast Food Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Breakfast Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Breakfast Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Breakfast Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Breakfast Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Breakfast Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Breakfast Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Italy Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Breakfast Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Breakfast Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Breakfast Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Breakfast Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Breakfast Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Breakfast Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Breakfast Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Breakfast Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Breakfast Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Breakfast Food Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Breakfast Food Market?

The projected CAGR is approximately 3.88%.

2. Which companies are prominent players in the Breakfast Food Market?

Key companies in the market include Nestle SA, Unilever, The Kellogg Company, Dr Oetker, General Mills Inc, PepsiCo Inc, Pladis Foods Limited (McVitie's), The Kraft Heinz Company, Conagra Brands*List Not Exhaustive, Del Monte Food Inc, ITC Limited.

3. What are the main segments of the Breakfast Food Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 202.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Rising Demand for Ready-to-eat Food.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

June 2022: Conagra Brands Inc. launched its extensive summer line of products to afford manufacturers inside single-serve frozen meals and collect brands with new dishes from Banquet, Marie Callender's, Wholesome Alternative, and Hungry Man. The motto of Conagra is to please consumers by serving nutritional food items such as frozen foods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Breakfast Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Breakfast Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Breakfast Food Market?

To stay informed about further developments, trends, and reports in the Breakfast Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence