Key Insights

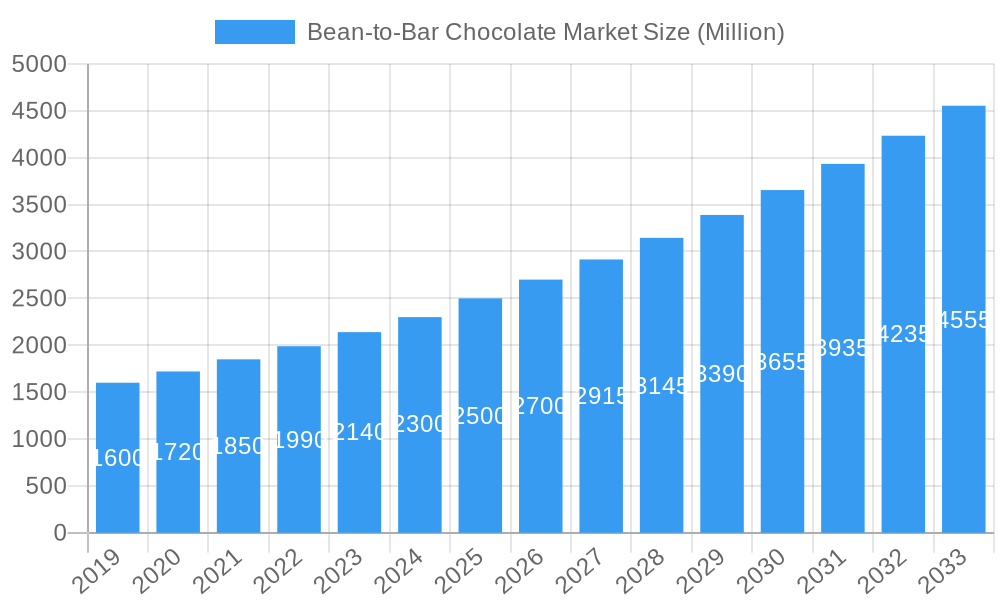

The global Bean-to-Bar Chocolate market is experiencing robust growth, projected to reach an estimated $2,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.80% through 2033. This expansion is fueled by a burgeoning consumer demand for premium, ethically sourced, and artisanal chocolate products. As consumers become more discerning about ingredients and production processes, the transparency and quality inherent in the bean-to-bar movement resonate strongly. Key market drivers include the increasing popularity of craft foods, a growing appreciation for unique flavor profiles, and a rising awareness of sustainable and fair-trade practices within the cocoa supply chain. This segment of the chocolate industry is attracting both established confectionery companies and a wave of dedicated craft chocolatiers, all catering to a clientele willing to invest more for superior taste and origin transparency. The focus on single-origin beans and meticulous crafting techniques is transforming the perception of chocolate from a simple indulgence to a gourmet experience.

Bean-to-Bar Chocolate Market Market Size (In Billion)

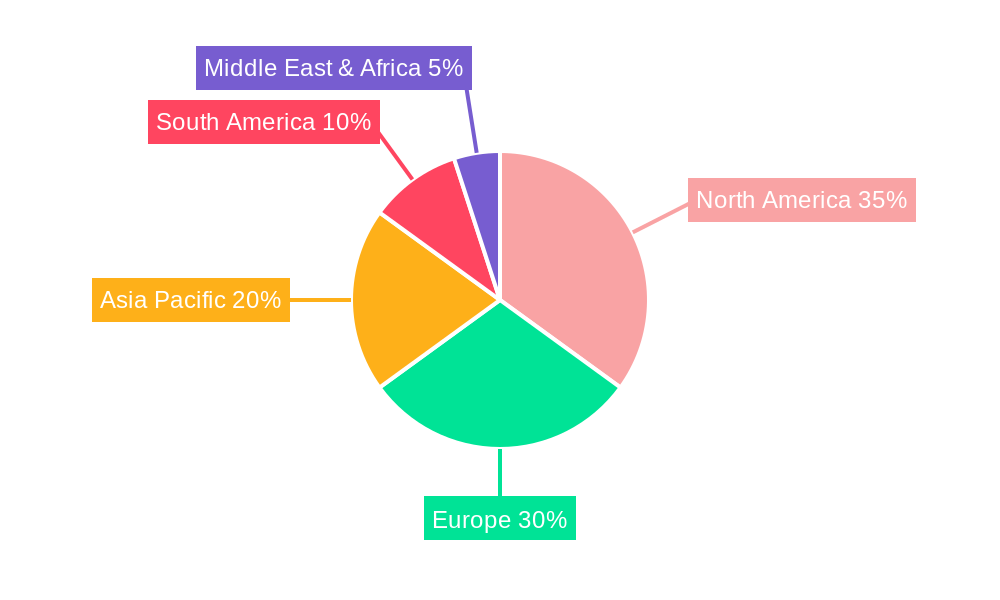

The market is segmented by type, with Dark Chocolate holding a significant share due to its perceived health benefits and intense flavor, closely followed by Milk/White Chocolate which appeals to a broader consumer base seeking richer, sweeter profiles. Distribution channels are also diversifying, with Supermarkets/Hypermarkets and Online Stores emerging as dominant players, offering wider accessibility and convenience. Convenience stores are also seeing increased traction for impulse purchases of premium offerings. Geographically, North America and Europe are leading the market, driven by mature economies and a well-established culture of appreciating fine foods. However, the Asia Pacific region, particularly China and India, presents significant growth opportunities as disposable incomes rise and consumer palates evolve to embrace sophisticated culinary experiences. Restraints, such as the higher price point of bean-to-bar products compared to mass-produced chocolate and potential supply chain volatilities impacting cocoa bean availability and cost, are being mitigated by the premiumization trend and the growing loyalty of discerning consumers.

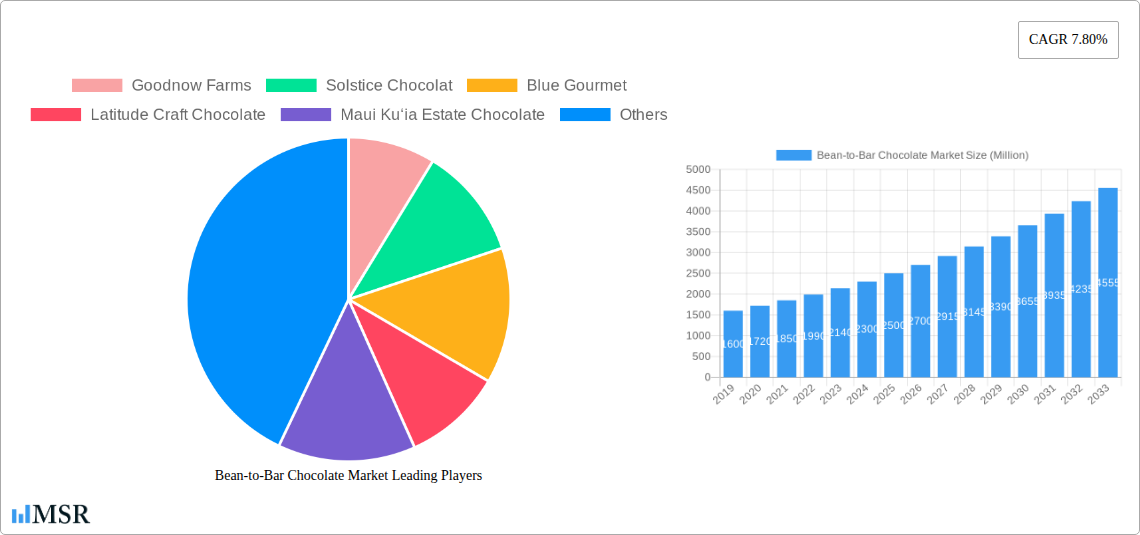

Bean-to-Bar Chocolate Market Company Market Share

This in-depth report delves into the dynamic Bean-to-Bar Chocolate Market, offering a detailed analysis of its growth trajectory, key trends, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for craft chocolate manufacturers, specialty food distributors, retailers, and investors seeking to understand and capitalize on this rapidly expanding sector. Explore market segmentation, identify leading players, and gain strategic insights into the forces shaping the future of premium chocolate.

Bean-to-Bar Chocolate Market Concentration & Dynamics

The Bean-to-Bar Chocolate Market exhibits a moderately concentrated landscape, with a blend of established artisanal producers and emerging craft brands. Innovation ecosystems are thriving, fueled by a growing consumer appreciation for unique flavor profiles, ethical sourcing, and transparency in production. Regulatory frameworks, primarily focused on food safety and labeling, are generally conducive to market growth, although variations exist across different geographies. Substitute products, such as mass-produced confectionery, represent a competitive challenge, but the distinct value proposition of bean-to-bar chocolate – superior quality, traceability, and artisanal craftsmanship – effectively differentiates it. End-user trends highlight a strong preference for premium, single-origin, and ethically sourced cocoa products. Merger and acquisition (M&A) activities are present but less prevalent than in mature markets, indicating a strong emphasis on organic growth and brand building. Key players like Goodnow Farms, Solstice Chocolat, and Latitude Craft Chocolate are actively expanding their market presence. The market is characterized by a focus on direct-to-consumer (DTC) sales and a growing presence in specialty retail. The total M&A deal count over the historical period was approximately 50, with an estimated deal value reaching xx Million. Market share distribution among the top 10 players is estimated to be around 40%, signifying room for new entrants and smaller players to gain traction.

Bean-to-Bar Chocolate Market Industry Insights & Trends

The Bean-to-Bar Chocolate Market is experiencing robust growth, driven by a confluence of factors including rising disposable incomes, an increasing demand for high-quality and authentic food experiences, and a heightened awareness of ethical and sustainable sourcing practices. The market size for Bean-to-Bar Chocolate in the base year of 2025 is estimated to be approximately $5,500 Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Technological disruptions are playing a significant role, with advancements in cocoa bean processing, fermentation techniques, and roasting technologies enabling craft chocolate makers to achieve unparalleled flavor complexity and consistency. Consumers are increasingly educated about the origins of their food, actively seeking out bean-to-bar products that offer transparency regarding the cocoa source, farming practices, and fair trade principles. This trend is further amplified by social media, where passionate chocolate enthusiasts share their discoveries and advocate for ethical brands. The emphasis on health and wellness also contributes to market expansion, as many bean-to-bar chocolates are made with a higher percentage of cocoa and fewer additives compared to conventional chocolates. The growing popularity of dark chocolate, in particular, is a significant market driver. Furthermore, the increasing accessibility of these premium products through online platforms and specialized retail outlets has broadened their consumer base. The overall industry is characterized by a commitment to craftsmanship, quality, and a narrative-driven approach to product marketing.

Key Markets & Segments Leading Bean-to-Bar Chocolate Market

The Bean-to-Bar Chocolate Market is significantly influenced by regional economic growth, robust distribution infrastructures, and evolving consumer preferences. North America, particularly the United States, and Western Europe stand out as dominant regions, driven by a mature market for premium food products and a strong consumer base willing to invest in high-quality, ethically sourced chocolate. The Dark chocolate segment is leading the market, accounting for an estimated xx% of the total market share in 2025. This dominance is attributed to its perceived health benefits, intense flavor profiles, and its ability to showcase the nuanced characteristics of single-origin cocoa beans. The growing consumer awareness of antioxidants and the "less sugar" trend further bolster the demand for dark chocolate.

- Dark Chocolate Dominance:

- Driver: Health Consciousness: Increasing consumer preference for darker chocolate due to perceived health benefits and lower sugar content.

- Driver: Flavor Complexity: Ability of dark chocolate to highlight the unique terroir and flavor notes of various cocoa bean origins.

- Driver: Artisanal Craftsmanship: Dark chocolate often serves as the primary canvas for bean-to-bar makers to showcase their expertise in processing and roasting.

The Online Stores distribution channel is experiencing exponential growth, projected to capture xx% of the market by 2025. This surge is fueled by the convenience it offers consumers to explore and purchase a wide variety of craft chocolates from different makers globally, bypassing geographical limitations. Many bean-to-bar producers have successfully established strong direct-to-consumer (DTC) online presences, fostering direct relationships with their customers and building brand loyalty.

- Online Stores Growth:

- Driver: Convenience & Accessibility: Consumers can easily browse and purchase from a diverse range of products globally.

- Driver: Direct-to-Consumer (DTC) Model: Enables producers to build direct relationships and control brand messaging.

- Driver: Wider Product Variety: Online platforms offer a greater selection than physical retail spaces.

While Supermarkets/Hypermarkets and Convenience Stores are important for broader market reach, their share in the premium bean-to-bar segment is comparatively smaller, focusing on curated selections rather than the full spectrum of artisanal offerings.

Bean-to-Bar Chocolate Market Product Developments

Product innovation in the Bean-to-Bar Chocolate Market is centered on enhancing flavor profiles, exploring unique ingredient pairings, and promoting sustainable sourcing. Companies are experimenting with diverse cocoa origins, showcasing distinct terroirs that offer nuanced flavor notes from fruity and floral to earthy and spicy. Innovations in fermentation and roasting techniques are further refining the taste and aroma of the chocolate. Product developments also include the introduction of innovative inclusions and flavor infusions, such as exotic spices, unique fruits, and even floral essences, to create novel taste experiences. The emphasis on single-origin and ethically sourced ingredients remains a cornerstone, with brands highlighting their direct relationships with farmers. Examples include Maui Kuʻia Estate Chocolate's focus on Hawaiian-grown cacao and Kocoatrait's commitment to Indian origin beans. This continuous drive for unique and high-quality products is a key competitive edge.

Challenges in the Bean-to-Bar Chocolate Market Market

Despite its growth, the Bean-to-Bar Chocolate Market faces several challenges. Supply chain volatility related to cocoa bean availability and price fluctuations, influenced by climate change and geopolitical factors, poses a significant threat. High production costs associated with artisanal methods, premium ingredients, and ethical sourcing contribute to higher retail prices, potentially limiting accessibility for some consumers. Intense competition from both established craft brands and larger chocolate manufacturers entering the premium space also presents a challenge. Furthermore, consumer education on the value and nuances of bean-to-bar chocolate remains an ongoing effort to justify premium pricing and differentiate from mass-produced alternatives. The market is also sensitive to economic downturns that could impact discretionary spending on premium goods.

Forces Driving Bean-to-Bar Chocolate Market Growth

The Bean-to-Bar Chocolate Market is propelled by several key growth drivers. The rising global demand for premium and artisanal food products, coupled with an increasing consumer consciousness about ethical sourcing and sustainability, is a primary catalyst. Technological advancements in cocoa processing and roasting techniques enable the creation of superior quality chocolates with complex flavor profiles. The growth of e-commerce platforms provides unprecedented accessibility to a wider range of craft chocolates for consumers worldwide. Furthermore, the increasing adoption of health and wellness trends, with a focus on natural ingredients and higher cocoa content, directly benefits the dark chocolate segment within the bean-to-bar market.

Challenges in the Bean-to-Bar Chocolate Market Market

Long-term growth catalysts for the Bean-to-Bar Chocolate Market lie in sustained innovation and strategic market expansion. Continued investment in research and development for novel flavor profiles and ingredient combinations will keep consumers engaged. Establishing robust partnerships with like-minded businesses, such as specialty coffee roasters or artisanal bakeries, can create synergistic marketing opportunities and broaden reach. Exploring emerging markets with growing disposable incomes and a nascent appreciation for premium foods will be crucial for future expansion. Furthermore, focusing on vertical integration and direct farmer relationships can ensure supply chain stability and enhance brand storytelling.

Emerging Opportunities in Bean-to-Bar Chocolate Market

Emerging opportunities in the Bean-to-Bar Chocolate Market are abundant. The growing demand for plant-based and vegan bean-to-bar chocolates presents a significant untapped segment. Innovations in functional chocolate, incorporating ingredients like adaptogens or probiotics for specific health benefits, offer new avenues for product development. Exploring limited-edition and collaborative releases with renowned chefs or artists can create buzz and attract new consumer segments. Furthermore, the development of traceable blockchain technology in the supply chain will enhance transparency and build greater consumer trust. The expansion of experiential retail, such as chocolate tasting workshops and factory tours, can foster deeper consumer engagement and brand loyalty.

Leading Players in the Bean-to-Bar Chocolate Market Sector

- Goodnow Farms

- Solstice Chocolat

- Blue Gourmet

- Latitude Craft Chocolate

- Maui Kuʻia Estate Chocolate

- Salgado Chocolates

- Kocoatrait

- French Broad Chocolate

- Omnom Chocolate

- Raaka Chocolate Ltd

Key Milestones in Bean-to-Bar Chocolate Market Industry

- 2019: Increased consumer interest in single-origin cocoa beans and ethical sourcing gains significant traction.

- 2020: Expansion of online retail channels and DTC models for bean-to-bar chocolate makers due to global events.

- 2021: Growing emphasis on sustainable packaging solutions within the craft chocolate industry.

- 2022: Introduction of novel flavor infusions and plant-based bean-to-bar chocolate options.

- 2023: Increased media coverage and awards recognizing excellence in bean-to-bar chocolate production.

- 2024: Growing adoption of more sophisticated fermentation and roasting techniques by smaller producers.

Strategic Outlook for Bean-to-Bar Chocolate Market Market

The Bean-to-Bar Chocolate Market is poised for continued robust growth, driven by an unwavering consumer preference for quality, authenticity, and ethical production. Future growth will be accelerated by a commitment to product innovation, including the development of unique flavor profiles, functional chocolates, and diverse dietary options like vegan varieties. Strategic focus on expanding distribution channels, particularly leveraging the reach of online platforms and curated specialty retail, will be crucial. Furthermore, fostering direct relationships with cocoa farmers and transparent supply chains will not only ensure a consistent supply of high-quality beans but also strengthen brand narrative and consumer trust. The market's potential is significant, with opportunities for both established players and agile newcomers to capture market share through dedication to craftsmanship and consumer engagement.

Bean-to-Bar Chocolate Market Segmentation

-

1. Type

- 1.1. Dark

- 1.2. Milk/White

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channel

Bean-to-Bar Chocolate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Bean-to-Bar Chocolate Market Regional Market Share

Geographic Coverage of Bean-to-Bar Chocolate Market

Bean-to-Bar Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Growing consumer preference for natural and healthy chocolates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bean-to-Bar Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dark

- 5.1.2. Milk/White

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Bean-to-Bar Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dark

- 6.1.2. Milk/White

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Bean-to-Bar Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dark

- 7.1.2. Milk/White

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Bean-to-Bar Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dark

- 8.1.2. Milk/White

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Bean-to-Bar Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dark

- 9.1.2. Milk/White

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Bean-to-Bar Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dark

- 10.1.2. Milk/White

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Bean-to-Bar Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Dark

- 11.1.2. Milk/White

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Online Stores

- 11.2.4. Other Distribution Channel

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Goodnow Farms

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Solstice Chocolat

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Blue Gourmet

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Latitude Craft Chocolate

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Maui Kuʻia Estate Chocolate

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Salgado Chocolates

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Kocoatrait

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 French Broad Chocolate

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Omnom Chocolate

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Raaka Chocolate Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Goodnow Farms

List of Figures

- Figure 1: Global Bean-to-Bar Chocolate Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Bean-to-Bar Chocolate Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Bean-to-Bar Chocolate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Bean-to-Bar Chocolate Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Bean-to-Bar Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Bean-to-Bar Chocolate Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Bean-to-Bar Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Bean-to-Bar Chocolate Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Bean-to-Bar Chocolate Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Bean-to-Bar Chocolate Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe Bean-to-Bar Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Bean-to-Bar Chocolate Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Bean-to-Bar Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Bean-to-Bar Chocolate Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Bean-to-Bar Chocolate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Bean-to-Bar Chocolate Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Bean-to-Bar Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Bean-to-Bar Chocolate Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Bean-to-Bar Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Bean-to-Bar Chocolate Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Bean-to-Bar Chocolate Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Bean-to-Bar Chocolate Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America Bean-to-Bar Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Bean-to-Bar Chocolate Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Bean-to-Bar Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Bean-to-Bar Chocolate Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East Bean-to-Bar Chocolate Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Bean-to-Bar Chocolate Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Middle East Bean-to-Bar Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East Bean-to-Bar Chocolate Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Bean-to-Bar Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Bean-to-Bar Chocolate Market Revenue (undefined), by Type 2025 & 2033

- Figure 33: Saudi Arabia Bean-to-Bar Chocolate Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Saudi Arabia Bean-to-Bar Chocolate Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 35: Saudi Arabia Bean-to-Bar Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 36: Saudi Arabia Bean-to-Bar Chocolate Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Bean-to-Bar Chocolate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Spain Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Bean-to-Bar Chocolate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: South Africa Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Bean-to-Bar Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bean-to-Bar Chocolate Market?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the Bean-to-Bar Chocolate Market?

Key companies in the market include Goodnow Farms, Solstice Chocolat, Blue Gourmet, Latitude Craft Chocolate, Maui Kuʻia Estate Chocolate, Salgado Chocolates, Kocoatrait, French Broad Chocolate, Omnom Chocolate, Raaka Chocolate Ltd.

3. What are the main segments of the Bean-to-Bar Chocolate Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Growing consumer preference for natural and healthy chocolates.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bean-to-Bar Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bean-to-Bar Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bean-to-Bar Chocolate Market?

To stay informed about further developments, trends, and reports in the Bean-to-Bar Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence