Key Insights

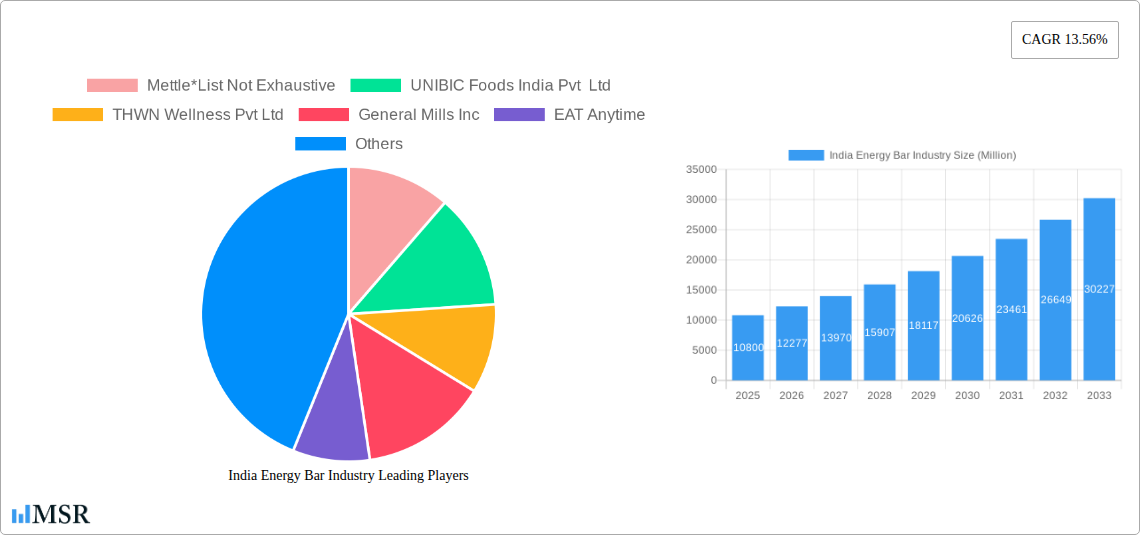

The India Energy Bar market is poised for substantial growth, projected to reach a valuation of INR 10,800 million by 2025. This expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 13.56% throughout the forecast period of 2025-2033. A significant driver of this market dynamism is the increasing health consciousness among Indian consumers, coupled with a growing preference for convenient and nutritious food options. The rising disposable incomes and an escalating demand for on-the-go nutrition for busy lifestyles are further propelling this trend. Furthermore, the expansion of modern retail formats such as supermarkets and hypermarkets, alongside the burgeoning online retail sector, are enhancing the accessibility and availability of energy bars across the nation. The pharmaceutical and drug store channel also contributes significantly, catering to consumers seeking specialized nutritional supplements.

India Energy Bar Industry Market Size (In Billion)

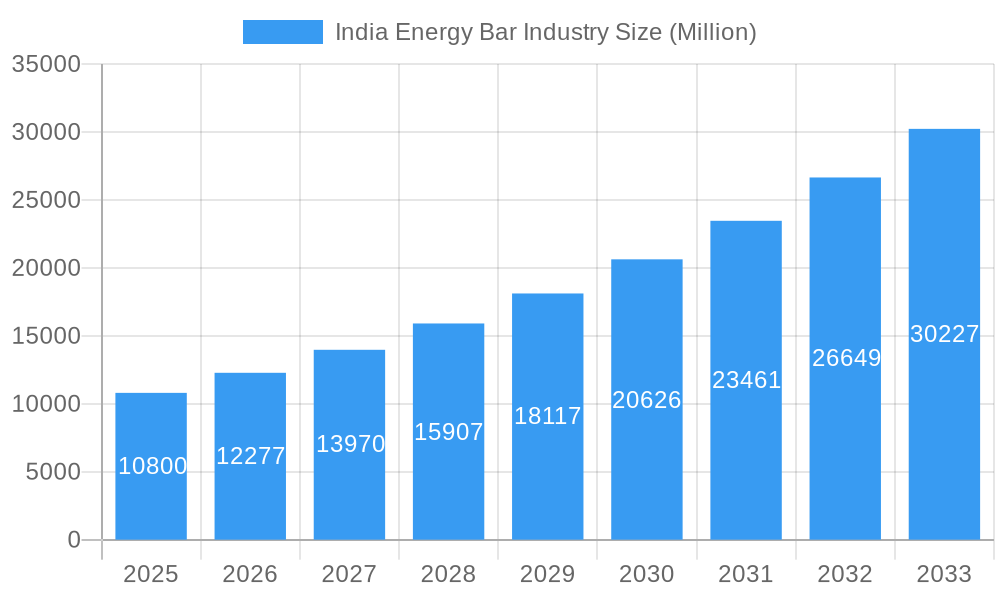

The energy bar market in India is characterized by a vibrant competitive landscape, with key players like UNIBIC Foods India Pvt Ltd, General Mills Inc., EAT Anytime, and Healthkart at the forefront. The market is witnessing a strong emphasis on product innovation, with companies focusing on developing bars with diverse flavors, natural ingredients, and specific functional benefits like protein enrichment and low-sugar content. While the market is experiencing a healthy uptake, potential restraints could include fluctuating raw material costs and intense price competition. However, the overarching trends of wellness, fitness, and a demand for wholesome food alternatives are expected to outweigh these challenges, solidifying the energy bar's position as a staple in the Indian consumer's diet. The evolving consumer preferences, particularly among millennials and Gen Z who are actively embracing healthier lifestyles, will continue to shape product development and marketing strategies within this segment.

India Energy Bar Industry Company Market Share

India Energy Bar Industry Market Report: Unlocking Growth in a Thriving Wellness Landscape (2019–2033)

**Unlock strategic insights into India's burgeoning energy bar market with this comprehensive report. Delve into market dynamics, consumer trends, and competitive strategies shaping the future of energy bars in India. This report is essential for industry stakeholders, including manufacturers, distributors, investors, and wellness brands seeking to capitalize on the *Indian energy bar market*, *healthy snacks India*, and **nutrition bar industry.

This in-depth analysis covers the India energy bar market size, energy bar market share India, and CAGR of energy bar market India from 2019 to 2033, with a base and estimated year of 2025. Explore key segments, distribution channels, and product innovations driving growth in this dynamic sector.

India Energy Bar Industry Market Concentration & Dynamics

The India energy bar market exhibits a moderately concentrated landscape, with a few dominant players vying for market share alongside a growing number of niche and emerging brands. Innovation plays a crucial role, with companies continually investing in R&D to develop healthier, tastier, and more specialized products. The innovation ecosystem is fueled by a growing awareness of health and wellness among Indian consumers, pushing for organic energy bars and plant-based energy bars. Regulatory frameworks, primarily concerning food safety and labeling, are evolving to align with international standards, ensuring consumer trust. Substitute products, including traditional Indian snacks, fruits, and other packaged healthy foods, present a competitive challenge, but the convenience and targeted nutritional benefits of energy bars offer a distinct advantage. End-user trends reveal a significant shift towards health-conscious consumption, with a rising demand for protein bars India and low-sugar energy bars. Mergers and acquisitions (M&A) activities, though not extensively documented, are anticipated to increase as larger entities seek to acquire innovative startups and expand their product portfolios in the Indian healthy snacks market. Current estimated M&A deal counts remain low, reflecting a relatively young but rapidly maturing market.

- Market Concentration: Moderately concentrated with key players and emerging brands.

- Innovation Ecosystem: Driven by health and wellness trends, focusing on premium ingredients and specialized formulations.

- Regulatory Frameworks: Evolving food safety and labeling standards, promoting transparency and consumer confidence.

- Substitute Products: Traditional snacks, fruits, and other healthy packaged foods.

- End-User Trends: Increasing demand for health-conscious, convenient, and nutritionally balanced options.

- M&A Activities: Anticipated to grow as market consolidation intensifies.

India Energy Bar Industry Industry Insights & Trends

The India energy bar market is poised for substantial growth, driven by a confluence of factors propelling the healthy snacks India sector. The estimated market size for the energy bar segment is projected to reach $800 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% projected for the forecast period of 2025–2033. This upward trajectory is fueled by an escalating health and wellness consciousness among the Indian populace, particularly in urban centers. Consumers are increasingly prioritizing convenience without compromising on nutritional value, making energy bars an ideal on-the-go solution. Technological disruptions are manifesting in advanced product formulations, utilizing superfoods, protein isolates, and functional ingredients to cater to specific dietary needs, such as gluten-free energy bars and vegan energy bars. Evolving consumer behaviors are characterized by a preference for transparency in ingredient sourcing and a growing demand for products that support active lifestyles and fitness goals. The rise of online retail channels has significantly broadened accessibility, enabling smaller brands to reach a wider audience and fostering greater competition. Furthermore, the increasing disposable income and a growing middle class with greater purchasing power are contributing to the adoption of premium and health-oriented food products. The industry is also witnessing a trend towards personalized nutrition, with consumers seeking energy bars tailored to their individual needs, whether for pre-workout energy, post-workout recovery, or general wellness. The impact of social media and influencer marketing is also noteworthy, shaping consumer perceptions and driving awareness of new brands and product benefits within the nutrition bar industry.

- Estimated Market Size (2025): $800 Million

- Projected CAGR (2025-2033): 15%

- Key Growth Drivers: Rising health consciousness, demand for convenience, increasing disposable income, and digital accessibility.

- Technological Advancements: Innovations in ingredient sourcing, formulation for specialized diets (e.g., keto, vegan), and functional benefits.

- Evolving Consumer Behavior: Shift towards informed purchasing decisions, preference for natural and organic ingredients, and support for active lifestyles.

Key Markets & Segments Leading India Energy Bar Industry

The India energy bar market is witnessing a significant surge in demand, with Online Retail Stores emerging as the dominant and fastest-growing distribution channel. This channel's dominance is attributed to several key drivers, including unparalleled convenience, wider product selection, competitive pricing, and the ability to reach consumers across geographical barriers. The ease of doorstep delivery, coupled with readily available product information and customer reviews, empowers consumers to make informed purchasing decisions for healthy snacks India. Furthermore, the proliferation of e-commerce platforms and direct-to-consumer (DTC) models has democratized market access for both established and emerging players in the nutrition bar industry.

- Dominant Distribution Channel: Online Retail Stores

- Drivers:

- Convenience: 24/7 accessibility and home delivery.

- Product Variety: Extensive range of brands, flavors, and specialized options (e.g., protein bars India, organic energy bars).

- Price Competitiveness: Online platforms often offer discounts and bundled deals.

- Information Accessibility: Detailed product descriptions, ingredient lists, and customer reviews.

- Reach & Scalability: Enables brands to connect with a national audience.

- Emerging Tech Integration: Personalized recommendations and subscription models.

- Drivers:

Supermarkets/Hypermarkets represent the second most significant distribution channel, benefiting from high foot traffic and impulse purchase opportunities. The visibility of energy bars alongside other healthy food options encourages trial among a broad consumer base. Convenience Stores cater to the immediate need for on-the-go energy, making them crucial for impulse buys, especially in urban and corporate settings. Pharmacies And Drug Stores are increasingly stocking energy bars as consumers associate them with health and wellness products, particularly those with specific nutritional benefits like low-sugar energy bars. Other Distribution Channels, including gyms, sports clubs, and corporate cafeterias, play a niche but vital role in targeting specific consumer segments with tailored product offerings. The continued growth of the Indian energy bar market will be intrinsically linked to the strategic expansion and optimization of these diverse distribution networks, with online retail leading the charge in shaping consumer accessibility and market penetration.

- Secondary Distribution Channels:

- Supermarkets/Hypermarkets: High visibility and impulse purchase potential.

- Convenience Stores: Catering to immediate, on-the-go consumption needs.

- Pharmacies And Drug Stores: Leveraging the health and wellness association.

- Other Distribution Channels: Targeted approach for fitness enthusiasts and specific demographics.

India Energy Bar Industry Product Developments

Product innovation is a cornerstone of the India energy bar market. Recent developments underscore a focus on catering to evolving consumer demands for healthier and more specialized options. For instance, in February 2022, the Yoga bar brand extended its product category into kids' nutrition with the launch of new mixes 'Yo Chos' and 'Yo Fills', addressing the growing demand for nutritious snacks for children. In January 2021, Clif Bar & Company introduced CLIF BAR thins, a thin and crispy energy snack bar emphasizing 100 calories, 5g of sugar, and plant-based organic ingredients like rolled oats, aligning with the trend for lower-sugar options. Furthermore, in November 2019, PROBAR LLC launched two new PROBAR Meal Bar flavors, blueberry muffin and s'mores, highlighting at least 9g of protein per serve, being 100% plant-based, gluten-free, and made from whole superfoods, reflecting the demand for protein-rich and clean-label products within the nutrition bar industry. These innovations reflect a strategic imperative to enhance product appeal, nutritional profiles, and cater to niche dietary requirements in the Indian healthy snacks market.

Challenges in the India Energy Bar Industry Market

The India energy bar market faces several challenges that temper its growth potential. Regulatory hurdles, particularly concerning novel ingredients and stringent labeling requirements for health claims, can slow down product launches and market entry. Supply chain disruptions, exacerbated by logistical complexities and the sourcing of high-quality raw materials, can impact production costs and product availability. Competitive pressures from a growing number of domestic and international brands, coupled with the persistent appeal of traditional Indian snacks, necessitate continuous innovation and effective marketing strategies. The perceived high cost of premium energy bars by a segment of the population also presents a barrier to widespread adoption.

- Regulatory Hurdles: Stringent food safety and labeling compliance.

- Supply Chain Issues: Sourcing of quality ingredients and logistical complexities.

- Competitive Landscape: Intense competition from established and emerging brands.

- Price Sensitivity: Perceived high cost for a segment of consumers.

- Consumer Education: Need for continuous awareness about the benefits of specialized energy bars.

Forces Driving India Energy Bar Industry Growth

Several potent forces are driving the growth of the India energy bar market. The escalating health and wellness consciousness among Indian consumers is a primary catalyst, leading to a proactive search for convenient and nutritionally beneficial food options. The increasing prevalence of sedentary lifestyles coupled with a growing interest in fitness and sports activities fuels the demand for energy and protein-rich snacks. Evolving consumer preferences towards natural, organic, and plant-based ingredients align perfectly with the product offerings in this segment, positioning organic energy bars and vegan energy bars for significant expansion. Furthermore, the growing disposable income and a burgeoning middle class with a greater willingness to spend on health-oriented products are critical economic drivers. The expansion of online retail channels has also democratized access, enabling wider reach and increased consumer choice within the nutrition bar industry.

- Rising Health & Wellness Consciousness: Proactive consumer approach to health.

- Growing Fitness & Sports Participation: Demand for performance-enhancing nutrition.

- Preference for Natural & Organic Ingredients: Alignment with clean-label trends.

- Increased Disposable Income: Greater purchasing power for premium health products.

- Digital Penetration & E-commerce Growth: Enhanced accessibility and market reach.

Challenges in the India Energy Bar Industry Market

Addressing long-term growth catalysts in the India energy bar market requires a strategic focus on sustained innovation and market expansion. The continuous development of innovative product formulations that cater to specific dietary needs, such as keto-friendly, low-FODMAP, or allergen-free options, will be crucial for capturing niche segments. Strategic partnerships with gyms, fitness centers, and corporate wellness programs can foster deeper penetration and brand loyalty. Furthermore, exploring untapped rural and semi-urban markets, supported by targeted marketing campaigns and accessible price points, presents a significant avenue for long-term growth. Investing in robust supply chain management for consistent availability of high-quality ingredients will also be paramount. The report forecasts a steady demand for plant-based energy bars and gluten-free energy bars, indicating a need for continued product diversification to meet these evolving dietary preferences and expand the Indian energy bar market.

Emerging Opportunities in India Energy Bar Industry

Emerging opportunities in the India energy bar market are multifaceted, offering substantial growth potential. The increasing demand for personalized nutrition presents a significant avenue, with opportunities to develop AI-driven recommendations and custom-blended energy bars based on individual dietary needs and fitness goals. Innovations in sustainable packaging and ethically sourced ingredients resonate strongly with environmentally conscious consumers, creating a competitive edge for brands prioritizing these aspects. The untapped potential in regional cuisines and flavors, adapted into energy bar formats, could unlock new consumer segments and enhance product appeal. Furthermore, the growing acceptance of energy bars as meal replacements or healthy snack alternatives for children and the elderly opens up novel market segments. The report anticipates a rise in demand for meal replacement bars and kids' nutrition bars in the coming years, presenting a lucrative opportunity for market players in the Indian healthy snacks market.

- Personalized Nutrition: Tailored energy bars based on individual needs.

- Sustainable & Ethical Sourcing: Growing consumer preference for eco-conscious brands.

- Regional Flavor Integration: Adapting popular Indian flavors into energy bar formats.

- Expanded Target Demographics: Children, elderly, and specific dietary needs.

- Functional Ingredient Innovation: Incorporation of adaptogens, probiotics, and nootropics.

Leading Players in the India Energy Bar Industry Sector

- Mettle

- UNIBIC Foods India Pvt Ltd

- THWN Wellness Pvt Ltd

- General Mills Inc

- EAT Anytime

- Sproutlife foods

- Mojo Bar

- Monsoon Harvest

- Healthkart

- The Whole Truth

Key Milestones in India Energy Bar Industry Industry

- February 2022: Yoga Bar brand expands into kids' nutrition with new mixes 'Yo Chos' and 'Yo Fills'.

- January 2021: Clif Bar & Company launches CLIF BAR thins, a thin and crispy energy snack bar (100 calories, 5g sugar, plant-based organic ingredients).

- November 2019: PROBAR LLC introduces two new PROBAR Meal Bar flavors (blueberry muffin, s'mores) with at least 9g protein, 100% plant-based, and gluten-free.

Strategic Outlook for India Energy Bar Industry Market

The strategic outlook for the India energy bar market is exceptionally positive, driven by a sustained shift towards healthier lifestyles and convenient nutritional solutions. Key growth accelerators include the continuous innovation in product formulations, focusing on catering to diverse dietary preferences such as plant-based energy bars and gluten-free energy bars. Strategic partnerships with fitness centers, corporate wellness programs, and healthcare providers will amplify reach and credibility. The expansion of online retail, coupled with the potential of direct-to-consumer (DTC) models, offers significant opportunities for market penetration and direct engagement with consumers. Furthermore, the exploration of untapped regional markets and the integration of local flavors present a unique avenue for diversification and market capture. The projected robust CAGR indicates a market ripe for investment and expansion, making it a compelling sector for stakeholders within the Indian healthy snacks market.

India Energy Bar Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Pharmacies And Drug Stores

- 1.4. Online Retail Stores

- 1.5. Other Distribution Channels

India Energy Bar Industry Segmentation By Geography

- 1. India

India Energy Bar Industry Regional Market Share

Geographic Coverage of India Energy Bar Industry

India Energy Bar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Preference for Healthy Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Energy Bar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Pharmacies And Drug Stores

- 5.1.4. Online Retail Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mettle*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UNIBIC Foods India Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 THWN Wellness Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EAT Anytime

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sproutlife foods

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mojo Bar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Monsoon Harvest

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Healthkart

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Whole Truth

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mettle*List Not Exhaustive

List of Figures

- Figure 1: India Energy Bar Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Energy Bar Industry Share (%) by Company 2025

List of Tables

- Table 1: India Energy Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 2: India Energy Bar Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: India Energy Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Energy Bar Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Energy Bar Industry?

The projected CAGR is approximately 13.56%.

2. Which companies are prominent players in the India Energy Bar Industry?

Key companies in the market include Mettle*List Not Exhaustive, UNIBIC Foods India Pvt Ltd, THWN Wellness Pvt Ltd, General Mills Inc, EAT Anytime, Sproutlife foods, Mojo Bar, Monsoon Harvest, Healthkart, The Whole Truth.

3. What are the main segments of the India Energy Bar Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Preference for Healthy Snacking.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

In February 2022, the Yoga bar brand extended its product category into kids' nutrition with the launch of new mixes 'Yo Chos' and 'Yo Fills'.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Energy Bar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Energy Bar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Energy Bar Industry?

To stay informed about further developments, trends, and reports in the India Energy Bar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence