Key Insights

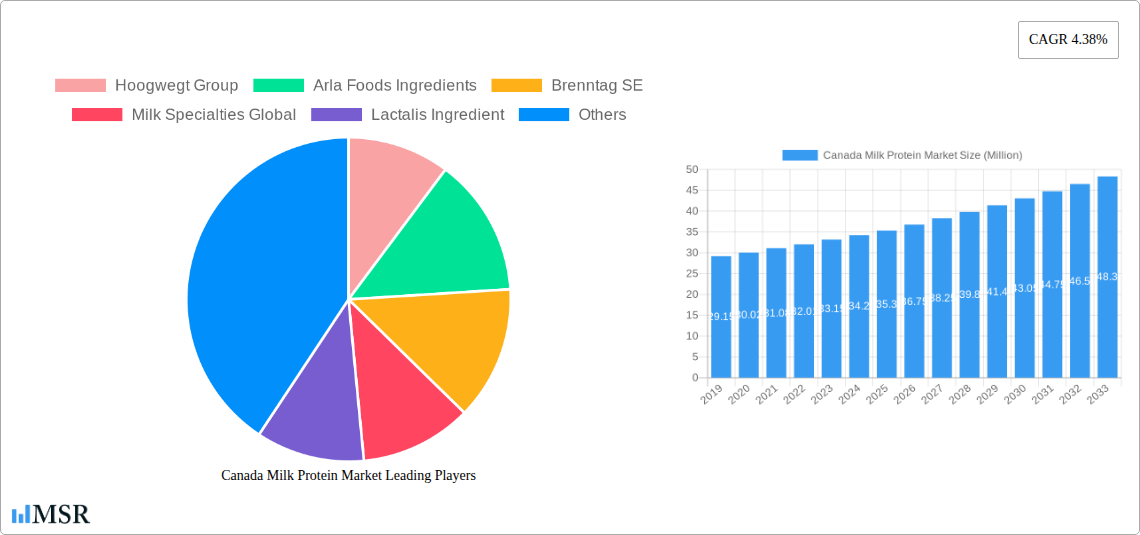

The Canadian milk protein market is poised for robust growth, projected to reach approximately USD 35.30 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.38% anticipated to continue through 2033. This expansion is primarily driven by the escalating demand for high-quality protein ingredients across various food and beverage applications, including bakery products, dairy and dairy alternatives, and ready-to-eat/ready-to-cook meals. The burgeoning health and wellness trend, emphasizing the importance of protein for muscle development, satiety, and overall well-being, is a significant catalyst for this market's upward trajectory. Furthermore, the increasing use of milk proteins as functional ingredients in sports nutrition and infant formula is contributing to sustained demand. The market is witnessing a strong preference for whey proteins due to their superior amino acid profile and rapid absorption, though casein and caseinates continue to hold a significant share, particularly in applications requiring slow-release protein benefits.

Canada Milk Protein Market Market Size (In Million)

The Canadian milk protein landscape is characterized by several key trends that will shape its future. A growing emphasis on clean label products and sustainable sourcing is influencing ingredient choices. Consumers are increasingly seeking natural, minimally processed protein sources, which benefits the milk protein sector. Innovation in processing technologies is leading to the development of specialized milk protein ingredients with enhanced functionality, such as improved solubility and emulsification properties, catering to a wider range of product formulations. While the market benefits from strong domestic demand, potential restraints could emerge from fluctuating raw milk prices, the competitive landscape with alternative protein sources, and evolving regulatory frameworks. However, the consistent demand from the animal feed sector, where milk proteins serve as a vital nutrient source, provides a stable foundation for the market. Key players are focusing on expanding their product portfolios and strengthening their supply chains to capitalize on these growth opportunities.

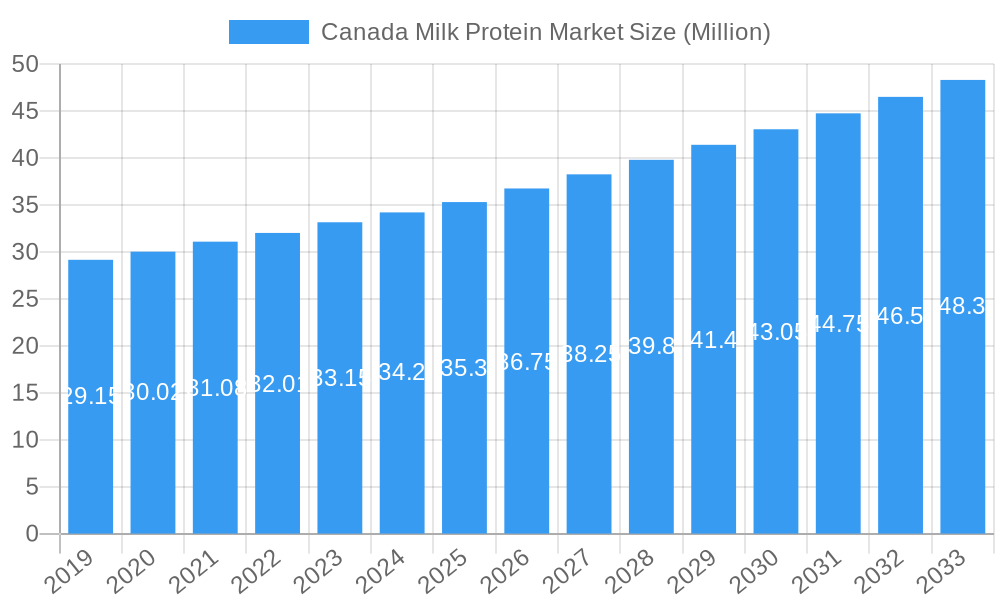

Canada Milk Protein Market Company Market Share

This in-depth report offers a panoramic view of the Canada milk protein market, a rapidly expanding sector driven by escalating consumer demand for high-protein foods, beverages, and specialized nutritional products. With a projected market size of XX Million by 2033, this analysis provides critical insights into market dynamics, industry trends, key players, and future growth opportunities. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering stakeholders a robust understanding of market evolution.

Canada Milk Protein Market Market Concentration & Dynamics

The Canada milk protein market exhibits a moderate to high degree of concentration, with key global and domestic players vying for market share. Fonterra Co-operative Group Limited, Lactalis Ingredient, and Arla Foods Ingredients are prominent entities shaping innovation and supply chains. The innovation ecosystem is vibrant, particularly in the development of specialized whey protein and casein derivatives catering to diverse end-user needs. Regulatory frameworks, overseen by Health Canada and CFIA, ensure product safety and quality, influencing product development and market entry. Substitute products, such as plant-based protein alternatives, present a growing challenge, compelling milk protein manufacturers to emphasize superior nutritional profiles and functional benefits. End-user trends indicate a strong preference for high-protein food and beverages and sports nutrition supplements, driving demand for whey proteins and isolates. Merger and acquisition (M&A) activities are anticipated to continue as companies seek to consolidate their market position and expand their product portfolios. The number of significant M&A deals in the past five years stands at approximately XX.

Canada Milk Protein Market Industry Insights & Trends

The Canada milk protein market is poised for substantial growth, estimated at XX Million in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% over the forecast period (2025-2033). This expansion is primarily fueled by increasing consumer awareness regarding the health benefits associated with protein consumption, including muscle building, satiety, and overall well-being. The burgeoning food and beverage sector is a significant contributor, with a rising demand for milk proteins in dairy and dairy alternative products, bakery items, and RTE/RTC food products. Technological disruptions are playing a crucial role, with advancements in processing techniques leading to enhanced protein purity, solubility, and functionality, thereby expanding their applications. The development of novel ingredients like alpha-lactalbumin-rich formulations for infant nutrition and microparticulate whey proteins for improved texture and mouthfeel in various food applications are noteworthy. Evolving consumer behaviors, marked by a growing preference for natural, minimally processed ingredients and a focus on functional foods, are further propelling the market forward. The demand for sport/performance nutrition products remains robust, driven by fitness enthusiasts and athletes seeking to optimize their performance and recovery. The increasing prevalence of chronic diseases and an aging population also contribute to the demand for elderly nutrition and medical nutrition products, where milk proteins offer essential nutritional support. The market is also witnessing a rise in demand for baby food and infant formula, where milk proteins are a foundational ingredient. The sustained interest in protein fortification across various food categories underscores the market's resilience and potential.

Key Markets & Segments Leading Canada Milk Protein Market

The Canada milk protein market is characterized by strong performance across multiple segments, with significant growth drivers and dominance observed in specific areas.

Dominant Product Type: Whey Proteins

- Drivers: High bioavailability, versatility in applications, strong consumer perception for muscle health and recovery.

- The whey protein segment stands as a titan within the Canada milk protein market. Its dominance is attributed to its superior nutritional profile, including essential amino acids, and its widespread application in the rapidly growing sports nutrition sector. Consumer preference for convenient, high-protein supplements and functional foods further bolsters its demand. The food and beverage industry also heavily relies on whey proteins for fortification in dairy and dairy alternative products, bakery items, and RTE/RTC food products, where it enhances texture and nutritional value.

Leading Form: Isolates

- Drivers: High protein content, low lactose and fat, suitability for sensitive consumers and low-calorie formulations.

- Milk protein isolates are experiencing remarkable growth, driven by their high purity and minimal presence of other macronutrients. This makes them an ideal choice for manufacturers catering to health-conscious consumers, individuals with dietary restrictions, and those seeking concentrated protein sources. Their application in supplements, particularly for sports nutrition and medical nutrition, is a key growth propeller.

Prominent End-User: Food and Beverages

- Drivers: Growing demand for protein-fortified products, increasing popularity of convenience foods, expansion of functional food categories.

- The food and beverages segment is the largest contributor to the Canada milk protein market. Within this, dairy and dairy alternative products form a cornerstone, with milk proteins enhancing texture, nutritional content, and shelf life. The bakery sector is increasingly incorporating milk proteins to boost protein content and improve product quality. RTE/RTC food products benefit from the functional properties of milk proteins for improved palatability and nutritional appeal. The snacks category is also seeing a rise in protein-fortified options.

Significant Segment: Supplements

- Drivers: Rising health and wellness consciousness, demand for specialized nutritional solutions, growth in fitness and active lifestyles.

- The supplements segment, encompassing baby food and infant formula, elderly nutrition and medical nutrition, and sport/performance nutrition, is a critical growth engine. The increasing birth rates and focus on infant development drive demand for high-quality milk proteins in baby food and infant formula. An aging population and rising healthcare awareness contribute to the demand for elderly nutrition and medical nutrition products. Simultaneously, the persistent popularity of fitness and sports activities fuels the sport/performance nutrition market.

Canada Milk Protein Market Product Developments

Recent product developments in the Canada milk protein market highlight a strong focus on innovation and catering to specific consumer needs. Arla Foods Ingredients has emerged as a key innovator, introducing in June 2023 a specialized alpha-lactalbumin-rich ingredient designed for low-protein infant formulas, addressing a niche but crucial market segment. Furthermore, in April 2023, Arla unveiled its novel Nutrilac ProteinBoost line of whey proteins, leveraging proprietary microparticulate technology for enhanced functionality, demonstrating a commitment to advanced ingredient solutions. Lactalis Ingredients, in November 2021, showcased its dedication to high-protein product concepts by launching innovative offerings utilizing Pronativ Native Micellar Casein and Pronativ Native Whey Protein, including shakes and puddings. These advancements underscore the industry's drive towards delivering superior protein-based solutions with improved nutritional profiles and diverse applications, providing a competitive edge and meeting evolving market demands.

Challenges in the Canada Milk Protein Market Market

The Canada milk protein market faces several challenges that could temper its growth trajectory. Regulatory hurdles, particularly stringent quality control and labeling requirements, can increase operational costs and complexity for manufacturers. Supply chain disruptions, exacerbated by global events, can impact the availability and pricing of raw milk and processed protein ingredients. Intense competition from both domestic and international players, coupled with the rising popularity of plant-based protein alternatives, puts pressure on market share and necessitates continuous innovation and competitive pricing strategies. Furthermore, fluctuating raw material costs, influenced by weather patterns and global agricultural trends, can affect profit margins.

Forces Driving Canada Milk Protein Market Growth

Several powerful forces are propelling the Canada milk protein market forward. The escalating global awareness of protein's role in maintaining a healthy lifestyle, including muscle development, satiety, and overall well-being, is a primary driver. This is directly fueling demand from the food and beverage industry for protein fortification across a wide array of products, from dairy alternatives to baked goods and ready-to-eat meals. Technological advancements in processing and extraction techniques are yielding higher purity, improved functionality, and novel protein ingredients, expanding their application scope. Economic factors, such as rising disposable incomes in key demographics, enable consumers to invest in premium, health-focused food and supplement options. Furthermore, a supportive regulatory environment that encourages product innovation while ensuring safety indirectly fosters market expansion.

Challenges in the Canada Milk Protein Market Market

While growth is robust, long-term catalysts are crucial for sustained expansion in the Canada milk protein market. Continued investment in research and development is paramount to unlock new functionalities and applications of milk proteins, such as enhanced bioavailability or improved digestion properties. Strategic partnerships and collaborations between ingredient manufacturers, food producers, and research institutions can accelerate product development and market penetration. Expanding into emerging markets and catering to specific demographic needs, like specialized formulations for seniors or athletes, will create new avenues for growth. Furthermore, sustainability initiatives within the dairy industry, focusing on ethical sourcing and reduced environmental impact, will be increasingly important for maintaining consumer trust and market acceptance.

Emerging Opportunities in Canada Milk Protein Market

Emerging opportunities within the Canada milk protein market are diverse and promising. The growing demand for clean-label and natural ingredients presents an opportunity for manufacturers to highlight the inherent benefits of milk proteins. The expansion of the plant-based beverage market, paradoxically, creates an opportunity for blended products or innovative protein fortification strategies that offer superior nutritional profiles compared to solely plant-based alternatives. The increasing consumer interest in personalized nutrition and functional foods opens doors for customized milk protein blends tailored to specific health goals, such as cognitive function or immune support. Furthermore, advancements in encapsulation and delivery systems can enhance the stability and bioavailability of milk proteins, leading to novel product formulations with extended shelf lives and improved efficacy.

Leading Players in the Canada Milk Protein Market Sector

- Hoogwegt Group

- Arla Foods Ingredients

- Brenntag SE

- Milk Specialties Global

- Lactalis Ingredient

- Glanbia PLC

- Lactoprot Deutschland GmbH

- Kerry Group PLC

- Farbest-Tallman Foods Corporation

- Fonterra Co-operative Group Limited

- Groupe Lactalis

Key Milestones in Canada Milk Protein Market Industry

- June 2023: Arla Foods Ingredients introduced a groundbreaking, alpha-lactalbumin-rich ingredient tailored specifically for low-protein infant formulas.

- April 2023: The Denmark-based company Arla Foods Ingredients unveiled their innovative line of whey proteins, leveraging patented microparticulate technology under the brand name Nutrilac ProteinBoost. The company maintains a robust presence in Canada, encompassing operational facilities and extensive distribution networks.

- November 2021: Lactalis Ingredients made waves with the launch of innovative high-protein product concepts utilizing Pronativ Native Micellar Casein and Pronativ Native Whey Protein. These concepts encompass a diverse range of high-protein offerings, including shakes and pudding. Furthermore, the company maintains a dedicated website catering to the Canadian market.

Strategic Outlook for Canada Milk Protein Market Market

The strategic outlook for the Canada milk protein market is highly positive, with significant growth accelerators in place. The increasing global consumer focus on health and wellness, coupled with the undeniable nutritional benefits of milk proteins, will continue to drive demand across diverse applications. Investments in R&D for novel protein forms and functional ingredients, along with a focus on sustainable sourcing and production practices, will be critical for competitive advantage. Expansion into niche markets such as medical nutrition and specialized dietary supplements presents substantial untapped potential. Furthermore, strategic collaborations and partnerships throughout the value chain, from dairy farmers to end-product manufacturers, will be instrumental in navigating market complexities and capitalizing on emerging opportunities, ensuring sustained growth and market leadership in the coming years.

Canada Milk Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

-

2. Product Type

- 2.1. Casein & Caseinates

- 2.2. Whey Proteins

-

3. End-User

- 3.1. Animal Feed

-

3.2. Food and Beverages

- 3.2.1. Bakery

- 3.2.2. Breakfast Cereals

- 3.2.3. Condiments/Sauces

- 3.2.4. Dairy and Dairy Alternative Products

- 3.2.5. RTE/RTC Food Products

- 3.2.6. Snacks

-

3.3. Supplements

- 3.3.1. Baby Food and Infant Formula

- 3.3.2. Elderly Nutrition and Medical Nutrition

- 3.3.3. Sport/Performance Nutrition

Canada Milk Protein Market Segmentation By Geography

- 1. Canada

Canada Milk Protein Market Regional Market Share

Geographic Coverage of Canada Milk Protein Market

Canada Milk Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1 Increasing Demand for Supplement Nutrition

- 3.4.2 Processed Food and Beverages.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Milk Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Casein & Caseinates

- 5.2.2. Whey Proteins

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Animal Feed

- 5.3.2. Food and Beverages

- 5.3.2.1. Bakery

- 5.3.2.2. Breakfast Cereals

- 5.3.2.3. Condiments/Sauces

- 5.3.2.4. Dairy and Dairy Alternative Products

- 5.3.2.5. RTE/RTC Food Products

- 5.3.2.6. Snacks

- 5.3.3. Supplements

- 5.3.3.1. Baby Food and Infant Formula

- 5.3.3.2. Elderly Nutrition and Medical Nutrition

- 5.3.3.3. Sport/Performance Nutrition

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hoogwegt Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arla Foods Ingredients

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Brenntag SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Milk Specialties Global

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lactalis Ingredient

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Glanbia PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lactoprot Deutschland GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kerry Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Farbest-Tallman Foods Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fonterra Co-operative Group Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Groupe Lactalis

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hoogwegt Group

List of Figures

- Figure 1: Canada Milk Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Milk Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Milk Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Canada Milk Protein Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Canada Milk Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Canada Milk Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Milk Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 6: Canada Milk Protein Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Canada Milk Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Canada Milk Protein Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Milk Protein Market?

The projected CAGR is approximately 4.38%.

2. Which companies are prominent players in the Canada Milk Protein Market?

Key companies in the market include Hoogwegt Group, Arla Foods Ingredients, Brenntag SE, Milk Specialties Global, Lactalis Ingredient, Glanbia PLC, Lactoprot Deutschland GmbH, Kerry Group PLC, Farbest-Tallman Foods Corporation, Fonterra Co-operative Group Limited, Groupe Lactalis.

3. What are the main segments of the Canada Milk Protein Market?

The market segments include Form, Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products.

6. What are the notable trends driving market growth?

Increasing Demand for Supplement Nutrition. Processed Food and Beverages..

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

June 2023: Arla Foods Ingredients introduced a groundbreaking, alpha-lactalbumin-rich ingredient tailored specifically for low-protein infant formulas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Milk Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Milk Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Milk Protein Market?

To stay informed about further developments, trends, and reports in the Canada Milk Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence