Key Insights

The United States ice cream market is projected to reach an estimated $19.51 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.81% through 2033. This expansion is propelled by increasing consumer demand for premium and artisanal ice cream, driven by evolving taste preferences and a preference for indulgent treats. The popularity of novel flavors, plant-based alternatives, and health-conscious options further stimulates market growth. The accessibility of ready-to-eat formats and the expansion of online retail channels are enhancing consumer reach and appeal. Key market players' marketing initiatives and product innovations are vital for sustained consumer engagement and market vitality.

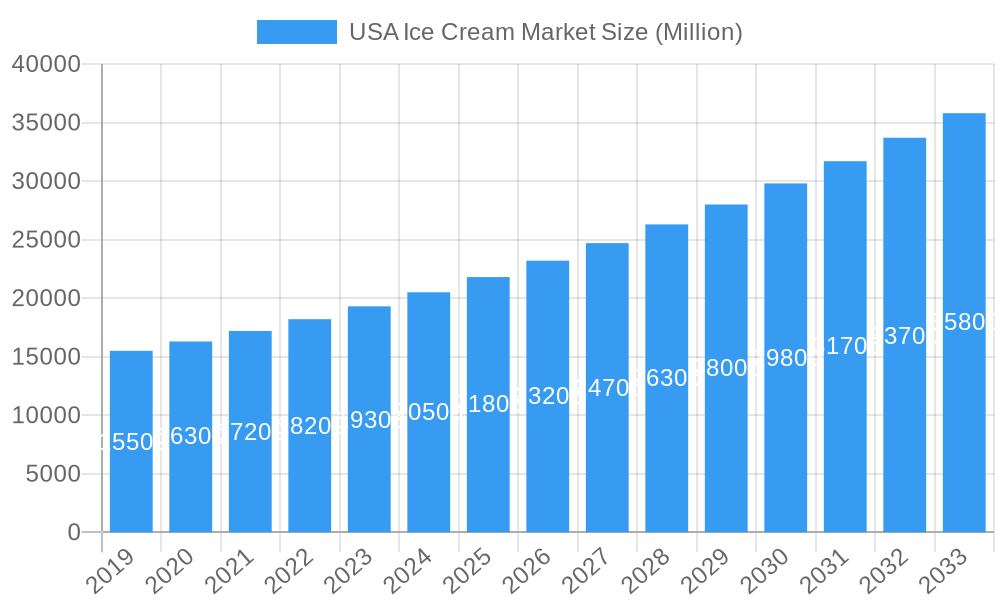

USA Ice Cream Market Market Size (In Billion)

Key drivers include rising disposable incomes, a growing trend in at-home dessert consumption, and continuous product innovation by leading companies such as Wells Enterprises Inc., Unilever PLC, and Dairy Farmers of America Inc. Strategic investments in research and development, focusing on unique flavor profiles, sustainable sourcing, and healthier formulations, also bolster market growth. While significant growth is evident, fluctuating raw material costs and intense competition may pose challenges. However, ongoing product innovation and effective marketing strategies are expected to mitigate these impacts, ensuring a positive outlook for the U.S. ice cream market. The distribution landscape is dominated by off-trade channels, with supermarkets and hypermarkets leading in volume, followed closely by the rapidly growing online retail segment.

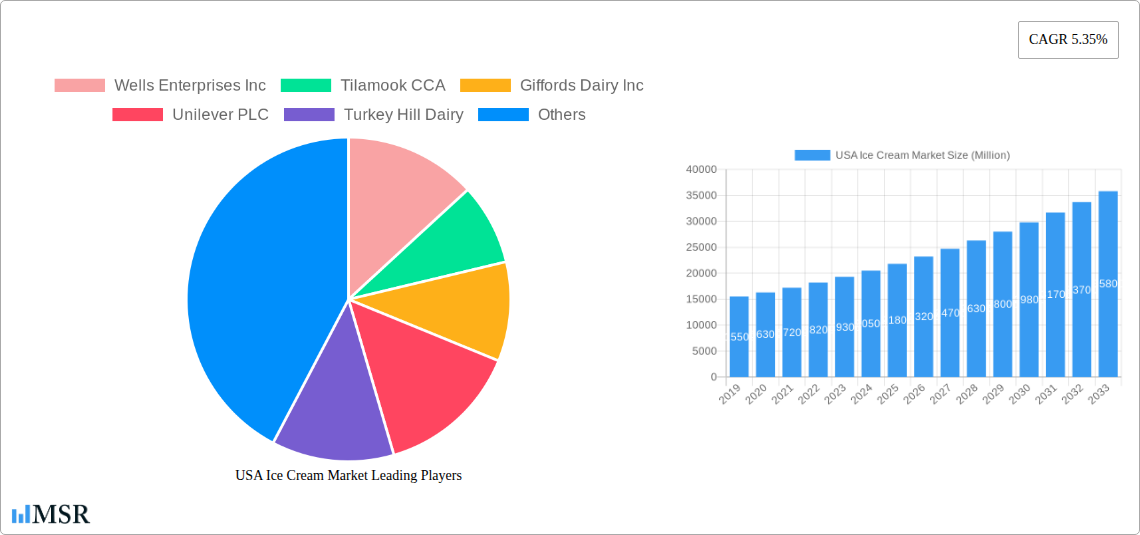

USA Ice Cream Market Company Market Share

U.S. Ice Cream Market: Growth Analysis & Future Outlook (2019-2033)

Explore the dynamic U.S. ice cream market with this comprehensive report, covering trends from 2019 to 2033, with a base year of 2025. Gain critical insights into market size, CAGR, dominant segments, competitive landscape, and strategic opportunities. This report is essential for ice cream manufacturers, food and beverage companies, retailers, investors, and industry stakeholders looking to understand the evolving U.S. frozen dessert market, premium ice cream trends, and dairy product innovation. Uncover key drivers, challenges, and the impact of distribution channels, including online retail and supermarkets.

USA Ice Cream Market Market Concentration & Dynamics

The USA ice cream market exhibits a moderately concentrated landscape, with key players like Wells Enterprises Inc., Unilever PLC, and Dairy Farmers of America Inc. holding significant market share. Innovation plays a crucial role, driven by a vibrant ecosystem focused on premiumization, novel flavor development, and healthier options. Regulatory frameworks, primarily governed by the FDA, ensure product safety and labeling standards. Substitute products, including frozen yogurt, sorbet, and plant-based alternatives, exert competitive pressure, influencing consumer choices. End-user trends highlight a growing demand for artisanal, gourmet, and plant-based ice creams, alongside a sustained interest in indulgent, classic flavors. Merger and acquisition (M&A) activities, although not as frequent as in some other sectors, are strategic moves to expand portfolios and market reach. The number of significant M&A deals is estimated at around 5-10 annually within the broader US frozen dessert space, signaling consolidation and strategic expansion.

USA Ice Cream Market Industry Insights & Trends

The USA ice cream market is experiencing robust growth, projected to reach a market size of over USD 35,000 Million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period (2025-2033). This expansion is fueled by several key factors. Evolving consumer behaviors are a primary driver, with an increasing preference for premium and artisanal ice cream offerings, driven by a desire for unique flavors, high-quality ingredients, and indulgent experiences. The rise of health-conscious consumers has also spurred demand for low-sugar, low-fat, and plant-based ice cream alternatives, creating significant opportunities for product innovation. Technological disruptions are reshaping the industry, particularly in online retail and direct-to-consumer (DTC) models, enabling brands to reach consumers more efficiently and offer personalized experiences. Advancements in freezing technology and packaging solutions are improving product quality and shelf life. Economic factors, including rising disposable incomes and a general propensity for comfort foods, contribute to sustained demand. The market is characterized by a strong emphasis on novelty, with limited-edition flavors, seasonal offerings, and collaborations with popular brands or cultural phenomena capturing consumer attention. Furthermore, the convenience of purchasing ice cream through various distribution channels, including supermarkets and hypermarkets, convenience stores, and increasingly, online platforms, ensures widespread accessibility and supports market growth. The overall trajectory indicates a market ripe with opportunities for brands that can cater to diverse consumer preferences, embrace innovation, and leverage effective distribution strategies.

Key Markets & Segments Leading USA Ice Cream Market

The USA ice cream market is primarily led by the Off-Trade segment, which dominates the Distribution Channel landscape. Within Off-Trade, Supermarkets and Hypermarkets stand out as the most significant channel, accounting for an estimated 45% of total sales due to their extensive reach, product variety, and convenience for consumers.

Supermarkets and Hypermarkets:

- Drivers: High foot traffic, wide product assortment, competitive pricing, and integrated shopping experiences.

- Dominance Analysis: These retailers offer consumers a one-stop shop for groceries and household essentials, making ice cream purchases a natural add-on. Their ability to stock a diverse range of brands, from national players to private labels, caters to a broad spectrum of consumer preferences and price points. Strategic placement of chilled sections further enhances impulse buys.

Convenience Stores:

- Drivers: Impulse purchases, accessibility, and immediate consumption.

- Dominance Analysis: Convenience stores play a crucial role in capturing impulse sales, particularly for single-serve portions and on-the-go consumption. Their widespread presence in urban and suburban areas ensures constant accessibility, especially during warmer months and for immediate cravings.

Online Retail:

- Drivers: Growing e-commerce penetration, convenience, and specialized delivery services.

- Dominance Analysis: The online retail segment is experiencing rapid growth, driven by increasing consumer comfort with online grocery shopping and the rise of dedicated food delivery platforms. This channel offers the advantage of wider selection and the ability to purchase from niche or premium brands that might not be readily available in traditional brick-and-mortar stores.

Specialist Retailers:

- Drivers: Niche offerings, premium quality, and unique brand experiences.

- Dominance Analysis: While smaller in overall market share, specialist retailers such as artisanal ice cream parlors and gourmet food stores are critical for establishing premium brand perception and catering to discerning consumers seeking unique flavor profiles and high-quality ingredients.

Others (Warehouse clubs, gas stations, etc.):

- Drivers: Bulk purchasing, accessibility in diverse locations.

- Dominance Analysis: These channels cater to specific consumer needs, such as bulk purchases at warehouse clubs or grab-and-go options at gas stations, contributing to the overall accessibility of ice cream products.

The On-Trade segment, encompassing restaurants and food service establishments, remains important for occasion-based consumption and premium dining experiences, but the sheer volume and frequency of purchases make the Off-Trade channels the undisputed leader in the USA ice cream market.

USA Ice Cream Market Product Developments

Product innovation is a cornerstone of the USA ice cream market. Manufacturers are actively developing novel flavors, such as spicy, savory, and exotic fruit combinations, to cater to adventurous palates. The rise of plant-based ice cream, utilizing ingredients like almond milk, oat milk, and coconut milk, addresses the growing demand for vegan and dairy-free options. Reduced-sugar and low-calorie formulations are also gaining traction among health-conscious consumers. Furthermore, advancements in packaging technology are leading to more sustainable and convenient options, including single-serve, resealable, and visually appealing designs. These developments aim to enhance consumer experience, expand market reach, and stay ahead of evolving preferences in the competitive US frozen dessert landscape.

Challenges in the USA Ice Cream Market Market

The USA ice cream market faces several challenges. Supply chain disruptions, including ingredient sourcing volatility and transportation issues, can impact production and profitability. Rising raw material costs, particularly for dairy and sugar, put pressure on profit margins. Intense competitive pressure from established brands, private labels, and emerging niche players necessitates continuous innovation and marketing investment. Stringent food safety regulations and evolving labeling requirements add to operational complexities. Furthermore, the growing popularity of healthier alternatives poses a challenge to traditional dairy-based ice cream sales. Quantifiable impacts include potential margin erosion due to cost increases and the need for significant R&D investment to remain competitive.

Forces Driving USA Ice Cream Market Growth

Several key forces are driving the USA ice cream market growth. Technological advancements in production, including improved freezing techniques and automation, enhance efficiency and product quality. Economic factors, such as rising disposable incomes and consumer spending on discretionary items, support increased demand for premium and indulgent ice cream products. Evolving consumer preferences for unique flavors, healthier options, and plant-based alternatives create significant market opportunities. The expansion of online retail and delivery services provides greater accessibility and convenience. Regulatory support for product innovation and food safety standards also fosters a conducive environment for growth.

Challenges in the USA Ice Cream Market Market

Long-term growth catalysts in the USA ice cream market are rooted in ongoing innovation and strategic market expansions. The continuous development of novel product lines, catering to diverse dietary needs (e.g., allergen-free, high-protein) and adventurous taste profiles, will sustain consumer interest. Strategic partnerships between ice cream brands and complementary businesses, such as confectionery or beverage companies, can unlock new product development avenues and cross-promotional opportunities. Furthermore, the exploration of emerging geographical markets within the US, and the refinement of direct-to-consumer (DTC) models, offer avenues for sustained revenue growth and enhanced customer engagement. Investing in sustainable sourcing and production practices will also become a significant long-term differentiator.

Emerging Opportunities in USA Ice Cream Market

Emerging opportunities in the USA ice cream market lie in tapping into the plant-based trend with innovative and delicious vegan formulations. The expansion of DTC e-commerce platforms and subscription services presents a direct channel for reaching consumers and offering personalized experiences. Innovations in functional ice cream, incorporating probiotics, vitamins, or adaptogens, cater to the growing wellness-conscious consumer base. Furthermore, the demand for artisanal and small-batch ice cream, emphasizing unique flavor profiles and high-quality ingredients, continues to grow, offering opportunities for niche brands. The development of sustainable packaging solutions also presents a significant opportunity to attract environmentally conscious consumers.

Leading Players in the USA Ice Cream Market Sector

- Wells Enterprises Inc.

- Tilamook CCA

- Giffords Dairy Inc.

- Unilever PLC

- Turkey Hill Dairy

- Van Leeuwen Ice Cream

- Dairy Farmers of America Inc.

- Focus Brands LLC

- Blue Bell Creameries LP

- Froneri International Limited

Key Milestones in USA Ice Cream Market Industry

- October 2022: Unilever partnered with ASAP for the delivery of its ice cream products. As per the partnership, ASAP will also deliver ice cream and treats from Unilever's virtual storefront, The Ice Cream Shop.

- October 2022: Kemps replaced Dean Foods throughout Iowa as Dairy Farmers of America completed the USD 433 million acquisition of Dean Foods properties. The business took over the Le Mars milk factory, which can process numerous Kemps products, from cottage cheese to ice cream.

- October 2022: Blue Ribbon's Street range launched three new two-liter tubs, each featuring two flavors. The range includes chocolate affair, caramel hokey pokey, and velvety caramel.

Strategic Outlook for USA Ice Cream Market Market

The strategic outlook for the USA ice cream market is one of sustained growth driven by consumer demand for premiumization, innovation, and convenience. Key growth accelerators include continued investment in product development, focusing on unique flavor profiles, healthier formulations, and plant-based alternatives. Expanding online retail capabilities and optimizing direct-to-consumer (DTC) strategies will be crucial for capturing market share and fostering brand loyalty. Strategic partnerships and collaborations with other food and beverage entities can unlock new avenues for product innovation and market penetration. Furthermore, a focus on sustainable practices in sourcing and packaging will increasingly influence consumer purchasing decisions, presenting a significant opportunity for brands that prioritize environmental responsibility. The market is poised for continued evolution, rewarding agile and consumer-centric businesses.

USA Ice Cream Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Retail

- 1.1.3. Specialist Retailers

- 1.1.4. Supermarkets and Hypermarkets

- 1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 1.2. On-Trade

-

1.1. Off-Trade

USA Ice Cream Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

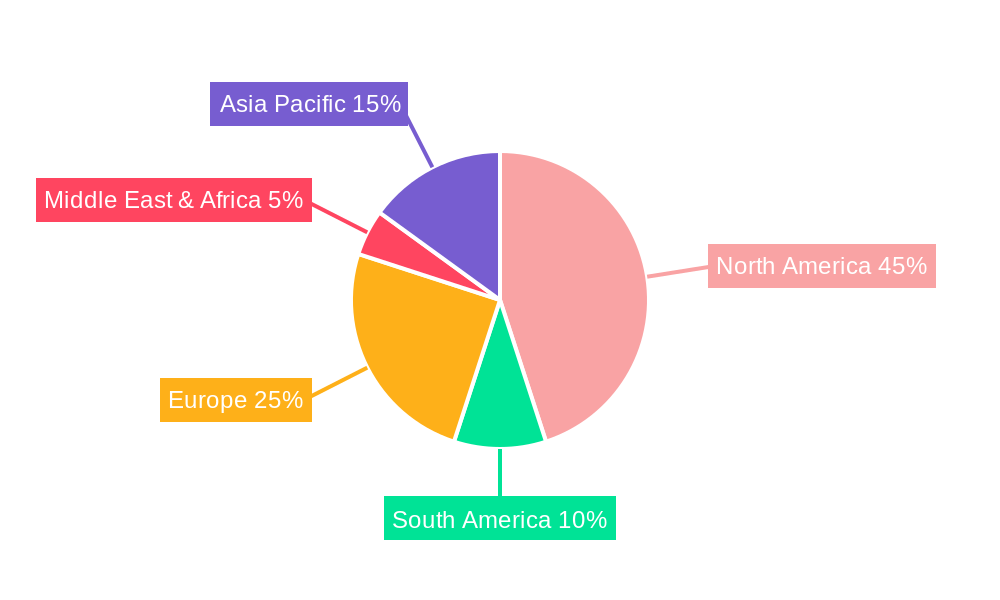

USA Ice Cream Market Regional Market Share

Geographic Coverage of USA Ice Cream Market

USA Ice Cream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Retail

- 5.1.1.3. Specialist Retailers

- 5.1.1.4. Supermarkets and Hypermarkets

- 5.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America USA Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Off-Trade

- 6.1.1.1. Convenience Stores

- 6.1.1.2. Online Retail

- 6.1.1.3. Specialist Retailers

- 6.1.1.4. Supermarkets and Hypermarkets

- 6.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 6.1.2. On-Trade

- 6.1.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America USA Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Off-Trade

- 7.1.1.1. Convenience Stores

- 7.1.1.2. Online Retail

- 7.1.1.3. Specialist Retailers

- 7.1.1.4. Supermarkets and Hypermarkets

- 7.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 7.1.2. On-Trade

- 7.1.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe USA Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Off-Trade

- 8.1.1.1. Convenience Stores

- 8.1.1.2. Online Retail

- 8.1.1.3. Specialist Retailers

- 8.1.1.4. Supermarkets and Hypermarkets

- 8.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 8.1.2. On-Trade

- 8.1.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa USA Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Off-Trade

- 9.1.1.1. Convenience Stores

- 9.1.1.2. Online Retail

- 9.1.1.3. Specialist Retailers

- 9.1.1.4. Supermarkets and Hypermarkets

- 9.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 9.1.2. On-Trade

- 9.1.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific USA Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Off-Trade

- 10.1.1.1. Convenience Stores

- 10.1.1.2. Online Retail

- 10.1.1.3. Specialist Retailers

- 10.1.1.4. Supermarkets and Hypermarkets

- 10.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 10.1.2. On-Trade

- 10.1.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wells Enterprises Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tilamook CCA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giffords Dairy Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unilever PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Turkey Hill Dairy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Van Leeuwen Ice Cream

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dairy Farmers of America Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Focus Brands LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Blue Bell Creameries LP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Froneri International Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Wells Enterprises Inc

List of Figures

- Figure 1: Global USA Ice Cream Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America USA Ice Cream Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 3: North America USA Ice Cream Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America USA Ice Cream Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America USA Ice Cream Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America USA Ice Cream Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: South America USA Ice Cream Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: South America USA Ice Cream Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America USA Ice Cream Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe USA Ice Cream Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe USA Ice Cream Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe USA Ice Cream Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe USA Ice Cream Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa USA Ice Cream Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Middle East & Africa USA Ice Cream Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Middle East & Africa USA Ice Cream Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa USA Ice Cream Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific USA Ice Cream Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 19: Asia Pacific USA Ice Cream Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific USA Ice Cream Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific USA Ice Cream Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Ice Cream Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global USA Ice Cream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global USA Ice Cream Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global USA Ice Cream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global USA Ice Cream Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global USA Ice Cream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global USA Ice Cream Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global USA Ice Cream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global USA Ice Cream Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global USA Ice Cream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global USA Ice Cream Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 33: Global USA Ice Cream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific USA Ice Cream Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Ice Cream Market?

The projected CAGR is approximately 2.81%.

2. Which companies are prominent players in the USA Ice Cream Market?

Key companies in the market include Wells Enterprises Inc, Tilamook CCA, Giffords Dairy Inc, Unilever PLC, Turkey Hill Dairy, Van Leeuwen Ice Cream, Dairy Farmers of America Inc, Focus Brands LLC, Blue Bell Creameries LP, Froneri International Limited.

3. What are the main segments of the USA Ice Cream Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: Unilever partnered with ASAP for the delivery of its ice cream products. As per the partnership, ASAP will also deliver ice cream and treats from Unilever's virtual storefront, The Ice Cream Shop.October 2022: Kemps replaced Dean Goods throughout Iowa as Dairy Farmers of America completed the USD 433 million acquisition of Dean Foods properties. The business took over the Le Mars milk factory, which can process numerous Kemps products, from cottage cheese to ice cream.October 2022: Blue Ribbon's Street range launched three new two-liter tubs, each featuring two flavors. The range includes chocolate affair, caramel hokey pokey, and velvety caramel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Ice Cream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Ice Cream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Ice Cream Market?

To stay informed about further developments, trends, and reports in the USA Ice Cream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence