Key Insights

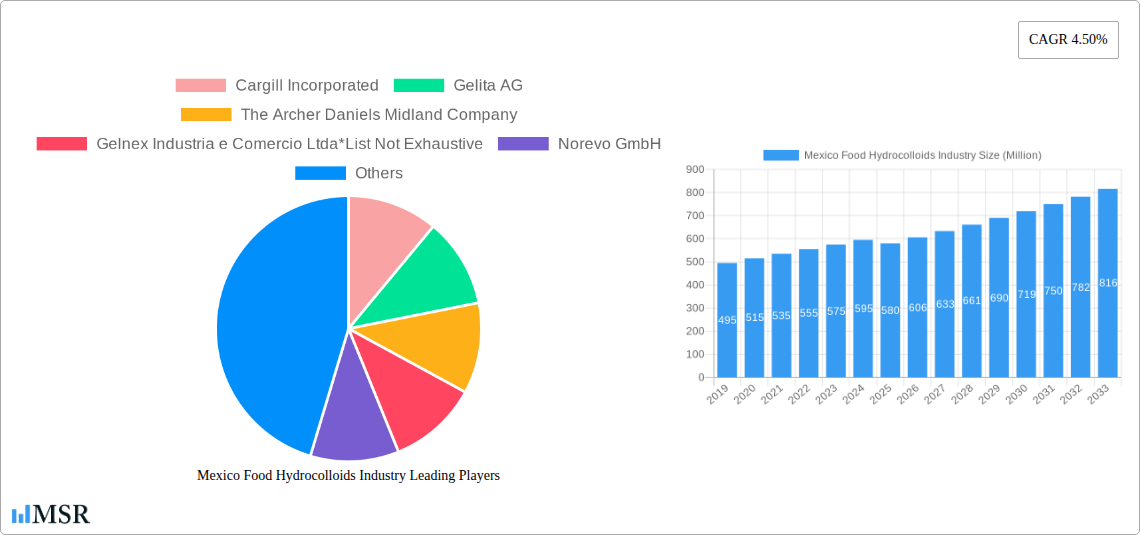

The Mexico Food Hydrocolloids Industry is poised for robust expansion, driven by a confluence of evolving consumer preferences, growing demand for processed foods, and the intrinsic functional benefits that hydrocolloids offer. With a projected market size of approximately USD 580 million in 2025, the industry is expected to witness a Compound Annual Growth Rate (CAGR) of 4.50% through 2033. This growth is significantly propelled by the increasing adoption of hydrocolloids across diverse applications, particularly in the dairy, bakery, and confectionery sectors. These ingredients are indispensable for improving texture, stability, and shelf-life, catering to the Mexican consumer's desire for convenient and high-quality food products. Furthermore, the rising health consciousness among consumers is also a key driver, as hydrocolloids can be utilized in "clean label" formulations and in the development of reduced-fat or sugar alternatives, aligning with global health trends. The demand for natural hydrocolloids like pectin and xanthan gum is particularly strong, reflecting a broader preference for ingredients perceived as more wholesome.

Mexico Food Hydrocolloids Industry Market Size (In Million)

The expansion of the Mexican food hydrocolloids market is supported by several critical trends and a strategic industry landscape. Key market drivers include the burgeoning food processing sector, the increasing export of Mexican food products, and the continuous innovation in food formulations that leverage the unique properties of hydrocolloids. While the market is generally optimistic, certain restraints, such as price volatility of raw materials and stringent regulatory compliances, warrant careful navigation by industry players. The market is segmented into various types, including Gelatin Gum, Pectin, and Xanthan Gum, each catering to specific functional needs. Major players like Cargill Incorporated, Gelita AG, and The Archer Daniels Midland Company are actively shaping the market through their product portfolios and strategic investments. The ongoing development of novel hydrocolloid applications and the potential for new market entrants to capitalize on specific unmet needs within the Mexican food industry are also noteworthy aspects of this dynamic market.

Mexico Food Hydrocolloids Industry Company Market Share

This in-depth market research report provides a detailed analysis of the Mexico food hydrocolloids industry, covering market dynamics, key trends, growth drivers, challenges, and opportunities. Leveraging extensive data from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the Mexican hydrocolloids market. We explore segments like gelatin gum, pectin, xanthan gum, and other hydrocolloids, and applications across dairy, bakery, confectionery, beverage, meat & seafood products, and other applications.

Mexico Food Hydrocolloids Industry Market Concentration & Dynamics

The Mexico food hydrocolloids market exhibits a moderate level of concentration, with several key players dominating market share. Leading companies such as Cargill Incorporated, Gelita AG, The Archer Daniels Midland Company, Gelnex Industria e Comercio Ltda, Norevo GmbH, Lonza Group Ltd, and Silvateam S p A are instrumental in shaping market dynamics. The innovation ecosystem in Mexico is progressively developing, driven by increased R&D investments and collaborations between ingredient suppliers and food manufacturers. Regulatory frameworks, while evolving, are generally supportive of food safety and quality standards, influencing product development and market entry. The threat of substitute products remains a consideration, though the unique functionalities of hydrocolloids in texture modification, stabilization, and emulsification often provide a competitive edge. End-user trends, particularly the growing demand for clean-label ingredients and plant-based alternatives, are significantly impacting product formulations and market strategies. Mergers and acquisitions (M&A) activity in the broader global hydrocolloids market can indirectly influence the Mexican landscape, with potential for consolidation and strategic partnerships. The market share of key players is estimated to be around 60-70%, with M&A deal counts fluctuating between 3-5 significant transactions annually in the broader Latin American context impacting Mexico.

Mexico Food Hydrocolloids Industry Industry Insights & Trends

The Mexico food hydrocolloids industry is poised for significant expansion, with a projected market size of US$ XXX Million in 2025 and a robust Compound Annual Growth Rate (CAGR) of approximately XX.X% during the forecast period (2025–2033). This growth is underpinned by several key factors, including the escalating demand for processed and convenience foods, which rely heavily on hydrocolloids for desirable textures, stability, and shelf-life extension. The burgeoning middle class and increasing disposable incomes in Mexico are fueling consumer spending on a wider variety of food products, from baked goods to dairy alternatives, all of which benefit from hydrocolloid applications.

Technological disruptions are playing a crucial role. Advances in extraction and modification techniques are leading to the development of novel hydrocolloids with enhanced functionalities and improved cost-effectiveness. For instance, the development of specialized pectin grades for low-sugar applications or novel gum blends for plant-based meat analogs is creating new market opportunities. Furthermore, the increasing focus on health and wellness is driving the demand for natural and clean-label ingredients. Hydrocolloids derived from natural sources, such as pectin from citrus fruits and gums from plant seeds, are gaining traction as consumers seek to avoid artificial additives.

Evolving consumer behaviors are also a major influence. The growing preference for visually appealing and texturally pleasing food experiences, coupled with the rise of specific dietary trends like veganism and gluten-free diets, necessitates innovative solutions that hydrocolloids are well-equipped to provide. The demand for healthier snack options, improved beverage mouthfeel, and stabilized dairy products all contribute to the sustained growth of the Mexican hydrocolloids market. The historical period (2019-2024) has already witnessed steady growth, laying a strong foundation for future expansion.

Key Markets & Segments Leading Mexico Food Hydrocolloids Industry

The Mexico food hydrocolloids industry is experiencing dominant growth driven by specific segments and applications.

Dominant Segments by Type:

- Gelatin Gum: This segment is a significant contributor, driven by its widespread use in confectionery, dairy products, and meat processing. Its gelling, stabilizing, and emulsifying properties make it indispensable in numerous formulations.

- Pectin: With the increasing consumer demand for low-sugar and healthier food options, pectin's role as a natural gelling agent in jams, jellies, and dairy beverages is expanding. Its application in fruit preparations for bakery and confectionery also bolsters its market presence.

- Xanthan Gum: This versatile hydrocolloid is crucial for its thickening and stabilizing capabilities, particularly in gluten-free bakery products, sauces, dressings, and beverages. Its ability to create stable emulsions and suspensions is highly valued.

- Other Types: This category includes hydrocolloids like carrageenan, agar-agar, guar gum, and alginates, each finding specific applications that collectively contribute to market growth.

Dominant Segments by Application:

- Dairy: The dairy sector is a primary driver, utilizing hydrocolloids extensively in yogurts, ice creams, flavored milk, and cheese products for texture enhancement, stabilization, and mouthfeel improvement.

- Bakery: Hydrocolloids are essential in bakery goods for dough conditioning, moisture retention, improved crumb structure, and extended shelf-life in cakes, pastries, and bread.

- Confectionery: This segment relies heavily on hydrocolloids for gelling (gummies), texture modification, and film formation in candies, chocolates, and other sweet treats.

- Beverage: In the beverage industry, hydrocolloids are used for viscosity control, suspension of pulp and particles, mouthfeel enhancement, and stabilization in juices, dairy-based drinks, and functional beverages.

- Meat & Seafood Products: Hydrocolloids play a role in improving water-holding capacity, texture, and binding properties in processed meats, sausages, and seafood products.

The economic growth in Mexico, coupled with improved infrastructure supporting food processing and distribution, acts as key drivers for these segments. The increasing consumer preference for convenience foods and indulgence products, coupled with a rising awareness of product quality and sensory attributes, further solidifies the dominance of these applications.

Mexico Food Hydrocolloids Industry Product Developments

Product innovation in the Mexico food hydrocolloids industry is largely focused on enhancing functionality, promoting natural and clean-label attributes, and meeting specific dietary needs. Developers are creating specialized hydrocolloid blends for improved texture in plant-based meat alternatives, longer shelf-life solutions for baked goods, and optimized gelling agents for sugar-reduced confectionery. The market relevance of these developments is significant, addressing consumer demand for healthier, more sustainable, and texturally superior food products. Technological advancements in extraction and purification are yielding hydrocolloids with greater purity and specific functionalities, offering competitive advantages to manufacturers integrating these innovations into their product lines.

Challenges in the Mexico Food Hydrocolloids Industry Market

The Mexico food hydrocolloids industry faces several challenges that could impede its growth trajectory. Regulatory hurdles related to food additive approvals and labeling requirements can be complex and time-consuming, potentially delaying market entry for new products. Supply chain disruptions, exacerbated by global events or local logistical issues, can impact the availability and cost of raw materials, affecting production efficiency and pricing. Furthermore, intense competitive pressures from both established global players and emerging local manufacturers can lead to price wars and reduced profit margins. The increasing cost of raw materials, influenced by agricultural yields and global demand, presents a significant restraint. Quantifiable impacts include potential delays of 6-12 months for new product approvals and a XX% increase in operational costs due to supply chain volatility.

Forces Driving Mexico Food Hydrocolloids Industry Growth

Several powerful forces are propelling the Mexico food hydrocolloids industry forward. Technological advancements in hydrocolloid extraction, modification, and application are yielding more efficient and functional ingredients. The growing consumer demand for healthier and convenience food products directly translates to increased reliance on hydrocolloids for texture, stability, and shelf-life. Economic factors, such as rising disposable incomes and urbanization, are expanding the market for processed foods. Favorable regulatory environments, which increasingly support food safety and innovation, also contribute to market expansion. For instance, the development of novel emulsifiers and stabilizers directly addresses the need for improved product quality in the rapidly growing dairy and beverage sectors.

Challenges in the Mexico Food Hydrocolloids Industry Market

Long-term growth catalysts for the Mexico food hydrocolloids industry are multifaceted. Continuous innovation in developing hydrocolloids with specific functionalities, such as improved heat stability or controlled release properties, will be crucial. Strategic partnerships between ingredient suppliers, food manufacturers, and research institutions can foster collaborative development and accelerate market penetration. Market expansion into new application areas, such as nutraceuticals and pharmaceuticals, presents significant untapped potential. Furthermore, a focus on sustainable sourcing and production practices will resonate with increasingly environmentally conscious consumers and stakeholders.

Emerging Opportunities in Mexico Food Hydrocolloids Industry

Emerging trends and opportunities within the Mexico food hydrocolloids industry are ripe for exploitation. The growing demand for plant-based and vegan food products creates a significant opportunity for hydrocolloids that can mimic the texture and mouthfeel of animal-derived ingredients. The clean-label movement is spurring innovation in natural hydrocolloids and those derived from sustainable sources. Personalized nutrition and functional foods are opening doors for hydrocolloids that can encapsulate active ingredients or modify texture in specialized dietary supplements. Furthermore, advancements in biotechnology are likely to yield novel hydrocolloids with unique properties, driving further market growth.

Leading Players in the Mexico Food Hydrocolloids Industry Sector

- Cargill Incorporated

- Gelita AG

- The Archer Daniels Midland Company

- Gelnex Industria e Comercio Ltda

- Norevo GmbH

- Lonza Group Ltd

- Silvateam S p A

Key Milestones in Mexico Food Hydrocolloids Industry Industry

- 2019: Increased investment in R&D for plant-based hydrocolloid alternatives.

- 2020: Growing consumer demand for clean-label ingredients.

- 2021: Expansion of dairy and bakery applications for hydrocolloids.

- 2022: Introduction of novel hydrocolloid blends for confectionery innovation.

- 2023: Focus on sustainable sourcing and production of hydrocolloids.

- 2024: Enhanced demand for hydrocolloids in functional beverages.

Strategic Outlook for Mexico Food Hydrocolloids Industry Market

The strategic outlook for the Mexico food hydrocolloids industry is highly optimistic, characterized by sustained growth fueled by evolving consumer preferences and technological advancements. Key growth accelerators include the burgeoning demand for processed and convenience foods, the increasing adoption of plant-based diets, and the continuous innovation in hydrocolloid functionalities for diverse applications. Strategic opportunities lie in expanding into emerging food categories, investing in sustainable sourcing and production, and leveraging partnerships to drive product development and market penetration. The industry is well-positioned to capitalize on these trends, ensuring a robust future expansion.

Mexico Food Hydrocolloids Industry Segmentation

-

1. Type

- 1.1. Gelatin Gum

- 1.2. Pectin

- 1.3. Xanthan Gum

- 1.4. Other Types

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Confectionery

- 2.4. Beverage

- 2.5. Meat & Seafood Products

- 2.6. Other Applications

Mexico Food Hydrocolloids Industry Segmentation By Geography

- 1. Mexico

Mexico Food Hydrocolloids Industry Regional Market Share

Geographic Coverage of Mexico Food Hydrocolloids Industry

Mexico Food Hydrocolloids Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Application of the Additive

- 3.4. Market Trends

- 3.4.1. Rising Demand of Xanthan Gum in Food Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Food Hydrocolloids Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gelatin Gum

- 5.1.2. Pectin

- 5.1.3. Xanthan Gum

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Confectionery

- 5.2.4. Beverage

- 5.2.5. Meat & Seafood Products

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gelita AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gelnex Industria e Comercio Ltda*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Norevo GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lonza Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silvateam S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Mexico Food Hydrocolloids Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Food Hydrocolloids Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Mexico Food Hydrocolloids Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Food Hydrocolloids Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Mexico Food Hydrocolloids Industry?

Key companies in the market include Cargill Incorporated, Gelita AG, The Archer Daniels Midland Company, Gelnex Industria e Comercio Ltda*List Not Exhaustive, Norevo GmbH, Lonza Group Ltd, Silvateam S p A.

3. What are the main segments of the Mexico Food Hydrocolloids Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification.

6. What are the notable trends driving market growth?

Rising Demand of Xanthan Gum in Food Industries.

7. Are there any restraints impacting market growth?

Low Awareness and Application of the Additive.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Food Hydrocolloids Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Food Hydrocolloids Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Food Hydrocolloids Industry?

To stay informed about further developments, trends, and reports in the Mexico Food Hydrocolloids Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence